Perp DEX (Decentralized Perpetual Contract Exchange) has become one of the most explosive and competitive sectors in current on-chain applications. OKX Ventures aims to systematically outline the complete evolution of Perp DEX from its inception, explosion, to differentiation through this research, and to deeply analyze its representative projects at different stages, showcasing how this core sector continuously reshapes itself amidst the alternation of bull and bear markets and technological iterations.

Based on an in-depth review, we will focus on dissecting the two early dominators, dYdX and GMX, exploring why they transitioned from prominence to decline, and further discussing how new forces like Hyperliquid and Aster have managed to break through in fierce competition: is it due to innovative architectural design? A reconstruction of trading philosophy? Or the evolution of community economic models?

Through a systematic comparison of successes and failures, this research aims to reveal the most critical, challenging, yet enlightening "trade-off moments" in the construction of Perp DEX, providing reusable experiences and deep insights for the new generation of entrepreneurs in product, technology, and market strategies.

Market Background

1.1 History of Perp DEX Market Development

The core of the first stage is the validation of concepts and the dawn of Layer 2 (2017 – 2021). The theory of Perpetual DEX/Perpetual Swap can be traced back to the release of the dYdX white paper “dYdX: A Standard for Decentralized Margin Trading and Derivatives” in 2017 and the release of the BitDEX white paper “BitDEX: A decentralized BitMEX using Priceless Financial Contract” by Hart Lambur in 2019. In 2020, dYdX launched the first BTC perpetual contract on the Ethereum mainnet, putting theory into practice, and that same year, Perpetual Protocol launched its v1 version on the xDai chain, with its innovative virtual AMM mechanism allowing users to trade without order book matching. However, these early explorations were invariably constrained by the performance limitations of the Ethereum mainnet. High gas fees and slow transaction confirmations made user experience unable to compete with centralized exchanges (CEX), with daily trading volumes hovering only between several million to several billion dollars, which was insignificant compared to the hundreds of billions on CEX at that time.

The real turning point came in 2021, with the maturation of Ethereum Layer 2 technology, Perp DEX experienced its first rapid growth. dYdX seized the opportunity to migrate its product to StarkWare's Layer 2 solution, significantly enhancing speed and reducing costs. On this basis, dYdX issued governance tokens and launched trading mining in August of the same year, which instantly ignited the market. On September 28, 2021, dYdX's daily trading volume surged to approximately $9 billion, surpassing the total of all other DEXs and even exceeding the data from mainstream CEXs like Coinbase during the same period. This milestone event proved for the first time, at scale, the potential of Perp DEX to challenge CEX, and pointed the entire industry in a direction: embracing Layer 2 is the only way to achieve growth.

The narrative of the second stage is dominated by the innovation of the AMM model and the rise of GMX (2021 – 2023). After dYdX validated the feasibility of L2 order books, the market began to explore more diverse protocol models. GMX, which launched alongside the Arbitrum mainnet in September 2021, became the flagbearer of this new wave. GMX innovatively combined multi-asset liquidity pools (GLP) with oracle price feeds, using the GLP pool as the counterparty for all traders, achieving unique advantages of zero slippage trading and LP impermanent loss. GMX's success was attributed to its precise market positioning (capturing the early explosion of the Arbitrum ecosystem), LP-friendly incentive mechanisms, and the market trust shift brought about by the collapse of centralized giants like FTX in 2022. As a result, GMX rapidly grew to dominate the Perp DEX space during this cycle.

