Author: Arthur Hayes

Original Title: Snow Forecast

Publication Date: November 17, 2025

It's that time again when I play amateur meteorologist. Concepts like La Niña and El Niño have entered the vocabulary.

Predicting the direction of storms is as important as snowfall amounts; it determines which slopes are suitable for skiing. I use my rudimentary knowledge of weather patterns to predict when autumn will end and winter will begin in Hokkaido, Japan.

I discuss with other local skiing enthusiasts about my dream of an early powder season. I no longer refresh my favorite crypto trading app frequently; now, the app I check the most is Snow-Forecast.

As data points start coming in, I have to decide when to hit the slopes with incomplete information. Sometimes, I only know what the weather patterns will be like the day before I put on my skis.

A few seasons ago, when I arrived in mid-December, I found the mountain covered in dirt. Only one lift was open, serving thousands of eager skiers. The wait in line was several hours just to ski a poorly snowed, flat beginner to intermediate slope. The next day, it snowed heavily, and I spent one of the epic powder days at my favorite ski resort, covered in forest trails.

Bitcoin is a free market barometer of global fiat currency liquidity. Its trading depends on expectations of future fiat currency supply. Sometimes reality meets expectations, and sometimes it does not.

Money is politics. And the rapidly changing political rhetoric affects the market's expectations of future fiat currency supply.

One day, the U.S. President calls for pumping up the assets of their favorite supporters with larger-scale, lower-cost funding, and the next day calls for the opposite measures to combat the destruction of ordinary people and inflation.

Like science, in trading, it is worthwhile to hold firm beliefs while maintaining a flexible attitude.

After the disastrous "massive tariff day" in the U.S. (April 2, 2025), I called for only increases, no decreases.

I believe President Trump and his Treasury Secretary "Buffalo Bill" Bessent have learned their lesson and will no longer try to change the world's financial and trade operating system too quickly.

To regain popularity, they will provide benefits to their supporters (who own substantial financial assets like real estate, stocks, and cryptocurrencies) funded by printed money.

On April 9, Trump "Taco'd" (yielded) and announced a tariff truce, turning what seemed like the beginning of a Great Depression crisis into the best buying opportunity of the year. Bitcoin rose by 21%, and some altcoins (mainly Ethereum) followed suit, with Bitcoin's dominance dropping from 63% to 59%, proving this point.

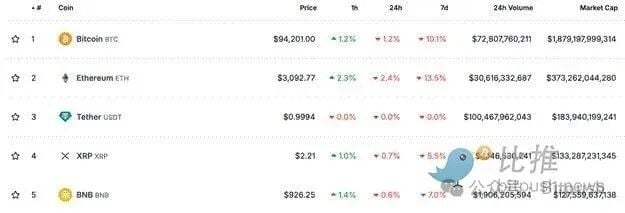

However, recently, Bitcoin's implied dollar liquidity forecast has worsened. Since hitting an all-time high in early October, Bitcoin has dropped 25%, with many altcoins suffering even more than capitalists in the New York City mayoral election.

What Changed?

The rhetoric from the Trump administration has not changed. Trump still criticizes the Federal Reserve for keeping interest rates too high. He and his aides continue to talk about pumping up the real estate market in various ways.

Most importantly, at every turning point, Trump has made concessions to China, delaying the forced reversal of the trade and financial imbalances between the two economic giants, as this financial and political pain is simply too hard for politicians who must face voters every two to four years.

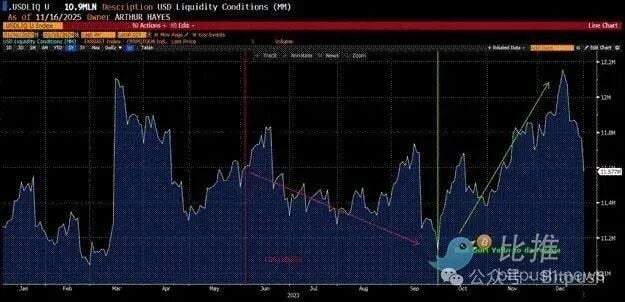

What has not changed, but is now given greater weight by the market than the rhetoric of politicians, is the contraction of dollar liquidity.

