However, current data indicates that breakthroughs in this field are still difficult to achieve in the short term.

Author: Sam

Translation: Deep Tide TechFlow

Key Insights:

Stock perpetual contracts remain a high-potential but unproven area, with limited appeal in the on-chain market, primarily due to audience misalignment, weak demand, and more popular alternatives (such as 0DTE options).

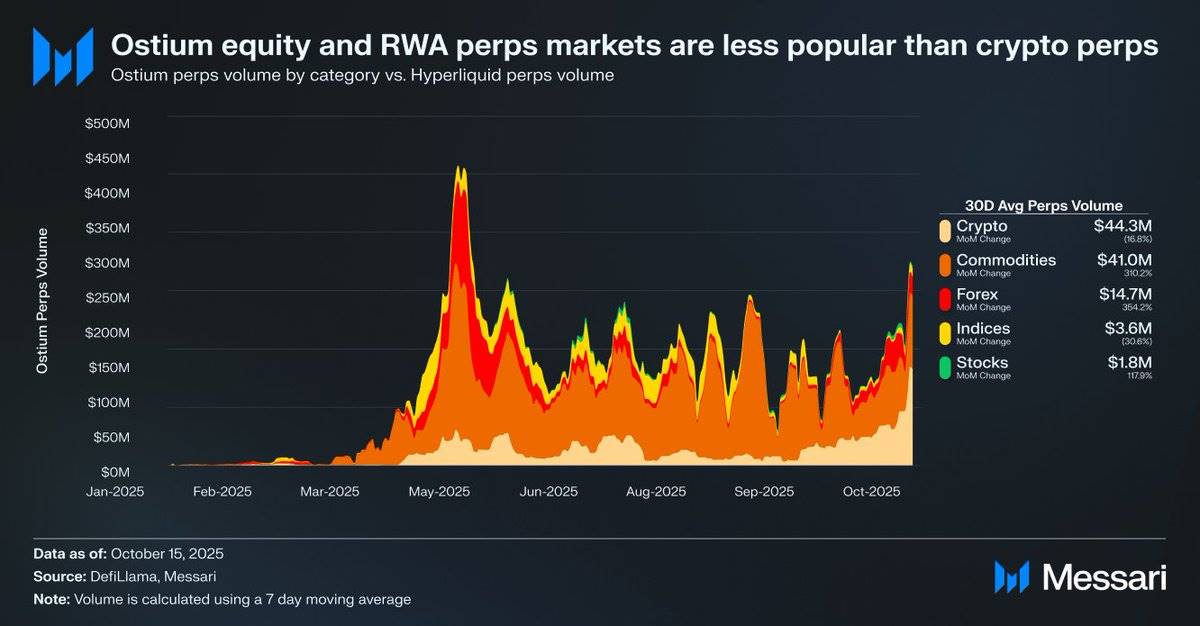

For example, the daily trading volume of stock perpetual contracts on the Ostium platform is only $1.8 million, while the trading volume of cryptocurrency perpetual contracts reaches $44.3 million, indicating weak market demand.

This may suggest that market demand has not been fully unleashed due to infrastructure and regulatory constraints. Hyperliquid's recent HIP-3 upgrade provides the best opportunity for stock perpetual contracts, but the adoption process is expected to be gradual.

Source: Messari (@0xCryptoSam)

Stock perpetual contracts are considered the next inevitable blue ocean for on-chain markets, but current data indicates that breakthroughs in this field are still difficult to achieve in the short term. Ostium, as a decentralized exchange focused on real-world assets (RWAs), has a daily trading volume of stock perpetual contracts of only $1.8 million, while the trading volume of cryptocurrency perpetual contracts reaches $44.3 million, reflecting weak demand.

This adoption gap primarily stems from audience misalignment. On-chain traders show little interest in stocks, while off-chain platforms (like Robinhood) allow traders to easily trade stocks and options but do not offer perpetual contracts. International investors may become a potential target group, as they cannot directly access the U.S. stock market. However, these investors may prefer to hold stocks directly to gain shareholder rights while avoiding funding fees and liquidation risks.

Compared to tokens, stocks face fewer interoperability challenges, while tokens benefit from the convenience of synthetic packaging. For ordinary investors, almost every stock in the global market has been abstracted through individual stock codes in the search bar. Therefore, although perpetual contracts add permissionless and censorship-resistant features to stocks, ordinary stock investors are either unaware of this or uninterested.

https://www.fow.com/insights/analysis-cboe-points-to-retail-flow-as-zero-day-options-grow

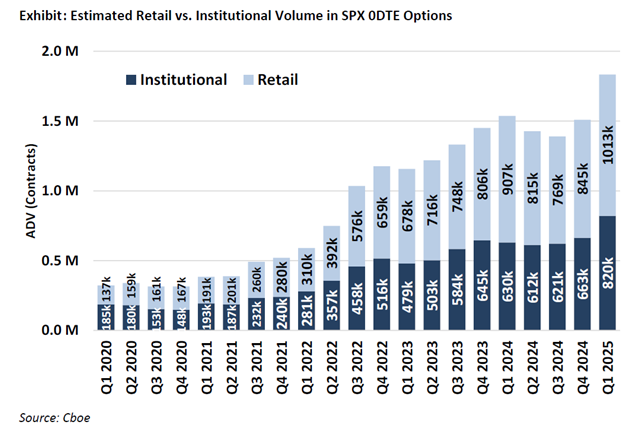

The most likely users of stock perpetual contracts are retail options traders (who drive 50%-60% of 0DTE trading on the Robinhood platform). However, traditional exchanges that rely on banking services will only adopt stock perpetual contracts when the law is clear. The U.S. Commodity Futures Trading Commission (CFTC) has approved trading of perpetual contracts for BTC and ETH, but these have been classified as non-securities. While perpetual contracts are more intuitive than options, the popularity of stock perpetual contracts may be slower than expected due to the close connection between retail adoption paths and legal clarity.

