作者:Alana Levin

编译:深潮TechFlow

注:文内图片针对文字较多的部分进行了翻译,如需了解详情可查看完整报告

非常激动地发布我的《2025年加密趋势报告》!

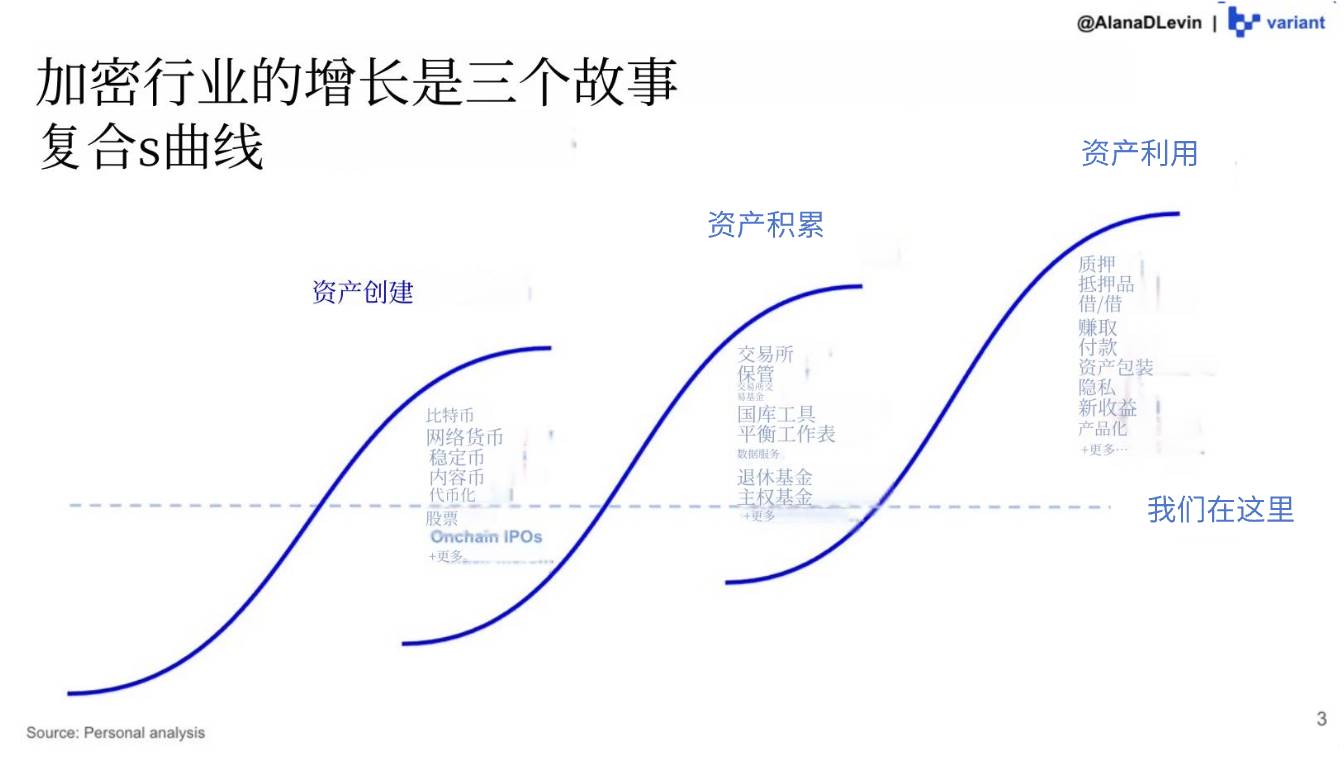

报告将加密行业的增长描绘为三个复合的 S 曲线故事:资产创造、资产积累和资产利用。

通过这一视角,报告从五大关键主题领域——宏观经济、稳定币、中心化交易所、链上活动和前沿市场——出发,预测行业的未来发展方向。

我们在每条曲线上的位置,有助于识别尚存的初创机会,以及可以预见的有利发展趋势。

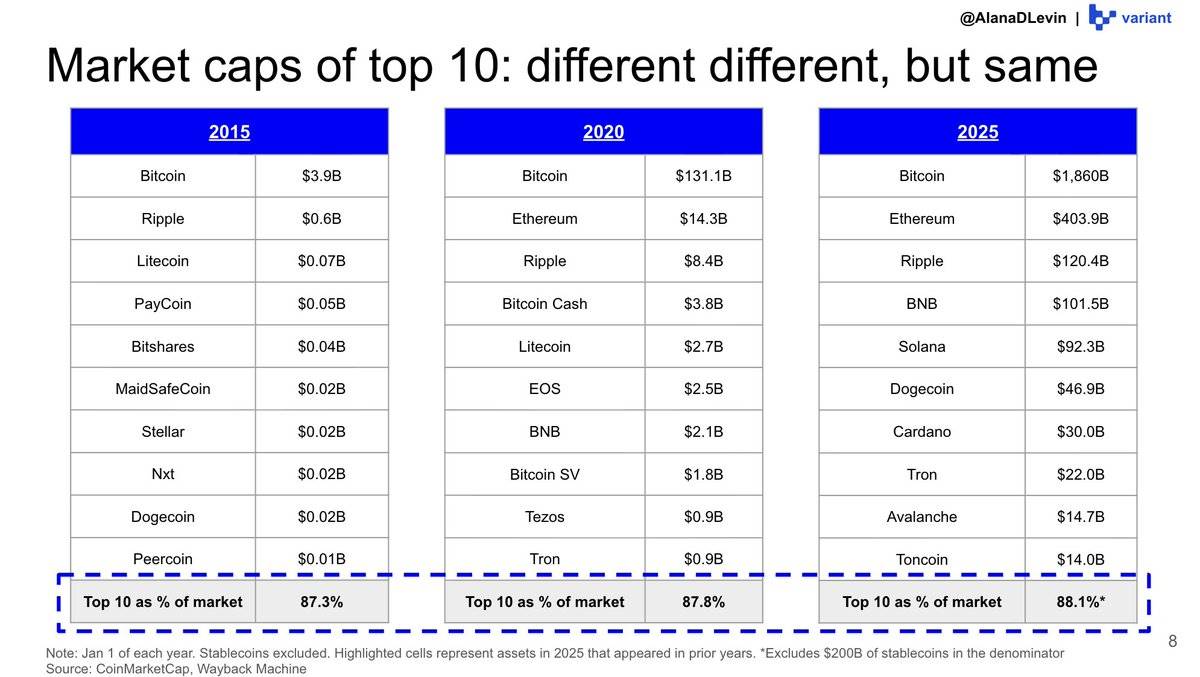

从宏观角度来看,主要加密资产的规模持续扩大。尽管市场上代币数量创下新高,但前十大加密资产的价值集中度却始终保持惊人的稳定。

资产积累是一种自我强化的循环:持有某资产的人越多,其价值增长越快,它就越有可能成为“Lindy效应”的受益者(Lindy Effect,指某事物存在的时间越长,其未来生存的可能性就越大)。

