For Solana, ICM is not only an extension of performance competition but also a redefinition of ecological structure.

Recently, the Meme ecosystem of Solana has once again heated up. The Chinese Meme "Solara," initiated by the community and recognized by Solana, has seen its market value surpass $15 million in a short period, making its launch platform Trends.fun a new focal point. Meanwhile, Pump.fun, a leading Meme launch platform in the Solana ecosystem, has recently opened a new X account called "Spotlight," which aims to accelerate the construction of ICM.

This series of market movements is not coincidental but rather a systematic strategic shift for Solana. ICM has been regarded by Solana officials as the strategic core for the future, aiming to elevate the internet from an information transmission layer to a value circulation layer. By fully putting issuance, pricing, and settlement on-chain, ICM attempts to reconstruct the underlying logic of the global capital market, allowing funds and users to achieve direct circulation without intermediaries and with high efficiency on an open network. For Solana, this is not only a technical performance competition but also an ecological reconstruction. Below, CoinW Research Institute will explore the roadmap of ICM and recent ecological trends.

1. Overview of ICM

1. Concept of ICM

ICM (Internet Capital Markets) refers to a new type of financial infrastructure based on blockchain and decentralized technology, aiming to put the entire process of issuance, pricing, and trading on-chain, allowing any user with internet access to participate directly in the capital market. Unlike traditional models that rely on intermediaries such as brokers and investment banks, ICM achieves trustless financing and investment through smart contracts, significantly lowering the barriers to asset issuance and investment. Its concept can be seen as a continuation of the development of crypto financing, from ICOs, IEOs, IDOs, to Launchpads, with each iteration reinforcing openness and liquidity, while ICM further integrates these mechanisms to build a unified on-chain capital market. The chairman of the Solana Foundation stated that the ultimate vision of ICM is "to create a global financial infrastructure through blockchain, allowing everyone with internet access to participate in asset investment and trading."

In May of this year, the concept of ICM quickly gained popularity due to the launch of new platforms in the Solana ecosystem, such as Believe. Believe is centered around the logic of "attention as capital," triggering on-chain issuance through social dissemination, allowing users to complete token creation, pricing, and trading within minutes. ICM not only continues the process of disintermediation in the crypto market but also represents a deep reconstruction of financing structures and value discovery mechanisms, with the potential to evolve on-chain markets from localized innovation to a system-level financial infrastructure.

2. ICM Roadmap

In July 2025, the Solana team, in collaboration with Anza, Jito Labs, Drift, and other institutions, released the "Internet Capital Markets Roadmap." According to the roadmap, the technical route of ICM is divided into three phases: short-term, mid-term, and long-term.

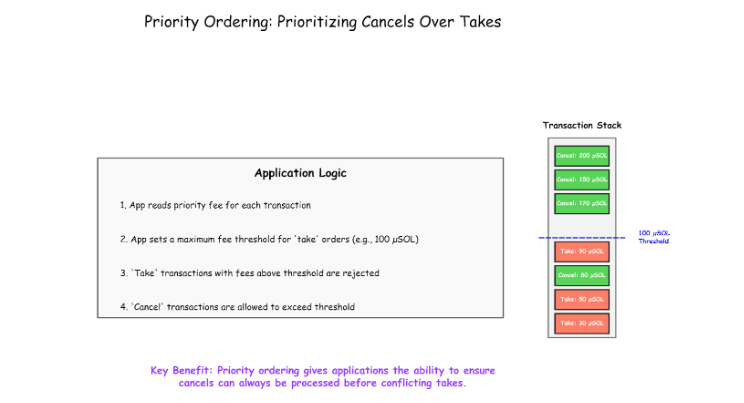

• Short-term: The focus is on launching the block assembly market BAM developed by Jito Labs and advancing the trading implementation of Anza. BAM is a next-generation high-performance trading execution system that operates in a Trusted Execution Environment (TEE), providing verifiable and privacy-protected execution space for validators and developers, allowing applications to customize trading order logic to achieve effects close to ACE. It enables the on-chain Central Limit Order Book (CLOB) to achieve matching efficiency comparable to centralized exchanges while maintaining transparency and certainty, significantly enhancing the fairness and trust of execution. BAM was launched on the mainnet at the end of September. Meanwhile, Anza is continuously improving the trading implementation mechanism by optimizing the QUIC protocol and introducing a unified scheduling system, allowing trades to be more stably completed on-chain within the same block period, thus building a low-latency, high-reliability execution layer foundation for Solana.

• Mid-term: The mid-term plan focuses on the DoubleZero fiber network, Alpenglow consensus protocol, and Asynchronous Program Execution (APE) mechanism. DoubleZero is a high-performance fiber network designed for distributed systems, capable of reducing transaction latency to sub-hundred milliseconds and increasing bandwidth by about ten times, while enhancing network stability and attack resistance through multicast acceleration and traffic filtering layers. Alpenglow is a new consensus protocol that shortens block confirmation time from about 12.8 seconds to 150 milliseconds while simplifying consensus logic, laying the foundation for Multi-Concurrent Block Production (MCL) and asynchronous execution. APE further shortens transaction landing time by removing execution replay paths. These three upgrades will collectively build Solana's low-latency, high-bandwidth execution foundation, providing more efficient infrastructure for decentralized capital markets.

