This year, Bitcoin's performance has almost lagged behind all major asset classes. By the fourth quarter of 2025, its performance has significantly underperformed compared to gold, the Nasdaq index, the S&P 500 index, the Hang Seng index, and the Nikkei 225 index. Investors who hoped that President Trump's support would bring a favorable market and bought Bitcoin around his inauguration in 2025 have only seen a meager return of just over 5%.

This article will delve into Bitcoin's recent weak performance, focusing on its key supply and demand dynamics. We will deconstruct Bitcoin's evolving price trends by analyzing the behavior of long-term holders, changes in mining activities, and the flow of funds into ETFs.

Bitcoin's "Disappointing Year"

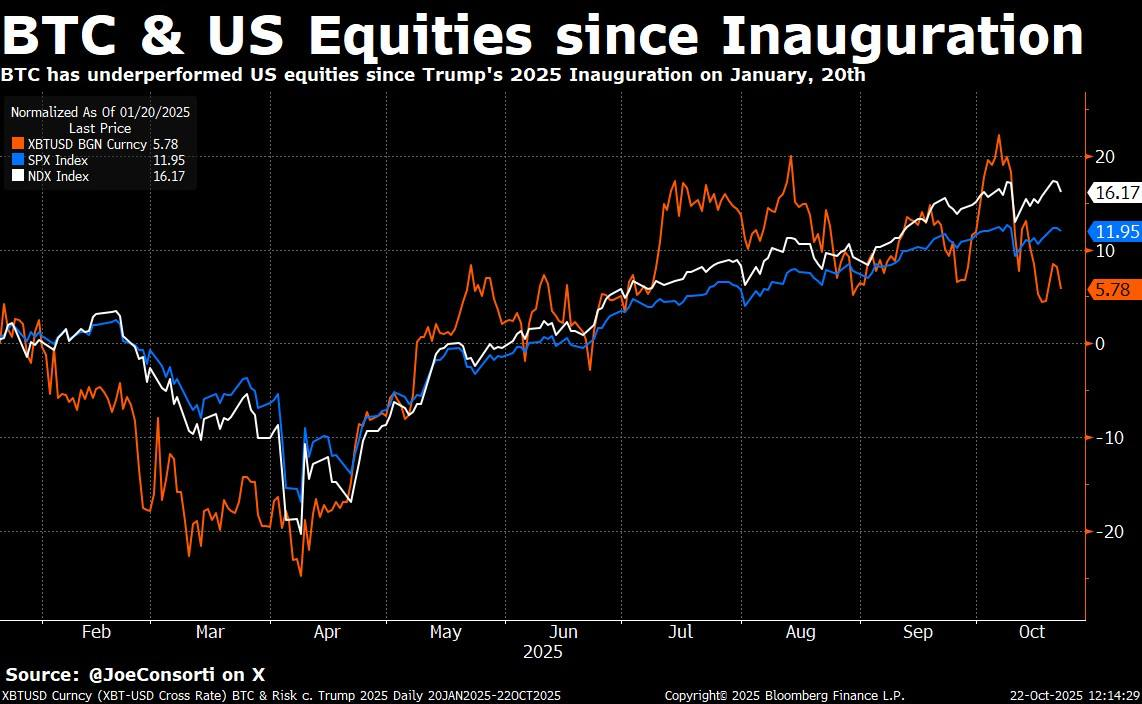

The above chart shows that since Trump's inauguration in 2025, Bitcoin's performance has significantly lagged behind the U.S. stock market. The gains in the Nasdaq and S&P 500 indices have outpaced Bitcoin by over 100%, while Bitcoin's trajectory has remained relatively flat.

If you bought Bitcoin on inauguration day (January 20, 2025), your investment return would only be 5.78%. In contrast, major stock indices like the Nasdaq and S&P 500 have far outperformed Bitcoin during the same period. Even traditional safe-haven asset gold has performed much better than Bitcoin.

