The Federal Reserve has lowered interest rates by 25 basis points as expected, and still anticipates one more rate cut next year, initiating RMP to purchase $40 billion in short-term bonds.

Source: Wall Street Journal

The Federal Reserve has once again lowered interest rates at a regular pace as the market expected, but this has revealed the largest internal disagreement among voting decision-makers in six years, suggesting a slowdown in actions next year and a possible pause in the near term. The Fed has also initiated reserve management as Wall Street anticipated, deciding to purchase short-term government bonds by the end of the year to address pressures in the money market.

On Wednesday, December 10, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range for the federal funds rate was lowered from 3.75% to 4.00% to 3.50% to 3.75%. This marks the third rate cut of 25 basis points this year. Notably, this is the first time since 2019 that the Fed's rate decision faced three dissenting votes.

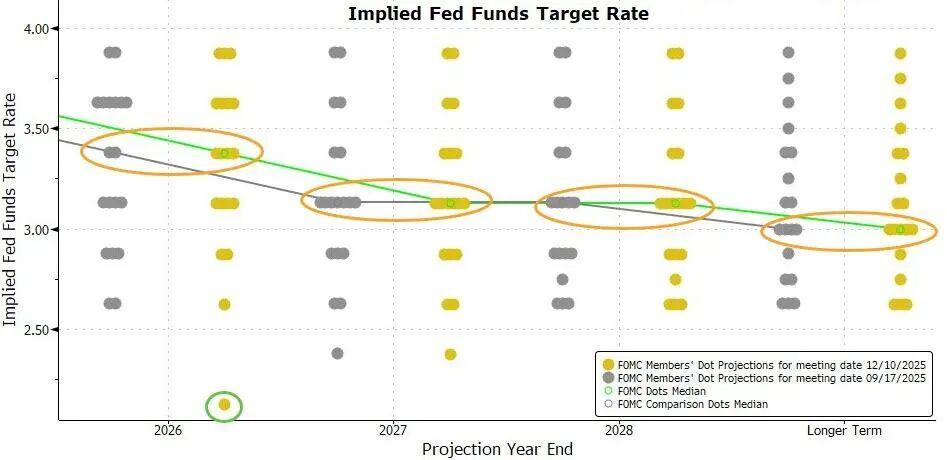

The dot plot released after the meeting shows that the Fed's rate path forecast remains consistent with the dot plot released three months ago, still expecting one 25 basis point rate cut next year. This indicates that the rate cuts next year will be significantly slower than this year.

As of Tuesday's close, CME tools indicated that the futures market expected an 88% probability of a 25 basis point rate cut this week, while the probability of at least another 25 basis point cut by June next year reached 71%. The probabilities for rate cuts in the January, March, and April meetings did not exceed 50%.

The predictions reflected by the CME tools can be summarized by the recently discussed term "hawkish rate cut." This means that the Fed will cut rates this time but simultaneously suggests a possible pause in actions afterward, indicating that there will be no further cuts in the near term.

Nick Timiraos, a senior reporter known as the "new Fed correspondent," stated after the Fed meeting that the Fed "implies that it may not cut rates again for the time being," due to a "rare" disagreement internally over whether inflation or the labor market is more concerning.

Timiraos pointed out that three officials opposed the 25 basis point cut at this meeting, making it the most divided meeting in recent years due to stagnant inflation and a cooling labor market.

Powell emphasized at the post-meeting press conference that he does not believe "the next move will be a rate hike" is anyone's basic assumption. The current position of interest rates allows the Fed to be patient and observe how the economy evolves next. He also stated that the data available currently indicates that the economic outlook has not changed, and the scale of bond purchases may remain high in the coming months.

01 The Federal Reserve has lowered interest rates by 25 basis points as expected, still anticipates one rate cut next year, and initiates RMP to purchase $40 billion in short-term bonds

On Wednesday, December 10, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range for the federal funds rate was lowered from 3.75% to 4.00% to 3.50% to 3.75%. This marks the third consecutive FOMC meeting where the Fed has cut rates, each time by 25 basis points, totaling a 75 basis point reduction this year, and a cumulative reduction of 175 basis points since the beginning of this easing cycle in September of last year.

Notably, this is the first time since 2019 that the Fed's rate decision faced three dissenting votes. Trump-appointed Governor Milan continued to advocate for a 50 basis point cut, while two regional Fed presidents and four non-voting members supported maintaining the current rate, resulting in a total of seven dissenters, reportedly the largest disagreement in 37 years.

A major change in this meeting's statement compared to the last one is reflected in the guidance on interest rates. Although the decision was made to cut rates, the statement no longer vaguely states that the FOMC will assess future data, evolving outlooks, and risk balances when considering further rate cuts, but rather more clearly considers the "magnitude and timing" of rate cuts. The statement was revised to:

"When considering the magnitude and timing of further adjustments to the target range for the federal funds rate, the (FOMC) committee will carefully assess the latest data, the evolving (economic) outlook, and the balance of risks."

The meeting statement reiterated that inflation remains slightly elevated, and the risks of employment have increased in recent months, removing the phrase "unemployment rate remains low," stating it has slightly risen as of September.

The addition of considering the "magnitude and timing" of further rate cuts is seen as an indication that the threshold for rate cuts has been raised.

