作者:Boaz Sobrado

编译:深潮TechFlow

2025年1月23日,著名的“狗戴帽”(Dogwifhat)梗图中的狗狗——Achi,现身纽约证券交易所(NYSE)开市钟仪式。

Dogwifhat(代币代码:WIF)是一款基于 Solana 区块链的狗狗主题迷因币,于2023年11月推出,其吉祥物是一只戴着针织帽的柴犬。

图片来源:TIMOTHY A. CLARY / AFP,由 TIMOTHY A. CLARY/AFP via Getty Images 提供

当 Benchmark 在2025年11月为 Fomo 领投1700万美元的 A 轮融资时,这家硅谷最具选择性的风投公司在加密领域做出了一个不同寻常的赌注。Benchmark 很少投资加密货币初创公司。尽管该公司曾在2018年支持了 Chainalysis 以及少数几家其他加密公司,但加密领域并非其典型投资组合的一部分。然而,合伙人 Chetan Puttagunta 却选择加入 Fomo 的董事会。Fomo 是一款支持跨多个区块链交易数百万种加密代币的消费者应用。

Benchmark 的投资并非仅仅针对另一款交易应用。他们押注的是“社交交易基础设施”这一迅速崛起的领域,这类基础设施正逐渐成为零售投资者与经纪服务一样不可或缺的工具。

不仅仅是投机者:Blossom Social 案例研究

Blossom Social 团队与社区成员在纳斯达克前合影

图片来源:Blossom Social

Blossom 的首席执行官 Maxwell Nicholson 对“用户阻力”有着比大多数人更深刻的理解。当你创建一个社交平台,并要求用户在注册过程中必须绑定他们的经纪账户时,这无疑会在用户旅程的早期阶段制造巨大的障碍。大多数消费类公司会选择移除这种门槛,而 Blossom 却将其设为强制要求。

这一决策看似违背直觉,直到你了解 Nicholson 的愿景。Blossom 于2021年推出,正值 GameStop 引发的散户交易热潮期间。当时,Reddit 上关于股票的讨论完全是匿名的,你无法看到真实的持仓,只能看到各种主张和言论。而虽然 StockTwits 已经积累了大量用户,但大多数用户分享的仅仅是未经验证的个人观点。

Nicholson 希望在真实投资的基础上构建一个社交网络,这一目标通过最近推出的 API(如 SnapTrade)实现了经纪账户连接的验证功能。技术已经成熟,问题在于用户是否能接受这种“阻力”。

结果证明,他们可以接受。如今,Blossom 已拥有50万注册用户,其中约10万人已绑定了他们的经纪账户,管理的资产总额接近40亿美元。在 Blossom 上,用户持有的资产中有一半是 ETF(交易型开放式指数基金),而非单一股票。其中,最受欢迎的持仓是标普500 ETF。

强制绑定经纪账户的要求最终塑造了 Blossom 的社区文化。Nicholson 在观察 StockTwits 时发现,该平台后来才将经纪账户绑定作为可选功能引入。尽管 Plaid 或 SnapTrade 等服务提供了技术支持,但 StockTwits 的用户并未广泛采用这一功能,因为绑定并非其平台的核心基因。而在 Blossom 上,几乎所有定期发帖的用户都会分享他们的真实持仓,并通过验证获得一个专属徽章。这种文化的形成,正是因为强制绑定筛选出了那些愿意分享真实投资组合的用户。

这种文化最终转化为商业价值。Blossom 在2023年创造了30万美元的收入,2024年收入达到110万美元。今年,他们预计收入将达到400万美元,其中75%的收入来自与 ETF 提供商的合作。

State Street(道富集团)向 Blossom 支付费用,以提高散户投资者对 SPY(标普500指数ETF)的认知,避免他们默认选择 Vanguard(先锋集团)的 VOO。VanEck 推广主题型 ETF,Global X 广告投放于专注领域的基金。目前大约有25家不同的基金提供商与 Blossom 合作,因为该平台能够触达那些正积极选择购买哪些基金的散户投资者。

这一商业模式之所以奏效,是因为 Blossom 的用户通过社区发现新的投资机会。他们的目标不是短线交易,而是为未来几十年构建投资组合。当用户绑定账户并讨论持仓时,他们不仅为其他用户创造了内容,还生成了关于真实散户行为的数据。

Nicholson 提到 Blossom 每季度发布的散户资金流入 ETF 的报告。这些数据展示了散户投资者实际如何使用他们的资金,而非依赖调查中声称的意图。这些数据因为经纪账户的验证而具有可信度,ETF 提供商愿意为这些数据买单,以了解其产品是否受到散户投资者的青睐。

目前,Blossom 上绑定的40亿美元资产代表了真实的资金,这些资金的配置决策基于社交平台上的讨论。从 ETF 提供商的角度来看,这不仅是一个娱乐平台,而是重要的基础设施。

散户投资者主宰世界,但究竟是哪类散户?

