The year 2026 is expected to be the "Year of Utility Wins," where digital assets will no longer attempt to replace traditional financial systems but will instead enhance and modernize existing systems.

Author: CoinShares

Compiled by: Deep Tide TechFlow

At the end of the year, various institutions have released their year-end reviews and outlook reports.

Adhering to the principle of not reading too long, we also attempt to quickly summarize and distill the long reports from various sources.

This report comes from CoinShares, a leading European digital asset investment management company established in 2014, headquartered in London, UK, and Paris, France, managing over $6 billion in assets.

**This 77-page *“2026 Outlook: The Year Utility Wins”* covers core topics such as macroeconomic fundamentals, the mainstreaming of Bitcoin, the rise of hybrid finance, competition among smart contract platforms, and the evolution of the regulatory landscape, along with in-depth analysis of subfields like stablecoins, tokenized assets, prediction markets, mining transformation, and venture capital.**

Here is our distilled summary of the core content of this report:

1. Core Theme: The Arrival of the Year of Utility

The year 2025 marked a turning point for the digital asset industry, with Bitcoin reaching an all-time high, shifting the industry from speculation-driven to utility-value-driven.

The year 2026 is expected to be the "Year of Utility Wins," where digital assets will no longer attempt to replace traditional financial systems but will enhance and modernize existing systems.

The core argument of the report is that 2025 marks a decisive shift of digital assets from speculation-driven to utility-value-driven, and 2026 will be a key year for accelerating this transformation.

Digital assets will no longer attempt to establish a parallel financial system but will enhance and modernize the existing traditional financial system. The integration of public blockchains, institutional liquidity, regulatory market structures, and real economic use cases is advancing at a pace exceeding optimistic expectations.

2. Macroeconomic Fundamentals and Market Outlook

Economic Environment: A Soft Landing on Thin Ice

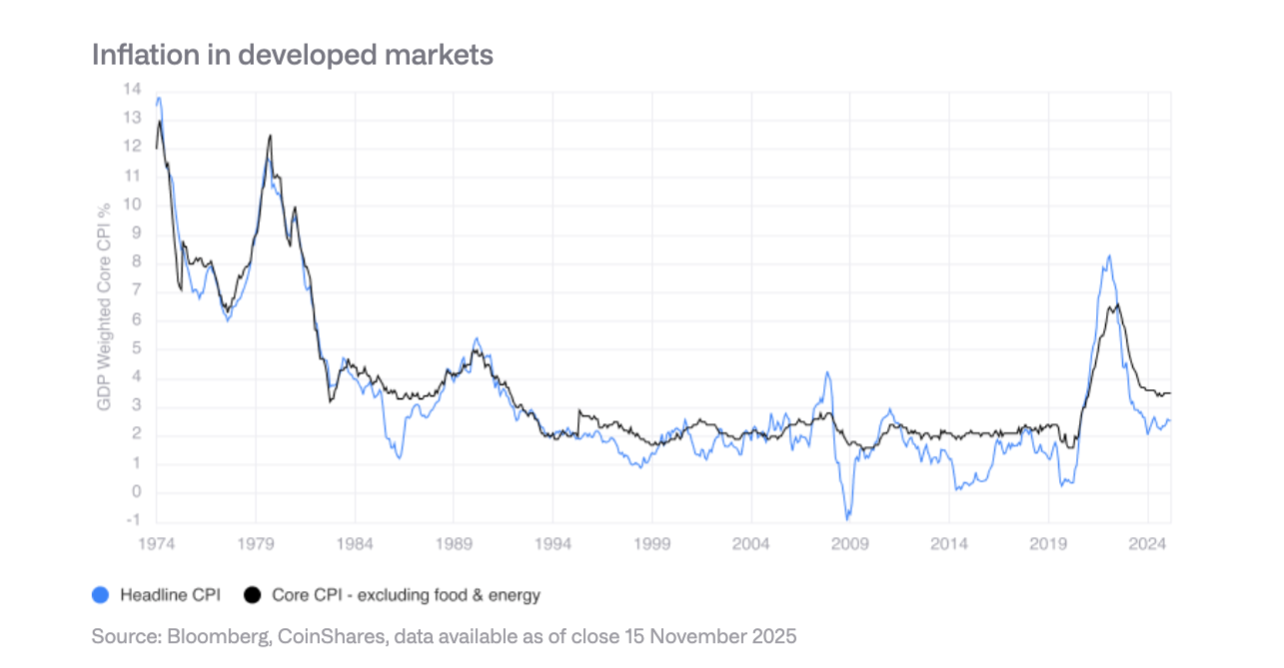

Growth Expectations: The economy may avoid recession in 2026, but growth is expected to be weak and fragile. Inflation continues to ease but not decisively, with tariff disruptions and supply chain restructuring keeping core inflation at levels not seen since the early 1990s.

Federal Reserve Policy: A cautious rate cut is expected, with the target rate possibly dropping to the mid-3% range, but the process will be slow. The Federal Reserve is still wary of the inflation surge in 2022 and is reluctant to pivot quickly.

Three Scenario Analyses:

Optimistic Scenario: Soft landing + productivity surprise, Bitcoin could break $150,000.

Baseline Scenario: Slow expansion, Bitcoin trading range of $110,000 to $140,000.

Bear Market Scenario: Recession or stagflation, Bitcoin could drop to the $70,000 to $100,000 range.

