本期看点

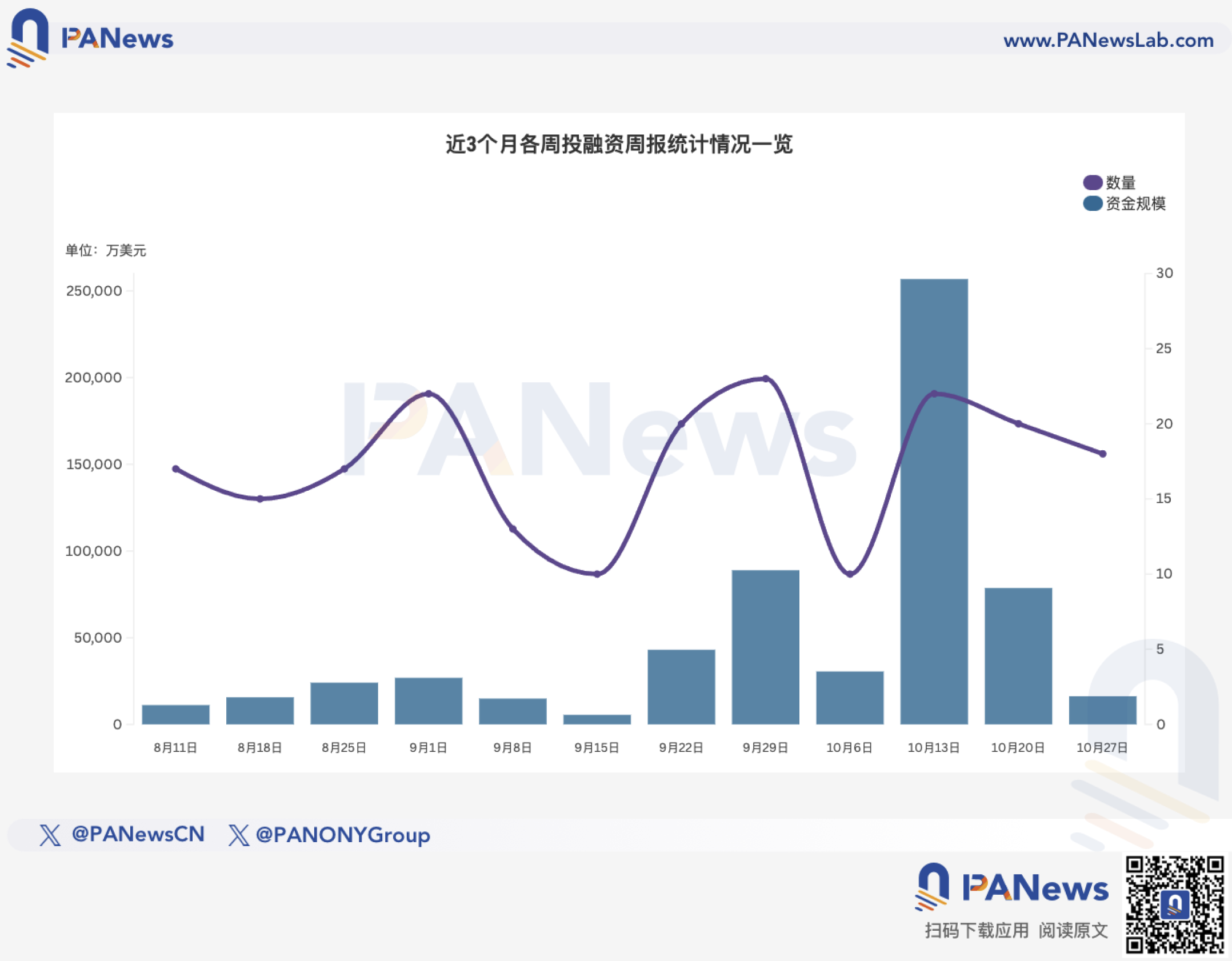

据 PANews 不完全统计,上周(10.20-10.26)全球区块链有18起投融资事件,资金总规模超1.62亿美元;此外,上市公司加密资产储备融资总额超1.1亿美元,概览如下概览如下:

- DeFi方面公布了1起投融资事件,链上流动性分配协议Turtle完成550万美元新融资,GSR等参投;

