撰文:Jaleel 加六

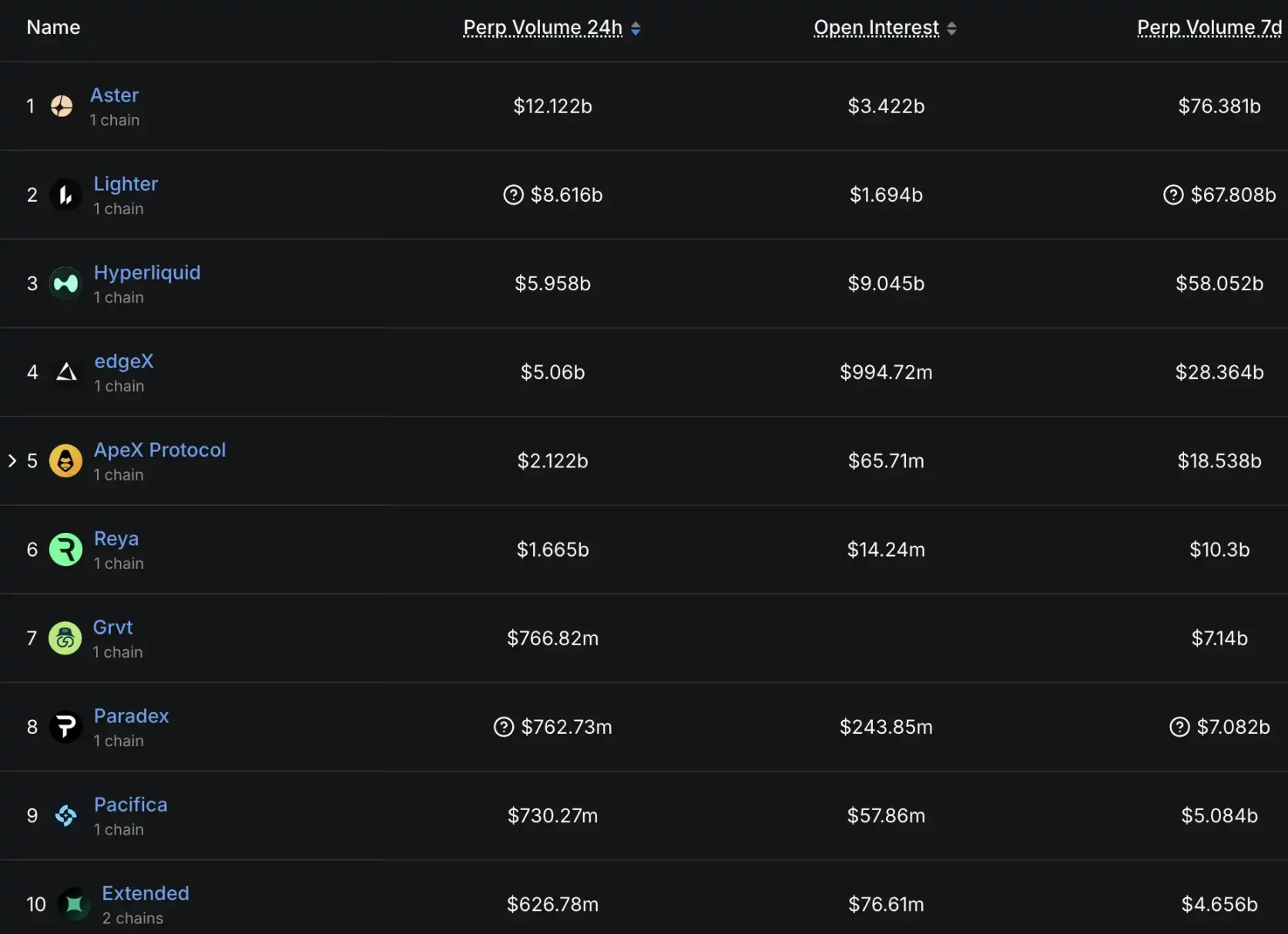

根据最新的链上数据,去中心化永续合约交易所(Perp DEX)市场格局已经相对明朗。从 24 小时交易量来看,Aster 以 121.2 亿美元高居榜首,Lighter 以 86.16 亿美元位列第二,Hyperliquid 以 59.58 亿美元排名第三,edgeX 和 ApeX Protocol 分别以 50.6 亿美元和 21.22 亿美元占据第四和第五位。

这五家平台的交易量总和超过 338 亿美元,在整个 Perp DEX 赛道中占据绝对主导地位。

对于想要深入了解 Perp DEX 赛道的投资者和交易者而言,关注这五大平台的动态基本就能把握整个赛道的走向,因此本文律动 BlockBeats 详细梳理了这 5 个平台近期的重要进展、产品更新和社区活动,帮助读者全面了解当前去中心化衍生品交易市场的最新动态。

Lighter

1、疑似知情人士透露 Lighter 融资额为 $1.5B。

近期,一位曾准确预测 Coinbase 收购 Echo 以及 Kalshi 获得 120 亿美元估值的知情人士,以同样的谜语形式暗示 Lighter 的融资额达到 15 亿美元。这一消息在社区引发广泛关注,尽管官方尚未正式确认,但该人士此前的准确预测为这一传闻增添了传播度。

