1. Base Begins Exploring Token Issuance: From "Absolutely Not Issuing" to "Currently Researching"

In September of this year, Jesse Pollak, the head of the Base network, first hinted at the BaseCamp conference that Base is actively exploring the possibility of issuing a native token. Shortly after, Coinbase co-founder and CEO Brian Armstrong stated: We are exploring the issuance of a native token for the Base network. Since its launch in 2023, Base has adhered to a strategy of "not issuing a native token," focusing on infrastructure and developer tools. The team's priority is clear: to build a secure, low-cost, and developer-friendly chain and ecosystem.

This significant shift has quickly sparked a huge response throughout the cryptocurrency community, marking a major transition for Base from a "no-token" strategy to a "possible token issuance." Although Base still emphasizes that "there is no final timeline, model, or distribution plan yet," the issuance of a token has moved from "possibility" to "public agenda."

2. Why Issue a Token: Restructuring to Address External Competition

The decision to issue a token is not a spur-of-the-moment choice for Base, but a strategic turning point made at a critical time. From the perspectives of funding, competition, technology, and regulatory environment, the question has shifted from "should we do it" to "we must do it now."

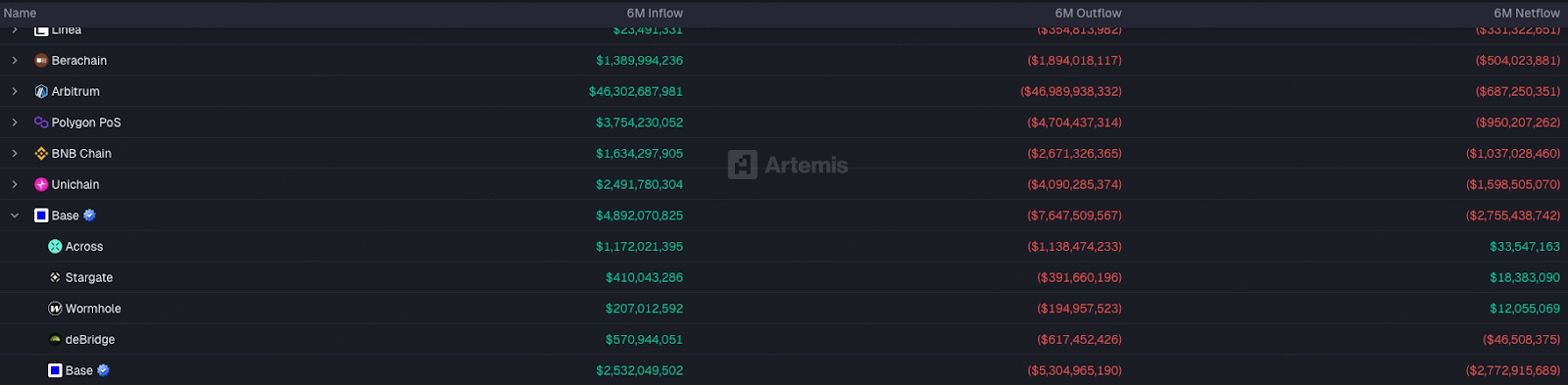

1. Continuous Outflow of Funds, Not Issuing Tokens Will Drive People Away

In the past six months, Base has seen a net outflow of over $2.77 billion. For a public chain that relies on ecosystem expansion, weak funding means an increased risk of losing developers and users. The ecosystem urgently needs to introduce new incentives through a token, making token issuance an inevitable choice to break through the liquidity bottleneck.

2. Using Tokens to Bind the Ecosystem Together, Creating a True Value Cycle

Tokens can establish a long-term effective value cycle for Base, binding developers, users, and liquidity within the same interest system. Jesse Pollak has clearly stated that the goal of issuing a token is to promote network decentralization and provide creators and developers with longer-term, more certain incentives. In the Web3 ecosystem, tokens are the most effective mechanism for coordinating interests, solidifying value, and maintaining vitality. For Base, which is entering a later growth stage, issuing a token represents a key step from "usage growth" to "value growth."

3. Competitors Are Issuing Tokens; Base Risks Being Squeezed Out

The current Layer 2 competition has entered an incentive war. L2s like Arbitrum, Optimism, and Blast have established strong capital cycles through token airdrops and ecosystem incentives, attracting liquidity and encouraging projects to take root in their ecosystems. In contrast, Base's long-standing refusal to issue a token, while reinforcing the "product-first" narrative, has gradually put it at a disadvantage in terms of DeFi development, liquidity pool expansion, and developer retention. In a landscape dominated by incentive-driven narratives, "not issuing a token" is gradually shifting from an advantage to a competitive disadvantage.

