撰文:深潮 TechFlow

市场现在正在经历又一次深度调整,大家都在等过度反应之后的反弹。

但当市场真的反弹,你觉得哪些板块会先收益?

最大的可能,来自于那些在大跌前引领市场但被打断的热门叙事。比如可以看看隐私币最近的表现;而在老币新炒的隐私币之外,另一个能带火相关资产的新叙事,那自然是 x402。

之前,我们也写过现在 x402 的机会大多都在 Base 链上;但回顾今年的市场脉搏,BNB Chain 在 Perp DEX 和 meme 等赛道上都实实在在做出过财富效应(尽管有争议),唯独 x402 是缺席的。

(相关阅读: x402 在 BASE 狂欢,BSC 和 Solana 上的资产机会在哪? )

那么我们再来理一下逻辑:

如果短期市场回暖,自带话题流量的 BNB Chain + x402,会不会迎来爆发?如果你认可这个逻辑,那自然需要在无人问津时提前做准备。

而按照 “流水的应用,铁打的基建”这一加密生态惯性,往往一个叙事里“卖铲人”角色的项目会有更大机会。

BNB Chain 上最值得关注的卖铲人是谁?b402 协议肯定是答案之一。

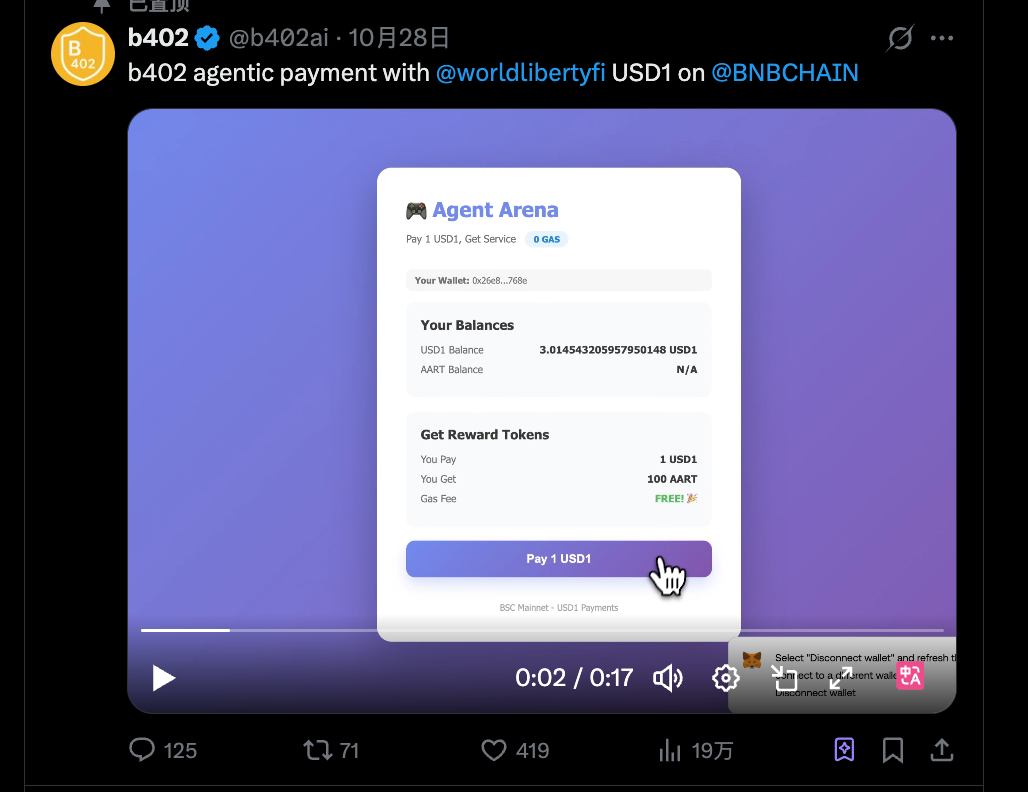

或许你不知道 b402 到底是啥,还不能 get 到其中的机会。不过 b402 官推最近发布的一个视频,也许能激发你对于这个项目在干什么的想象空间:

在 BNBChain 上,基于 x402 协议,用特朗普家族项目 WLFI 的 USD1 稳定币,向 AI Agent 转账,整个过程丝滑流畅。

不要忘记,USD1 近 80%的供应量都跑在 BNB Chain 上。

那么 x402 这个大话题里,除了 base 和 USDC,这个技术或许还有另一种你忽略的解:

当 b402 协议与 BNB Chain、币安可能在各赛道扶持项目来应对竞争、USD1 这几个要素存在某种联系时,技术叙事借由话题、资本和争议来发酵,里面所能搅动的能量或许更大。

因此本期内容,我们也来看看这个 b402 协议,看看它是否站得住脚,以及相比 x402 的其他协议有啥过人之处。

x402 无法直接照搬,b402 填补空白

我相信大多数人在听到 b402 这个名字时,本能的第一反应是:

直接把 x402 搬到 BNB Chain 不就完了,为什么要搞个 b402,这是不是重复造轮子?

b402 官推之前有一个短小的说明,其实非常精准的解释了这个问题:

