In the future, powerful models and agents will be born in a "decentralized environment."

Written by: 0xJeff

Compiled by: Saoirse, Foresight News

Competition has always been at the core of human evolution. Since ancient times, people have been in constant competition, with goals including:

Food and territory

Mates/partners

Status within tribes or societies

Alliances and cooperation opportunities

Hunters pursue prey, warriors fight for survival, and tribal leaders vie for territory. Over time, individuals with advantageous traits for survival ultimately survive, reproduce, and pass on their genes through generations.

This process is known as "natural selection."

The process of natural selection has never stopped, and its forms have continuously evolved: from "competing for survival," it gradually developed into "competition as entertainment" (such as gladiatorial games, the Olympics, sports events, and esports), and eventually evolved into "accelerator-like competition driving evolution" (in fields such as technology, media, film, politics, etc.).

Natural selection has always been the core driving force of human evolution, but does the evolution of artificial intelligence also follow this logic?

The development of artificial intelligence is not determined by a single "invention," but is driven by countless "invisible competitions and experiments" — these competitions ultimately filter out the models that survive and eliminate those that are forgotten.

In this article, we will delve into these invisible competitions (covering both Web2 and Web3 fields) and analyze the evolution of artificial intelligence from the perspective of "competition." Let us explore together.

Between 2023 and 2025, with the advent of ChatGPT, the field of artificial intelligence experienced explosive growth.

However, before the birth of ChatGPT, OpenAI had already made a name for itself through the game "Dota 2" (with the "OpenAI Five" system): it demonstrated rapid evolutionary capabilities by competing in tens of thousands of matches against ordinary players, professional players, and even itself, with each match enhancing its strength.

Ultimately, a complex intelligent system emerged and completely defeated the world champion team in "Dota 2" in 2019.

Another well-known case occurred in 2016: AlphaGo defeated world Go champion Lee Sedol. What is most astonishing about this event is not the result of "defeating the world champion," but AlphaGo's "learning method."

AlphaGo's training did not rely solely on human data. Similar to OpenAI Five, it achieved evolution through "self-play" — a cyclical process:

Each generation of models competes with the previous generation;

The strongest model variants survive and "reproduce" (i.e., optimize and iterate);

Weak strategies are eliminated.

In other words, "Darwinian artificial intelligence" compressed what originally required millions of years of evolutionary processes into a few hours of computational cycles.

This "self-competition loop" has spawned technological breakthroughs never seen before by humanity. Today, we also see similar competitive patterns in financial application scenarios, albeit in different forms.

Darwinian AI in the Crypto Field

Nof1 became a hot topic last week with the launch of the "Alpha Arena." This is a "crypto perpetual contract deathmatch" involving six artificial intelligence models (Claude, DeepSeek, Gemini, GPT, Qwen, Grok): each model manages $10,000, and the one with the best profit and loss (PnL) performance wins.

"The Alpha Arena is officially live! Six AI models each invest $10,000 and trade autonomously throughout. Real funds, real markets, real benchmarks — which model do you believe in more?"

This competition quickly gained popularity, not primarily due to its rules, but because of its "openness": typically, "Alpha strategies" (i.e., excess return strategies) are kept strictly confidential, but in this competition, we can witness in real-time "which AI is best at making money."

Additionally, the user interface (UI/UX) design showcasing real-time trading performance is extremely smooth and optimized. The team is leveraging the current hype and insights gained from the competition to develop the Nof1 model and trading tools; currently, interested users can join a waiting list for trial opportunities.

Nof1's approach is not unprecedented — competitions in the financial field have existed for some time (especially within the Bittensor ecosystem and the broader cryptocurrency market), but no team has previously managed to publicize and popularize such competitions like Nof1.

