The market is no longer driven by fundamentals.

Written by: arndxt

Translated by: Chopper, Foresight News

If you have read my previous articles on macro dynamics, you may have already caught a glimpse of the situation. In this article, I will break down the true state of the current economy: the only engine driving GDP growth is artificial intelligence (AI); all other areas, such as the labor market, household finances, affordability, and asset accessibility, are on a downward trend; and everyone is waiting for a "cyclical turning point," but there is currently no such "cycle."

The truth is:

- The market is no longer driven by fundamentals

- AI capital expenditure is the only pillar to avoid a technical recession

- A wave of liquidity will arrive in 2026, yet market consensus has not even begun to price this in

- The wealth gap has become a macro resistance forcing policy adjustments

- The bottleneck for AI is not GPUs, but energy

- Cryptocurrency is becoming the only asset class with real upside potential for the younger generation, giving it political significance

Do not misjudge the risks of this transformation and miss the opportunity.

Decoupling of Market Dynamics and Fundamentals

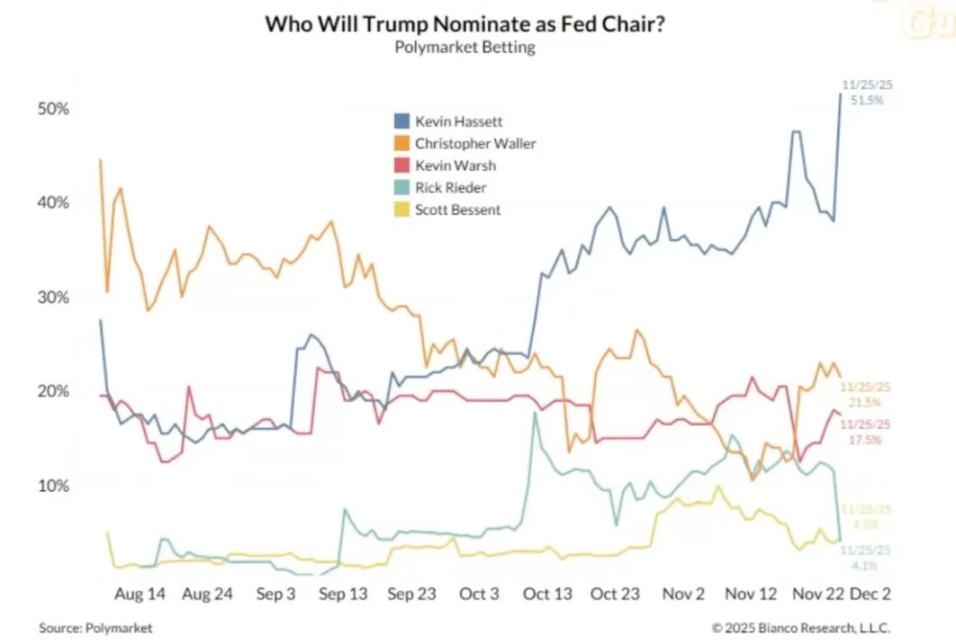

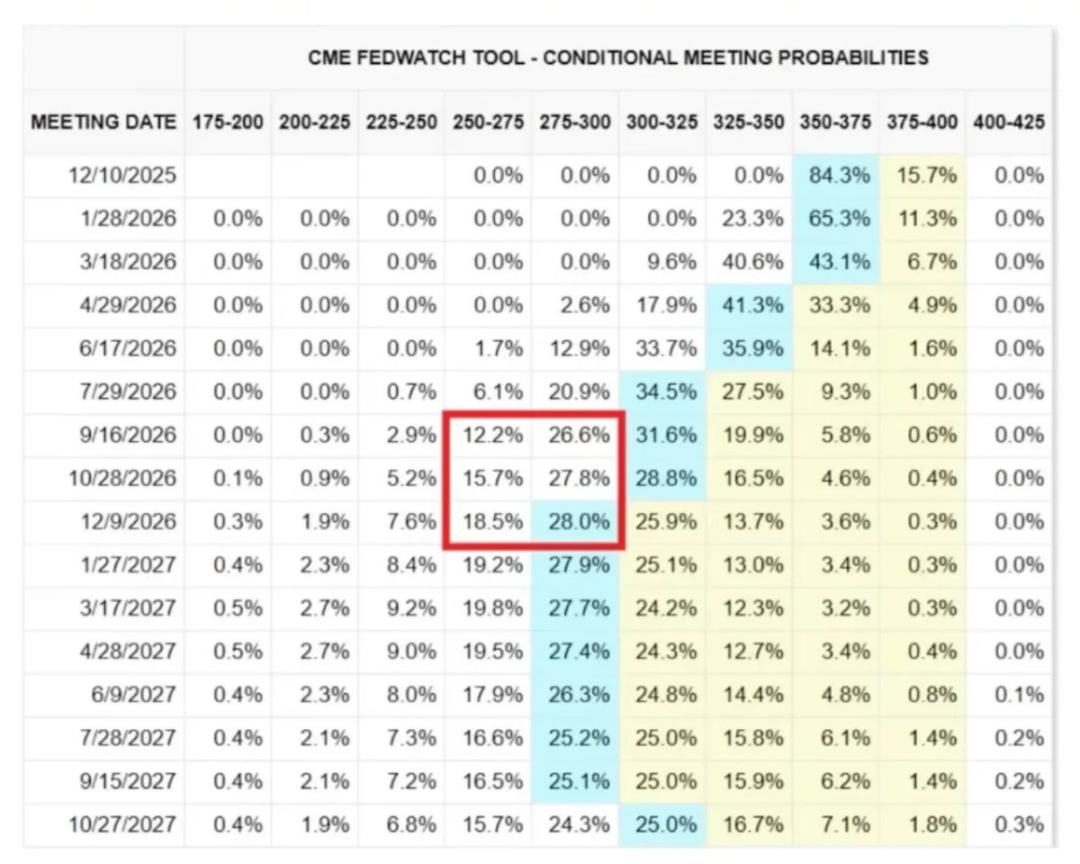

The price fluctuations over the past month have occurred without any new economic data to support them, yet they have triggered violent oscillations due to a shift in the Federal Reserve's stance.

The probability of interest rate cuts has switched back and forth from 80% → 30% → 80% solely based on the comments of individual Federal Reserve officials. This phenomenon confirms the core characteristic of the current market: the influence of systemic capital flows far exceeds that of active macro views.

Here is evidence from the micro-structural level:

1) Volatility-targeting funds mechanically reduce leverage when volatility spikes and increase leverage when volatility declines.

These funds do not care about the "economy" because they adjust their investment exposure based on one variable: the level of market volatility.

When market volatility increases, they reduce risk → sell; when volatility decreases, they increase risk → buy. This leads to automatic selling when the market is weak and automatic buying when the market is strong, amplifying bidirectional volatility.