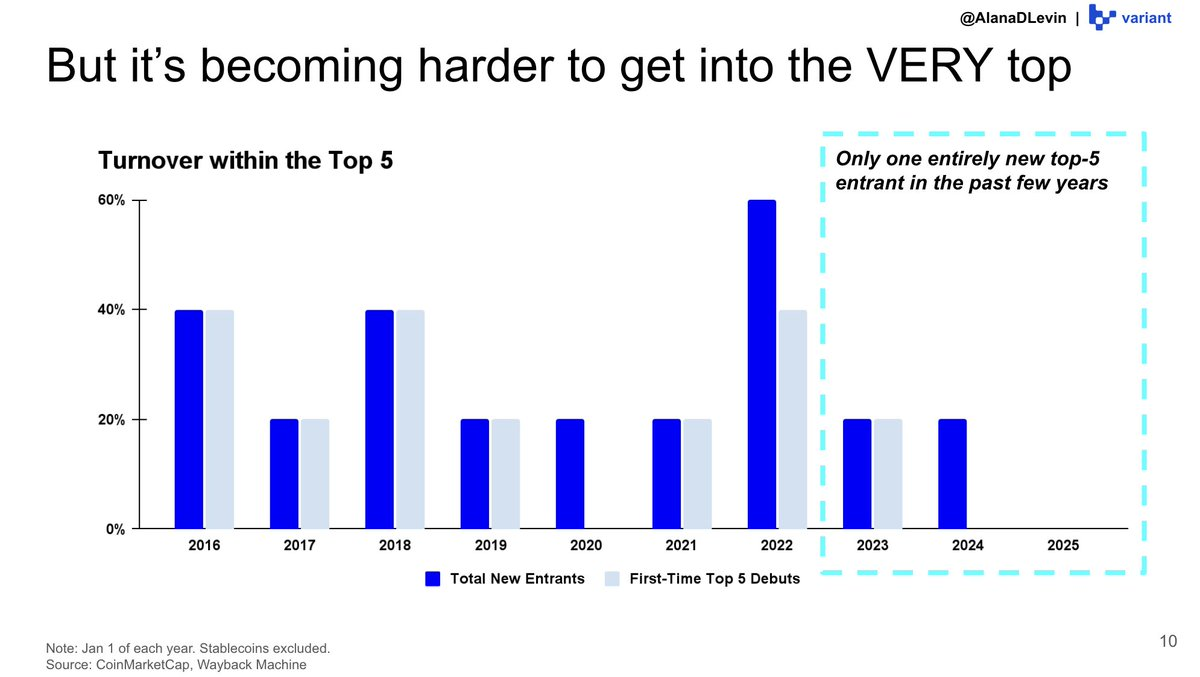

这一趋势在前五大加密资产中尤为明显——过去几年几乎没有新的资产进入这一梯队。

然而,有一个资产类别未被纳入上述图表中,那就是稳定币。

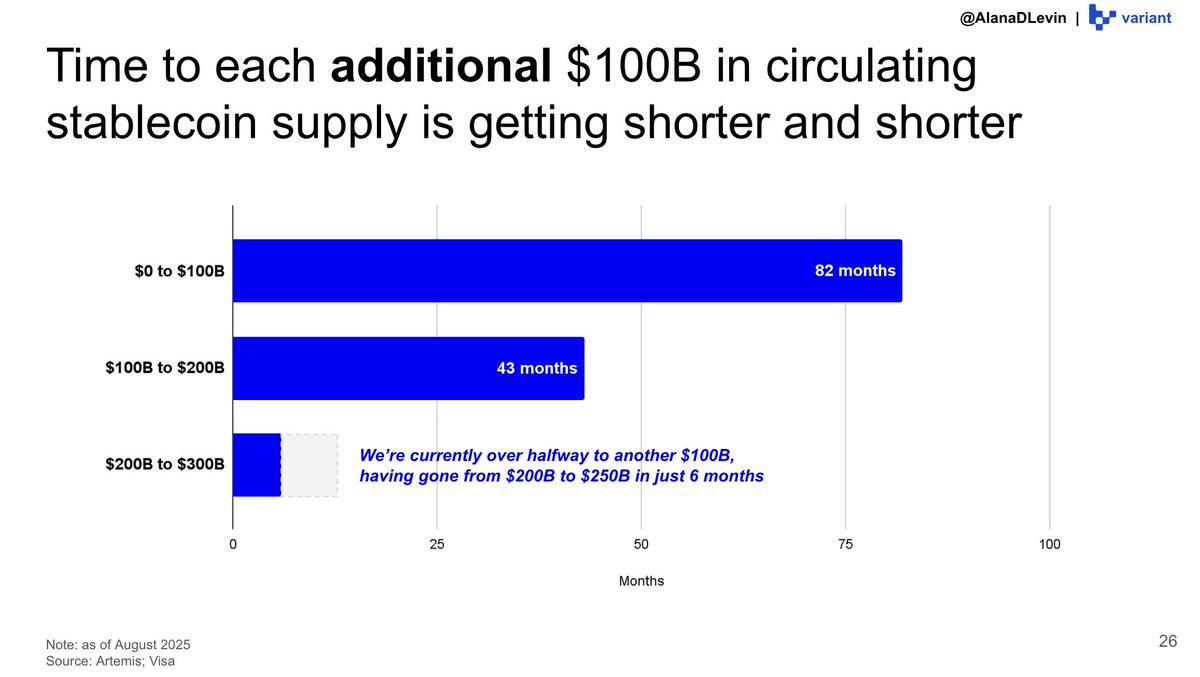

新的稳定币正以创纪录的速度涌现。

第一个 1000 亿美元的供应量用了 80 多个月,第二个 1000 亿美元用了 40 多个月。而现在,我们预计第三个 1000 亿美元的供应量将在不到 12 个月内达成。