“x402 支持了 AI Agent 之间用 USDC 来支付,而 b402 则可以让它们之间用所有的 BEP-20 标准的代币来支付。”

换句话说,你不能把 x402 那一套轻松的从 base 链上照搬到 BNB Chain 上。

要理解为什么搬不了,我们得先搞清楚 x402 的核心是什么。

不是所谓的 HTTP 402 状态码,不是支付协议,而是让 AI Agent 不需要管理 Gas 就能完成支付。

想象一下,如果每个 AI Agent 都要同时持有 USDT(用来支付)和 BNB(用来付 Gas),会有多麻烦。它需要监控 BNB 余额,需要在 BNB 不足时充值,需要处理 Gas 价格波动。这对人类用户都很烦,对程序来说更是噩梦。

x402 在 Base 上的解决方案很巧妙:利用了 USDC 的一个特殊功能。Coinbase 发行的 USDC 实现了一个叫 EIP-3009 的标准,允许用户只签署一个授权消息:

“我同意转 X 个 USDC 给某地址”,然后任何人都可以拿着这个签名去链上执行转账,Gas 费由执行者支付。

这就是 x402 能实现低 gas 支付的原因。AI Agent 只需要签名,x402 的 Facilitator 拿着签名去执行,Agent 完全不用碰 ETH。

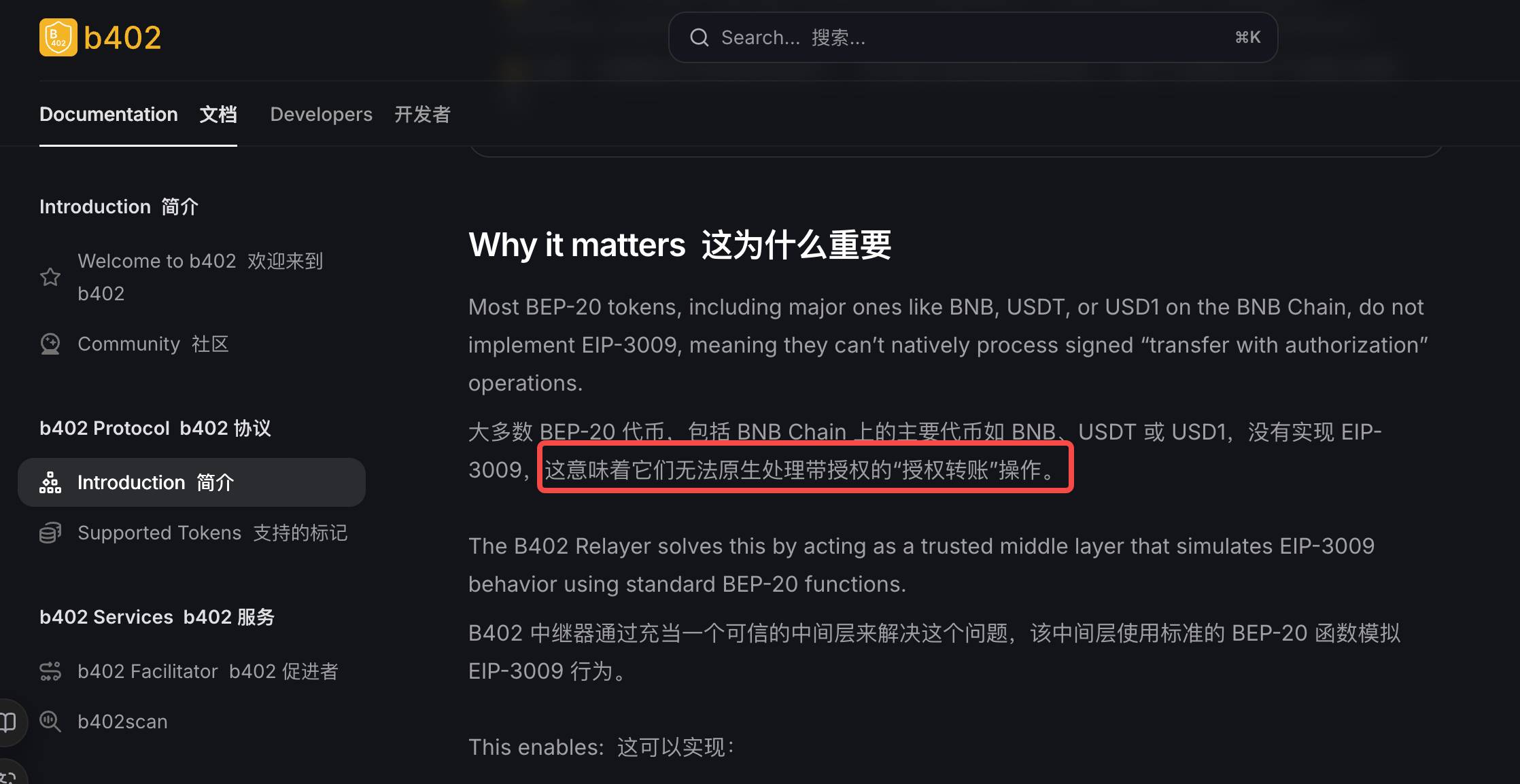

但在 BNB Chain 上,这条路走不通。

BSC 上的 USDT、BUSD,包括新出的 USD1,都没有支持 EIP-3009。它们是标准的 ERC-20 代币,只认链上交易,不认链下签名。你拿着签名去找 USDT 合约,它根本不理你。

