一.Uniswap重磅提案:深度解读

Uniswap CEO Hayden Adams近日公布了其首个治理提案,内容涉及启用协议费用、销毁UNI代币、增加Unichain费用等多项措施,使UNI代币转向通缩模型。 若提案通过,Uniswap协议预计每年将产生约4.6亿至5.1亿美元的资金用于回购UNI,此规模将成为代币价格的强大支撑。提案的内容具体如下:

1.开启协议费,协议侧收入全部用于回购+销毁UNI。

这是本次提案最核心的价值捕获机制。它从根本上改变了UNI的代币模型,使其从纯粹的治理代币,转变为拥有直接现金流支撑的“生产性资产”。这类似于上市公司用利润回购股票,能为代币价格提供长期且坚实的价值托底,是驱动其进入“通缩升值”飞轮的核心引擎。这是价值捕获的核心。UNI将从无现金流的治理代币,转变为拥有直接收入支撑的“生产性资产”,类似股票回购。

2.Unichain 序列器费并入销毁池。

此举旨在将Uniswap整个生态系统产生的价值都汇聚到UNI代币上。序列器费是Unichain这条Layer2区块链的固有收入,将其纳入销毁,意味着UNI的价值不再仅仅依赖于DEX的交易业务,而是与整个Uniswap生态(包括其公链)的繁荣深度绑定,拓宽了其价值基础。

3.一次性销毁1亿 UNI(对历史未开费期的追溯销毁)。

这是一次强烈的通缩信号和市场信心提振措施。一次性销毁占总供应量16%的代币,能立即提升剩余代币的稀缺性。其“追溯补偿”的逻辑,意在公平地回馈早期支持者,并试图为过去未能为持有者创造收益的历史“补票”,预计将对市场情绪产生巨大的短期刺激。

4.上线PFDA:用拍卖形式给交易者“手续费折扣”,同时把 MEV 收益留在协议内。

这是一项一石二鸟的创新机制。它通过拍卖手续费折扣权,巧妙地将原本被第三方搜索者捕获的MEV价值回收至协议内部。最终这部分收入将反哺UNI的回购,增强了整个经济模型的健壮性。

5.v4 聚合器 Hook:聚合外部DEX流动性并收协议费。

这意味着Uniswap正从“流动性提供者”向“流动性聚合层和收费关口”进化。即使交易不发生在Uniswap自有的资金池,只要通过其Hook进行路由,协议就能捕获费用。这极大地扩大了Uniswap的可收费市场,是对其收入天花板的一次战略性突破。

6.收费口径统一:界面/钱包/API 不再额外收费,收入口径统一到协议层。

此举是为了巩固协议层的核心地位和商业模式的护城河。它防止了各个前端(如官网、第三方接口)为了竞争而进行“零费用”内战,从而侵蚀整个生态的收入基础。统一收费确保了协议收入的可见性、可预测性和稳定性,是经济模型能够长期健康运行的重要保障。

7.治理与组织:Labs 与基金会合并,设每年2000万 UNI 预算用于增长。

这体现了Uniswap在短期财务回报与长期生态发展之间寻求平衡。合并能提升决策效率,而设立明确的增长预算,则表明团队并非只关注当下的币价,而是将持续投资于开发者、流动性等生态建设,确保协议在未来十年的竞争中保持活力和领先地位。

8.资产迁移:Unisocks 流动性迁至 Unichain v4,并销毁该 LP 头寸。

这一操作更具战略象征意义。它表明团队正在清理旧有资产,将资源和注意力全面转向以Unichain和v4为核心的下一代战略。可以看作是生态系统的一次“新陈代谢”,象征着与旧模式的切割,并集中全力建设未来。

图片来源 uniswap 创始人 ( Hayden Adams)

