Stablecoins represent the largest potential market in the crypto space, while yield is the final challenge.

Written by: Vishal Kankani, Multicoin Capital

Translated by: AididiaoJP, Foresight News

Our liquidity fund at Multicoin has invested in ENA, the native token of the Ethena protocol. The Ethena protocol is the issuer of the leading synthetic dollar, USDe.

In our article "The Endgame of Stablecoins," we articulated that stablecoins are the largest potential market in the crypto space, while yield is the final challenge. While we were correct in the direction of "yield-bearing stablecoins," we underestimated the market size of synthetic dollars.

We categorize stablecoins into two parts:

Yield-sharing

Non-yield-sharing

Yield-sharing stablecoins can be further divided into two parts:

Always fully backed 1:1 by government-supported treasury assets

Synthetic dollars

Synthetic dollars are not fully backed by government-supported treasury assets; rather, they aim to generate yield and create stability by executing neutral trading strategies in financial markets.

Ethena is a decentralized protocol and the largest operator of the synthetic dollar, USDe.

Ethena aims to provide a stable alternative to traditional stablecoins like USDC and USDT, whose reserves roughly earn short-term U.S. Treasury yields. Ethena's USDe reserves generate yield and aim to maintain stability through one of the largest and most mature strategies in traditional finance: basis trading.

The scale of basis trading in U.S. Treasury futures alone reaches hundreds of billions of dollars, if not trillions. Today, hedge funds with the infrastructure to conduct basis trading at scale have access limited to accredited investors and qualified institutional buyers. Crypto technology is rebuilding the financial system from the ground up, tokenizing opportunities for everyone.

We have been conceptualizing a synthetic dollar built on basis trading for years. As early as 2021, we published an article outlining this opportunity and announced our investment in UXD Protocol, the first token fully backed by basis trading.

While UXD Protocol was ahead of its time, we believe that Guy Young, founder and CEO of Ethena Labs, has executed this vision exceptionally well. Today, Ethena has become the largest synthetic dollar, with a circulating supply that grew to $15 billion within two years of launch, later retracing to about $8 billion after the market washout on October 10. It is the third-largest digital dollar overall, behind USDC and USDT.

USDe circulating supply over time - DefiLlama

Systemic Bullish Factors for Synthetic Dollars

Ethena is at the intersection of three powerful trends reshaping modern finance: stablecoins, perpetualization, and tokenization.

Stablecoins

Currently, there are over $300 billion in circulating stablecoins, and this number is expected to grow to trillions in a decade. For nearly a decade, USDT and USDC have dominated the stablecoin market, together accounting for over 80% of the total supply. Neither directly shares yield with holders, but we believe that over time, sharing yield with users will become the norm rather than the exception.

We believe stablecoins compete and differentiate on three key vectors: distribution, liquidity, and yield.

Tether has established an excellent liquidity and global distribution network for USDT. It serves as the primary quote asset in crypto trading and is the most widely used way for emerging markets to access digital dollars.

Circle focuses on gaining distribution by sharing economic benefits with partners like Coinbase. While this strategy has been effective for growth, it has pressured Circle's margins. As crypto adoption accelerates, we expect more companies with deep distribution networks in finance and technology to issue their own stablecoins, further commoditizing the treasury-backed stablecoin market.

For new entrants in the digital dollar space, the primary way to stand out has been to offer higher yields. The narrative around yield-bearing stablecoins has gained momentum in recent years. However, those stablecoins backed by U.S. Treasuries have failed to provide sufficient yield to drive meaningful adoption within the crypto space. The reason is that the opportunity cost of crypto-native capital has historically been higher than U.S. Treasury yields.

Among new entrants, Ethena is the only project that has achieved meaningful distribution and liquidity, primarily due to its higher yield offerings. Based on the price changes of sUSDe since its launch, we estimate its annualized yield since launch to be slightly above 10%, more than double the yield of treasury-backed stablecoins. It achieves this by leveraging basis trading, a strategy that monetizes market demand for leverage. Since its launch, the protocol has generated nearly $600 million in revenue, with over $450 million generated in the past twelve months.