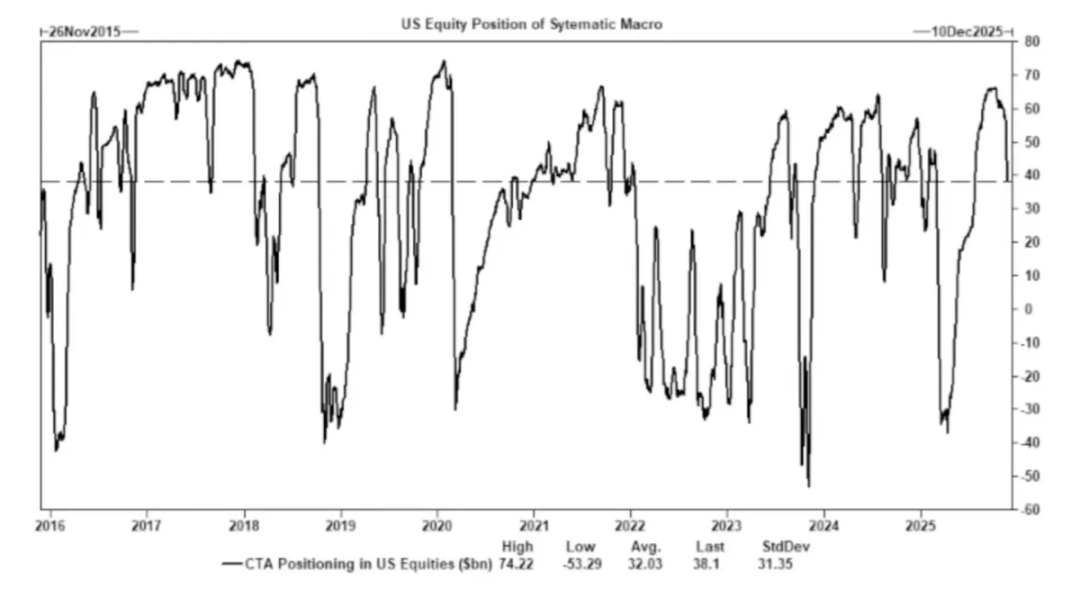

2) Commodity Trading Advisors (CTAs) switch long and short positions at preset trend levels, creating forced flows.

CTAs follow strict trend rules, with no subjective "views" involved; they purely execute mechanically: buy when prices break above a certain level, sell when prices fall below a certain level.

When enough CTAs hit the same threshold at the same time, it can trigger large-scale coordinated buying and selling, even if the fundamentals remain unchanged, potentially driving the entire index to fluctuate for several consecutive days.

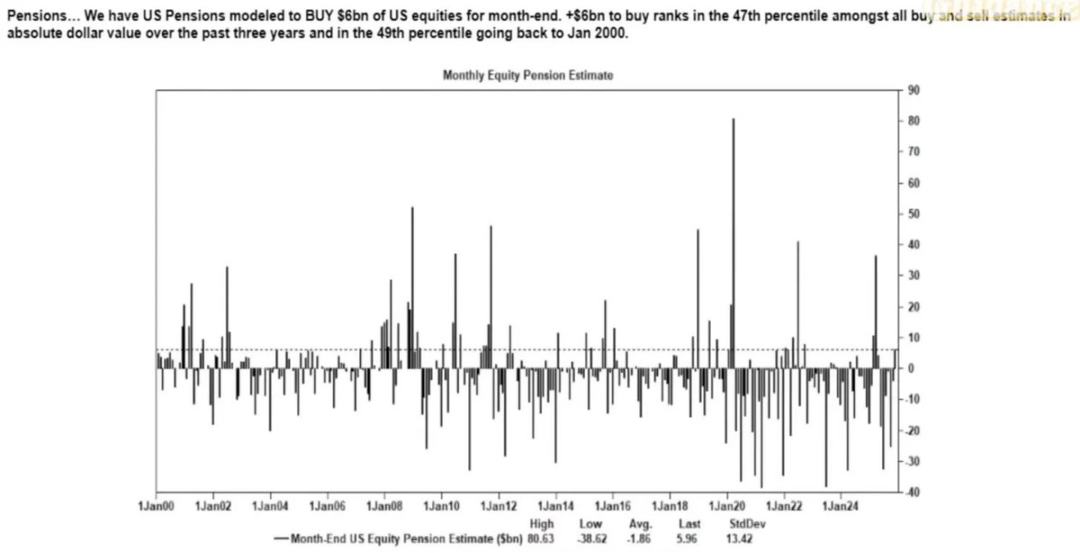

3) Stock buyback windows remain the largest source of net equity demand.

Companies repurchasing their own shares are the largest net buyers in the stock market, surpassing the buying scale of retail investors, hedge funds, and pension funds.

During buyback windows, companies inject tens of billions of dollars into the market weekly, leading to:

- An inherent upward momentum in the market during buyback seasons

- A noticeable market weakness after buyback windows close

- Structural buying that is unrelated to macro data

This is also why the stock market may still rise even when market sentiment is low.

4) The inverted VIX curve reflects short-term hedging imbalances rather than "panic."

