作者:@Jjay_dm,Wintermute OTC 交易策略师

编译:深潮TechFlow

市场动态更新 – 2025年10月27日

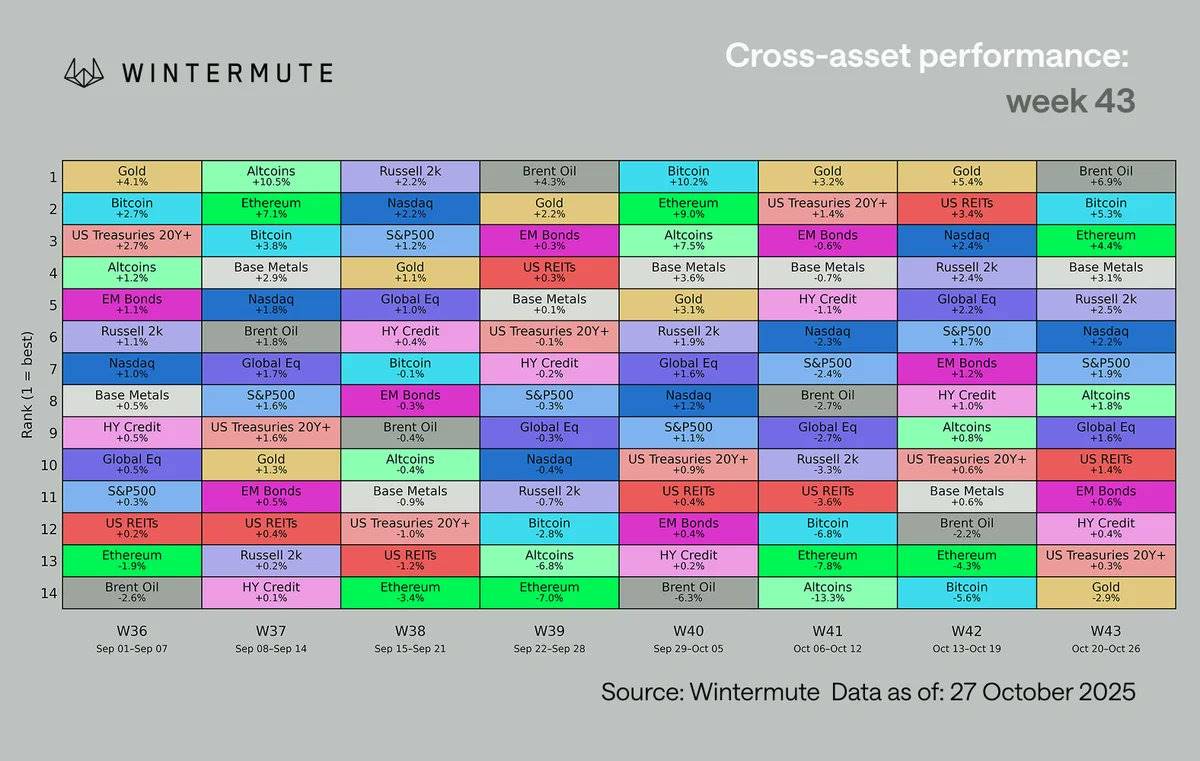

随着美国CPI数据走软以及特朗普与习近平关系改善的消息提振市场情绪,风险偏好正在回归。债券收益率下行,市场波动性下降。比特币因ETF资金流入和空头回补重回11.5万美元关口,而去中心化金融(DeFi)和人工智能(AI)板块领涨复苏。市场仓位得到清理,流动性改善,为11月的持续动能奠定了积极基础。

宏观动态

市场在鸽派的宏观信号和中美对话恢复的推动下强势反弹。特朗普与习近平将在首尔举行峰会的消息,加上美国CPI数据低于预期(同比增长3.0%,预期为3.1%),引发了资产的全面反弹。标普500指数上涨1.9%,波动率指数(VIX)降至约16,国债收益率下滑,同时本周美联储(FOMC)会议前降息预期增强。

比特币表现强劲,单日上涨5.3%,升至11.5万美元以上,收复了10月初因清算而失去的部分地位。这一涨势受到1.6亿美元空头清算的推动,而这一清算则因美国贸易框架确认后市场情绪改善而引发,成为数周来最猛烈的空头回补之一。以太坊价格也随之上涨,接近4200美元,而黄金价格从高点回落近7%,显示资金从防御性资产转向风险资产。

市场资金流动出现扩展的初步迹象,超越了主流资产范围:

-

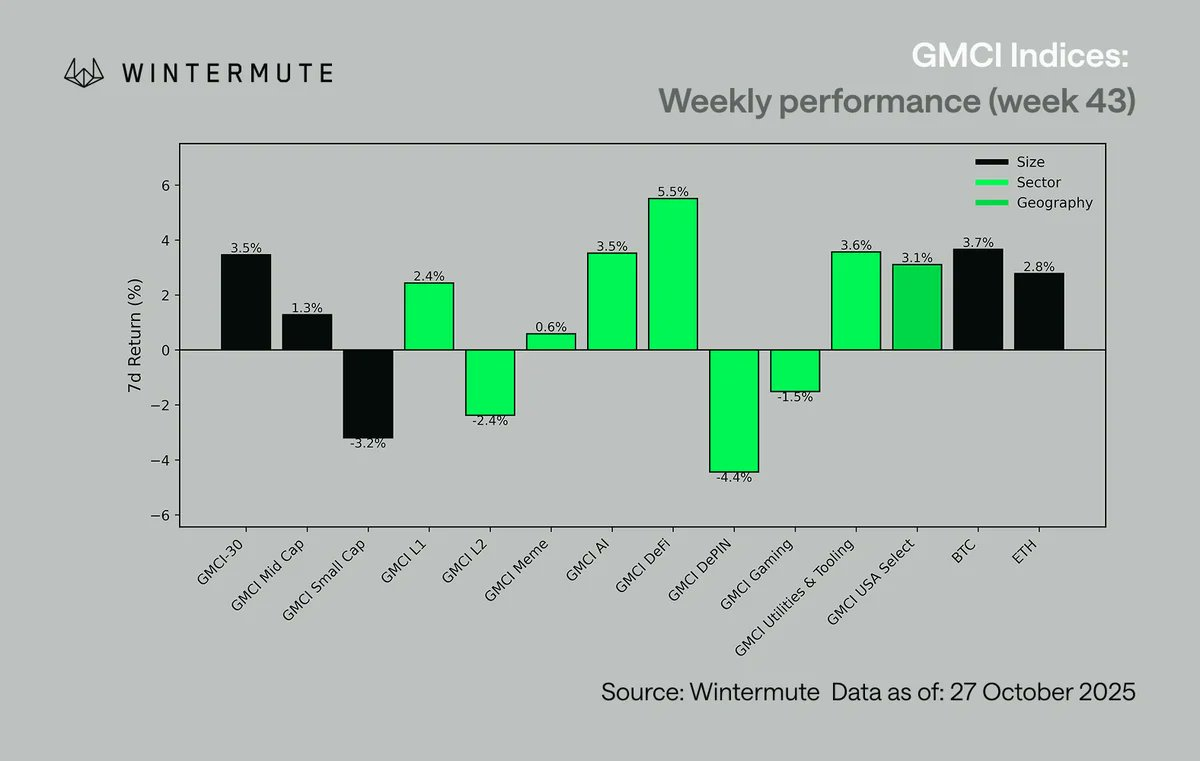

DeFi与AI板块:受益于强劲的协议收入数据和链上活动改善,领涨市场。

-

基础设施与工具类资产:随着新的第二层(L2)网络部署和重新质押(restaking)机制的推出,相关领域吸引了更多流动性。

在永续合约市场方面,大多数主要资产的资金费率再次转为正值,这表明观望中的资金正在逐步回流市场,尽管当前仓位布局仍远未达到过度拥挤的程度。稳定币供应自9月以来首次出现回升,进一步表明宏观利好开始转化为新的资金流入。

ETF资金流入也持续为市场提供稳定的需求基础。尽管交易量有所减少,美国现货比特币 ETF 本周吸收了适量资金流入,显示出结构性需求的韧性。比特币和以太坊永续合约的未平仓合约在月初清算后以稳健的节奏重新积累,表明衍生品市场的杠杆状况更加健康,资金费率更为平衡。

