Tokenized gold has proven that RWA can attract capital, but it also exposes the limitations of the current tokenization model.

Author: Yuki is short, so is life

Translated by: Deep Tide TechFlow

Tokenized gold has attracted a large number of crypto users into the realm of real-world assets (RWA), but at what cost?

Figure: Comparison of Binance PAXG price and spot gold price

The following is a simple price chart showing the price trends of one of the tokenized gold solutions—PAXG (blue line) compared to spot gold (yellow line). Each token represents one ounce of spot gold. However, during the displayed time period, almost all PAXG buyers paid a premium above the spot price.

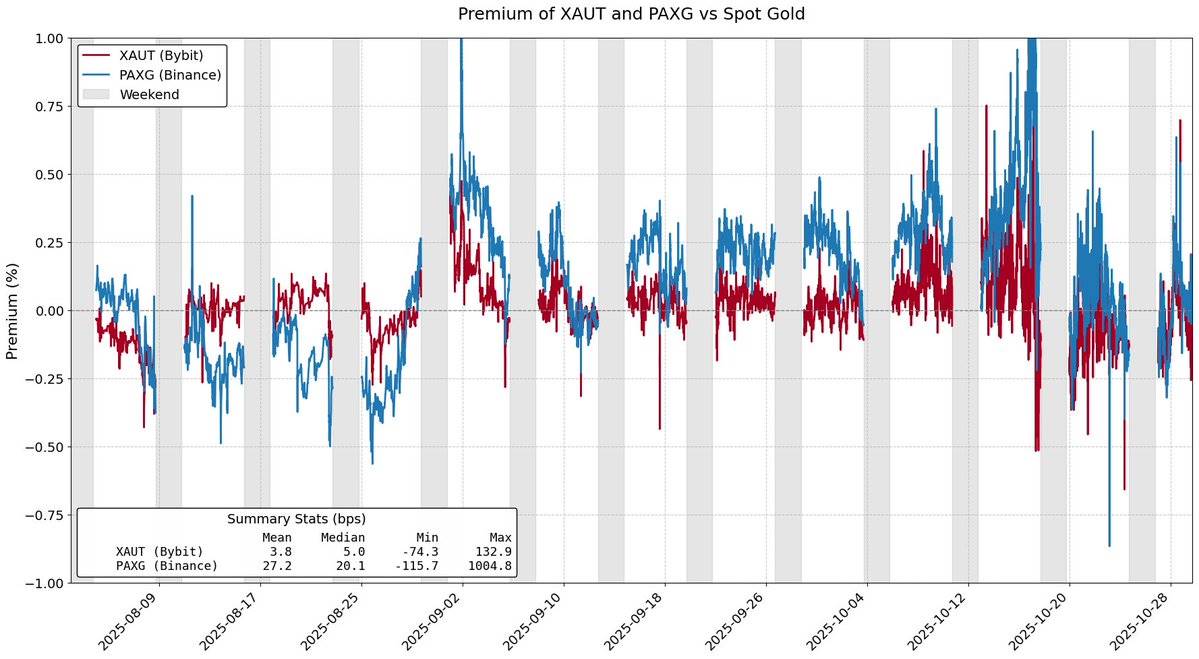

Figure: Premium of PAXG and XAUT compared to spot gold

The original intention of tokenizing real-world assets (RWA) is to allow users to acquire real assets at a lower cost. However, tokenized gold, which accounts for about 84% of the total market capitalization of tokenized commodities, has failed to achieve this goal. The premium on tokenized gold can easily be mistaken for being demand-driven, but in reality, this premium stems from the inherent structural frictions in the design of these token issuance models.

