Highlights of This Issue

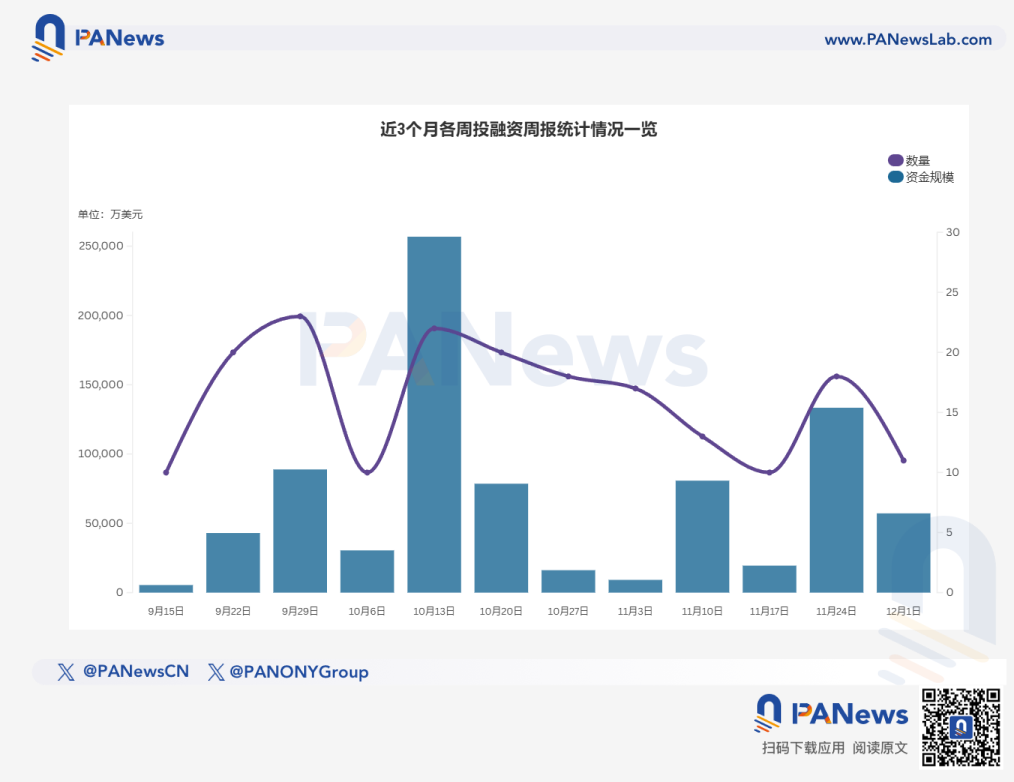

According to incomplete statistics from PANews, there were 11 financing events in the global blockchain sector last week (11.24-11.30), with a total funding scale exceeding $572 million. Additionally, the total financing amount for listed companies' crypto asset reserves exceeded $235 million. The overview is as follows:

- DeFi announced 4 financing events, including Paxos announcing the acquisition of New York DeFi wallet startup Fordefi for over $100 million;

- The Web3+AI sector announced 1 financing event, where decentralized AI computing network Gonka AI received a $12 million strategic investment from Bitfury;

- The Infrastructure & Tools sector announced 3 financing events, including SpaceComputer completing a $10 million seed round financing for secure blockchain computing from space;

- The Centralized Finance sector announced 1 financing event, with Exodus acquiring the parent company of Baanx and Monavate, W3C Corp, for $175 million;

- In Other Web3 Applications, 2 financing events were announced, including decentralized job market and labor automation protocol WorkQuest completing a $1.16 million seed round financing;

- Additionally, 2 listed companies announced plans to finance for crypto treasury strategies: Upexi plans to raise $23 million through a targeted issuance to strengthen its SOL treasury strategy.

DeFi

Paxos Acquires DeFi Wallet Company Fordefi for Over $100 Million

Paxos announced the acquisition of New York DeFi wallet startup Fordefi for over $100 million. Founded in 2021, Fordefi has about 40 employees and around 300 clients, with a previous valuation of $83 million. After the acquisition, it will continue to operate independently, and Paxos plans to integrate its technology into its own system. This transaction marks Paxos' second acquisition within a year, following the acquisition of EU stablecoin issuer Membrane Finance in February to comply with MiCA regulations.

