Author: Azuma, Odaily Planet Daily

On December 2, BlackRock, the world's largest asset management company, released its 2026 investment outlook report. Although the report has little direct relevance to the cryptocurrency market (only one page of the 18-page PDF mentions stablecoins), as the "king of global asset management," BlackRock outlines the current environment and variables of the global economy in the report. Given the increasingly close linkage between the cryptocurrency market and mainstream financial markets, this may provide some guidance on macro changes in the future. Additionally, BlackRock offers its allocation strategies in the new market environment, which may serve as a reference for users looking to expand their investment scope.

The full report is lengthy, and below, Odaily Planet Daily will attempt to summarize BlackRock's 2026 preparation guide.

"Mega Forces" Reshaping the World

BlackRock mentions at the outset that today's world is undergoing a structural transformation driven by several "mega forces," including geopolitical fragmentation, the evolution of the financial system (note from Odaily: this section mainly discusses stablecoins), and energy transition. Among these, the most significant transformative force is undoubtedly artificial intelligence (AI) — the development of AI is advancing at an unprecedented speed and scale, and the industry's shift from a "light capital" model to a "heavy capital" model is profoundly changing the investment environment.

In the current market structure, investors find it difficult to avoid making judgments about future market directions — this means there is no absolutely neutral position, and even broad index investing is not a neutral choice.

Dominant Force: AI

AI is currently the dominant mega force, driving U.S. stocks to new highs this year. In recent months, investors have increasingly worried whether an AI bubble is forming — the Shiller price-to-earnings ratio indicates that U.S. stock valuations have reached peak levels not seen since the internet bubble and the Great Depression of 1929.

Historically, significant transformation periods have often seen market bubbles, and this time may be no different, but bubbles typically only reveal clear signs after they burst. For this reason, BlackRock will focus on examining the matching of AI investment scale and potential returns in the report — this is both the main thread of BlackRock's tracking of the AI technology revolution and the core question the report aims to answer.

BlackRock believes that the AI theme remains a major driving force in the U.S. stock market, and thus the institution will maintain a risk appetite. However, the current market environment demands higher standards for active investment. Whether identifying winners in the current AI race or capturing opportunities when AI returns begin to spread in the future, active selection is crucial.

Core Market Question: Are "Front-Loaded Expenditures" and "Back-Loaded Returns" Matched?

Currently, the core question for market investors is how to assess the massive capital expenditures on AI and their potential revenue scale, and whether the two can be matched.

The development of AI requires front-loaded investments in computing power, data centers, and energy infrastructure, but the ultimate returns on these investments are delayed. The time lag between capital expenditures and final returns has prompted AI builders to begin using debt to bridge financing gaps. This front-loading of expenditures is necessary to achieve final returns but also creates a distinctly different investment environment — its core characteristics include:

- Higher leverage: Significant increases in public and private market credit issuance;

- Better capital costs: Massive borrowing drives up interest rates;

- Concentrated opportunities: Before AI returns spread to the broader economy, market gains remain highly concentrated in the tech sector;

- Increased space for active investment: When income truly spreads beyond technology, the space for active management and stock selection will significantly increase.

