作者:zhou, ChainCatcher

MMT 轧空事件已过去四天,市场余波尚未平息。曾经高调宣传 MMT 潜力的 KOL 们如今也未能逃脱被市场教训的命运。时至今日,事件的全貌逐渐清晰,从造势拉新、盘前破发预警、狂拉爆空单,到暴跌吃多单,这场崩盘不仅戳破了投机泡沫,更暴露了行业内操纵与信任危机的深层问题。

图片来源:X用户 @cloakmk

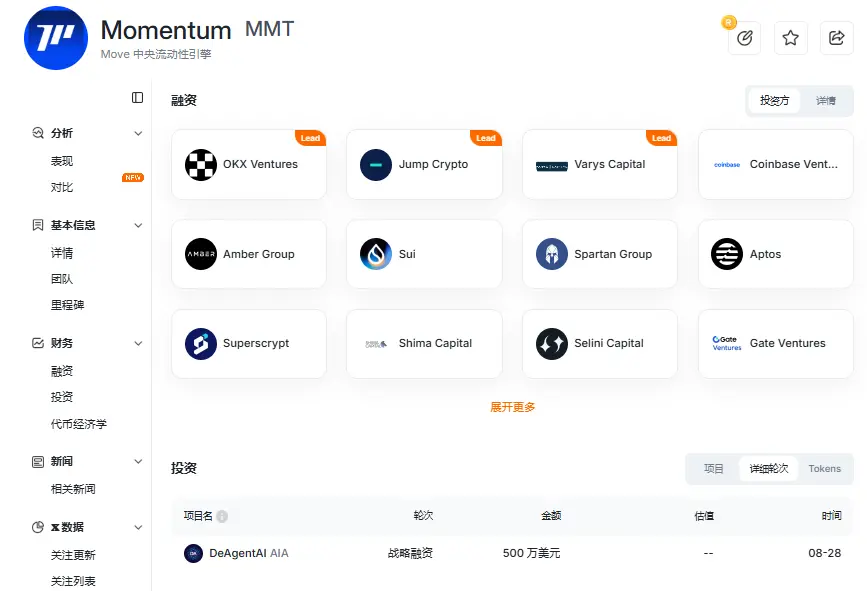

据悉,Momentum作为 Sui 网络上领先的集中流动性做市商(CLMM)DEX,以其基于Uniswap v3式架构和高效率的交易机制吸引了广泛关注。据 Rootdata 信息显示,Momentum 先后获得 OKX Ventures、Jump Crypto、Varys Capital、Coinbase Ventures、Amber Group、Sui 等机构的投资,并于今年8月参与了DeAgentAI(AIA)的500万美元战略融资。

自 2025 年 3 月测试版上线以来,Momentum 已积累超过 200 万独立交易用户,累计交易量突破 180 亿美元,锁仓总价值(TVL)更是超过 5 亿美元。这些亮眼成绩曾让市场对其寄予厚望,却也为后续风波埋下隐患。