Native AI re-staking and arbitrage execution protocol Nexton Solutions has completed $4 million in strategic financing, led by South Korean payment company Danal, with participation from Amber Group, Value Systems, Metalabs Ventures, Vista Labs, Outlier Ventures, Kaia Foundation, TON Foundation, STON.fi, and PayProtocol. Nexton is building a unified AI execution layer that includes two core components: the Nexton-ai cross-DEX/CEX arbitrage routing engine and the Nexton-re automatic re-staking module.

Pruv Finance has completed approximately $3 million in Pre-A round financing, led by UOB Venture Management, with participation from Saison Capital, Taisu Ventures, Ascent, Spiral Ventures, and Royal Group. Pruv claims to be the first digital finance platform approved by Indonesia's OJK regulatory sandbox, addressing the "compliance and liquidity" conflict of RWAs, supporting asset transfers without whitelist locks, cross-chain transfers, and compatibility with DeFi natively.

Digital Asset Lending Platform CreatorFi Receives $2 Million Strategic Investment

Digital asset lending platform CreatorFi announced a strategic partnership with the Aptos Foundation and Aptos Labs, as part of which CreatorFi will launch its platform on Aptos and receive a total of $2 million in strategic funding to accelerate its development. CreatorFi, developed by Insomnia Labs, is a fintech platform that converts digital media revenue into lendable assets, providing risk-adjusted pre-approved financing for creators, studios, and media companies.

AI

Decentralized AI Computing Network Gonka AI Receives $12 Million Strategic Investment from Bitfury

Leading global crypto mining company Bitfury Group recently completed a $12 million strategic investment in decentralized AI computing network Gonka.ai, purchasing 20 million GNK tokens at a price of $0.60 each. Gonka.ai was founded by serial entrepreneurs the Liberman brothers, aiming to build a blockchain-based distributed GPU computing market. This investment is Bitfury's first public investment following the establishment of a $1 billion ethical AI fund, indicating that traditional mining companies are systematically laying out decentralized AI infrastructure. According to public data, Gonka's network has over 5,000 equivalent computing power of NVIDIA H100 series GPUs and supports nearly 20 mainstream AI devices, including 3080, 4090, H100, and H200, forming a distributed computing cluster.

Infrastructure & Tools

London-listed private equity investment firm Bridgepoint announced the acquisition of a majority stake in digital asset audit and technology service provider ht.digital for approximately £200 million. HT has over 700 clients, including major global crypto exchanges, asset management companies, and banks, benefiting from the rising institutional demand for crypto asset allocation.

SpaceComputer Completes $10 Million Seed Round Financing for Secure Blockchain Computing from Space

Space computing startup SpaceComputer has completed a $10 million seed round financing, co-led by Maven11 and Lattice, with participation from Superscrypt, Arbitrum Foundation, Nascent, Offchain Labs, Hashkey, and Chorus One. Individual investors include Marc Weinstein, Jason Yanowitz, and Ameen Soleimani. The company plans to build a satellite network to provide secure computing services for blockchain from space.

SpaceComputer will use the funds to launch satellites equipped with SpaceTEE secure computing hardware, creating an orbital network capable of privacy computing and secure record-keeping. Its co-founder stated that the opportunities brought by space for decentralized technology are undeniable, and more applications will include a space computing layer. Previously, JPMorgan's digital asset department completed a tokenized value transfer test using near-Earth orbit satellites. The company is known for testing satellites on SpaceX's Falcon 9 rocket and is currently collaborating with institutions like the Technical University of Munich and Cornell Tech to explore extraterrestrial blockchain computing.

Cryptocurrency Payment Solution Provider Alchemy Receives Investment from C1 Fund

Crypto fund C1 Fund has invested in cryptocurrency payment solution provider Alchemy, with the specific amount not disclosed. Alchemy is currently a core infrastructure layer in the Web3 market, providing transaction support for Robinhood, Stripe, JPMorgan, and Coinbase. C1 Fund has previously invested in Chainalysis and Ripple.

DAT

(Such transactions are not included in this financing weekly report statistics)

NASDAQ-listed biopharmaceutical company Enlivex Therapeutics announced it will raise $212 million through PIPE private financing to acquire Rain tokens (RAIN) as the core reserve of its digital asset treasury (DAT), claiming this project is the first DAT established around prediction market tokens. Rain is a decentralized prediction market protocol on the Arbitrum chain. After this fundraising is completed, former Italian Prime Minister Matteo Renzi will join Enlivex's board of directors.