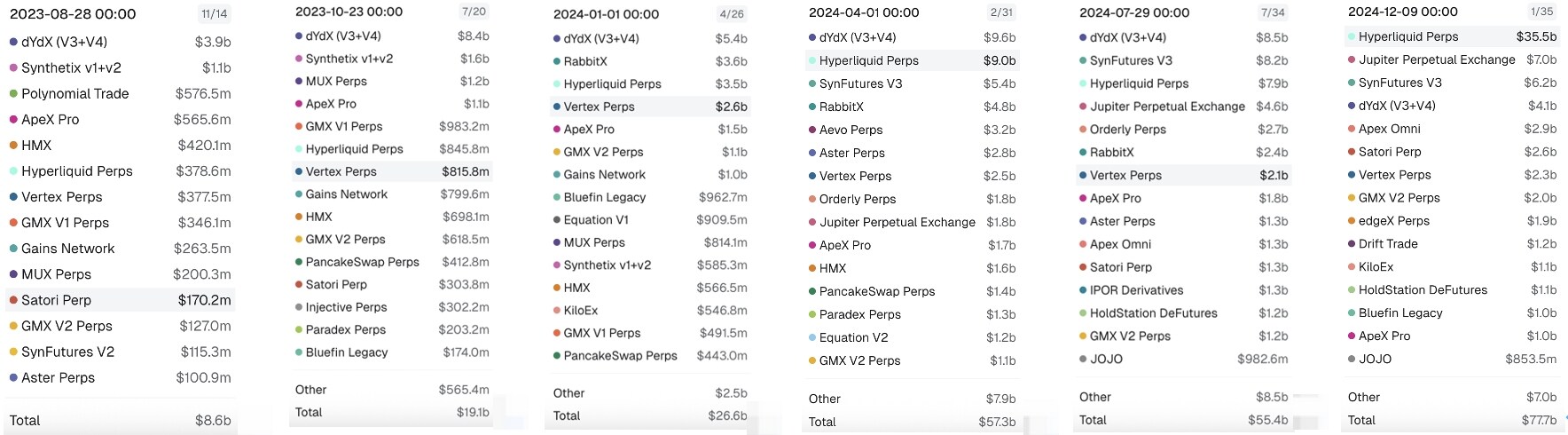

At the same time, projects like Synthetix's synthetic asset perpetual contracts and Gains Network's oracle trading further expanded the landscape of Perp DEX. The characteristics of this stage were diversification of models and intensifying competition. Despite the market entering a bear phase, the trading volume of Perp DEX remained resilient, steadily increasing its share of the crypto derivatives market. A key trend was the sharp decline of dYdX's market share from 73% in January 2023 to 7% by the end of 2024, marking the end of its era of dominance. The intensifying competition also spurred a route dispute over underlying infrastructure: dYdX announced a shift to an independent Cosmos application chain (v4), while high-performance DEXs like Mango and Drift emerged on Solana, and dedicated application chains like Sei began to rise, laying the groundwork for the arrival of the third wave.

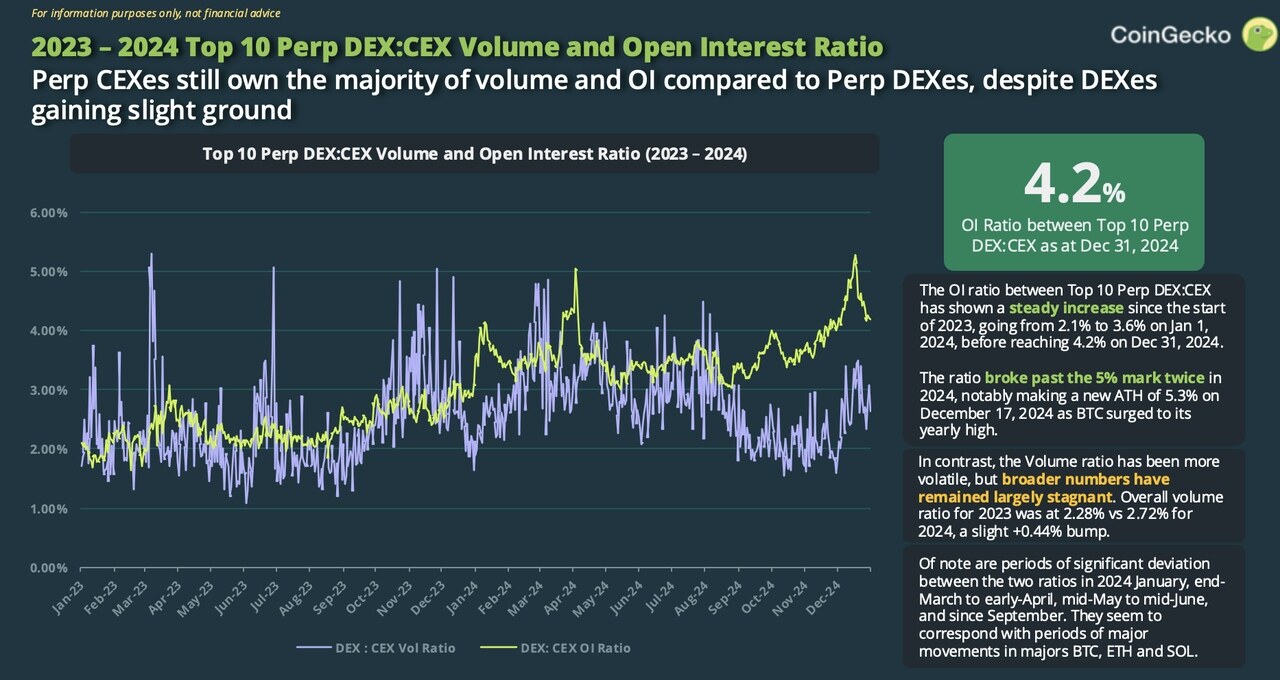

Chart: The trading volume and open interests of perp DEX as a percentage of perp CEX show a generally slow upward trend from 2023 to 2024.

The third stage is the high-performance revolution led by Hyperliquid (2023 to present). The core feature of this wave is the pursuit of extreme on-chain performance and a professional trading experience, aiming to truly match CEX in speed and depth. Hyperliquid launched in early 2023, achieving exponential growth with its "dedicated high-performance chain + CLOB order book" technical architecture and aggressive market incentives. Its ignition point was the HYPE token airdrop on November 29, 2024, which allocated 31% of the total supply to early users, greatly stimulating community enthusiasm. Its growth momentum continued unabated after the airdrop, reaching a monthly trading volume of $160 billion by December 2024, with a market share climbing to about 66%, and setting a single-day historical high of $21 billion on January 19, 2025.