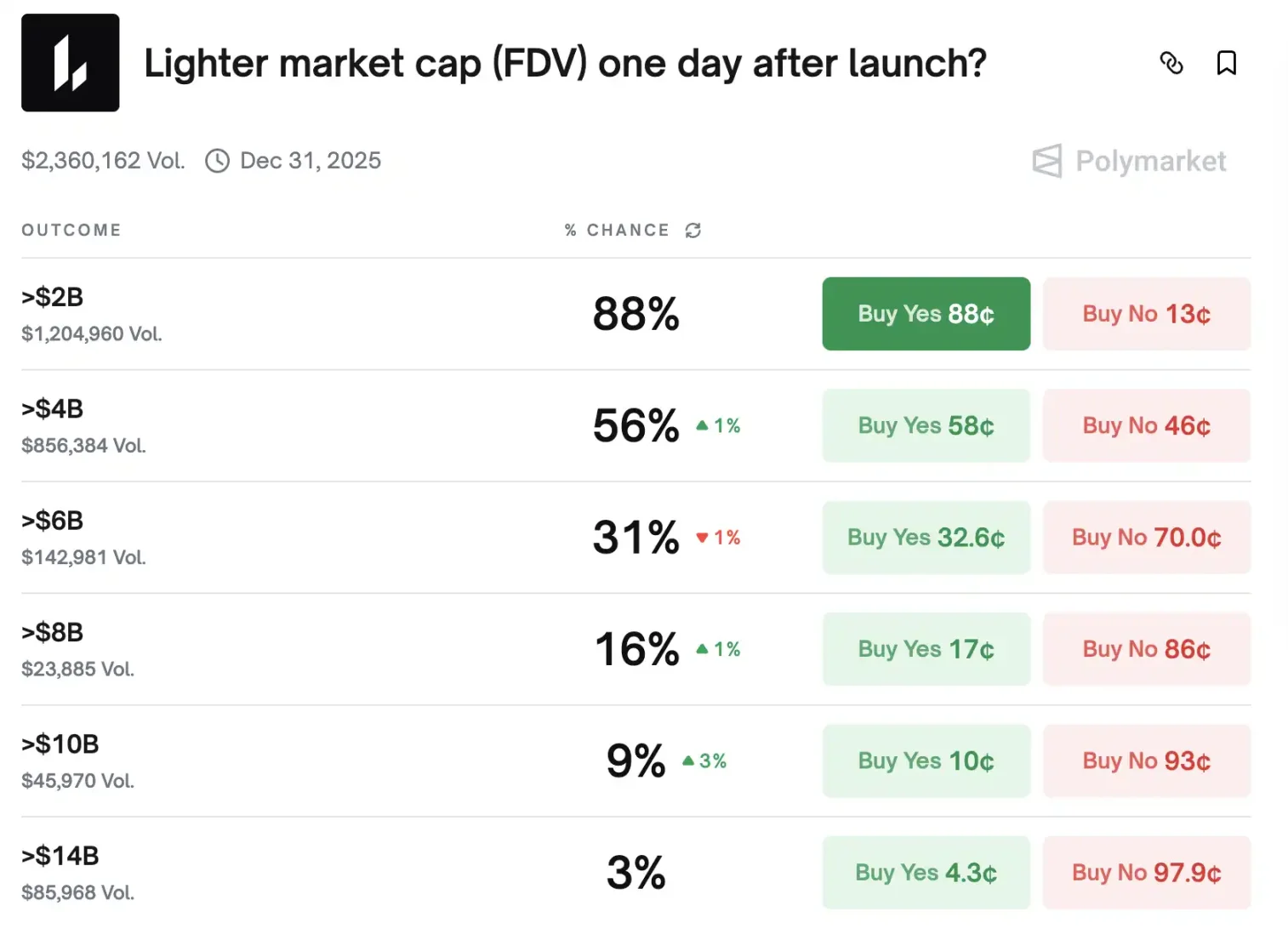

从市场表现来看,Polymarket 上的预测数据显示出投资者对 Lighter 的高度看好:88% 的概率认为其上线首日 FDV 将超过 20 亿美元,55% 的概率认为将超过 40 亿美元。与此同时,场外 OTC 市场的价格稳定维持在 80 美元左右。

2、 Lighter CEO 暗示 Lighter 空投节点在大节日

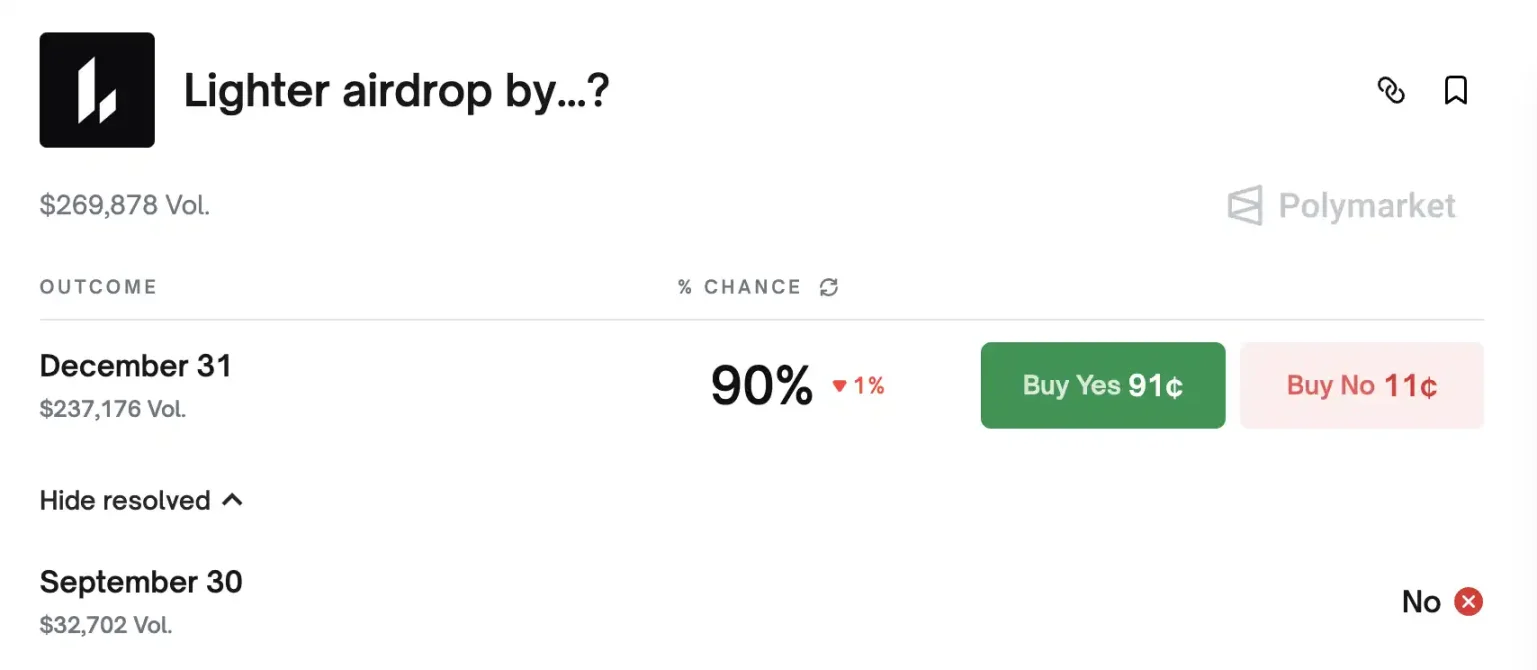

Lighter CEO 在推特上的最新暗示让社区对空投时间有了更明确的预期。他明确表示第二季积分计划将在年底前结束,但不是 12 月 31 日,并发推称"今年的假期将会很精彩"(the holidays will be lit this year)。