创造 → 积累 + 利用

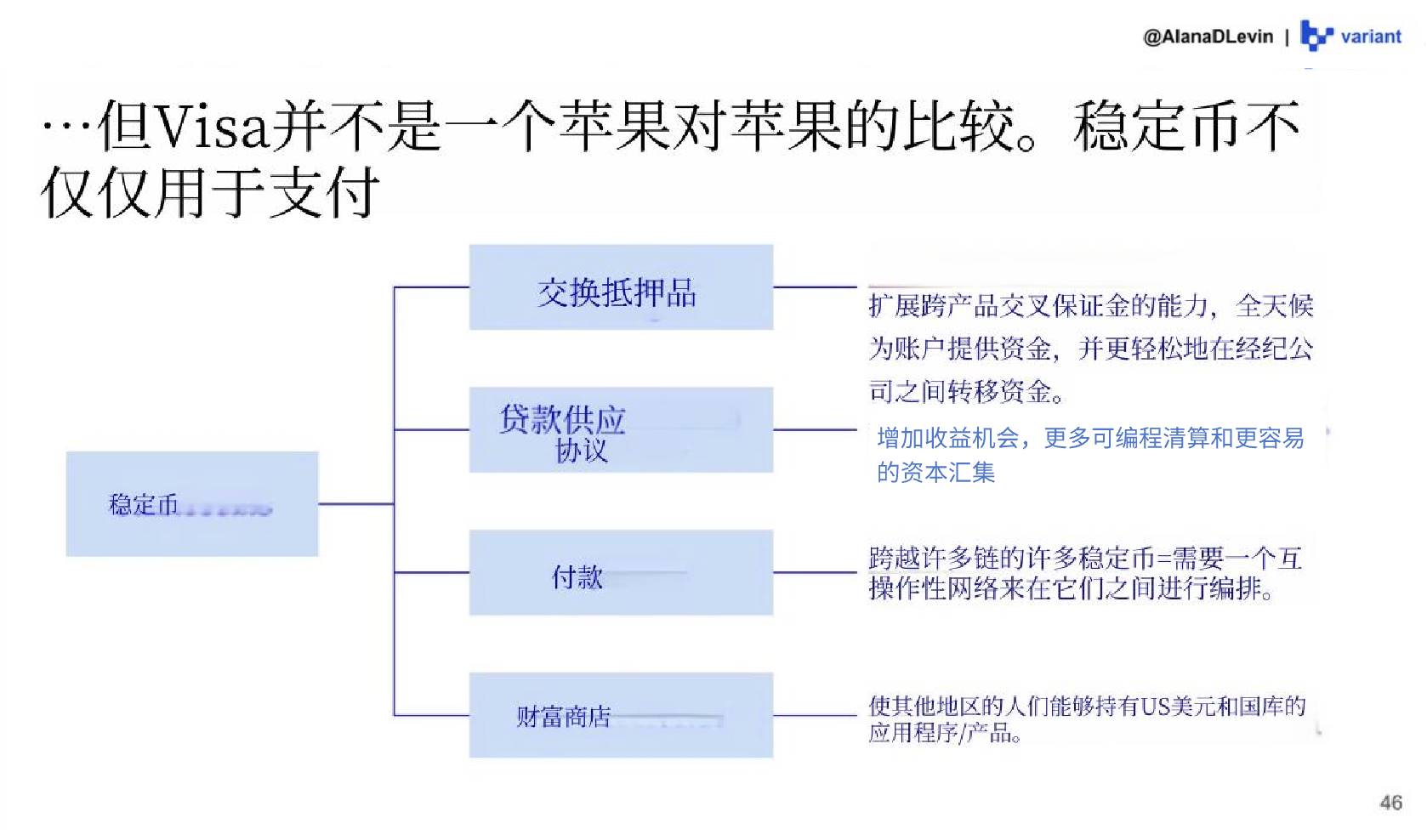

稳定币正被广泛应用于各种产品和场景,包括支付、借贷协议、交易所,甚至作为财富储存工具。

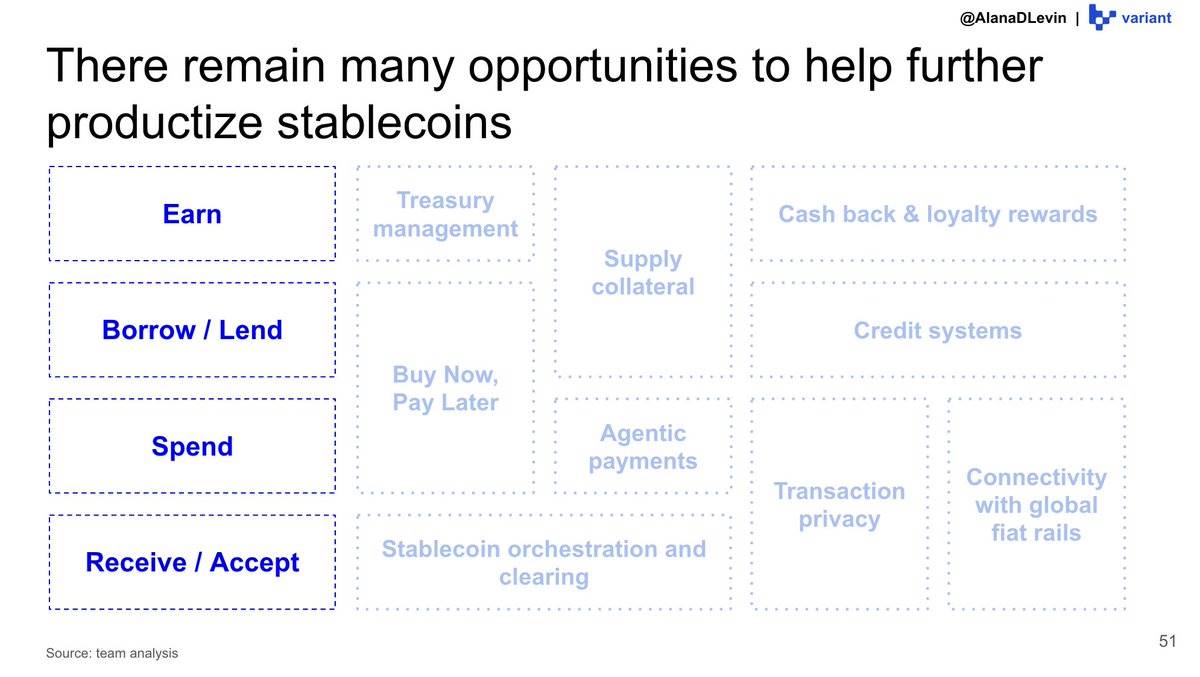

稳定币的利用率依然是初创企业的巨大机会。

我们已经开始看到一些产品化的早期迹象,如收益产品、借贷、消费支付以及接收/接受支付等,但这仅仅是个开始!

