Author: Zhou, ChainCatcher

In the past year, beneath the fluctuating surface of the cryptocurrency market and the rapid evolution of narratives, there are only a handful of projects that have been truly validated and have generated real value.

However, when we put together the names of the most talked-about projects recently, whether it’s the high-performance public chains MegaETH and Monad, the popular stable yield protocol Ethena, or the pioneer in prediction markets Polymarket, the investment fund Dragonfly is almost always present in their early or key investment lists.

As a seasoned investor in the industry has said, Dragonfly is the biggest winner in this cycle.

Dragonfly's Investment Profile and Background: Driven by Trading Instinct

Dragonfly is a venture capital fund focused on the cryptocurrency space, founded by Feng Bo. As an early investor, Feng Bo has a deep understanding of exchange operations, liquidity needs, and trading scenarios, which has given Dragonfly a financial perspective from the very beginning. He has often mentioned that blockchain should not be simply understood as "a faster internet," but rather as a set of tools for rebuilding the financial stack.

Dragonfly's managing partner Haseeb Qureshi has repeatedly emphasized cross-cycle issues. He believes that the real tough challenges are not the rotation of tracks or narratives, but rather the systemic pain points that repeatedly emerge across bull and bear markets:

How can performance bottlenecks be overcome? Can on-chain clearing mechanisms withstand extreme pressure? Does the yield structure have long-term sustainability? How can data be transformed into tradable financial assets? How can institutional funds safely enter the market in the absence of systematic risk hedging?

These questions can easily be overshadowed by the fervent narratives of a bull market, only to be brought back to the table when the market returns to a state of calm.

Recently, Haseeb Qureshi pointed out in an article titled "Defending Exponential Growth" that the market often misjudges the value of Ethereum, Solana, and the new generation of L1s (like Monad and MegaETH) because it falls into the "error of linear thinking": they use traditional models such as P/E ratios and revenue metrics to evaluate blockchains, treating exponentially growing companies as stable businesses.

He firmly believes that the pricing logic of L1 projects is similar to that of biotechnology: with only a 1% to 5% chance of becoming the next Ethereum or Solana, it is rational to support their multi-billion dollar valuations (i.e., "probability premium"). Therefore, long-term belief is the true advantage in crypto investment that is often forgotten by most.

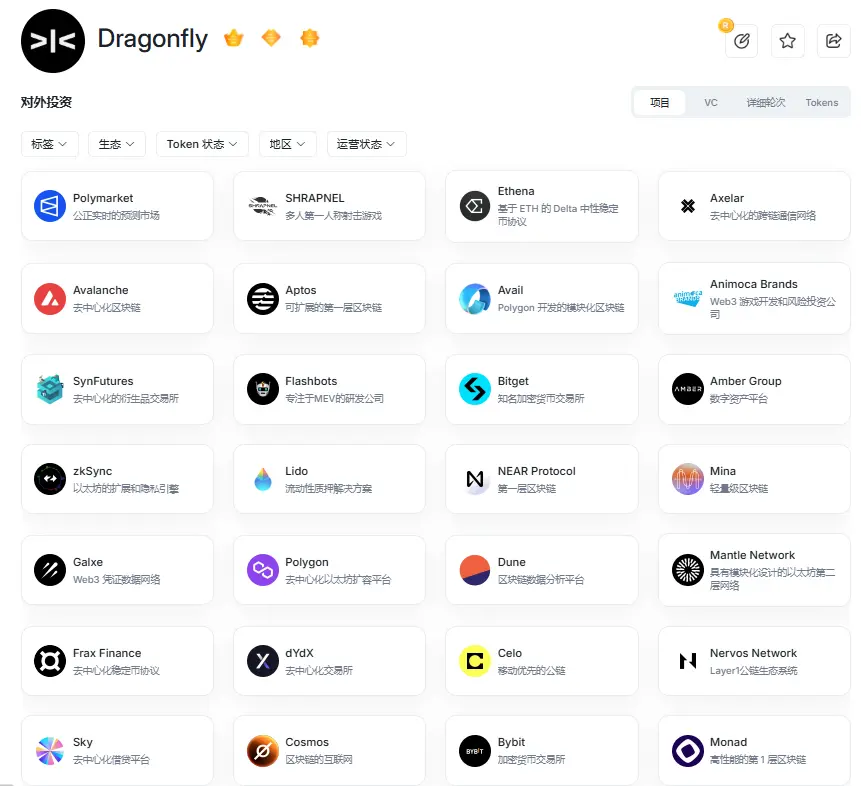

Looking back at Dragonfly's investment list over the past three years, a complete chain from underlying infrastructure to upper-layer applications can be clearly outlined:

- Public chains and scalability: Monad (2023 seed round), MegaETH (2024), Prodia (2024), Caldera (2023), etc.;

- Trading infrastructure: Lighter (2024), Level (2024), Orderly (2023 expansion), Bitget (2023 strategic round), etc.;

- Stable assets and yields: Ethena (2023-2024 multiple rounds), Pendle (2023), etc.;

- Data and tools: Kaito (2023 seed/A round), Polymarket (2024-2025 two rounds), etc.

This is not a strategy of casting a wide net, but rather a clear preference: prioritizing bets on long-term gaps across key links, and then seeking key pieces in each link.

This deep understanding is directly reflected in Dragonfly's investment preferences; they seem to rarely chase whether a project can achieve multiple growth in the short term, but are more concerned with whether this mechanism or product will still be valued by the industry five or even ten years later.

Core Differentiation Advantages and Challenges

The underlying logic of Dragonfly's success is supported by two interdependent pillars of differentiation.

First, Dragonfly has a strong secondary market trading team, which fundamentally distinguishes it from many purely primary market VCs. This layout began as early as 2019, managing over $1 billion in liquidity, creating a moat for its investment decisions. The L2 team can capture the real trading sentiment, capital flow, and narrative rotation in the market earlier; their sensitivity to liquidity, clearing pressure, and other indicators far exceeds that of traditional primary VCs, allowing them to feed real-world data back into primary decision-making. Haseeb Qureshi has publicly stated that the secondary market is not an exit, but a front line for investment.

Second, Dragonfly has invested in multiple trading platforms such as Bitget and Bybit, not only for the equity appreciation of the exchanges themselves but also to transform them into amplifiers for distributing stable assets and liquidity channels.

Through strategic positioning in trading platforms, Dragonfly has successfully integrated its supported stable assets (like Ethena's USDe) into the exchange system. Once stable assets can be used as collateral for exchanges or as the underlying assets for trading pairs, it will greatly stimulate user demand and purchases, rapidly expanding the issuance scale of stablecoins.

Indeed, the best time to evaluate a VC is not during a bull market, but when everyone is hesitant to make moves. Over the past year, the cooling of the crypto primary market has been evident. According to RootData statistics, there have been 1,058 financing events recorded in 2025 so far, a 46% decrease from the peak of 1,962 in 2022. In an environment where sentiment is retreating, most funds have actively slowed down, and some capital has simply shifted to AI or traditional technology.

In this context, competition for quality projects has intensified. Dragonfly not only needs to compete with well-funded veteran VCs like Paradigm for early star projects but also faces the liquidity impact from traditional financial investment giants entering the space; additionally, leading exchanges are also laying out vertical tracks through their own investment and incubation departments. This poses a severe test for Dragonfly's project acquisition, ecosystem control, and long-term holding capabilities.

Moreover, as cutting-edge technology fields like AI deeply integrate with crypto, whether an investment institution like Dragonfly, with a purely crypto background, can gain recognition from founders when acquiring cross-domain quality projects becomes a key challenge.

Conclusion

Previously, ChainCatcher interviewed several early crypto investors, mentioning in the article "The New Cycle and Old Rules of Crypto VC" that when many native crypto VCs are immersed in narrative-driven and short-term speculation, they face a mismatch between value capture and risk-bearing. The trading instinct, secondary market hedging ability, and emphasis on stablecoin cash flow demonstrated by Dragonfly precisely return to the old rules of long-cycle dollar funds: meticulous management of systemic risks and the search for sustainable income models with endogenous growth momentum.

From this perspective, Dragonfly's ability to become a winner in this cycle is a reflection of fund managers returning to traditional rules in the new crypto cycle. However, in the face of competition from traditional giants, traditional financial investment giants, and leading exchanges, as well as the professional challenges brought by the integration of crypto and cutting-edge technology, Dragonfly must think about how to extend this trading instinct to cross-domain technological infrastructure to maintain its long-term competitive advantage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。