Where is the Selling Pressure? Long-term Holders and Miners

$100,000: The Psychological Profit-Taking Level for Old Players

Bitcoin's price has been hovering around the psychological level of $100,000. As the price stagnates at this level, long-term holders seem to be engaging in risk aversion (de-risking).

Whenever BTC > $100,000, the selling by "old players" increases.

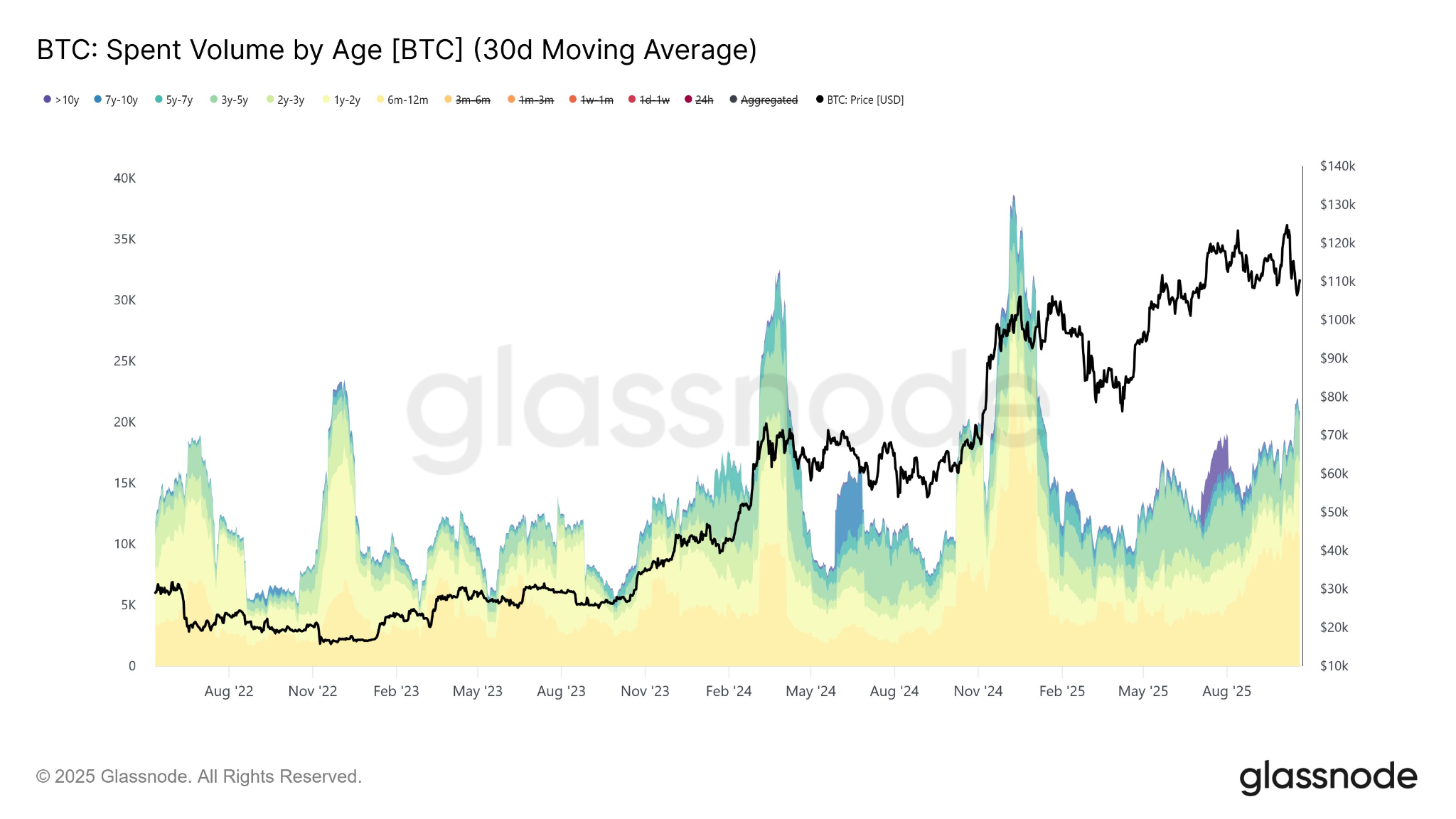

The above chart (shown in purple and blue) indicates that the "Spent Volume" of long-term holders has increased, suggesting that more Bitcoin "old hands" are choosing to sell after holding for many years. The chart reveals that trading activity of old coins significantly increases when the BTC price is above $100,000, reinforcing the notion that early Bitcoin holders are liquidating their positions at current price levels.