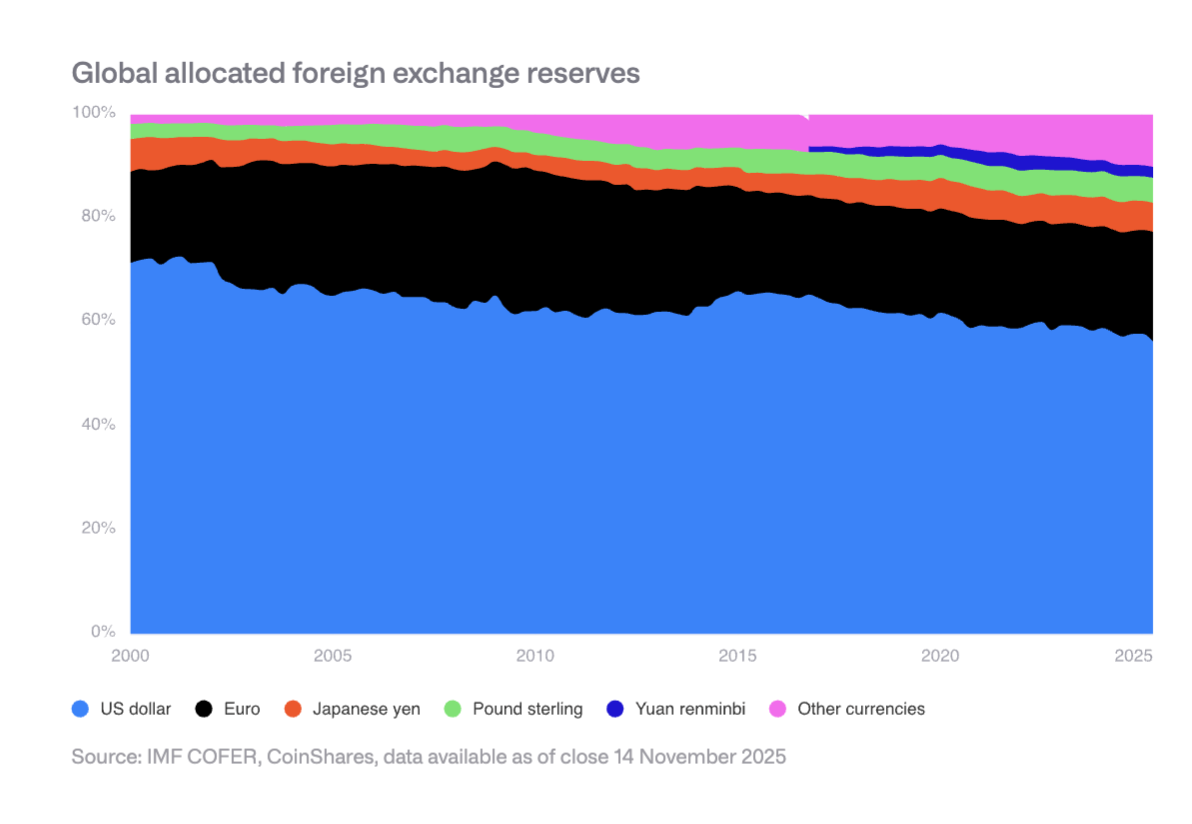

Slow Erosion of the Dollar's Reserve Status

The dollar's share of global foreign exchange reserves has fallen from 70% in 2000 to the mid-50% range currently. Emerging market central banks are diversifying their holdings, increasing allocations to assets like the renminbi and gold. This creates structural advantages for Bitcoin as a non-sovereign store of value.

3. The Mainstreaming of Bitcoin in the U.S.

In 2025, the U.S. achieved several key breakthroughs, including:

Approval and launch of a spot ETF.

Formation of a top ETF options market.

Lifting of restrictions on retirement plans.

Application of fair value accounting rules for corporations.

The U.S. government designating Bitcoin as a strategic reserve.

Institutional Adoption Still in Early Stages

Despite the removal of structural barriers, actual adoption remains constrained by traditional financial processes and intermediaries. Wealth management channels, retirement plan providers, and corporate compliance teams are still gradually adapting.

Expectations for 2026

The private sector is expected to make key progress: the four major brokerages will open Bitcoin ETF allocations, at least one major 401(k) provider will allow Bitcoin allocations, at least two S&P 500 companies will hold Bitcoin, and at least two major custodial banks will offer direct custody services.

4. Risks of Holding Bitcoin for Miners and Corporations

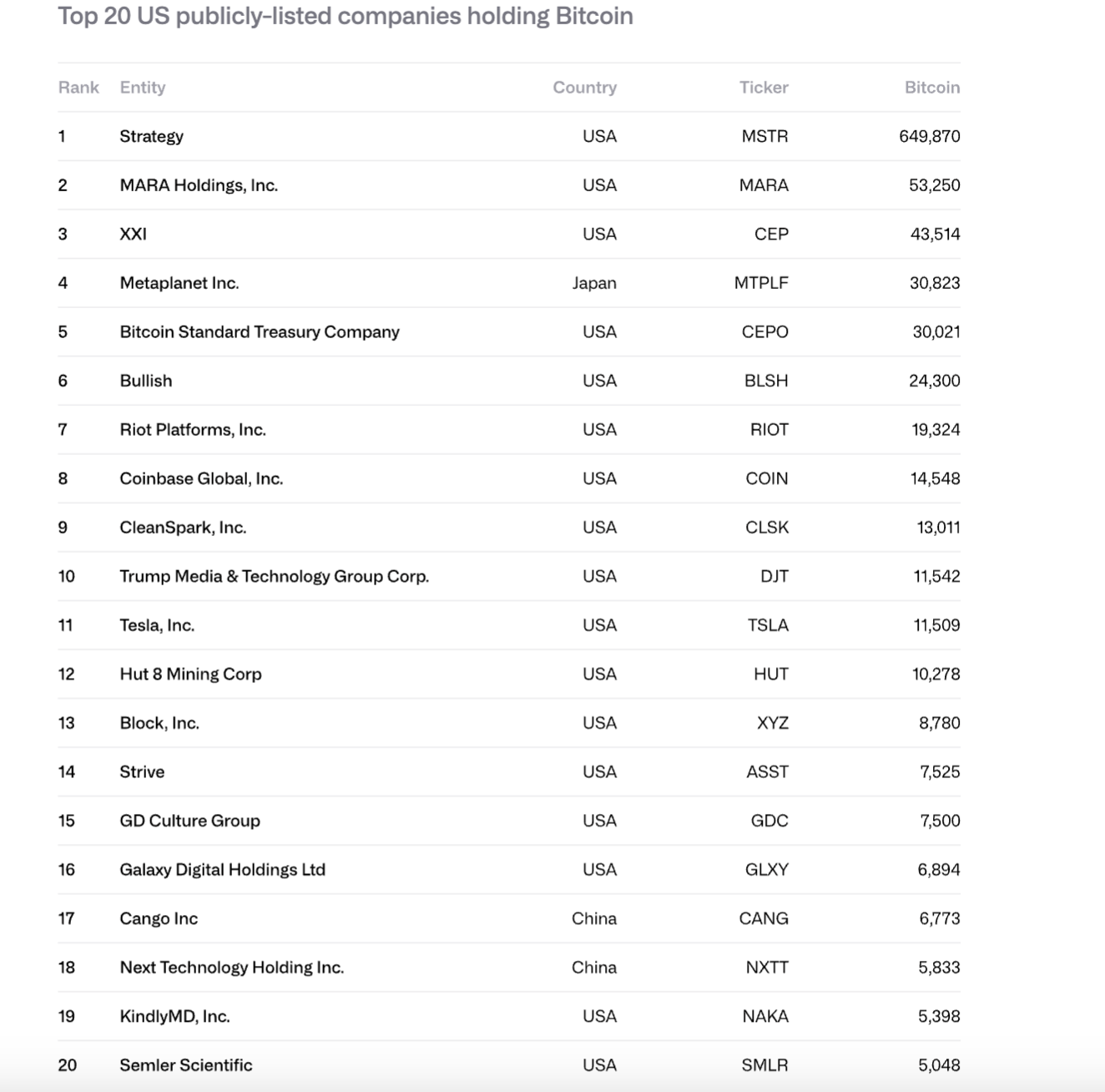

Surge in Corporate Bitcoin Holdings

From 2024 to 2025, the Bitcoin holdings of publicly traded companies increased from 266,000 to 1,048,000, with a total value rising from $11.7 billion to $90.7 billion. MicroStrategy (MSTR) accounts for 61%, with the top 10 companies controlling 84%.

