Author: J1N, Techub News

The government "shutdown" has brought negative impacts to multiple industries in the United States over the past month, prompting several U.S. officials to sound the alarm on economic downturns, even affecting U.S. military bases overseas.

The longest government shutdown in U.S. history is finally coming to an end.

November 9 marks the 40th day of this "closure" crisis that began on October 1.

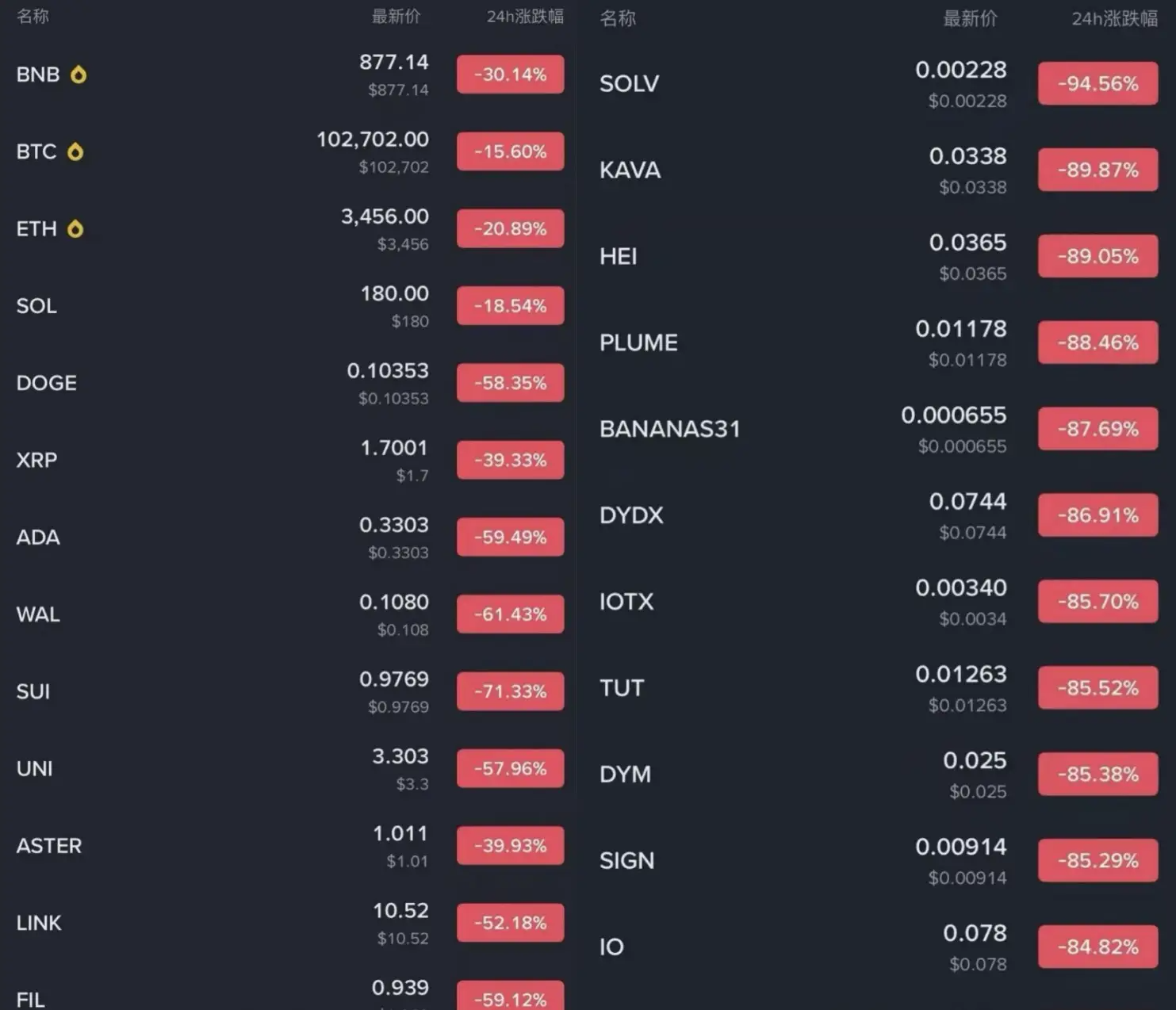

The 40-day fiscal deadlock has left the global market feeling suffocated: U.S. stocks have fluctuated, gold has retreated, and Bitcoin briefly fell below the $100,000 mark. Investors are anxiously waiting in uncertainty.

