At the beginning of 2025, the Bitcoin (BTC) market was filled with fervent optimism, with institutions and analysts collectively betting that the price would soar to over $150,000 by the end of the year, even aiming for $200,000 or higher. However, reality played out a "reverse indicator" drama: BTC plummeted over 33% from its peak of about $126,000 in early October, entering a "bloodbath" mode in November (with a monthly drop of 28%), and as of December 10, the price stabilized in the $92,000 range.

This collective failure is worth a deep review: Why were the predictions at the beginning of the year so consistent? Why did almost all mainstream institutions get it wrong?

1. Comparison of Predictions at the Beginning of the Year vs. Current Situation

1.1 Three Pillars of Market Consensus

At the start of 2025, the Bitcoin market was permeated with unprecedented optimism. Almost all mainstream institutions set a year-end target price of over $150,000, with some aggressive predictions even pointing to $200,000-$250,000. This highly consistent bullish expectation was built on three major "certainty" logics:

Cyclical Factors: The Halving Curse

Historically, price peaks have occurred 12-18 months after the fourth halving (April 2024). After the 2012 halving, prices rose to $1,150 in 13 months; after the 2016 halving, they broke $20,000 in 18 months; and after the 2020 halving, they reached $69,000 in 12 months. The market generally believes that the supply-side contraction effect will manifest with a lag, and 2025 is seen as being in a "historic window."

Capital Expectations: The ETF Tsunami

The approval of spot ETFs was viewed as the opening of the "institutional capital floodgates." The market expected that net inflows in the first year would exceed $100 billion, with traditional funds like pensions and sovereign funds allocating massively. Endorsements from Wall Street giants like BlackRock and Fidelity made the narrative of "Bitcoin mainstreaming" deeply ingrained.

Favorable Policy: The Trump Card

The Trump administration's friendly attitude towards crypto assets, including discussions on strategic Bitcoin reserves and expectations of SEC personnel adjustments, was seen as long-term policy support. The market believed that regulatory uncertainty would significantly decrease, clearing obstacles for institutional entry.

Based on these three logics, the average target price set by mainstream institutions at the beginning of the year reached $170,000, implying an expected increase of over 200% within the year.

1.2 Overview of Institutional Predictions: Who Was the Most Aggressive?

The table below summarizes the year-end predictions from 11 mainstream institutions and analysts, comparing them to the current price ($92,000), with deviations clearly visible:

Institution/Analyst

End of 2025 Prediction (USD)

Brief Reasoning

Deviation from Current Situation (92k Benchmark)

VanEck

180,000 - 250,000

ETF inflows + BTC market cap reaching half of gold (~$13 trillion), January ChainCheck report reaffirming $180,000 target

+95% ~ +170%

Tom Lee (Fundstrat)

150,000 - 250,000+

Interest rate cuts + institutional adoption + retirement fund allocation;

+65% ~ +175%

InvestingHaven

80,000 - 151,000

Cyclical center + Fibonacci retracement

-13% ~ +64%

Flitpay

Average 106,000 (Bull 133k / Bear 72k)

Macro + global adoption

+15%

CoinDCX

100,000 - 150,000

ETF recovery + macro

+9% ~ +63%

Standard Chartered

200,000

ETF + institutional buying

+115%

Finder

Average 138,300

Expert panel voting

+50%

MMCrypto (X Analyst)

Q3 crash, down to 70-80k, entering bear market in Q4

Leverage bubble + end of cycle

Deviation 5%

AllianceBernstein

200,000 (September)

Bull market cycle + ETF

+115%

Bitwise

200,000

New ATH + ETF driving

+115%+

JPMorgan

Low 94,000, high 170,000

Fair value + macro

+2% ~ +85%

Characteristics of Prediction Distribution:

- Aggressive (8 institutions): Target price over $150,000, average deviation exceeding 80%, representative institutions include VanEck, Tom Lee, Standard Chartered

- Moderate (2 institutions): JPMorgan provided a range prediction, Flitpay offered bull and bear scenarios, leaving room for downside

- Contrarian (1 institution): Only MMCrypto explicitly warned of crash risks, becoming the sole accurate forecaster

Notably, the most aggressive predictions came from the most well-known institutions (VanEck, Tom Lee), while accurate predictions came from relatively niche technical analysts.