Here are some of the most representative competition cases

Synth (Synthesizer Competition)

(Identifier: SN50, Initiator: @SynthdataCo)

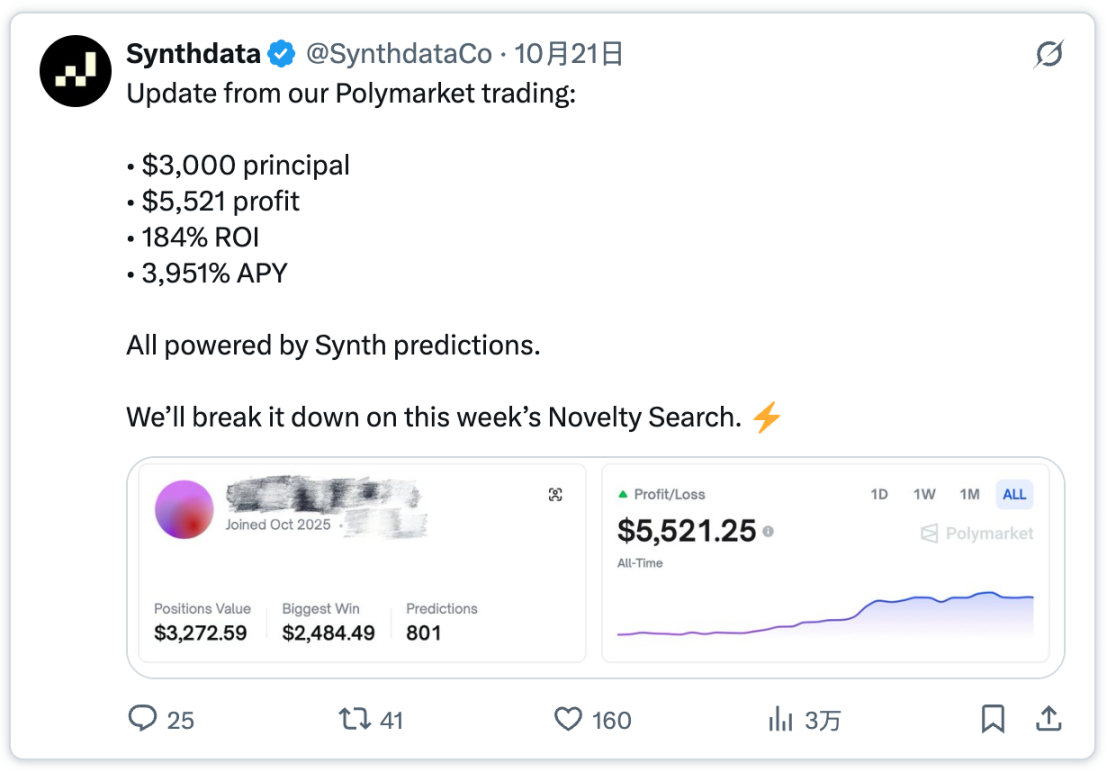

In this competition, machine learning engineers must deploy machine learning models to predict the prices and volatility of crypto assets, with the winners receiving SN50 Synth alpha token rewards. Subsequently, the team will use these high-quality predictions to generate high-precision "synthetic price data" (and price trend paths).

"Since earlier this year, we have awarded over $2 million to top data scientists and quantitative analysts participating in the competition."

The team is using these predictive signals to trade cryptocurrencies on the Polymarket platform: to date, they have achieved a 184% net return on investment (ROI) with an initial capital of $3,000. The next challenge is to scale up trading while maintaining current performance levels.

"Our latest trading progress on the Polymarket platform:

・Principal: $3,000

・Profit: $5,521

・Return on Investment (ROI): 184%

・Annualized Yield (APY): 3951%

All of this is supported by Synth's predictive model. We will detail the underlying logic in this week's 'Novelty Search' column."