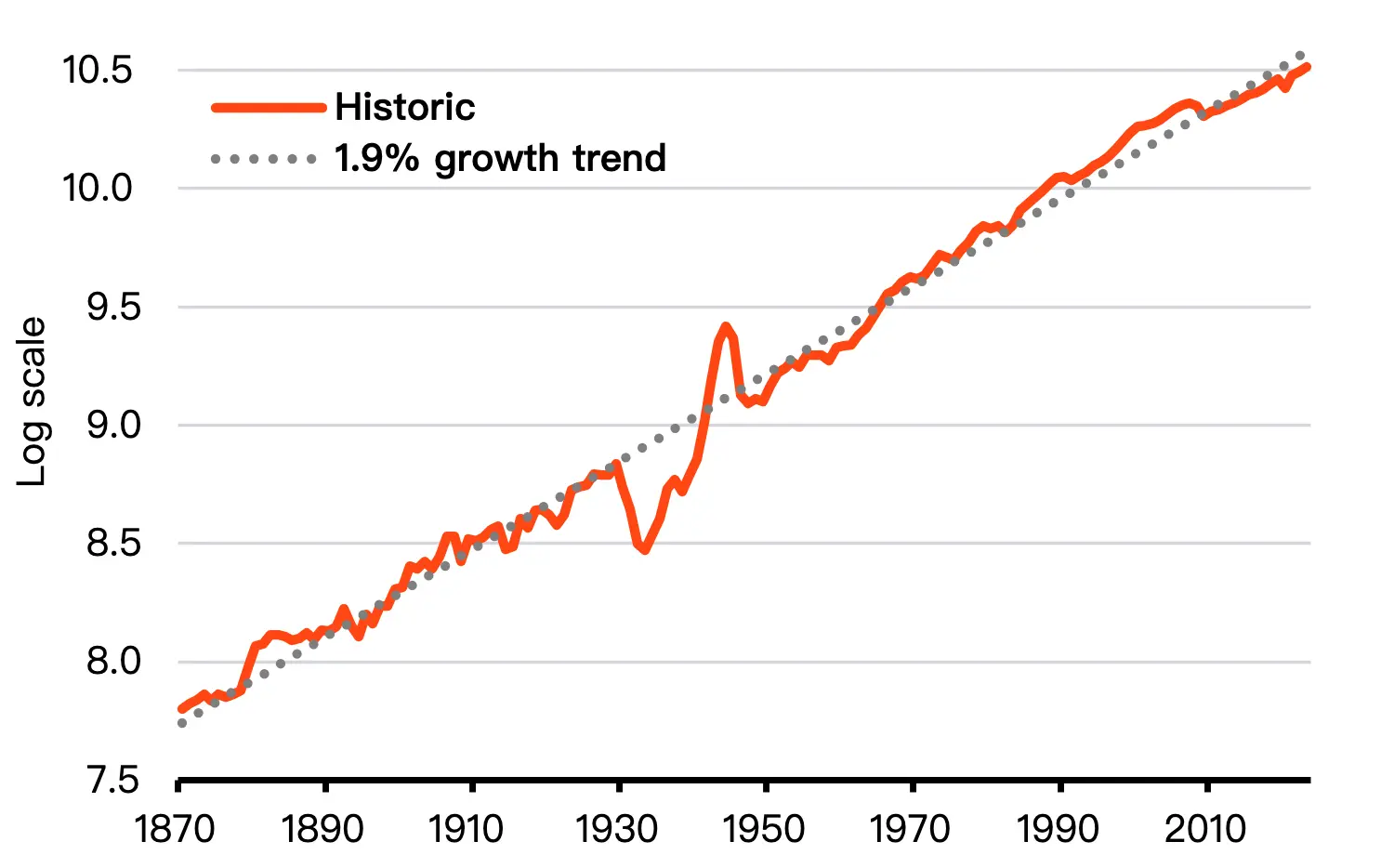

There is no definitive answer to whether expenditures and revenues are matched. BlackRock believes the final answer depends on whether U.S. economic growth can break through the long-term 2% trend line.

BlackRock expects that capital expenditures on AI will continue to support economic growth in 2026, with this year's investment contributing three times the historical average to U.S. economic growth. This "heavy capital" model's growth momentum is likely to continue into next year, allowing economic growth to remain resilient even if the labor market continues to cool.

But is this enough to push the U.S. economy beyond the long-term 2% trend line? Over the past 150 years, all major innovations — including the steam engine, electricity, and the digital revolution — have failed to achieve this breakthrough. However, AI may make it possible for the first time. The reason is that AI is not only an innovation in itself but also has the potential to accelerate other innovations. It goes beyond automating tasks; it can accelerate idea generation and scientific breakthroughs through self-learning and iterative improvement.

Three Core Themes

Micro Has Become Macro

The infrastructure construction of AI is currently dominated by a few companies, and their spending scale is already large enough to have macro-level impacts. Future overall revenues generated through AI may support this expenditure, but it remains unclear how much share the leading tech companies will capture.

BlackRock will maintain a risk appetite for the AI theme and overweight U.S. stocks (supported by strong earnings expectations. Even if individual companies cannot fully recoup their investments, overall capital expenditures are expected to yield returns), while also believing that now is an excellent time for active investment.

Rising Leverage

To cross the financing hump of "front-loaded investments and back-loaded returns" in AI development, long-term funding support is needed, making leverage inevitable. This process has already begun, as evidenced by recent large tech companies issuing bonds on a massive scale.