于是,b402 的创新在于,既然 BNB Chain 上的代币合约不支持签名授权,那就自己造一个中间层。

b402 把这个中间层叫做 Relayer(中继),实际在执行上是部署了一个 Relayer 合约,你可以把它的作用理解成“翻译”:

它接收用户的签名授权,验证真实性,然后由它替用户去调用 USDT 的转账功能。

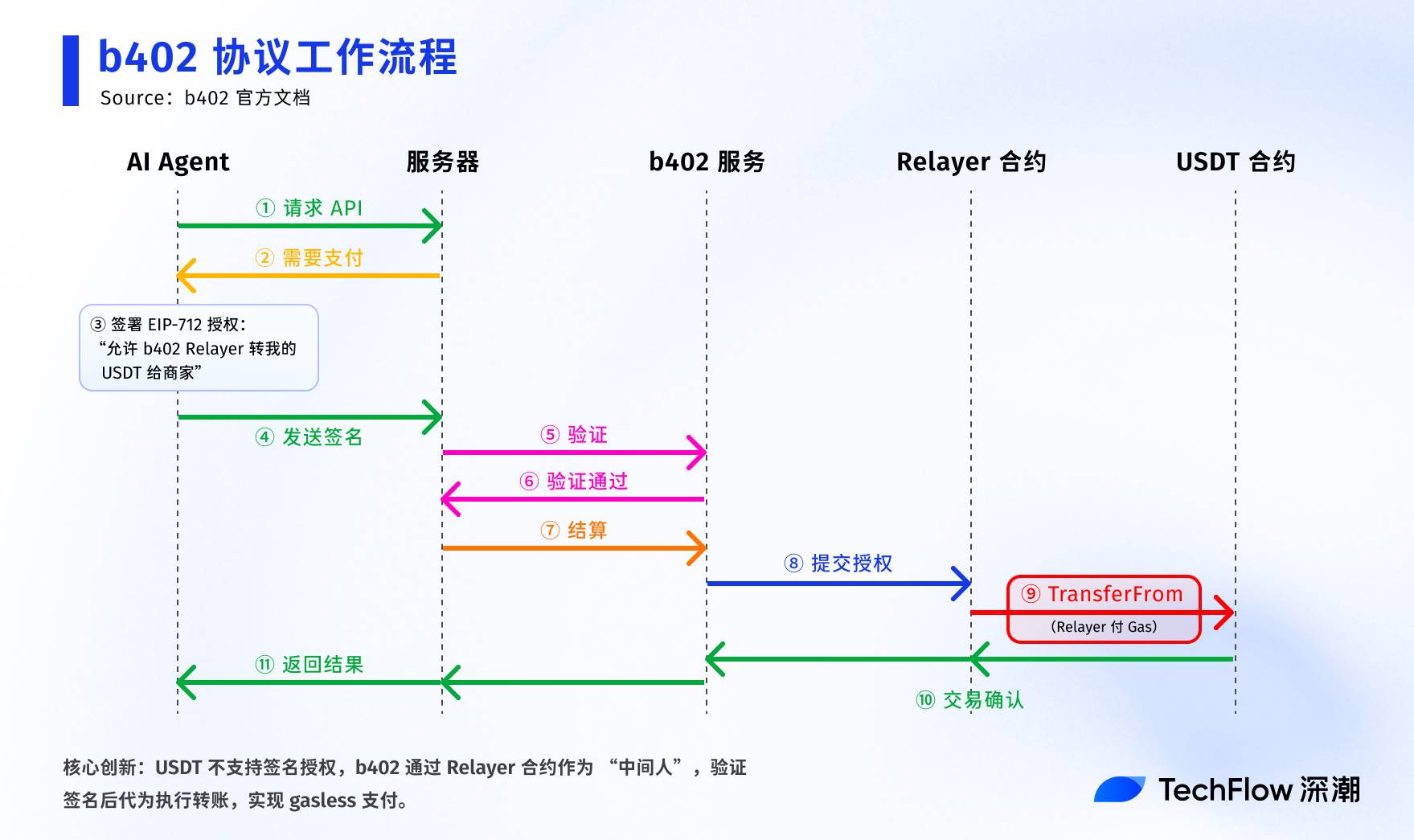

从 USDT 的角度看,是 Relayer 在执行转账;从用户角度看,自己只是签了个名。整个流程是这样的:

-

用户签署一个消息,内容包括"从我的地址转 X 个 USDT 给商家,有效期到某时间"。

-

b402 的 Facilitator 收到签名后,提交给 Relayer 合约。

-

Relayer 验证签名真实性、检查代币是否在白名单、确认时间窗口有效。

-

一切 OK 后,它调用 USDT 的 transferFrom 完成转账。

结果是什么?AI Agent 依然只需要签名,不需要持有 BNB。虽然技术路径完全不同,但用户体验和 x402 一模一样。

更妙的是,因为 Relayer 是 b402 自己的合约,所以可以支持任何 BEP-20 代币。

只要加入白名单,USDT 能用,USD1 能用,将来的新稳定币也能用。这种灵活性,反而是原版 x402 做不到的。

所以,回答这章开篇的问题:

b402 不是重复造轮子,而是在 BSC 的技术限制下,找到了一条同样能让 AI Agent 用链上代币支付的新路。

造个新轮子,开个新市场

解决了技术问题只是第一步。BSC 想要在 AI Agent 经济中分一杯羹,光有协议不够,还需要真正能用的基础设施。

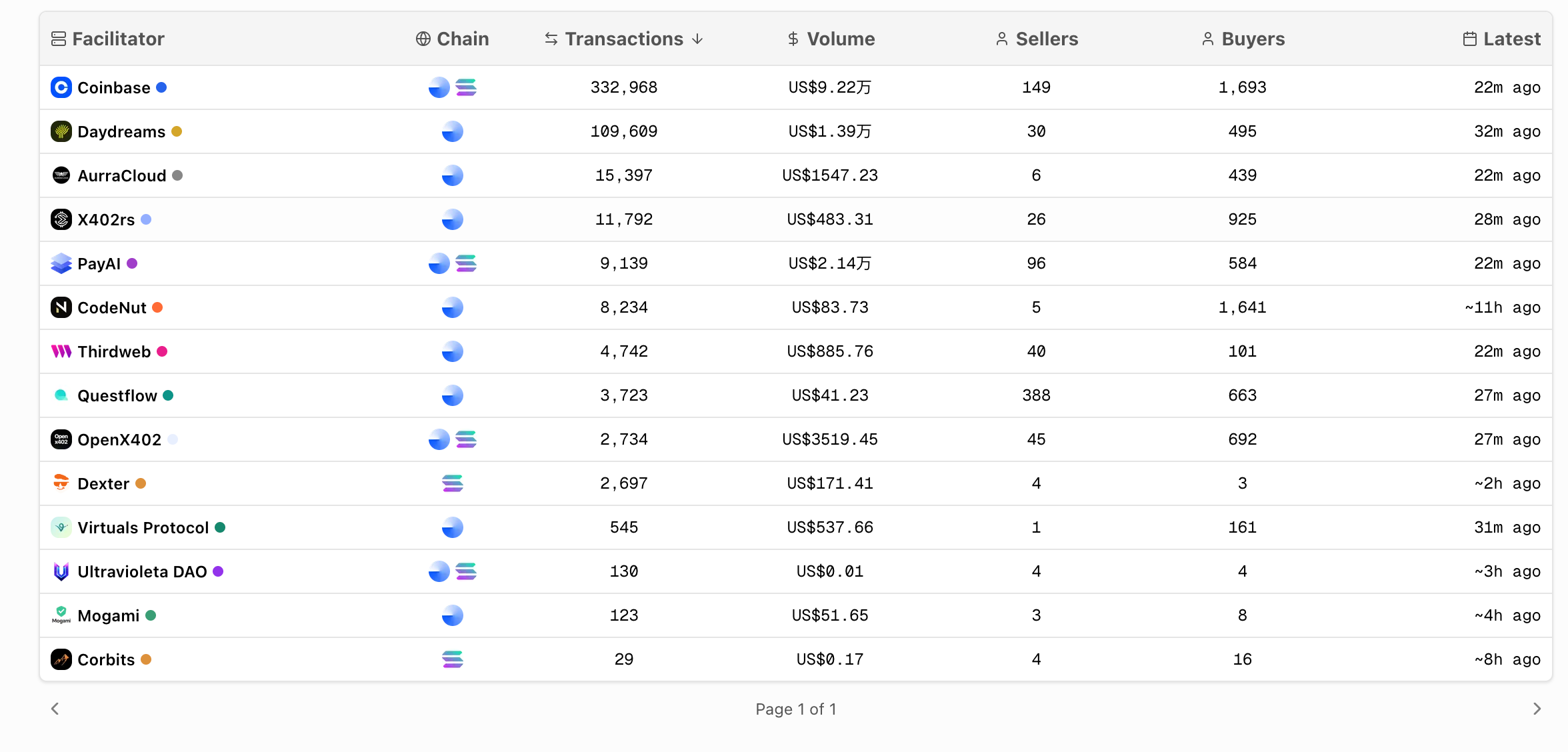

看看 x402 的 Facilitator 排行榜就知道现状有多尴尬。Coinbase 排第一,处理了 33 万笔交易。接下来是 Daydreams、AurraCloud、PayAI……清一色都在Base和Solana上。BSC?一个都没有。