综合这些信息,社区普遍推测空投最有可能在西方最重要的节日——圣诞节期间进行。

Polymarket 的数据进一步印证了这一预期,显示 Lighter 在 12 月 31 日前完成空投的概率高达 90%。这意味着参与者可能在年底前就能收到期待已久的代币奖励。

3、Lighter 第二赛季规则调整

本月 Lighter 公布的第二赛季积分发放细则相比第一季有所调整。每周五将发放 20 万积分,覆盖每周三至下周二的交易活动。分配机制更加多元化,综合考虑交易量、持仓量、金库额度、清算和杠杆倍数、盈亏额以及交易品类等多个维度。

值得注意的是,积分与交易指标并非简单的线性关系。例如,两倍的交易量可能产生三倍或 1.5 倍的积分,这种非线性设计旨在鼓励更多样化的交易行为。平台采用了全自动和半自动相结合的女巫检测系统,每位用户最多可拥有 10 个账户而不受惩罚,超出部分将面临处罚。

具体内容可见官方文档。

4、代币经济与产品路线图

两周前,Lighter 创始人做了一次俄语 AMA,透露了一些关键信息:

Lighter 计划将 25-30% 的代币用于第一季和第二季的积分空投,社区总分配比例达到 50%,剩余部分将用于未来空投、合作伙伴计划和资助项目。

产品方面,现货交易功能预计在 10 月底或 11 月初推出,首批上线的将是 ETH、BTC 等核心资产,随后会增加精选的模因币和合作伙伴项目。

未来 6-12 个月的路线图:年底前实现跨保证金功能,允许使用现货作为永续合约抵押品;明年初推出 EVM"侧车"智能合约扩展;RWA 衍生品(贵金属和加密相关股票)计划年底上线;期权和暗池功能分别定于明年和明年底推出。

