撰文:Yash

编译:AididiaoJP,Foresight News

我曾经认为加密世界是完整的系统,但最近我的视角发生了转变,开始从建设者的角度将加密世界视为两个主要领域:

-

叙事型加密世界

-

实用型加密世界

我将解释如何准确理解它们以及如何从中构建项目并赚取赚钱。

实用型加密世界

它们通常是「最好的生意」:

-

钱包(@Phantom、@MetaMask)

-

稳定币(USDT、USDC)

-

交易所(@HyperliquidX、@Raydium、@JupiterExchange)

-

启动平台(@pumpdotfun)

-

机器人和交易终端(@AxiomExchange)

-

去中心化金融(@aave、@kamino、@LidoFinance)

这些项目存在实际应用场景,并且能产生巨额收益。

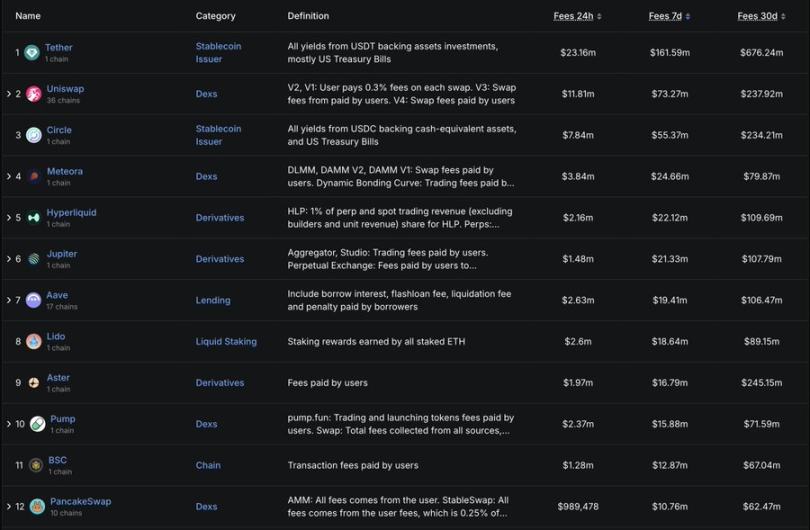

加密世界中产生费用最高的项目

叙事型加密世界:

通常有一个好故事和愿景(价值 1000 亿美元以上),足够强大到可以改变世界:

-

比特币(数字黄金的故事)

-

AI x 加密(大多数 GPU 基础设施和智能体框架)

-

去中心化科学或知识产权相关(Story Protocol)

-

较新的 L1/L2(例如,稳定币 L1 或永续合约 L2)

-

隐私(@Zcash)

-

再质押和任何基础设施

-

x402

它几乎不产生收入,但因为故事吸引了机构和散户,使得代币价格上涨。

现在叙事型加密世界和实用型加密世界并非相互排斥。

想想这个:

确实有人使用 Zcash(每天 5-10 千笔交易),但它目前有一个非常强大的隐私叙事,因此获得了更高的关注度。而且很有可能这种关注也会推动其实用性。

类似地,@CoinbaseDev 的 x402 几乎没有任何使用量,但它是最近的热门话题,并且肯定会通过投机驱动更多的认知和使用。

Zcash 每日交易笔数(来源:bitinfocharts.com)

两者同样重要,因为它们相互促进:

叙事型加密世界驱动 → 投机,投机驱动 → 实用型加密世界的采用

在实用型加密世界,你的产品(用户)是王道,而在叙事型加密世界,你的社区是王道。

建设者的困境

每个建设者都面临这个困境:是为叙事型加密世界还是为实用型加密世界进行建设。

一个经验法则是:

如果你擅长吸引注意力的游戏,并且有足够的影响力来创建一场运动,你应该为叙事型加密世界进行建设。

例如如果你擅长代币经济游戏(以及中心化交易所上线 / 小圈子) ,你应该专注于构建宏大的叙事和愿景。

当然如果有足够的势头,它也会变得足够有用。例如像 Solana 这样的区块链,资本确实吸引了人才,并使得这些链变得有用。

如果你想拥有一个 10 亿美元以上的叙事,你必须从第一性原理出发,思考利用加密技术栈能实现哪些独特的东西。

这个愿景是否足够有说服力,如果成功能拥有 1000 亿美元以上的市场?它是否足够令人兴奋,能在散户中引发炒作?

例如 Plasma 拥有万亿美元级别的稳定币市场叙事,从而以 140 亿美元的估值进行代币生成事件,尽管尚未有实际使用量。

如果你擅长构建产品,你应该为实用型加密世界进行建设,你可以尝试解决一个细分领域的问题(例如,Axiom 为 Memecoin 交易者服务,或一个 DeFi 协议)。

实用型加密世界关乎构建;交易者或加密原生用户会直接通过终端 / 交易所需要的东西。

它不一定只是为了助长投机,同样的产品也可以有非投机性的用例。例如稳定币用于支付。

在这里叙事也很重要例如对于 Polymarket,其叙事是预测市场。因为叙事确实能吸引用户,可以将叙事视为市场营销。

当然你最终可以两者兼顾,但开始时最好专注于其中之一,而且识别自己的优势相当困难。你必须找到自己的长处。

对于交易者

你必须始终押注于叙事。

你押注于你认为在未来几周、几个月或几年内最具前瞻性的叙事。

每个交易代币的人都在玩「注意力套利」的游戏,即买入那些正在获得关注的东西,卖出那些已经风光过的东西。例如,从永续合约代币轮动到隐私代币,现在是 AI 代币。

对于特定的叙事,你必须押注于你认为能够获得关注并成为 alpha 和 beta 标的的团队。如果他们能做到,你的押注就会起飞。

总结:

实用型和叙事型加密世界都是加密领域的重要方面。

作为建设者,开始时总是选择其中之一,并在叙事性或实用性上做到非常强大。一旦其中一点做好了,你就可以扩展到另一点,那就是最终目标。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。