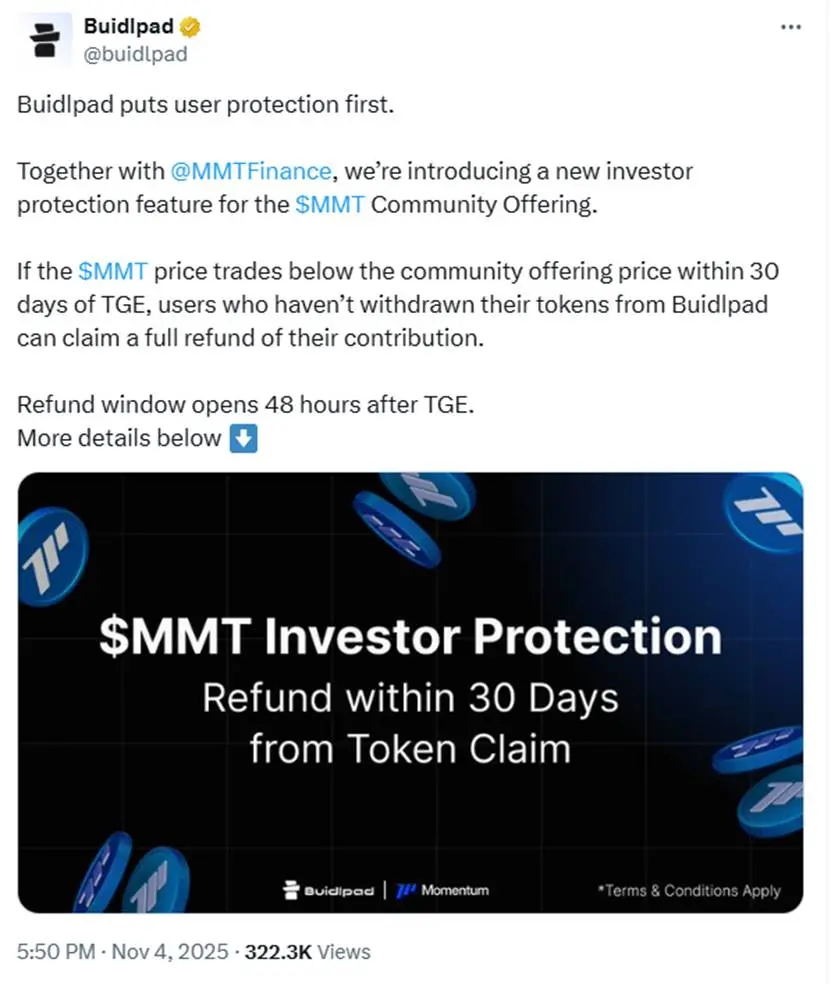

2025年10月,Momentum Finance 通过 Buidlpad 平台开启 MMT代币社区认购,计划总募资额定为 450 万美元。一级估值设为 2.5 亿美元,惠及通过 Buidlpad HODL 或 Wagmi 活动合格质押的用户;二级估值则为 3.5 亿美元,面向其他合格参与者。认购金额从 50 美元至 2000 美元不等,部分通过质押或活动达标的用户最高可达 2 万美元。

此外,10 月 25 日前通过 Buidlpad HODL 活动向合格 LP 池质押3000 美元以上的用户可享受一级定价并提升出资上限至 3000至2 万美元;参与 Wagmi 1 与 Wagmi 2 的长期社区成员无需质押即可获一级估值;内容创作者提交 Momentum 生态原创内容还可额外获得 150 美元以上优先配额。这一低门槛、高激励的认购设计迅速点燃了散户和KOL的热情。

11 月 4 日 TGE 当日,在 Bybit 平台的盘前交易中,MMT 价格低开至 0.3 美元,低于大部分散户 ICO 成本 0.35 美元,这一走势明显呈现破发趋势,促使大量投资者选择开空套保,试图通过做空锁定利润;正式开盘后,MMT现货和合约价格一度拉升至0.8美元,这一短暂上涨符合近期新币上市的常规模式,即通常会上涨一波后回落,因此拉升后做空被视为合理操作,从而吸引了更多人加入空头阵营。