Potential Sell-off Risks

MicroStrategy faces two major risks:

Inability to fund perpetual debt and cash flow obligations (annual cash flow of nearly $680 million).

Refinancing risk (recently maturing bonds are due in September 2028).

If the mNAV approaches 1x or cannot refinance at zero interest rates, it may be forced to sell Bitcoin, triggering a vicious cycle.

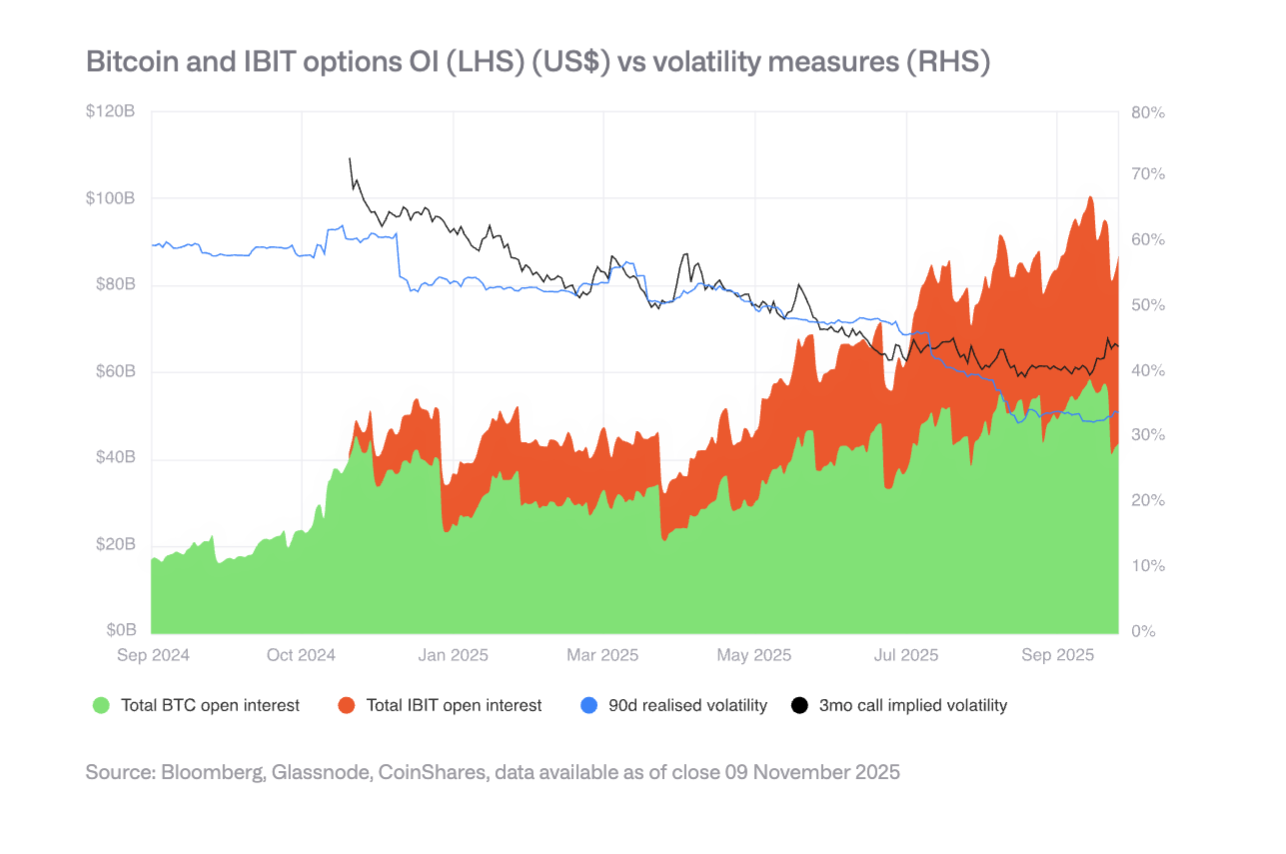

Options Market and Declining Volatility

The development of the IBIT options market has reduced Bitcoin's volatility, which is a sign of maturation. However, declining volatility may weaken demand for convertible bonds, affecting corporate purchasing power. A turning point in declining volatility was observed in the spring of 2025.

5. Divergence in the Regulatory Landscape

EU: Clarity of MiCA

The EU has the most comprehensive legal framework for crypto assets globally, covering issuance, custody, trading, and stablecoins. However, 2025 exposed coordination limitations, and some national regulators may challenge cross-border passports.

U.S.: Innovation and Fragmentation

The U.S. has regained momentum with its deep capital markets and mature venture capital ecosystem, but regulation remains fragmented across multiple agencies, including the SEC, CFTC, and the Federal Reserve. Stablecoin legislation (GENIUS Act) has passed, but implementation is still ongoing.

Asia: Moving Towards Prudent Regulation

Regions like Hong Kong and Japan are advancing Basel III crypto capital and liquidity requirements, while Singapore maintains a risk-based licensing system. Asia is forming a more coherent regulatory group, converging around risk-based standards and bank alignment.