未来,稳定币的产品化方向还包括信用体系、隐私交易、资金协调、“先买后付”(BNPL)等更多领域。

接下来的部分将聚焦于中心化交易所(CEXs):

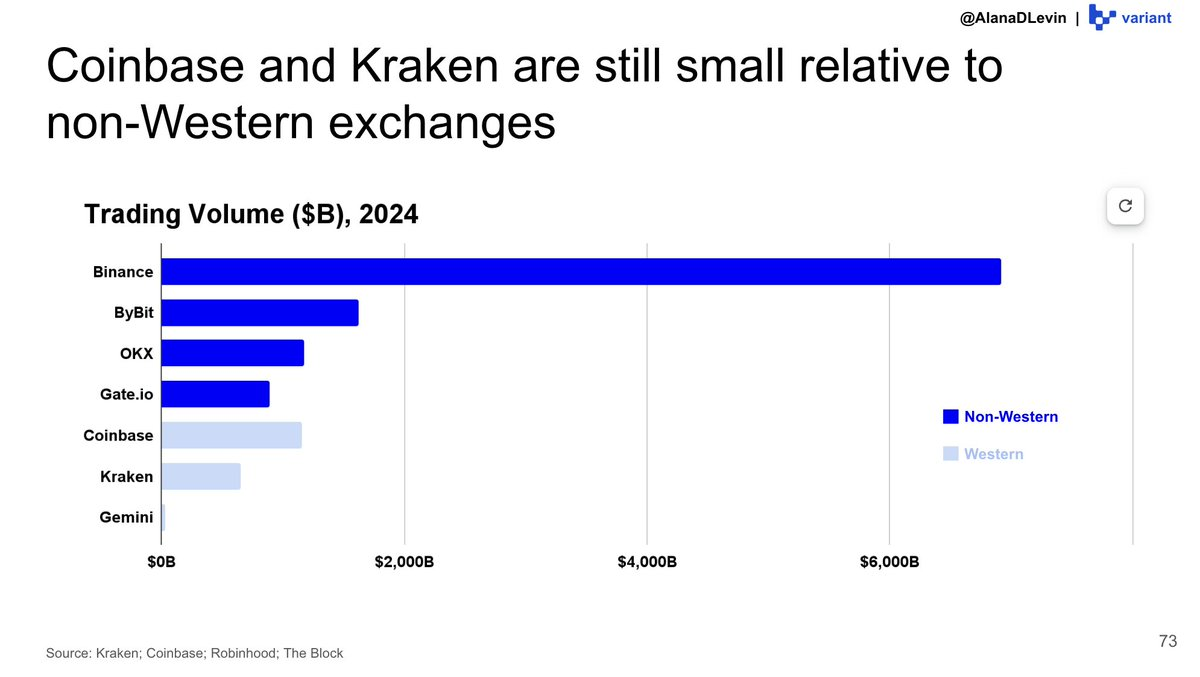

中心化交易所从“积累”的顺风趋势中受益匪浅。随着越来越多的人希望买入、卖出和持有加密资产,他们往往选择中心化交易所,这也为其带来了数万亿美元的交易量。

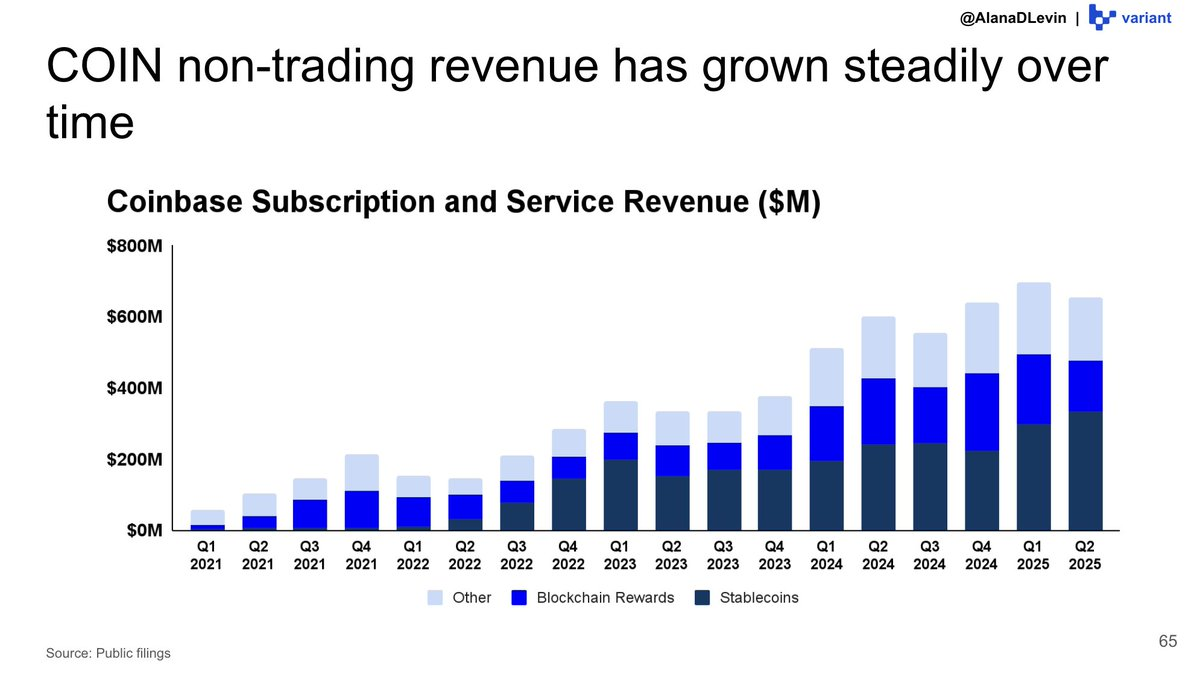

交易所是复合型业务。像 @Coinbase 这样的公司围绕用户的二级需求构建了强大的业务线,例如托管服务、质押服务以及收益产品。

许多新的加密资产利用方式将直接构建在链上,但可能通过中心化交易所(如 @Coinbase、@RobinhoodApp和 @krakenfx)实现强大的分发能力。

那么,为什么资产利用的未来会建立在链上?

