They mostly revolve around two things: trading and attention.

Author: Viee, Core Contributor of Biteye

After the bubble bursts, what is the survival bottom line for crypto projects?

In an era where anything could be told as a story and anything could be overvalued, cash flow seemed unnecessary. But now, things are different.

VCs are retreating, and liquidity is tightening. In such a market environment, whether one can make money and whether there is positive cash flow have become the first filters to test a project's fundamentals.

In contrast, some projects rely on stable income to weather the cycles. According to DeFiLlama data, by October 2025, the top three crypto projects by revenue can generate $688 million (Tether), $237 million (Circle), and $102 million (Hyperliquid) in a month.

In this article, we want to talk about these projects with real cash flow. They mostly revolve around two things: trading and attention. The two most essential sources of value in the business world are no exception in the crypto space.

01 Centralized Exchanges: The Most Stable Revenue Model

In the crypto space, the fact that "exchanges are the most profitable" has never been a secret.

The main sources of income for exchanges include trading fees, listing fees, etc. Take Binance, for example; its daily spot and futures trading volume has long accounted for 30-40% of the entire market. Even in the quietest year of 2022, its annual revenue was $12 billion, and during the bull market of this cycle, revenue will only increase. (Data from CryptoQuant)

In summary: as long as there are trades, exchanges can generate income.

Another example is Coinbase, which, as a publicly traded company, has clearer data disclosure. In the third quarter of 2025, Coinbase reported revenue of $1.9 billion and a net profit of $433 million. Trading revenue is the main source, contributing over half, while the remaining income comes from subscriptions and service fees. Other leading exchanges like Kraken and OKX are also steadily making profits, with Kraken reportedly generating about $1.5 billion in revenue in 2024.

The biggest advantage of these CEXs is that trading naturally brings in revenue. Compared to many projects still worrying about whether their business models can work, they are already charging for services in a tangible way.

In other words, in this phase where storytelling is becoming increasingly difficult and hot money is dwindling, CEXs are among the few players that can survive without financing, relying solely on themselves.

02 On-Chain Projects: PerpDex, Stablecoins, Public Chains

According to DefiLlama data as of November 27, 2025, the top ten on-chain protocols by revenue over the past 30 days are shown in the image below.

From this, we can see that Tether and Circle firmly occupy the top positions. With the interest rate spread behind USDT and USDC, these two stablecoin issuers earned nearly $1 billion in a month, followed closely by Hyperliquid, which remains the "most profitable derivatives protocol on-chain." Additionally, the rapid rise of projects like Pumpfun further validates the old logic that "trading coins is not as good as selling coins, and selling shovels is not as good as selling tools" still works in the crypto industry.

Notably, dark horse projects like Axiom Pro and Lighter, although their overall revenue scale is not large, have already established positive cash flow paths.

2.1 PerpDex: The Real Earnings of On-Chain Protocols

This year, the standout PerpDex is Hyperliquid.

Hyperliquid is a decentralized perpetual contract platform that uses an independent chain and has its own matching engine. Its explosion in performance was quite sudden, achieving a trading volume of $383 billion in just one month in August 2025, with revenue reaching $106 million. Furthermore, the project allocates 32% of its revenue for buying back and burning platform tokens. According to a report from @wublockchain12 yesterday, the Hyperliquid team unlocked 1.75 million HYPE ($60.4 million), with no external financing and no selling pressure, as protocol revenue is used to buy back tokens.

For an on-chain project, this is already close to the revenue efficiency of CEXs. More importantly, Hyperliquid genuinely earns money and then returns it to the token economic system, establishing a direct connection between protocol revenue and token value.

Now let's talk about Uniswap.

In recent years, Uniswap has been criticized for benefiting token holders without giving them any returns, as it charges a 0.3% fee on each transaction but gives it all to LPs, leaving UNI holders with nothing.

Until November 2025, Uniswap announced plans to initiate a protocol fee-sharing mechanism and use part of its historical revenue to buy back and burn UNI tokens. According to estimates, if this mechanism had been implemented earlier, the funds available for burning in just the first ten months of this year would have reached $150 million. Upon the announcement, UNI surged 40% in a single day. Although Uniswap's market share has dropped from a peak of 60% to 15%, this proposal could still reshape the fundamental logic of UNI. However, after this proposal was released, @EmberCN detected that an investment institution holding UNI (possibly Variant Fund) transferred millions of $UNI ($27.08 million) to Coinbase Prime, suspected to be for price manipulation.

Overall, the previous DEX model relying on airdrops and hype has become increasingly difficult to sustain. Only those projects that genuinely generate stable income and complete a business loop are likely to retain users.

2.2 Stablecoins and Public Chains: Earning Through Interest

Beyond trading-related projects, there is also a group of infrastructure projects that continue to attract capital. Among them, the most typical are stablecoin issuers and frequently used public chains.

Tether: The Giant That Keeps Printing Money

The company behind USDT, Tether, has a very simple revenue model: every time someone deposits $1 in exchange for USDT, Tether uses that money to buy government bonds, short-term notes, and other low-risk assets to earn interest, which goes to them. With global interest rate hikes, Tether's earnings have also soared. In 2024, net profit reached $13.4 billion, and it is expected to exceed $15 billion in 2025, approaching traditional financial giants like Goldman Sachs. @Phyrex_Ni recently stated that Tether's rating was downgraded but remains a cash cow, earning over $130 billion in collateral through U.S. Treasury bonds.

