Starting with the acquisition fates of Clanker and Padre.

Written by: mary in sf

Translated by: AididiaoJP, Foresight News

In the short term, the market is a voting machine, but in the long term, it is a weighing machine — Benjamin Graham.

We are currently in a phase of industry consolidation, and everyone can see who is swimming naked.

Although liquidity has been declining for some time, on October 10, liquidity dramatically and completely vanished. "Death of a Salesman" is an extremely apt metaphor for this moment in crypto history. The play focuses on the corrosive illusion of the American Dream, the fragility of family ties, and the psychological costs imposed by societal expectations; all of these reflect the illusions of the superstructure, the vulnerabilities of crypto companies in reality, and the psychological toll borne by market participants burned by one token after another.

Now that we have awakened from the fantasy of "what crypto could be" that we were told in 2021, we speculators are cleaning up the mess instead of facing what crypto looks like in reality.

Last year, I read "Built to Last," a book that discusses what distinguishes generational companies from ordinary ones. The author elaborates on the internet bubble, one key point being that in every innovation cycle, the public speculates on "new mysterious technologies," but what truly distinguishes the good from the great is the people behind each company. Tokens that do not clearly codify the rights of actual token holders within the legal system are somewhat worthless, but the past few weeks have shown which tokens have teams that care about the long-term survival of the tokens and which are short-term, never having had relevant plans.

For all those rhetorical questions that have long been treated more as jokes, now is a moment of reckoning:

Where does value accumulate?

If value accumulates to equity entities, why buy tokens?

Are all tokens just meme coins?

Here is the mental framework for the tokens that I believe will continue to exist in the future:

Bitcoin

Revenue-backed: such as Hyperliquid

Social capital, attention tokens

This article will lean more towards observation rather than the analytical approach I previously favored, as I find it interesting but do not have the time for a deeper exploration like zachxbt.

Acquisitions

This week gave us two examples of token acquisitions: one token rose (Clanker), and the other token fell (Padre).

Clanker

Yesterday, @farcaster_xyz announced the acquisition of Clanker. Clanker is a token launch platform on Base, built by an excellent team, with its corresponding token launched about a year ago:

Protocol fees will be used to buy and hold $CLANKER

The Clanker team burned the tokens collected as protocol fees in product versions v0 - v3.1.

The team permanently locked about 7% of the total supply of $CLANKER in a unilateral liquidity pool to provide additional liquidity (which reduced the circulating supply).

The token subsequently rose because it was clear that the Clanker team viewed their token as equity in their deal with Farcaster.

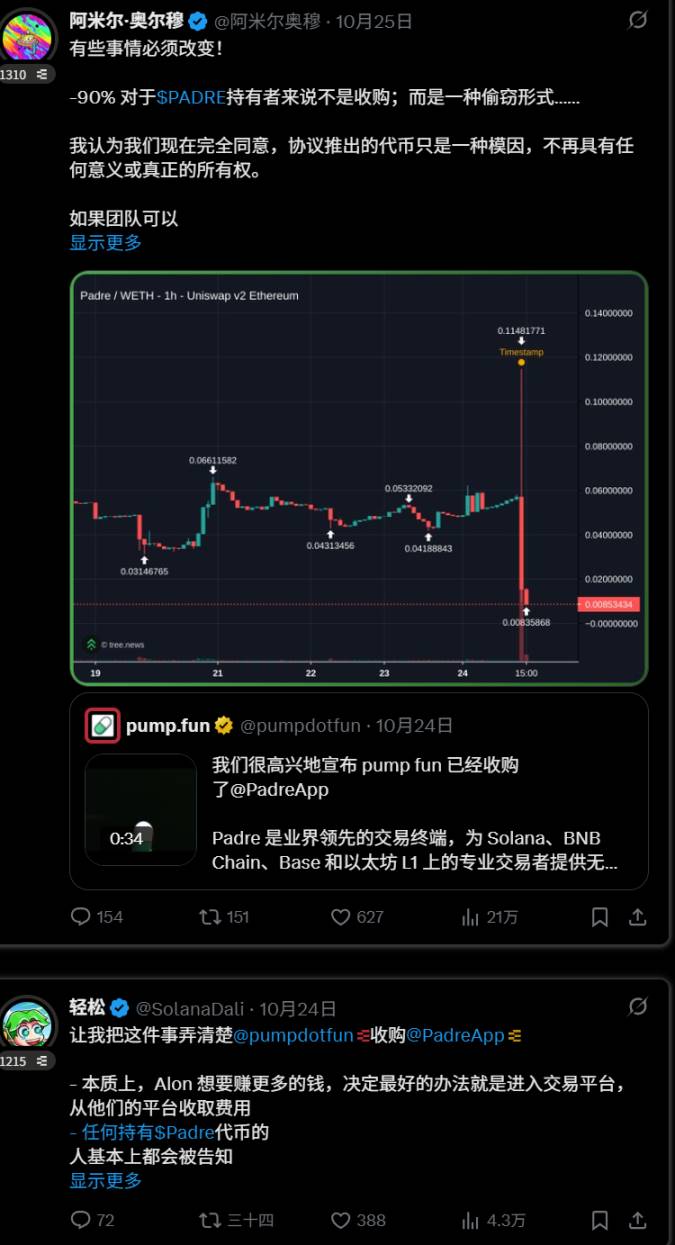

Padre

The market rarely gives you the opportunity to experiment without confounding variables. Both Clanker and Padre are products that can seemingly generate revenue. Let's see what happens when a team does not act.

The team raised funds on a platform similar to an ICO, promising buybacks and revenue sharing, but ended up not doing so? Instead, the team retained all profits, occasionally promising to restore revenue sharing and buybacks while their token continued to trade. Now Padre has been acquired, and token holders have gained nothing, with the token revealed to be worthless.

Ironfish

If anyone has time to explain the details of this acquisition to me, I would love to know. As I understand it, the token is still trading because the network is still maintained by the Iron Fish Foundation, and the core team has been employed in a manner similar to an acquisition by Base. It feels a bit strange to see the former founder tweeting about price trends. Does this mean Base acquired the Labs entity? Did they purchase any amount of tokens?

Collapse

Eclipse and Kadena

These companies have been exposed for scandals close to their TGE and mainnet launches, providing a very stark reminder: not all blockchains are secure structures. In fact, they remind us that blockchain trades on trust in its potential, and the strength and belief of the team is a significant indicator of that.

I won't emphasize the token price of Eclipse or any further tweets, but I do find it somewhat ridiculous. Eclipse was doomed to fail from the start because its intent was never to operate a blockchain with a long-term vision; it was always about extracting liquidity.

There are many different circles in the crypto world. Our small circle of crypto Twitter knows that Kadena has never been a properly functioning blockchain. Many employees from different companies have told me that their companies lack viable products; they are just in a state of suspension until the music stops.

This is a rather bad and frustrating time for the crypto space. We need to provide rights protection for token holders and more productive assets with smaller market caps.

I find that if you view crypto merely as an accelerated economic experiment, it becomes slightly less frustrating, but the byproduct of such an experiment is that those who misplace their faith in the wrong teams lose a lot of money.

What does it say when decentralized technology is so reliant on trustworthy teams? Only up, never down.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。