The issuance of Base tokens is almost a foregone conclusion. However, most investors overlook Definitive—a platform supported by Coinbase with over 50 institutional clients. As institutional capital enters DeFi, Definitive has built the infrastructure to make this possible.

Key Points

- Definitive is an institutional-grade DeFi trading platform developed by the Coinbase Prime team.

- It is used by over 50 institutions, providing advanced trading features that help hedge funds like Starkiller Capital achieve outstanding performance.

- The project has received direct investment from Coinbase and is listed on its exchange, expected to benefit from the expansion of the Base ecosystem.

1. Hidden Players in the Base Ecosystem

The current market focus is on the Base ecosystem.

As discussed in previous reports, Coinbase is positioning itself as a leader in the broader Web3 landscape by going beyond its regulated exchange business through a series of strategic acquisitions. With the launch of Base applications, large-scale user onboarding has begun, and efforts to strengthen the internal ecosystem are accelerating.

Adding momentum to this trend is the anticipation of the Base token issuance. Although no official announcement has been made, the market generally believes this has been confirmed and is actively exploring related opportunities.

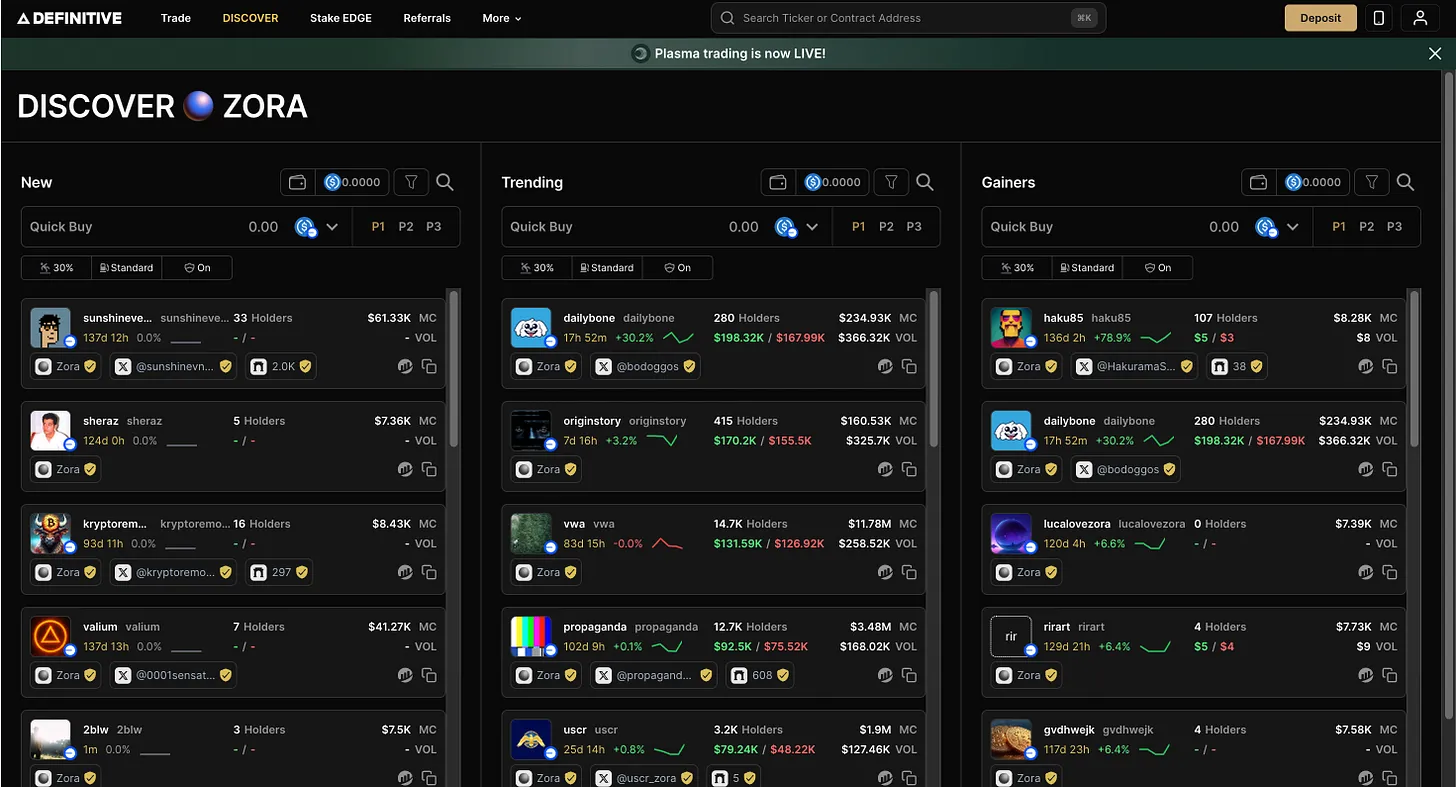

Source: Definitive.fi

Projects like Zora have gained attention in this context. However, one project remains relatively unknown—Definitive Finance. Founded by the team that built Coinbase Prime, Definitive has received direct investment from Coinbase Ventures and was listed on Coinbase on the first day of its token generation event (TGE).

As the Base era unfolds, the question remains: why is Definitive still not widely known?

2. Why Institutions Choose It First

From the beginning, Definitive was designed for institutional users.