2. Roots of Misjudgment: Why Did Institutional Predictions Fail Collectively?

2.1 Consensus Trap: When "Good News" Loses Marginal Effect

Nine institutions coincidentally bet on "ETF inflows," forming a highly homogenized predictive logic.

When a factor is fully recognized by the market and reflected in prices, it loses its marginal driving force. By early 2025, the expectation of ETF inflows had already been fully priced in—every investor knew this "good news," and prices had already reacted in advance. The market needed "exceeding expectations," not "meeting expectations."

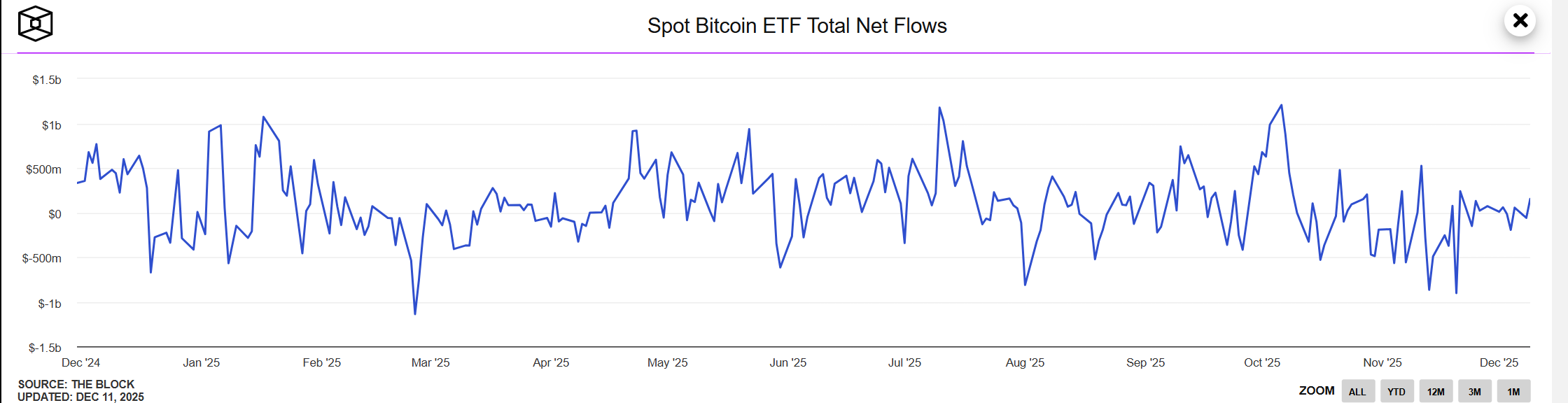

Throughout the year, ETF inflows fell short of expectations, with a net outflow of $3.48-$4.3 billion in November. More critically, institutions overlooked that ETFs are a two-way channel—when the market turns, they not only fail to provide support but also become a highway for capital outflows.

When 90% of analysts are telling the same story, that story has lost its alpha value.

2.2 Cycle Model Failure: History Does Not Simply Repeat

Institutions like Tom Lee and VanEck heavily relied on the historical pattern of "price peaks 12-18 months after halving," believing that cycles would automatically materialize.

Fundamental Environmental Changes: The macro environment facing 2025 is fundamentally different from historical cycles:

2017: Global low interest rates, liquidity easing

2021: Pandemic stimulus, central bank liquidity

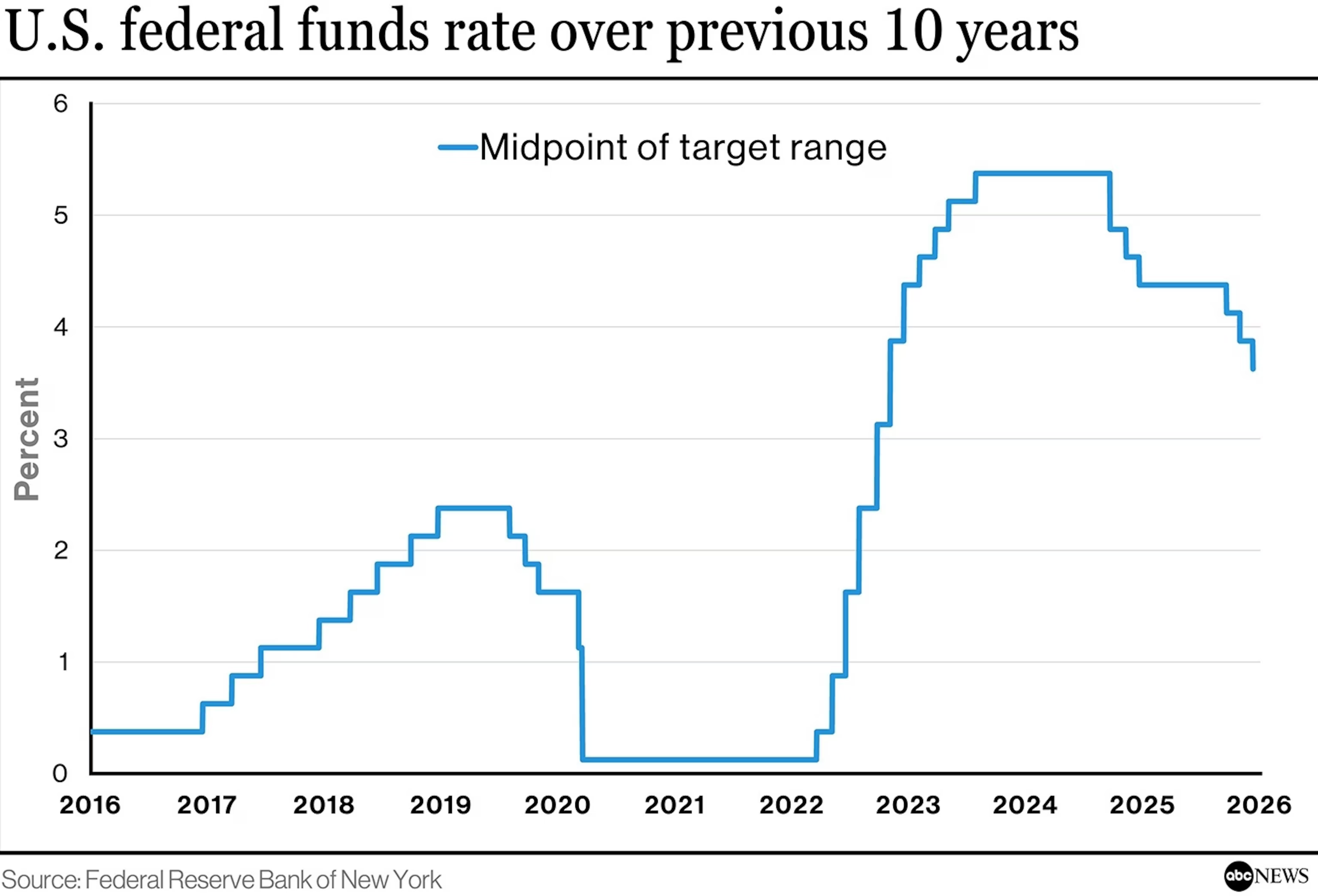

2025: Aftermath of the most aggressive interest rate hike cycle in 40 years, with the Federal Reserve maintaining a hawkish stance

The expectation of Federal Reserve interest rate cuts plummeted from 93% at the beginning of the year to 38% in November. This abrupt shift in monetary policy has never occurred in historical halving cycles. Institutions viewed "cycles" as a deterministic rule, ignoring that it is essentially a probability distribution, highly dependent on the macro liquidity environment.

When environmental variables undergo fundamental changes, historical models inevitably fail.

2.3 Conflicts of Interest: Structural Biases of Institutions

Top institutions like VanEck, Tom Lee, and Standard Chartered exhibited the largest biases (over +100%), while niche players like Changelly and MMCrypto were the most accurate. The size of institutions often correlates negatively with prediction accuracy.