BlackRock expects corporations to continue to heavily utilize public and private credit markets. The expansion of borrowing in the public and private sectors may continue to exert upward pressure on interest rates. High debt repayment costs are one reason we believe the term premium (the compensation investors require for holding long-term bonds) will rise and push up yields. Based on this, we have shifted to underweight long-term U.S. Treasuries.

The Pitfalls of Diversification

Investment decisions made in the name of "diversification" have, in fact, become larger active bets aimed at avoiding the few forces currently driving the market. BlackRock's analysis shows that after excluding common drivers of stock returns such as value and momentum, the increasing share of U.S. stock market returns reflects a single, common driving source. Market concentration is intensifying, and breadth is narrowing. Attempting to diversify risk exposure to the U.S. or AI by turning to other regions or equal-weight indices essentially constitutes a larger active decision than before.

BlackRock believes that true diversification means shifting from a broad asset class or regional perspective to a more refined, flexible allocation and theme that can work across scenarios. Portfolios need a clear B plan and be ready to pivot quickly. In this environment, investors should reduce blind risk diversification and focus more on consciously taking on risk.

Views on Stablecoins

In summarizing the "mega forces" currently reshaping the global economy and financial markets, BlackRock emphasizes five directions: AI, geopolitical factors, the financial system, private credit, and energy infrastructure.

