一、引言

本周来自全球各地的开发者正齐聚布宜诺斯艾利斯,参加一年一度的以太坊开发者大会。此外,12月以太坊即将迎来代号“Fusaka”的重大升级,将把数据吞吐提升8倍、加强网络安全并引入新开发工具。同时,机构参与度提高带来强劲资金流入,RWA市场有望为以太坊带来新的增长引擎。

然而,由于宏观环境的不确定性,从10月初开始,以太坊价格从4900美元的新高跌落进入下行通道。尤其经历“10·11暴跌”黑天鹅事件后,ETH价格一蹶不振,近期徘徊在3000美元上下,较高点回落逾30%。前期支撑ETH上涨的资金正在撤离:以太坊财库公司(DAT)股票大跌、持币由盈转亏,部分股东抛售套现;全球多支ETH现货ETF持续净流出,传统机构资金观望情绪升温。与此同时,以太坊生态频频遇冷:总锁仓量自10月以来下降超20%,链上稳定币接连暴雷脱锚,DeFi协议接二连三受挫。

本文将通过回顾以太坊近期表现,深度剖析当前以太坊所面临的利好和利空因素,并展望以太坊年底、明年乃至中长期的前景和走势,希望为普通投资者厘清迷雾、把握趋势,助力在关键转折期作出更理性的判断提供一定的参考。