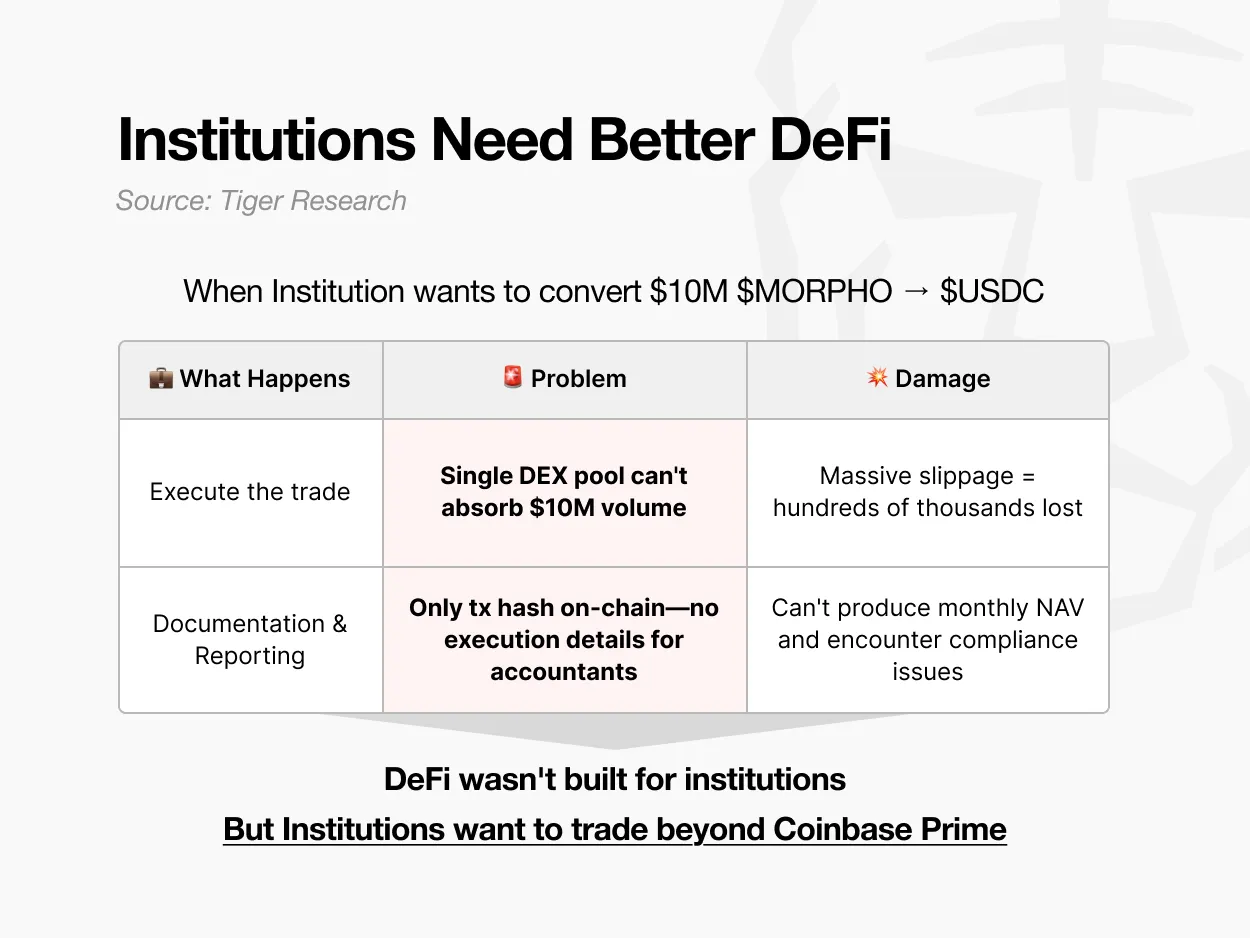

Consider a hedge fund planning to convert $10 million worth of MORPHO tokens into USDC. Executing this trade on a single decentralized exchange (DEX) would result in severe price slippage, as the liquidity pool cannot absorb such a large transaction volume. The result is a direct loss for the fund.

Institutional traders also face audit and compliance requirements. Each month, hedge funds must provide detailed records to external accountants showing when each trade was executed, at what price, and how it was executed. Traditional DeFi platforms only leave transaction hashes on-chain, without providing formal trade reports suitable for fund accounting.

In short, institutions need advanced trading features tailored to their operational needs, but most DeFi services are built for retail users. Definitive targets this gap. With a background from the Coinbase Prime team serving institutional clients, Definitive accurately understands what institutions need—and builds the platform accordingly.