Ethena token terminal

We believe the true test of a synthetic dollar's adoption is whether it is accepted as collateral by major exchanges. Ethena has excelled in integrating USDe as a core collateral form in major centralized exchanges like Binance and Bybit, which is a key driver of its rapid growth.

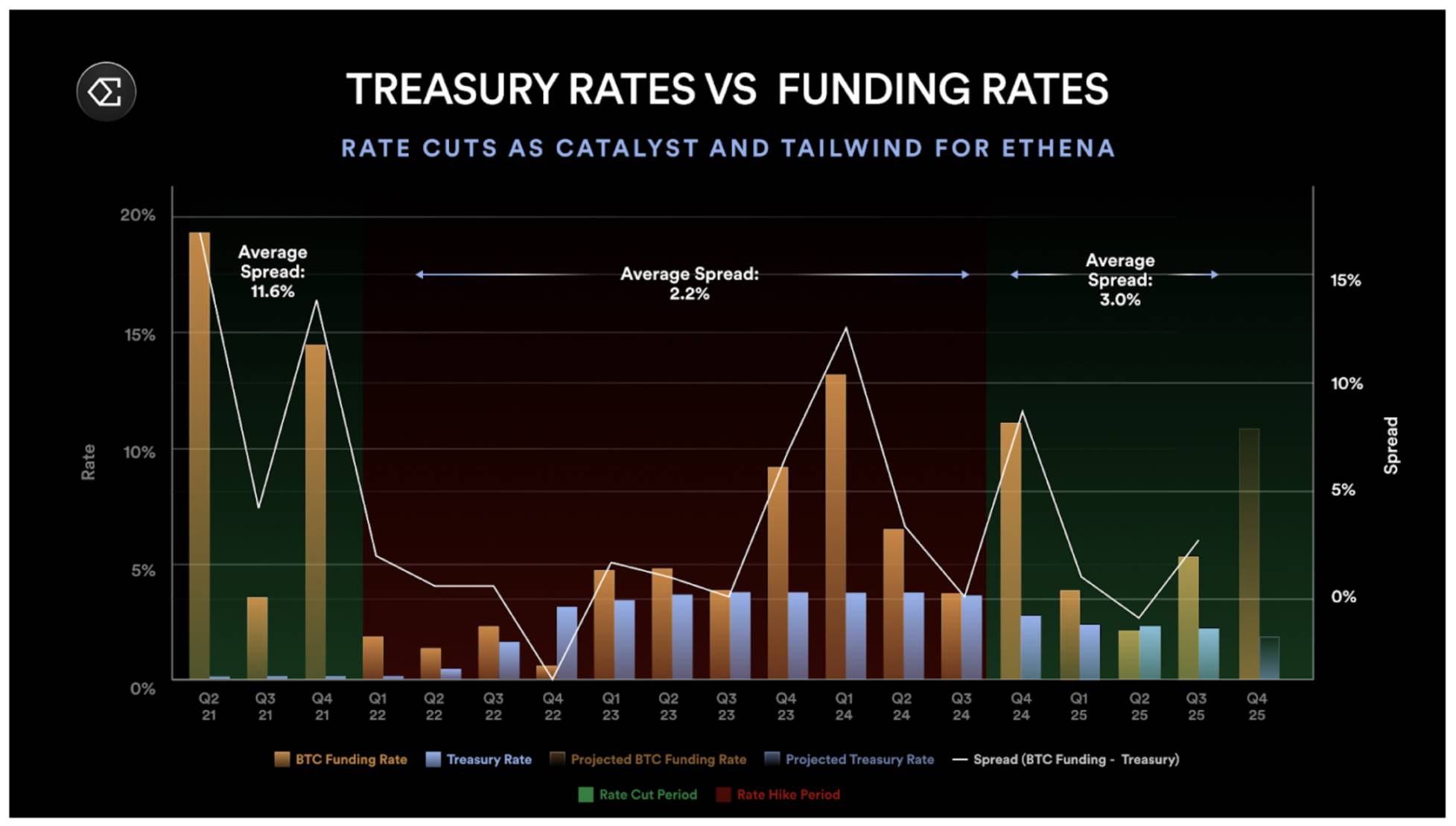

Another unique aspect of Ethena's strategy is its slight negative correlation with the federal funds rate. Unlike treasury-backed stablecoins, Ethena is expected to benefit when interest rates decline, as lower rates stimulate economic activity, increase demand for leverage, lead to higher funding rates, and strengthen the basis trading that supports Ethena's yield. We saw a version of this in 2021 when the spread between funding rates and treasury yields widened to over 10%.

