撰文:Dave

摘要

HYPE 实施了强劲的回购机制(截至目前约 13 亿美元,约占 2025 年全部代币回购的 46 %),并且拥有稳健的收入支撑。相信几乎所有研究员对这个代币都是非常看好的,但是今天我要唱一个反调:若干结构性和宏观因素让 HYPE 成为一笔不那么「甜」的交易

1,回购 VS 解锁

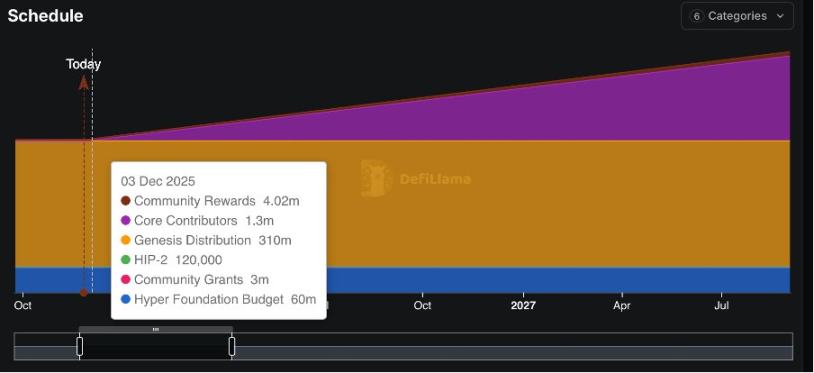

回购一直是支撑 HYPE 价格的主要机制,许多 KOL 也提及这一点。然而,未来的代币解锁同样不容忽视。

从 2025‑11‑29 起,将解锁 3.73 亿 HYPE(约占总供应的 37 %),每日约 21.5 万 HYPE,解锁期为 24 个月。按当前价格计算,这将产生约 2 亿美元 / 月 的潜在供应压力

与此相比,2025 全年回购总额为 6.4464 亿美元,月均约 6550 万美元,回购资金来源于 97 % 的交易手续费。每日回购只能覆盖 25‑30 % 的每日解锁量。即使收入继续强劲增长,回购能力也难以吸收如此规模的解锁,必然导致价格压缩。

2,市场周期风险 & 估值脆弱性

当前几乎所有对 HYPE 的估值(包括广为引用的 P/E,其实是 ttm 的计算模式)都基于过去几个月的强劲数据, 牛市。但是作为经历过 2022 年熊市的韭菜,我认为宏观周期因素是必须纳入的关键变量。至少在可见的未来,熊市的概率并不低于牛市,核心假设和指标均受到挑战。

2.1 现状速览

当前收入指标表现确实很强劲:

-

·年化收入:12 亿美元

-

·全稀释估值(FDV):316 亿美元

-

·流通供应:200 亿美元(数据来源:Defillama)

-

· TTM PE 约为 16.67

·2024‑12 至 2025‑08 月度复合收入增长为 +11.8 %

这些数据相较于大多数美股公司看似诱人,但问题也在这里——在即将到来的熊市中, HYPE 如同可能面临比其他项目更严重的戴维斯双杀情况

2.2 熊市情景与戴维斯双杀

回测来看。永续合约交易量 与 BTC 价格 的相关系数 > 0.8(跨周期)

-

·2022 年熊市:永续合约交易量相较 2021 年峰值下跌 70 %。

-

·收入依赖:91 % 来自交易手续费,极易受到交易量冲击。

-

·提现延迟:HLP 金库需 4 天锁定,中心化交易所提现需 24‑48 小时

这是经典戴维斯双杀构造:加密资产价格下跌 → 交易量 & 手续费下降,同时估值倍数收缩 → 形成恶性循环。

$HYPE 的估值多数基于过去一年牛市的表现。然而在 Web3 领域,收入具有高度的周期性。我们也应相应地调整基本假设。

与美股不同,拉长来看标普 2008 年以来几乎可以看作平滑增长,但是加密货币市场依然呈现暴涨暴跌的周期特征。虽然宏观市场因素确实难以量化出来,但能否把握这种周期性,正是区分圈内优秀交易员和顶尖交易员的地方。

2.3 加密原生指标

我们知道,即使在传统金融中,市盈率(PE)也非唯一指标,还有比如 EV/EBITDA P/FCF ROIC,对于 HYPE 而言,一些其他重要指标也需要纳入考虑。包括:

-

TVL:43 亿美元,但是较 2025.09 峰值 61 亿美元呈明显下降趋势。

-

P/TVL:2.0( Solana 1.5)。

市场份额:市场份额已从 80 % 峰值降至 70 %,credit to 黑马 Aster。当然还有 lighter edgex 等一堆。

3,傻逼 Dave fud HYPE?也不是那么绝对

尽管我目前不赞同投资 HYPE,但我的看空立场只适用于中期视角。如果我们着眼于 2-5 年的长期投资周期,HYPE 绝对值得投资。这是不需多解释的。

一个完整的投资决策取决于多种因素,包括仓位占比、回撤承受度和投资 目标等等。

熊市里所有项目都承压,有什么出路呢?

预测市场目前可能有更高的性价比, @a16z 研究说预测市场和大盘相关性只有 0.2‑0.4,相较于 $HYPE 的> 0.8。

而且 2026 年将迎来多场高关注度事件,比如世界杯(梅罗等大量老人最后一届)、美国中期选举、冬奥会、英雄联盟全球赛等等,还有相当多游戏电影动漫发行,比如 GTA6, 可以预见将会迎来博彩大年。相当多场外资金可能转入这项盘子,对纳指可能都有影响。所有中期顺势而为的话,prediction market 类项目值得关注

结语:

从中期时间维度来看,大规模解锁、收入周期性以及宏观市场环境转变的风险大于当前估值所带来的回报。本文不构成任何投资建议,所有投资均伴随风险。NFA, DYOR 。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。