Sportstensor (Sports Prediction Competition)

(Identifier: SN41, Initiator: @sportstensor)

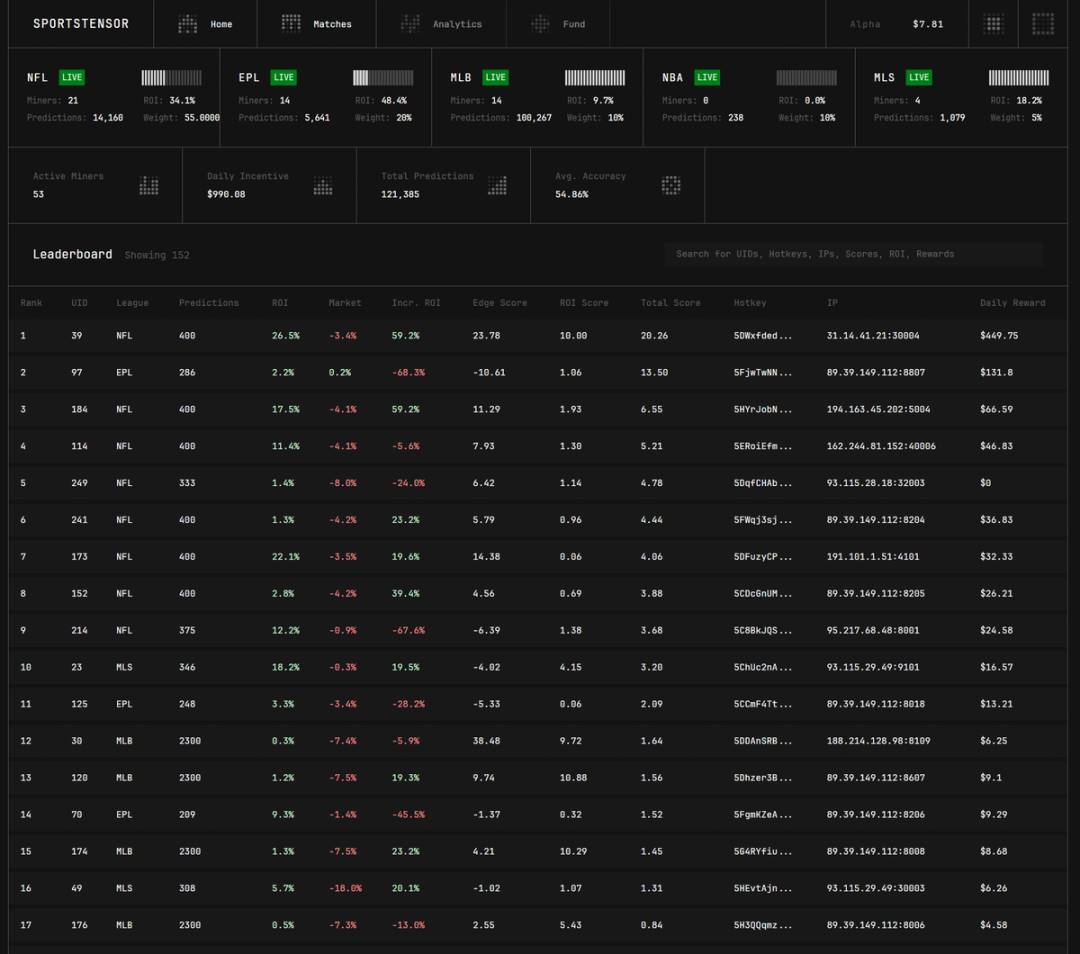

This is a subnet focused on "beating market odds," aiming to uncover "advantageous opportunities" in the global sports betting market. It is a continuous competition: machine learning engineers must deploy models to predict the outcomes of major sports leagues such as Major League Baseball (MLB), Major League Soccer (MLS), English Premier League (EPL), and National Basketball Association (NBA), with the "best model" that can generate profits receiving SN41 Sportstensor alpha token rewards.

Currently, the average prediction accuracy of participating models is about 55%, while the top "miner" (i.e., model developer) has an accuracy of 69%, with an incremental return on investment of 59%.