5、套利机会

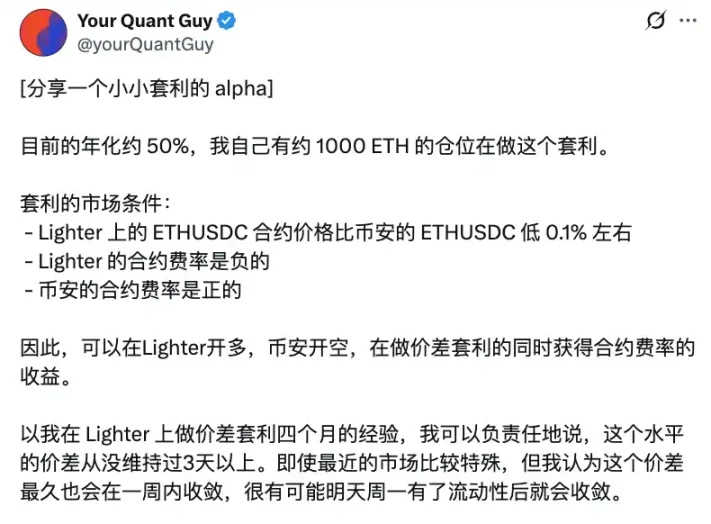

社区用户 Your Quant Guy 分享了关于 Lighter 的一个套利 Alpha 策略,收益的年化约为 51.5%。

6、数据表现

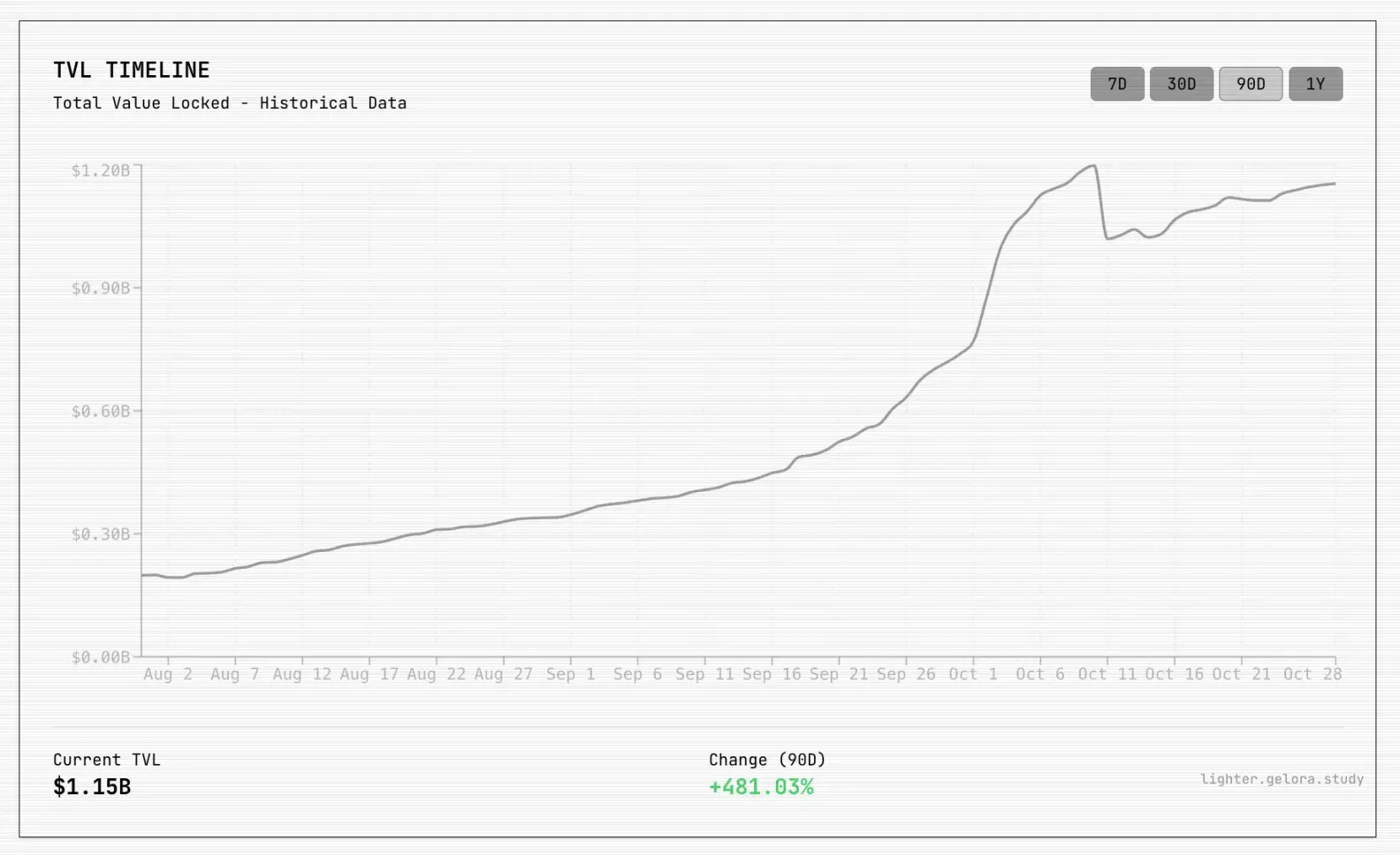

据社区制作的仪表盘网站和 ighterlytics 数据显示了 lighter 的数据增长,lighter 目前的 TVL 为 1.15B,过去三个月增长率为 481%。

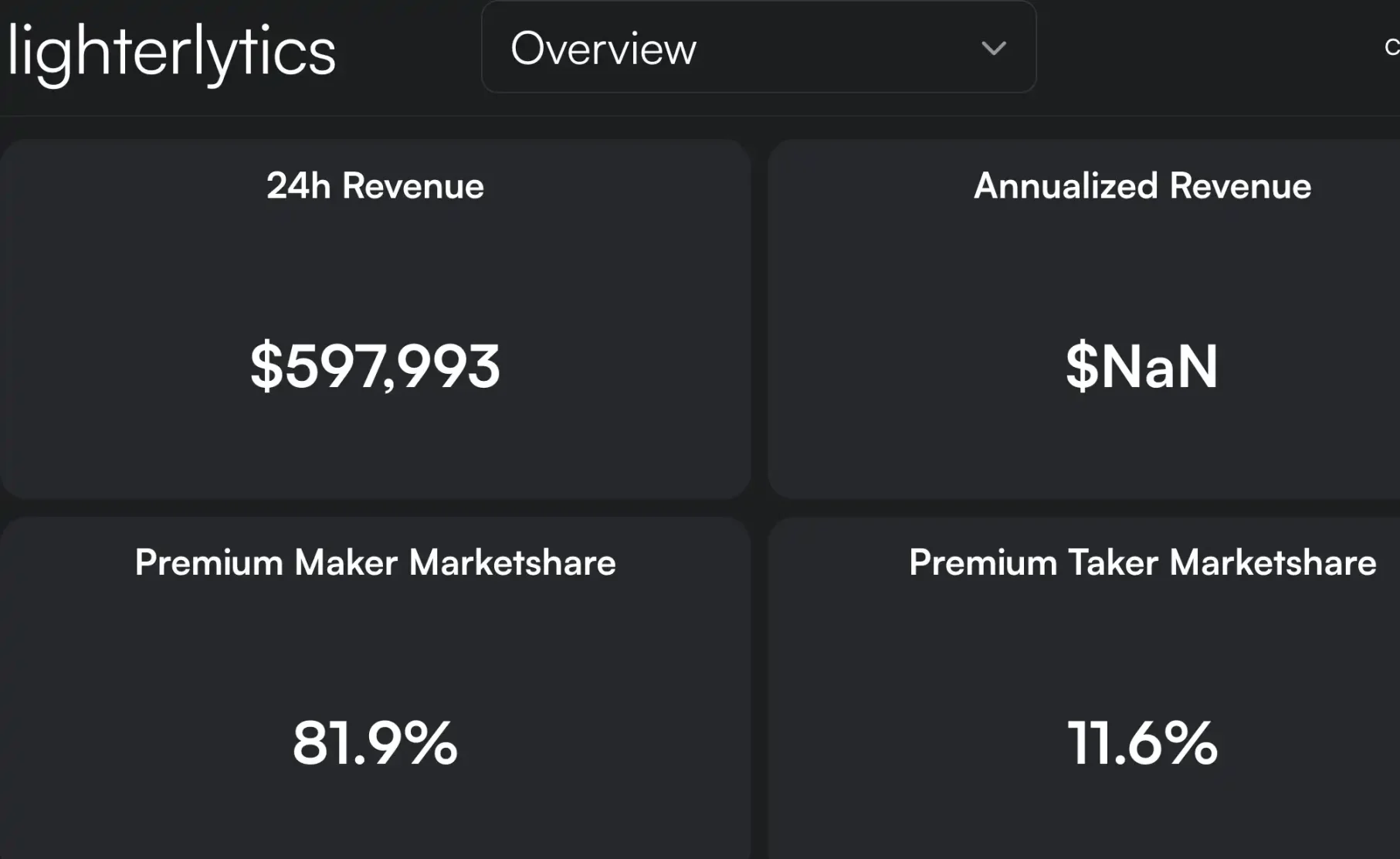

24 小时收入达到 59.8 万美元,显示平台交易活跃度极高。做市商占据主导地位,Premium Maker 市场份额达 81.9%。Premium Taker 市场份额为 11.6%。