• Long-term (after 2027): The long-term goal is to achieve a multi-concurrent block producer mechanism and an Application Control Architecture (ACE) with protocol-level enforcement. The MCL model allows multiple validators to produce blocks simultaneously, reducing geographic latency and censorship risk while improving global information synchronization efficiency; ACE will empower applications to customize matching logic and trading order at the protocol level, creating a truly open and programmable microstructure. At that time, Solana may become the infrastructure for the most liquid decentralized capital market globally, providing the technical foundation for the comprehensive realization of internet capital markets.

Source: anza.xyz

2. Recent Popular Projects in the ICM Ecosystem

1. MetaDAO

MetaDAO is currently the highest market cap project within the ICM concept, backed by Paradigm, and is seen as a new engine for decentralized fundraising. Its core innovation lies in introducing the Futarchy (prediction market governance) model proposed by economist Robin Hanson, which decides project proposals based on market prices rather than token holder votes, thus achieving more efficient and market-oriented governance. All USDC raised on the platform is held in an on-chain treasury, and the system allows participants to bet on the potential impact of proposals through a prediction market mechanism. If the majority believes that a proposal will help increase the token price, the price of the "Yes" (bullish) position in the market will be higher than that of the "No" (bearish) position. When the price of the "Yes" market is at least 1.5% higher than that of the "No" market, it indicates a strong consensus in the market that the proposal has a positive impact on token value, at which point the team is allowed to use treasury funds. This design ensures that the use of funds must be market-validated, mechanically preventing subjective decision-making, fund misuse, or short-term arbitrage behavior.

At the same time, MetaDAO has designed strict anti-rug and performance incentive mechanisms to balance security and incentive effects. Among them, 20% of the raised funds and 50% of the project tokens will be locked in a liquidity pool controlled by the protocol to prevent the team from cashing out early; the team incentive portion will be gradually unlocked only after the token price reaches predetermined stage goals. Notably, MetaDAO has also introduced a "3-month average price verification mechanism," meaning that the token price must remain above the corresponding stage's target average price for three consecutive months to trigger the corresponding incentive unlock. Additionally, there is an 18-month lock-up period, which reinforces the long-term construction orientation and protects the interests of investors and the community. Through the triple mechanisms of Futarchy governance, on-chain treasury custody, and performance incentives, MetaDAO protects investor safety while encouraging the team to focus on long-term value growth and sustainable operations. Currently, its platform token META has a market cap of approximately $173 million.

2. Believe

Believe pioneered the model of tweeting as a token, significantly lowering the barriers to token issuance. Users only need to reply “@launchcoin + token name” under any tweet to automatically mint a token. Once created, the token automatically generates a trading pool through a bonding curve, achieving initial price discovery. When the token's market cap reaches $100,000, it is considered to have "graduated" and can enter the deep liquidity pool of the Solana decentralized trading platform Meteora, gaining stronger trading capacity. The platform's revenue distribution is also innovative, with creators and the Believe platform each receiving 50% of the transaction fees, creating continuous incentives. The project's fundraising adopts a phased unlocking mechanism to ensure the long-term and transparent use of funds. The platform token LaunchCoin's market cap once exceeded $400 million, rapidly popularizing the ICM concept.

However, Believe still faces certain uncertainties. The flywheel mechanism of LaunchCoin has not yet been disclosed, and the founding team has repeatedly announced updates that have not materialized, leading to a market cooldown from its peak, with the community showing a wait-and-see attitude towards subsequent narratives; the lack of sniper protection and liquidity support mechanisms has resulted in most tokens remaining at a small-cap stage, with limited capital depth, making it difficult to support larger price breakthroughs. Overall liquidity remains concentrated in the on-chain market, lacking strong sentiment-driven leaders. The Believe platform has generated 53,720 types of tokens, but only about 104 of them are active. Aside from LaunchCoin itself, the upside potential of other tokens is limited. Currently, LaunchCoin has a market cap of $67.02 million.

Source: believescreener

3. Trends.fun

On October 20, the Chinese Meme "Solara," initiated by the community and recognized by Solana, completed its token launch on Trends.fun, quickly igniting market enthusiasm. Other related tokens issued by Trends.fun have also become the new focus of PVP. Trends.fun is a recently emerging content financialization platform, with the core idea of enabling social content to achieve "instant issuance and tokenization." Users can mark any post on X through the Trends.fun social tokenization bot to automatically generate corresponding tokens, creating a direct mapping between social dissemination, community consensus, and token price. Unlike traditional ICM platforms, Trends.fun emphasizes a value discovery mechanism driven by social data, meaning that the higher the content's attention, the more active the token trading, and the price fluctuations can more accurately reflect market sentiment and consensus, thus constructing a new economic form where content equals assets.