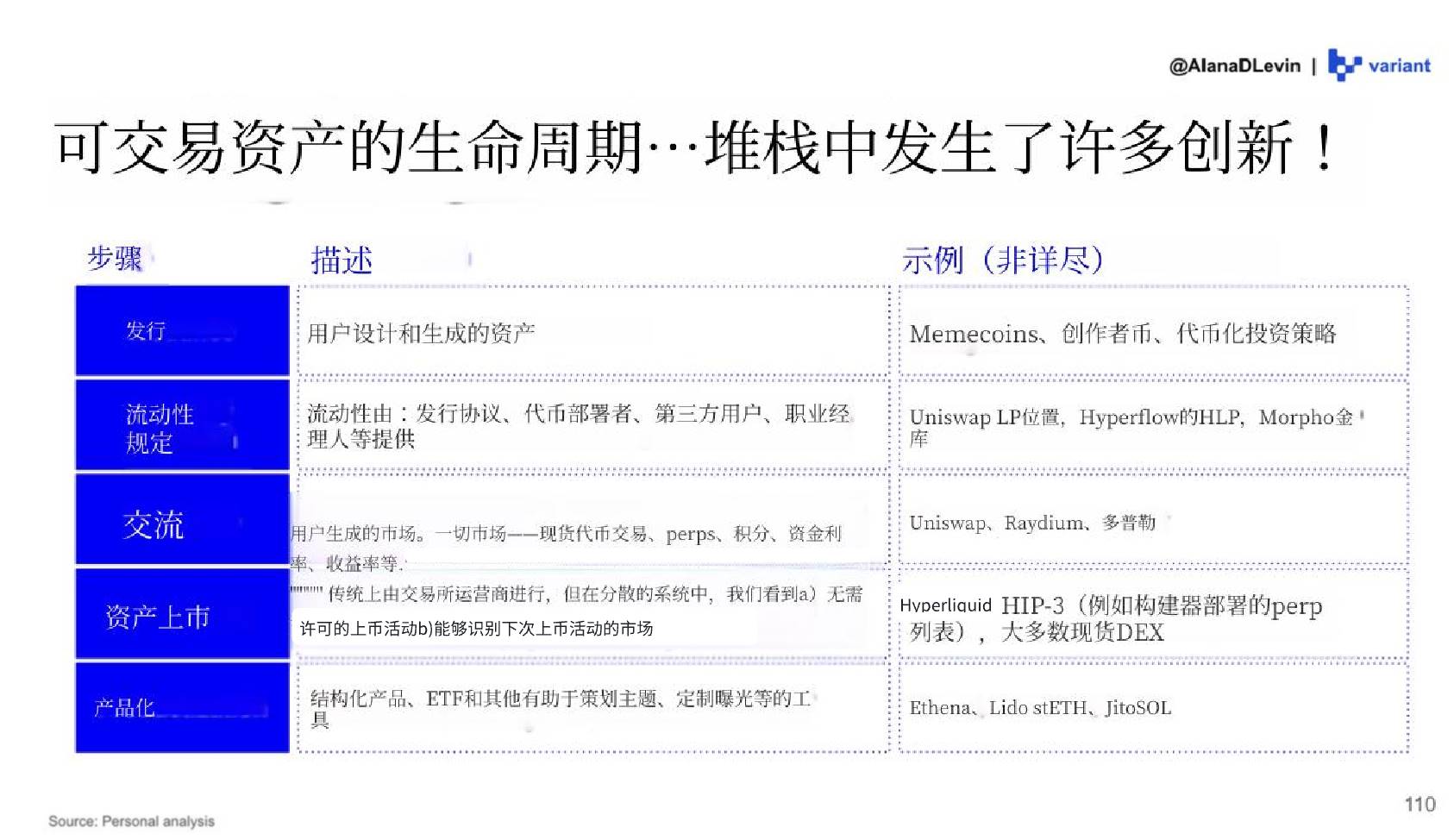

链上活动是创新的温床。资产生命周期的每个环节都可以在链上进行实验,而传统金融中这些步骤往往受到限制和许可的约束。

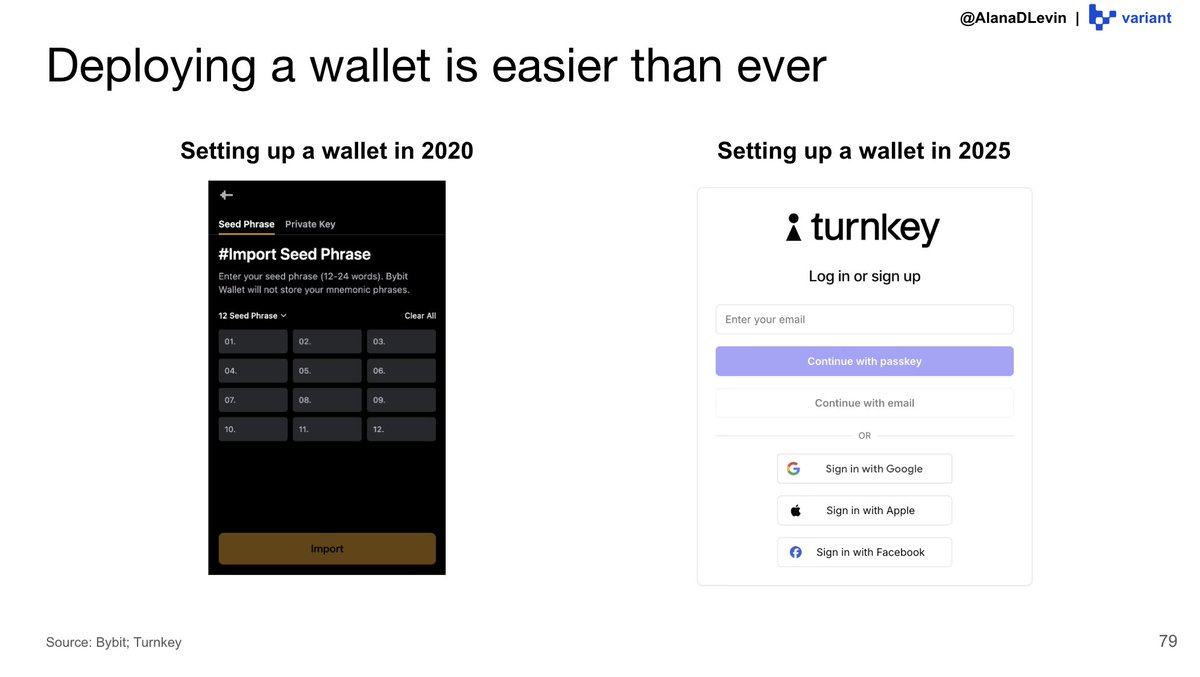

此外,新用户现在比以往任何时候都更容易开始链上探索——这意味着任何人,无论身处何地,无论年龄,都可以开始创造、积累和利用加密资产。

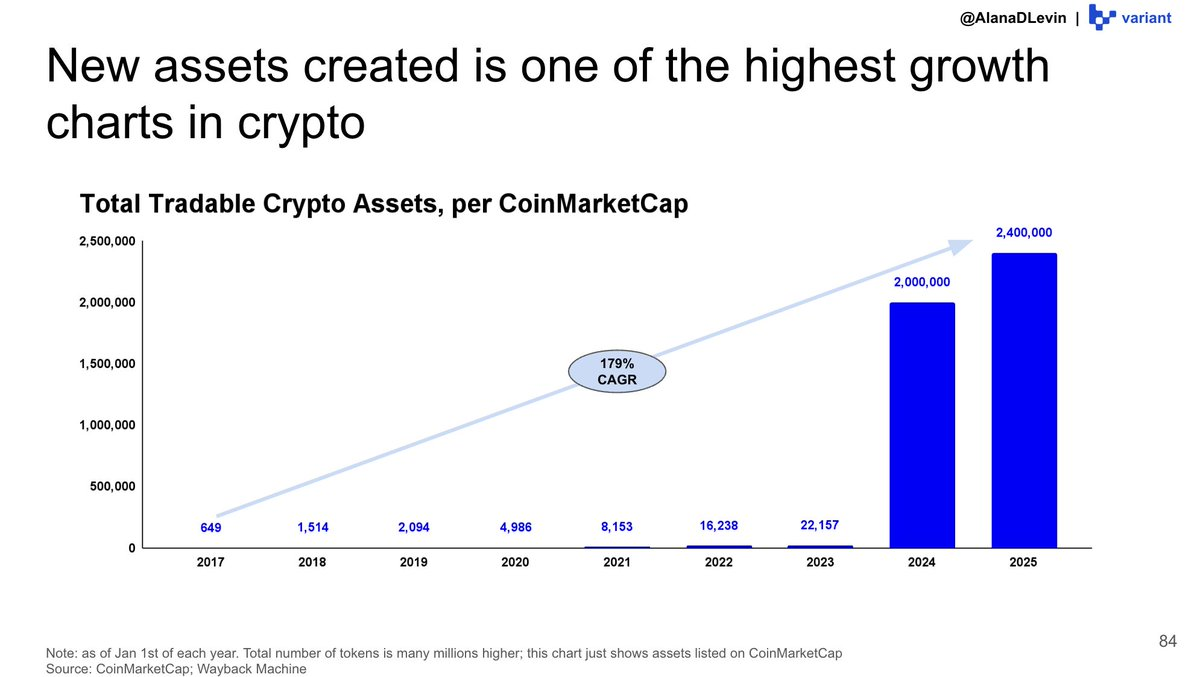