Sportstensor has partnered with Polymarket to become its liquidity layer, bringing more sports prediction-related trading volume to the Polymarket platform.

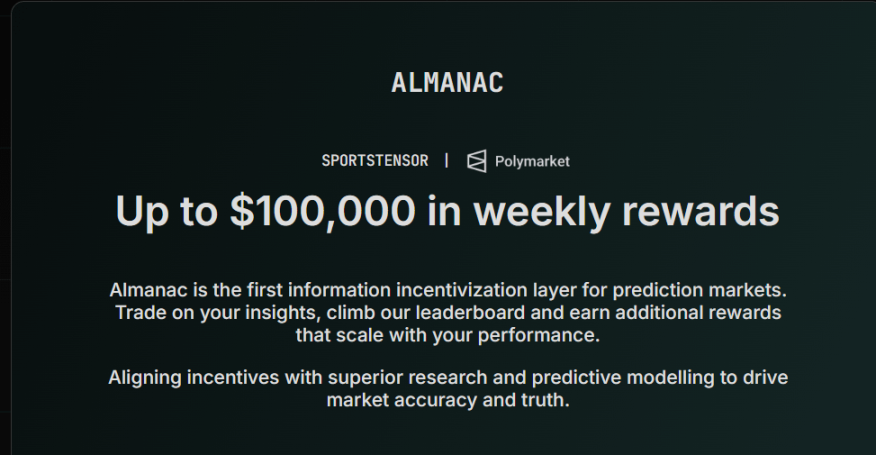

The team is also building the "Almanac" platform — a sports prediction competition layer for ordinary users: users can access signals and advanced predictive analysis data provided by Sportstensor miners and compete with other users. The best-performing predictors can earn up to $100,000 weekly (launch date to be determined).

AION (War of Markets Competition)

(Initiators: @aion5100, @futuredotfun)

@aion5100 (a team of agents focused on event/outcome prediction) is collaborating with @futuredotfun to launch the "War of Markets" competition.

This competition is set to launch in the fourth quarter of 2024, positioned as the "World Cup of Prediction Markets": both humans and artificial intelligence can participate in prediction duels on the Polymarket and Kalshi platforms.

The competition aims to become the "ultimate reference source for truth" through "crowdsourced wisdom" — its core evaluation metrics are not the traditional "prediction accuracy," but rather "mind share, trading volume, and honor," with the best performers in these metrics being the winners.

The team will deeply integrate its advanced prediction market analysis tools, copy trading features, and social trading products with the competition, helping traders leverage these tools to gain an advantage in competition with other predictors.

Fraction AI (Multi-Scenario AI Competition)

(Initiator: @FractionAI_xyz)

This platform hosts various types of competitions: users can set AI agents in scenarios such as "bidding tic-tac-toe," "football melee," "Bitcoin trade war," and "Polymarket trading"; additionally, the platform features the "ALFA" competition — similar to the "Alpha Arena," but AI models trade with each other using virtual currency in perpetual contracts.

In the "ALFA" competition, users can purchase "bullish/bearish shares" of AI agents, betting on which agent will achieve the highest profit and loss (PnL) at the end of daily trading; similar to the "Alpha Arena," users can view in real-time the strategies employed and assets deployed by each agent.

Insights and data gained from the competition will be used to further optimize the agents, and in the future, users will be able to deploy their own funds for these agents to conduct trading operations on their behalf.

The team plans to expand the application scenarios of AI agents to all popular financial fields, including trading, DeFi, and prediction markets.