Another significant change in this meeting's statement is the addition of a paragraph specifically mentioning the purchase of short-term bonds to maintain sufficient reserves in the banking system. The statement reads:

"The (FOMC) committee believes that reserve balances have fallen to adequate levels and will begin purchasing short-term government bonds as needed to maintain sufficient reserve supplies."

This effectively announces the initiation of what is called reserve management, to rebuild liquidity buffers in the money market. This is often necessary as market disruptions can occur at year-end, and banks typically reduce their activities in the repurchase market at year-end to support their balance sheets in response to regulatory and tax settlements.

The statement indicates that reserves have fallen to adequate levels, and short-term bond purchases will begin this Friday. The New York Fed plans to purchase $40 billion in short-term bonds over the next 30 days, with expectations that reserve management purchases (RMP) of short-term bonds will remain high in the first quarter of next year.

The median value of the interest rate forecasts released after the meeting shows that the Fed officials' expectations this time are identical to those from the last forecast released in September.

Fed officials currently also expect that after three rate cuts this year, there will likely be one 25 basis point cut each in the next two years.

Previously, many expected that the dot plot reflecting future rate changes would show a more hawkish stance from Fed officials. However, this time the dot plot did not reflect such a tendency and was instead more dovish compared to the last one.

Among the 19 Fed officials providing forecasts, seven now expect the rate to be between 3.5% and 4.0% next year, down from eight in the last forecast. This means that the number of officials expecting no rate cuts next year has decreased by one compared to the last meeting.

The economic outlook released after the meeting shows that Fed officials have raised their GDP growth expectations for this year and the next three years while slightly lowering the unemployment rate forecast for 2027, or the year after next, by 0.1 percentage points, with the unemployment rate expectations for other years remaining unchanged. This adjustment indicates that the Fed believes the labor market is more resilient.

At the same time, Fed officials have slightly lowered the PCE inflation and core PCE inflation expectations for this year and next year by 0.1 percentage points each. This reflects a slight increase in the Fed's confidence regarding a slowdown in inflation over the coming period.

02 Powell: The current interest rate allows for patient waiting, and does not believe "the next move will be a rate hike" is anyone's basic assumption

With today's rate cut, the Federal Reserve has cumulatively lowered the policy rate by 75 basis points over the past three meetings. Powell stated that this will help gradually bring inflation back to 2% after the impact of tariffs fades.

He mentioned that the adjustments made to the policy stance since September have placed the policy rate within various estimates of "neutral rates." The median forecast of the Federal Open Market Committee members indicates that the appropriate level for the federal funds rate by the end of 2026 is 3.4%, and by the end of 2027 is 3.1%, which remains unchanged from the September forecast.

Powell stated that currently, inflation risks are skewed to the upside, while employment risks are skewed to the downside, creating a challenging situation.

A reasonable basic judgment is that the impact of tariffs on inflation will be relatively short-lived, essentially a one-time increase in price levels. Our responsibility is to ensure that this one-time price increase does not evolve into a persistent inflation problem. However, at the same time, the risks of employment have increased in recent months, and the overall balance of risks has changed. Our policy framework requires maintaining a balance between the two aspects of our dual mandate. Therefore, we believe that it is appropriate to lower the policy rate by 25 basis points at this meeting.

Due to the stagnation in progress on inflation reduction, Fed officials had hinted before this week's decision that further rate cuts might require evidence of a weakening labor market. Powell stated at the press conference:

"Our current position allows us to be patient and observe how the economy evolves next."

In the Q&A session, in response to the question of whether "the current policy rate is closer to neutral, and whether the next adjustment is necessarily downward, or if the policy risks have truly become two-way," Powell responded that currently no one considers a rate hike as a basic assumption, and he has not heard such views. There are differing opinions within the committee: some members believe the current policy stance is appropriate and advocate for maintaining the status quo and further observation; others believe that another rate cut may be needed this year or next, and possibly more than once.

When committee members write down their judgments on the policy path and appropriate interest rate levels, expectations are mainly concentrated on a few scenarios: either maintaining the current level, making a small cut, or a slightly larger cut. Powell emphasized that the current mainstream expectations do not include a scenario of rate hikes.

Powell stated that as an independent decision, the Fed has also decided to initiate purchases of short-term U.S. government bonds, with the sole purpose of maintaining sufficient reserve supplies over a longer period, thereby ensuring that the Fed can effectively control policy rates. He emphasized that these issues are separate from the monetary policy stance itself and do not represent a change in policy direction.

He indicated that the scale of short-term U.S. Treasury purchases may remain high in the coming months, and the Fed is not strictly "worried" about the tight conditions in the money market, but rather that this situation has occurred slightly faster than expected.

Powell also stated that according to the New York Fed's announcement, the initial scale of asset purchases will reach $40 billion in the first month and may remain at a high level in the following months to alleviate anticipated short-term pressures in the money market. After that, the purchase scale is expected to decrease, with the specific pace depending on market conditions.

Regarding the labor market, Powell stated that although the official employment data for October and November have not yet been released, existing evidence indicates that both layoffs and hiring activities remain at low levels. At the same time, households' perceptions of job opportunities and businesses' feelings about hiring difficulties are both continuing to decline. The unemployment rate has continued to rise slightly to 4.4%, while employment growth has noticeably slowed compared to earlier this year. Additionally, the Fed no longer uses the phrase "the unemployment rate remains low" in its statement.**

In the subsequent Q&A session, Powell stated that after adjusting for the overestimation in employment data, employment growth may have slightly turned negative since April.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。