The dollar liquidity index (white line) has fallen by 10% since April 9, 2025, while Bitcoin (gold line) has risen by 12%. This divergence is partly due to the liquidity-positive rhetoric released by the Trump administration. Part of the reason is that retail investors view the inflow of funds into Bitcoin ETFs and the DAT mNAV premium as evidence of institutional investors seeking Bitcoin exposure.

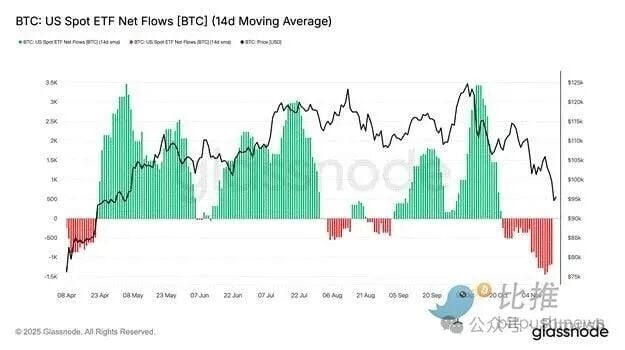

The narrative is that institutional investors are flooding into Bitcoin ETFs. As you can see, the net inflow from April to October provided sustained buying pressure for Bitcoin, despite the decline in dollar liquidity. I must attach a warning to this chart. The largest holder of the biggest ETF (BlackRock IBIT US) uses the ETF as part of a basis trade; they are not bullish on Bitcoin.

They short Bitcoin futures contracts listed on the CME while buying the ETF to profit from the spread between the two.

This practice is capital efficient because their brokers typically allow them to use the ETF as collateral for their short futures positions.

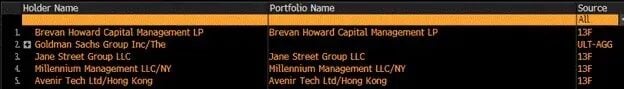

These are the five largest holders of IBIT US. They are large hedge funds or investment banks focused on proprietary trading, such as Goldman Sachs.

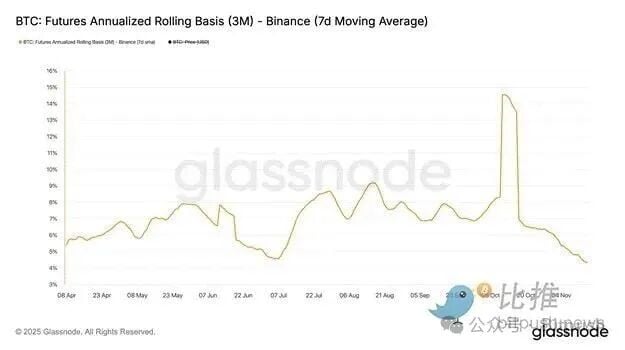

The above chart shows the annualized basis yield these funds have obtained by buying IBIT US and selling CME futures contracts.

While the exchange above is Binance, the annualized basis on the CME is essentially the same. When the basis is significantly above the federal funds rate, hedge funds will rush in to trade, creating large and sustained net inflows for the ETF.

This creates the illusion for those who do not understand the market microstructure that institutional investors have a huge interest in holding Bitcoin exposure, when in fact they do not care about Bitcoin at all; they are just playing in our sandbox to earn a few percentage points above the federal funds rate. When the basis declines, they quickly sell their positions. Recently, as the basis has declined, the ETF complex has recorded massive net outflows.

Now retail investors believe that these institutional investors do not like Bitcoin, creating a negative feedback loop that prompts them to sell, which further lowers the basis, ultimately leading to more institutional investors selling the ETF.