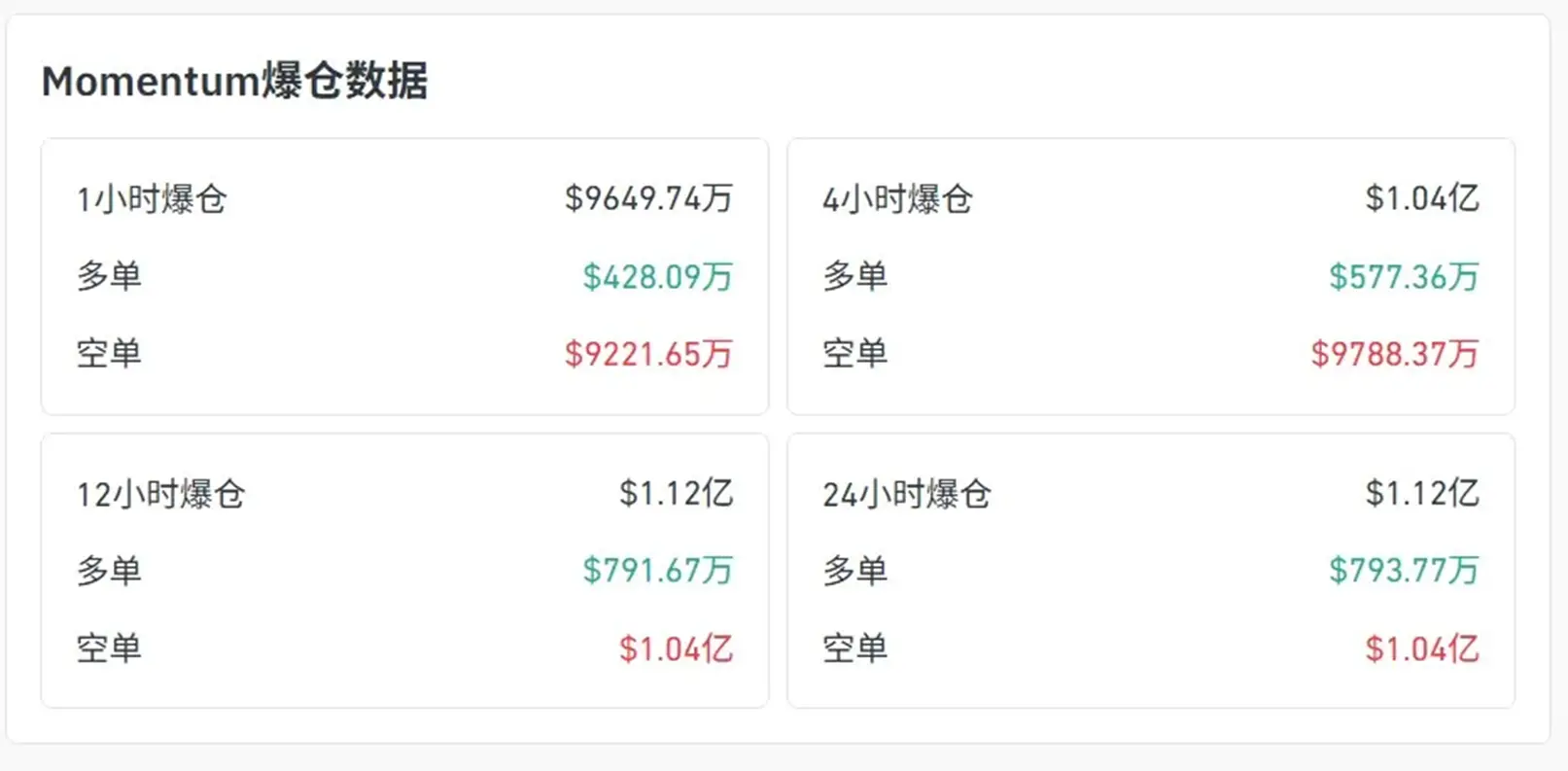

然而,局面在第二日开始转变。MMT 价格在11月5日凌晨 0 点至 5 点之间爆拉数倍,从低位迅速攀升至 6.47 美元(币安合约),Bybit 上甚至触及 10.5 美元。这一剧烈拉升精准引爆空单爆仓,短时间内空单爆仓规模超过 1 亿美元。