The rise of Hyperliquid has completely reshaped the market landscape. In 2024, the total trading volume of perpetual DEXs across the industry reached $1.5 trillion, a year-on-year increase of 138%, with Hyperliquid alone contributing over half in the fourth quarter. By mid-2025, Hyperliquid held over 75% of the market share, while former kings dYdX and GMX both fell to single digits. In response to the impact, established projects are also actively adapting: dYdX officially launched its technologically advanced independent Cosmos chain (v4) in November 2023, achieving decentralization of the matching engine, but failed to reverse the decline in market share; GMX, through gradual improvements, also could not stop the loss of users. Meanwhile, Jupiter in the Solana ecosystem rapidly climbed to second place in the market, demonstrating the strong gravitational pull of a robust ecosystem.

The third wave has clarified future technological trends: high-performance on-chain order books have become the focus. The success of Hyperliquid proves that a dedicated chain can achieve a unity of decentralization and high performance. However, this also raises new trade-offs, namely the performance advantages of dedicated chains versus their shortcomings in ecological composability. As noted by Multicoin Capital, dedicated chains face issues such as insufficient cross-chain asset support and reliance on bridges. To address this, projects like dYdX and Hyperliquid are also working to bridge these gaps, such as by integrating native USDC or launching EVM-compatible sub-chains. It is foreseeable that the future Perp DEX sector will continue to explore the trade-off between "performance" and "ecosystem," seeking the best combination of speed, depth, and DeFi composability.

1.2 Market Data

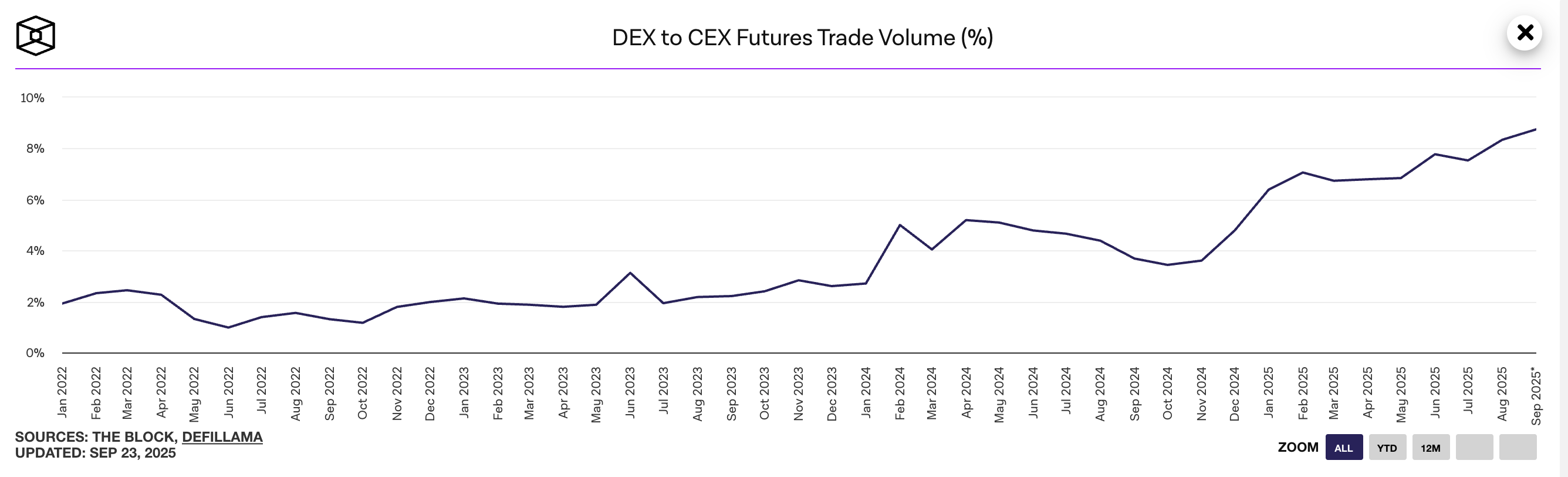

Chart: DEX trading volume divided by CEX Volume indicator: Spot DEX is 20%, Perp DEX is 8%; this indicator for Perp DEX has seen rapid growth after mid-2024.

Chart: DEX trading volume divided by CEX Volume indicator: Spot DEX is 20%, Perp DEX is 8%; this indicator for Perp DEX has seen rapid growth after mid-2024.