关于创造: 新代币的创造数量是加密领域增长最快的图表之一。

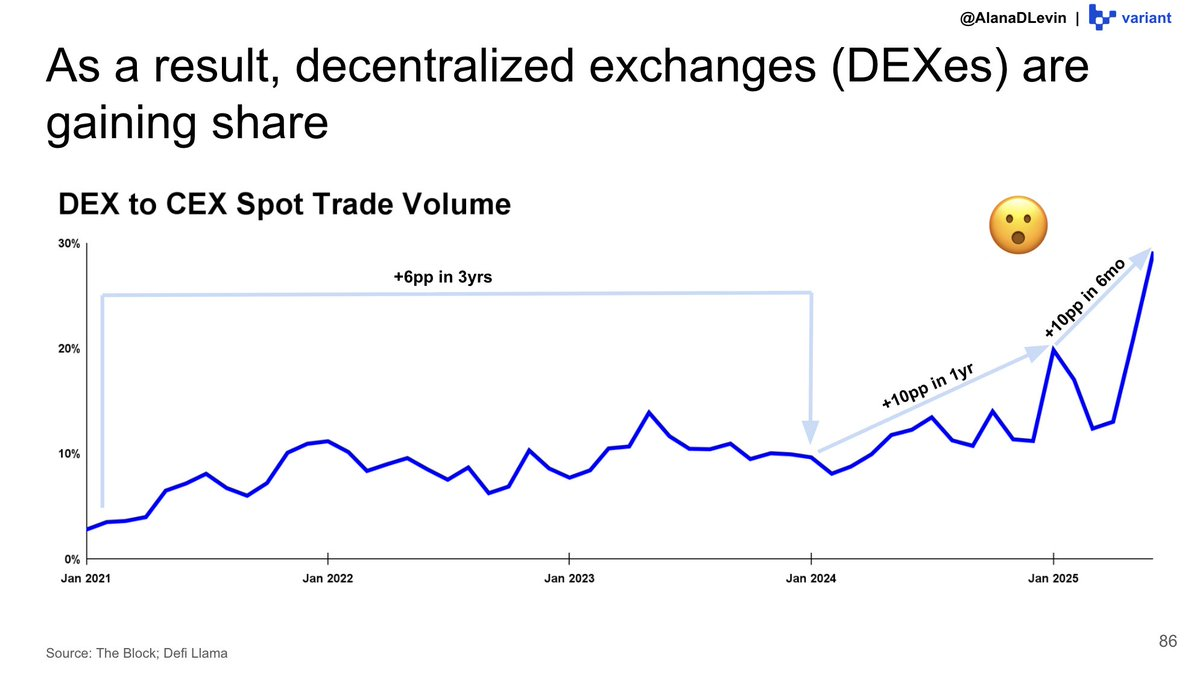

因此,总交易量飙升,去中心化交易所(DEX)的发展也在持续。DEX 在 2025 年前六个月内的市场份额增长,超过了 2021-2023 年的总和。

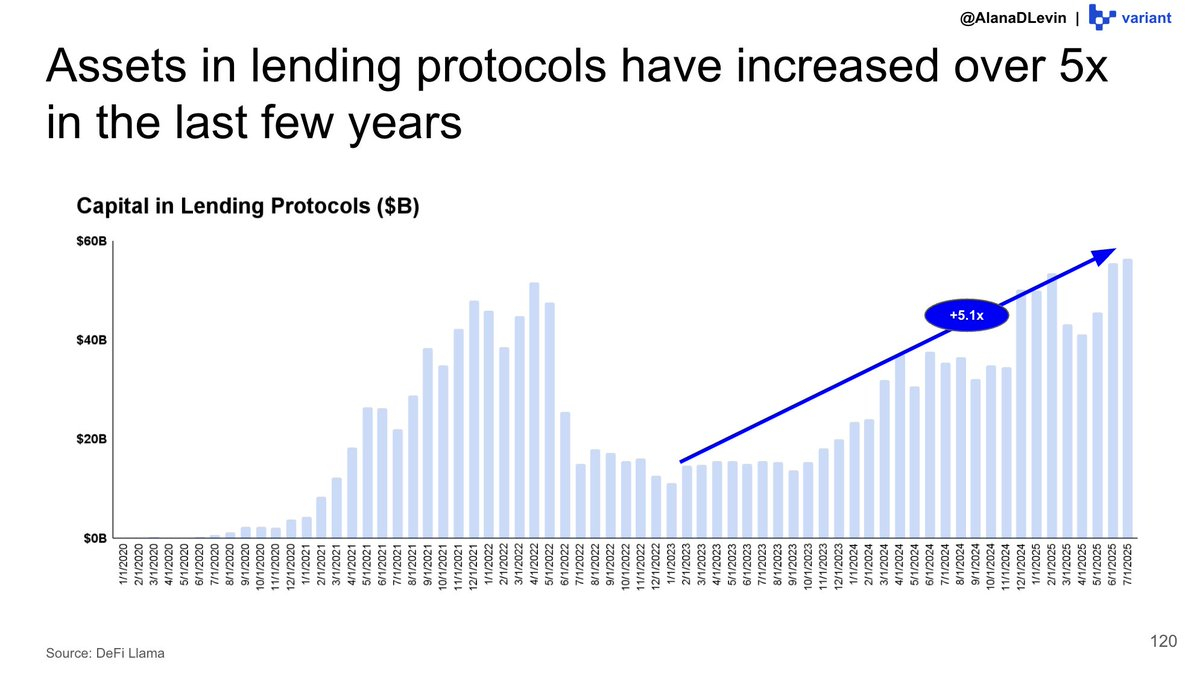

另一个可以观察到资产利用早期迹象的领域是链上借贷。借贷协议中的资产(如 @Morpho)在过去几年增长了 5 倍以上,并且仍在持续增长!