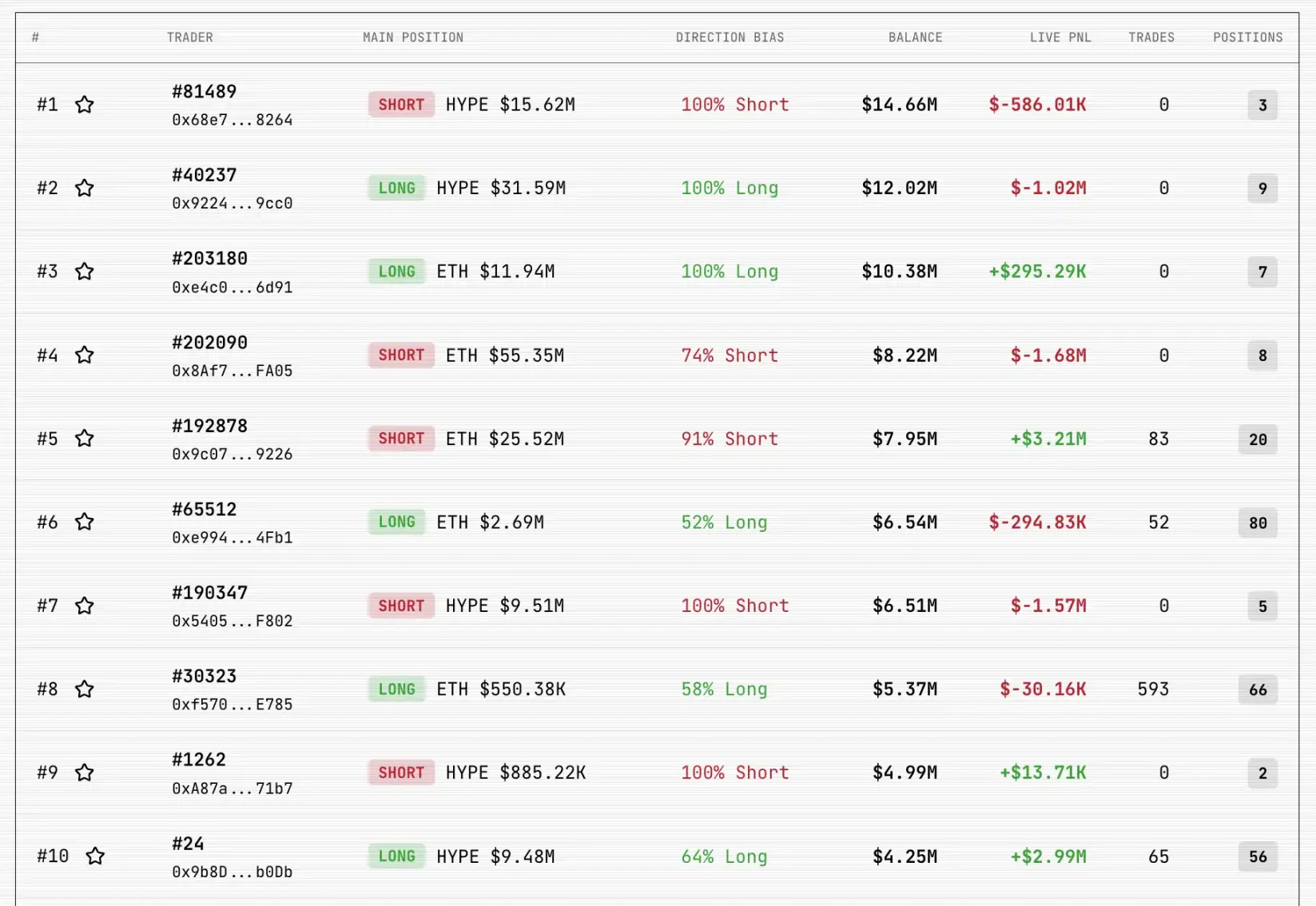

lighter 的前十名交易者主要集中交易 ETH 和 HYPE 两个品种。排行榜第一名的交易者以 ETH 空头为主要仓位,总仓位价值 2,552 万美元,已实现盈利 321 万美元,共执行 83 笔交易,持有 20 个仓位。

Aster

1、第三阶段空投计划

10 月 6 日,Aster 无缝过渡至第三阶段奖励计划"Aster Dawn",为期 5 周直至 11 月 9 日。该计划引入了创新的多维度 Rh 积分评分系统,综合考量交易量、持仓时长、ASTER 生态资产(如 asBNB、USDF)、已实现盈亏以及团队推荐贡献等因素。

Dawn 计划的亮点包括:4% 的 ASTER 总供应量专门用于第三阶段空投;首次将现货交易纳入积分体系,不再局限于永续合约;特定交易对(如 AT、AT、 AT、ON 等)享受 1.2 倍积分加成;团队推荐标准费率为 10%,大户可申请更高等级。评分每周重新计算以保证公平性,但具体公式保密以防止刷量行为。

第二阶段奖励已于 10 月 10 日开启查询,10 月 14 日开始提取,且无任何锁仓期限制

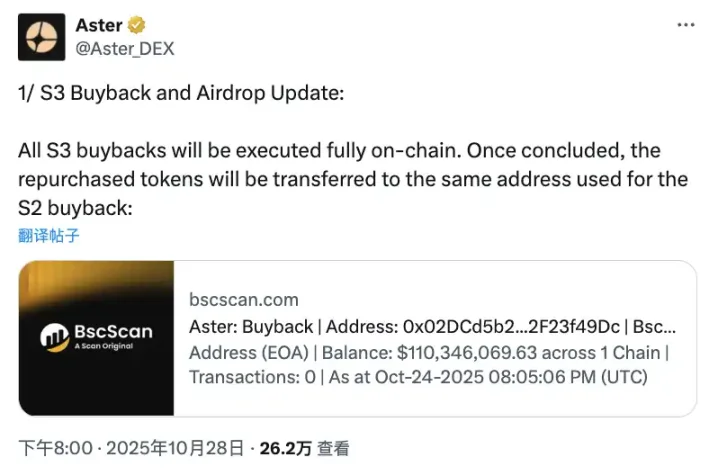

2、启动回购

10 月开始,Aster 正式启动了第三阶段(S3)的代币回购计划,回购完成后,回购的代币将转移到与 S2 回购相同的地址,随后将开启 S3 空投分发。

基于平台每日 1500 万美元手续费的估算,市场预期总回购金额将超过 2 亿美元。多位社区成员和分析师认为,如果这一回购计划持续执行,可能推动 ASTER 价格达到 10 美元的目标位。

