Author: Jae, PANews

This year, the highly anticipated high-performance public chain Monad has finally made its debut. On the evening of November 24, the Monad mainnet and MON token officially launched. Previously, it was the first Launchpad project on Coinbase, attracting 85,820 participants who invested $269 million. Even in a bleak market environment, the oversubscription of the Monad token sale demonstrates its ability to attract capital and generate buzz.

As a leader in the parallel EVM track, Monad has consistently promoted a throughput promise of up to 10,000 TPS (transactions per second) and a final confirmation time of 1 second, which is now set to undergo a "real-world" market test. As an additional bet from investment firm Paradigm in the public chain space, Monad also serves as a litmus test for its investment capabilities in the crypto market, aiming to redeem itself from the previous embarrassment of Blast.

The value of a high-performance public chain will depend on its ecological carrying capacity. Unlike strategies that rely solely on "copy-pasting" existing EVM applications, Monad, with its unique technical architecture, has attracted a number of emerging projects looking to leverage its high-frequency trading capabilities.

The Monad ecosystem comprises a total of 304 protocols, of which 77 are unique to it, with DeFi protocols accounting for over 60%. PANews has compiled a list of representative emerging projects within the Monad ecosystem, considering various dimensions such as unique protocols, investment institutions, and project activity, covering tracks like DeFi, Launchpad, prediction markets, DeAI, and DePin. However, Monad is still in the early stages of ecological construction, with many projects in testing or early interaction phases, and users should be aware of potential risks while participating.