Under normal circumstances, long-term volatility (3-month VIX) is higher than short-term volatility (1-month VIX). When this relationship reverses, people often interpret it as "rising panic," but this phenomenon is now driven more by the following factors:

- Short-term hedging demand

- Adjustments by options market makers

- Weekly options capital inflows

- Systematic strategies hedging at month-end

This means: a spike in VIX ≠ panic, but rather a result of hedging capital flows.

This distinction is crucial; volatility is now driven by trading behavior rather than narrative logic.

The current market environment is more sensitive to sentiment and capital flows: economic data has become a lagging indicator of asset prices, while the Federal Reserve's communication has become the main trigger for volatility. Liquidity, position structure, and policy tone are replacing fundamentals in the price discovery process.

AI is Key to Avoiding a Full Recession

AI has become a stabilizer for the macro economy: it effectively replaces cyclical hiring demands, supports corporate profitability, and maintains GDP growth even when labor fundamentals are weak.

This means that the U.S. economy's dependence on AI capital expenditure far exceeds what policymakers publicly acknowledge.

- Artificial intelligence is suppressing labor demand for the lowest-skilled, most easily replaceable third of the workforce. This is typically where cyclical economic recessions first manifest.

- Productivity gains mask what appears to be a widespread deterioration in the labor market. Output remains stable because machines are taking over jobs previously done by entry-level workers.

- A reduction in the number of employees leads to increased corporate profit margins, while households bear the socioeconomic burden. This shifts income from labor to capital—typical of recession dynamics.

- AI-related capital has artificially sustained GDP resilience. Without capital expenditure in the AI sector, overall GDP data would be significantly weaker.

Regulators and policymakers will inevitably support AI capital expenditure through industrial policies, credit expansion, or strategic incentives, as the alternative is economic recession.

The Wealth Gap has Become a Macro Constraint

Mike Green's proposal of a "poverty line ≈ $130,000 - $150,000" has sparked strong backlash, highlighting the deep resonance of this issue.

The core truths are as follows:

- Child-rearing costs exceed rent/mortgage

- Housing has structurally become unaffordable

- The baby boomer generation dominates asset ownership

- The younger generation holds only income, with no capital accumulation

- Asset inflation is widening the wealth gap year by year

The wealth gap will force adjustments in fiscal policy, regulatory stances, and asset market interventions. As a tool for the younger generation to participate in capital growth, cryptocurrency's political significance will become increasingly prominent, prompting policymakers to adjust their attitudes accordingly.

The Bottleneck for AI Scaling is Energy, Not Computing Power

Energy will become the new narrative core: the scaled development of the AI economy relies on the simultaneous expansion of energy infrastructure.

Discussions about GPUs overlook a more critical bottleneck: power supply, grid capacity, nuclear and natural gas capacity construction, cooling infrastructure, copper and key minerals, and data center site restrictions.

Energy is becoming a limiting factor for AI development. In the next decade, the energy sector (especially nuclear power, natural gas, and grid modernization) will become one of the most leveraged investment and policy directions.

A Dual-Track Economy is Emerging, with Gaps Continuing to Widen

The U.S. economy is splitting into two major sectors: the capital-driven AI sector and the labor-dependent traditional sector, with almost no overlap and increasingly divergent incentive structures.

The AI economy continues to expand:

- High productivity

- High profit margins

- Low labor dependency

- Strategically protected

- Attracting capital inflows

The real economy continues to shrink:

- Weak labor absorption capacity

- High consumer pressure

- Declining liquidity

- Asset concentration

- Inflationary pressures

The most valuable companies in the next decade will be those that can reconcile or leverage this structural divergence.

Future Outlook

- AI will receive policy backing, as the alternative is recession

- Liquidity led by the Treasury will replace quantitative easing (QE) as the main policy channel

- Cryptocurrency will become a political asset class tied to intergenerational equity

- The real bottleneck for AI is energy, not computing power

- In the next 12-18 months, the market will still be driven by sentiment and capital flows

- The wealth gap will increasingly dominate policy decisions

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。