二、以太坊近期表现分析

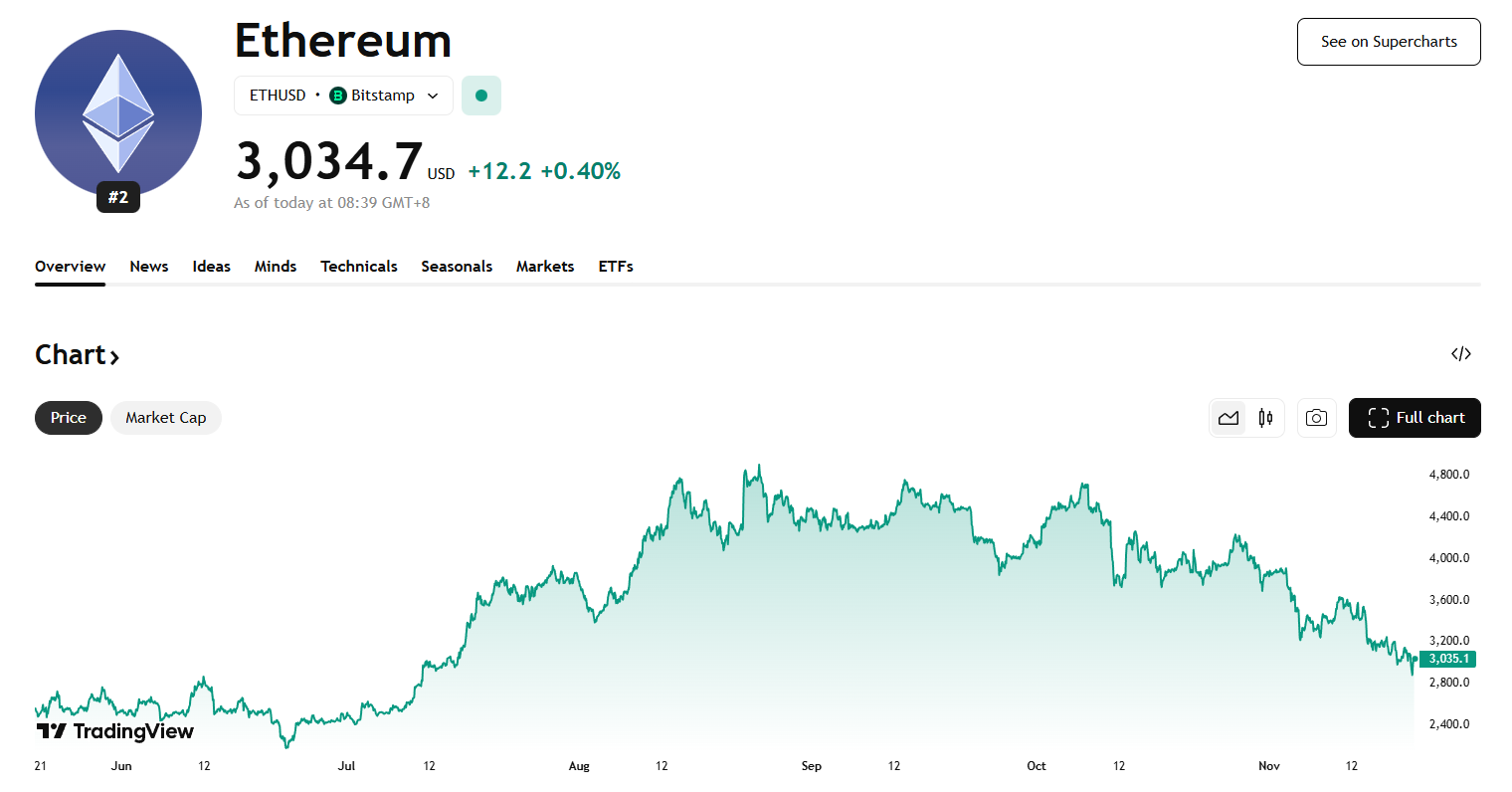

今年三季度,以太坊价格曾随市场情绪高涨一路攀升,从6月底约2500美元飙至8月下旬接近4950美元的年内峰值。然而进入10月,宏观与市场内生风险叠加,引爆了一场“史诗级暴跌”。10月11日,美方意外宣布对华加征关税的消息成为导火索,引发全球风险资产抛售,加密市场更是出现暴跌,以太坊价格一度闪崩20%以上至约3380美元的低位。虽然随后市场有所反弹,但流动性逐渐流失,总体震荡下行,截至目前,ETH报价约在3000美元,较8月高点累计下跌超过三成。

来源:https://www.tradingview.com/symbols/ETHUSD

1. 宏观环境趋紧: 此轮调整背后,宏观流动性收紧和利率预期转鹰是不可忽视的因素。美联储在11月释放强硬信号,市场对12月降息的预期降温,风险偏好显著下降。加密市场在第三季度的繁荣,很大程度上得益于机构资金“炒新”——多支以太坊现货ETF在夏季相继推出,传统投资者跑步进场,叠加几家上市公司宣布巨额购币计划,形成强力买盘支撑。但进入10月,宏观环境不确定性增加,避险资金回流美元和美债,加密市场的边际增量迅速枯竭。