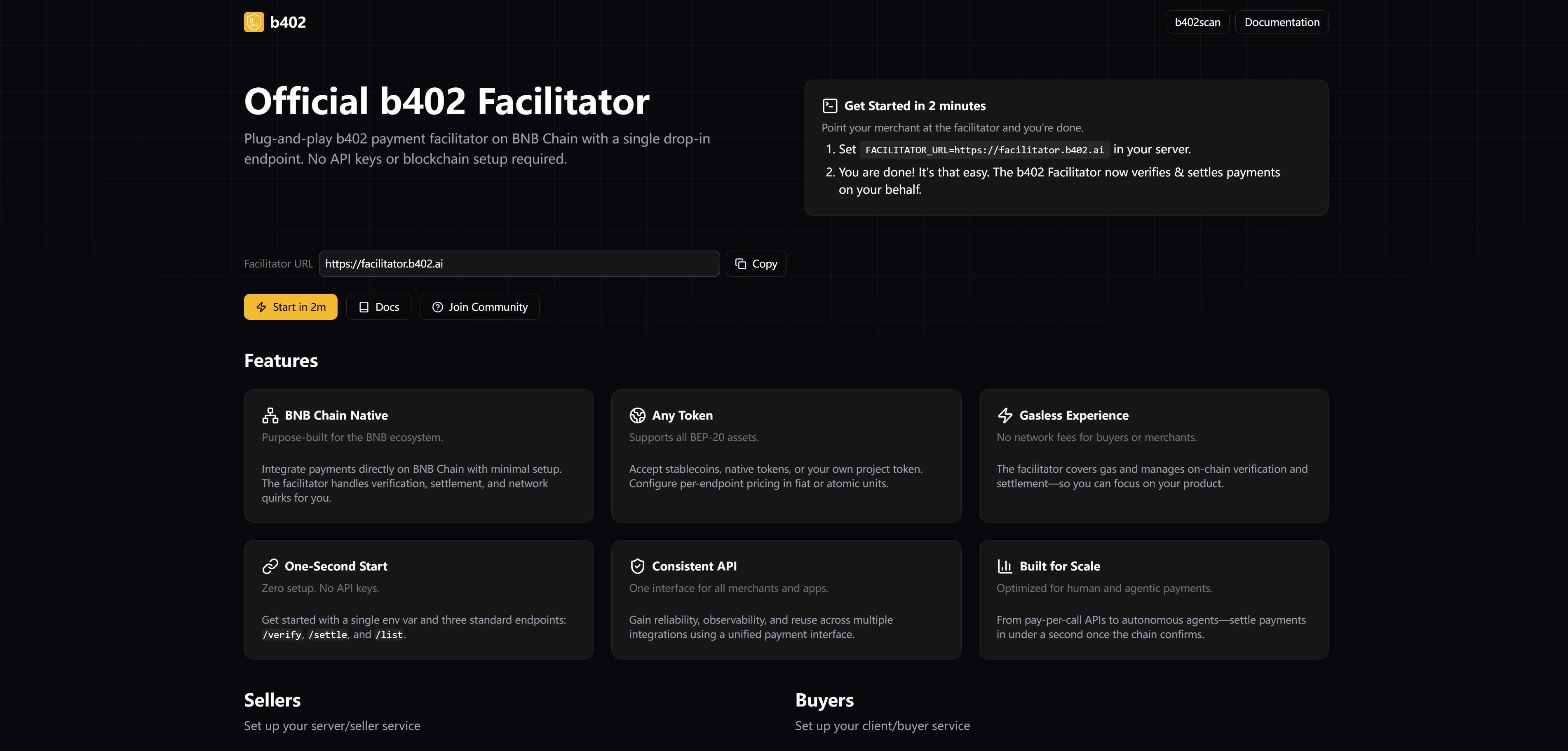

Facilitator 是什么?

它是 x402 生态的核心基础设施,相当于支付网关。当 AI Agent 要付费调用 API 时,Facilitator 负责验证支付请求、检查余额、执行链上交易、返回结果。没有 Facilitator,x402 协议就是一纸空文。

可以说,谁控制了 Facilitator,谁就控制了 AI Agent 的支付入口。

b402 的 Facilitator 就是目前 BSC 的答案。它不只是把 x402 的功能复制过来,而是针对 BSC 的特点做了优化。最大的不同是多币种支持,不只是 USDT,任何 BEP-20 代币都能用。

这意味着 USD1 这种新稳定币可以直接接入,不需要等待额外开发。

对开发者来说,接入 b402 Facilitator 极其简单。在服务器配置里加一行 “FACILITATOR_URL=https://facilitator.b402.ai”,你的 API 就能开始向 AI Agent 收费。不需要懂区块链,不需要管理私钥,b402 会处理所有技术细节。

但 b402 的野心不止于此。如果说 Facilitator 是基础设施,那 b402scan 就是上层建筑。

你如果只看 scan 这个名字很容易把它理解成一个类似的区块链浏览器,但实际上它是一个“AI 服务市场”。

市场意味着,服务商可以在上面发布 API,设定价格并展示自己的 AI 能实现哪些功能;其他的 AI Agent 可以搜索需要的服务,查看历史交易,直接调用这些服务商提供的功能。

从当前情况来看,这个市场仍未完全开放,不过可以持续关注项目的进展,看看后续市场上会跑出哪些有意思的 AI 服务。

不过从整体上看 b402 的卖铲人定位是很清晰的,Facilitator 更像一个技术关口,而 b402scan 则是个更像 Shopify 或者亚马逊的商业模式。

这就形成了一个完整的闭环:

-

开发者通过 b402 Facilitator 让自己服务的 API 能收费;

-

开发者通过 b402scan 让 API 被其他人发现;

-

AI Agent 通过同一个系统完成发现、调用、支付的全流程。每一笔交易都在强化 BSC 作为 AI Agent 支付链的地位。

而 b402 官方的技术示意图,则在讲一个更大的故事:

底层是协议和 Relayer 合约,解决技术问题;中间是 Facilitator 和 b402scan,提供服务能力;上层是各种 SDK,降低接入门槛。这种全栈布局,笔者认为其实是在补齐 BSC 在 AI Agent 经济中缺失的每一块拼图。

特别值得一提的是 USD1 这个变量。当 b402 在 10 月 28 日在官推展示用 USD1 支付 AI 服务时,可能无意中踩中了一个大热点。

特朗普家族的 WLFI 选择 BSC 作为 USD1 的主要发行链,80%的供应量都在这里。

一个新稳定币最需要什么?极具叙事张力和收益的使用场景。而 AI Agent 的高频小额支付,可能是答案之一。

如果把 AI Agent 经济比作一场战争,那么 Base 依托 Coinbase 的资源经占领了高地,Solana 也在办黑客松快速推进。

BSC 通过 b402,正在构建自己的根据地。这个根据地的特点不是最早或最大,而是最开放,任何代币都能用,任何服务都能上,任何 Agent 都能来。

当前进度与代币预期

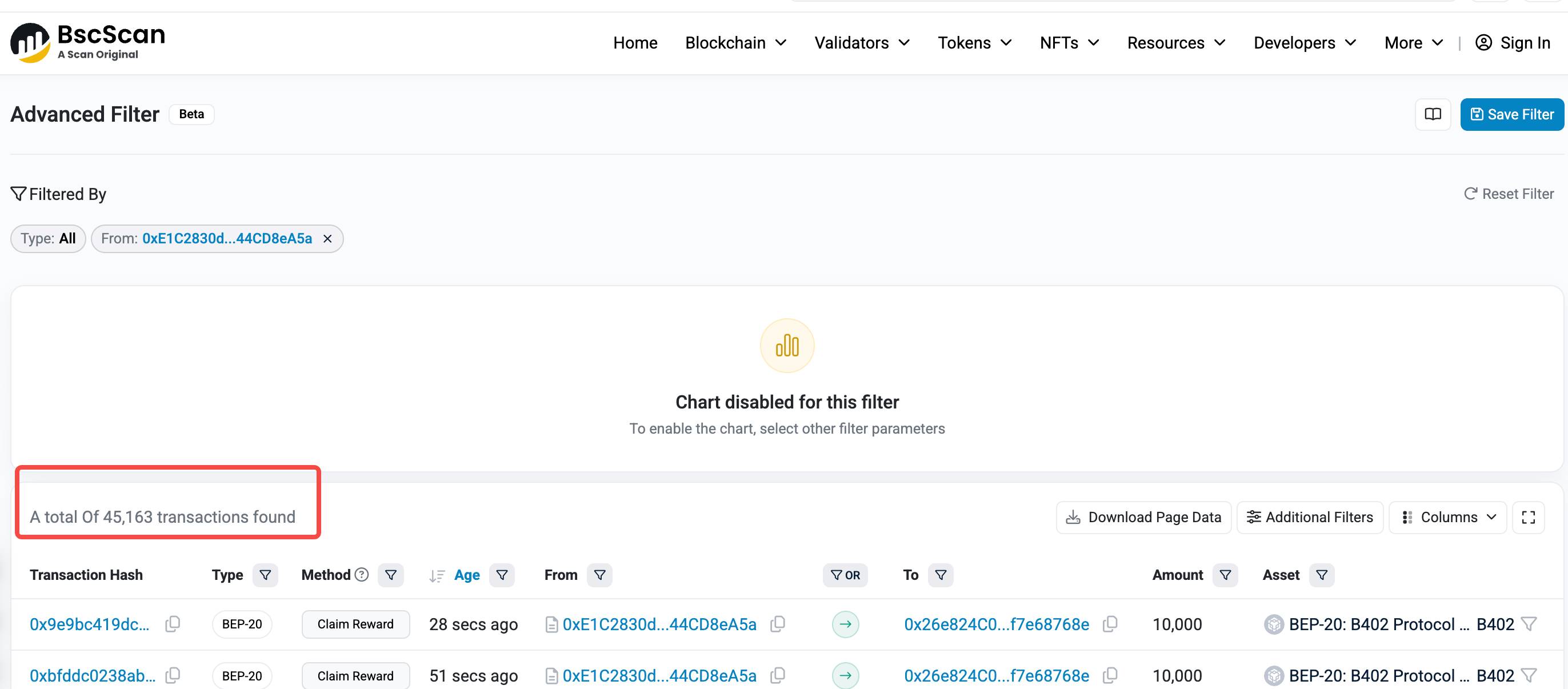

根据 bscscan 数据显示 ,b402 已经悄悄跑起来了。

截止 11 月 7 日,b402 最新的 relayer 合约已经产生了约 4.5 万笔交易;而加上之前老的因技术原因即将弃用的老 relayer 合约,b402 当前已经产生了近 8.6 万笔交易。