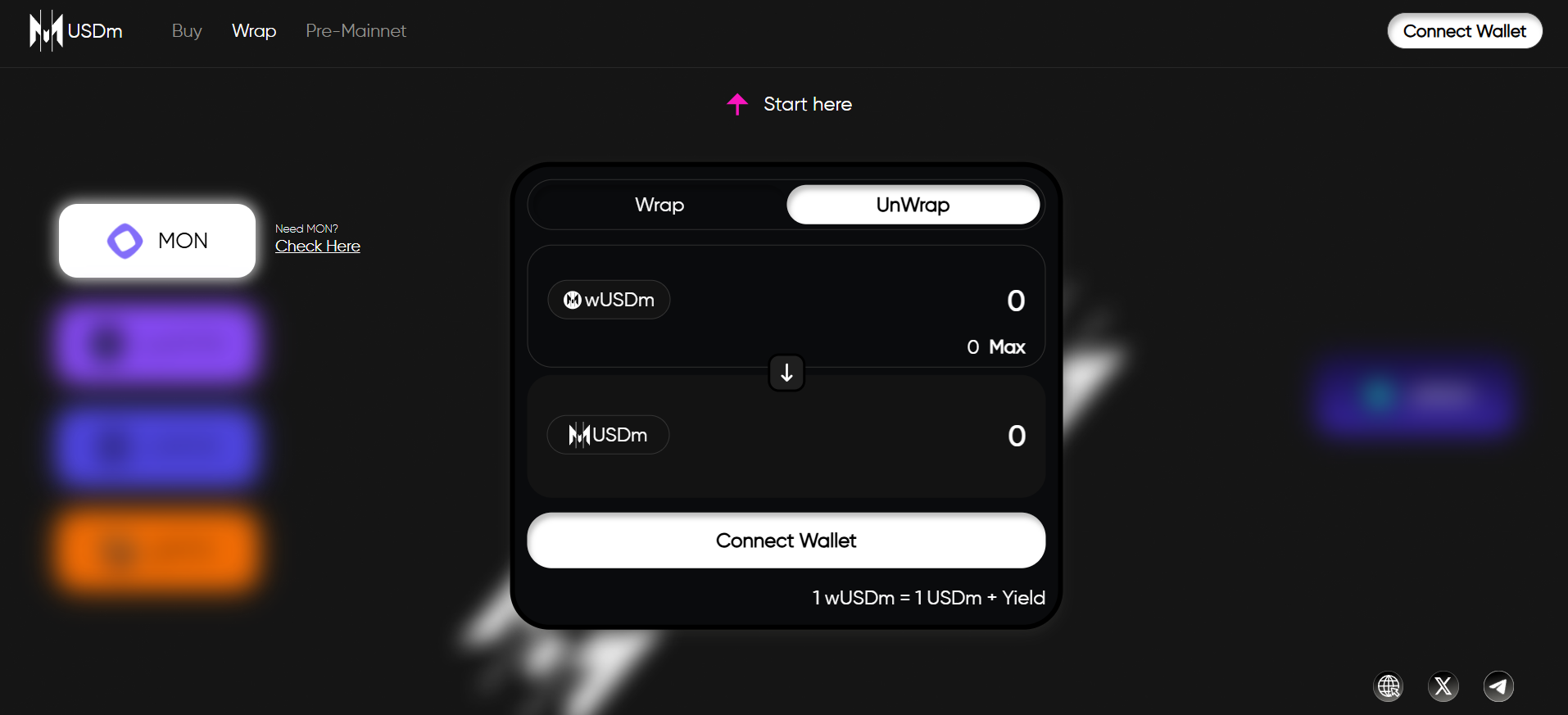

Mynt (USDm)

Mynt (USDm) is a zero-knowledge proof stablecoin protocol, powered by Succinct's SP1 zkVM (zero-knowledge virtual machine), and combines a collateralized minting model. Users can use MON tokens as collateral to mint USDm while earning yields from reserve assets. Mynt emphasizes verifiable privacy and collaborates with Fairblock, utilizing additive homomorphic encryption (PHE) and multi-party computation (MPC) technology to secure transaction amounts, thus avoiding the risk of front-running.

Mynt also introduces the concept of "state liquidity." Thanks to ZK technology, USDm can achieve seamless combinations of liquidity across different protocols, meaning users do not need to frequently transfer tokens between different DeFi protocols; liquidity reuse and verification can be achieved simply through state proofs.

During the testnet phase, Mynt processed over 1 million transactions, generating $250,000 in revenue.

Kintsu

Kintsu is positioned as a liquid staking protocol focused on maximizing capital efficiency. After staking MON, users receive sMON, a circulating token that accumulates staking rewards over time. The sMON token model aims for deep DeFi integration. By allowing sMON to circulate and trade across various DeFi applications, Kintsu not only maintains the liquidity of staked assets but also enables users to deploy assets in yield markets without sacrificing base staking rewards.

After the mainnet launch, Kintsu demonstrated a strong early lead, with a TVL of 17.5 million MON (approximately $540,000) and 605 sMON holders. The protocol secured $4 million in seed funding led by Castle Island Ventures.

Magma

Magma is a liquid staking platform that allows users to obtain circulating staking certificates gMON by staking MON tokens. gMON not only represents staking rewards but also has composability, serving as collateral within various dApps (decentralized applications) in the Monad ecosystem for activities like lending and trading. After the mainnet launch, Magma's TVL (total locked value) exceeded 7.13 million MON (approximately $200,000), with over 800 gMON holders and 800 unique addresses, and more than 1,000 transactions completed. The protocol raised $3.9 million in seed funding with participation from Animoca Ventures and others.

Kuru

Kuru is a fully on-chain executed CLOB DEX (Central Limit Order Book Decentralized Exchange). The uniqueness of the protocol lies in its use of Monad's parallel execution and low latency to provide a user experience similar to CEX while maintaining self-custody. Kuru's design allows market makers to provide and withdraw limit orders at low, constant Gas costs, addressing the core pain points of efficiency and price discovery in traditional DEXs. Keone Hon, co-founder and CEO of Monad Labs, stated that Kuru can help DEXs close the execution gap with CEXs.

After the mainnet launch, Kuru's TVL quickly surpassed $1.4 million, with a 24-hour trading volume exceeding $11 million, generating approximately $9,000 in protocol revenue. Kuru secured $2 million in seed funding led by Electric Capital and $11.5 million in Series A funding led by Paradigm.