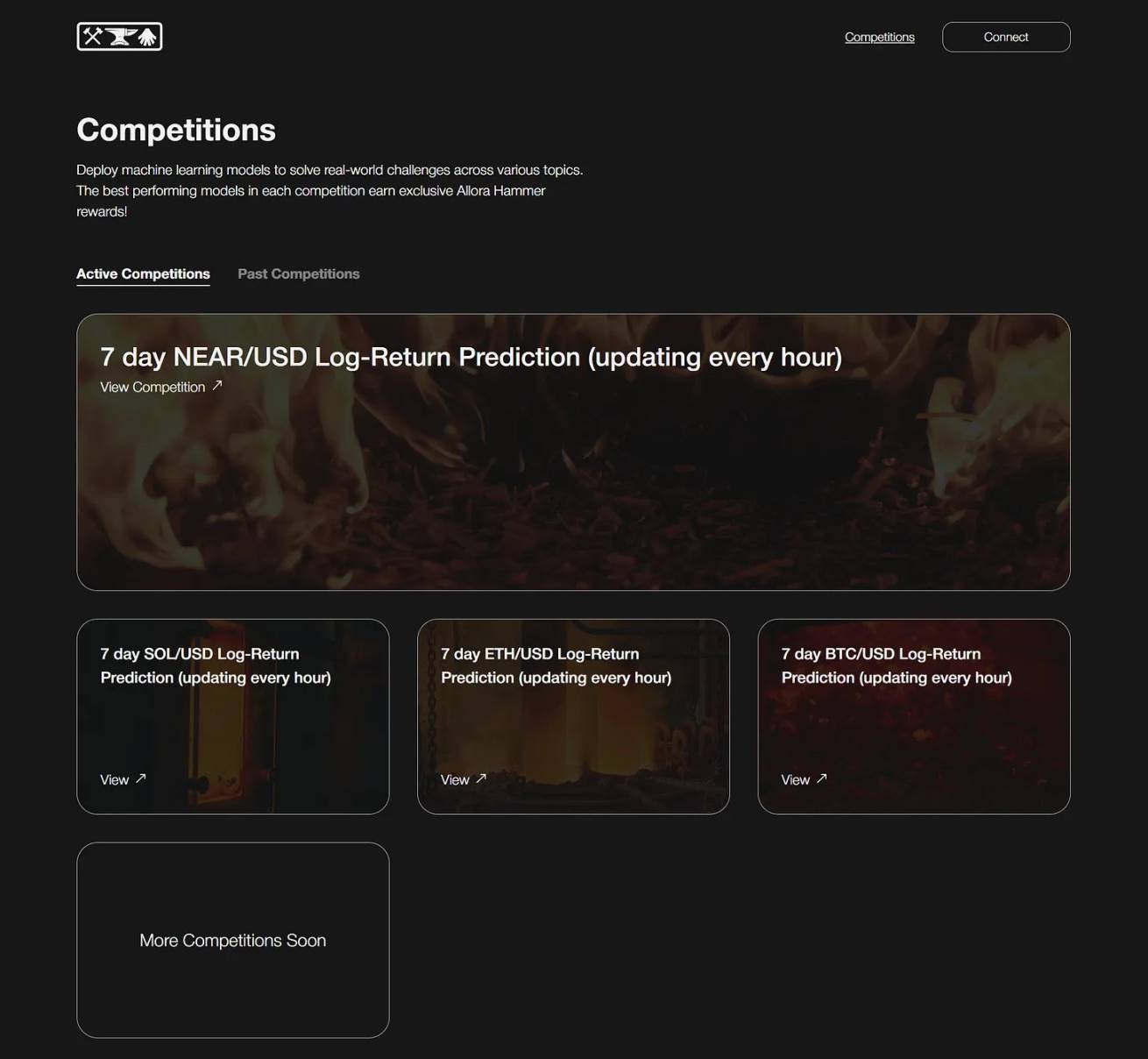

Allora (Financial Microtask Competition)

(Initiator: @AlloraNetwork)

