作者:MarylandHODL

编译:深潮TechFlow

深潮总结:

-

金融主义者的统治模式:通过控制信贷、价格发现机制和货币传导渠道,金融主义者维持了一个以法币为核心的高度中央化体系。

-

主权主义者的反击:这一阵营由寻求货币独立的国家、厌倦银行系统的机构和企业,以及选择比特币作为财富储存手段的个人组成。他们认为比特币可以打破传统货币的垄断。

-

STRC 的意义:MicroStrategy 推出的 STRC 是一种创新的金融工具,它将法币储蓄转化为以比特币为抵押的真实收益,同时通过收紧比特币流通量强化了比特币的稀缺性。

-

摩根大通的反击:摩根大通迅速推出与比特币挂钩的合成金融产品,试图将比特币敞口重新拉回传统银行体系,却完全不涉及真实比特币。

-

历史的对照:文章将当前的比特币革命与1900-1920年美国工业时代的中央化重组相比较,指出这一次的基础是去中心化的比特币,而非以法币为核心的债务体系。

潜在影响:

-

对个人:比特币为普通人提供了一种保护财富免受通胀侵蚀的手段,同时也提供了绕过传统金融体系的可能性。

-

对社会:如果比特币被广泛采用,将重新调整货币与社会激励,可能引发一场深远的经济与伦理变革。

-

对金融体系:比特币和 STRC 等工具的崛起可能削弱传统金融机构的权力,导致货币基础的分裂与重组。

最重要的想法:

-

比特币不仅是一种资产,它还是一种打破传统货币垄断的工具。

-

STRC 是比特币生态系统的关键创新,它为比特币提供了一个合法且可扩展的资本市场入口。

-

当前的货币战争不仅是经济层面的博弈,更是关于未来社会结构与价值观的深刻较量。

-

真相一旦浮现,去中心化的比特币可能会迅速改变现有的金融与社会秩序。

深潮注:内容借助GPT4.0进行总结。

在我的上一篇文章中,我描绘了一个宏大的战场:围绕比特币展开的货币架构之争。而现在,是时候深入探讨其背后的运作机制了。

这篇后续文章旨在为你揭示那些具体的杠杆和结构性动态,以解释眼下正在发生的一切。我们将深入分析,探讨衍生品体系与新型金融产品如何融入这一新兴框架。

故事的全貌正在逐渐浮现:

比特币是战场,MicroStrategy是信号,而这场冲突则是“金融主义者”(Financialists)与“主权主义者”(Sovereignists)之间的正面较量。

这不仅仅是关于资产配置的争论,而是一个跨越数十年的转型初期阶段——就像社会深处的地壳板块在缓慢挤压,直至裂缝终将显现。

让我们走上这条断层线,直面真相。

I. 两大货币架构的碰撞

Matt @Macrominutes 为我们提供了迄今为止最有力的框架:

金融主义者(The Financialists)

自1913年那场隐秘的幕后交易以来,金融主义者便完全掌控了游戏规则。这一阵营包括:

-

美联储(Federal Reserve),

-

摩根大通(JPMorgan)及美国银行业集团,

-

欧洲银行世家,

-

全球主义精英,

-

日益增多的受控制政客,

-

以及一个基于衍生品的框架,支撑着全球资本流动已逾百年。

他们的权力建立在“合成货币信号”之上——即通过制造信贷、塑造预期、改变价格发现机制以及调控所有主要结算形式的能力。

欧元美元(Eurodollars)、掉期(swaps)、期货(futures)、回购协议(repo facilities)以及前瞻性指引(forward guidance)——这些都是他们的工具。他们的生存依赖于对抽象层的掌控,这些抽象层掩盖了底层货币基础的真实面貌。

主权主义者(The Sovereignists)

另一边是主权主义者——那些追求更少扭曲、更为稳健货币的人。这一群体并非总是步调一致,他们由朋友与对手、个人与国家、不同的政治倾向与伦理框架组成。

这一阵营包括:

-

追求货币独立的主权国家,

-

对银行业瓶颈感到沮丧的机构和企业,

-

以及选择退出基于信贷体系、转向自我主权的个人。

他们将比特币视为对抗集权货币权力的解药。即便许多人尚未完全理解其深远意义,但他们本能地意识到一个核心真理: 比特币打破了货币现实的垄断。

而这一点,是金融主义者所无法容忍的。

引爆点:转换轨道

当前的战争聚焦于转换轨道——即将法币转换为比特币,以及将比特币转换为信贷的系统。

掌控这些轨道的人,将掌控:

-

价格信号,

-

抵押品基础,

-

收益率曲线,

-

流动性路径,

-

以及最终从旧货币体系中崛起的新货币秩序。

@FoundInBlocks

这场战斗已不再是理论上的假设。它已经到来……并且似乎正在加速发展。

II. 上一次类似的变革(1900-1920)

我们曾经历过类似的情景……虽然当时的主角不是比特币,而是一场具有颠覆性的技术变革,它迫使美国的金融、治理和社会架构进行全面重建。

在1900年至1920年间,美国的工业精英们面临着:

-

民粹主义的愤怒,

-

反垄断的压力,

-

政治敌意,

-

以及其垄断体系可能崩溃的威胁。

他们的应对方式并非退缩,而是走向中央化。

这些努力的例子至今仍深刻影响着社会结构:

医疗领域

1910年的《弗莱克斯纳报告》(The Flexner Report)对医学教育进行了标准化,摧毁了延续几千年的传统替代疗法,并催生了洛克菲勒主导的医疗体系,这一体系成为现代美国制药业权力的基石。

教育

工业巨头资助了一套标准化的学校系统,旨在培养能够顺从中央化工业生产的工人。这一框架至今仍然存在,只是如今已从制造业优化为服务业。

食品与农业

农业企业的整合催生了一套廉价、高热量却低营养的食品体系,充斥着防腐剂和化学添加剂。这种体系在过去一个世纪里重塑了美国人的健康状况、激励机制以及政治经济结构。

货币架构

1913年12月,《联邦储备法案》(Federal Reserve Act)引入了欧洲的中央银行模式。

而在十个月前,联邦所得税(对年收入超过3,000美元的部分仅征收1%,约等于2025年的90,000美元)开创了一条永久性的收入渠道,用于偿还联邦债务。

以法币为基础的债务体系由此诞生。

这是美国权力的上一次重大转折——一次围绕中央化货币核心的静默重组,由一个独立于民选政府的机构控制,并由模糊不清的授权治理。

如今,我们正经历下一次转折。

但这一次,底层基础是去中心化的……且无法被腐化。

这个基础就是比特币。

参与者依然熟悉:一边是工业巨头的回声,另一边是杰斐逊式的民粹主义者。只是这一次,赌注更高。金融主义者拥有一个世纪以来构建的合成压制手段和叙事控制,而主权主义者阵营虽分散,却正在部署传统体系从未预料到的工具。

自1913年以来,这场斗争首次蔓延到了街头。

III. STRC:伟大的转换机制

今年7月,MicroStrategy 推出了 STRC(“Stretch”)。大多数观察者对此不以为然,认为这不过是 Saylor 的又一个怪异发明——一个古怪的企业借贷工具或短暂的注意力实验。

然而,他们忽视了 STRC 的真正意义。

“STRC 是资本市场的伟大转换机制。它是第一个关键的激励重塑工具。”

STRC 是首个可扩展且符合监管要求的机制,它:

-

存在于现有的金融体系之内,

-

原生地与资本市场对接,

-

将收益匮乏的法币储蓄转化为以比特币为抵押的真实回报。

当 Saylor 将 STRC 称为“MicroStrategy 的 iPhone 时刻”时,许多人对此不屑一顾。

但从转换轨道的角度来看呢?