The Rise of Hybrid Finance

Infrastructure and Settlement Layer

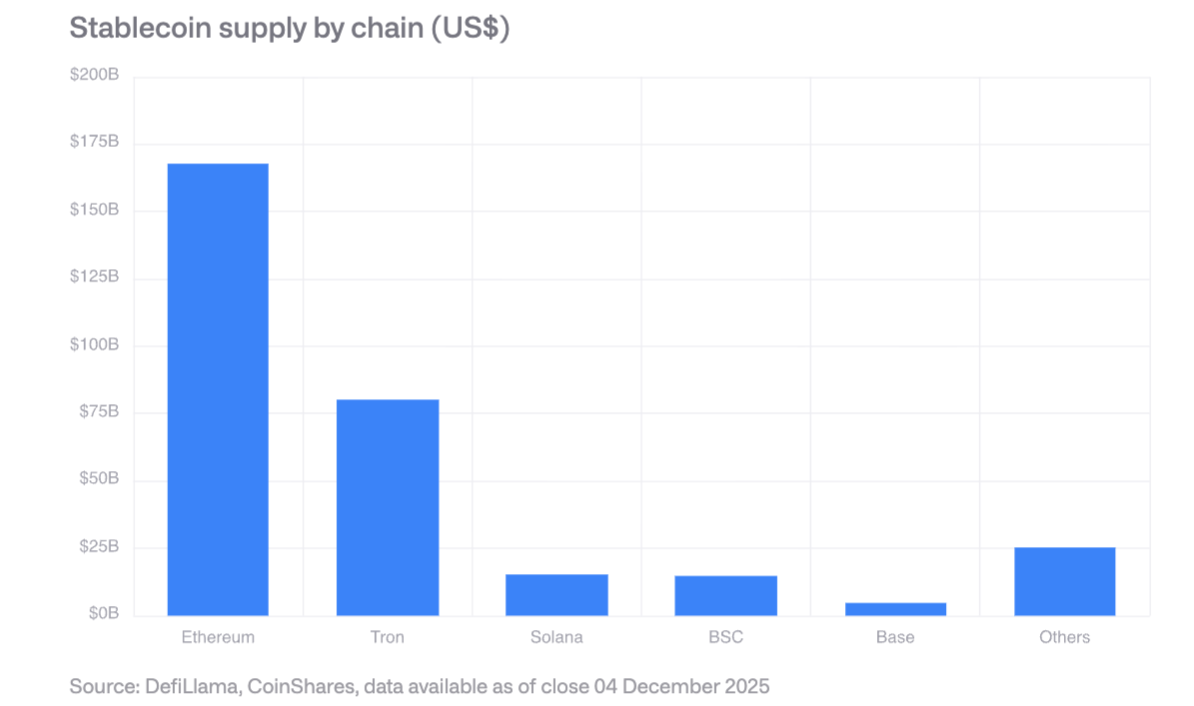

Stablecoins: The market size exceeds $300 billion, with Ethereum holding the largest share and Solana experiencing the fastest growth. The GENIUS Act requires compliant issuers to hold U.S. Treasury reserves, creating new demand for Treasuries.

Decentralized Exchanges: Monthly trading volume exceeds $600 billion, with Solana processing $40 billion in daily trading volume.

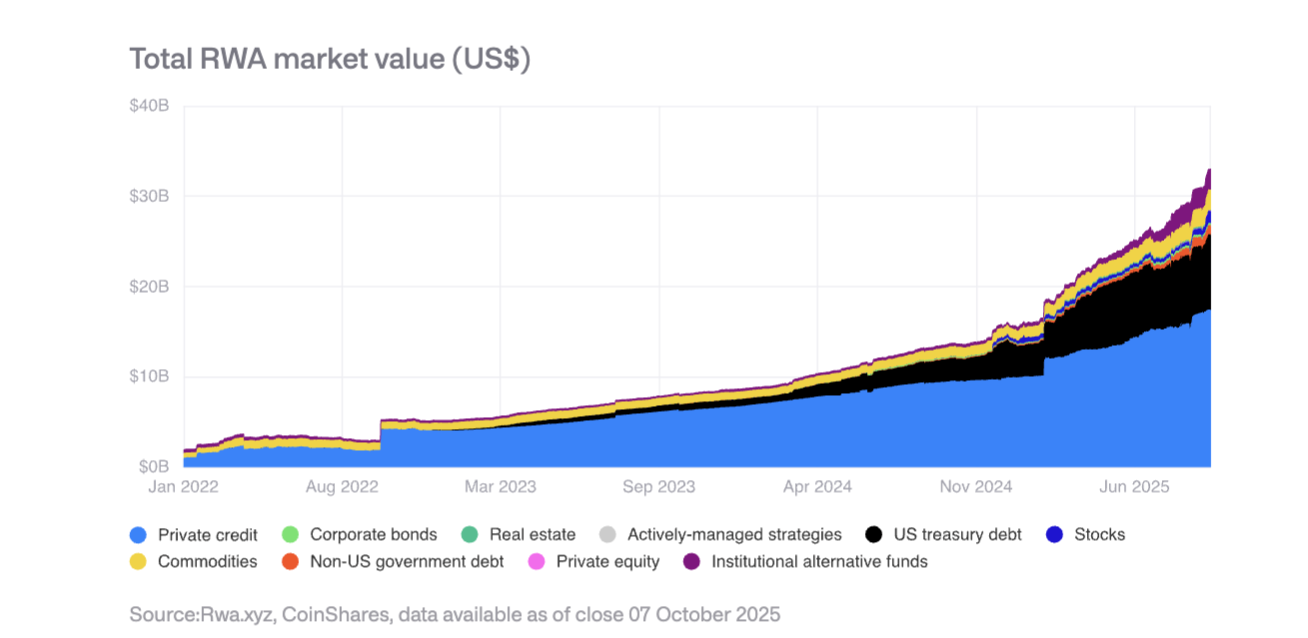

Tokenization of Real-World Assets (RWA)

The total value of tokenized assets increased from $15 billion at the beginning of 2025 to $35 billion. Private credit and tokenization of U.S. Treasuries are growing the fastest, with gold tokens exceeding $1.3 billion. BlackRock's BUIDL fund has significantly expanded its assets, and JPMorgan has launched JPMD tokenized deposits on Base.