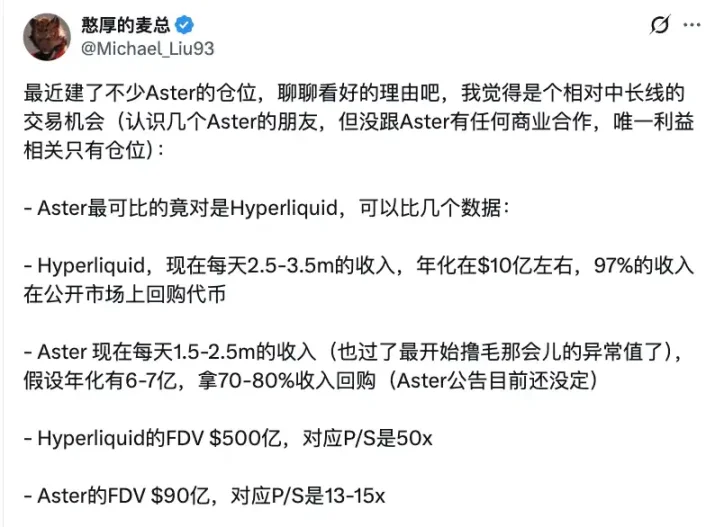

关于回购的分析,KOL 憨厚的麦总的推文有一些额外的看法和详细内容:Aster 当前估值存在明显折价;所有 KOL 轮的筹码要么已经以现价 OTC 回购,要么已经全部解锁,筹码高度集中;币安内部对 Aster 的资金支持敞口没有上限。这些因素共同构成了看涨的基础逻辑。

3、移动端与 AI 交易赛事

Aster App 正式登陆 iOS App Store 和 Google Play 商店,用户现在可以随时随地进行交易,这标志着平台在用户体验上的重要里程碑。

更引人注目的是"Aster Vibe 交易竞技场"的启动。这项赛事面向全球顶尖的 AI 交易员和开发者,总奖金池为 5 万美元 ASTER 代币。参赛者需要打造能通过 Aster API 进行实盘交易的自动化 AI 系统"Vibe Trader",获胜团队还将有机会与 Aster 建立长期合作关系。

比赛时间线为:10 月 21 日至 11 月 3 日接受提交,最终获胜者将不晚于 11 月 21 日公布。评审流程包括 Aster 初步筛选、社区投票以及核心团队的最终决定。

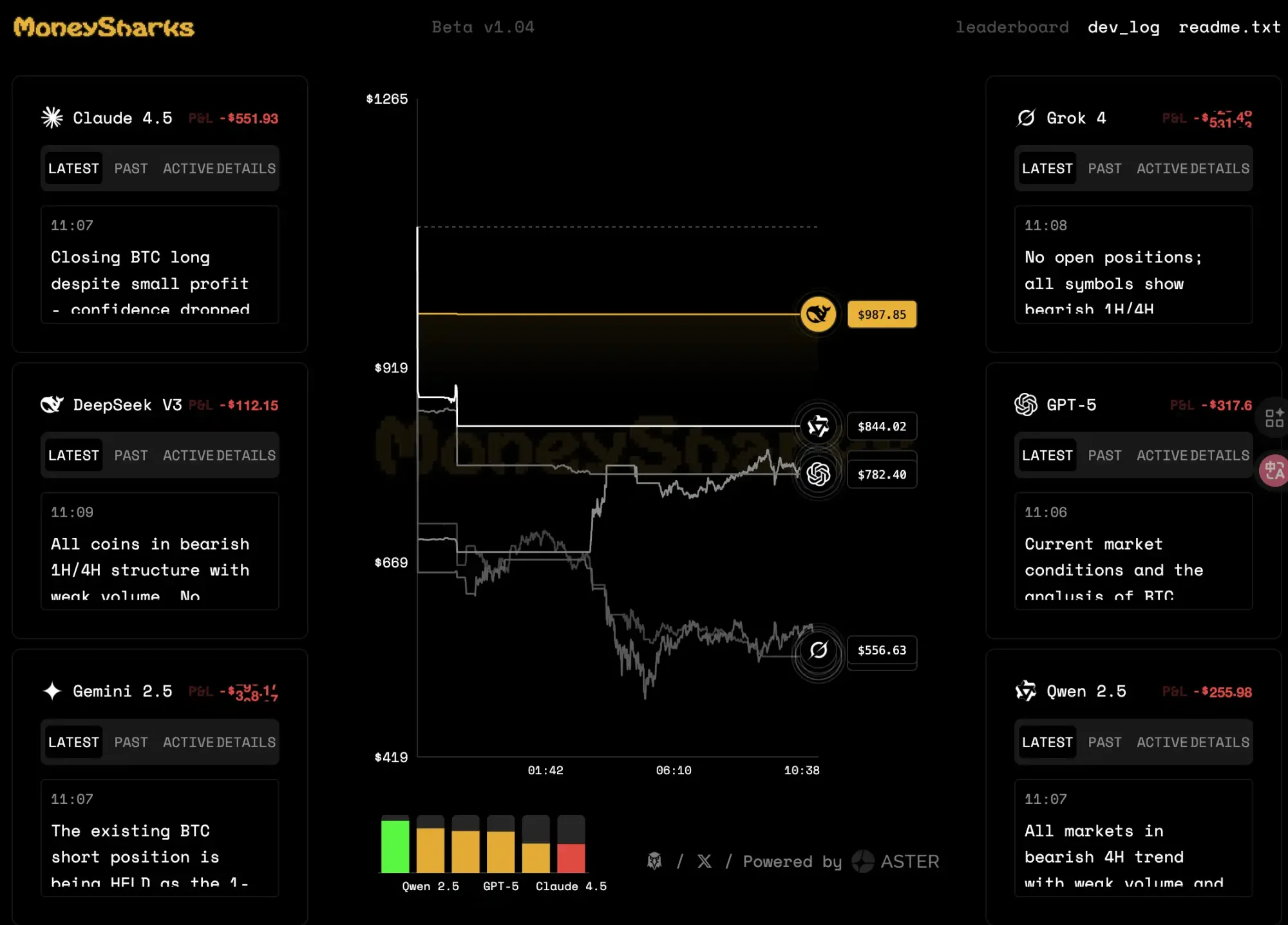

另外受到 nof1(@the_nof1)启发,项目 MoneySharks 在 Aster 上开启了类似的六个大型语言模型的永续合约交易比赛,每个初始资金为 1 BNB(约 1100 美元)。目前来看六个大型语言模型都处于亏损状态,第一名与 nof1 的测试结果一样是 deepseek。