- Web3+AI赛道公布了2起投融资事件,其中AI Web3初创公司Bluwhale完成1000万美元A轮融资,UOB Venture Management参投;

- 基础设施&工具领域公布了8起投融资事件,其中YZi Labs领投了Sign 2550万美元的战略融资;

- 中心化金融领域公布了1起投融资事件,“可编程银行”Pave Bank完成3900万美元A轮融资,Tether等参投;

- 其它Web3应用方面公布了5起投融资事件,其中预测市场Limitless宣布完成1000万美元种子轮融资,1confirmation领投;

- 此外,有1家上市公司完成融资以建立加密财库,Greenlane Holdings获得1.1亿美元私募融资,以启动Berachain资金管理策略;

- DePIN赛道公布了1起投融资事件,去中心化通信与数据基础设施项目 Depinsim完成 800 万美元战略融资,Outlier Ventures 领投

DeFi

链上流动性分配协议Turtle完成550万美元新融资,GSR等参投

链上流动性分配协议Turtle宣布额外融资550万美元,使其总融资额达到1170万美元。最新一轮融资得到了Bitscale VC、Theia、Trident Digital的追加投资,机构投资者包括SNZ HOLDING、GSR、FalconX、Anchorage VC、Fasanara Capital、NRD、Tower 18 Capital、Varys Capital、Relayer、Coinix、Flowdesk、Wise3、JPEG、Reflexive、Amber、Gami Capital、Wise3 Ventures等,并获得Polygon、1inch、Gnosis、Altlayer项目创始人的支持。

据介绍,流动性分配协议Turtle借助一个透明、数据驱动的协调层,将资金与协议连接起来。该协调层能够精选投资机会、整合流动性,并将其分配至不断扩大的合作伙伴网络中。

AI

AI Web3初创公司Bluwhale完成1000万美元A轮融资,UOB Venture Management等参投

AI Web3初创公司Bluwhale宣布完成1000万美元A轮融资,该轮融资由一家全球金融机构和L1/L2区块链公司支持。本轮融资的主要投资者是UOB Venture Management,许多现有投资者参与了此轮融资,而新的支持者包括PAID Network、Sublime Ventures、High Cosmos Capital、CMY Ventures、DataSpike、NewHeritage和亚马逊人工智能主管等。据介绍,Bluwhale是一个基于区块链基础设施构建人工智能的去中心化智能网络。Bluwhale的代币生成事件 (TGE) 于2025年10月21日举行,推出其去中心化AI网络的原生代币BLUAI。

Web3社区验证平台Me3完成300万美元融资,Outlier Ventures等参投

基于AI驱动的Web3社区验证平台Me3宣布完成300万美元新一轮融资,Kakao Games、Outlier Ventures、Tokocrypto、Master Ventures、Maven Capital和Marshland参投,该公司旨在利用AI模型解决Discord等Web3社区平台中机器人和虚假用户骗取奖励的问题,新资金还将支持其代币发行计划。

基础设施&工具

YZi Labs领投了Sign 2550万美元的战略融资,IDG Capital也参与了本轮融资。Sign首席执行官Xin Yan表示,Sign致力于构建数字基础设施,并计划利用这笔资金扩充技术团队。资金还将用于拓展各种旨在推动主权区块链基础设施发展的合作伙伴关系。今年1月,Sign从YZi Labs获得1600万美元融资。Sign在种子轮、A轮和战略轮三轮融资中总共筹集了超过5500万美元。

稳定币支付平台StraitsX完成1000万美元融资,NTT DOCOMO等参投

稳定币支付平台StraitsX宣布完成1000万美元融资,UQPAY和日本数字服务提供商NTT DOCOMO参投,新资金将支持其构建与法定货币支付网络和Web3生态系统相结合的稳定币基础设施,并且扩大其区域业务。

BitcoinOS完成1000万美元融资,以扩展机构BTCFi功能

BitcoinOS完成1000万美元融资,用于拓展其机构级比特币金融工具及开发者协议。本轮融资由Greenfield Capital领投,FalconX、DNA Fund、Bitcoin Frontier Fund以及包括Anchorage Digital首席执行官Nathan McCauley和Spartan Group的Leeor Groen在内的一群天使投资人跟投。

BitcoinOS计划利用这笔资金来扩大其开发者和机构基础设施的规模,其中包括目前正与托管机构进行试点的BTC收益协议Grail Pro。该项目还支持在以太坊和Cardano等其他区块链网络间实现无需信任的跨链桥接。

