撰文:Miles Deutscher

编译:AididiaoJP,Foresight News

我在加密货币市场已经摸爬滚打超过了 6 年。我赚过几百万,也亏过几百万,创立过加密项目,坦白说,在这个领域里,我坐遍了所有能想象到的情绪过山车。

我写这篇文章的目标很简单:拆解我花费了数百万美元才学到的 12 个来之不易的经验教训。通过阅读本文并将这些教训应用到你自己的加密旅程中,希望你能成为一个更好的交易者,让自己免于巨大的资金回撤,并增加通过加密货币改变人生的机会。

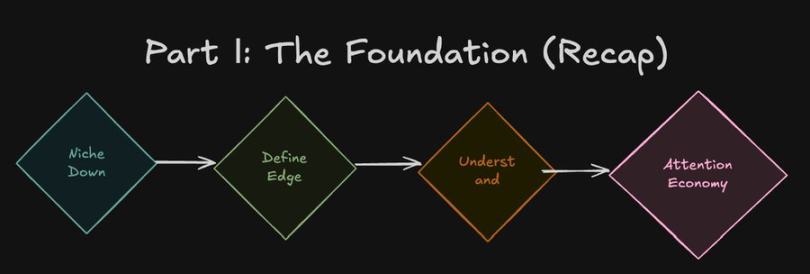

第一部分:基础

第一课:专注细分领域的力量

在加密货币市场,赚钱的方法有很多;你的任务是找到最适合你的那一种,并成为那个细分领域的专家。

在 2020 年和 2021 年,我深入研究了 DeFi。我在多条链上进行挖矿,探索各种 DeFi 生态系统,运行循环 / 治理策略。

这让我对这个领域有了很多了解:从风险管理和头寸规模控制到博弈论和飞轮效应。

如果我同时在进行合约交易、链上狙击、空投耕种等等,我怀疑我是否能积累起现有的知识。

在加密领域,成为某一方面的专家胜过成为万事通。

第二课:优势就是一切

我认识最好的加密货币交易者都清晰地定义了自己的优势,并将 99% 的精力集中在从中获取最佳结果上。

你的优势可能是速度、精准、耐心、风险管理、人脉网络,或是上述各项的结合,但你需要一个差异化因素。

你的市场优势很大程度上取决于你的个性、已有的技能组合、在这个领域的时间以及其他一些变量。

定义你的优势,掌握它,然后执行。

第三课:只参与你理解的东西

如果你不理解某个东西,在理解之前不要购买。

很多人因为炒作或 FOMO 而购买代币,但并未真正理解项目或其商业模式。

永远不要投资你并不真正理解的东西。

在加密货币市场,如果你没有构建完善的逻辑 / 强大的底层信念,你将很难承受其波动。

第四课:叙事 > 基本面

资金流决定一切。

叙事总是跑在基本面之前。

你可能研究了一个拥有最好团队、最佳商业模式等的项目,但如果没有社区、没有叙事、没有资金流入该领域,这些都无关紧要。

相反有大量基本面「糟糕」的代币和板块因为受到关注而价格暴涨。

研究炒作,研究社区,研究叙事,这是一个注意力经济。

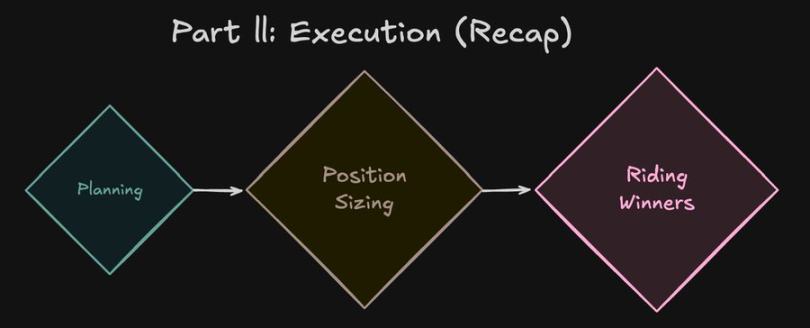

第二部分:执行

第五课:市场惩罚无计划的交易者

永远带着计划进行交易,不要盲目入场。

定义这是长期持有还是短期交易。

在进入交易之前,定义你的获利了结区域和失效点(技术面和基本面)。

没有计划的交易就是计划爆仓。

在加密货币中,管理资金回撤是长久生存的关键。

第六课:头寸规模控制

这可能是散户交易者搞砸的首要问题。

你可能在正确的时间选对了币,但如果你没有正确控制入场头寸规模,那就毫无意义。

相反,你可能在错误的时间选错了币,如果你仓位过重,这可能对你的整体投资组合造成毁灭性打击。