Source: Binance

Until Sunday, the U.S. Senate finally voted on the temporary funding proposal put forward by the Republicans, advancing the bill with a 60-40 result. As long as the proposal passes the House of Representatives and receives the President's signature, the government can reopen.

According to the latest developments, a group of centrist Democrats reached a preliminary consensus with Republicans: as long as Republicans commit to voting on healthcare subsidies before December, Democrats will support the government restart. The bill also includes a provision prohibiting federal agencies from laying off employees before January 30, which is seen as a key victory for federal unions.

Eight Democrats switched sides, pushing this bill, which had been rejected 14 times before, and market sentiment began to warm up.

A "Shutdown" That Drags Down the Nation

The past 40 days of "shutdown" have nearly paralyzed American society.

Food safety inspections have been suspended, research projects have been forced to halt, and core agencies like NASA and the Department of Homeland Security have entered "minimum operational mode." Some overseas U.S. military bases have experienced delays in logistical support, affecting even military operations abroad.

Several U.S. officials have warned: if the shutdown continues, the risk of economic recession will sharply increase, with millions of federal employees on unpaid leave or forced to work without pay, frequent flight delays, increased food safety risks, national parks closing, and tax refunds being delayed.

This is not just an administrative shutdown; it is a "chain reaction" in the economic system.

The overseas impact is also evident, with supply chain delays and canceled business orders, while limited military supplies have weakened the U.S.'s global deployment capabilities.

Behind what seems to be a political standoff, the entire economic machine is being forced to slow down.

Consumer confidence indices have fallen for three consecutive weeks, and the manufacturing PMI has dropped below the growth line. Some state governments have been forced to tap into emergency reserves due to stalled funding, and the liquidity coverage ratio (LCR) of U.S. small and medium-sized banks has fallen to its lowest level since October last year. Goldman Sachs warned in its latest report that if the shutdown continues until the end of the year, U.S. quarterly GDP growth will be dragged down by 1.2%, and the unemployment rate may rise to 4.5%. The risk premium in financial markets has rapidly increased, leading to further inversion of the U.S. Treasury yield curve, with the market briefly experiencing expectations of a "technical recession."

Why Does the U.S. Government Always "Shut Down"?

The reason for the "government shutdown" is that Congress has failed to reach an agreement on the budget for the new fiscal year.