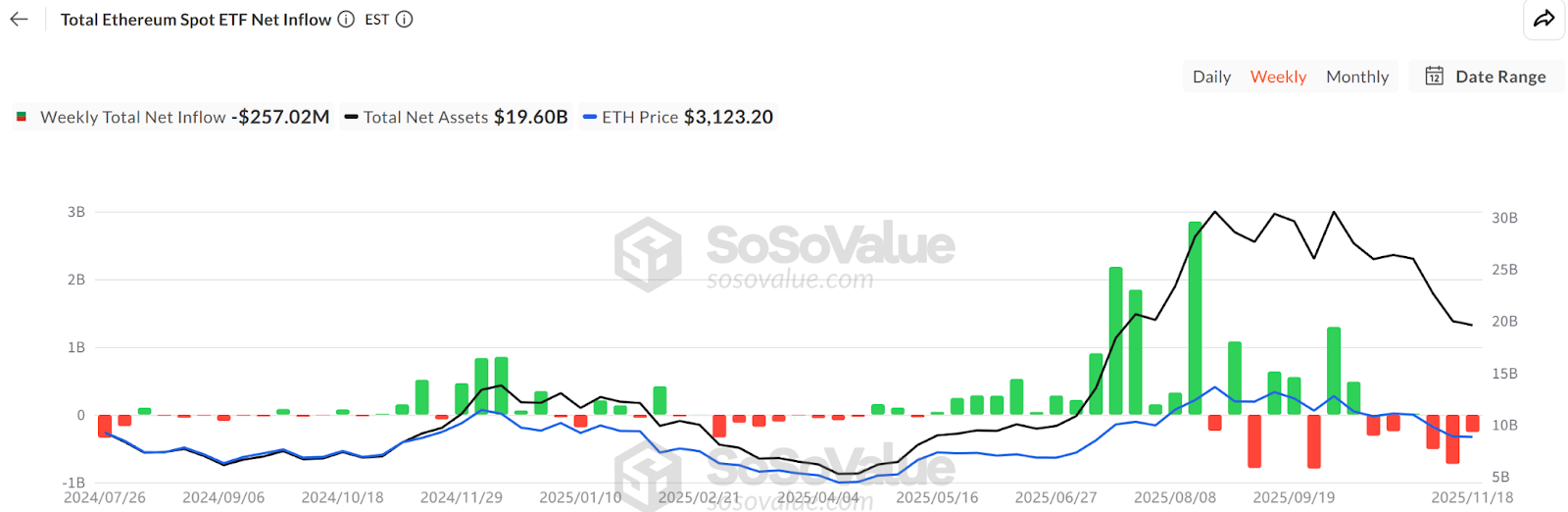

2.ETF资金流出:根据SoSoValue数据,11月中旬以太坊现货ETF总持仓规模约634万枚(192.8万亿美元),占ETH供应量的5.19%,但本月资金已由净流入转为净流出,月内撤资规模显著高于新进资金,单日最大流出额高达1.8亿美元。这与7-8月ETF每日稳健吸金形成鲜明对比。ETF投资者多为中长期配置,连续数日净赎回,意味着传统金融渠道对ETH的需求增量在减弱,其撤离不仅直接减少买盘,还可能放大短期波动性。