Admittedly, as crypto merges with traditional financial markets, more capital will flow into the same basis trading and narrow the spread between basis trading and the federal funds rate, but this integration will take years.

Treasury yields vs funding rates

Finally, JPMorgan predicts that yield-bearing stablecoins could capture up to 50% of the stablecoin market in the coming years. With the total stablecoin market expected to soar to trillions, we believe Ethena is fully capable of becoming a major player in this transition.

Perpetualization

Perpetual futures have achieved strong product-market fit in the crypto space. In the approximately $40 trillion crypto asset class, perpetual contracts have a daily trading volume exceeding $100 billion, with total open contracts on CEX and DEX exceeding $100 billion. They provide investors with an elegant way to gain leveraged exposure to the price movements of underlying assets. We believe that over time, more asset classes will adopt perpetual contracts, which is what we refer to as "perpetualization."

A common question about Ethena is the scale of its potential market, as the scale of its strategy is limited by the open contracts in the perpetual market. We agree that this is a reasonable constraint in the short term, but we believe it underestimates the medium- to long-term opportunity.

Tokenized Stock Perpetual Contracts

The global stock market is valued at approximately $100 trillion, nearly 25 times the size of the entire crypto market. The U.S. stock market alone is valued at about $60 trillion. Just like in the crypto space, participants in the stock market have a strong demand for leverage. This is evident in the explosive growth of 0DTE options, which are primarily traded by retail investors and account for over 50% of SPX options trading volume. Retail investors clearly seek leveraged exposure to the price movements of underlying assets, a demand that can be directly met through tokenized stock perpetual contracts.

SPX ODTE options

For most investors, perpetual contracts are easier to understand than options. A product that provides 5x exposure to the underlying asset is much simpler than understanding the Theta, Vega, and Delta of options, which require a deep understanding of options pricing models. We do not expect perpetual contracts to replace the 0DTE options market, but they may capture a significant market share.

Translator's Note: Theta, Vega, and Delta of options measure how option prices fluctuate due to changes in different factors. Delta is the sensitivity to changes in the underlying price; Vega is the depreciation rate of the option's value; Vega is the sensitivity to volatility.

As stocks are tokenized, stock perpetual contracts present a much larger opportunity for Ethena. We believe this positions Ethena as a valuable source of liquidity to guide new markets, benefiting both CEX and DEX, and can also capture internally by establishing a stock perpetual contract DEX under the Ethena brand. Given the scale of the stock market relative to the crypto market, these developments could expand the capacity for basis trading by several orders of magnitude.

Net New Distribution from Integration of Fintech Companies and Decentralized Perpetual Exchanges

When we first published our paper on decentralized digital dollars supported by basis trading, decentralized derivatives exchanges were still in their early stages, with poor liquidity and not ready for mainstream use. Since then, stablecoins have become mainstream, and low-fee, high-throughput chains have been battle-tested. Today, platforms like Hyperliquid facilitate about $40 billion in decentralized perpetual trading volume daily, with open contracts reaching $15 billion.

Daily DEX perpetual trading volume

As crypto regulation becomes more favorable, fintech companies around the world are likely to increasingly embrace crypto technology. Leading players like Robinhood and Coinbase have evolved into "full-service exchanges." Many of them have already integrated with DeFi middleware to support spot trading of long-tail assets that are not listed on their platforms.

Today, most non-crypto native users can only access a limited range of crypto assets and can only do so in spot form. We believe this group represents a significant untapped demand for leverage. As decentralized perpetual exchanges become mainstream, it is natural to expect fintech companies to directly integrate these products.

For example, Phantom recently integrated with the decentralized perpetual exchange Hyperliquid, allowing users to trade perpetual contracts directly from their Phantom wallets. This integration has generated approximately $30 million in annual revenue. If you are a fintech founder who sees this, it’s hard not to want to follow suit. For instance, Robinhood recently announced its investment in the decentralized perpetual exchange Lighter.