2.1. Six Features for Institutional-Level Trading

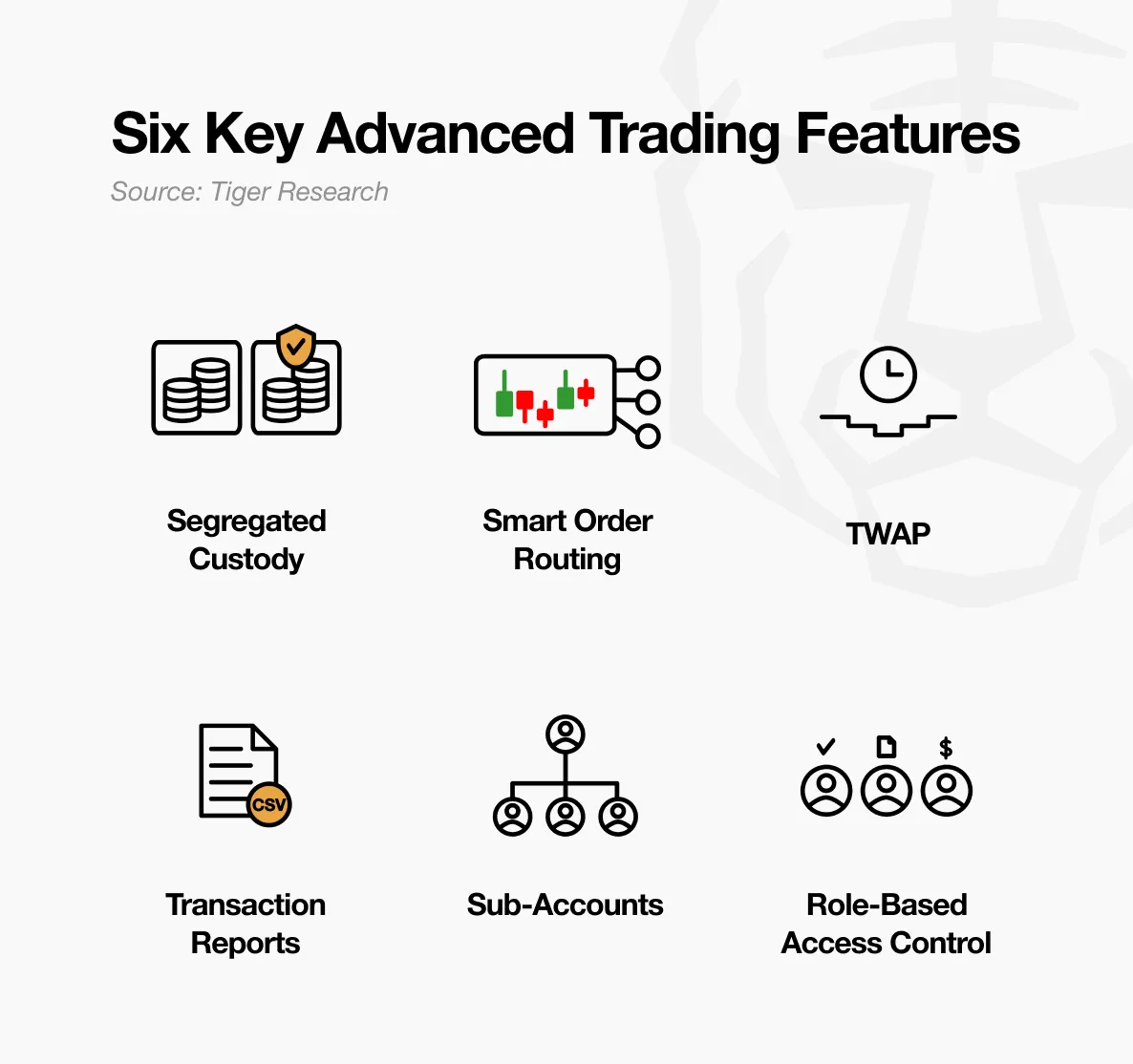

- Isolated Custody: Each client holds assets in a separate trading account, with full ownership. Even if another client is attacked, their assets remain unaffected.

- Smart Order Routing: Real-time aggregation and analysis of liquidity across all major EVM chains and over 100 DEXs on Solana, automatically executing trades through the most efficient paths.

- TWAP (Time Weighted Average Price): Large trades are split and executed over time to minimize price impact. For example, spreading a $100 million swap over 30 days prevents sudden price fluctuations.

- Trade Reporting: All trades are automatically recorded and can be exported as CSV files, available for external audits and accountants at any time.

- Sub-Accounts: Assets are separated by trader, allowing for independent portfolio and risk management within the same institution.

- Role-Based Access Control: Different permissions are assigned based on function—traders execute orders, portfolio managers (PMs) approve orders, and risk managers monitor positions—ensuring operational security and internal controls.