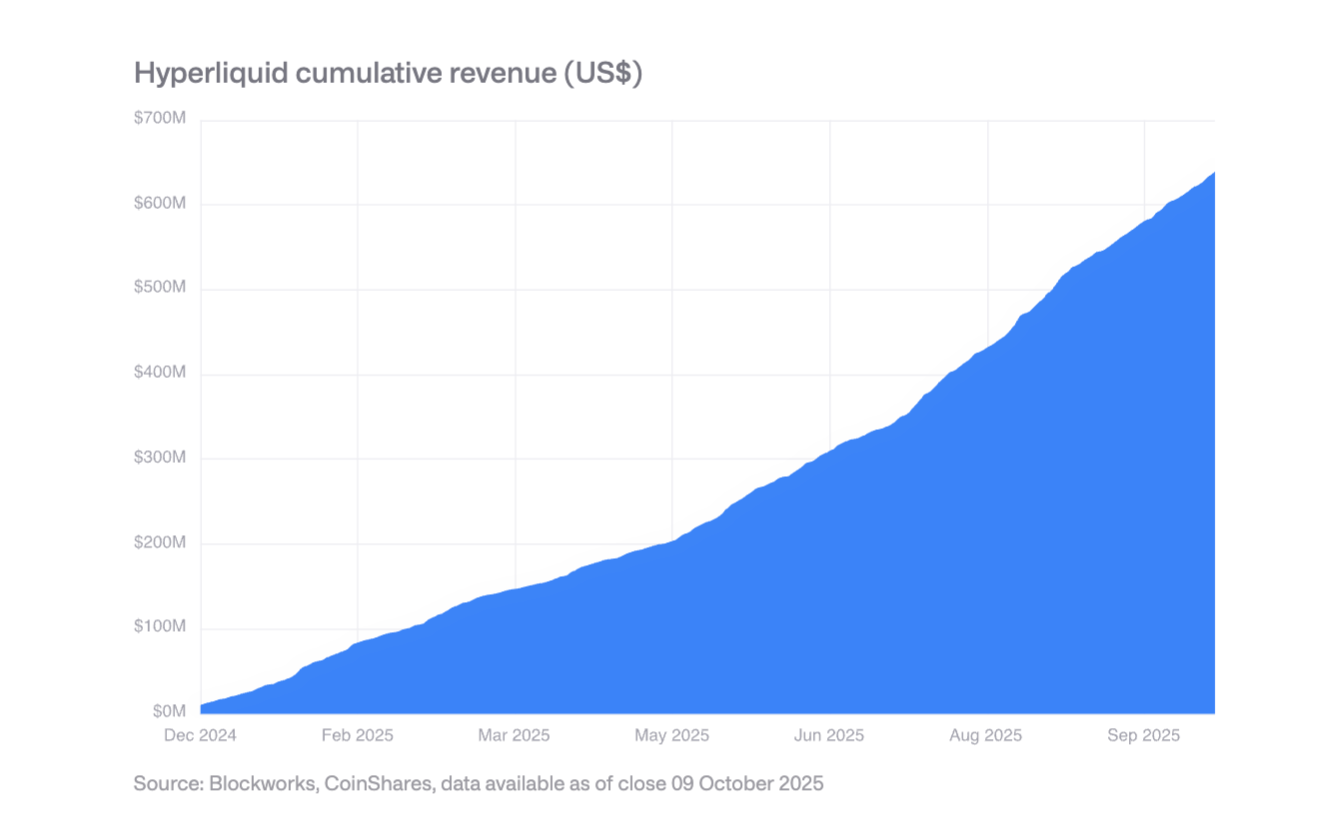

Revenue-Generating On-Chain Applications

An increasing number of protocols are generating hundreds of millions in annual revenue and distributing it to token holders. Hyperliquid uses 99% of its revenue for daily token buybacks, and Uniswap and Lido have also introduced similar mechanisms. This marks a shift of tokens from purely speculative assets to equity-like assets.

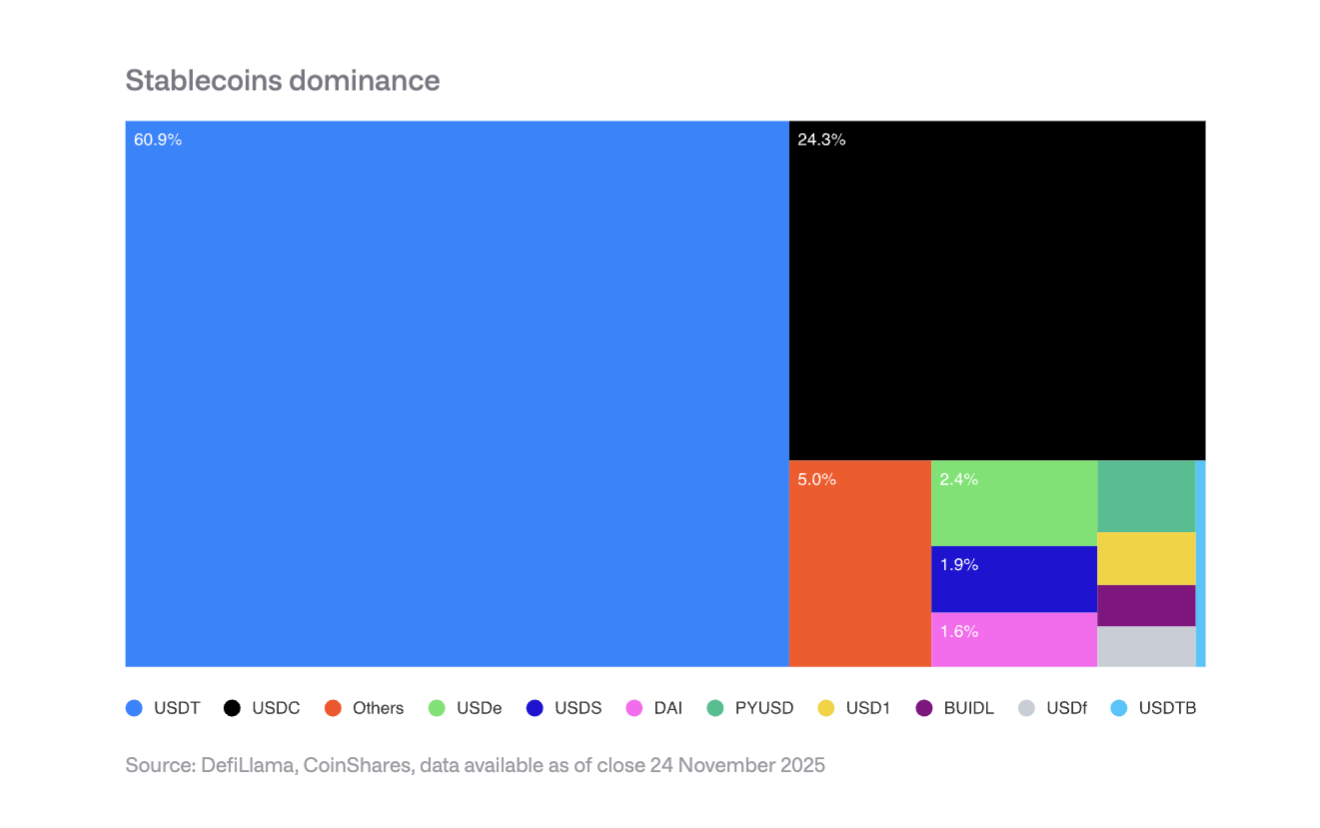

7. Dominance of Stablecoins and Corporate Adoption

Market Concentration

Tether (USDT) accounts for 60% of the stablecoin market, while Circle (USDC) holds 25%. New entrants like PayPal's PYUSD face challenges from network effects, making it difficult to disrupt the duopoly.