Fundamental Reasons: These institutions are stakeholders themselves:

- VanEck: Issuing Bitcoin ETF products

- Standard Chartered: Providing crypto asset custody services

- Fundstrat: Serving clients holding crypto assets

- Tom Lee: Chairman of the Ethereum treasury BMNR

Structural Pressures:

- Being bearish is equivalent to undermining their own business. If they release a bearish report, it is tantamount to telling clients "our products are not worth buying." This conflict of interest is structural and unavoidable.

- Clients need a target price of "over $150,000" to justify their holdings. Most clients served by these institutions entered the market at high levels during the mid-bull market, with holding costs in the $80,000-$100,000 range. They need analysts to provide a target price of "over $150,000" to validate their decisions and provide psychological support for continued holding or even increasing their positions.

- Aggressive predictions are more likely to gain media coverage. Headlines like "Tom Lee predicts Bitcoin will reach $250,000" clearly attract more clicks and shares than conservative predictions; the exposure brought by aggressive forecasts directly translates into institutional brand influence and business traffic.

- Well-known analysts find it difficult to overturn their historical positions. Tom Lee gained fame for accurately predicting Bitcoin's rebound in 2023, establishing a public image as a "bullish standard-bearer." At the beginning of 2025, even if he had reservations about the market, it would be challenging for him to publicly overturn his optimistic stance.

2.4 Liquidity Blind Spot: Misjudging Bitcoin's Asset Attributes

The market has long been accustomed to comparing BTC to "digital gold," viewing it as a safe-haven asset against inflation and currency devaluation. However, in reality, Bitcoin behaves more like high-beta tech stocks, being extremely sensitive to liquidity: when the Federal Reserve maintains a hawkish stance and liquidity tightens, BTC's performance is closer to that of high-beta tech stocks rather than safe-haven gold.

The core contradiction lies in the natural conflict between Bitcoin's asset characteristics and a high-interest-rate environment. When real interest rates remain high, the attractiveness of zero-yield assets systematically declines. Bitcoin generates no cash flow and pays no interest; its value entirely relies on "someone being willing to buy it at a higher price in the future." In a low-interest-rate era, this is not an issue—after all, there is not much return from keeping money in the bank, so it is better to take a gamble.

However, when the risk-free rate reaches 4-5%, the opportunity cost for investors significantly increases, and Bitcoin, as a zero-yield asset, lacks fundamental support.

The most fatal misjudgment was that almost all institutions presupposed "the Federal Reserve's interest rate cut cycle is about to begin." The market pricing at the beginning of the year anticipated 4-6 rate cuts throughout the year, with a cumulative reduction of 100-150 basis points. But November's data provided a completely opposite answer: the risk of inflation rebounding reignited, and the expectations for rate cuts collapsed entirely, with the market shifting from anticipating "rapid rate cuts" to pricing in "maintaining high rates for a longer time." When this core assumption collapsed, all optimistic predictions based on "liquidity easing" lost their foundation.

Conclusion

The collective failure of 2025 teaches us that precise predictions are a false proposition. Bitcoin is influenced by multiple variables, including macro policies, market sentiment, and technical factors, making it difficult for any single model to capture this complexity.

Institutional predictions are not without value—they reveal the mainstream narratives, capital expectations, and emotional directions of the market. The problem is that when predictions become consensus, consensus becomes a trap.

True investment wisdom lies in understanding what the market is thinking through institutional research reports, but not letting it dictate what you should do. When VanEck and Tom Lee are collectively bullish, the question you need to ask is not "Are they right?" but "What if they are wrong?" Risk management always takes precedence over return predictions.

History may repeat itself, but it never simply replicates. The halving cycle, ETF narrative, and policy expectations—all these logics failed in 2025, not because the logic itself was flawed, but because the environmental variables fundamentally changed. Next time, the catalyst will have a different name, but the essence of market over-optimism will remain unchanged.

Remember this lesson: independent thinking is more important than following authority, contrarian voices are more valuable than mainstream consensus, and risk management is more critical than precise predictions. This is the moat for long-term survival in the crypto market.

This report's data was edited and compiled by WolfDAO. If you have any questions, please contact us for updates;

Written by: Nikka / WolfDAO (X: @10xWolfdao)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。