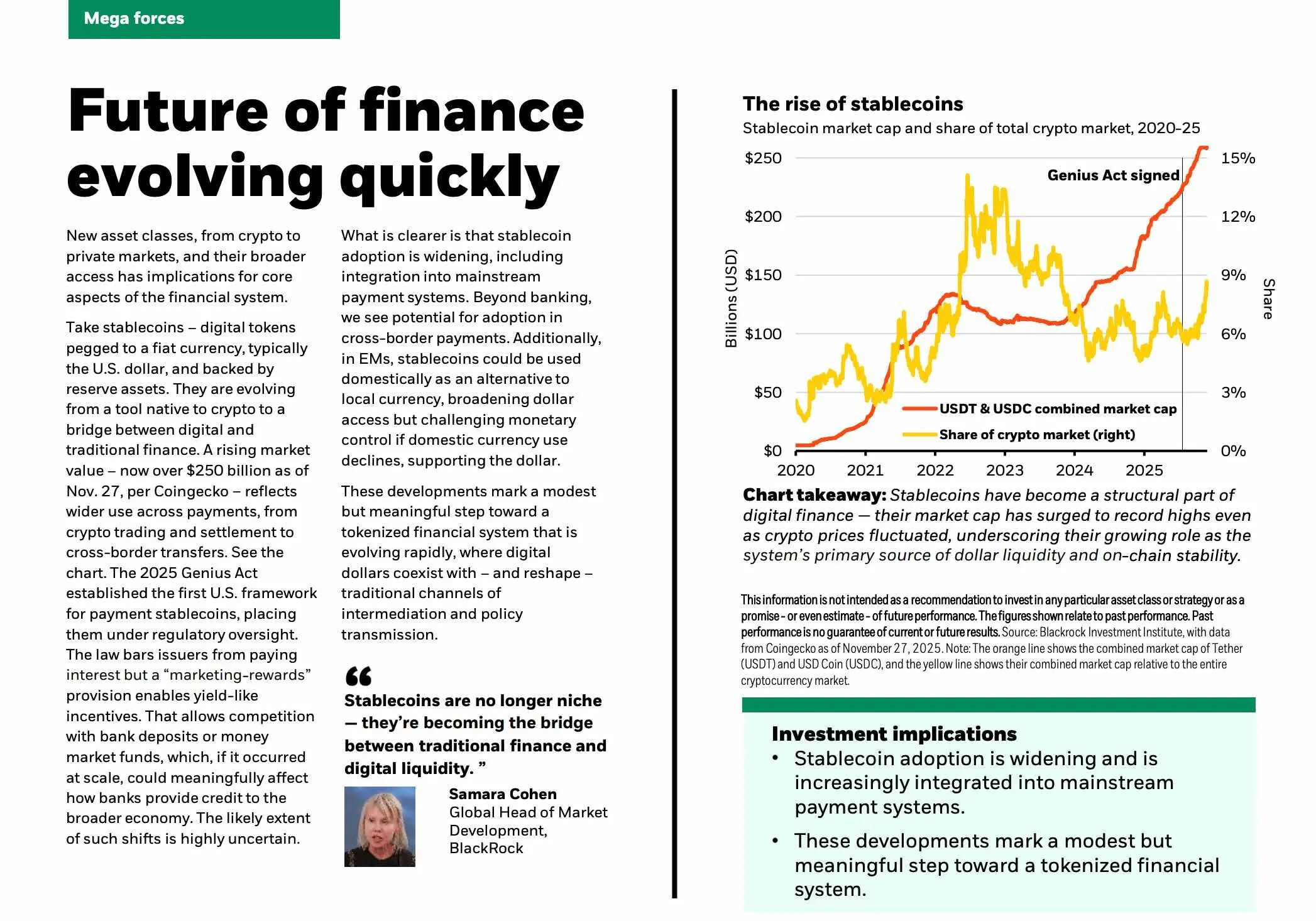

Among these, in the direction of the evolution of the financial system, BlackRock discusses the development of stablecoins as a unique case. The trend BlackRock observes is that the adoption of stablecoins is expanding and is further integrating into mainstream payment systems.

Stablecoins are expected to compete with bank deposits or money market funds, and if their scale is large enough, they could significantly impact how banks provide credit to the broader economy. Beyond the banking sector, BlackRock has also noted the potential for stablecoins in cross-border payments. In emerging markets, stablecoins can serve as an alternative to local currencies for domestic payments, expanding the use of the dollar, while a decline in local currency usage could challenge monetary policy control and, to some extent, support the dollar.

These changes mark a modest but important step toward a tokenized financial system. This system is rapidly evolving — digital dollars coexist with traditional channels, reshaping intermediaries and policy transmission methods.

BlackRock's Allocation Plan

Now, we come to the most important content: BlackRock provides its allocation strategies for various asset classes at the end of the report and analyzes its investment logic from both tactical and strategic perspectives. "Wisdom" is not as good as "following," and if one is unwilling to think independently, perhaps simply copying the homework is a better option.

In terms of strategic (over 5 years) and tactical (6-12 months) cycles, BlackRock's core allocation ideas are as follows.

On a strategic level:

- Portfolio Construction: As the winners and losers in AI become clearer, we tend to use scenario analysis to construct portfolios. We rely on private markets and hedge funds to obtain special returns, anchoring our allocation to "mega forces."

- Infrastructure Equity and Private Credit: We find infrastructure equity valuations attractive, and mega forces support structural demand. We remain optimistic about private credit but foresee differentiation in the industry — highlighting the importance of manager selection.

- Beyond Market Cap Weighted Benchmarks: We will conduct refined allocations in the public market. We prefer developed market government bonds outside the U.S. In terms of stocks, we are generally more optimistic about emerging markets than developed markets, but we will selectively invest within both. In emerging markets, we favor India, which is at the intersection of multiple transformative forces; in developed markets, we are optimistic about Japan, as moderate inflation and corporate reforms are improving its outlook.