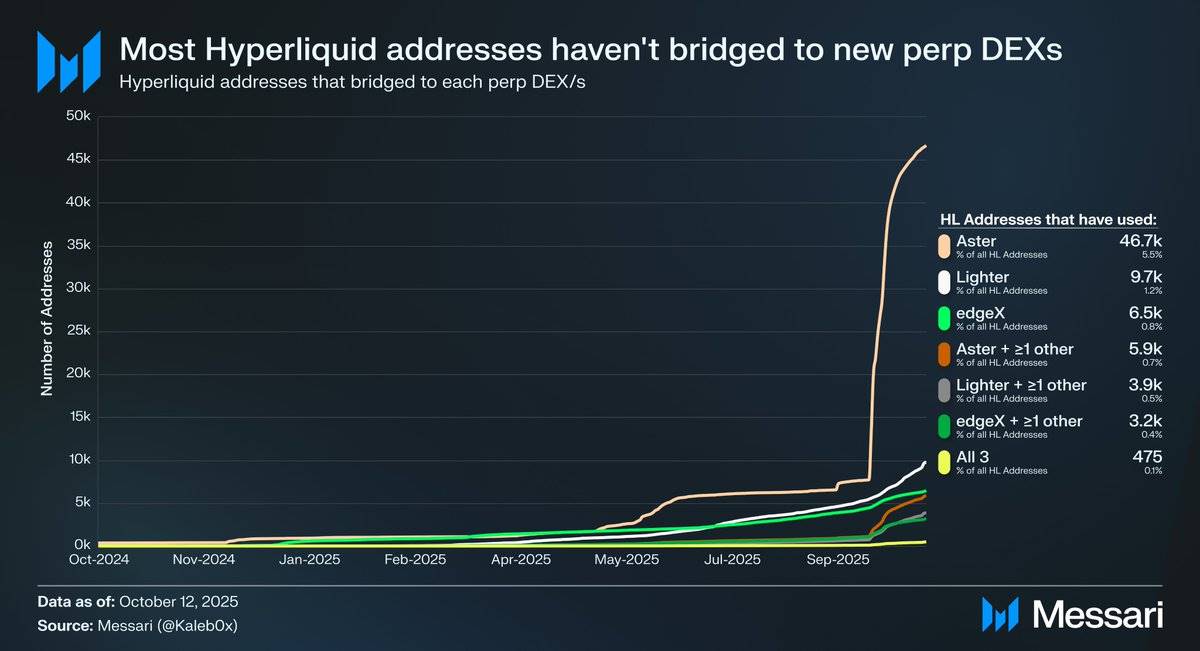

Source: @Kaleb0x

Let’s explore the potential development direction of stock perpetual contracts in the context of Hyperliquid's HIP-3 upgrade. HIP-3 introduces a permissionless perpetual contract market, and data shows that **less than 10% of Hyperliquid addresses have *bridged* to Aster, Lighter, and edgeX, with even fewer users choosing multiple perpetual contract decentralized exchanges (DEXs)**. This indicates that Hyperliquid's capital is sticky and of high quality. Based on this data, the future of stock perpetual contracts can be predicted from two perspectives:

Hyperliquid users are loyal to the platform; regardless of asset listings or features, they are more inclined to choose Hyperliquid over other perpetual contract DEXs.

Hyperliquid users are satisfied with the current products in the perpetual contract market.

I believe both viewpoints have merit. Considering that Hyperliquid users have not massively shifted funds in the face of incentives, they may be loyal to Hyperliquid. However, since most of the trading volume and open interest on Hyperliquid is concentrated in mainstream assets, similar to other perpetual contract DEXs, it is currently difficult to determine whether Hyperliquid users care about market diversity and whether stock perpetual contracts are attractive to ordinary users (more importantly, to the large holders who hold 70% of Hyperliquid's open interest).

Additionally, these traders may also have accounts on traditional exchanges and brokerage platforms, further limiting the potential market size for stock perpetual contracts on Hyperliquid.

It is important to note that stock perpetual contracts may not bring new open interest or trading volume to Hyperliquid but may instead divert existing trading flow.

Although Ostium (with an annual average perpetual contract trading volume of $22 billion) and stock token packaging tools (like xStocks, which has a spot trading volume of $279 million) have not yet achieved explosive growth, this may reflect infrastructure limitations rather than a lack of potential demand. This pattern is similar to the early growth trajectory of perpetual contracts. GMX demonstrated that there is demand for on-chain perpetual contracts, but the infrastructure at that time could not support sustained trading volume. Hyperliquid has addressed this bottleneck, releasing potential demand. By the same logic, stock perpetual contracts may find their first scalable product-market fit on Hyperliquid after HIP-3 provides the necessary performance and liquidity. While current data cannot confirm this outcome, this precedent is worth noting.

Compared to 0DTE options, the long-term potential of stock perpetual contracts remains evident. Projects like Trade[XYZ] can leverage regulatory arbitrage to build an early user base before entering the market through traditional exchanges. However, the real challenge lies in attracting off-chain retail traders, which has always been difficult for crypto applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。