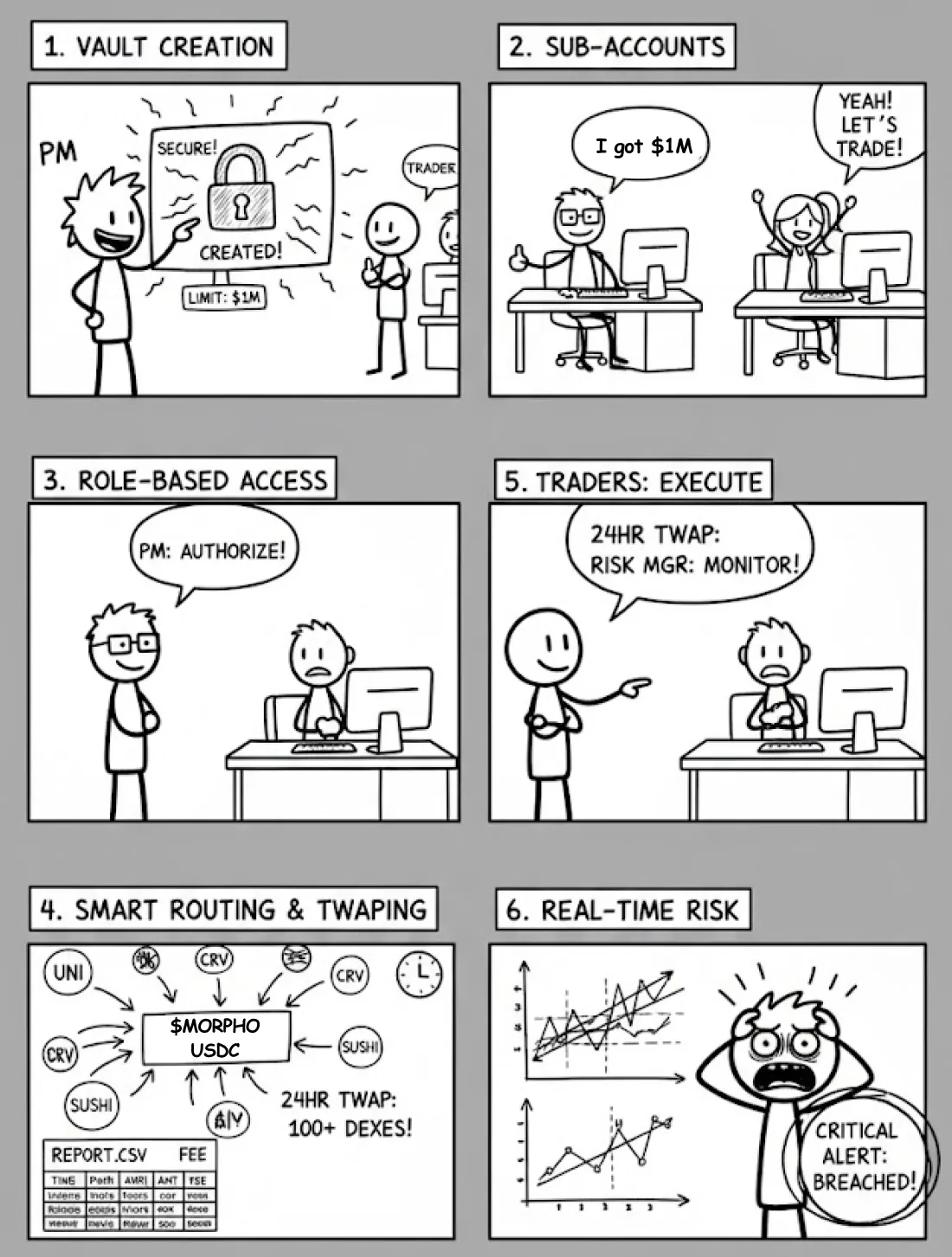

To illustrate how these features work in practice, consider the Tiger Crypto Fund, which plans to exchange $2 million worth of MORPHO for USDC. The fund has two traders, one risk manager, and one portfolio manager.

- Create and Isolate Vaults: Create dedicated trading vaults controlled solely by the fund's wallet.

- Sub-Account Setup: Each trader receives a separate sub-account with predefined trading limits.

- Role-Based Access: The portfolio manager authorizes trading ideas, traders execute orders, and the risk manager monitors risk exposure.

- TWAP Execution: Traders can use TWAP orders to automatically exchange $2 million worth of MORPHO tokens for USDC over 24 hours through hundreds of smaller trades to minimize price slippage.

- Smart Routing: The system dynamically compares prices across over 100 DEXs (e.g., Uniswap, Curve) in real-time and executes through the most efficient path.

- Automated Reporting: After 24 hours, all trades are completed and recorded with execution prices, sizes, and fees. Reports are exported as CSV files for monthly accounting or annual audits.

- Real-Time Risk Monitoring: The risk manager tracks the positions of the two traders and can alert the team when risk exposure approaches internal limits.

2.2. Starkiller Capital Achieves 21% Gains in AERO Token Execution

Source: Starkiller Capital

To understand how these features work in practice, let's look at the case of the crypto hedge fund Starkiller Capital.