Minting and Redemption Fees

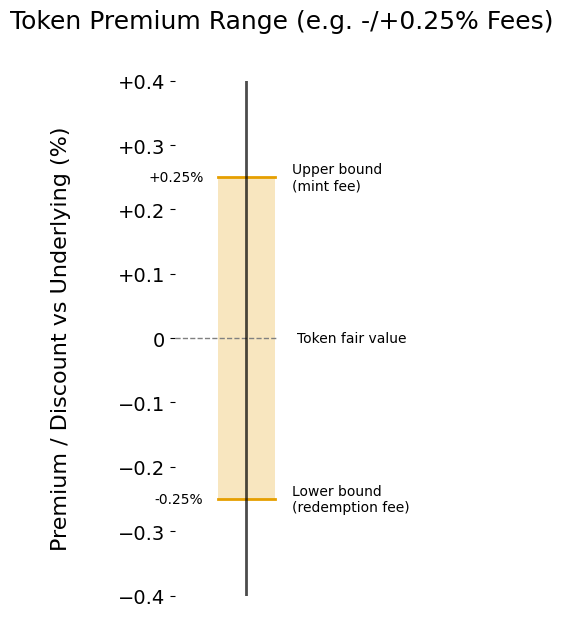

The premium of any tokenized product compared to its underlying asset is primarily driven by minting and redemption fees. Minting and redemption fees effectively set a "premium range" for the price of tokenized products compared to the underlying asset.

Suppose you are a market maker for XAUt or PAXG. If the price of gold rises sharply, the inflow of funds into tokenized gold significantly increases. So, at what price would you sell XAUt or PAXG? To break even, you would need to sell at a price no lower than the cost of acquiring these tokens as inventory, which is defined by the minting fee of the token and effectively sets a soft upper limit on the token price.

Under the same logic, tokenized gold could also trade at a discount. Suppose there is an outflow of funds from tokenized gold. As a market maker, you would only buy XAUt or PAXG at a price lower than what you could obtain by redeeming these tokens from Tether or Paxos. Just as minting fees limit the upward price movement, redemption fees also limit the downward price movement.

Figure: Premium range driven by minting/redemption fees

The higher the fees, the wider the premium range, and the more likely the token price is to deviate from its fair value. As of the writing of this article, Tether charges a 0.25% fee for minting and redeeming XAUt, while Paxos' fee structure varies based on the scale of minting and redemption: a 1% fee for 2-25 PAXG, and only a 0.125% fee for scales exceeding 800 tokens.

Considering the expenses and operational costs associated with tokenized physical gold, one might argue that the minting and redemption fees charged by Paxos and Tether are reasonable. However, it is evident that reducing minting and redemption fees would decrease the tracking error of tokenized real-world assets (RWA), ultimately enhancing cost efficiency for end investors.

Structural Friction

Minting and redemption fees only set a "soft" upper and lower limit on the price of tokenized gold. Other frictions related to the primary issuance model of tokens can also significantly widen the premium range of tokenized gold prices.

For example, Tether Gold requires a minimum scale of 50 XAUt (approximately $200,000) for minting and a minimum scale of 430 XAUt (approximately $1.7 million) for redemption. This scale limitation poses a significant barrier for market makers, forcing them to hold inventory for extended periods and incur substantial opportunity costs.

Another major challenge in the current tokenized gold market is the settlement delays during the minting and redemption processes. When redeeming PAXG, Paxos states that user account balances may take several business days to update, resulting in locked funds and significant opportunity costs.

These frictions collectively deter active participation from market makers unless there is sufficient profit margin. This ultimately causes the prices of tokenized gold assets to deviate more significantly from their fair value, even beyond the upper and lower limits set by minting and redemption fees.

Tokenized gold has proven that real-world assets (RWA) can attract capital, but it also exposes the limitations of the current tokenization model. **On-chain gold trading has premiums and slow redemption cycles. These obstacles effectively act as an **indirect tax. If tokenized assets are to achieve scalable development, users should not be penalized for choosing on-chain solutions.

Liquidity, redemption efficiency, and price consistency must complement each other rather than compromise. This status quo must change.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。