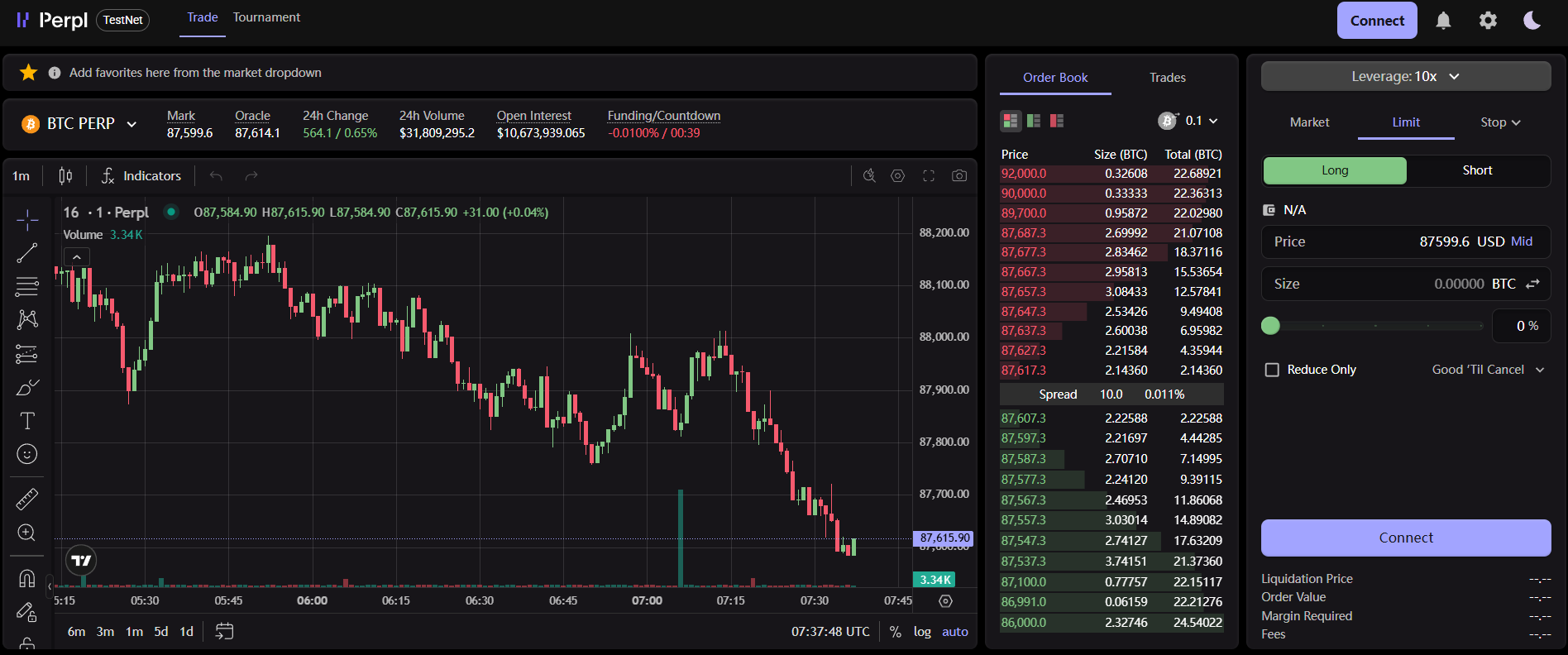

Perpl

Perpl is a full-chain Perp DEX (Decentralized Perpetual Contract Trading Platform) built on Monad, also utilizing the CLOB model. Derivative trading pairs have extremely high requirements for pricing, liquidation, and margin real-time updates, where any delay can lead to significant slippage or liquidation risks. The protocol leverages Monad's high throughput and sub-second finality to ensure that the entire process of order matching and trade execution can be completed on-chain, eliminating reliance on centralized components like off-chain orderers, thereby enhancing trading transparency and efficiency.