We speculate that as other asset classes (especially in the AI sector) have surged this year, many tech-focused "old players" seem to be rotating out of Bitcoin into other areas to diversify and seize new opportunities. This shift has created ongoing upward selling pressure, limiting each rebound this year.

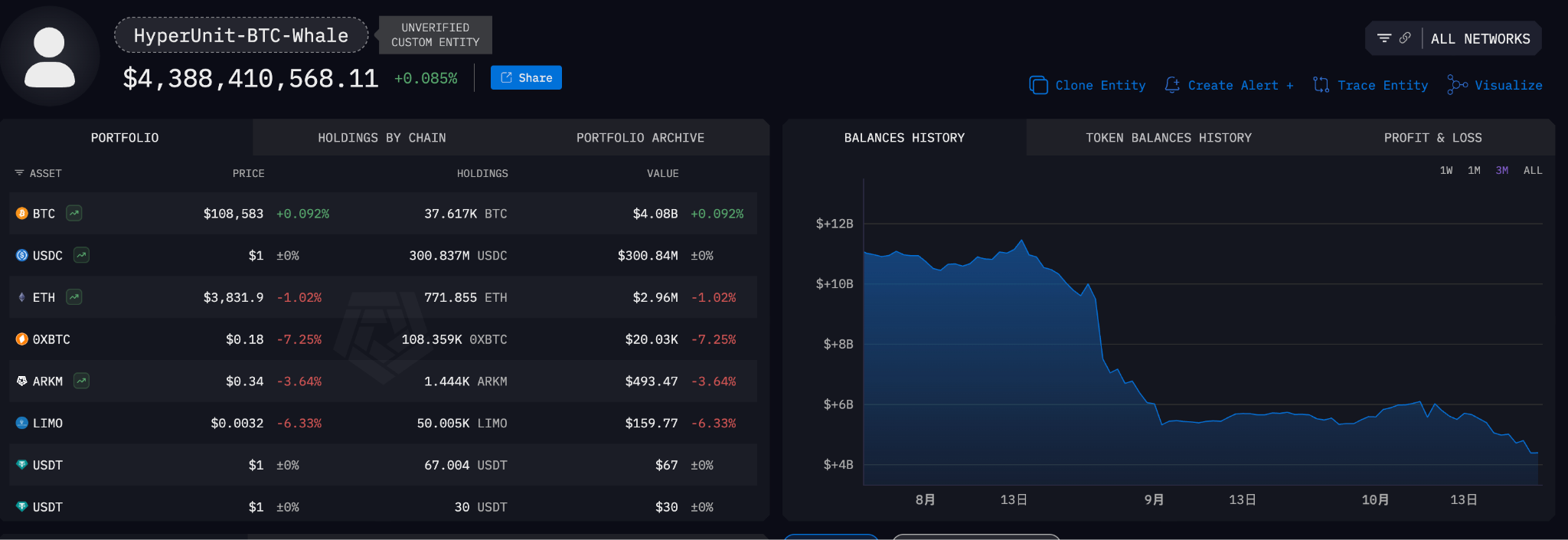

Tracking Bitcoin Whales

This selling pressure may lead to a frustrating market environment, causing Bitcoin to remain in a volatile state this year rather than experiencing meaningful breakthroughs. To trigger a potential upward trend, Bitcoin may first need to break below the $100,000 support level to effectively wash out these sellers.