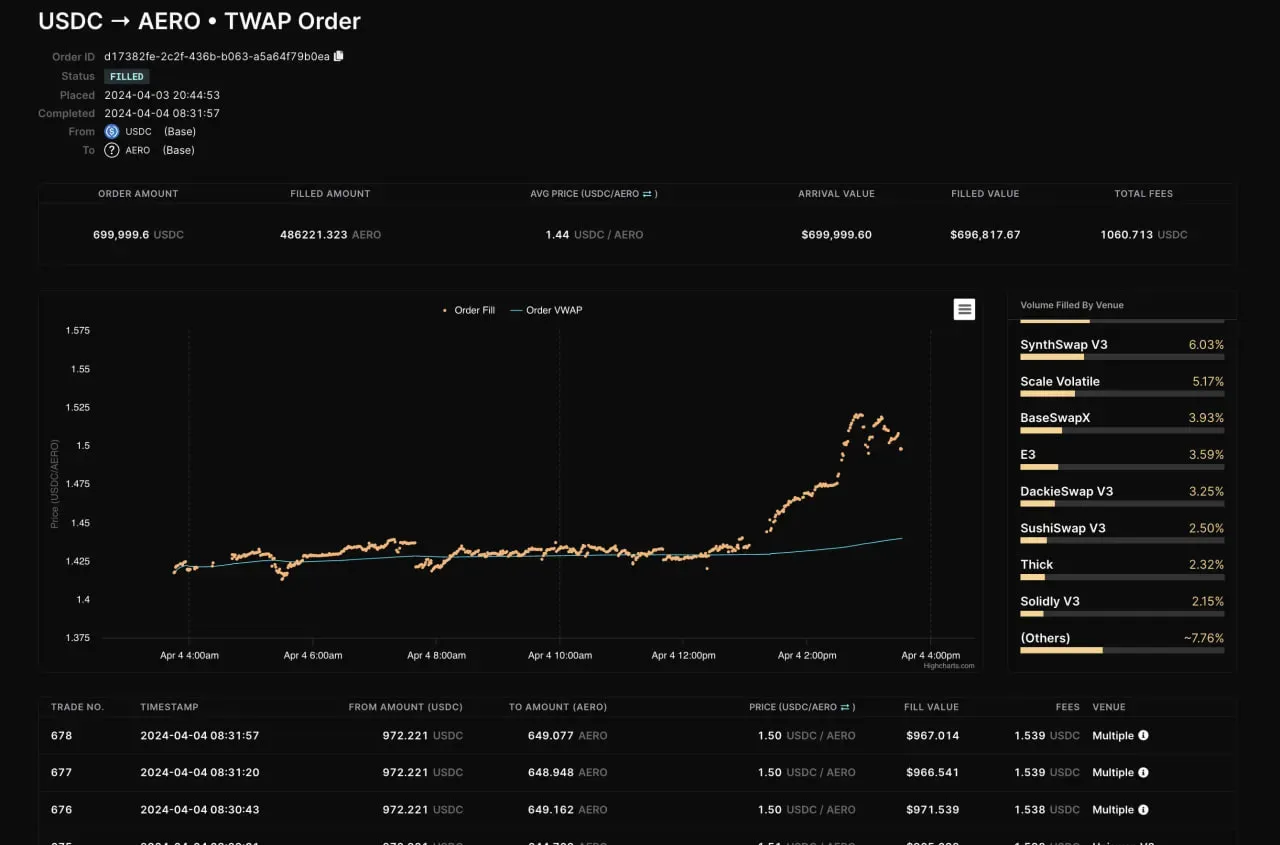

Starkiller planned to purchase $700,000 worth of AERO tokens. Although AERO is already listed on Coinbase and KuCoin, executing such a large order at once would cause the price to spike sharply, leading to significant slippage losses. When Starkiller contacted major OTC market makers, the quoted bid-ask spread was 26.19%—effectively meaning that for every $100 of AERO purchased, they would pay $126.

Source: Definitive

Instead, the fund used Definitive's TWAP order feature to split the $700,000 order into 678 smaller trades executed over time. The smart order routing compared prices across multiple DEXs—Uniswap V3, PancakeSwap V3, Aerodrome, etc.—and automatically selected the most efficient path for each execution.

As a result, Starkiller acquired AERO tokens at a price 21.33% better than through OTC execution, while only paying $10.71 in network fees. This effectively avoided a potential 20% loss in execution efficiency.

Starkiller Capital's Chief Investment Officer Leigh Drogan summarized:

Source: Definitive

2.3. Definitive in the Era of Institutional Capital Inflow

Current market expectations suggest that institutional capital inflow will drive the next growth phase more than retail participation. In this environment, institutional-grade infrastructure like Definitive is crucial.

Imagine a bullish scenario where, with increased regulatory clarity, traditional financial institutions enter DeFi. These entities manage billions of dollars in portfolios, but existing DeFi services cannot safely and effectively handle such large transaction volumes.