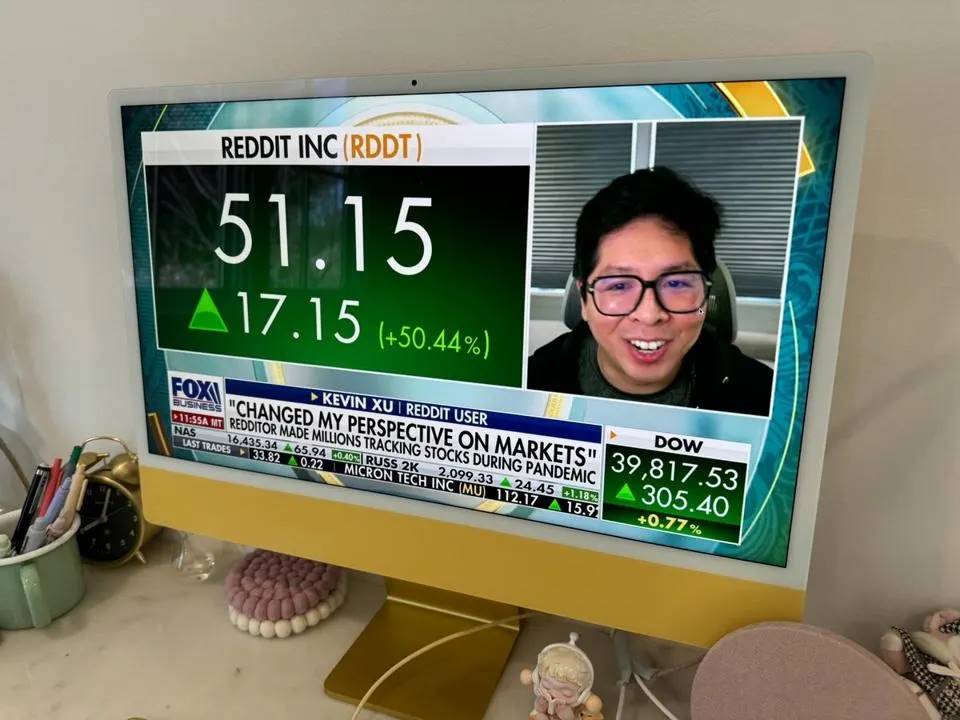

著名的 Reddit 投资者 Kevin Xu 是 AfterHour 和 Alpha 的创始人。

图片来源:Kevin Xu

社交交易的爆发揭示了一个事实:散户投资者并非一个单一的群体。在这一领域取得成功的平台,服务的却是截然不同的受众,这些受众在风险偏好、投资时间跨度和投资动机上存在显著差异。

AfterHour 瞄准的是 WallStreetBets 的用户群体。创始人 Kevin Xu 在“迷因股”热潮期间,将3.5万美元变成了800万美元,他以化名“Sir Jack”在 WallStreetBets 社区中透明地分享了每一笔交易。他创建 AfterHour 正是为了服务这一群体。用户可以通过化名分享自己的持仓,但需通过绑定经纪账户来验证其投资组合。他们分享的是真实的金额,而不仅仅是百分比。基于股票的聊天室功能类似于交易版的 Twitch 直播间。

AfterHour 在 2024 年 6 月从 Founders Fund 和 General Catalyst 筹集了450万美元。该平台显然非常受欢迎,据称 70% 的用户每天都会打开应用程序。他们并不是那种每季度才查看一次账单的被动投资者,而是将市场视为娱乐和社区的活跃参与者。截至目前,平台已向用户提供了近600万个交易信号,并验证了超过5亿美元的关联投资组合资产。