We believe that as fintech companies adopt crypto perpetual contracts, they will create a new distribution channel for these products, driving higher trading volumes and open contracts, thereby expanding the capacity and scalability of the basis trading that supports Ethena.

Tokenization

The superpower of crypto technology lies in its ability to allow anyone to seamlessly issue and trade tokens. Tokens can represent anything of value, from stablecoins and L1 assets to meme coins and even tokenized strategies.

In traditional finance, the closest equivalent to tokenization is ETFs. Today, the number of ETFs in the U.S. exceeds the number of publicly listed individual stocks. ETFs package complex strategies into a single, tradable code that investors can easily buy, sell, or hold—without worrying about execution or rebalancing. All this complexity is handled by the ETF issuer behind the scenes. Unsurprisingly, the CEO of the world’s largest ETF issuer, BlackRock, seems fully committed to tokenization.

Tokenization goes beyond ETFs; it allows assets to be held and traded faster, cheaper, and more easily at any scale while improving distribution and capital efficiency. Anyone with internet access can instantly buy, sell, send, or receive tokens, and they can even stake them as collateral to unlock additional liquidity. We envision a future where fintech companies around the world become the primary distributors of tokenized strategies, bringing institutional-grade products directly to global consumers.

Ethena starts with tokenizing basis trading, but nothing prevents Ethena from diversifying its sources of yield over time. In fact, it is already doing so today. When basis trading provides lower or negative returns, Ethena can shift some of its collateral into another product within its ecosystem, USDtb (a stablecoin backed by BlackRock’s tokenized treasury fund BUIDL), to maintain stability and optimize yield.

Reasons to Invest in ENA

While we have described the long-term bullish reasons for Ethena's potential market size so far, it is also important to understand more about the team and protocol features, especially regarding risk management, value capture, and future growth opportunities.

Team

"I quit my job a few days after the Luna crash to build Ethena and assembled the team a few months after the FTX incident," says Ethena founder Guy Young.

In our experience, Guy has proven to be one of the sharpest and most strategic thinkers in the DeFi space, bringing his experience from Cerberus Capital Investments to a crypto market that is undergoing rapid financialization.

Guy's success is supported by a lean and experienced operational team of about 25 people. Just to name a few members of the Ethena team: Ethena's CTO Alex Nimmo was one of the first employees at BitMEX, where he helped build and develop perpetual futures into one of the most important financial instruments in the crypto space. Ethena's COO Elliot Parker has worked at Paradigm Markets and Deribit, and his connections with market makers and exchanges have contributed to Ethena's successful integration with these counterparties today.

The results speak for themselves. Ethena has become the largest synthetic dollar in less than two years. During this time, the team acted quickly, integrating with top centralized exchanges and establishing hedging channels that most projects take years to achieve. USDe is now accepted as collateral by major venues like Binance and Bybit. Many of these exchanges are also investors in Ethena, demonstrating a clear strategic alignment between the protocol and key players in the global crypto market.

Risk Management

My partners Spencer and Kyle wrote an article in 2021 titled "DeFi Protocols Don't Capture Value, DAO Manages Risk." The core argument is simple: DeFi protocols that do not manage risk and try to charge fees will be forked, and there will always be free forks. Meanwhile, protocols that essentially manage risk must charge fees; otherwise, no one will support the system.

Ethena best embodies this principle. The protocol demonstrates strong risk management capabilities, successfully navigating two major stress events this year, each enhancing its credibility, resilience, and brand trust within the crypto ecosystem.

Bybit Hack: The Largest Crypto Hacking Incident to Date

The $1.4 billion hack of Bybit's hot wallet on February 21, 2025, was a real-world stress test of Ethena's exchange counterparty model. The incident triggered a massive withdrawal wave from Bybit, but Ethena's strategy remained unaffected.

Due to hedged positions and collateral being spread across multiple venues and protected in off-exchange custody, Ethena maintained normal operations throughout the event. Importantly, there were no losses of Ethena's collateral, nor was there any disruption to the flow of funds related to minting or redeeming due to the Bybit incident.