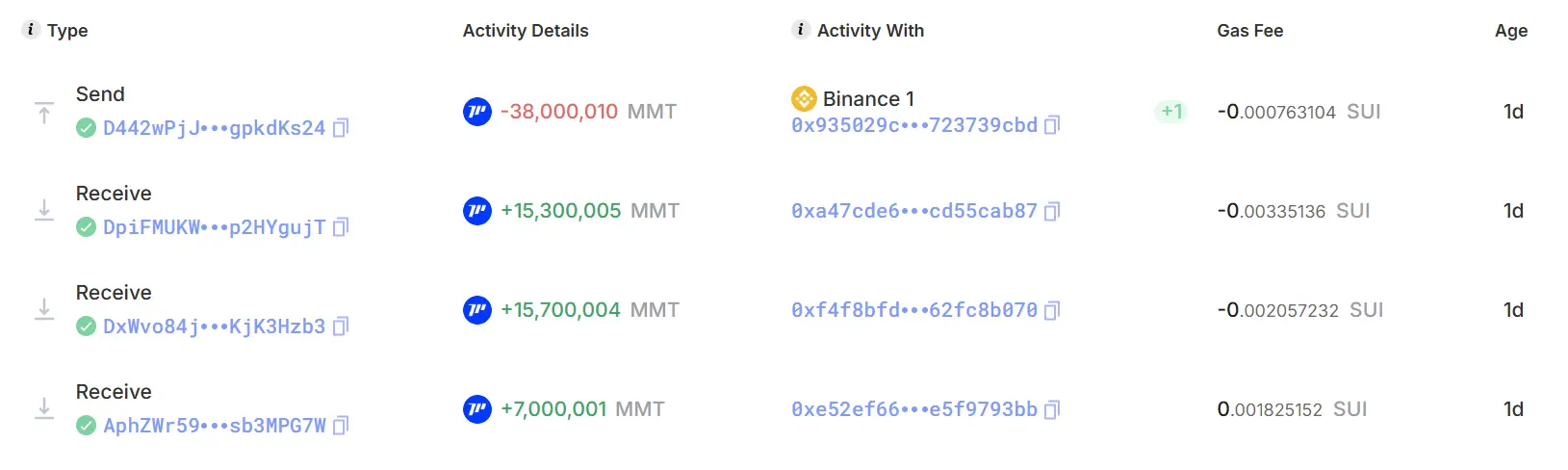

紧接着,MMT 价格从高点大幅回落至不足1美元,回撤幅度超80%。据 Suiscan 数据显示,Momentum 团队关联地址 0xe7cd…7a88a4向币安转入了 3800 万枚 MMT 代币,价值约 4560 万美元。这批代币来自第二大持币地址 0x1b4d2…7355c8,该地址持有 MMT 总供应量的 18.57%,这一抛售行动引发市场恐慌。

紧接着,MMT 价格从高点大幅回落至不足1美元,回撤幅度超80%。据 Suiscan 数据显示,Momentum 团队关联地址 0xe7cd…7a88a4向币安转入了 3800 万枚 MMT 代币,价值约 4560 万美元。这批代币来自第二大持币地址 0x1b4d2…7355c8,该地址持有 MMT 总供应量的 18.57%,这一抛售行动引发市场恐慌。

这场操作的套路似曾相识,社区里猜测这件事件背后可能存在交易所内鬼与做市商的合谋。知名加密 KOL 加密无畏分析称,这次 MMT 轧空,除了项目方配合做市商推迟空投发放控筹、在半夜时间急剧拉盘等原因,还有更隐秘的内幕:交易所内部人员把做空大户的头寸信息分享给了做市商,做市商得以精准爆空。这与 2023 年 Spartan Group 曝光的类似案例如出一辙,进一步动摇了行业信任。

对于参与打新的KOL和散户,他们原本通过推广获得空投代币和优先配额,却因高杠杆操作和市场剧烈波动而爆仓。典型例子是交易员@Elizabethofyou,其套保金额7000美元最后亏损13万美元,爆仓价是6.85美元,她表示在Bybit套保被定点爆仓,Bybit则回应正在跟进中。

回望这场事件,此前KOL的积极推广为MMT轧空埋下了深层伏笔。他们通过社交媒体和内容创作营造了极高的市场预期,吸引了大量散户参与,而且 Buidlpad 平台此前几个项目的打新赚钱效应更让投资者对其信心满满。值得一提的是,Buidlpad曾宣布破发保本机制,承诺若MMT在TGE后30天内低于社区发行价,未提取代币的用户可申请全额退款。

理论上,若不做空,打新者本可避免亏损。然而,盘前 Bybit 价格低开,直接触发了破发预期,促使投资者情绪化地开空套保。项目方则通过延迟解锁和凌晨剧烈拉盘,成功将投资者的资金转化为自身利润;3800万枚代币的抛售进一步暴露了项目方的短线获利意图。

当前 MMT 价格徘徊在 0.6 美元,距离高点下跌约 85%,未来走势仍取决于团队剩余筹码的动向。值得注意的是,昨日中午12点起,Momentum 投资的 DeAgentAI 代币 AIA 突然异动拉升,一日内实现惊人十倍涨幅。此前,AIA 曾以相似的操纵套路精准引爆套保投资者的爆仓,历史重演的迹象令人警觉。

对于投资者而言,这场风波无疑再次敲响警钟:即便是套保做空,即便是再看跌某个项目,都需要对合约交易中潜在的风险加以控制,在异常交易环境中更需利用止损单等工具以及调整保证金,否则早晚会遭受市场的惨痛教训。在监管尚未完善的市场环境中,类似事件或将成为常态。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。