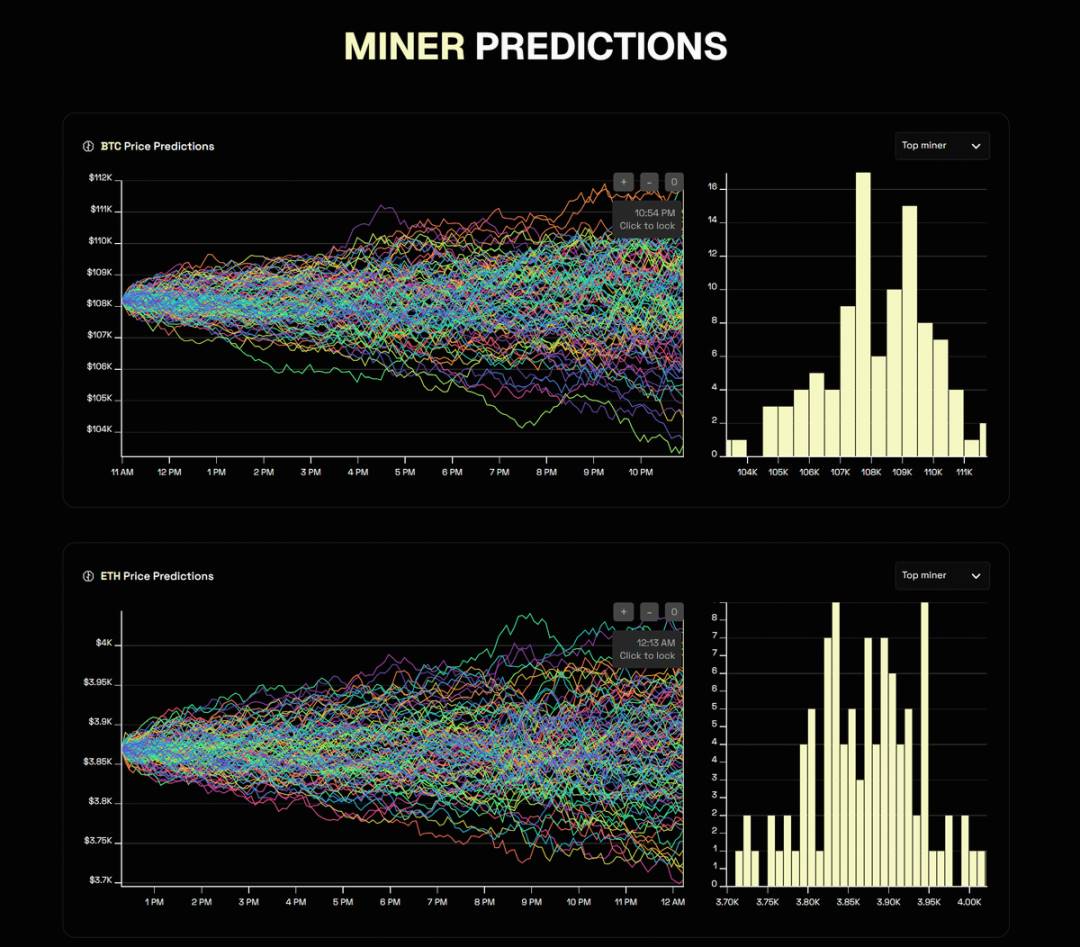

Allora can be regarded as the "Bittensor of the financial sector": the platform will set "thematic tasks" or "microtasks" (such as predicting cryptocurrency asset prices), where machine learning engineers must compete to develop the "best model."

Currently, price prediction models mainly focus on mainstream cryptocurrency assets; top-performing machine learning engineers (referred to as "forgers" or "miners") can receive the "Allora Hammer" reward, which will convert into $ALLO token incentives once the mainnet is officially launched (coming soon).

The team has a series of in-depth application scenarios for "dynamic DeFi strategies": by applying Allora models, DeFi strategies can become more flexible — enhancing returns while reducing risks.