来源:https://sosovalue.com/assets/etf/us-eth-spot

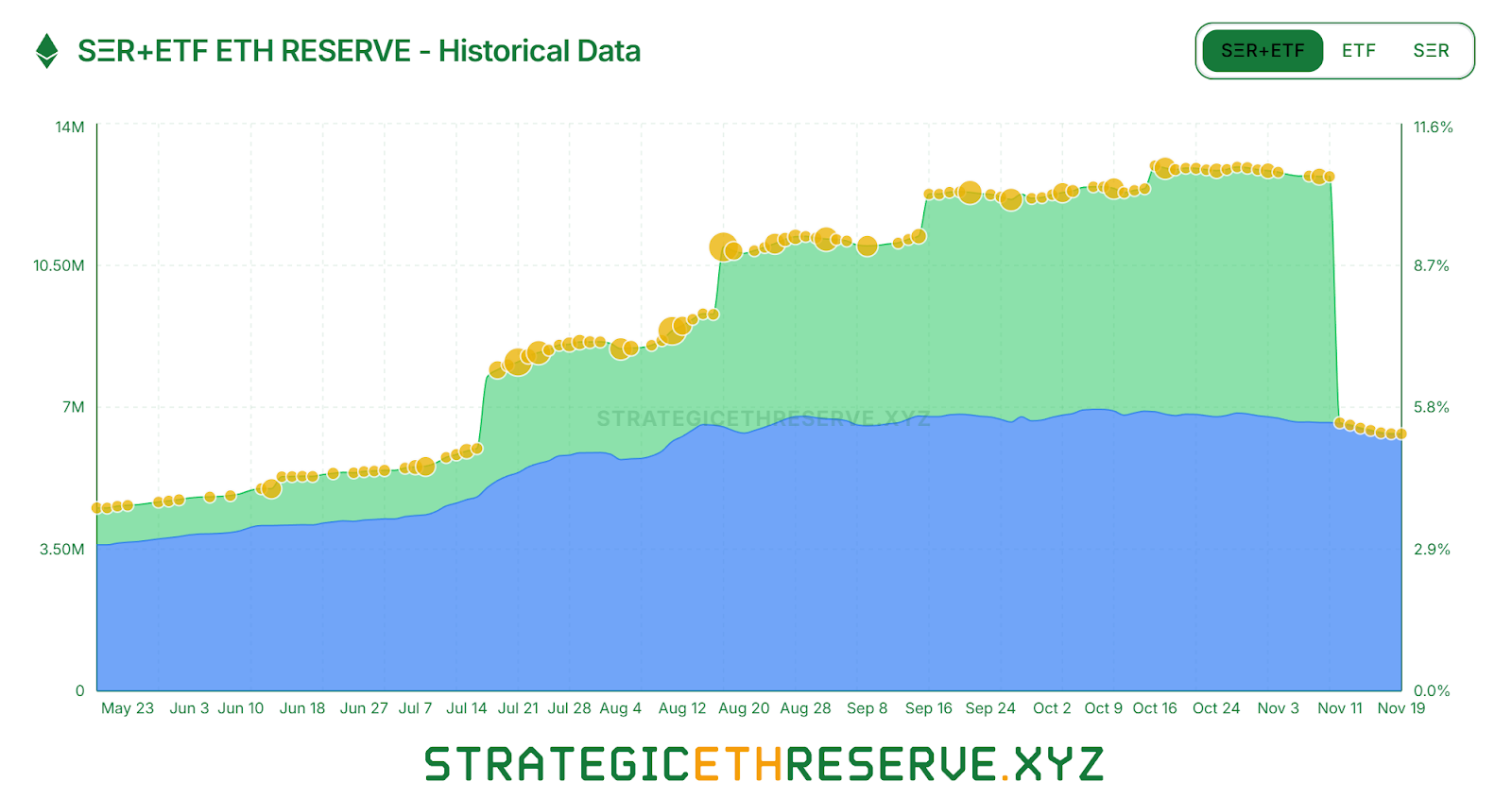

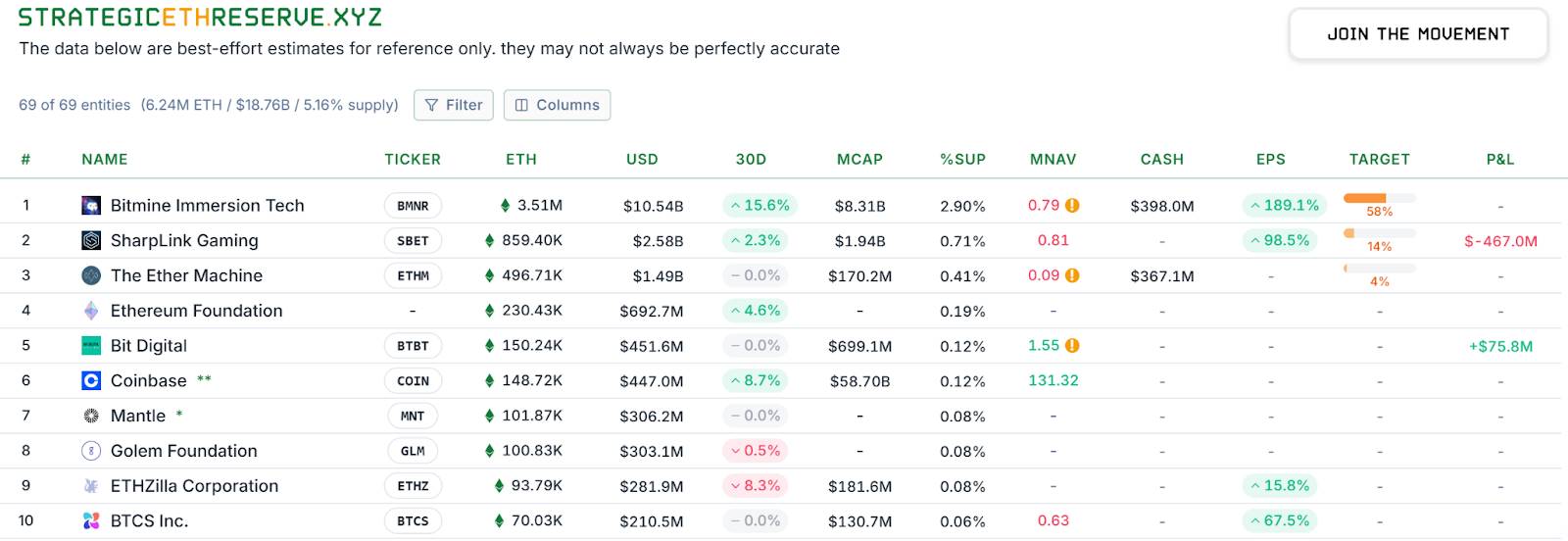

3.DAT公司增量收缩:板块内部也出现分化。截至11月中,总体DAT持有的以太坊战略储备约624万枚,占供应量5.15%,增持步伐近月明显放缓。在“大户”中,先行者BitMine几乎成了唯一仍在大举买入ETH的主力:仅过去一周又增持了6.7万枚。而另一头部公司SharpLink自10月中旬买入1.93万枚后已偃旗息鼓,其持仓成本约3609美元,账面转为浮亏状态。更有中小财库公司被迫断臂求生:例如“ETHZilla”在10月底抛售了约4万枚ETH,用于回购本公司股票,希望缩窄股价折价。财库行业由此前的齐头扩张转为两极分化:有实力的巨头尚能勉力维持买盘,而中小玩家已陷入流动性束缚和偿债压力,被迫减仓止损。

来源:https://www.strategicethreserve.xyz/

4.杠杆出清与抛压显现: 二级市场上,杠杆资金的快速退潮进一步加剧了ETH抛压。10月暴跌期间,大户“麻吉大哥”等连续做多的巨鲸仓位遭遇强平,引发市场恐慌情绪蔓延,一定程度上打击了多头信心。据Coinglass统计,ETH合约未平仓量自8月高点以来已骤降近50%,杠杆资金正快速去杠杆,这意味着市场投机热度和流动性双双降温。不仅杠杆多头在撤退,长期囤币的大户也开始松动仓位。链上分析机构Glassnode报告称,持币超过155天的长期持有者近期每天抛售约4.5万枚ETH(约合1.4亿美元),这是自2021年以来的最高抛售水平,表明部分老币东选择在高位套现离场。这一系列迹象显示,市场内部的看涨力量明显削弱。