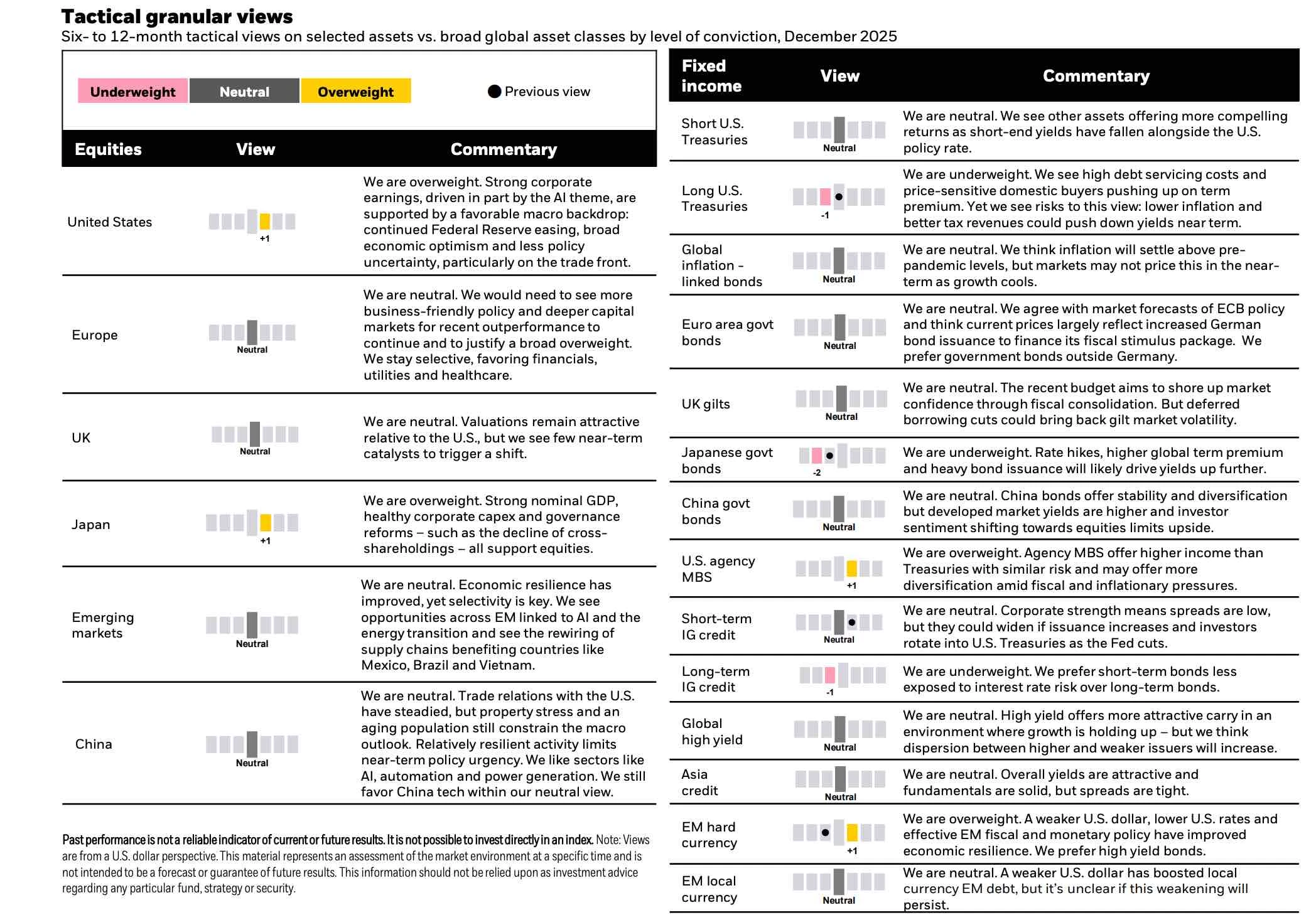

On a tactical level:

- Continued Optimism for AI: The strong earnings of large listed tech companies, robust profit margins, and healthy balance sheets will continue to support AI development. The Federal Reserve's continued accommodative policy through 2026 and reduced policy uncertainty reinforce our overweight position in U.S. stocks.

- Selective International Exposure: We are optimistic about Japanese stocks due to their strong nominal growth and progress in corporate governance reforms. We maintain selective investments in European stocks, favoring financials, utilities, and healthcare sectors; in fixed income, we prefer emerging markets due to their enhanced economic resilience and more robust fiscal and monetary policies.

- Evolving Diversification Tools: Given that long-term U.S. Treasuries can no longer provide portfolio stability, we recommend seeking "B plan" hedging tools and paying attention to potential shifts in sentiment. Gold, due to its unique driving factors, can serve as a tactical operation, but we do not view it as a long-term portfolio hedging tool.

In more detail, BlackRock explains its allocation ideas and reasons for stocks and fixed income across various markets as follows.

- U.S. Stock Market (Overweight): Strong corporate earnings (partly driven by the AI theme) combined with a favorable macro backdrop will support U.S. stock performance;

- European Stock Market (Neutral): We need to see more pro-business policies and deeper capital markets, temporarily favoring financials, utilities, and healthcare sectors;

- UK Stock Market (Neutral): Valuations remain attractive relative to the U.S., but there is a lack of catalysts for upward movement in the short term, so we maintain a neutral stance.

- Japanese Stock Market (Overweight): Strong nominal GDP, healthy corporate capital expenditures, governance reforms, etc., all favor Japanese stock performance.

- Chinese Stock Market (Neutral): We prefer tech stocks within a neutral range.

- Emerging Markets (Neutral): Economic resilience has improved, but careful selection is still needed. We will focus on opportunities related to AI, energy transition, and supply chain restructuring, such as in Mexico, Brazil, and Vietnam.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。