October 10 Sell-off: The Largest Single-Day Liquidation Event in Crypto History

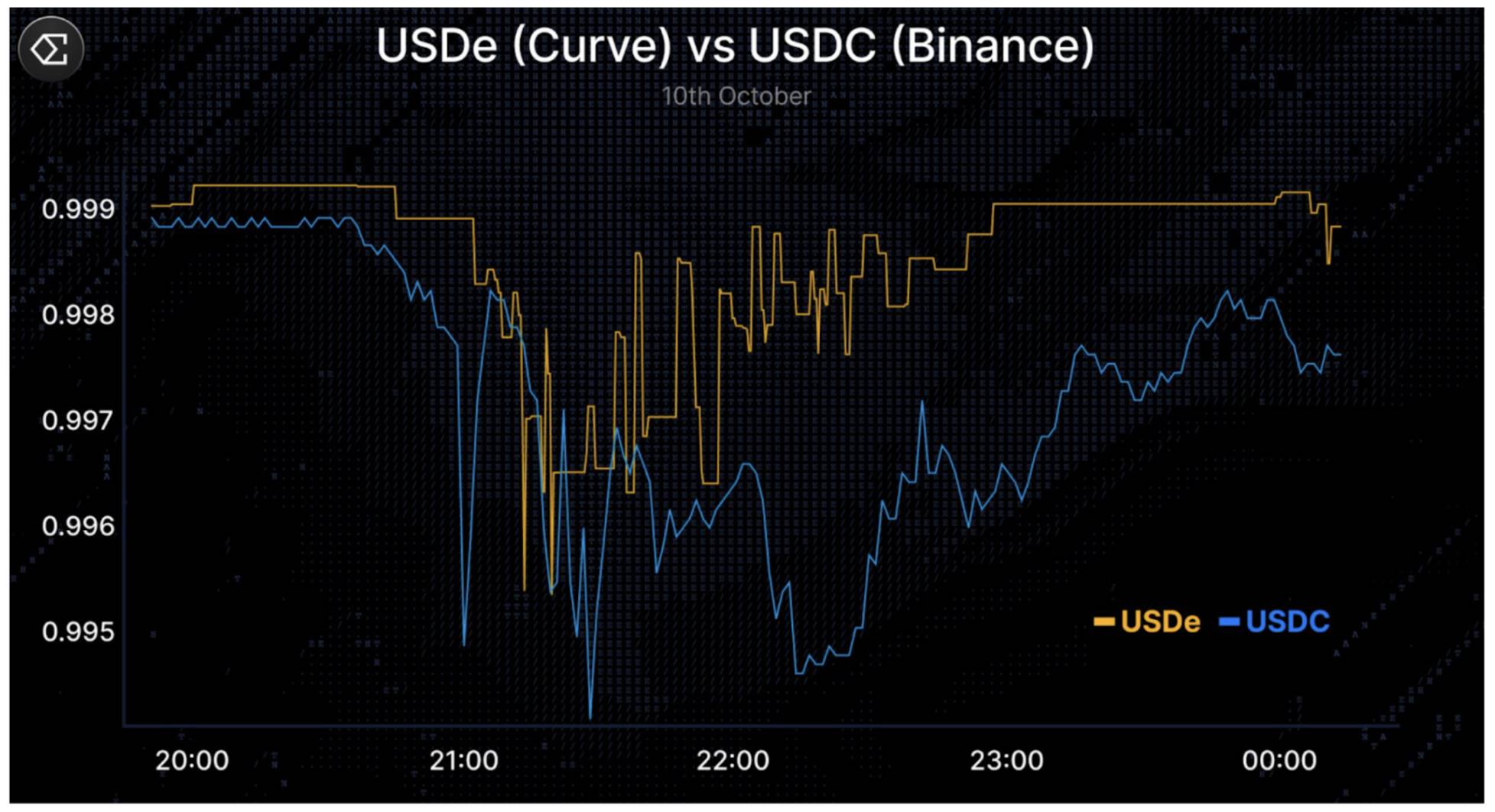

On October 10, 2025, the crypto market experienced an extreme deleveraging event, with approximately $20 billion in positions liquidated within hours as open contracts on major CEXs and DEXs collapsed. During the chain liquidation process, USDe briefly traded as low as about $0.65 on Binance due to the oracle design of Binance, which drew criticism. However, USDe maintained near parity on more liquid chain venues (such as Curve), and the redemption function continued to operate normally, indicating that this was a venue-specific dislocation rather than a systemic decoupling. Guy's tweet on X is an excellent read for understanding the events of October 10.