Expectations for Corporate Adoption in 2026

Payment Processors: Visa, Mastercard, Stripe, and others have structural advantages that allow them to shift to stablecoin settlements without changing the front-end experience.

Banks: JPMorgan's JPM Coin has demonstrated potential, with Siemens reporting forex savings of up to 50%, and settlement times reduced from days to seconds.

E-commerce Platforms: Shopify has accepted USDC for checkout, and markets in Asia and Latin America are piloting stablecoin payment providers.

Impact on Revenue

Stablecoin issuers face risks from declining interest rates: if the Federal Reserve's rate drops to 3%, they would need to issue an additional $88.7 billion in stablecoins to maintain current interest income.

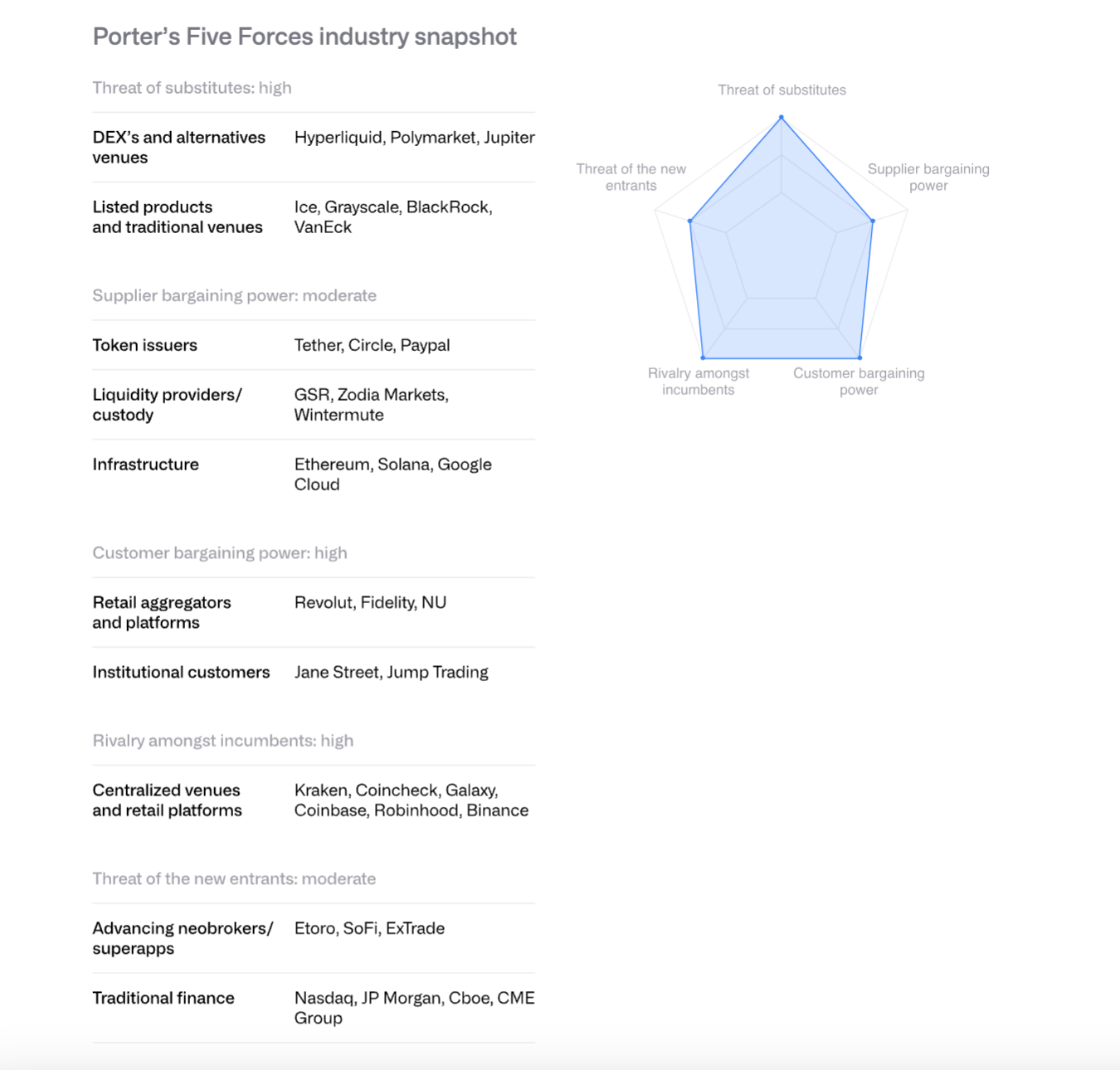

8. Analyzing the Exchange Competitive Landscape Using Porter's Five Forces Model

Existing Competitors: Competition is intense and escalating, with fee rates dropping to low single-digit basis points.

Threat of New Entrants: Traditional financial institutions like Morgan Stanley E*TRADE and Charles Schwab are preparing to enter but will rely on partners in the short term.

Supplier Bargaining Power: Stablecoin issuers (like Circle) enhance control through the Arc mainnet. The revenue-sharing agreement between Coinbase and Circle for USDC is crucial.

Customer Bargaining Power: Institutional clients account for over 80% of Coinbase's trading volume, giving them strong bargaining power. Retail users are price-sensitive.

Threat of Substitutes: Decentralized exchanges like Hyperliquid, prediction markets like Polymarket, and CME crypto derivatives pose competition.

The industry is expected to accelerate consolidation in 2026, with exchanges and large banks acquiring customers, licenses, and infrastructure through mergers and acquisitions.

9. Competition Among Smart Contract Platforms

Ethereum: From Sandbox to Institutional Infrastructure

Ethereum is achieving scalability through its Rollup-centric roadmap, with Layer-2 throughput increasing from 200 TPS a year ago to 4,800 TPS. Validators are pushing to raise the base layer Gas limit. The U.S. spot Ethereum ETF has attracted approximately $13 billion in inflows.

In terms of institutional tokenization, BlackRock's BUIDL fund and JPMorgan's JPMD demonstrate Ethereum's potential as an institutional-grade platform.

Solana: High-Performance Paradigm

Solana stands out with its highly optimized execution environment, accounting for about 7% of the total DeFi TVL. Stablecoin supply exceeds $12 billion (growing from $1.8 billion in January 2024), with RWA projects expanding; BlackRock's BUIDL increased from $25 million in September to $250 million.

Technological upgrades include the Firedancer client and the DoubleZero validator communication network. The spot ETF launched on October 28 has attracted $382 million in net inflows.

