为什么ETH和BTC在比特币ETF流入和以太坊ETF流出时激增

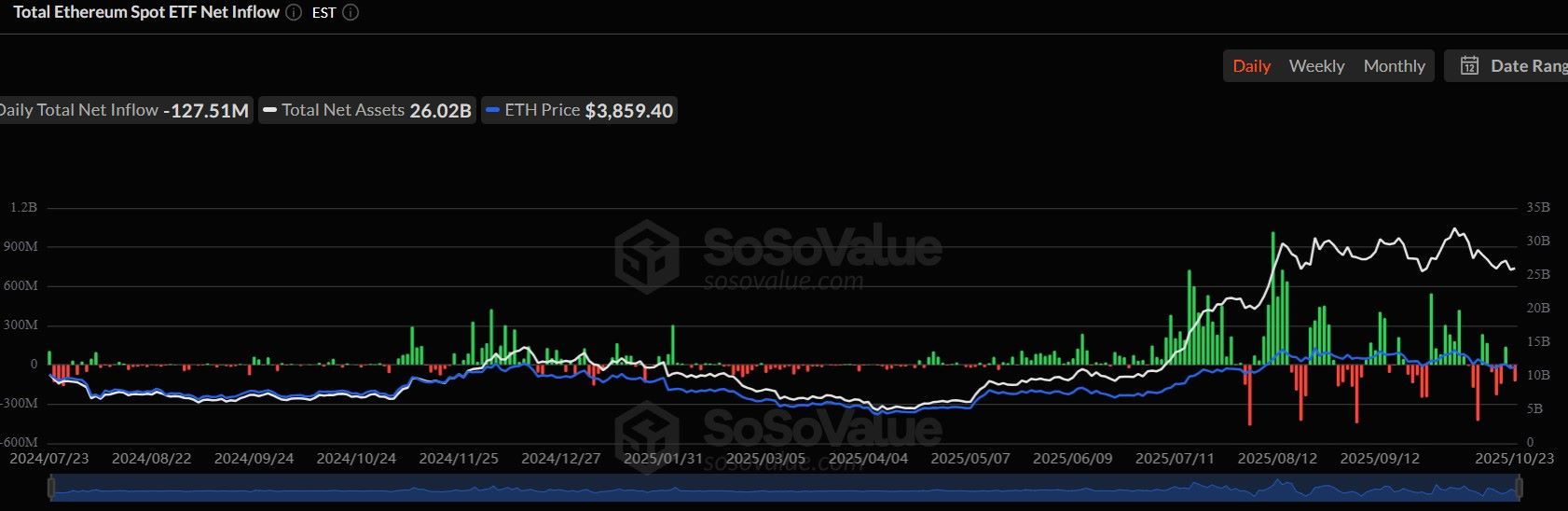

加密市场再次展现出惊人的转折——比特币ETF流入正在上升,而以太坊ETF流出则快速增长。根据最新的SoSoValue数据(10月23日),$ETH现货ETF总共流出了1.28亿美元,九家公司的ETF没有一家公司获得新的流入。

另一方面,$BTC现货交易所交易基金记录了2033万美元的流入,其中贝莱德的IBIT领衔,单独增加了1.08亿美元。

这两种资产之间的突然差异让交易者和投资者感到好奇。这是因为今天即将发布的美国CPI数据 FOMC会议,还是市场上发生了更深层次的事情?

比特币ETF流入激增:机构为何大举下注

交易所交易基金的流入再次成为焦点,显示出即使在市场放缓时,大投资者仍然信任该代币。资产增加了2033万美元,贝莱德的IBIT增加了1.08亿美元,但为什么?根据今天的比特币新闻,这里有两个流入的原因。

牛市周期仍然强劲:数据显示“海豚钱包”(持有100–1000 BTC的钱包)仍在购买。这意味着牛市周期尚未结束。大型基金和国库也在关键事件之前增加了该代币,例如今天的美国CPI数据发布和下周的FOMC会议。

强劲的机构需求:这些稳定的比特币ETF流入表明,大型投资者将其视为安全的数字资产。

为什么以太坊ETF流出在上升——不是恐慌,只是调整

尽管代币流出达到了1.28亿美元,但这并不意味着投资者失去了信任。事实上,ETH价格USDT本周上涨了3.9%,达到了3947美元。代币流出的背后有两个原因:

在反弹后获利了结:大型投资者似乎在专家看到以太坊三重底部形态并接近4000美元时选择获利了结。在CPI数据和美国通胀新闻等重大新闻之前获利是正常的。

短期再平衡:机构在新的经济更新之前正在重新平衡他们的投资组合。这是短期的谨慎,而不是恐惧。

真实的危险:59亿美元的期权到期增加了波动性

今天,59.1亿美元的加密期权即将到期,根据Ash Crypto。这可能会使价格在短时间内剧烈波动。

与此同时,投资者正在关注美中贸易谈判和即将召开的FOMC会议。这些事件可能会影响ETH流出与BTC事件,因为投资者在两者之间转换以管理风险。

BTC价格激增分析与以太坊价格预测

今天比特币价格约为111,004.99美元,24小时内上涨2%。交易量降至503.5亿美元,但市场看起来稳定。它保持在110K以上,如果比特币ETF流入继续,可能会升至112K–114K。

在减半和2025年稳定的上市基金需求之后,它甚至可能触及135K–150K。

另一方面,以太坊ETF流出显示出短期疲软,在其交易接近3947美元时,主要突破前的表现。根据最新的ETH新闻,这种山寨币在3850美元到4000美元之间,如果全球最大的加密货币保持稳定,可能会测试4100美元。

随着CPI数据的发布和即将召开的降息会议,如果代币流出转变为流入,那么它可能会瞄准5200美元到5800美元。

结论

比特币ETF流入和以太坊ETF流出之间的差异并不意味着一个在赢而另一个在输。这表明机构正在调整他们的投资组合,以应对重大经济事件。

交易者密切关注今天预计为3.1%的美国CPI数据和下周的FOMC会议。如果通胀数据低于预期或美联储给出较温和的语气,投资者可能会重新关注这些资产。

免责声明:本文仅用于教育目的,不提供任何投资建议。请始终进行自己的研究,因为加密市场存在风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。