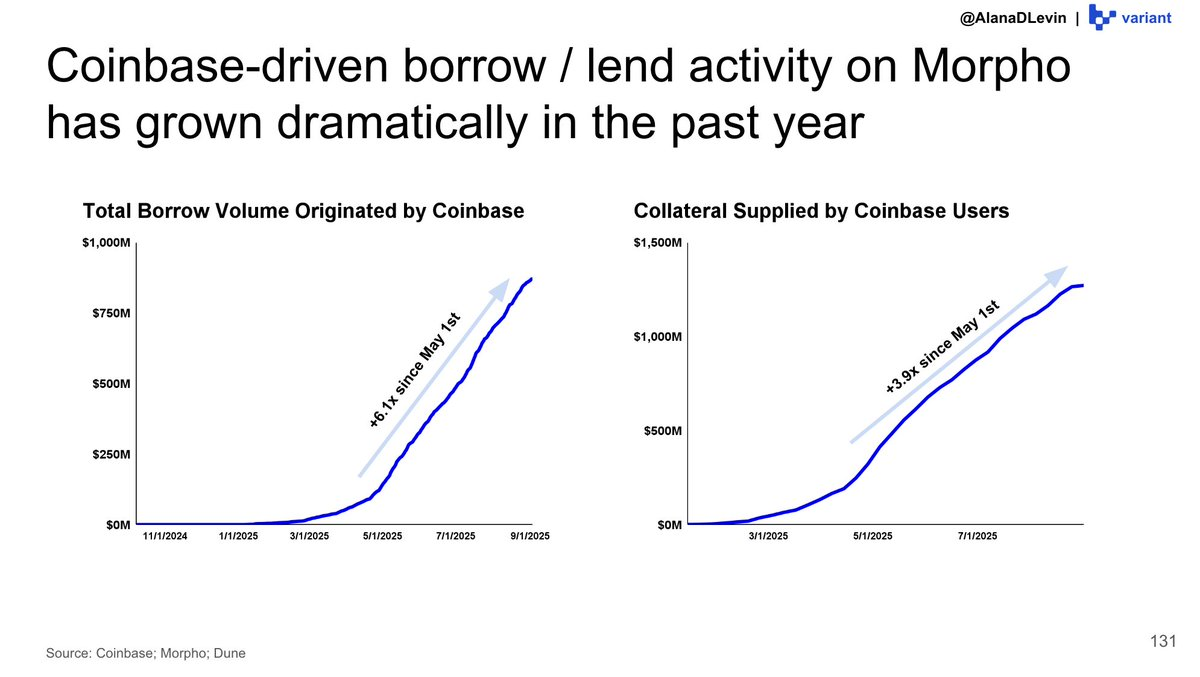

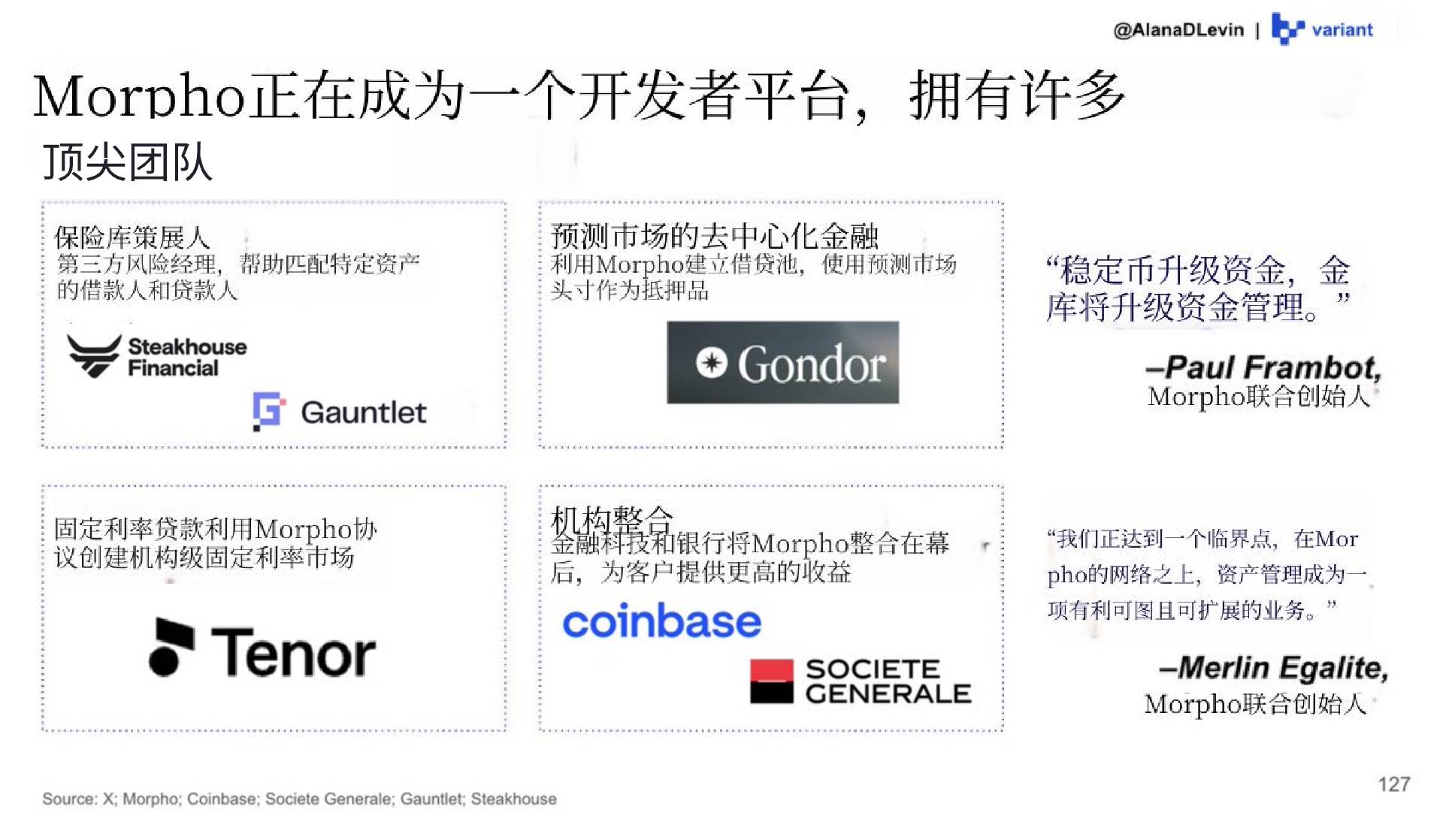

@Morpho 也是一个很好的例子,展示了“链上构建,全球分发和利用”这一正在兴起的趋势。

值得注意的是,资产创造的 S 曲线仍有发展空间。那么,我们可以在哪里找到这种机会?当然是在链上!