另一方面,Fomo 则专注于那些追逐加密货币的“狂热分子”(Crypto Degens),这些人希望能接触到每条区块链上的数百万种代币。Fomo 的创始人通过列出 200 位理想天使投资人名单并利用人脉网络进行引荐,成功吸引了其中的140位投资者,其中包括 Polygon Labs 的 CEO Marc Boiron、Solana 的联合创始人 Raj Gokal 和 Coinbase 前 CTO Balaji Srinivasan。

最近从Benchmark筹资的Fomo应用背后的团队

Benchmark 对 Fomo 的投资是在三位曾与 Fomo 创始人 Paul Erlanger 和 Se Yong Park 合作过的人引荐后促成的。这三人都曾在 dYdX 工作,并认可他们的愿景:打造一个超级应用,为用户提供访问任何区块链上所有加密资产的能力,同时融入社交功能,让用户可以实时关注朋友和领袖的交易动态。

Fomo 的创始人打造了一个为用户提供全天候交易体验的平台,无论是比特币还是冷门迷因币,只要存在于任何区块链上,都可以交易。该应用收取 0.5% 的交易费用,但会承担用户的链上 Gas 费用,这对关注主流币种的交易者极具吸引力。当你可以在周日凌晨 3 点交易 Solana 代币而无需担心网络费用时,传统市场的种种限制便显得尤为明显。

Fomo 在 2025 年 6 月新增了 Apple Pay 支持,用户可以下载应用后立即开始交易。此后,其收入飙升至每周 15 万美元,日交易量达到 300 万美元。到 9 月融资轮结束时,平台的日交易量已攀升至 2000 万至 4000 万美元,日收入从交易费用中达到了 15 万美元,用户数量突破 12 万。

这一增长验证了 Puttagunta 的判断:社交交易已经从一个功能演变为一种基础设施。支持社交交易的平台正在为散户投资者探索、讨论和执行交易的方式构建永久性的架构。

Blossom 则有意吸引那些倾向于长期投资的用户,他们会讨论是否应该将投资组合偏向小盘价值股或国际股票。大约 37% 的持仓集中在标普 500 ETF,其余 63% 则涵盖了红利基金、备兑看涨期权 ETF、加密货币 ETF、固定收益和单只股票的 ETF。用户将其投资策略描述为“核心-卫星”策略:以广泛的市场敞口为基础,辅以围绕特定主题的边缘投资。

这些平台服务的受众群体有着根本性的不同。将 Blossom 账户绑定以讨论 SCHD(施瓦布高股息股息ETF)分红收益率的投资者,与午夜在 Fomo 上交易特朗普迷因币的用户完全不同。他们都是散户投资者,但目标、风险偏好以及与市场的关系却截然不同。

这些平台的成功源于明确的受众定位。Blossom 强制要求绑定经纪账户,筛选出愿意分享真实投资组合的严肃投资者;AfterHour 的化名透明性吸引了希望获得可信度但又不愿暴露个人信息的交易者;而 Fomo 的多区块链访问功能则服务于将 24/7 全天候交易视为常态的加密原住民。理论上,每个平台都可以服务于所有散户投资者,但它们都选择了不这么做。

金融超应用的构想

纽约,纽约——2025年7月29日:在线券商 Robinhood 的创始人 Baiju Bhatt(右)和 Vlad Tenev 在华尔街漫步,这一天 Robinhood 宣布上市。尽管在纳斯达克的首秀中,Robinhood Markets Inc. 的股价下跌了约 5%。

图片来源:Spencer Platt/Getty Images

Robinhood 在 2025 年 9 月推出的“Robinhood Social”从一个意想不到的方向验证了社交交易的趋势。当这个以交易佣金平民化闻名的平台决定增加社交功能时,表明经纪行业的结构性变化已经发生。

Robinhood 的 CEO Vlad Tenev 在拉斯维加斯的一场现场活动中描绘了这一愿景:“Robinhood 不再只是一个交易平台——它是你的金融超应用(Financial SuperApp)。” 此次发布的功能包括:AI 驱动的定制化指标、期货交易、卖空、隔夜指数期权以及多账户管理功能。然而,核心亮点是 Robinhood Social——一个内嵌于 Robinhood 应用中的交易社区,提供经过验证的交易和真实的用户档案。