USDe (Curve) vs USDC (Binance)

In both events, the Ethena team communicated transparently and did not lose any user funds. Meanwhile, the protocol continued to operate normally, processing nine-figure redemptions within hours, all of which can be verified on-chain. Moments like these test the risk discipline of any protocol. Successfully managing such stress events at scale not only enhances trust and credibility but also builds brand value and defensibility—creating a strong moat for DeFi protocols like Ethena.

It is important to clarify that it is reasonable to expect the Ethena protocol to undergo more stress tests in the coming years. We do not imply that risks do not exist or have been fully mitigated; rather, we emphasize that Ethena has demonstrated strong performance and resilience during some of the most significant market stress events in recent memory.

Value Capture

We believe Ethena can command a higher fee rate than stablecoins like USDC. Unlike USDC, Ethena actively manages market risk, sharing higher yields with users in most cases, and may exhibit a negative correlation with interest rates in the medium to short term, all of which strengthen its ability to capture and maintain long-term value.

While the ENA token currently primarily functions as a governance token, we believe there is a clear path for it to begin accumulating value. Ethena generated approximately $450 million in revenue over the past year, none of which has been passed on to ENA token holders.

A fee switch proposal introduced in November 2024 outlines several milestones that need to be reached before value can flow to ENA holders. All these conditions were met before the October 10 crash. The only metric currently below its target is the circulating supply of USDe, which we expect to exceed $10 billion before the fee switch is activated. The risk committee and community are currently reviewing the implementation details of the fee switch.

Our assessment is that these developments are likely to be well-received by the public markets, as they strengthen Ethena's governance consistency, long-term holder base, and reduce selling pressure on the token.

Long-Term Growth Potential

In and of itself, Ethena is already one of the highest-revenue protocols in the crypto space.

Ethena is leveraging its leadership position to launch a series of new product lines built on its core strengths in stablecoin issuance and expertise in crypto perpetual exchanges. These product lines include:

Ethena Whitelabel: A stablecoin-as-a-service product where Ethena builds stablecoins for the largest chains and applications. Ethena has already launched Ethena Whitelabel in partnership with SUIG, megaETH, Jupiter, Sui, and others.

HyENA and Ethereal: Two third-party perpetual DEXs built on USDe collateral, which both drive use cases for USDe and bring trading fee revenue back to the Ethena ecosystem. Both are built by external parties but directly bring value back to Ethena.

These potential product lines can further solidify Ethena's leading position in the synthetic dollar space.

For all net new product lines built on Ethena, Ethena should enjoy the economic benefits generated by these initiatives, coexisting with its already strong revenue figures.

Why We Are Bullish on Ethena Long-Term

Ethena has carved out a unique niche in the larger stablecoin market, long dominated by Tether and Circle, becoming a clear market leader in the synthetic dollar category.

With the surge in stablecoins, the tokenization of traditional assets, and the rise of perpetual DEXs, we believe Ethena is uniquely positioned to capture these bullish factors, converting global demand for leverage into attractive and accessible yields for its users and fintech companies worldwide.

The protocol's strong risk management culture has been tested in real-world stress tests and has consistently delivered, helping Ethena build deep trust and credibility among its users and partners.

In the long run, Ethena can leverage its scale, brand, and infrastructure to expand into other products, diversify its revenue, and enhance its resilience to market shocks.

As the issuer of the fastest-growing synthetic dollar in the yield-bearing stablecoin category, Ethena is fully capable of incubating new business lines, bringing additional growth potential to its most profitable business exchanges and inflow/outflow channels in the crypto space, while also growing the supply of USDe.

The opportunities ahead are immense, and as long-term ENA token holders, we are excited.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。