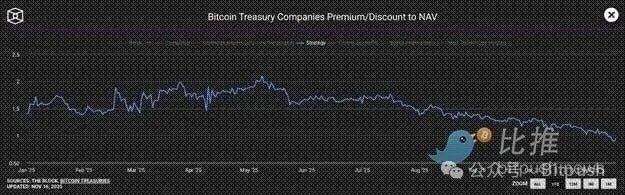

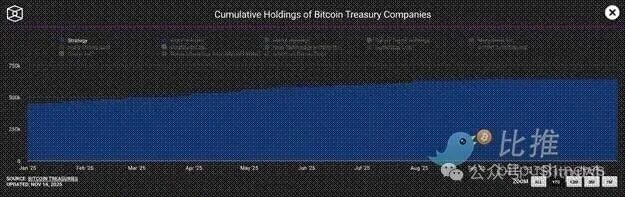

Digital Asset Trust (DAT) companies provide another way for institutional investors to gain Bitcoin exposure. Strategy (ticker: MSTR US) is the largest DAT holding Bitcoin. When its stock price trades at a significant premium relative to its Bitcoin holdings (known as mNAV), the company can issue shares and other financing methods to acquire Bitcoin at a low price. As the premium declines to a discount, Strategy's pace of acquiring Bitcoin slows down.

This is a cumulative holding chart, not a rate of change for that variable, but you can see that as Strategy's mNAV premium disappears, the growth rate of its holdings slows down.

Despite the contraction of dollar liquidity since April 9, the inflows into Bitcoin ETFs and purchases by DAT have allowed Bitcoin to rise. But that situation has now ended.

The basis is no longer attractive enough to sustain institutional investors' continued purchases of ETFs, and most DATs are trading at a discount below mNAV, leading investors to now avoid these Bitcoin derivative securities. Without these flows to mask the negative liquidity situation, Bitcoin must fall to reflect current short-term concerns that dollar liquidity will contract or grow at a pace slower than politicians promise.

Time to Show Evidence

Now it's time for Trump and Bessent to show evidence or shut up. Either they have the ability to make the Treasury override the Federal Reserve, creating another real estate bubble, issuing more stimulus checks, etc., or they are a bunch of weak, powerless liars.

Complicating matters further, blue camp Democrats have discovered (not surprisingly) that campaigning on various affordability themes is a winning strategy. Whether the opposition can deliver on these promises, such as free bus passes, a plethora of rent-controlled apartments, and government-run grocery stores, is not the point. The point is that American voters want to be heard and can at least delude themselves into believing that someone is looking out for them. People do not want Trump and his "Make America Great Again" (MAGA) supporters to gloss over the inflation they see and feel every day with fake news.

They want to be heard, just as Trump told them in 2016 and 2020 that he would fight and expel "people of color," so their high-paying jobs would magically reappear.

For those with a long-term outlook, these short-term stalls in fiat currency creation are irrelevant. If red camp Republicans cannot print enough money, the stock and bond markets will crash, forcing the dogmatic members of both parties to return to the satanic cult of money printing.

Trump is a shrewd politician, similar to former President Biden—who also faced similar discontent due to inflation caused by COVID stimulus measures—he will publicly change course, blaming the Federal Reserve for the inflation that troubles ordinary voters. But don't worry, Trump won't forget the wealthy asset holders who fund his campaign. "Buffalo Bill" Bessent will receive strict orders to print money in creative ways that ordinary people cannot comprehend.