Perpl raised $9.25 million in funding led by Dragonfly.

Mu Digital

Mu Digital is a RWA (Real World Asset) platform aimed at bringing the Asian credit market on-chain, targeting the tokenization of the $20 trillion Asian credit market. The protocol offers two main risk-tiered products: 1) AZND (Asian Dollar): a high-risk tier product backed by high-quality Asian credit instruments, offering a native yield of 6% to 7% at launch; 2) muBOND: a primary risk tier product designed to provide enhanced yields of up to 15% for users seeking higher returns.

The protocol secured $1.5 million in Pre-Seed funding, with traditional financial institution UOB Venture Management among the investors. Mu Digital launched its mainnet simultaneously, with muBond's TVL reaching $20 million and AZND's TVL soaring to $80 million.

Castora

Castora is a decentralized P2P (peer-to-peer) prediction market, similar to platforms like Polymarket and Kalshi, allowing users to place P2P bets on real-world events, such as elections or sports matches, with on-chain settlement. The protocol leverages Monad's low-latency features to achieve real-time odds updates.

Unlike traditional order book models, Castora adopts a pool-based betting model. Users pay an "Entry Fee" to enter a specific prediction pool, and the system determines at the snapshot time which user predicted the outcome closest to reality, winning the prize pool. Compared to order book-based prediction markets, Castora's mechanism is more akin to a "full split" or "jackpot" model, lowering the barrier for market makers and making it easier for ordinary retail investors to participate in liquidity provision and betting.

Currently, Castora has launched early pools such as ETH price predictions and is one of the more frequently interacted dApps within the Monad community.