Other High-Performance Chains

Next-generation Layer-1s like Sui, Aptos, Sei, Monad, and Hyperliquid compete through architectural differentiation. Hyperliquid focuses on derivatives trading, accounting for over one-third of total blockchain revenue. However, the market is highly fragmented, and EVM compatibility has become a competitive advantage.

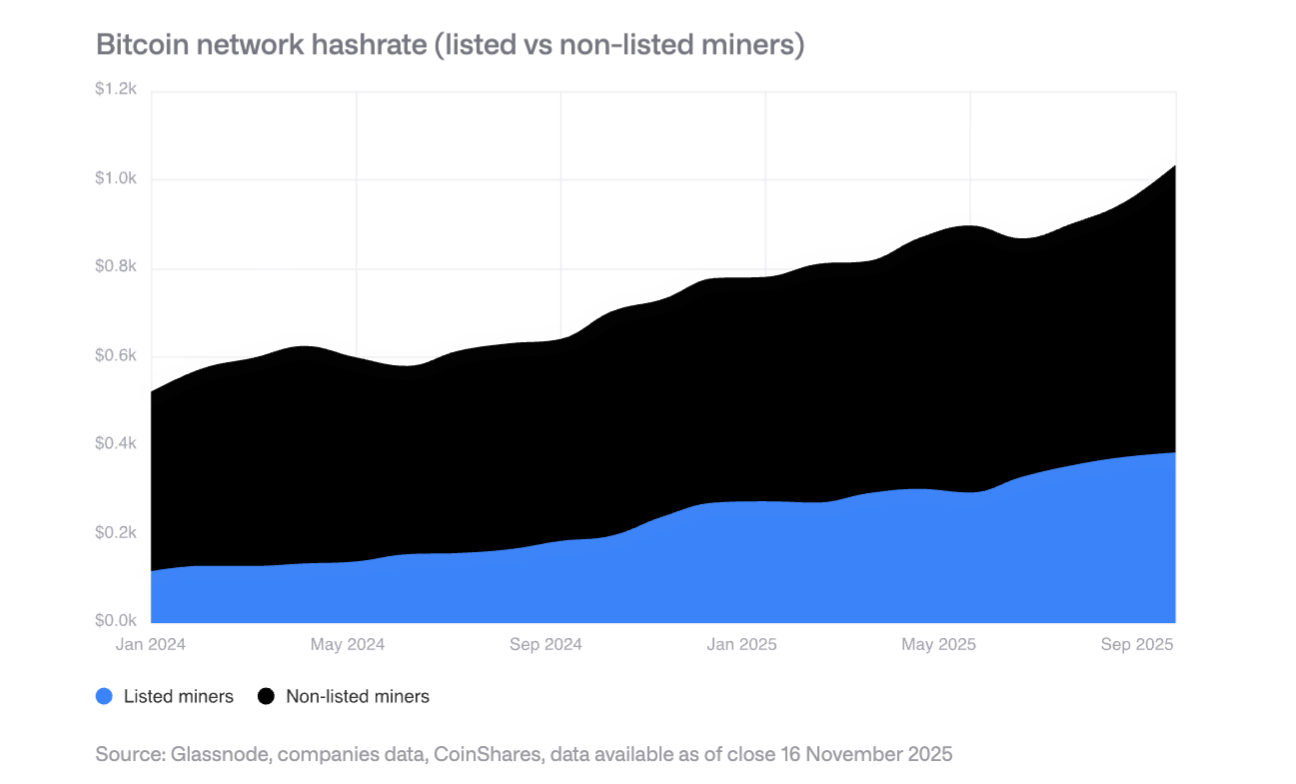

10. Mining Transformation to HPC (High-Performance Computing Centers)

Expansion in 2025

Publicly traded miners' hash power grew by 110 EH/s, primarily from Bitdeer, HIVE Digital, and Iris Energy.

HPC Transformation

Miners announced HPC contracts worth $65 billion, with Bitcoin mining revenue expected to drop from 85% to below 20% by the end of 2026. HPC business operating margins reach 80-90%.

Future Mining Models

Future mining is expected to be dominated by the following models: ASIC manufacturers, modular mining, intermittent mining (coexisting with HPC), and sovereign nation mining. In the long term, mining may return to small-scale decentralized operations.