One of the most important wallets driving this behavior can be tracked on Arkham Intelligence. In October alone, this wallet deposited over $600 million worth of Bitcoin into various exchanges, which is a key indicator to monitor whether market pressure is easing. You can explore this wallet here.

Bitcoin Miners: From "Network Guardians" to "AI Data Centers"

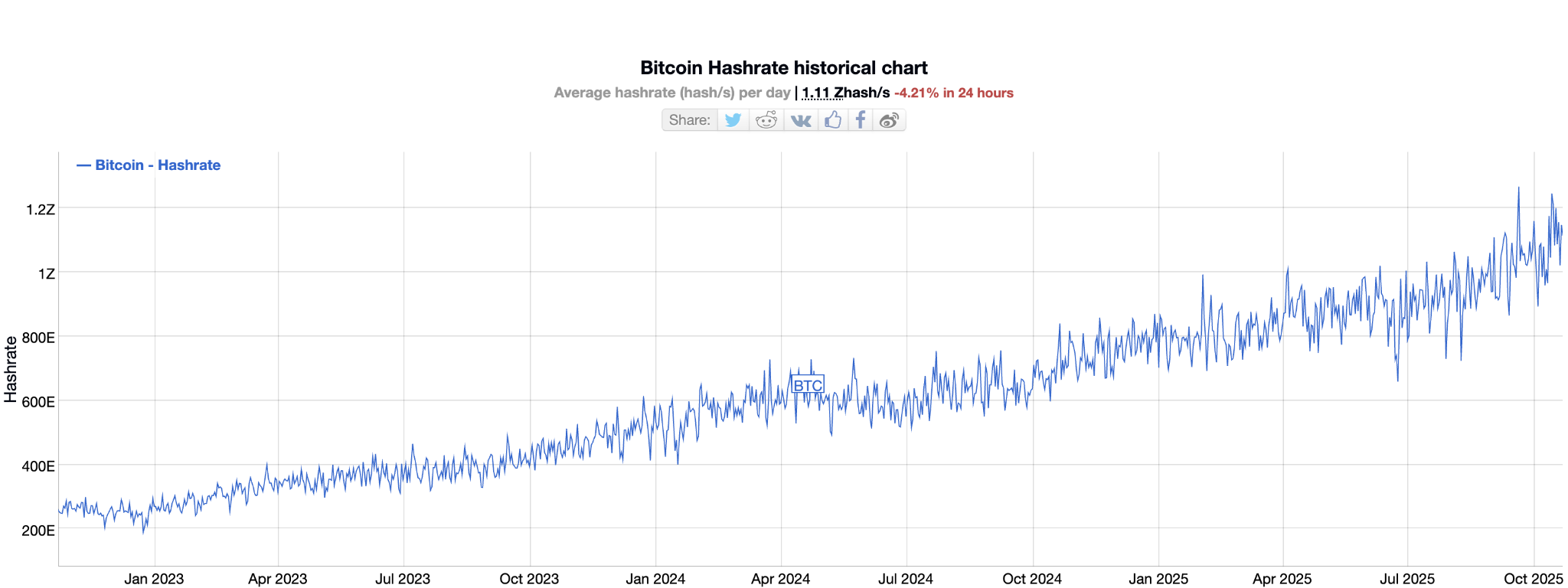

As Bitcoin miners shift part of their operations from Bitcoin mining to AI-driven high-performance data centers (HPC), the security of Bitcoin may face new risks. The miners' transition to AI could weaken Bitcoin's decentralized network, potentially leading to a decline in hash rate in the long run.

- Core Scientific ($CORZ): Signed a 12-year HPC hosting agreement with CoreWeave, converting existing 100 megawatt (MW) infrastructure and paving the way for broader merger votes by the end of the month.