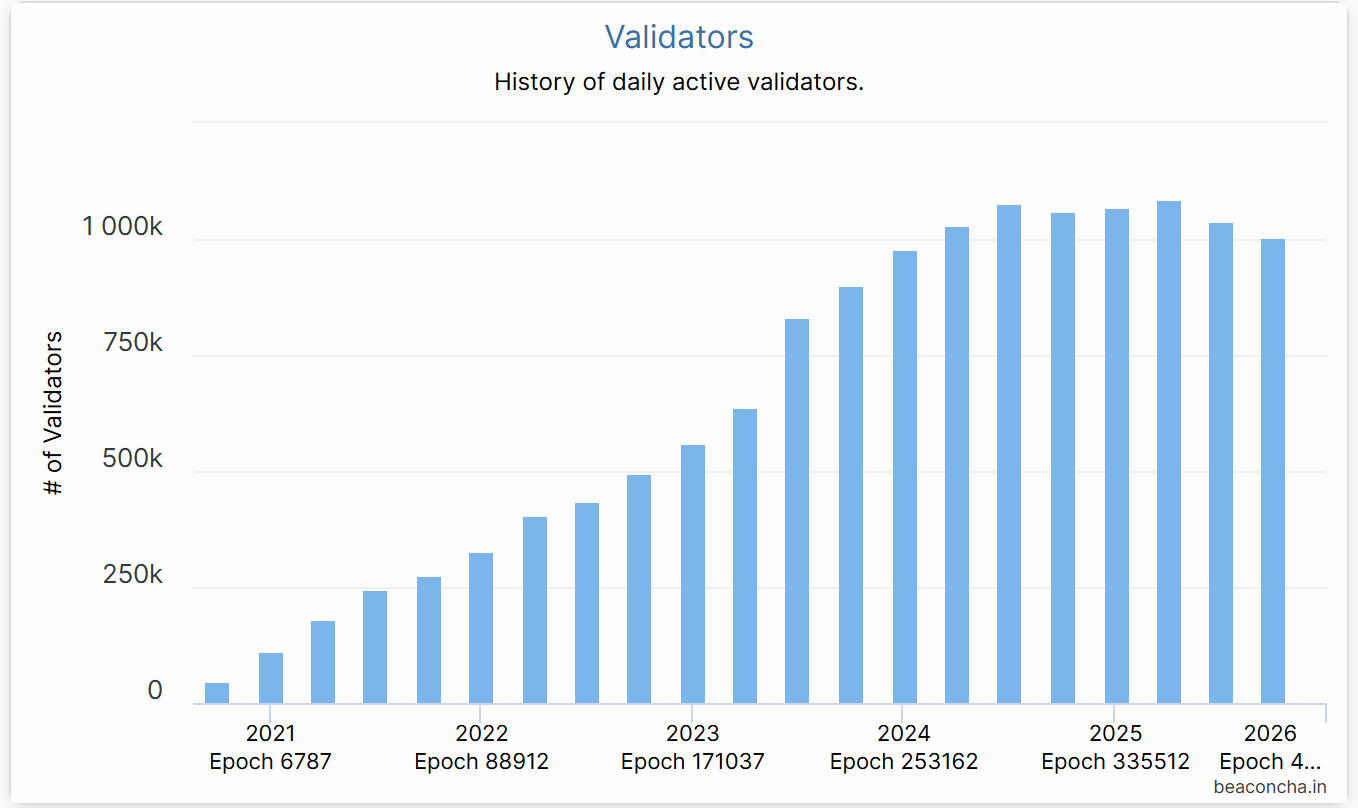

5.以太坊质押退潮:Beacon链数据显示,自7月以来以太坊活跃验证者数量下降了约10%,这是自2022年合并转POS以来验证者规模的首次大幅回落。主要原因一是今年上半年ETH大涨,不少节点运营者在高位选择退出质押变现收益,7月下旬验证者退出排队一度骤增,单日退ETH量创历史新高;二是近期质押年化收益率降至约2.9%,同时链上借贷利率攀升,套利空间被挤压,质押对ETH的价格支撑也相应减弱。