这些功能与独立的社交交易平台已经提供的服务十分相似。用户可以实时查看经过验证的交易记录,包括买入和卖出的时间点。他们可以讨论交易策略、关注其他交易者,并直接在信息流中完成交易操作。用户还可以查看自己关注的交易者过去一年的每日盈亏、收益率以及历史交易记录。每个用户档案都属于通过“了解你的客户”(KYC)流程验证的真实个人。甚至,用户还能基于公开披露的交易记录,关注政治人物、内部人士和对冲基金,即使这些人并未使用 Robinhood 平台。

Robinhood 将社交功能设为仅限邀请使用,表明其对这一领域的重视。Robinhood 拥有 2400 万个有资金账户,具备强大的分发能力。他们开创了零佣金交易,并花费数年时间捍卫“订单流支付”(Payment-for-Order-Flow)的盈利模式。而如今,他们增加社交功能,是因为经纪行业本身正面临日益严重的同质化竞争。

零佣金已经成为整个行业的标配。移动应用是基本要求,零散股交易也已成为标准功能。Robinhood 在 2015 年的差异化优势,如今已被 Charles Schwab、Fidelity 和 TD Ameritrade 等传统券商全面覆盖。而社区与互动,正成为新的差异化竞争点。

Robinhood 的举措验证了一个事实:社交交易不再只是一个功能需求,而是基础设施。当用户数最多的零售券商引入社交功能以与专业化平台竞争时,这些平台已经证明了这个领域的存在意义和重要性。

此举的时机也显得颇有防御性。Blossom、AfterHour 和 Fomo 正在通过针对特定散户投资者群体赢得市场关注。这些平台无需成为券商,它们通过 API 连接现有券商,却掌握了投资者发现和讨论的关键环节——也就是投资者决定买什么的地方。而 Robinhood 虽掌握交易执行的核心,但如果投资者的讨论和决策发生在其他平台上,它就有可能沦为同质化的基础设施管道。

社交层带来的用户粘性是单靠交易执行无法实现的。如果你的朋友都在 AfterHour 交易,而你尊敬的投资者都在 Blossom 上分享见解,那么切换平台的成本就远远超出了简单的资产转移。你还将失去社区、讨论以及为决策提供背景的社交环境。Robinhood 很清楚这一点,并正在采取应对措施,但在这一领域,它已经从引领者变成了追随者。

社交媒体正在成为市场基础设施

Howard Lindzon:社交交易如何重塑散户投资生态

2011年4月14日,StockTwits首席执行官 Howard Lindzon 在美国纽约的 Bloomberg Link Empowered Entrepreneur Summit 上发表讲话。此次峰会汇聚了最具创新精神的企业家,与其他创业者、投资者及潜在商业伙伴展开了一天的讨论,主题围绕如何创业、融资及发展业务。

摄影师:Peter Foley/Bloomberg

社交交易平台将零售投资中原本分离的两大功能——金融媒体和市场基础设施——整合为一体,提供了全新的投资体验。

想象一下华尔街的专业人士是如何工作的。他们每年支付 24,000 美元订阅 Bloomberg 终端服务。而这一终端的价值不仅在于数据或交易执行,更在于其无缝衔接的工作流。专业人士可以在同一个屏幕上观察市场动态、阅读新闻、分析图表、与其他交易员交流并完成交易。Bloomberg 的即时消息系统之所以被广泛使用,正是因为它嵌入了整个工作流,而不是迫使用户频繁切换上下文。

社交交易平台正在为散户打造类似的工作流体验。以 StockTwits 为例,该平台拥有 600 万用户,实时讨论市场动态。其创始人 Howard Lindzon(“堕落经济指数”的创造者)早在 2008 年就推出了该平台,比当下的散户交易热潮早了数年。社区讨论的内容往往是正在发生的市场动态,而不是 CNBC 三小时前报道的内容。2021 年 GameStop 暴涨时,讨论的主战场是 Twitter、StockTwits 和 Reddit,而非传统金融媒体。

Blossom 则将这一概念与经过验证的投资组合数据相结合。当用户链接账户并讨论自己的实际持仓时,他们为其他用户创造了内容。该平台既是媒体属性,又是数据来源。ETF 提供商会为曝光度买单,因为散户投资者通过社交动态发现基金,而不是通过 Morningstar 的评级或财务顾问的推荐。

AfterHour 则在你关注的用户进行交易时,实时推送信号。通知即时送达,营造出传统媒体无法比拟的紧迫感。当你尊敬的投资者买入某只股票时,你可以第一时间看到交易记录,而不是等到市场收盘后再从 CNBC 的新闻中得知当日的热门交易。