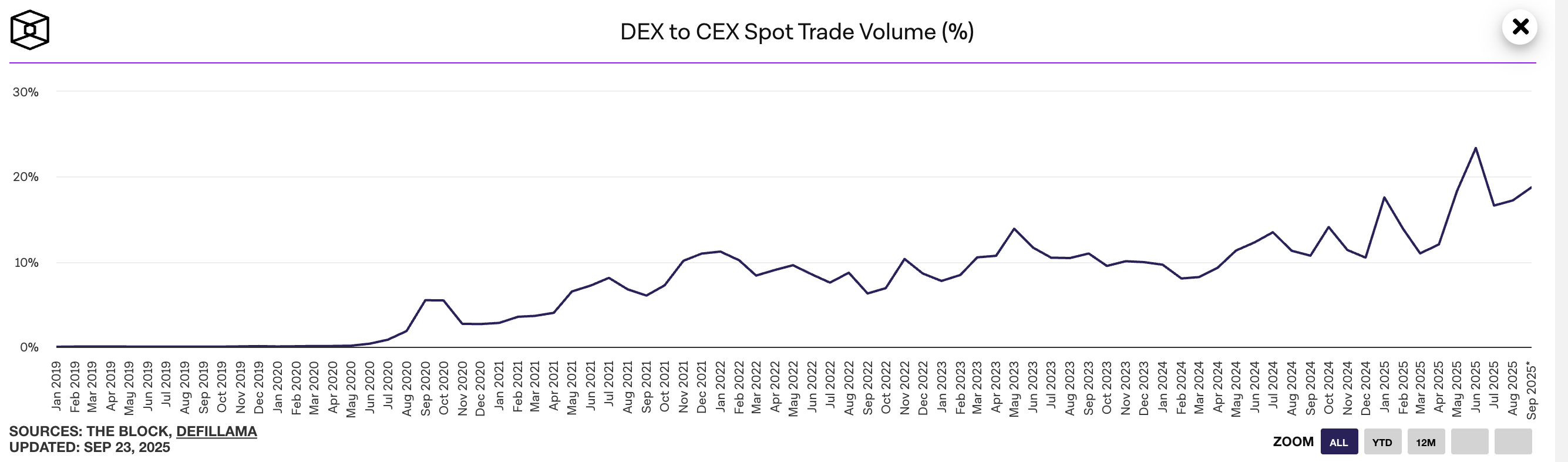

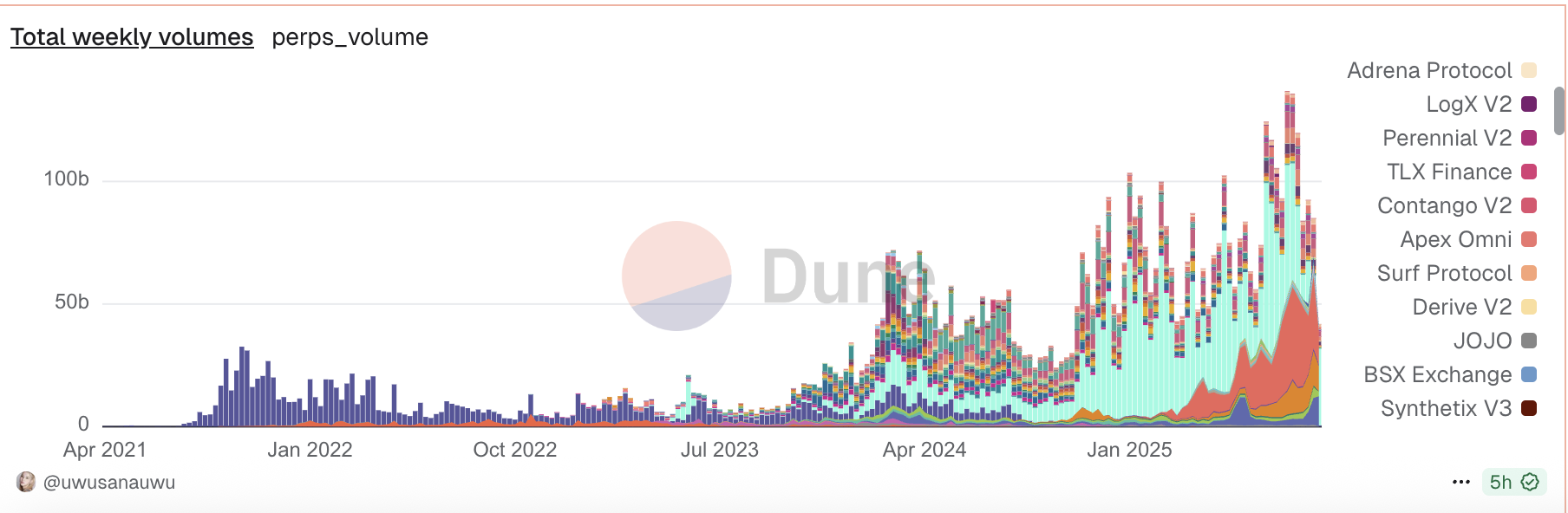

Chart: From 2021 to 2023, the market was essentially monopolized by dYdX and GMX; after dYdX completed a large-scale token airdrop in August 2021, its weekly volume basically maintained around $10 billion, while GMX's weekly volume remained around $2 billion. Hyperliquid emerged around May 2023 and by the end of 2023, its weekly volume maintained between $2 billion and $3 billion, flipping GMX, and by around August 2024, it grew to about $10 billion, flipping dYdX v4._

Chart: From 2021 to 2023, the market was essentially monopolized by dYdX and GMX; after dYdX completed a large-scale token airdrop in August 2021, its weekly volume basically maintained around $10 billion, while GMX's weekly volume remained around $2 billion. Hyperliquid emerged around May 2023 and by the end of 2023, its weekly volume maintained between $2 billion and $3 billion, flipping GMX, and by around August 2024, it grew to about $10 billion, flipping dYdX v4._