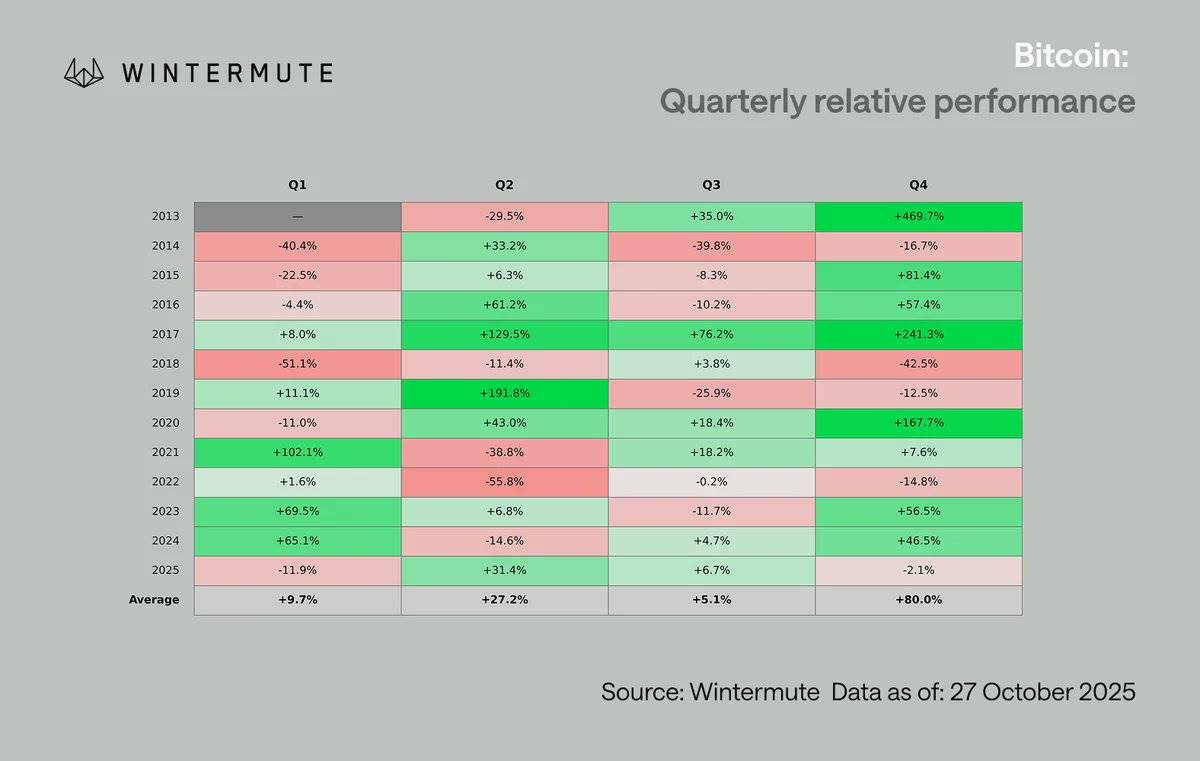

尽管“Uptober”行情开局略显不及预期,但宏观利好、通胀降温、“稳定”的地缘政治局势以及美联储的鸽派立场正在为全年剩余时间营造有利环境。历史数据显示,第四季度通常是比特币表现最强劲的时期。当前仓位更为清理,波动性有所下降,为资本向加密资产的轮动铺平道路,这正是市场目前的趋势。

宏观利好、通胀降温、全球外交关系改善以及美联储即将转向的预期,为11月的进一步上涨奠定了基础,而11月历来是比特币表现最强劲的月份。随着仓位洗盘、波动性降低以及资本逐步流向加密市场,流动性条件的改善和市场情绪的稳定为第四季度的持续复苏提供了积极支持。

我们的观点

随着通胀放缓和中美对话重启提振市场情绪,市场正在向风险资产回归。更清晰的仓位布局为11月的积极行情铺平了道路。

宏观数据的支持推动市场重新进入风险模式。通胀放缓和中美关系改善缓解了收益率的压力,并降低了市场波动性,帮助风险资产站稳脚跟。

比特币通过稳定的 ETF 资金流入收复了10月初的跌幅,并继续作为市场结构的核心支柱,而去中心化金融(DeFi)和人工智能(AI)等板块引领了市场反弹。尽管山寨币仍处于轮动交易状态,局部出现强势表现,但整体市场信心仍显不足。在更清晰的仓位、更平静的波动性和更好的宏观环境下,11月的市场前景健康,为加密市场的进一步复苏和轮动提供了有利条件。

值得关注的头条新闻

-

摩根大通(@jpmorgan)现已允许机构客户将比特币(BTC)和以太坊(ETH)作为抵押品,这是推动加密货币更广泛整合的重要一步。

-

美联储正在研究“支付账户”(payment accounts),这将为加密货币和金融科技公司提供直接接入美联储支付系统的可能性。

-

Coinbase(@coinbase)通过以3.75亿美元收购 @echodotxyz 的方式扩展了其零售产品阵容,@echodotxyz 是一个简化链上投资组合管理的平台。

-

Polychain Capital(@polychain)领投1.1亿美元投资于 @berachain,以建设一个支持链上流动性和治理的加密国库。

-

Meteora AG(@MeteoraAG)完成了其代币生成活动(TGE),并推出了 Presale Vaults、Meteora Invent 和 Dynamic Fee Sharing,以提升资本效率。

-

MegaETH Labs(@megaeth_labs)在 Sonar/Echo 平台上启动了公开销售,初始全面摊薄估值(FDV)为100万美元。

-

自5月推出以来,围绕 x402 Protocol 的讨论热度不断上升,推动了基于区块链的人工智能代理(AI Agent)叙事的市场势头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。