Fomo 则让你在交易数百万种加密货币时,实时查看其他用户的持仓情况。社交动态会展示哪些代币正在引发关注,而这些信息通常要在主流加密货币媒体报道之前就能被发现。通过社区进行发现,而非依赖中心化编辑对“新闻价值”的判断,这种模式正在改变人们的投资决策方式。

这种整合解释了为何传统金融媒体难以吸引年轻投资者。CNBC 采用的是广播模式,主持人讨论股票,观众被动观看。然而,媒体消费与交易执行之间的脱节增加了摩擦。年轻投资者不看有线电视,也不会等待市场总结。他们通过手机实时获取内容,并在当下做出决策。

社交交易平台通过让媒体内容创作变得具有参与性来解决这一问题。用户通过交易和讨论来创造内容。这些平台本质上是媒体公司,但信号由用户生成。这种结构反映了年轻群体消费所有媒体的方式——他们不区分内容的创作与消费。社交交易平台将这种行为映射到了金融市场中。

其商业模式也体现了媒体与基础设施的融合。Blossom 的收入来源于 ETF 提供商购买曝光度,这与媒体公司出售广告位类似。但这种广告与经过验证的投资组合数据相结合,使提供商能够了解其产品是否受到欢迎,并根据实际表现付费。AfterHour 和 Fomo 则通过交易手续费获利,这与券商通过交易执行盈利的方式类似。但这些交易发生在社交语境中,由社区推动发现。

这些平台并不试图取代 CNBC 或 Bloomberg,而是取代了将金融媒体消费与交易分离的割裂体验。整合才是创新的核心。当发现、讨论和执行在一个工作流中完成且无需切换上下文时,平台就从一个简单的应用程序升级为基础设施。

交易数据即产品

Blossom Social 曾在多伦多举办了一场吸引 1,400 人参加的大型活动,地点是 Rogers Centre(蓝鸟队在第七场比赛中错失世界大赛冠军的地方)。

Blossom Social

社交交易平台生成了一种前所未有的零售市场数据集。这些数据集本身就是一种独立的产品,与生成它们的社交功能分离。

Blossom 的 40 亿美元关联资产揭示了散户投资者的真实行为,而非他们的主观意图。传统的市场调研会询问投资者持有哪些资产或计划购买什么,但问卷调查往往受到选择偏差、记忆偏差以及理想化回答的影响。而 Blossom 通过券商账户的连接验证数据,准确掌握散户投资者的实际持仓。

公司每季度都会发布关于零售资产管理规模(AUM)流入 ETF 的报告。这些报告揭示了哪些类别吸引了新资金,哪些则出现了资金外流。这些数据之所以重要,是因为散户投资者如今在市场交易量中占据了重要地位。在 2021 年,散户的交易活动达到了令机构投资者不得不调整策略的水平。即便 GameStop 热潮退去,散户投资者依然活跃在市场中。

ETF 提供商愿意为这些数据买单,因为它能显示他们的产品是否真正受到散户的青睐。State Street 与 Vanguard 在争夺散户对标普 500 ETF 的投资;VanEck 与 Global X 在争夺主题型 ETF 的资金流入。这些提供商需要知道,散户投资者是否真的在购买他们的基金,而不仅仅是听说过它们。

Blossom 能为他们提供答案。当 37% 的关联资产配置于标普 500 ETF 时,这说明这一类别对投资者很重要。当覆盖看涨期权的 ETF 显示出强劲的资金流入时,这验证了市场对以收益为导向产品的需求。当加密货币 ETF 获得采用时,这证明散户的兴趣已超越交易所上的投机行为。这些数据来自经过验证的投资组合,而非问卷调查或焦点小组讨论。

AfterHour 的经过验证的投资组合数据揭示了 WallStreetBets 群体实际交易的股票与他们讨论的股票之间的区别。许多股票在社交媒体上热度飙升,但却未见显著的散户交易量。而 AfterHour 能够通过用户关联的真实持仓数据,将噪音与有效信号区分开来。平台上连接的 5 亿美元投资组合代表了社区讨论后真正落地的资金流向。