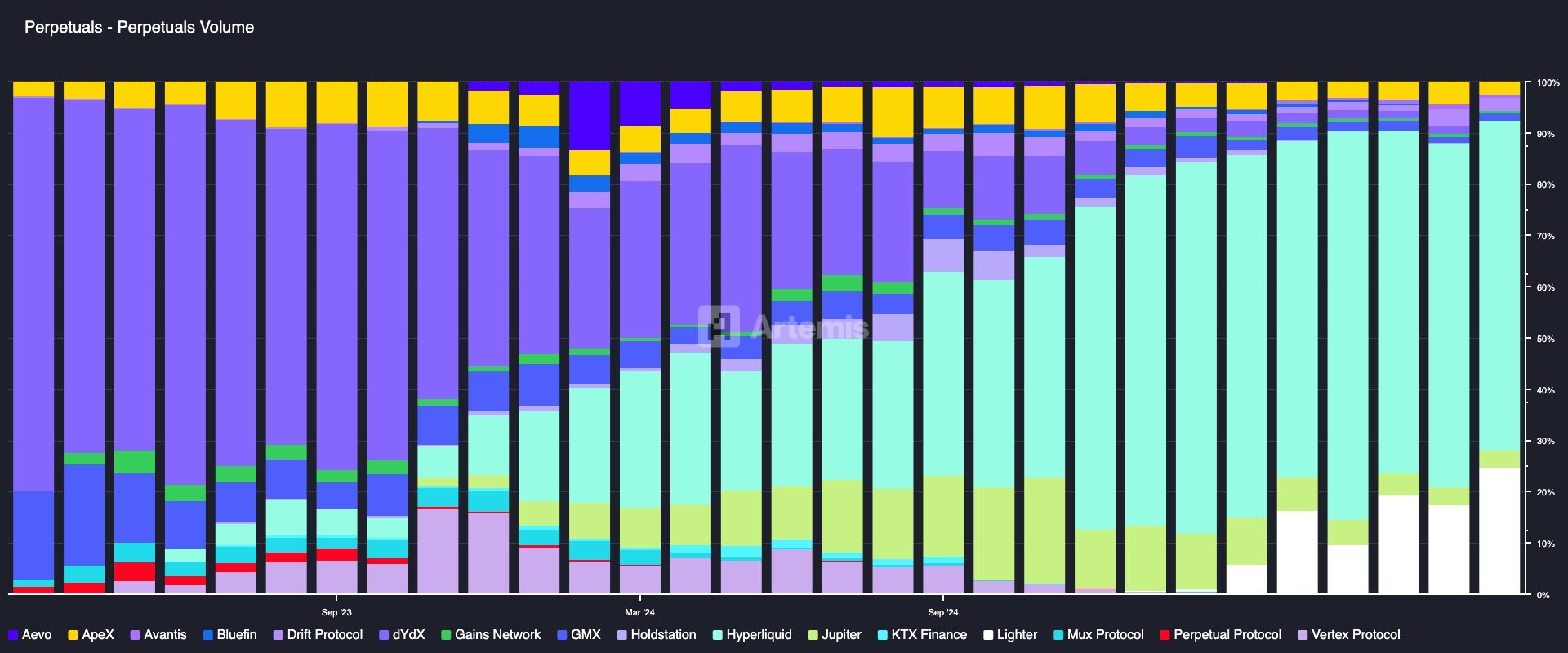

Chart: In terms of market share, Hyperliquid has maintained a market share of 50%-70% in Perp DEX since November 2024.

Chart: In terms of market share, Hyperliquid has maintained a market share of 50%-70% in Perp DEX since November 2024.