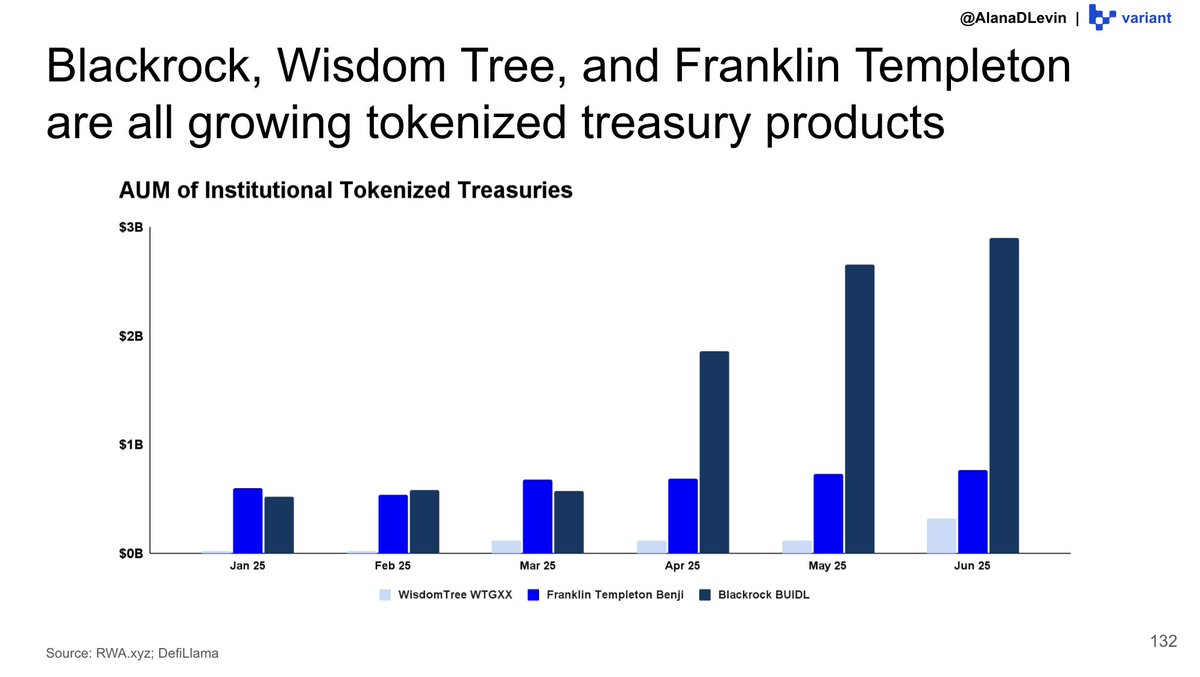

一个重要的新代币类别是由机构创建的代币。代币化国库(Tokenized Treasuries)是众多新兴实例中的首批代表之一。

同样地,我们也开始看到链上股权的实验性探索。许多设计正在测试中,未来可能会形成一系列代币化股权产品的多样化光谱。

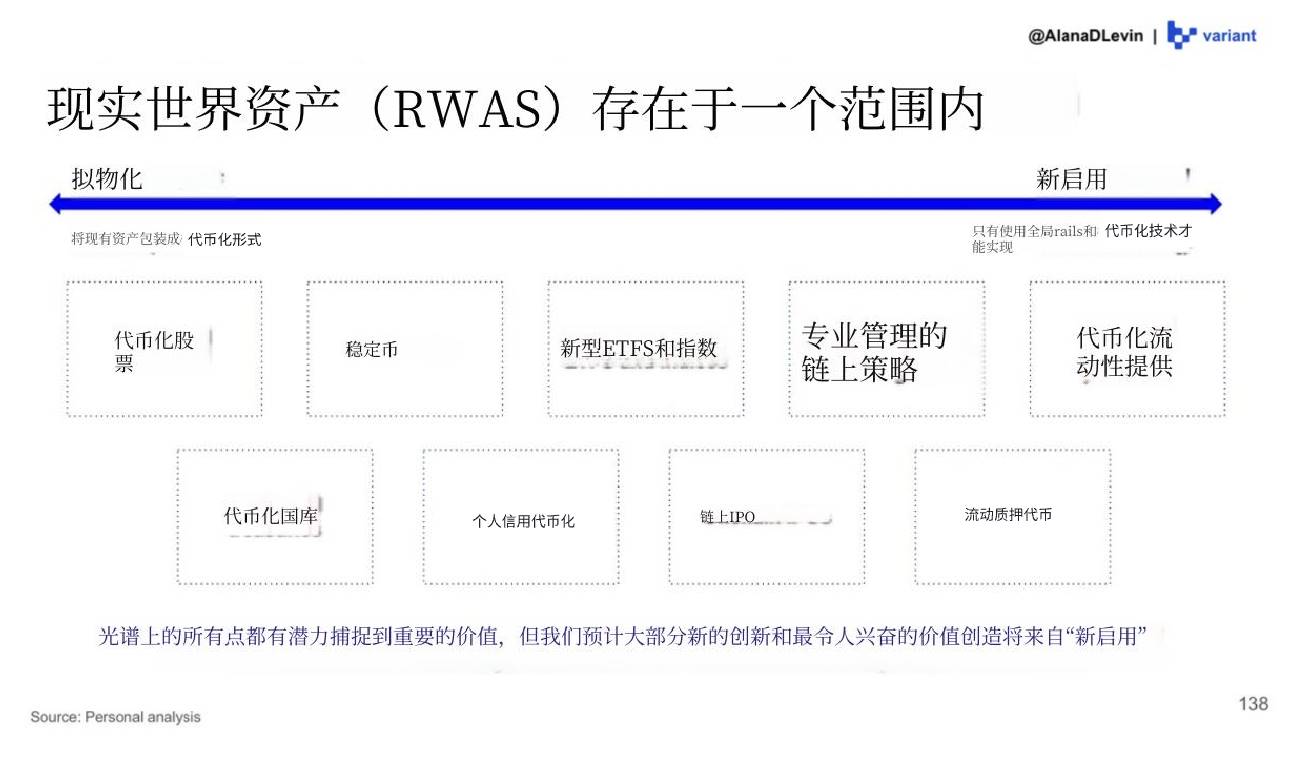

最终,“RWA”(实物资产,Real World Assets)这一术语将扩展,涵盖比现今更广泛的产品类型和代币构建方式。这些新资产不仅自身具有价值,还将催化新一轮的资产积累与利用需求。

报告的最后部分聚焦于前沿市场,预测市场成为一个典型案例,展示了如何通过加密技术将产品转变为平台。

加密技术将产品转化为平台的能力并不新鲜。我们已经在永续合约(如 @HyperliquidX)和借贷协议(如 @Morpho)中见证过这一点。

因此,如果你在思考未来在哪里,不妨从链上开始探索吧! :)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。