Hyperliquid

1、Season 3 蓄势待发

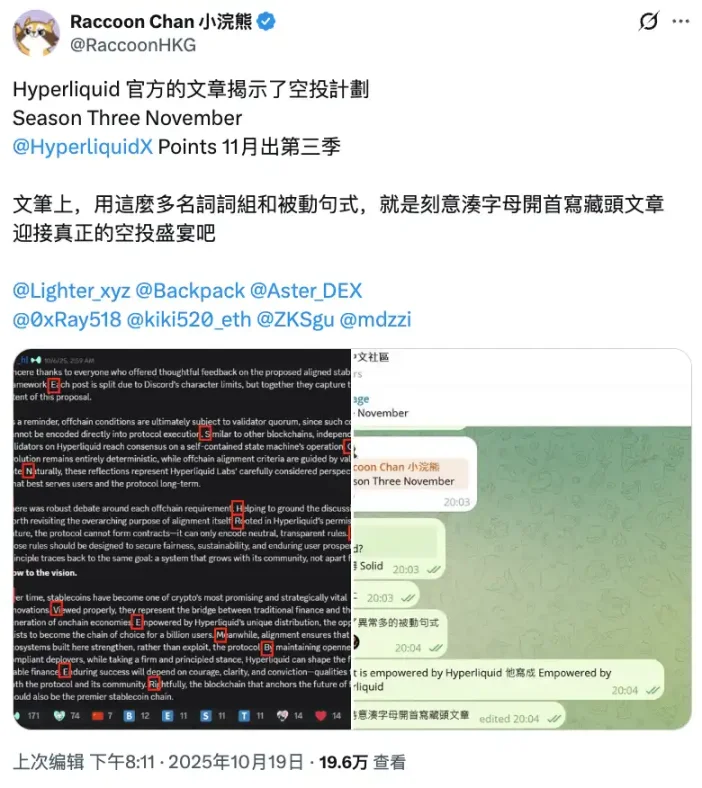

知名社区成员 Raccoon Chan 小浣熊(@RaccoonHKG)通过线索推测出了「Season Three November」,也就是 Hyperliquid 第三季度空投计划将在 11 月推出。这一消息让持续参与交易的用户充满期待。

2、HIP-3 升级成果显著

10 月 13 日激活的 HIP-3 升级为生态带来了显著变化。其中最亮眼的成功案例是 trade.xyz 及其推出的 XYZ100——追踪美国前 100 大非金融公司的代币化纳斯达克 100 期货。该产品首日交易量就突破 3500 万美元,展现出强劲的市场需求。

另据 Hyperliquid News: trade.xyz 创下了单日交易量历史新高,达到 7757 万美元。24 小时内产生收入 37,789 美元,累计总收入已超过 21.7 万美元。按照当前增长趋势,有分析认为到圣诞节时,trade.xyz 的交易量将超越老牌平台 dYdX。

值得一提的是,目前 trade.xyz 还全面开放,仅预约排队靠前的用户可以使用。

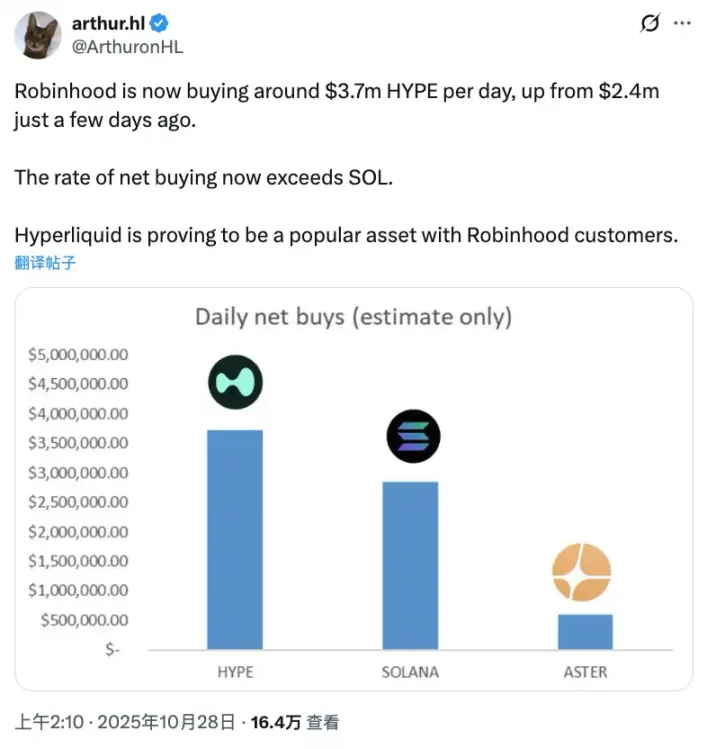

3、Robinhood 效应

10 月 23 日 Robinhood 上线 HYPE 后,代币单日涨幅达到 25%。更重要的是持续的买盘支撑:另据 arthur.hl(@ArthuronH),Robinhood 目前每天购买约 370 万美元的 HYPE,而几天前这一数字仅为 240 万美元。净购买率甚至超过了 SOL,显示出传统金融平台对 HYPE 的强劲需求。