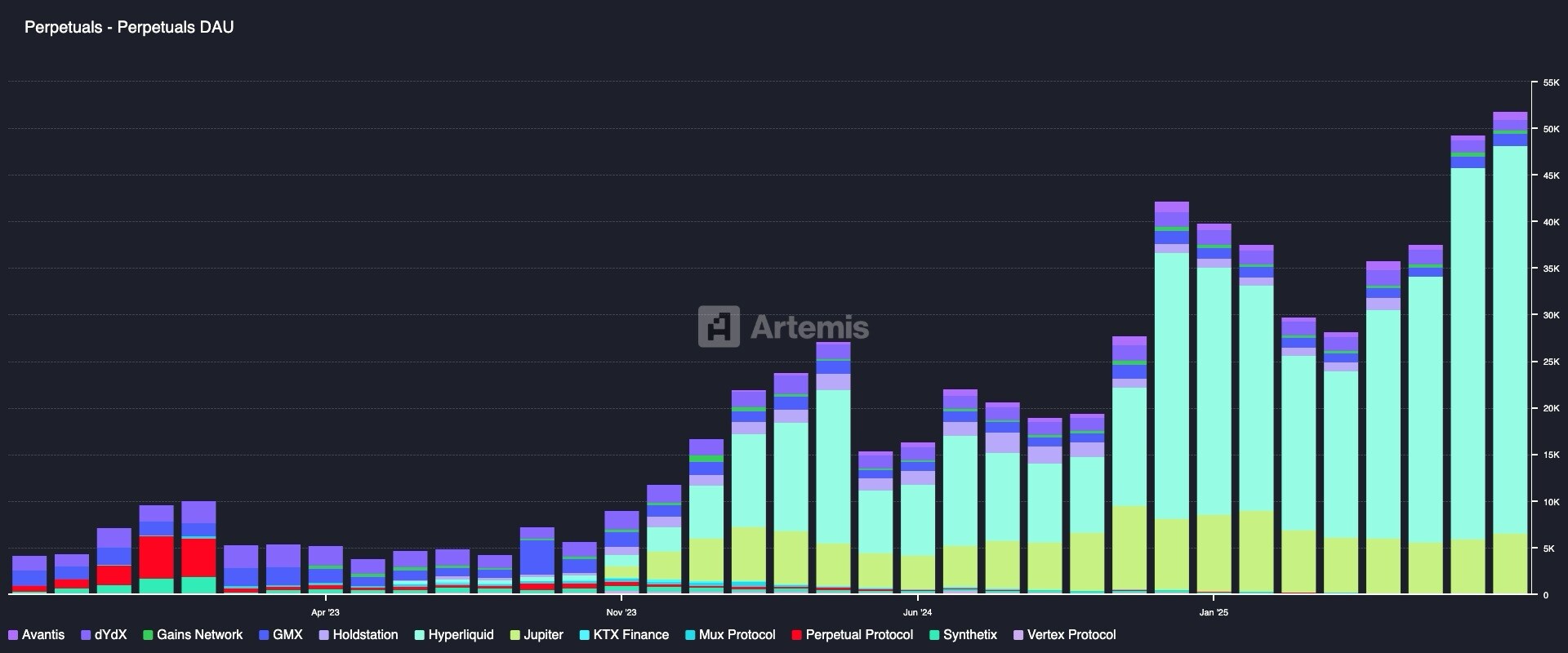

Chart: From the perspective of DAU, after Hyperliquid completed its airdrop at the end of November 2024, DAU has maintained a level of 25k+ and has grown to 40k in recent months.

Chart: From the perspective of DAU, after Hyperliquid completed its airdrop at the end of November 2024, DAU has maintained a level of 25k+ and has grown to 40k in recent months.

2. Core Modules and Fundamental Challenges in Building Perp DEX

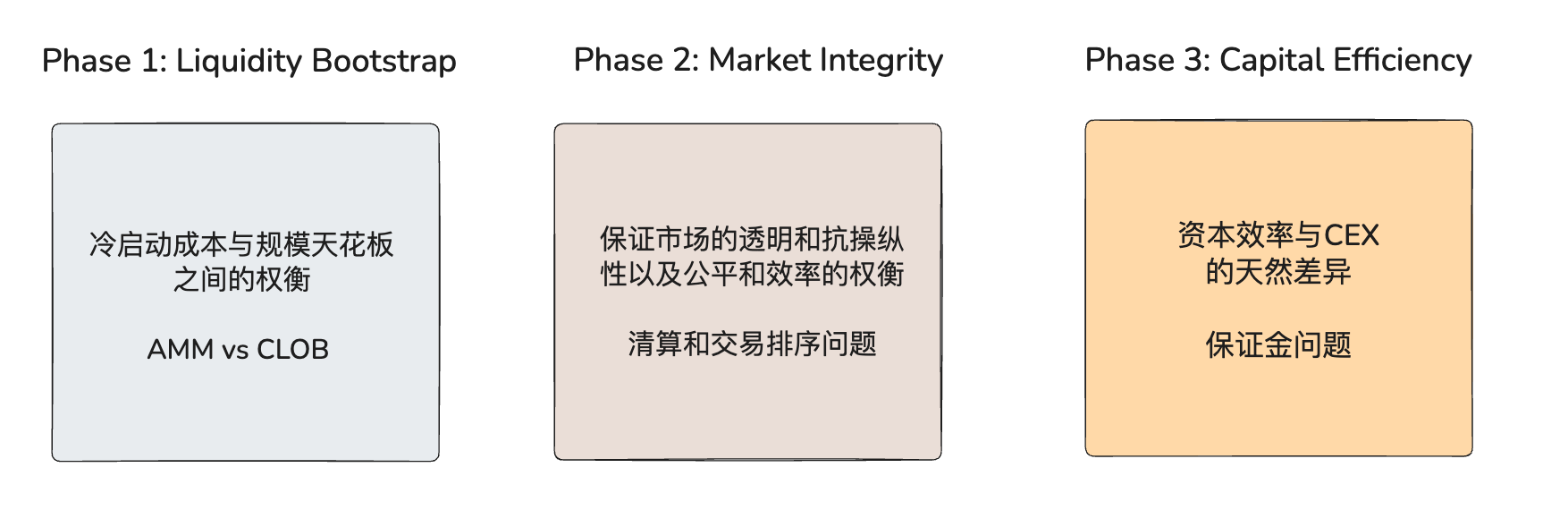

2.1 Trade-offs Between Liquidity Cold Start Costs and Scalability Ceiling (AMM vs. CLOB)

The primary issue faced by Perp DEX in its early stages is the liquidity cold start, which revolves around the trade-off between "cold start costs" and "scalability ceilings." This trade-off is mainly reflected in two mainstream underlying architecture choices: Automated Market Makers (AMM) and Central Limit Order Books (CLOB).