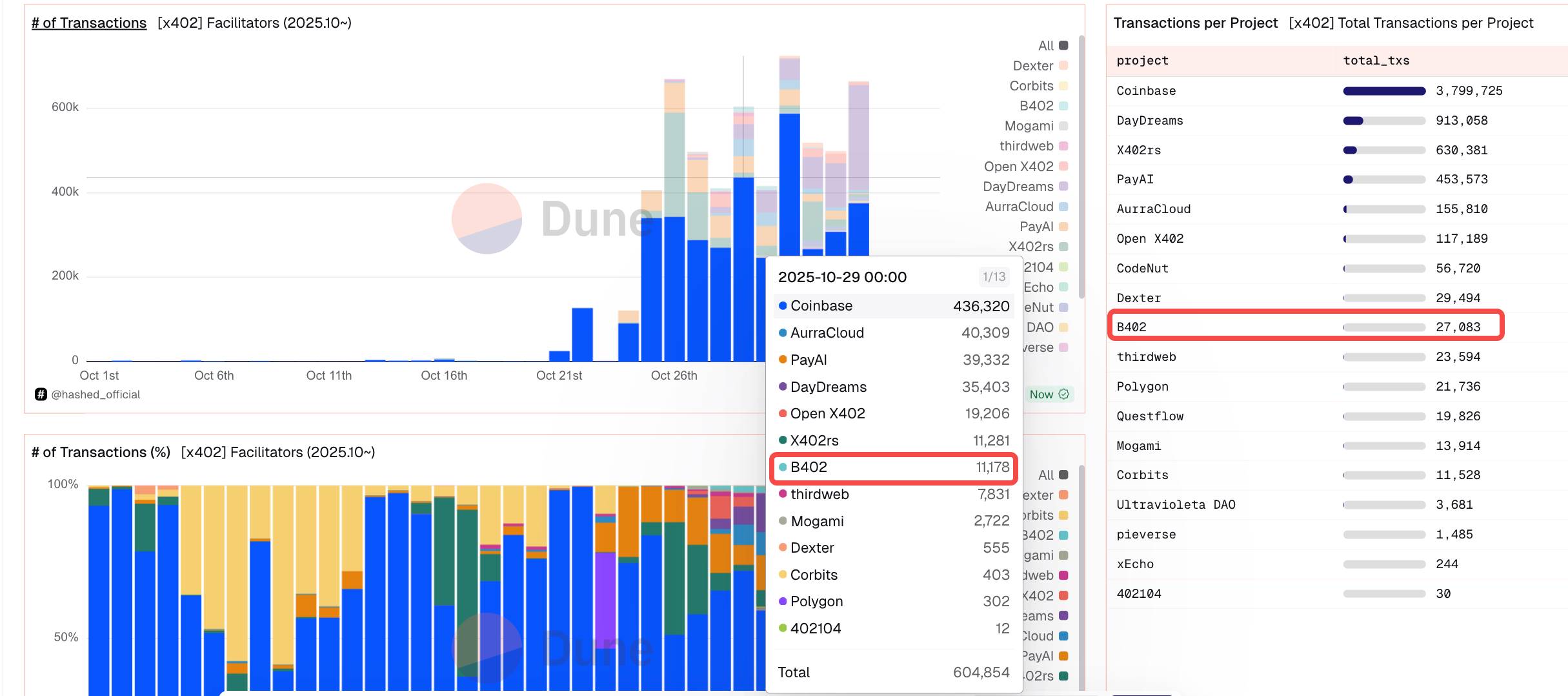

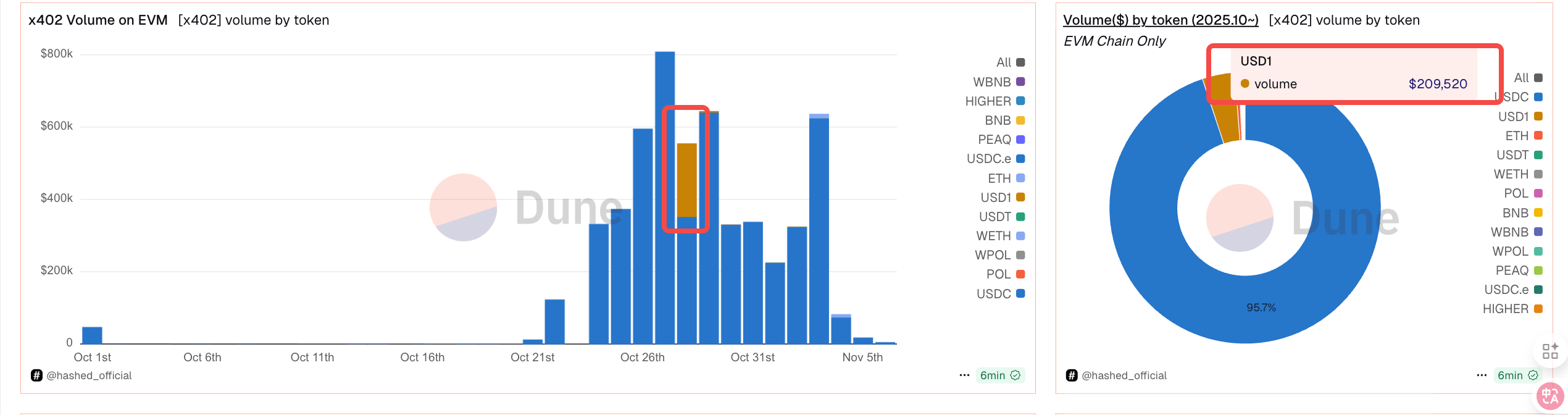

从第三方 Dune 数据来看,虽然交易量和 Coinbase 相比仍有距离,但考虑到 b402 才刚上线不到一个月,这个起步速度不算慢。

更有意思的是交易分布,b402 的交易量在 10 月 26 日之后开始稳定增长,这正好是他们发布 USD1 支付 demo 的时间点。

看代币分布更能说明问题。整个 x402 生态 98.7%的交易额用的是 USDC,剩下的 1.3%分散在 USD1、USDT、ETH 等十几种代币上。

这种极度集中其实反映了一个问题:目前 x402 生态严重依赖 Coinbase 和 USDC。而 b402 支持多币种的设计,恰好可以打破这种垄断。

当然,USD1 现在的交易额只有 20 万美元,但这恰恰说明机会还在早期。

如果特朗普概念在明年再次炒作,USD1 的使用量可能出现爆发式增长。到时候,BSC 上唯一成熟的 AI 支付协议就是 b402。

这其实也涉及到了对 b402 代币的预期。不过关于代币经济学,b402 团队还没有公布具体方案;但从技术架构可以推测几个方向。

第一是协议费用,每笔交易可能收取 0.1-0.3% 的手续费,这些费用可以用来回购或分红。第二是治理权,决定白名单代币、费率调整、协议升级等重要事项。第三是质押机制,运营 Facilitator 可能需要质押一定数量的代币作为保证金。

如果用这种设计,好处是让代币价值和协议使用量直接挂钩。交易越多,协议收入越高,代币价值越大,也踩中了真实收入的叙事。

当然以上只是推测,实际的代币经济,感兴趣的玩家也可以进一步关注项目官推所放出的进展。

总体来看,关注 b402,其实是在押注 BSC 能不能在 AI Agent 经济中占一席之地。保守看,这是个 BSC 生态的基础设施项目,跟着生态慢慢成长。激进看,这里或许也可以在 AI 经济的叙事下诞生更多有财富效应的项目。

结语

写到这里,b402 的故事基本讲清楚了。但最后还想聊聊这个项目背后更大的图景。

x402 的爆发不是偶然。它解决了一个真问题,让 AI Agent 能够自主支付。这个需求会随着 AI Agent 的普及而指数级增长;至于 b402 能在其中分到多少羹,我们并没有一个明确的答案。