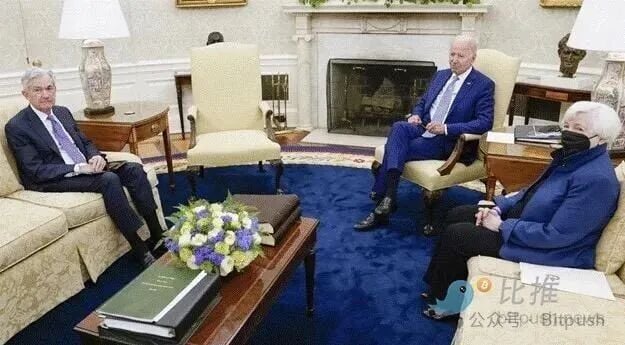

Remember this group photo from 2022? Our favorite "yes man," Federal Reserve Chairman Powell, was then schooled by former President Biden (Slow Joe Biden) and U.S. Treasury Secretary Yellen (Bad Gurl Yellen). Biden explained to his supporters that Powell would crush inflation. Then, because he needed to boost the financial assets of the wealthy who got him into office, he told Yellen to reverse all of Powell's rate hikes and balance sheet reductions at all costs.

Yellen issued more Treasury bills than notes or bonds, draining $2.5 trillion from the Federal Reserve's reverse repo program from Q3 2022 to Q1 2025, thereby pumping up stocks, housing, gold, and cryptocurrencies.

For ordinary voters—and some readers present—what I just wrote may seem like a foreign language, and that is precisely the point. The inflation you feel firsthand is caused by the very politician who claims to care about alleviating the burdens of the common people.

"Buffalo Bill" Bessent must perform similar magic. I am 100% confident he will engineer similar outcomes. He is one of the greatest masters of monetary market plumbing and currency trading in history.

What’s the Situation

The market setups in the second half of 2023 and the second half of 2025 bear striking similarities. The debt ceiling standoff ends in mid-summer (June 3, 2023, and July 4, 2025), forcing the Treasury to rebuild the General Account (TGA), thereby siphoning liquidity from the system.

2023:

2025:

"Bad Girl" Yellen is pleasing her boss. Can "Buffalo Bill" Bessent find his "BB" and reshape the market with Bismarckian means to secure the votes of financially asset-holding constituents for the Republicans in the 2026 midterm elections?

To eliminate the idea that they allowed credit contraction, the market will present a Hobson’s Choice. Once investors realize that printing money is off the table in the short term, stock and bond prices will plummet rapidly. At that point, politicians must either print money to save the highly leveraged fiat financial system that supports the broader economy, which would accelerate inflation again; or allow credit contraction, which would destroy wealthy asset holders and lead to massive unemployment as over-leveraged companies must cut output and jobs.

Typically, the latter is politically more palatable, as 1930s-style unemployment and financial distress are always electoral losers, while inflation is a silent killer that can be hidden through subsidies to the poor funded by printed money.

Just as I have confidence in the "snow machines" of Hokkaido, I am 100% confident that Trump and Bessent want their red camp Republicans to remain in power,

So they will find a way to appear tough on inflation while printing the necessary money to continue supporting the Keynesian "fractional reserve banking" scam in the status quo of the U.S. and global economy.

On the slopes, arriving too early can sometimes lead you to ski on dirt. In financial markets, before we return to "Up Only," as Nelly would say, the market must first "Drop Down and Get Their Eagle On." (By the way, they don’t make music videos like they used to.)

The Bull Case

The argument contrary to my negative dollar liquidity theory is that as the U.S. government resumes operations after the shutdown, the TGA will quickly decrease by $100 billion to $150 billion to reach a target of $850 billion, which will add liquidity to the system. Additionally, the Federal Reserve will stop reducing its balance sheet on December 1 and will soon restore balance sheet expansion through quantitative easing (QE).

I was initially optimistic about risk assets post-shutdown. However, as I delved into the data, I noticed that since July, approximately $1 trillion of dollar liquidity has evaporated according to my index. Adding $150 billion is great, but what comes next?