1) Regarding the AMM Model: Low Barrier to Entry Advantage and Inherent Scalability Bottleneck

AMM-based liquidity pools (typically Oracle-based AMM, such as the architecture used by GMX) have a core advantage in significantly lowering the barrier to liquidity provision through the design of liquidity pool LP Pool. Any user can deposit assets into the pool to become a liquidity provider, allowing the protocol to quickly and cost-effectively gather initial liquidity in the early stages, effectively addressing the cold start problem. However, this architecture also brings two interrelated inherent bottlenecks that limit its scalability ceiling:

Bottleneck 1: Passive Risk Exposure of LPs and Difficulty in Attracting Professional Market Making Capital. The essence of AMM liquidity pools is to serve as a collective counterparty for all traders. This model is characterized by "passive management," where LPs cannot actively manage their quotes and risks like order book market makers. This leads LPs to face directional risk: when traders' positions collectively lean in one direction (e.g., a large number of long positions in a bull market), the LP pool must take on a corresponding net short position. If the market continues to move in one direction, and traders collectively profit, the LP pool will incur systemic losses. Although GMX v2 introduced a dynamic funding rate mechanism to balance the holding costs of both long and short positions to some extent, it remains limited to risk mitigation rather than risk elimination. For large-scale professional market-making capital seeking precise risk control and active strategy execution, this passive, collective risk exposure is less attractive, making it harder for pure AMM pool models to attract top-tier market makers compared to order book models.

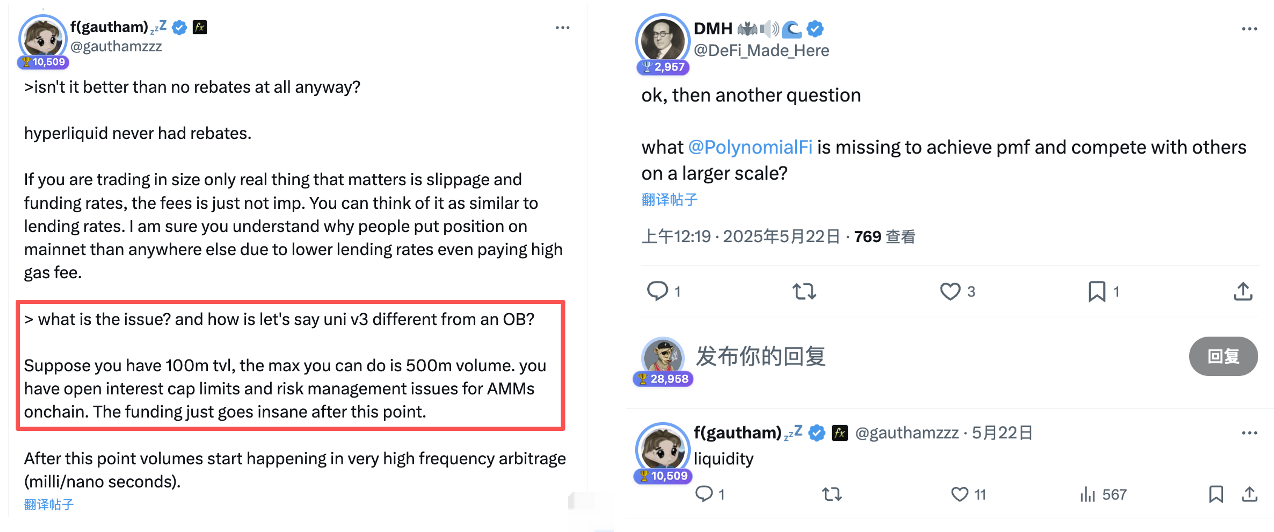

Bottleneck 2: TVL Size as a Ceiling for Open Interest. The aforementioned risk model directly leads AMM protocols to set a hard ceiling on the total amount of open interest they can support. The size of this ceiling is directly related to the protocol's TVL. To protect the solvency of the LP pool and prevent bad debts due to extreme market fluctuations or excessive position imbalances, the protocol must limit its risk exposure, meaning total open interest cannot grow indefinitely. This upper limit is typically set as a multiple of the TVL (with the total open interest ceiling being about 5 times the TVL, depending on asset volatility and the protocol's risk control parameters). For example, a liquidity pool with $100 million TVL may set the total open interest limit for both long and short positions at $500 million to control risk. Once open interest approaches this threshold, the protocol's risk control mechanisms (such as sharply rising funding rates) will activate, significantly increasing holding costs to suppress users from continuing to open positions in the imbalanced direction. This design is particularly critical during periods of high volatility or when market sentiment is aligned; while it ensures the protocol's safety, it also clearly limits the market's growth potential.

Chart: Polynomial founder Gautham expressed similar thoughts in a discussion on order book vs AMM in perp DEX applications: the scale of AMM pools also limits trading scale; the team entered the decentralized derivatives market in 2021.