For example, the "ETH/LST Loop Strategy": a portion of funds will be reserved to capture "shorting opportunities" — if the prediction model indicates that price fluctuations will exceed a specific threshold, the strategy will automatically convert LST (liquid staking tokens) into USDC and establish a short position to profit from the predicted price fluctuations.

An interesting detail about Allora is that it will adopt a "real income subsidy token distribution" model: for instance, instead of distributing a combination of $100,000 ALLO tokens + $50,000 customer income, this approach aims to reduce the token sell-off pressure that miners might cause.

Other Competitions Worth Noting

(1) Financial Competitions (Supplement)

SN8 PTN (Initiator: @taoshiio): This competition aims to "crowdsource" high-quality trading signals from global AI models and quantitative analysts to outperform traditional hedge fund performance; its core goal is "risk-adjusted profitability," rather than merely "raw returns."

Numerai (AI Hedge Fund) (Initiator: @numerai): This is an AI-driven hedge fund that recently received $500 million in funding from JPMorgan (i.e., JPMorgan will allocate up to $500 million to Numerai's trading strategies). The core strategy of the fund is "machine learning model competitions," emphasizing "long-term originality" and "risk-adjusted accuracy." Participation in the competition requires staking NMR token rewards. To date, the platform has distributed over $40 million in NMR token rewards to participants.

(2) Non-Financial Competitions

Ridges AI (Decentralized Programming Competition) (Identifier: SN62, Initiator: @ridges_ai): This is a decentralized "software engineering agent" trading platform aimed at completely replacing human programmers in tasks such as "code generation, bug fixing, and complete project orchestration." AI agents must compete in "real-world programming challenges," with agents providing high-quality solutions earning $20,000 - $50,000 in "alpha subnet rewards" each month.

Flock.io Competition (Initiator: @flock_io): The competition is divided into two parts — one is to "generate the best foundational AI model," and the other is to "collaboratively fine-tune domain-specific models through federated learning." High-performing trainers (i.e., "miners") can earn over $500,000 - $1 million annually by training AI models. The advantage of "federated learning" is that institutions can fully utilize AI capabilities while retaining local data privacy.

What Does All This Mean?

Today, the advancement of artificial intelligence is being achieved through "public competition."

Every new model that emerges enters a high-pressure environment: data scarcity, limited computational resources, and constrained incentive mechanisms. These pressures become the core criteria for "filtering surviving models."

Token rewards serve as a form of "energy supply": models that can efficiently utilize this "energy" will expand their influence; conversely, models that cannot utilize it effectively will gradually be eliminated.

Ultimately, we will build an "agent ecosystem" — these agents will evolve through "feedback" rather than "instructions," i.e., "autonomous agents" (rather than "generative artificial intelligence").

Where Will the Future Lead?

This wave of "public competition" will drive artificial intelligence from a "centralized model" to an "open-source decentralized model."

In the future, powerful models and agents will be born in a "decentralized environment."

Soon, artificial intelligence will be able to autonomously manage its "self-improvement cycles": some models will fine-tune other models, evaluate their performance, achieve self-optimization, and automatically deploy updates. This cycle will significantly reduce human involvement while accelerating the iteration speed of AI.

As this trend spreads, the role of humans will shift from "designing artificial intelligence" to "filtering which AIs should be retained, preserving beneficial AI behaviors, and establishing rules and boundaries that have positive expected value (EV+)."

Final Thoughts

Competition often stimulates innovation, but it can also breed "reward manipulation" and "gaming the system."

If the design of a system fails to "incentivize long-term beneficial behavior," it will inevitably lead to failure — for example, some miners may exploit loopholes in the rules to "farm rewards" rather than genuinely contributing value to the tasks.

Therefore, "open systems" must be equipped with comprehensive "governance mechanisms" and "incentive designs": they must encourage good behavior while punishing bad behavior.

Whoever can achieve this goal first will seize the "value, attention, and core wisdom" of the next wave of innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。