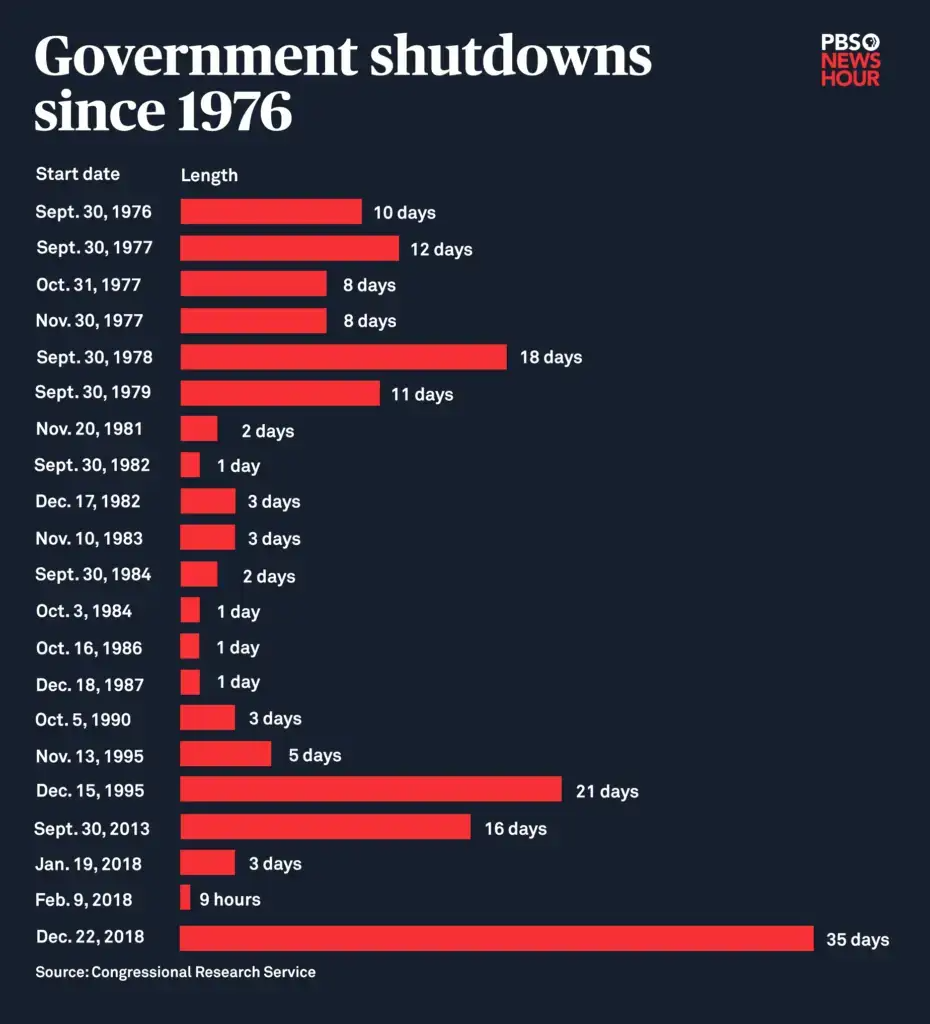

On the surface, this is a budget disagreement; in essence, it is a reflection of the political polarization in the United States. Since 1976, the U.S. government has "shut down" 21 times. As long as Congress fails to pass a budget or a temporary funding bill before the end of the fiscal year (September 30), the government will fall into "partial paralysis."

Federal government shutdowns since 1976 compiled by American Public Broadcasting

From Reagan to Biden, nearly every president has experienced a shutdown.

1981: The Reagan administration experienced its first shutdown, lasting only one day, but it opened the curtain on the long-standing confrontation between Republicans and Democrats over fiscal and social policies.

1995-1996: During the Clinton administration, two shutdowns occurred due to disagreements over healthcare reform and deficit reduction, lasting a total of 27 days, nearly bringing the federal service system to a halt.

2013: During the Obama administration, Republicans blocked the "Affordable Care Act" (Obamacare), leading to a 16-day shutdown, during which the Dow Jones index fell by 2.6%, and the U.S. GDP evaporated by about $24 billion.

2018-2019: Trump shut down the government for 35 days over budget disputes regarding the "construction of the U.S.-Mexico border wall," setting a record for the longest shutdown at that time. However, all three major U.S. stock indices fell, with the Nasdaq plummeting over 10%, and the GDP evaporating by about $11 billion.

Now, this record has been broken by the shutdown in 2025. This deadlock stems from disagreements between Republicans and Democrats over healthcare subsidies, the debt ceiling, and fiscal priorities. The 40-day shutdown has plunged the U.S. into an unprecedented administrative freeze. FDA inspections have been suspended, NASA missions delayed, border controls limited, and flight delays have become frequent. The economic losses alone have exceeded $50 billion.

This recurring fiscal deadlock is undermining global trust in the "American model." Bloomberg points out that over the past decade, the "shutdown cycle" in the U.S. has been shortening, and fiscal negotiations have almost become an annual routine. International investors no longer view U.S. Treasury bonds as "absolutely safe assets," and some central banks have begun to reduce their dollar reserves. IMF President Kristalina Georgieva bluntly stated: "The political dysfunction in Washington is becoming one of the biggest sources of uncertainty for the global economy."

What Does a "Shutdown" Have to Do with the Market?

Many people may ask: What does the government being closed have to do with my stock or cryptocurrency trading?

In fact, the relationship is significant.

On the surface, it seems like just politicians arguing. But in reality, it directly affects whether funds flow in the market, as this is not just a political shutdown but a liquidity freeze. Every government shutdown represents a contraction of liquidity. With fiscal spending paused, federal wages unpaid, and funding projects frozen, it means that "money" is being pulled out of the market.

During the 2013 shutdown, the Dow Jones index fell by 2.6%, and the S&P dropped by 3%, with the U.S. GDP evaporating by $24 billion; during the 2019 shutdown, U.S. stocks plummeted, and Bitcoin was halved, dropping from $6,000 to $3,000, as liquidity was "choked off."

The same is true this year. Since the "Black Friday" crash on October 11, U.S. stocks, gold, and Bitcoin have all plummeted almost simultaneously. The Nasdaq fell by 3.5%, the S&P dropped by 2.8%, gold fell from $4,300 per ounce to $3,900, and Bitcoin dropped from a high of $126,000 to below $100,000, with a total market value evaporating by over a trillion dollars.

Source: Coinglass

The reason is straightforward: the balance of the Treasury General Account (TGA) surged from $800 billion to $1 trillion, indicating that $200 billion in liquidity was "sucked away." Meanwhile, the short-term financing market tightened rapidly, with the overnight borrowing rate (SOFR) soaring to 4.22%, exceeding the upper limit of the Federal Reserve's policy range; interbank borrowing costs rose, corporate financing tightened, and the Federal Reserve's "emergency repurchase facility" (SRF) saw daily usage reach $50.3 billion, the highest since the pandemic began in 2020.