On the other hand, Circle, the issuer of USDC, although its circulation scale and net profit are slightly smaller, also exceeded $1.6 billion in total revenue for the entire year of 2024, with 99% coming from interest income. It should be noted that Circle's profit margin is not as exaggerated as Tether's, partly due to revenue sharing with Coinbase. In short, stablecoin issuers are like money printers; they do not rely on storytelling for financing but on users' willingness to deposit their money with them. In a bear market, such savings-type projects tend to thrive. @BTCdayu also believes that stablecoins are a good business, printing money globally while earning interest, and sees Circle as the king of stablecoin profits.

Public Chains: Eating Through Traffic, Not Incentives

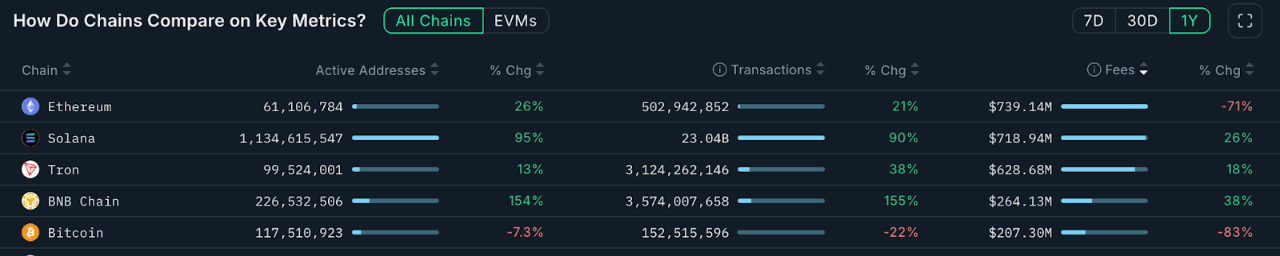

Looking at mainnet public chains, the most direct monetization method is gas fees. The data in the chart below comes from Nansen.ai:

In the past year, if we only look at the total transaction fee revenue of public chains, we can more clearly see which chains have truly converted usage value. Ethereum's annual revenue was $739 million, still the primary source of income, but it saw a 71% year-on-year decline due to the Dencun upgrade and L2 diversion. In contrast, Solana's annual revenue reached $719 million, a 26% year-on-year increase, significantly boosted by the Meme and AI Agent trends, leading to increased user activity and interaction frequency. Tron generated $628 million in revenue, an 18% year-on-year increase. Bitcoin's annual revenue was $207 million, mainly affected by the decline in inscription trading popularity, showing a significant overall drop.

BNB Chain's annual revenue reached $264 million, a 38% year-on-year increase, ranking first in growth among mainstream public chains. Although its revenue scale is still lower than ETH, SOL, and TRX, combined with its trading volume and active address growth, it shows that its on-chain usage scenarios are expanding, and its user structure is becoming more diverse, indicating strong user retention and real demand. This stable growth in revenue structure also provides clearer support for the continuous evolution of its ecosystem.

These public chains are like "water sellers"; no matter who is mining gold in the market, they will always need their water, electricity, and roads. Such infrastructure projects, while lacking short-term explosive power, excel in stability and cyclical resistance.

03 Business Around KOLs: Attention Can Also Be Monetized

If trading and infrastructure are the overt business models, then the attention economy is the "hidden business" in the crypto world, such as KOLs, agencies, etc.

Since the beginning of this year, crypto KOLs have formed a center of attention and traffic.

Active influencers on X, Telegram, and YouTube leverage their personal influence to develop diversified revenue models: from paid promotions, community subscriptions, to course monetization, and a series of traffic businesses. According to industry rumors, mid-tier and top-tier crypto KOLs can earn $10,000 a month from promotions. At the same time, audience expectations for content quality are also rising, so KOLs that can weather the cycles are often those creators who gain user trust through professionalism, judgment, or deep companionship. This has also invisibly driven the content ecosystem to shuffle during the bear market, with the restless being eliminated and long-termists remaining.

It is worth noting the third layer of attention monetization, KOL financing rounds. This makes KOLs direct participants in the primary market: acquiring project tokens at a discount, taking on traffic exposure tasks, and exchanging for "early stakes brought by influence," which directly bypasses VCs.

Around KOLs themselves, a whole set of matching services has also emerged. Agencies are beginning to play the role of traffic intermediaries, matching projects with suitable KOLs, making the entire process increasingly resemble an advertising placement system. If you are interested in the business models of KOLs and agencies, you can refer to our previous long article "Unveiling KOL Rounds: A Wealth Experiment Wrapped in Traffic" (https://x.com/BiteyeCN/status/1986748741592711374) to gain deeper insights into the real interest structures behind them.

In summary, the attention economy is essentially a form of trust monetization, and trust is even scarcer in a bear market, making the monetization threshold even higher.

04 Conclusion

Projects that can maintain cash flow even in the crypto winter mostly validate the two cornerstones of "trading" and "attention."

On one hand, whether centralized or decentralized trading platforms, as long as there are stable user trading behaviors, they can obtain continuous income through fees. This direct business model allows them to be self-sufficient even when capital exits. On the other hand, KOLs focusing on user attention monetize user value through advertising and services.

In the future, we may see more diverse models, but regardless, those projects that accumulated real income during poor market conditions will have a better chance of leading new developments. In contrast, some projects that rely solely on storytelling and lack the ability to generate revenue may eventually be left unnoticed, even if they experience short-term hype.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。