根据你的风险承受能力和投资组合规模,你应该设定每笔交易风险资金的比例(并且该比例应由预设的标准决定:例如,信念水平、市场条件、市值、流动性等)。

第七课:让赢家奔跑,砍掉输家

我一直在看到这个错误。

人们会卖出强势的币,换成那些不太成熟的币,试图进行补涨交易。

你应该尽可能地让赢家持续奔跑,并尽可能快地砍掉输家。

加密货币交易全是关于动量;尽可能长时间地乘浪前行,并避免被浪拍倒。

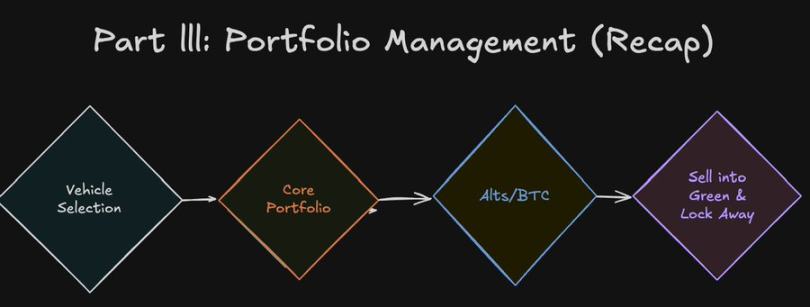

第三部分:掌握投资组合管理

第八课:工具选择

根据你处于旅程的哪个阶段,你将使用不同的工具来实现你的目标。

我当初在加密货币中赚到第一个 1 万美元所使用的工具,与我现在管理数百万美元资金所使用的工具截然不同。

较小的资金量实际上可能是一种优势,因为它允许交易低流动性的代币。有太多的错位机会可以利用。对于大鲸鱼来说,玩这些游戏根本不值得,但你可以。

一些例子包括:空投耕种、套利、链上低市值代币等。

第九课:集中,不要分散

为了保护财富,分散投资是有道理的。

但要取得成功,过度分散可能弊大于利。

我强烈建议大多数人只持有 5-10 个仓位作为其核心投资组合。

这将确保你有足够的时间来管理这些仓位,及时了解最新消息,并定期调整。臃肿的投资组合会减慢你的响应速度。

在市场泡沫期,你可以超过这个范围以抓住机会,但你真正需要的是一个由 5-10 个高信念标的构成的核心组合。

我用我的「退化」组合打破了这个规则,但它只占我总组合的 10-20%。如果你想广撒网碰运气,请在一个隔离的环境中进行,将你的大部分资金集中在高信念的玩法上。

第十课:从山寨币到比特币

记住:你的目标是积累比特币。

使用山寨币作为利润来源,然后积累比特币。

然后你会开始以不同的方式对待你的交易(例如,对比特币绘制图表、分析相对于比特币的风险因素、分析影响比特币的宏观趋势,从而影响山寨币)。

这是一种非常强大的心态,单凭它本身就能显著改善你的风险管理。

第十一课:在上涨时卖出,然后锁定利润。

在上个周期,我重新赌博式地投入了很多利润,仅仅是因为有稳定币放在交易所上,我就会不停地用它们进行赌博。

我的框架本应是这样的:

-

步骤 1:在山寨币大涨的上涨市中,总是要获利了结。

-

步骤 2:将稳定币转换回法币以「锁定」收益。或者,另一种方法是,提现到难以访问的冷钱包,这将防止过度交易。

第四部分:现代秘方

第十二课:让 AI 承担繁重工作

你应该记录你的整个加密旅程,以收集关于你自己的数据并进行改进。

你可以通过在 X 上发帖、使用 MCP 与 Notion 数据库集成、私人的 Google 文档,或者任何对你有用的方式来实现。

在记录和收集数据之后,将其分享给 AI,以帮助发现你优势中的盲点。

不使用记录 + AI 系统会让你处于巨大的劣势,而且由于加密货币是零和游戏,你真的需要争取每一寸优势。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。