研究员观点:本提案的核心在于构建“协议收入 → 回购销毁 → 代币通缩升值”的价值飞轮。若能顺利运转,将为UNI提供持续的现金流折现与价格托底。

二.提案通过:回购测算与协议收入分析

我们基于历史数据和公开提案参数进行测算。本次提案通过直接销毁1亿枚(占总量16%),核心假设:每日回购交易量0.05%。即协议费用(0.3%)- LP奖励(0.25%)=回购(0.05%)。

1.核心收入来源分析

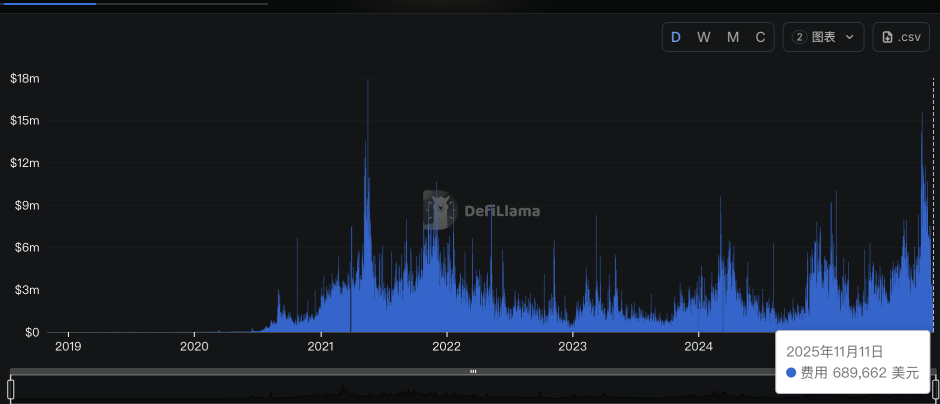

1.核心DEX业务:基于V2与V3版本约$1万亿美元的年化交易量,按0.05%费率计算,预计可产生$5.0亿美元的年化协议收入。

2.v4聚合器业务:作为增量来源,预计贡献核心交易量的10%-20%,相应带来$0.5亿–$1亿美元的潜在年收入。

3.PFDA与MEV捕获:虽为重要创新收入,但目前难以精确量化,暂未计入本次测算。Unichain序列器费用:仍处发展早期,规模较小,同样暂不计入。

2.年化回购资金汇总

保守情景(仅计入核心DEX业务):年回购资金约为 $5亿美元。

乐观情景(加入v4聚合器收入):年回购资金预计在 $5.5亿–$6亿美元 之间。

研究员观点:综合市场共识与本报告测算,每日协议0.05%用以回购,该机制有望实现1.5%-2%的年化通缩率,在当前交易量水平下,Uniswap每年可用于回购UNI的资金预计落在 $5亿–$5.5亿美元区间,此为相对保守的估计。相当于每月可为市场提供 $3500万–$4200万美元 的持续性买盘支撑,这对其中长期价值构成坚实支撑。

三.市场反应:巨额买盘预期驱动价格飙升

针对这一提案,市场各方迅速给出积极评价。Base生态龙头DEX Aerodrome背后开发团队Dromos Labs的首席执行官Alexander指出,以Uniswap当前的交易量测算,预计每年将有约4.6亿美元的手续费被用于回购及销毁,这将成为$UNItoken强劲且可持续的买盘支撑。

CryptoQuant CEO Ki Young Ju 同样指出,费用转换机制可能推动 Uniswap 价格呈抛物线式上涨。他分析称,即便仅统计 v2 和 v3 版本,协议年交易量也高达 1 万亿美元,以此测算,每年销毁的 UNI 价值将达约 5 亿美元。此外,交易平台仅持有 8.3 亿美元的 UNI,意味着未来的解锁抛压相对有限。受此乐观预期驱动,UNI 在提案公布后几小时内大幅上涨近 50%。

数据来源defillama

研究员观点:该提案无疑为UNI的长期价值形成了“硬托底”。其核心机制在于:短期通过一次性销毁1亿UNI(占流通16%)制造通缩冲击;长期则依靠高达约3800万美元/月的持续回购(年化4-5亿美元)来提供稳定买盘。这种双重通缩模型,对价格构成了强有力的支撑。