6.稳定币与DeFi震荡:以太坊生态自身的问题也集中暴露,进一步打击了投资者信心。10月11日暴跌当日,USDe因循环借贷套利机制失灵而崩盘,一度跌至0.65美元。尽管随后迅速恢复接近1美元,但已引发连锁反应。紧接着,去中心化稳定币领域再现多起风险事件:Stream协议发行的xUSD先因底层对冲基金爆雷而严重脱锚,随后同属一类策略的USDX也在流动性告急时跌至0.38美元,出现无法按1:1赎回的风险;另一算法稳定币deUSD同样未能幸免,纷纷跌破锚定价。这些曾被寄予厚望的新型稳定币,在极端行情下纷纷折戟,暴露出“delta中性”类稳定币模式在极端行情下的脆弱性和黑箱风险。稳定币的接连失守对DeFi造成重创。10月中旬起,多家借贷和收益聚合协议报告出现坏账和TVL暴跌:Morpho协议的USDC金库因关联的Elixir稳定币池子价值归零,不得不下架相关策略,造成约占金库3.6%的资产亏空;老牌借贷协议Compound也因部分长尾稳定币价值崩盘承受坏账压力,一度触发清算危机。Balancer协议则在10月底遭遇黑客攻击,损失金额达上亿美元。这些事件引发了DeFi资金的持续外流。截至11月上旬,Ethereum链上TVL已从年内高点的975亿美元降至约695亿美元,短短一个多月蒸发了超过300亿美元资产。

来源:https://defillama.com/chain/

总体而言,过去两个月以太坊经历了一场由外而内的“双杀”考验:外部宏观环境收紧,三大主要买盘力量(ETF、财库、链上资金)同步受压,内部生态在稳定币和安全层面遭遇动荡。在质疑声中,以太坊价格与市值双双承压。

三、利空因素:宏观阴霾与潜在隐忧

不可否认,当前笼罩在以太坊上空的利空阴霾,可能在中短期内持续对ETH价格和生态发展构成压力。

1.宏观紧缩与资金抽离

眼下最大的不利因素来自宏观环境。全球主要央行在通胀未稳之际维持谨慎利率政策,12月降息预期受挫,市场避险情绪浓厚。今年上半年推动ETH上涨的几股力量(ETF申购、DAT买入、链上杠杆加仓)如今反过来成为潜在的抛压来源。如果宏观环境在未来半年持续偏冷,不排除会有更多机构通过赎回ETF或出售财库公司股票间接减持ETH头寸,形成持续的资金流出。特别是财库模式本身存在一定脆弱性:BitMine等公司目前股价大幅折价,股东信心不足,一旦其融资链条断裂或面临清偿压力,被迫抛售ETH变现的风险不容忽视。总之,在全球流动性未见拐点之前,资金面的逆风可能持续笼罩以太坊。

2.竞争与分流效应

其他公链如Solana和BSC一定程度上分流了投机资金。此外,跨链协议和Plasma、Stable、Arc等应用链兴起也削弱了一部分以太坊对项目方和用户的吸引力。随着模块化区块链概念兴起,一些项目甚至构建起自己的主权Rollup,不再依赖以太坊的安保。而在Layer2领域内部,诸多Rollup之间也存在竞争关系:Arbitrum、Optimism为争夺用户和流量不惜高额激励或空投,可能导致“L2战争”,而L2的成功并不直接等同于主链ETH价格上涨,反而可能稀释部分价值。如部分L2发行了独立代币用于支付费用,长期看可能对ETH作为Gas的需求造成影响。当然,目前ETH仍是主要结算资产,短期竞争冲击有限,但长期值得警惕。

3.监管与政策不确定性

监管环境同样是悬在头顶的达摩克利斯之剑。虽然SEC主席保罗·阿特金斯表示以太坊不应被视为证券,若未来监管层态度生变,以太坊的合规地位可能遭到质疑,进而影响机构参与热情。此外,各国对于DeFi的监管讨论正在展开,去中心化稳定币、匿名交易等功能或将面临更严格的限制甚至打压。这些政策变数都可能成为以太坊生态发展的掣肘。比如,如果某些国家禁止银行参与质押或限制散户买卖加密资产,将直接减少潜在资金流入。再如欧洲的MiCA法规对稳定币发行和DeFi服务提出要求,可能增加以太坊项目的合规成本。