稳定币和法币支付基础设施公司Cybrid的首席执行官Avinash Chidambaram透露,该公司已筹集到1000万美元的A轮融资。

Pieverse完成700万美元融资,Animoca Brands和UOB Ventures领投

Web3支付与合规基础设施初创公司Pieverse宣布完成700万美元战略融资。本轮融资由Animoca Brands和UOB Ventures联合领投,10K Ventures、Signum Capital、Morningstar Ventures等参投。Pieverse专注于通过智能合约和多链兼容性,开发可验证的链上发票、收据和支票协议,旨在实现去中心化交易的透明合规化。本轮融资将用于协议扩展、团队扩充以及多链集成开发。Pieverse是币安MVB第九季项目成员,获币安生态支持。

Web3基础设施提供商Entry完成100万美元的Pre-Seed轮融资

Web3基础设施提供商Entry宣布完成100万美元的Pre-Seed轮融资,由Modern Niagara领投,Qrecendo和Perrfin参投。此次融资结合了股权与未来代币简单协议(SAFT)要素,种子期FDV约为 2500 万美元,TGE预计约为5000万美元。Entry是一个合规原生的Web3基础设施,连接机构和去中心化金融。通过将合规性转化为可验证的链上证明,Entry允许机构引入经过验证的用户、筛选干净资产并维护实时审计跟踪。该网络由ENT代币提供支持,支持零知识计算、权益质押和AI合规性调用。

StableFi层项目TBook获得Sui基金会战略投资,总融资额达到500万美元

为数字劳动力提供服务的StableFi层项目TBook,已获得Sui基金会的战略投资,使得总融资额达到500万美元。本轮融资还吸引了HT Capital、KuCoin Ventures、Vista Labs、Bonfire Union以及来自顶级Web3项目的创始人天使投资人的参与。这笔资金将加速TBook基础设施的推广,包括即时稳定币支付、真实世界资产(RWA)分配金库以及与身份关联的结算渠道。据介绍,TBook是专为数字劳动力打造的StableFi层项目。TBook的模块化、跨链基础设施将可验证凭证与稳定币及RWA分配相结合,为数十亿创作者、自由职业者和AI智能体带来可编程金融。

APRO宣布获得YZi Labs通过EASY Residency领投的战略融资

去中心化预言机网络APRO宣布完成新一轮战略融资,由YZi Labs通过EASY Residency领投,Gate Labs、WAGMI Venture、TPC Ventures参投。资金将用于推进跨链数据基础设施、预测市场、AI与RWA(现实世界资产)场景。

其它

预测市场Limitless完成1000万美元种子轮融资,1confirmation领投

预测市场Limitless宣布完成1000万美元种子轮融资,由1confirmation领投,Collider Ventures、DCG、Node Capital、Arrington Capital、Coinbase Ventures、F-Prime、Flyer One Ventures、SID Venture Partners参投。据介绍,Limitless基于Base链构建,系Base上规模最大的预测市场。

Nubila完成800万美元种子轮融资,宣布全面进军预测市场预言机赛道

去中心化数据基础设施 Nubila 宣布完成 800 万美元种子轮融资,累计融资总额达到 1050 万美元。由 Blockspace Force 和 Quantum Holdings 领投,IoTeX、Assemblyers、Synharbour AI 以及多位顶级协议创始人参投。融资完成后,Nubila 将全面进军 Prediction Oracle(预测市场预言机)赛道,致力于将更多高价值的真实世界数据上链,并实现更高的精度与可信度。Nubila 计划未来在 Polymarket 和 Kalshi 等平台上发挥数据价值,将经过验证的真实世界智能转化为链上预测数据单元,为温度阈值、极端事件和真实世界数据等场景提供可信的结算预言机服务,连接真实世界信号与金融市场,实现透明的交易与对冲。

AI驱动的Web3约会平台METYA完成600万美元战略融资

由AI驱动的Web3约会平台METYA宣布完成600万美元战略融资,Echo3与Greenwood Global Capital领投。据介绍,Metya是一个由人工智能驱动的Web3约会平台,它将社交互动与代币经济相结合,使用户能够在全球范围内建立联系,并通过参与获得经济利益。METYA提供实时通信、内容创作和数据共享等功能,这些功能均由去中心化的社交基础设施支持。

