第33次BNB销毁完成:代币能否很快达到新的历史高点?

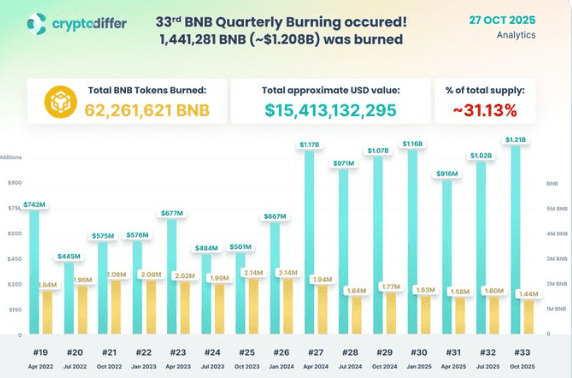

当超过16.6亿美元的代币在一次事件中被抹去时,会发生什么?答案在于第33次BNB销毁,这是基金会的一项战略性通缩举措,销毁了1,441,281.413个代币,将流通供应量减少到137,738,379.26个代币。随着交易者对其下一步行动的猜测,所有目光都集中在价格预测上,以及这次重大销毁是否能重新点燃其看涨的反弹。

理解第33次BNB销毁及其影响

基金会的第33次季度销毁是项目自动销毁系统的一部分,旨在逐步将总供应量减少到1亿个代币。与手动销毁不同,自动销毁机制根据BNB的价格和每个季度在BSC上生成的区块数量来调整销毁量——确保了可预测和透明的代币减少过程。

来源: CryptoDiffer

来源: CryptoDiffer

这种通缩模型强化了稀缺性,这是长期价格升值的基本因素。每次事件都使代币更接近其上限供应,给价值施加上行压力,同时展示了Binance对生态系统可持续性和持有者信心的持续承诺。

为什么今天BNB的价格上涨?

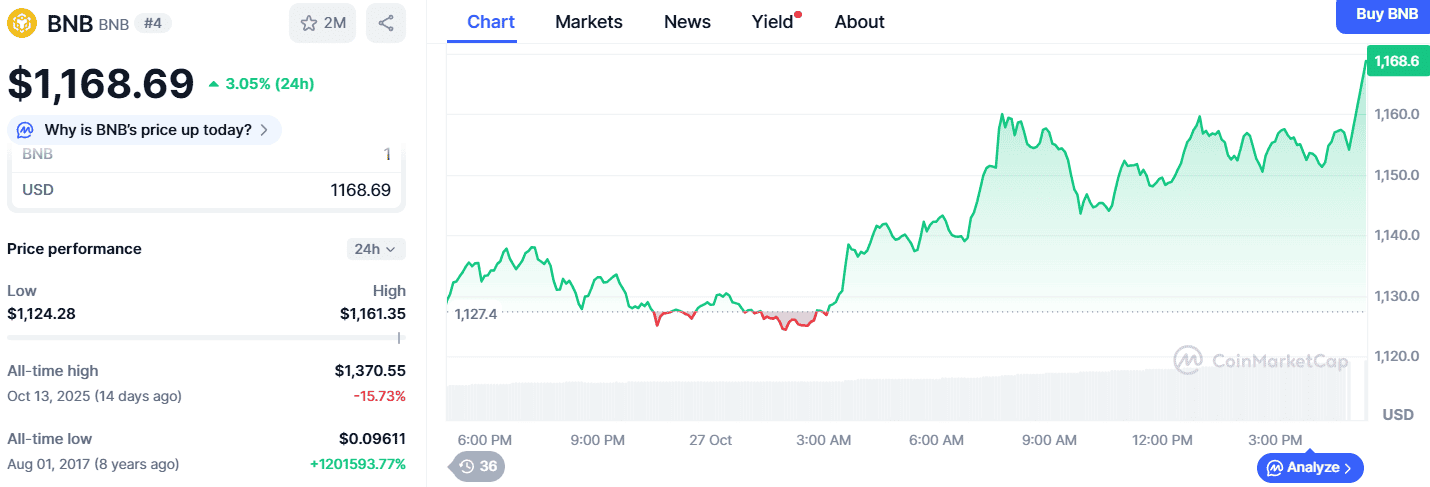

市场数据显示对销毁事件的直接反应。截至发稿时,BNB的交易价格为1,154.94美元,24小时内上涨2.53%,24小时交易量为38.1亿美元。本月早些时候,代币曾接近1,000美元,随后迅速反弹并重新测试1,160美元以上的水平。

来源: CoinMarketCap

来源: CoinMarketCap

在10月13日,它达到了历史最高点1,370.55美元,分析师建议,重新获得的动能可能很快会再次测试这些高点。

BNB价格预测:多头能否维持动能?

在4小时图表上,代币正在形成一个圆形模式。相对强弱指数(RSI)为55.31,表明中性动能,而MACD指标显示出看跌信号减弱和看涨交叉的出现——潜在上行延续的早期迹象。

来源: TradingView

来源: TradingView

短期(1-2周): 它可能在1,200-1,250美元之间面临阻力,1,100美元为即时支撑。如果多头能将价格维持在1,150美元以上,向1,280美元的小幅反弹是可能的。

中期(1-3个月): 持续的买入趋势可能将其推高至1,350-1,400美元,重新夺回之前的高点。然而,任何跌破1,000美元的情况可能会触发向900美元的修正。

长期(6-12个月): 其通缩供应模型,加上BSC和Greenfield的强大链上实用性,支持看涨的长期前景。突破1,400美元可能为1,700-2,000美元铺平道路,与整体市场复苏相一致。

结论

第33次BNB销毁不仅仅是一个象征性的行为——它是Binance通缩路线图中的一个计算步骤。通过永久性地移除超过16亿美元的代币,它强化了稀缺性和投资者信任。随着市场指标转向有利,价格预测趋势看涨,表明这次销毁的影响可能点燃反弹的下一阶段。

免责声明: 本文仅供信息参考,不应视为财务建议。在投资之前请自行研究。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。