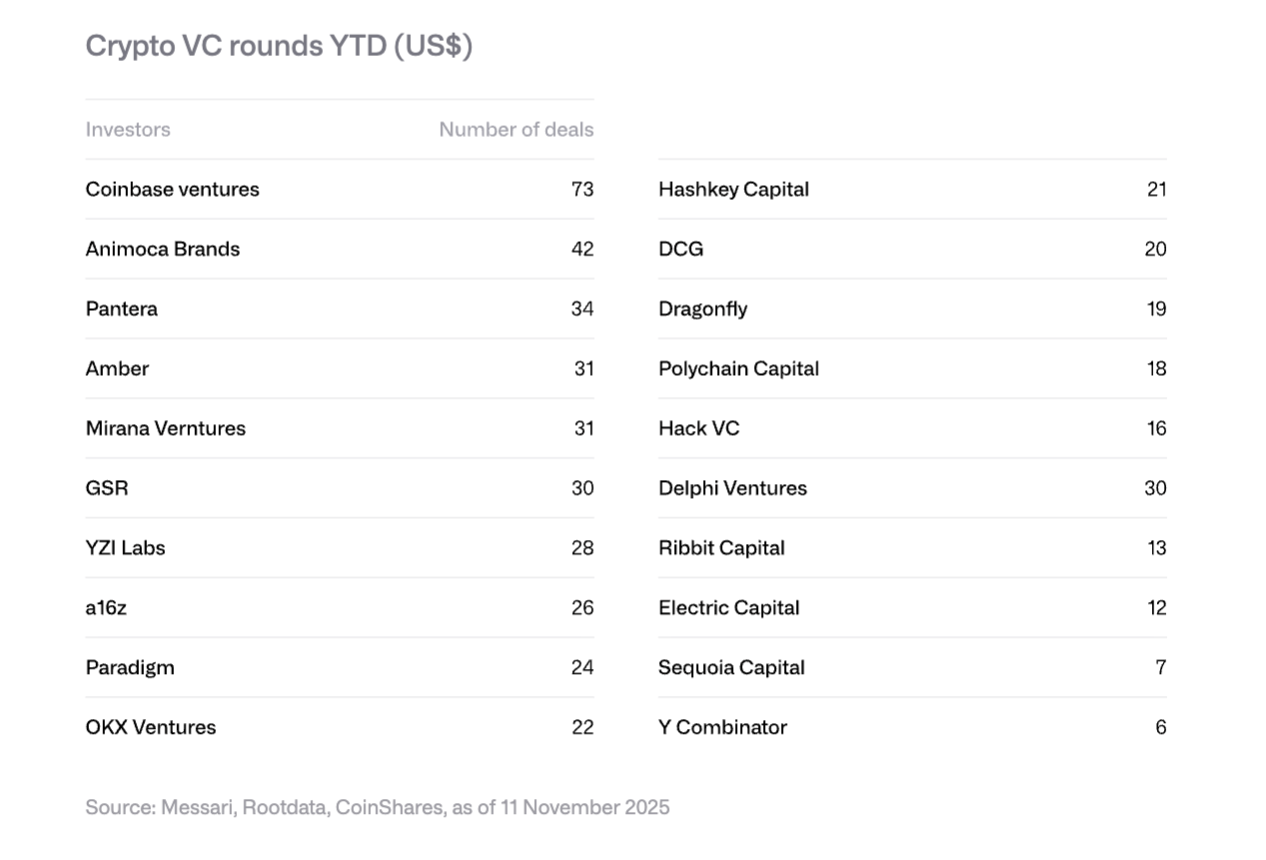

11. Venture Capital Trends

Recovery in 2025

Crypto venture capital financing reached $18.8 billion, surpassing the total for 2024 ($16.5 billion). This was primarily driven by large transactions: Polymarket secured $2 billion in strategic investment (ICE), Stripe's Tempo raised $500 million, and Kalshi raised $300 million.

Four Major Trends in 2026

RWA Tokenization: Securitize's SPAC and Agora's $50 million Series A show institutional interest.

AI and Crypto Integration: Applications like AI agents and natural language trading interfaces are accelerating.

Retail Investment Platforms: Decentralized angel investment platforms like Echo (acquired by Coinbase for $375 million) and Legion are emerging.

Bitcoin Infrastructure: Projects related to Layer-2 and the Lightning Network are gaining attention.

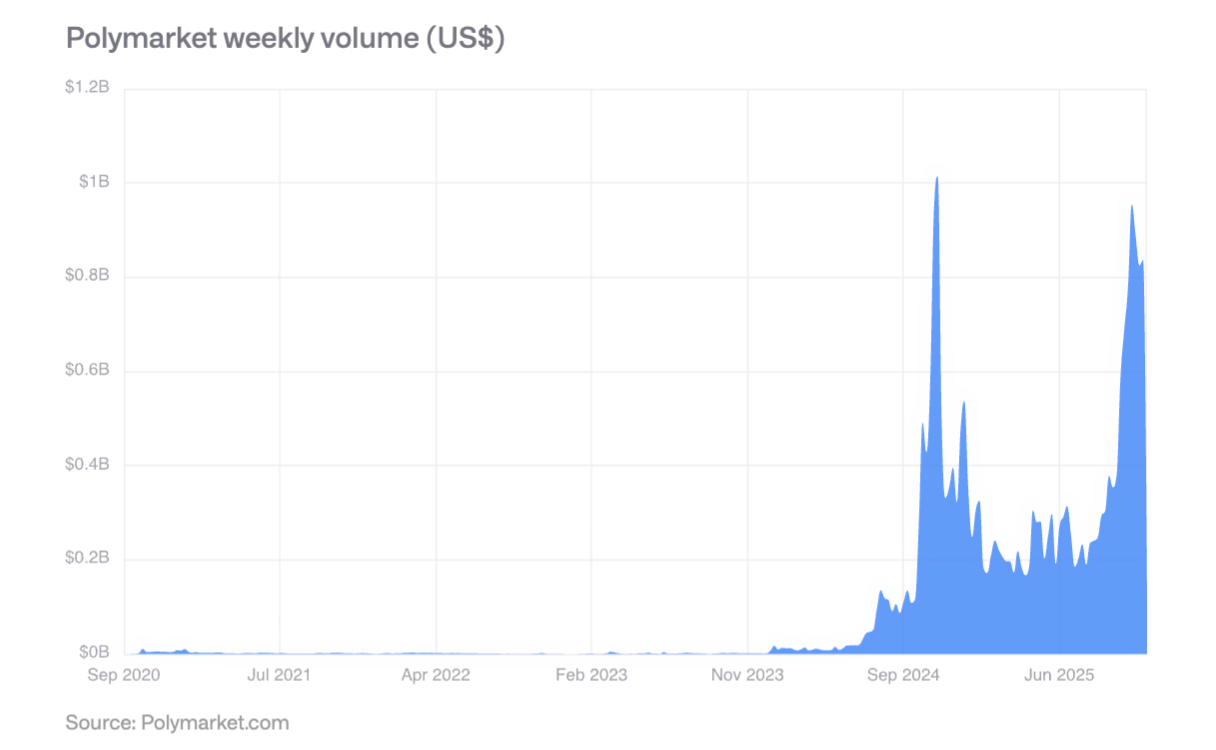

12. The Rise of Prediction Markets

Polymarket saw weekly trading volumes exceeding $800 million during the 2024 U.S. elections, with post-election activity remaining strong. Its prediction accuracy has been validated: events with a 60% probability occurred about 60% of the time, and events with an 80% probability occurred about 77-82% of the time.

In October 2025, ICE made a strategic investment of up to $2 billion in Polymarket, marking recognition from mainstream financial institutions. Weekly trading volumes are expected to potentially exceed $2 billion in 2026.

13. Key Conclusions

Acceleration of Maturation: Digital assets are shifting from speculation-driven to utility-value and cash flow-driven, with tokens increasingly resembling equity assets.

Rise of Hybrid Finance: The integration of public blockchains with traditional financial systems is no longer theoretical but is becoming visible through strong growth in stablecoins, tokenized assets, and on-chain applications.

Increased Regulatory Clarity: The U.S. GENIUS Act, EU MiCA, and Asia's prudent regulatory frameworks lay the groundwork for institutional adoption.

Gradual Institutional Adoption: Although structural barriers have been removed, actual adoption will take years, and 2026 will be a year of incremental progress for the private sector.

Reshaping of Competitive Landscape: Ethereum remains dominant but faces challenges from high-performance chains like Solana, with EVM compatibility becoming a key advantage.

Risks and Opportunities Coexist: High concentration of corporate holdings poses sell-off risks, but emerging areas like institutional tokenization, stablecoin adoption, and prediction markets offer significant growth potential.

Overall, 2026 will be a pivotal year for digital assets as they transition from the margins to the mainstream, from speculation to utility, and from fragmentation to consolidation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。