Web3教育协议Open Campus完成500万美元战略融资,Animoca Brands、YZi Labs等参投

Web3教育协议Open Campus宣布完成500万美元战略融资,Animoca Brands、YZi Labs、Sequoia、Shima Capital、Polygon、Caladan、Kingsway Capital、GameFi Ventures参投。

Open Campus表示,此次融资加速其为教育领域打造的全新金融和信誉层。该项目计划将为全球数百万用户提供学生贷款、证书验证和支付链上服务。Open Campus基金会将利用资金:在公开市场上购买EDU代币以支撑关键价格点;通过Pencil Finance支持链上学生贷款;加速Open Campus ID、OC钱包和EDU链主网的推出。

跨链Meme币Launchpad平台Printr累计完成450万美元融资

由Bybit Venture Studio孵化并支持的首个项目Printr已累计获得450万美元融资,该初创公司准备正式推出其链抽象化代币Launchpad平台。其中,250万美元来自由Axelar、Sui基金会、Flow区块链、Draper Dragon和Bitscale Capital支持的pre-seed轮融资,另外200万美元则来自包括Mantle EcoFund、Mirana Ventures、L1D、Sfermion、Flowdesk和知名天使投资人在内的种子轮扩展融资。

据介绍,Printr基于Axelar与LayerZero等跨链通信协议构建,使用户能够在Base、BNB Chain、以太坊、Mantle、Solana等多个区块链上同时发行Meme币。该项目旨在修复流动性碎片化问题,帮助代币创作者接入多元的加密生态系统。

DAT

(此类交易不计入本期融资周报统计)

上市公司Greenlane Holdings获得1.1亿美元私募融资,以启动Berachain资金管理策略

Greenlane Holdings, Inc.(纳斯达克代码:GNLN)宣布,已完成一项私募股权投资于公开市场(PIPE)交易的定价与签约。本交易由Polychain Capital领投,Blockchain.com、Kraken、North Rock Digital、CitizenX、dao5等投资方共同参与。公司拟将本交易所得净款项用于实施数字资产资金管理策略,并收购Berachain区块链的原生加密货币BERA。BERA将成为公司的主要资金储备资产。

中心化金融

“可编程银行”Pave Bank完成3900万美元A轮融资,Tether等参投

为数字资产和人工智能时代打造的可编程银行的Pave Bank完成3900万美元A轮融资,Accel领投,Tether Investments、Wintermute、Quona Capital、Helios Digital Ventures等参投。Pave Bank自诩为一家商业银行,旨在为有法币和数字资产双重需求的客户提供服务。这家在格鲁吉亚获得牌照的银行表示,将利用这笔资金“扩大监管覆盖范围,加速产品开发,继续构建机构级基础设施,并扩大其全球市场的客户覆盖面”。

Moon完成880万美元融资,成为首家在全球发行比特币预付卡的香港上市公司

香港上市公司Moon Inc.(港交所代码:1723)宣布完成约6550万港元(约合880万美元)融资,本轮融资由多家比特币矿企及投资者通过新股及可转债形式支持。Moon Inc.计划将资金用于泛亚扩张,首站包括泰国与韩国,并推出支持比特币交易的预付卡产品。该公司结合电信预付卡分销渠道及区块链技术,用户可无需复杂钱包设置即可购买、储存及转移比特币。Moon Inc.此前已被Sora Ventures与UTXO Management控股,并被《资本杂志》评为“香港十大创新企业”之一。

(该融资不计入本期融资周报统计)

DePIN

Depinsim完成800万美元战略融资,开启连接即价值时代

去中心化通信与数据基础设施项目 Depinsim 宣布完成 800 万美元战略融资,由 Outlier Ventures 领投,DWF Labs等多家知名机构参投。

Depinsim 基于 eSIM 技术,致力于打造 Free Mobile Internet Protocol,让用户在连接中获得价值。通过融合 eSIM 通信、数据挖矿与区块链激励机制,用户可通过激活矿机、完成任务或使用流量获得收益,用于 eSIM 流量充值或兑换稳定币 PIN,实现“连接—收益—再连接”的价值闭环。Depinsim 正在构建一个由用户驱动的全球连接经济,让通信网络从单一服务演变为可共享、可增值的去中心化体系。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。