Despite several Federal Reserve governors suggesting the need to restore quantitative easing to rebuild bank reserves and ensure the smooth functioning of the money market, this is just talk. We will only know they are serious when the Federal Reserve "whisperer"—Nick Timiraos of The Wall Street Journal—announces that quantitative easing has received the green light. But we are not there yet. In the meantime, the Standing Repo Facility will be utilized to print money, amounting to hundreds of billions of dollars, to ensure the money market can cope with the massive Treasury issuance.

Theoretically, Bessent could reduce the TGA to zero. Unfortunately, because the Treasury must roll over hundreds of billions of dollars in Treasury bills weekly, they must maintain a large cash buffer to guard against unforeseen events. They cannot afford the risk of defaulting on maturing Treasury bills, which rules out the possibility of immediately injecting the remaining $850 billion into the financial markets.

The privatization of government-sponsored mortgage agencies Fannie Mae and Freddie Mac will certainly happen, but not in the coming weeks. Banks will also fulfill their "duty" to lend to those making bombs, nuclear reactors, semiconductors, etc., but this too will occur over a longer time frame, and this credit will not immediately flow into the veins of the dollar money market.

The bulls are correct; over time, the money printing machine will surely "chug along."

But first, the market must correct the gains made since April to better align with the liquidity fundamentals.

Finally, before I discuss the positions in Maelstrom, I do not acknowledge that the "four-year cycle" is valid. Bitcoin and certain altcoins will only reach new all-time highs after the market has flushed out enough chips to accelerate the pace of money printing.

Positions in Maelstrom

Last weekend, I increased our position in dollar stablecoins, anticipating a decline in cryptocurrency prices. In the short term, I believe the only cryptocurrency that can outperform the negative dollar liquidity situation is Zcash ($ZEC).

With the rise of artificial intelligence, large tech companies, and big government, privacy in most areas of the internet has vanished. Zcash and other privacy cryptocurrencies using zero-knowledge proof encryption technology are humanity's only chance to combat this new reality. This is why people like Balaji believe that the grand narrative of privacy will drive the crypto market for years to come.

As a follower of Satoshi Nakamoto, I am offended that the third, fourth, and fifth largest cryptocurrencies are dollar derivatives, a coin that does nothing on a stagnant chain, and CZ's centralized computer.

If 15 years from now, these are the largest cryptocurrencies after Bitcoin and Ethereum, what exactly are we doing?

I have no personal opinion about Paolo, Garlinghouse, and CZ; they are masters at creating value for their token holders. Founders, take note. But Zcash or similar privacy cryptocurrencies should be right below Ethereum.

I believe the grassroots crypto community is awakening to the realization that by granting such high market caps to these types of coins or tokens, we are tacitly supporting something that is antithetical to a decentralized future, where we, as flesh-and-blood humans, retain agency in the face of technology, government, and AI giants.

Therefore, while we wait for Bessent to find his rhythm in money printing, Zcash or another privacy-focused cryptocurrency will enjoy a long-term price increase.

Maelstrom remains bullish in the long term, and if I have to buy back at a higher price (as I had to do earlier this year), that’s fine; I proudly accept my failure because I have spare fiat currency on hand, allowing me to boldly bet to win and make it truly valuable. Having liquidity when the scenario from April 2025 reappears is far more decisive for your overall cycle's profit and loss than having to return the small profits you earned to the market due to trading losses.

Bitcoin has dropped from $125,000 to a low of $90,000, while the S&P 500 and Nasdaq 100 indices hover at historical highs, which tells me a credit event is brewing.

As I observe the decline in my dollar liquidity index since July, I confirm this view.

If I am correct, a 10% to 20% adjustment in the stock market, coupled with 10-year Treasury yields approaching 5%, will be enough to create urgency, prompting the Federal Reserve, the Treasury, or another U.S. government agency to launch some form of money printing scheme.

During this weakness, Bitcoin could absolutely drop to $80,000 to $85,000. If the broader risk markets implode and the Federal Reserve and Treasury accelerate their money printing farce, then Bitcoin could soar to $200,000 or $250,000 by the end of the year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。