STRC 可能实际上是 比特币的 iPhone 时刻——即比特币价格动态达成反身性均衡的节点,为新的货币秩序的揭幕奠定了稳定基础。

STRC 连接了:比特币这一资产→ 抵押品基础→ 由比特币驱动的信贷与收益。

这之所以重要,是因为在通胀和货币贬值的体系中,价值会悄然从毫无戒心的人们手中被抽取。而那些了解当前局势的人,可以接触到**“无瑕疵的抵押品”**——一种能够跨越时间与空间储存和保护他们生命能量与积累财富的方式。

最终,当信任崩塌时,人们会本能地寻求真相……而比特币代表着数学真理。(如果这一点尚未引起你的共鸣,这仅意味着你还没有真正开始深入探索这条“兔子洞”。)

当信任崩塌时,人们会寻求真相……而比特币正是数学真理的化身。而 STRC 将这一原则转化为一个金融引擎。

它不仅仅提供收益,它将被压抑的法币流动性引导至一个螺旋式上升的比特币抵押循环中。

金融主义者感受到了威胁。他们中的一些人甚至可能已经意识到,这对他们剥削性体系的威胁有多大。

他们隐约察觉到,如果这个循环实现规模化,会发生什么。

IV. 金融主义者最害怕的正反馈循环

当美国试图通过“经济增长”摆脱财政主导困境(通过货币扩张和收益率曲线控制)时,储户将会在通胀复苏的情况下追逐真实回报。

然而,传统渠道无法提供这些回报:

-

银行做不到,

-

债券做不到,

-

货币市场基金也做不到。 但比特币可以。

MicroStrategy 构建了一个企业级的货币循环:

-

比特币升值

-

MicroStrategy 的抵押品基础得到加强

-

借贷能力扩大

-

资本成本降低

-

STRC 提供了极具吸引力的比特币支持收益

-

资本从法币流向 → STRC → 比特币抵押品

-

比特币的流通量收紧

-

循环在更高的基础上重复

这就是“稀缺引擎”(Scarcity Engine)——一个随着法币削弱而不断增强的系统。

法币压抑的回报率与比特币的结构性内部收益率(IRR)之间的套利空间(ARB)正成为一个货币黑洞。

如果 STRC 实现规模化,金融主义者将面临失去对以下领域控制的风险:

-

利率,

-

抵押品稀缺性,

-

货币传导机制,

-

流动性渠道,

-

以及资本成本本身。

这便是首次攻击的背景所在。

V. 协同打压行动

(这是模式,而非确凿证据。)

在比特币于10月6日达到峰值后:

-

BTC 从 126k 下跌至低位 80k,

-

MSTR 从 360 美元区间下跌至 100 美元高位区间,

-

STRC 在加密市场的广泛动荡中保持平稳,

-

直到 11 月 13 日,突然出现流动性真空,STRC 才出现裂痕。

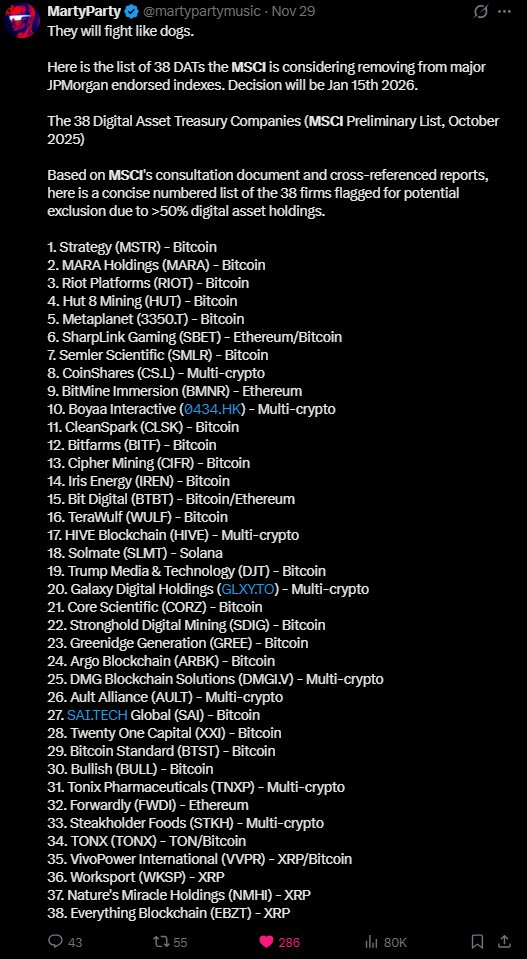

几天后,MSCI 的“下市”叙事再次被提出,目标直指 MSTR。

这一系列事件看起来并不自然。它带有明显的迹象,表明这是对转换轨道的首次协同打击。(再强调一次,这是模式,而非确凿证据,但这个模式很难被忽视。)

当 STRC 保持平稳时,它展现了一个正常运行的比特币抵押信贷引擎可能会成为什么样子。

尽管前两周的数据规模较小,但其意义却极为重大:

-

11月3日–9日:从 64 亿美元的交易量中购买了 2620 万美元的 BTC;

-

11月10日–16日:从 83 亿美元的交易量中购买了 1.314 亿美元的 BTC。

别把注意力放在具体的美元数字上,真正重要的是其运作机制。

将这些机制规模化后,金融主义者的反应就不言自明了。

如果 STRC 实现规模化:

-

货币市场将失去相关性,

-

回购市场(repo)将不再占据主导地位,

-

衍生品价格压制机制将被削弱,

-

银行制造的收益率将崩塌,

-

资本流动将绕过银行系统,

-

国库将失去对国内储蓄的控制,

-

美元的货币基础将开始分裂。

MicroStrategy 推出的不仅仅是一个产品,它是在构建一条新的转换轨道。

而摩根大通(JPMorgan)则迅速作出回应。

VI. 摩根大通的反击:合成阴影

(这是模式,而非确凿证据。)

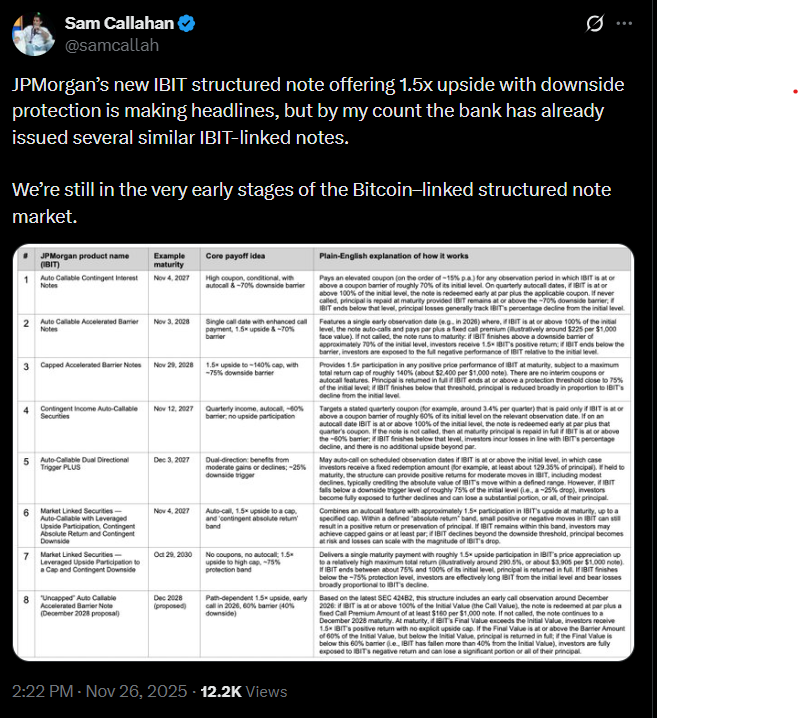

在一个因假期缩短的交易周中——理想的安静结构调整时间——摩根大通高调发布了一款“与比特币挂钩”的结构性票据(structured note)。

其设计看起来像是一种“坦白”:

-

与 IBIT 挂钩,而非现货价格,

-

以现金结算,

-

不购买任何比特币,

-

不减少比特币的流通量,

-

上行收益受限,

-

凸性收益由银行保留,

-

下行风险转嫁给客户。

然而,正如 @Samcallah 所揭示的那样,其真正的深意更加险恶:摩根大通最近推出了一系列与 IBIT 挂钩的结构性产品。

这不是创新,这只是中央化的老套路——将收益留给设计者,将损失社会化。

这是一次“重新捕获”的尝试——试图将比特币的敞口重新拉回银行体系之内,而完全不接触真实的比特币。

这正是“纸黄金”体系的重生。在这种体系中:“合成阴影” = 无法检测的纸比特币数量。

而相对而言:

-

STRC 需要真实的比特币,

-

STRC 收紧了比特币的流通量,

-

STRC 强化了“稀缺引擎”。

两个产品,两种范式,一个属于未来,一个属于过去。

VII. 为什么 MicroStrategy 成为首个目标

(这是模式,而非确凿证据。)

MicroStrategy 威胁到了金融主义者的模式,因为它是:

-

拥有最大公开比特币资产负债表的公司,

-

第一家将比特币作为储备资产的企业“银行”,

-

唯一一家在机构规模上将比特币抵押货币化的公司,

-

唯一一家提供比特币抵押真实收益的受监管实体,

-

唯一一家绕过所有合成敞口渠道的桥梁。

这也解释了针对它的压力模式:

MSCI 对比特币持仓较重的公司进行惩罚——详见 @martypartymusic 的帖子:

(注意,他们巧妙地避开了 Coinbase、特斯拉(Tesla)或 Block。)

-

信用评级机构(Credit Rating Agencies,华尔街的产物)勉强对 MicroStrategy 的优先股进行评级,却又“巧妙地”将目标转向 Tether,两者都意在削弱稳健货币作为合法抵押品的地位。

-

关于摩根大通(JPMorgan)阻碍 MicroStrategy 股票转让的传言。

-

与 MSCI 相关报道同步出现的 BTC 和 MicroStrategy(MSTR)股价下跌。

-

突然引发政策制定者的关注,既有正面也有负面。

-

银行争相重建合成比特币敞口,以将需求拉回传统体系内。

MicroStrategy 遭到攻击并不是因为迈克尔·塞勒(Michael Saylor)本人,而是因为它的资产负债表架构打破了金融主义者的体系。

这依然是一个模式(并非确凿证据)……但这些信号却有着惊人的相似性。

VIII. 主权层——最终的归宿

放眼全局,整体架构逐渐清晰:

-

稳定币(Stablecoins)将主导收益曲线的前端,

-

比特债券(BitBonds)将稳定曲线的长端,

-

比特币储备将成为主权资产负债表的核心锚点。

MicroStrategy 是资本市场层面的比特币储备银行的原型。

主权主义者(Sovereignists)或许未明确表达这一计划,但他们正逐步向这一方向靠拢。

而 STRC 正是这一进程的上游催化剂。

因为 STRC 实际上并不是一种债务或权益产品。STRC 是一种“越狱机制”。

它是一种衍生品,能够引发剧烈的化学反应,让法币在稀缺性中逐渐溶解。

它打破了对以下领域的垄断:

-

收益,

-

抵押品,

-

以及货币传导机制。

更重要的是,它从传统体系内部发起,通过利用体系本身的监管框架作为杠杆实现这一目标。

IX. 我们所处的时刻

此刻,法币内嵌的贬值逻辑已成为简单且无法否认的数学事实……并且正被越来越多的人所察觉。

如果比特币被主权主义者作为工具加以利用,金融主义者的架构可能会像柏林墙一样迅速崩塌。

因为最终,真相一旦得以浮现,总会迅速战胜一切。

比特币是这场战斗的战场。

MicroStrategy 是这场战斗的信号。

STRC 是连接两者的桥梁。

这场战争(公开、可见、无可否认)是围绕法币与比特币之间转换轨道的战争。

这场战争将定义整个21世纪。

而在过去110年间的首次,两方都开始亮出底牌。

活在这样的时代,何其非凡。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。