但回顾加密行业的项目发展史,b402 和 x402 当前的处境,让笔者想起了当年 Uniswap 和 0x Protocol 的关系。

当时的 0x Protocol 技术很先进,订单簿很完善;但太超前了,和当时的链上需求脱节;Uniswap 技术上反而退了半步,没有订单簿,只有简单的 swap,却恰好切中了 DeFi 爆发的需求。

今天,Uniswap 已经成为 DeFi 的基础设施。

x402 用 USDC 做微支付确实很优雅,但现在看来用例还很分散,远没到真正发光发热的时候。b402 的实现方案原本是因为 BSC 无法照搬 x402 的无奈之举,但这个“妥协”可能无心插柳柳成荫。

为什么?因为 b402 让任何 BEP-20 代币都能做无 gas 交易,这至少打开了三个意想不到的机会:

第一,普通用户和 AI Agent 的使用门槛彻底消失了。想象一下,一个新用户或者 Agent 可以用空钱包接收任意代币,然后直接转账或在 PancakeSwap 交易,完全不需要先充 BNB 作为 Gas。

第二,链上 Agent 经济可能因此真正爆发。当所有代币都能 gasless 交易,Agent 的交易策略、理财策略都会变得更灵活。一个 DeFi Agent 可以在各种代币间自由切换,不用担心 Gas 管理。这种便利性可能让 Agent 交易量出现指数级增长。

第三,链上行为可能因此变得更加匿名。当大量交易通过 Relayer 完成,不再需要账户来补充 Gas,外部观察者就无法通过 Gas 来源追踪钱包关系了。

这就回到了开头的问题:如果市场反弹,你买什么?

现在看来,b402 不只是 BSC 上的 x402 替代品,而可能是一个更大机会的起点。它解决的不只是 AI Agent 支付问题,而是整个 BSC 生态的 gasless 交易问题。这个市场比 AI Agent 大得多。

如果你相信 AI Agent 叙事能贯穿加密市场数年,如果你认为 gasless 交易是 Web3 普及的关键,如果你觉得链上隐私会成为下一个热点,那么 b402 都值得关注。

不是因为它一定会成功,而是因为它可能无意中打开了一扇更大的门。就像当年的 Uniswap,最简单的方案,往往蕴含最大的机会。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。