- Iris Energy ($IREN): Expanded its AI cloud to over 23,000 NVIDIA GPUs and achieved "preferred partner" status with NVIDIA.

- TeraWulf ($WULF): Secured a 10-year AI hosting contract exceeding 200 MW, valued at up to $8.7 billion.

- Bitdeer ($BTDR): As one of the most aggressive participants, plans to convert part of its Norwegian Tydal mine (175 MW) and Ohio Clarington facility (570 MW capacity) into AI data centers by the end of 2026, aiming for over 200 MW of AI IT load.

- CleanSpark ($CLSK) / Riot Platforms ($RIOT): Even traditional pure mining companies like CleanSpark and Riot Platforms are hiring "Chief Data Center Officers" and designing new campuses around "dual-use computers."

The Impact of Weakened Bitcoin Network: Unseen Risks

Source: BitInfoCharts

The decline in hash rate due to miners no longer maintaining Bitcoin's network security may reduce the network's security. A less secure Bitcoin network diminishes its appeal to institutional investors, which could lead to decreased demand and ultimately lower prices.

Miners, who once provided critical support for Bitcoin's infrastructure, are now turning their attention to more profitable businesses in AI and cloud services. This migration raises concerns about the future prospects of Bitcoin as a store of value and decentralized asset.

Demand Dynamics: ETF Inflows and Government Seizures

ETF: The Biggest Demand Driver

This chart shows the correlation between Bitcoin ETF inflows and price movements. When ETF inflows are strong, Bitcoin prices rise; however, since mid-July, the lack of inflows has led to stagnation in Bitcoin prices, highlighting the important role of ETFs in driving demand.

In 2025, Bitcoin ETF inflows are highly positively correlated with Bitcoin prices. It indicates that earlier this year, Bitcoin ETF inflows significantly drove price increases—however, since July 10, inflows have stagnated, and Bitcoin's price has followed suit.

Limited Growth in ETF Inflows While institutional capital flowing through Bitcoin ETFs is seen as a strong indicator of Bitcoin's maturation as an asset class, the ongoing lack of inflows suggests that institutional interest may have peaked.

U.S. Government Seizures and Their Impact on Bitcoin's Viability

One of Bitcoin's core narratives is "against government control." However, recent events are challenging this premise. The U.S. government recently seized billions of dollars worth of Bitcoin through law enforcement actions. Although there are no issues with Bitcoin's security itself, this action has raised market concerns about Bitcoin as a censorship-resistant asset. When an asset can potentially be seized by the government, its value as a "hedge against government" diminishes. This enhanced government censorship capability may also be one reason some "old players" have lost confidence and chosen to sell.

Safe-Haven Shift: The Quiet Rise of Privacy Coins

As the transparency of the Bitcoin blockchain (easy to monitor) and government intervention increase, some investors seeking true anonymity are beginning to turn to privacy coins (like Zcash).

The ZEC/BTC exchange rate chart shows that privacy coins like Zcash (ZEC) may benefit when Bitcoin's viability is questioned.

Conclusion: Bitcoin is at a Crossroads

In summary, Bitcoin's weak performance in 2025 is the result of combined supply and demand factors:

- Supply Side (Selling Pressure): Long-term holders are taking profits at the $100,000 level, while miners are attracted to higher profits in AI, bringing potential network security risks.

- Demand Side (Buying Pressure): ETF inflows have stagnated since mid-July, while government regulation and seizure actions have shaken some investors' confidence in its decentralized value.

Future Outlook: The key question is whether Bitcoin can regain upward momentum or will it fall into a prolonged sideways trend under continued supply pressure? Investors should closely monitor the following two key signals to gauge a shift in market direction:

- Whales stop depositing Bitcoin into exchanges.

- The net asset value (NAV) and inflows of Bitcoin ETFs show renewed growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。