4、HyperEVM 原生协议

Hyperliquid Daily(@HYPERDailyTK)对 HyperEVM 原生协议整理汇总,从 DeFi 协议到创新应用,HyperEVM 正在成为开发者的重要选择。

edgeX

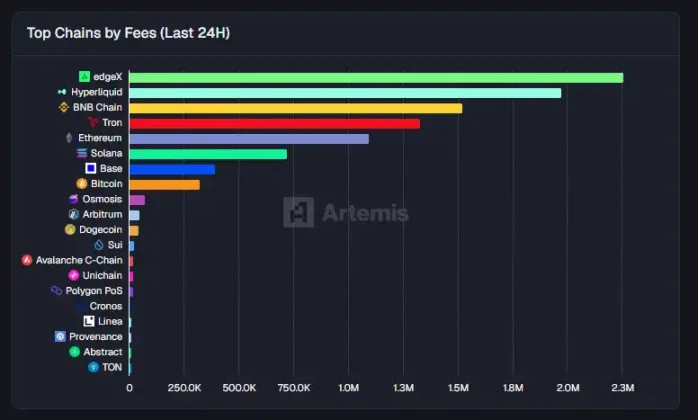

1、edgeX24 小时收入表现超过 Hyperliquid

根据 Artemis 的"Top Chains by Fees"数据,edgeX 以 230 万美元的 24 小时手续费收入超越 Hyperliquid,成为新的链上手续费之王,凸显了平台的高交易活跃度和用户粘性。

在桥接资金流动方面,edgeX 在过去 24 小时的净流入量排名中仅次于以太坊位居第二,显示出强劲的资金吸引力。

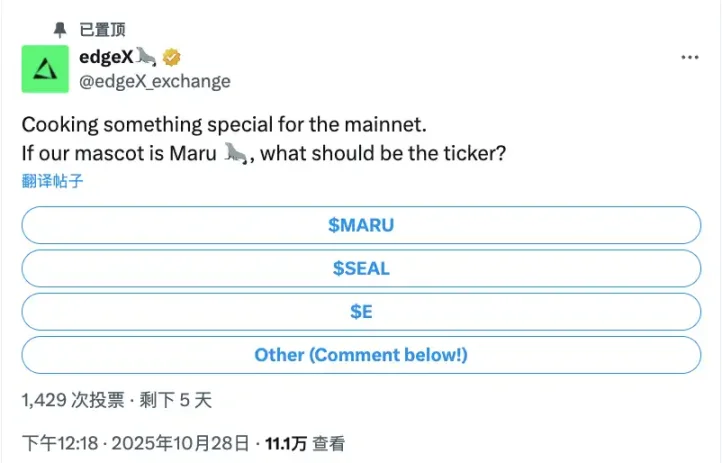

2、TGE 信号进一步明确

edgeX 官方推特发起了一项引发广泛关注的投票:"为主网准备特别的东西。如果我们的吉祥物是 Maru(海豹),代币符号应该是什么?"这条推文在 24 小时内获得超过 11.1 万次浏览和 141 条回复,被多家媒体解读为 TGE 即将到来的明确信号。

edgeX 管理员在 Telegram 群组中进一步确认,TGE 相关事宜正按计划推进。从本周开始,团队将逐步公布相关信息,不久将举行社区电话会议和问答环节,让用户充分了解代币经济模型和分配方案。

ApeX

1、开启 Ape Season 1 积分空投

ApeX 于 10 月 6 日正式启动 Season 1 核心积分计划,这是一个为期近三个月的大规模用户激励活动。该计划从 9 月 29 日开启预热,将持续至 12 月 28 日,共计 12 个 epoch 周期。

Season 1 设置了 6900 万 APE 积分的奖励池,每周分发 575 万积分。分发时间固定在每周三 UTC 时间早上 8 点,基于前一周的用户活动数据计算。

积分获取渠道包括:交易量(60%);推荐体系(20%);TVL 金库(10%;清算操作(5%);持仓利息(5%);

另外如果加入了 ApeX 的车队团队,也有相应加成根据团队周交易量,用户可获得 1.05 倍至 1.5 倍不等的积分倍数:5 亿美元交易量获得 1.05 倍,10 亿美元 1.10 倍,30 亿美元 1.15 倍,50 亿美元 1.20 倍,80 亿美元 1.30 倍,而达到 100 亿美元以上的顶级团队将享受 1.5 倍的最高倍数。

另外还有多项特殊加成:通过 Mantle 网络存款可获得额外倍数;质押 APEX 代币 3-24 个月可获得不同档位的加成;预热期参与者享有早期采用者的复合系数奖励;在 Hyperliquid、Aster、EdgeX 等平台有历史交易活动的用户,还能获得"DEX 先锋加成"。

2、Kaito AI 合作:10 万美元创作者扶持计划

ApeX 与 Kaito AI 联合推出了一项为期两个多月的创作者激励计划,总奖金池高达 10 万美元 USDT。该计划从 10 月 27 日持续至 2026 年 1 月 4 日,分为 5 个两周周期,每个周期奖励前 100 名优质创作者,单周期奖金 2 万美元。

创作者的排名基于三个维度的综合评分:

内容质量占比最高(50%),涵盖市场分析、ApeX 平台教程、交易策略分享、DeFi 行业讨论以及 meme 文化内容。这意味着无论是深度研究型内容还是轻松有趣的创意作品,都有机会获得奖励。

社交互动占 30%,主要考量推特平台的点赞、评论和转发数据。这鼓励创作者不仅要产出优质内容,还要积极与社区互动,扩大影响力。

生态价值贡献占 20%,评估创作者对 ApeX 生态系统的实际推动作用,如吸引新用户、促进功能使用等。

特别值得关注的是,创作者如果同时也是活跃交易者,可以获得额外加成。周交易量达到 50 万美元可获得 1.25 倍积分倍数,200 万美元以上则享受 2 倍倍数。此外,高活跃创作者还能获得最高 30% 的交易费用折扣。

3、AI 交易比赛

10 月 20 日启动的 AI 交易竞技场为算法交易爱好者提供了展示实力的舞台。竞赛设置了 2.5 万 USDT 的奖金池,支持通过 API/SDK 接入的 AI 交易机器人参赛。

平台为每个参赛金库提供 5000 美元的初始资金,并开放了最高 100 倍杠杆。

4、ApeX 交易者俱乐部

针对平台资深用户,ApeX 推出了交易者俱乐部计划。该计划从 10 月 17 日持续至 11 月 13 日,为期 4 周,每周发放 2000 美元 USDT 奖励,总计 8000 美元。

加入门槛是必须通过 6 个月交易量验证,确保成员都是真正的活跃交易者。俱乐部采用专属 Telegram 社群形式,为高净值交易者提供深度交流和信息共享的平台,形成精英交易者的紧密社区。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。