Some analyses suggest that market liquidity decreased by nearly $700 billion in just one month. This is equivalent to the Federal Reserve "silently" raising interest rates several times.

Compared to traditional markets, the crypto market reacts more quickly and amplifies changes in dollar liquidity. The issuance of stablecoins decreased by about 8% during the shutdown, and daily transaction volumes on the Ethereum network fell to a new low for the year. Many institutions withdrew cash from risk assets and turned to short-term U.S. Treasuries and money market funds, creating a "flight to safety." Even if the Federal Reserve does not take action, the Treasury's operations are enough to reshape market sentiment.

Why Does the Market Rebound After "Opening"?

Every time the government "opens" again, the market almost always experiences a short-term rebound. The logic is quite simple: "Fiscal spending resumes."

When the shutdown ends, the government resumes operations, back wages are paid, and budget expenditures restart, leading to funds flowing back into the market. The balance of the Treasury General Account (TGA) begins to decrease, and liquidity within the Federal Reserve system returns to the financial system, prompting a natural "recovery" reaction in the market.

Historical examples of typical shutdowns have confirmed this pattern. After the government reopened in 2013, the Dow Jones index rose by 3.5% in just two weeks; after the 2019 shutdown ended, U.S. stocks experienced a quarterly-level rebound, and Bitcoin also resumed its upward momentum. The market has always feared not bad news, but uncertainty. When the funding proposal passes and fiscal order is restored, confidence returns, and risk assets are immediately supported.

This time is no exception. With the Senate voting to pass the proposal, U.S. stock futures rebounded by 1%, and Bitcoin climbed back above $106,000. Investors are betting that the government restart means a new round of fiscal stimulus is about to begin, especially in the technology and cryptocurrency sectors, which will be the most direct beneficiaries.

Morgan Stanley noted in a report that within the first two weeks after the shutdown ends, U.S. stocks average a rise of about 3%, but they often enter a consolidation or correction phase afterward. This is because the market quickly prices in the expected "liquidity effect," while the actual fiscal stimulus will take weeks to materialize. In other words, the government's "opening" only provides a short-term respite and cannot fundamentally change the structural dilemma of U.S. finances.

"Shutdown" Has Become a Chronic Illness of U.S. Finances

However, this cycle of "opening—shutting—reopening" has long become a stubborn ailment of U.S. finances.

By 2025, the total U.S. national debt will exceed $36 trillion, accounting for about 130% of GDP. Of this, interest payments alone amount to $1 trillion annually, nearly half of the defense budget. The massive debt is shrinking the fiscal maneuvering space, and every budget negotiation feels like walking a tightrope on the edge of a cliff.

The Republicans advocate for spending cuts and tax reductions to stimulate the economy, while the Democrats emphasize expanding social welfare and green investments. The divide between the two sides continues to widen, with the debt ceiling repeatedly used as a political bargaining chip. Politicians have gained the upper hand in discourse but have caused the market to lose trust.

Rating agencies have repeatedly warned that the U.S. sovereign credit may be downgraded due to political uncertainty. Long-term Treasury yields have risen from 4% to 4.5%, further increasing financing costs and creating a vicious cycle. Meanwhile, the trend of "de-dollarization" is accelerating, with more institutional investors beginning to increase allocations to non-sovereign assets like gold and Bitcoin to hedge against potential fiscal risks.

In the cryptocurrency market, trading volumes of stablecoins have surged, and DeFi protocols are becoming new financing channels. To some extent, the U.S. government's fluctuating credit is inadvertently driving the restructuring of the global financial system.

In Conclusion

The U.S. government's "shutdown" is never just a political spectacle; it is essentially a game about currency, liquidity, and global credit.

When the lights in Washington go out, fiscal spending halts, liquidity is locked in the treasury, U.S. stocks fall, gold is pressured, and Bitcoin sneezes; but when the government "opens," that light turns back on, and the market immediately feels that "money" has returned.

In today's global financial system, the impact of a budget negotiation can be as significant as a Federal Reserve interest rate hike. Because it directly controls the "money valve," determining global risk appetite.

So the next time you see the words "government shutdown," don't think it's just a congressional farce. It may very well be the prelude to the next global market turbulence. When Washington holds its breath, global capital does too.

In this interconnected financial era, politics and markets are already tied together. The "shutdown" game in the U.S. also reminds us: when the "central bank" of the world cuts its power, everyone has to feel their way forward in the dark.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。