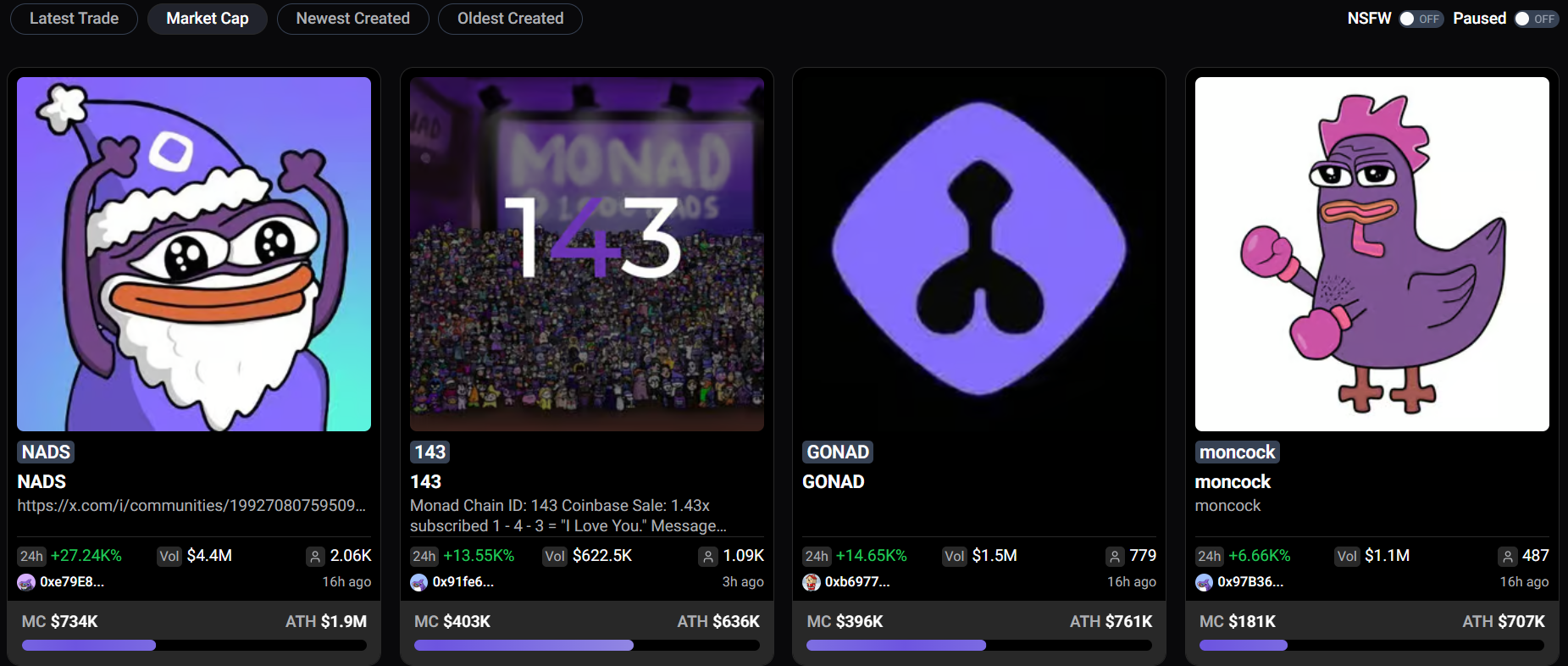

Nad.fun

Nad.fun is a social meme coin issuance platform that allows users to deploy tokens at a very low cost within minutes, supporting the entire process of creation, issuance, and trading, similar to pump.fun. The protocol employs classic bonding curve pricing to ensure a fair launch for early participants.

After the mainnet launch, Nad.fun has generated 30 new meme tokens. Currently, the meme coin with the highest market cap is NADS, valued at $730,000, with an ATH (all-time high) market cap that once approached $2 million.

FortyTwo

Fortytwo is a DeAI reasoning network that utilizes "collective reasoning" technology to achieve scalable, low-illusion AI through node contributions. The protocol supports distributed model training and reasoning, where AI Agents can directly exchange data on-chain. Fortytwo has high latency requirements for its operation. It ensures that data exchange and reasoning tasks between AI Agents can be completed with extremely low latency through Monad's high-performance parallel execution environment. High transaction speed is also a prerequisite for achieving scalable intelligence.

The protocol relies on a dynamic load balancing system to optimize resource utilization, ensuring that nodes maintain high activity levels during lightweight tasks like video calls or web browsing, while automatically reducing or pausing reasoning during heavy operations like 4K video editing. This fine-grained resource management is only feasible when the underlying public chain can handle fast and inexpensive transactions.

As of now, Fortytwo has 450 active nodes, completing over 4,500 reasoning tasks daily. The protocol secured $2.3 million in Pre-Seed funding led by Big Brain Holdings.

Rumi

Rumi aims to establish an AI-driven media and advertising company. The protocol adopts a unique "watch-to-earn" model, rewarding users for their content consumption behavior through visual language models. Rumi is dedicated to transforming passive media content into interactive experiences, supporting intelligent analysis of media content, and has established partnerships with TVision, Story Protocol, and others.

Rumi achieved a live streaming duration of 8.5 billion hours in Q3, equivalent to 970,000 years of attention. The protocol secured $4.7 million in Pre-Seed funding co-led by a16z crypto CSX and EV3.

Multisynq

Multisynq aims to build a real-time application layer for the internet, striving to bring Google Docs-level instant collaboration experiences to all online applications, including DeFi, gaming, and ambient programming, without relying on centralized cloud service giants.

The protocol secured $2.2 million in seed funding led by Manifold.

Poply

Poply is an NFT marketplace and issuance platform that emphasizes respect for creator royalties and has specifically optimized the minting and listing experience for NFTs based on Monad's high-frequency trading characteristics. Poply also provides AI tools (such as prompt-based generative artworks that can be minted into series NFTs) and user-friendly real-time bidding and trading features.

The protocol will launch the Poply Otters series of 6,000 NFTs on November 24, granting holders benefits such as lower transaction fees, higher token allocation limits, and exclusive airdrops.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。