Fomo 的交易数据揭示了哪些加密货币代币在热潮之外真正获得了散户的广泛采用。该平台以提供访问所有区块链上数百万代币的承诺而启动。尽管其中大多数代币注定会失败,但数据能够显示哪些代币吸引了持续的交易量,而哪些只是短暂暴涨后消失。这些数据对于理解散户在加密市场中的行为具有重要价值。

随着散户交易在市场活动中占比的不断增加,这些数据的价值也在提升。社交交易平台收集了传统数据提供商难以追踪的投资者群体信息。散户投资者不提交 13F 表格,也不会公开报告其持仓信息。券商数据则是各自为政,难以共享。而社交交易平台通过用户的账户连接,跨越了传统数据孤岛,汇总来自各大券商的数据,形成了全面的视角。

这些平台的商业模式之所以有效,是因为它们通过信息流获利,而非交易量。Blossom 并不需要用户频繁交易,而是需要用户真实分享投资组合数据,以提升数据的价值。这种模式使其激励机制不同于依赖交易频率盈利的佣金制券商或订单流支付模式。

此外,这些数据产品还构筑了强大的护城河。一旦 ETF 提供商开始依赖 Blossom 的季度报告来制定策略,他们就会对这些数据产生依赖。一旦 AfterHour 向对冲基金展示了散户交易的真实动态,这些信息就会被纳入其投资流程中。社交交易平台不仅成为散户投资者的基础设施,也逐渐成为机构和产品提供商理解散户行为的关键工具。

交易已成为一种消费行为

社交交易基础设施如今已成为市场的永久架构。这些平台虽因受众不同而细分,但它们共享着相同的核心特质:经过验证的持仓数据、实时对话功能,以及基于透明度而非交易量的商业模式。

支持这一基础设施的技术已不可逆转。券商连接的 API 已经存在,并且只会不断优化。实时验证投资组合数据的能力现已普及,任何平台都可以利用这一技术。因此,问题不在于社交交易基础设施是否存在,而在于哪些平台能够吸引哪些受众。

自 GameStop 热潮以来,散户交易浪潮并未逆转。2021 年期间开设账户的散户投资者并未因迷因股的退热而关闭账户。数据表明,散户参与市场的行为是持续的。这些投资者需要能够满足其工作流需求的基础设施——一个能够无缝整合资产发现、讨论和交易的综合平台。

传统券商可以添加社交功能,正如 Robinhood 所示。但那些以社交为核心、以交易集成为辅助的原生平台可能具有结构性优势。Blossom、AfterHour 和 Fomo 并不需要成为券商,它们通过 API 连接所有券商。这意味着用户可以在自己偏好的交易平台上进行交易,同时在其他社交社区中参与互动。

这些商业模式的可持续性已经得到验证。Blossom 的收入从 30 万美元增长到 400 万美元,仅用了两年时间,证明了 ETF 提供商愿意为接触散户投资者支付费用。AfterHour 的日活跃用户数据表明,社交交易能够形成用户习惯。而 Fomo 的交易量增长则显示,加密原住民渴望拥有集成社交体验的交易平台。这些平台并非新奇产品,而是真正满足市场需求的基础设施。

监管环境为社交交易基础设施提供支持,而非威胁。社交交易平台不持有资产,也不执行交易,它们的核心在于围绕经过验证的投资组合数据提供社区和讨论。这种架构规避了券商面临的大部分监管复杂性。相反,这些平台选择与受监管的券商合作,而非与之竞争。

未来的发展路径在于持续细分。更多服务于特定散户投资者细分市场的平台将不断涌现。一些平台将专注于期权交易者,另一些则服务于股息收入投资者,还有的将目标锁定在新兴市场。每个平台都将围绕经过验证的数据构建社区,并在不成为券商的前提下整合交易功能。

成功的关键在于精准定位受众,而非试图面面俱到。散户投资者并非一个同质化的群体。成功的社交交易平台会在产品设计、商业模式和社区文化中反映这一现实。Benchmark 对 Fomo 的投资验证了这种方法。该公司并未投资一个试图服务所有散户投资者的平台,而是选择了一个专注于服务加密原住民的平台,这些用户希望与社区一起交易数百万种代币。

社交交易基础设施并非取代券商,而是为其之上增添了一层社区、讨论与发现的功能。这一层正逐渐成为与券商本身同等重要的存在。正在构建这层基础设施的平台,正在为散户投资者的运作方式打造永久的市场架构。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。