Upexi Plans to Raise $23 Million Through Targeted Issuance to Strengthen SOL Treasury Strategy

NASDAQ-listed company Upexi (UPXI) announced a targeted issuance of up to $23 million in stocks and warrants to support its core Solana treasury strategy. The issuance price is $3.04 per share with warrants, initially raising $10 million, and if all warrants are exercised, an additional $13 million will be raised. Despite a recent market correction that caused its SOL holdings to lose over $200 million in value, Upexi remains committed to a long-term holding strategy and will use the raised funds for general operations and further accumulation of SOL.

Centralized Finance

Exodus to Acquire W3C Corp, Parent Company of Baanx and Monavate, for $175 Million

Cryptocurrency wallet company Exodus Movement (NYSE American: EXOD) is acquiring W3C Corp, the parent company of cryptocurrency card and payment companies Baanx and Monavate, for $175 million. The funding for this transaction consists of the company's existing cash and financing provided by Galaxy Digital, secured against the Bitcoin held by Exodus. Baanx and Monavate have been collaborating with institutions such as Visa, Mastercard, and MetaMask to develop cryptocurrency cards and user-custodied Web3 payment services. Overall, this transaction will make Exodus one of the few self-custody wallet providers capable of controlling the entire payment experience from wallet to card.

Exodus stated that it will take over the underlying card and payment technology stack and will have the ability to issue payment cards through networks such as Visa, Mastercard, and Discover, while expanding its business scope to the U.S., U.K., and EU to support new products and partnerships. Exodus also mentioned that this infrastructure is expected to enhance the capabilities of enterprise clients whose customers transact through Exodus's XO Swap application. The transaction is subject to customary adjustments and approval processes and is expected to be completed by 2026.

Others

Decentralized Job Market WorkQuest Completes $1.16 Million Seed Round Financing

Decentralized job market and labor automation protocol WorkQuest announced the completion of $1.16 million in seed round financing, led by Black Dragon Capital, with participation from Prometeus Labs, TrustDAO Capital, Chain Ridge Capital, Kyros Ventures, Magnus Capital, Titans Ventures, and Matrix Ventures. The new funds will be used to upgrade its platform, allowing employers and employees to interact through smart contracts, stablecoin payments, and on-chain reputation scoring.

Monad Chain Launchpad Platform Announces $1.1 Million Financing to Date

Nad.fun announced that it has completed $1.1 million in financing to date, with the recent seed round led by Neoclassic Capital, and angel investments from Monad community members, developers, and on-chain traders. Nad.fun is the native Launchpad platform on the Monad chain, designed around community-driven meme coin mining and leveraged price prediction markets.

Venture Capital Firms

Entrée Capital announced the successful raising of a new $300 million fund, focusing on early-stage investments. This brings the total assets under management to $1.5 billion. The new funds will primarily be deployed in pre-seed, seed, and Series A investment projects in Israel, the U.K., Europe, and the U.S. The new fund will target founders in the following areas: artificial intelligence (covering native AI applications, vertical AI, and enabling infrastructure); deep tech and quantum computing (including computational technology, science-driven systems, advanced materials, etc.); software, data, and B2B productivity enhancement; cryptocurrency (focusing mainly on infrastructure and security); and unconventional frontier innovations.

It is reported that Entrée Capital has previously invested in Web3 domain registrar Freename and Bitcoin payment startup Breez.

European venture capital firm Índico Capital Partners officially announced the launch of its sixth venture capital fund, Indico VC Fund III, with a size of €125 million, in which the European Investment Fund (EIF) plans to commit €30 million. The fund's single investment size will range from €1 million to €10 million and will focus on sustainable economic models in areas such as artificial intelligence, deep tech, blockchain/Web3, fintech, and digital markets. Índico Capital Partners' investment portfolio in the Web3 space includes luxury NFT platform Exclusible and metaverse startup Sound Particles.

DWF Labs Launches $75 Million DeFi Investment Fund

Crypto market maker DWF Labs announced the launch of a new investment fund focused on decentralized finance (DeFi) with a size of $75 million. This plan will target projects built on Ethereum, BNB Chain, Solana, and Base. This is a further expansion of DWF's "incubation and risk-building work," specifically seeking to invest in the next batch of founders dedicated to "solving practical structural issues in areas such as liquidity, settlement, credit, and on-chain risk management, rather than making incremental improvements to existing protocols." This includes tools such as "dark pool" perpetual DEXs, on-chain money markets, fixed income or yield-generating products, which are expected to see significant growth as liquidity continues to migrate structurally on-chain. The new fund is funded by DWF's own capital and is currently not accepting new investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。