The economic model of Trends.fun is based on a bonding curve mechanism, dynamically adjusting prices driven by social popularity, achieving a direct linkage between content influence and market value. The platform's fee structure is clear: creating a token requires a payment of approximately 0.016 SOL, which includes the on-chain creation fee charged by Solana and the metadata storage fee charged by Metaplex, with no additional fees charged by the platform itself; buying and selling tokens and DEX transactions require a 1% transaction fee. In terms of revenue distribution, "Creators" can earn 20% of the transaction fees from trades related to their associated trend tokens, while "Trendors" can earn 5% of the transaction fees from each trade related to their trending X posts. The remaining portion is used for system maintenance and ecological development. All unclaimed rewards will automatically expire three months after generation, creating a certain incentive timeliness and deflationary effect.

4. ICM.RUN

ICM.RUN is a decentralized project incubation platform built on the ICM concept, aiming to establish an open entrepreneurship and financing system within the Solana ecosystem. ICM.RUN is governed by a DAO as its core governance structure, allowing anyone to initiate fundraising and incubation proposals on the platform; investors can participate in project crowdfunding and gain governance rights. The overall process includes founders submitting applications, mentors voting for evaluation, DAO onboarding for incubation, token injection into the treasury, and subsequent distribution. Accepted projects are required to allocate about 1% of their token supply to the DAO treasury for future proportional distribution to ICM token holders. All operations are completed on-chain, ensuring transparency and traceability.

The core mechanism of ICM.RUN revolves around value capture and ecological collaboration. The platform achieves token value recirculation through a three-layer structure: the first layer is the incubation layer, where the DAO selects projects through mentor voting and shares early token profits; the second layer is the ecological layer, where the platform collaborates with multiple Launchpads on Solana to assist in the incubation and launch of quality projects; the third layer is the NFT incentive layer, providing community members with rights such as whitelists, airdrops, and presales. Overall, the design of ICM.RUN aims to replace traditional venture capital models with decentralized incubation and market-oriented governance, lowering the early financing threshold for projects and increasing the transparency of fund usage. Currently, the project team is planning to launch a Venture Arm under the DAO to expand on-chain incubation channels for traditional entrepreneurial teams. As of now, the market cap of its platform token ICM is approximately $17.9 million.

Source: icm.run

5. DoubleZero

DoubleZero is an infrastructure focused on optimizing underlying network performance within the Solana ecosystem and is an important technical component for realizing the ICM vision. DoubleZero proposes the IBRL (Increase Bandwidth, Reduce Latency) architectural concept, aiming to significantly reduce consensus latency and enhance system throughput performance by improving node communication paths and reducing network jitter and congestion. The goal of DoubleZero is to achieve an average latency of less than 10 milliseconds and a multiple increase in throughput capacity on the Solana mainnet, thereby providing performance support for capital market applications such as high-frequency trading and real-time settlement.

From a technical positioning perspective, DoubleZero is a high-performance dedicated fiber network layer designed for distributed systems, playing a foundational performance support role within the Solana network and ICM ecosystem. In addition to performance optimization, DoubleZero can also serve as a powerful data filtering layer to protect the network from denial-of-service (DoS) attacks and abnormal traffic, alleviating the overload pressure on validators and RPC nodes, allowing node resources to focus on executing tasks and expanding block space, thus enhancing the overall processing efficiency and scalability of the network. Through this structure, DoubleZero provides core underlying communication and protection capabilities for the ICM built on Solana.

3. Conclusion

ICM is currently Solana's most strategically significant long-term direction, aiming to upgrade the internet from an information transmission layer to a value circulation layer, fully putting asset issuance, price formation, and settlement on-chain, and constructing an open, transparent, and low-friction global capital network. This system aims to lower the barriers to capital formation, enhance market efficiency and verifiability, thereby promoting the development of blockchain from a transaction carrier to a financial infrastructure. For Solana, ICM is not only an extension of performance competition but also a redefinition of ecological structure, integrating network performance, market mechanisms, and governance structures into a cross-layer capital operation framework.

However, ICM is still in its early stages, and its overall system has not yet formed a closed loop. Although Solana officials have clarified the technical direction through the roadmap, including important modules such as the BAM trading execution layer and the DoubleZero network layer, these infrastructures are still undergoing performance validation; on the application side, projects like MetaDAO, Believe, and Trends.fun have shown different dimensions of attempts, but ecological collaboration and liquidity integration remain limited. Currently, ICM resembles a systemic consensus rather than a mature market structure. Whether it can truly materialize in the future will depend on the realization of underlying performance, the sustainability of market mechanisms, and the level of development of the institutional environment. As these elements gradually improve, Solana may transform from a high-performance public chain into a financial infrastructure supporting global value circulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。