4.生态内部风险与信任重建

经过这一系列风波,以太坊生态的信任赤字需要时间弥合。一方面,稳定币密集脱锚事件让DeFi用户对高收益产品心有余悸。当下整个市场风险偏好降低,保守策略盛行,用户更青睐中心化平台或USDT/USDC等主流稳定币,这将使以太坊上许多创新型协议在未来一段时间里流动性匮乏、增长受限。另一方面,频繁的安全事件(如黑客攻击、漏洞)也让人质疑以太坊应用层的安全性,每一次重大攻击或崩盘,往往伴随相关协议用户抛售ETH或撤出资金离场。可以预计,在未来一段时间,风险治理将成为以太坊社区关注重点,项目方可能会加强储备和保险措施以恢复用户信任。然而熊市心理一旦形成惯性,投资者往往需要更多正向刺激(如价格筑底反弹、新应用爆发等)才愿重新投资。

总之,当前的以太坊正处在内外交困的磨底阶段。宏观资金面的退潮、行业竞争和监管压力、以及自身生态的问题,都可能在短期内持续压制ETH表现。这些不利条件需要时间和足够的利好刺激去化解。在此过程中,市场或许还将经历阵痛和反复。

四、利好因素:升级驱动与基本面支撑

即便近期风波不断,以太坊作为最大公链生态的基本盘依然稳固,其网络效应、技术基础和价值共识在长期维度上展现出韧性。

1.网络效应与生态韧性

- 开发和创新活跃:以太坊上活跃开发者数量和项目数量仍居行业之首,大量新应用、新标准持续涌现。DevConnect大会期间,多项重要动向引发社区关注:Vitalik重申以太坊“可信中立、自主自托管”的理念;账户抽象、隐私保护等前沿话题成为焦点。

- Layer2生态方兴未艾:尽管总TVL近期受挫,但Arbitrum、Optimism、Base等二层网络的用户活跃度和交易量仍保持相对高位,表明低成本环境下链上需求依旧存在潜力。Fusaka升级后,随着数据发布成本进一步降低,Rollup的经济模型将更具可持续性,吸引更多用户和项目部署到以太坊二层,从而反哺主链价值。

- 以太坊网络的安全与分散性:链上总质押ETH数量仍超过3500万枚,占供应量约20%,提供了坚实的POS安全保障;即便验证者近期略有回落,但新进场的机构节点运营商正在填补空缺。未来将有更多传统机构通过持有并质押ETH来获得稳定收益,这将为以太坊带来持续的资金“蓄水池”。

- 手续费燃烧保持ETH通缩:EIP-1559手续费燃烧维持通缩属性,有望放大ETH价格弹性,使其具备类似“数字资产通胀对冲”的特征。

可见以太坊强大的网络效应(开发者+用户+资金网络)和日益完善的经济模型,构成了长线投资者持续看好的底层逻辑。

2.重大升级与改进

- Fusaka升级扩容降费:Fusaka升级被视为以太坊网络有史以来最大胆的扩容尝试。按照计划,此次升级将于12月4日在主网激活。Fusaka的最大亮点是引入同行数据采样 (PeerDAS) 技术,即通过让每个节点只存储全部交易数据的约1/8,其余通过随机采样和重构验证,从而显著降低每个节点的存储带宽要求。这一改变有望让以太坊单块可容纳的数据blob数量提高8倍,使L2 Rollup提交交易数据的成本大幅下降。换言之,Fusaka将进一步扩大数据容量、降低Gas费用,直接惠及Arbitrum、Optimism等Layer2网络和用户。

- 其他关键改进:除了核心的PeerDAS,此次升级还包含多项关键改进:如Blob经济模型调整,抗DoS强化以限制极端交易和区块大小,以及用户与开发者新工具;EIP-7951原生支持P-256椭圆曲线签名,提高与硬件钱包和移动端兼容性,CLZ指令优化合约算法等。

如果进展顺利,Fusaka或将成为继2022年合并、2023年Shanghai升级之后,以太坊迈向全球结算层愿景的又一里程碑,为下一个增长周期奠定技术基础。

3.应用新趋势与价值共识

- 链上实用价值的提升:随着以太坊性能改善和费用降低,一些曾被寄望却因成本问题难以规模化的应用领域有望重获生机。例如区块链游戏、社交网络、供应链金融等,需要高频小额交易的平台将更愿意选择升级后的以太坊或其L2作为底层架构。