Definitive bridges this gap. It enables institutions to transfer large amounts of capital on-chain while maintaining security through isolated custody, minimizing market impact through TWAP execution, and meeting compliance standards with automated reporting tools.

As a result, more institutional capital can confidently enter the DeFi market. Positioned at the center of this capital flow, Definitive will benefit from exponential growth in trading volume and fee revenue, reinforcing its strategic value within the Base ecosystem.

3. Why Retail Users Are Also Satisfied

If institutions find the platform effective, retail investors will benefit even more. Definitive has made most of its institutional-grade features available to individual users, providing a fast and cost-effective professional trading experience.

- Degen Mode: Allows for up to 20% dynamic slippage during network congestion to prevent trade failures and improve execution success rates for popular tokens.

- Quick Trading: Enables one-click buy/sell orders from the side panel using preset amounts—ideal for fast-changing markets.

- Discovery: Displays newly launched tokens on platforms like Zora in real-time, allowing users to filter by trends or performance for immediate trading.

- Bridging: Compares cross-chain routing through multiple bridging providers (including debridge, Bungee, Socket, LiFi, and Relay) and automatically selects the most efficient bridge, reducing time and costs.

- Cross-Chain Exchange: Allows for the exchange of any token to any token across different blockchains without a separate bridging step, completing the transaction in one operation.

Why are these features important?

Consider a practical scenario. A new creator token is launched on Zora and quickly gains attention on X (Twitter), causing the price to soar.

What happens if users trade through a typical DEX?

They first need to bridge their assets to Zora, a process that may take several minutes—long enough for the price to rise significantly. When they finally attempt to trade, network congestion and strict slippage settings may lead to trade failures. Each retry takes additional time, resulting in missed opportunities and potential losses.

Source: Definitive

What if users trade through Definitive?

Tokens immediately appear in the discovery feature, allowing users to find them without delay. If their assets are on another chain, they can execute a cross-chain exchange directly—no separate bridging needed. Degen mode ensures successful execution even during network congestion, while quick trading allows purchases to be completed with just one click. Using any of these options, the entire process is completed in seconds rather than minutes.

A more important factor is the low trading fees. While fees are crucial for institutions trading large volumes, they are equally important for retail investors managing smaller amounts.

Source: Definitive

Definitive charges a market order fee of 0.05-0.25% based on trading volume and token type. In contrast, standard DEX platforms charge 0.25-0.30%, making Definitive already competitive.

Users can reduce fees by staking EDGE tokens. By staking 2,000 EDGE tokens and achieving a monthly trading volume of $100,000, fees can be reduced to 0.15%—a 40% reduction from the base rate.

The team has hinted that trading pairs like USDC/USDT will be free, and plans to offer major assets like BTC, ETH, and SOL at just 0.05% fees. This tiered approach strategically targets the highest trading volume pairs that are most sensitive to fees.

Lower costs accumulate compounding effects over time. For active traders, fee savings directly translate into higher net returns.

4. Core Infrastructure of the Base Era

Definitive has proven itself first in the institutional market.

Since the beta launch in March 2024, over 50 institutions have joined the platform, including hedge funds like Starkiller Capital and Skycatcher, major OTC desks like Blockfills, and top venture capital firms like Base Ecosystem Fund. Cumulative trading volume has reached billions of dollars.

After gaining credibility among institutions, Definitive is now expanding to retail users. It has launched retail-focused features such as quick trading, discovery, and cross-chain exchange, and has released iOS and Android mobile applications. A new trading product called Turbo is also set to launch soon.

The Base ecosystem is entering a critical phase. Coinbase has begun large-scale user onboarding through the Base application, and market expectations for the Base token issuance continue to rise.

Definitive is at the center of this momentum. Founded by the developers behind Coinbase Prime, supported by direct investment from Coinbase Ventures, and listed on Coinbase on the first day of its TGE, Definitive is establishing itself as the core infrastructure of the Base ecosystem and the broader field.

As institutional capital flows into DeFi, Definitive stands out as one of the best-positioned projects. When the Base token is issued and the ecosystem expands, Definitive is likely to remain at the center of this growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。