四.竞品对比:回购力度跻身顶级行列

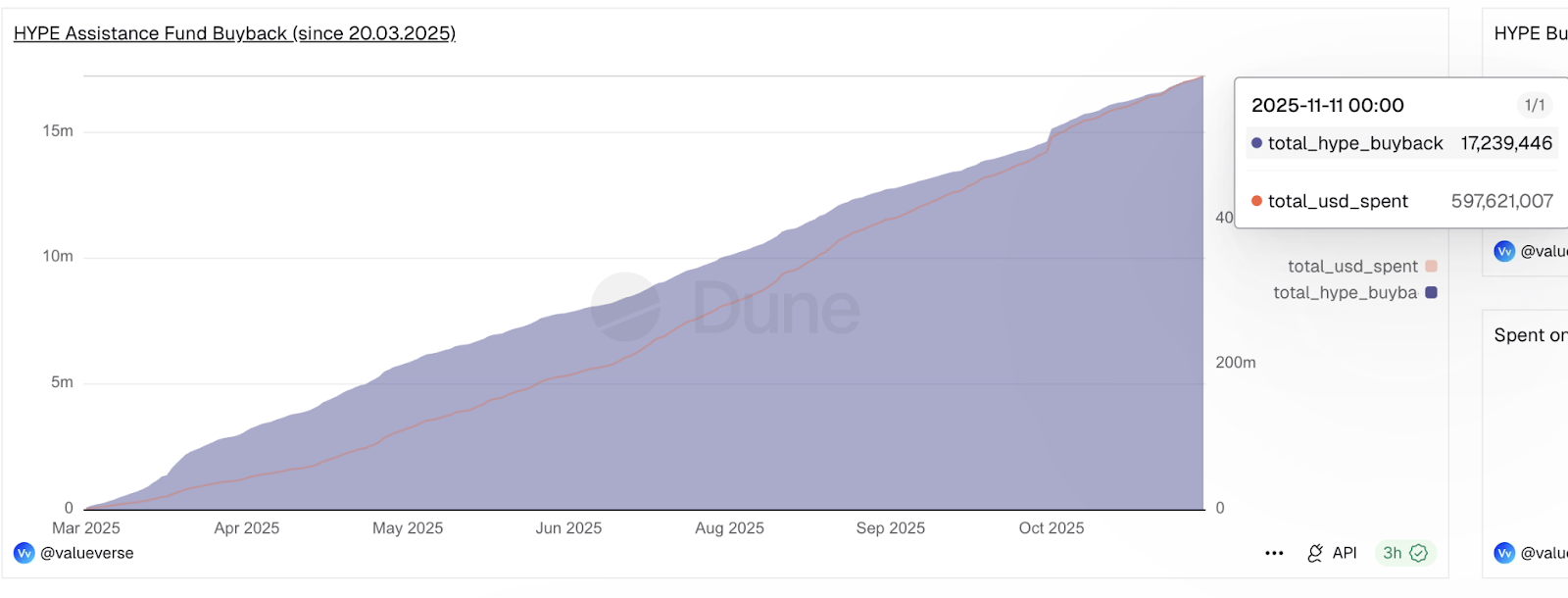

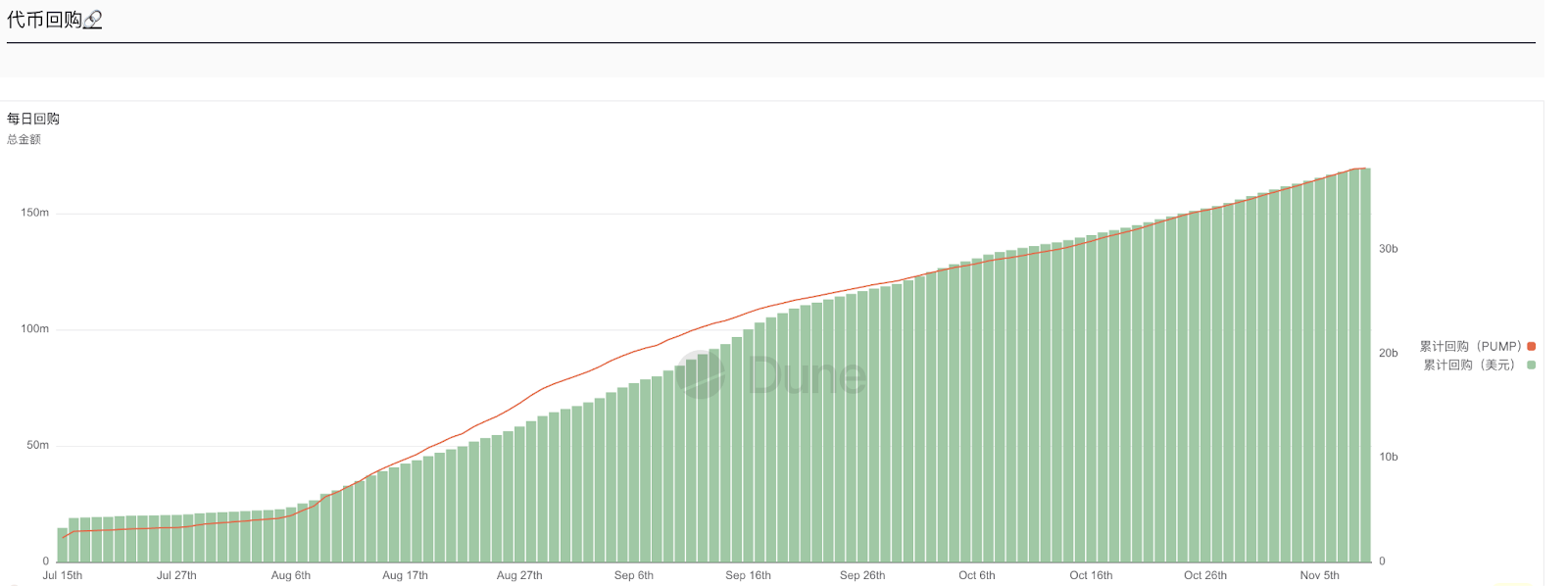

根据提案机制,Uniswap计划将原本0.3%的LP费用进行拆分,其中0.25%仍归属流动性提供者,而0.05%将分配给协议,用于UNI的回购。若以其约280亿美元的年化费用收入为基准进行测算,这意味着协议每月可产生约3800万美元的专项回购资金。这一规模,使其在同类具备回购机制的代币中占据了有力位置:不仅显著超越了PUMP(3500万美元/月),同时也向当前最高的HYPE(9500万美元/月)看齐。

图片来源 DUNE(HYPE)

图片来源 DUNE(PUMP)

研究员观点:此前UNI庞大的交易量无法为其代币持有者带来直接收益。而每年数亿美元的回购计划,相当于开启了持续性的“股东回报”。这不仅有望追赶竞品,更是协议的价值回归其代币持有者。

五.未来展望:成败系于流动性提供者(LP)之锚

Uniswap此次提案若通过,将为UNI带来长期利好,相当于为币价建立了“托底机制”。然而,其成功与否,完全取决于一个核心环节:流动性提供者(LP)是否会留下。

成功路径:提案将LP费用从0.3%降至0.25%(降幅17%)。只有当PFDA和MEV内化等新收益能足额弥补LP的损失,他们才会留下。LP稳定,资金池深度和交易体验才有保障,协议费用收入才能持续,回购销毁的“托底”机制才能健康运转。

风险路径:反之,若LP因收益下降而撤离,将导致流动性萎缩、交易量流失,最终使协议收入和回购资金同步缩水,托底机制便无从谈起。

因此,对于普通用户而言,需重点关注2点。短期:治理投票结果与合约上线时间。长期:LP留存率与资金池深度、每月3800万美元的回购是否稳定、PFDA与MEV内化的实际效果、以及竞品市场份额的变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。