- DeFi持续创新进行:以Sky(原MakerDAO)为代表,DeFi协议正大举引入合规资产:通过子项目Spark、Grove、Keel等,将版图扩展至稳定币贷款、国债投资、协议间结算等多个领域。头部DEX Uniswap近期通过社区投票开启收费开关,将对部分池收取0.15%的协议费用于积累国库。这标志着DeFi协议开始探索可持续盈利模式,为治理代币赋能,间接反哺以太坊网络活力。此外,Aave计划推出V4版本引入跨链功能和更精细的风险控管。一旦市场环境改善,功能更强、风控更好的DeFi 2.0有望吸引新一波用户回流。

- 认可度提升,政策逐步明朗:美国ETF的陆续获批、香港等地开放散户交易、新兴市场对稳定币需求强劲,均为以太坊带来用户增长契机。尤其在高通胀国家(如阿根廷、土耳其等),以太坊网络上的稳定币、支付应用正成为居民抗通胀和跨境汇款的重要工具,体现出真实世界的使用价值,潜移默化推动ETH的全球价值共识。

综上,尽管短期经历波折,但以太坊的长期价值支撑仍在,其在全球区块链版图中的核心地位未被撼动。这些利好因素不会立竿见影地扭转行情,但却如同埋在冰雪下的种子,一旦春风吹拂,便有可能迅速发芽成长。

五、展望与结论

综合以上分析,我们对以太坊后续走势做出如下判断与展望:

短期(今年年底前): 以太坊大概率维持弱势震荡基调,存在区间筑底的迹象,但难有大幅度反弹。Fusaka升级本身属于预期内利好,市场已基本消化,因此不太可能单靠升级消息扭转趋势。不过,考虑到ETH价格自高位快速下跌超过30%,技术上存在超卖,空方获利回吐压力也在增加,年底前进一步深跌的空间相对有限。如果宏观不出现新的大利空(如利率意外上调等),投资者信心有望略有修复,年底前ETH或缓慢爬升至3500美元上方整固。需注意的是,年底临近流动性偏紧,缺乏量能配合的反弹高度恐有限,3500美元一线将是重要阻力。

中期(2024全年至2025年上半年): 预期2024年上半年,以太坊将经历一个磨底蓄势阶段,下半年起有望逐步走强。具体来说,明年一季度ETH可能延续震荡,年底前的减税卖压、机构财报季调仓等因素也可能在1月对市场造成扰动。然而,下半年前后,形势或迎来转机:若通胀下降驱动美联储降息,全球流动性环境边际改善,将利好包括ETH在内的风险资产反弹。届时叠加美国中期选举风险偏好回暖,ETH有机会开启新一轮升势,上涨至4500-5000美元区间。

长期(2025年底及以后): 展望更长远,以太坊依然有望在下一轮完整牛市周期中创出新高,巩固其“全球价值结算层”的地位。2025年下半年到2026年,若宏观环境宽松叠加区块链大规模应用落地,ETH价格有潜力向6000-8000美元区间迈进。这一判断基于以下逻辑:其一,Fusaka升级之后,以太坊持续的升级,例如例如Verkle树、PBS提案、分片完全体等,将不断提高性能、降低成本,技术红利将吸引海量新应用和用户涌入,为价值提升提供坚实支撑。其二,以太坊的网络效应呈现加速滚雪球态势,用户多吸引开发者多,进而资产和应用更多,如此循环。长期看,以太坊极有希望成为支撑数万亿美元规模经济活动的基础网络,那时对ETH的需求(支付Gas、抵押担保、价值存储)将远超当前想象。此外,ETH作为生产性资产(可质押赚收益)这一属性在机构眼中独具魅力,一旦制度环境成熟,大型养老金、主权基金配置ETH可能成为趋势,就像如今配置房地产和股权一样。这将带来全新的巨量增量资金,把ETH推向更高的价值中枢。

结论: 以太坊作为加密世界的重要基石,经历了数轮牛熊交替,每一次都在质疑声中涅槃重生。利好与利空因素的博弈终将见分晓,而时间会站在技术和价值这一边。在完成自我革新、渡过市场洗礼之后,一个更加强健的以太坊或将在未来几年再次屹立于舞台中央,续写新的辉煌篇章。

关于我们

Hotcoin Research 作为 Hotcoin 交易所的核心投研机构,致力于将专业分析转化为您的实战利器。我们通过《每周洞察》与《深度研报》为您剖析市场脉络;借助独家栏目《热币严选》(AI+专家双重筛选),为您锁定潜力资产,降低试错成本。每周,我们的研究员还会通过直播与您面对面,解读热点,预判趋势。我们相信,有温度的陪伴与专业的指引,能帮助更多投资者穿越周期,把握 Web3 的价值机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。