4. Regulatory Environment Warming Up, Coinbase Finally Sees a Compliance Window

The biggest obstacle to Base's previous refusal to issue a token was regulatory risk: if the U.S. classifies tokens as securities, issuers will face significant legal costs. As a publicly traded company in the U.S., Coinbase finds it difficult to bear such uncertainties. However, there has been a significant shift in the U.S. political landscape regarding cryptocurrency, leading to a structural improvement in the regulatory environment. In this context, Coinbase's compliance capabilities have become an advantage, enabling it to design compliant token models and regulatory community structures.

3. What Changes Will Occur After Token Issuance?

1. True Community Governance Will Begin to Operate

Currently, decision-making power in Base is mainly concentrated in Coinbase. After introducing a token, governance power may gradually be transferred to the community, allowing token holders to participate in key decisions through voting, including protocol upgrades and fund allocations, truly realizing a community-driven governance model. The rules for the entire ecosystem's distribution will also become transparent, marking the true beginning of decentralization.

2. A Fully Upgraded Incentive System Will Erupt

The BASE token can incentivize all roles in the ecosystem:

Developers: project subsidies, fund support

Users: gas discounts, points redemption, airdrops

Creators: earn money by creating on Base

Liquidity providers: earn incentives in DEX pools

3. BASE Is Expected to Become the "Quote Currency" on the Base Chain

While ETH will still be used as the currency for gas fees, BASE is expected to become the primary quote currency in decentralized exchanges within the ecosystem. This means that most trading pairs will be priced in BASE, creating stable market demand and solidifying its core position within the Base ecosystem.

4. Institutions May Enter the Base Ecosystem on a Large Scale

Coinbase's institutional resources and compliance capabilities lay the foundation for institutional-level applications of the BASE token. Institutional investors can use BASE for staking, governance, or as collateral for DeFi protocols. This institutional-level application scenario will bring traditional financial market funds and recognition to Base, creating a differentiated advantage compared to other Layer 2 solutions.

4. Projects in the Ecosystem Worth Noting

Aerodrome

Aerodrome is one of the largest DEXs on Base, recently announcing a merger and upgrade with Velodrome Finance from the Optimism ecosystem. The integration will build a unified governance and incentive system covering Ethereum, Base, OP, and Arc, becoming a central scheduling layer for cross-chain liquidity. AERO and VELO will merge into a single token, with original token holders mapped according to weight, and the new token will capture the revenue of the entire cross-chain network. Dromos is expected to launch on the Ethereum mainnet in Q2 2026 alongside Arc, further strengthening cross-chain layout.

Zora

Despite a decline in meme popularity, Zora remains one of the largest and most active content and token issuance platforms on Base. Its unique creator token issuance model continues to attract community participation. Recently, Base founder Jesse released his first personal token $jesse on Zora, but due to the market downturn, its market cap currently hovers around $17 million.

Avantis

This year, the Perp Dex sector has exploded in popularity, driven by Hyperliquid and Aster, with Avantis becoming one of the fastest-growing and most active Perp DEXs in the Base ecosystem. As the sector continues to expand, Avantis's position in Base is worth ongoing attention.

Limitless

The prediction market is one of the hottest sectors this year. As a project backed by Coinbase, Limitless has grown into the largest prediction platform in the Base ecosystem. If leading players in the sector like Polymarket and Kalshi issue tokens in the future, the price of LMTS is expected to see further growth.

Virtuals

One of the largest AI Agent launch platforms in the market, it once led a wave of market enthusiasm with its "staking to participate in new launches" model. Although its short-term performance has weakened with the cooling of meme trends, AI Agents remain a super hot sector, and Virtuals has a first-mover advantage that is still worth close attention in the future.

5. Issuing a Token is Not the End, But the Beginning

Overall, issuing a token is a significant boon for the ecosystem, users, and developers, marking an important step in the maturity of its infrastructure. In the blockchain world, while technology and ecosystems are undoubtedly important, without token incentives, it is like building a city without an economic system, making it difficult for users and developers to stay long-term. Tokens not only carry value but also drive the ecosystem cycle, allowing participants to see tangible benefits, thus truly activating the ecosystem.

The BNB chain is a great example: this year, it attracted a large number of users and funds through the collaboration of FourMeme and Binance Alpha. As a base token, BNB allows the value of ecosystem innovation and short-term hotspots to ultimately flow back to the underlying assets, creating stable demand and long-term growth. In contrast, while Base has popular projects like Zora and Virtuals that can ignite the market in the short term, the lack of a native token means that user profits primarily flow to the projects themselves, making it difficult to solidify long-term value for the Base chain, and the ecosystem's activity cannot translate into sustained growth.

Issuing a token can change this situation, establishing a complete value cycle that tightly binds users, developers, and ecosystem projects, ensuring that every participation and every transaction leaves real value on the chain, forming a virtuous cycle of "ecosystem activity—value accumulation—user retention." This not only makes short-term enthusiasm sustainable but also allows Base to form a unique advantage in the fierce Layer 2 competition, upgrading from a technology-friendly chain to an ecosystem platform with economic dynamism and long-term potential.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial management) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether it is suitable for you based on your investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。