2) Regarding the Order Book Model: High Ceiling Advantage and Severe Cold Start Challenge

The CLOB (Central Limit Order Book) model is a mature paradigm in traditional financial markets such as stock and futures exchanges, and is also adopted by many high-performance Perp DEXs like Hyperliquid. Its core mechanism facilitates trading by directly matching buy and sell limit orders submitted by both parties in a peer-to-peer manner.

The order book model fundamentally avoids the scalability limitations faced by AMM pool models in its underlying design.

- Decoupled Liquidity and Risk: Unlike relying on a single liquidity pool as a collective counterparty, the liquidity in an order book is provided by numerous independent market makers and order users. Transactions are directly matched between buyers and sellers, with risk transferring between individuals rather than concentrating in one pool.

- Unlimited Open Interest Ceiling: Since it does not rely on a fixed liquidity pool's TVL size, the open interest scale of the order book model is theoretically unlimited. Its ceiling only depends on the total liquidity and risk-bearing capacity that all participants in the market are willing to provide. As long as there are enough market makers and traders participating, the market size can continue to grow.

- Excellent Trade Execution Quality: This competitive quoting environment can lead to a better price discovery mechanism. For large trades and high-frequency arbitrage strategies, the order book can provide extremely low slippage and tighter bid-ask spreads, deeper liquidity, and more accurate pricing.

Overall, the order book model is an ideal choice for accommodating large-scale, specialized market-making liquidity, with a theoretically high scalability ceiling, widely regarded as the ultimate form of maturity for Perp DEX.

However, the significant advantages of the order book model come with a severe challenge—high cold start costs. A healthy, active order book market requires multiple professional market makers to continuously provide deep, tightly priced two-sided quotes from day one. However, market makers can only profit when there is sufficient trading volume (Taker Flow), and traders are only willing to enter the market when there is enough liquidity. This creates a classic "chicken or egg" dilemma. To break this deadlock, new platforms must invest substantial capital and resources in the early stages of operation, using market maker incentive programs (such as providing token rewards, fee rebates, etc.) to attract and coordinate the first batch of market makers.

Chart: A recent Twitter article “Deadly Perp DEX Traps (and the Paths Out)” revealed that if a team charges a 0.035% fee, after distributing to market makers and rebates, they may only have 0.015% left. Assuming the team's monthly operating cost is $500,000, they need at least $111.1 million in daily taker volume to break even.

2.2 Establishing Fair Market Game Rules

After addressing the initial liquidity issues of Perp DEX, the core challenge shifts to issues related to market integrity, including transparency, resistance to manipulation, and the trade-off between fairness and efficiency, primarily reflected in transaction ordering and settlement mechanisms.

1) Regarding Transaction Ordering: The Game of Fairness vs. Efficiency

In a blockchain environment, the final packaging order of transactions directly determines the transaction results, giving rise to MEV (Miner Extractable Value). This issue is particularly prominent in Perp DEX, as the nature of leveraged trading amplifies price sensitivity, with MEV strategies such as front-running and sandwich attacks exponentially increasing user losses in a leveraged environment, hindering participation from ordinary retail traders and making it easy for market makers' orders to be exploited by high-frequency traders (HFT), leading to continuous losses and exposure to so-called "toxic flow."

This forces protocol designers to confront a fundamental trade-off: should they prioritize fairness, protecting ordinary users and small to medium market makers from MEV exploitation; or should they prioritize efficiency, allowing fierce competition among HFTs to drive deeper liquidity and faster price discovery? This is a philosophical choice without a perfect answer, with different protocols providing starkly different responses.

Hyperliquid's design clearly leans towards a "fairness-first" protectionist approach. To achieve this goal, the protocol introduces a key mechanism known as "Speed Bumps," which includes: memory pool buffering (providing about 3 blocks of processing buffer time for transactions) and prioritizing cancel orders (in the matching engine, cancel order instructions have higher execution priority than new orders). The direct effect of this design is to provide a strong protective layer for makers, especially small to medium market makers. When they detect a taker order that would cause losses to their orders entering the memory pool, they have sufficient time and priority advantage to preemptively cancel or modify their orders, thus avoiding being "sniped" by HFT strategies.

Opponents like GTE lean towards a "efficiency-first" Darwinian path, arguing that Hyperliquid's "Speed Bump" mechanism, while protecting certain participants, sacrifices overall market efficiency and may limit the upper bound of liquidity depth. Their argument is that true market efficiency and price discovery stem from unrestricted fierce competition among the top and most sophisticated market makers. This is evident in both the leading firms in the crypto industry and traditional finance's Nasdaq/CME, where top exchanges do not impose similar protective "Speed Bumps" for market makers. Most trading volume at leading exchanges does not come from "market makers vs. retail," but rather from "market makers vs. market makers." Protecting weaker market makers allows them to easily avoid losses, which can actually undermine the profitability of top market makers with genuine alpha (excess returns), potentially driving them out of the market and ultimately harming overall liquidity.

2) Regarding the Clearing Mechanism: Balancing Transparency and Resistance to Manipulation

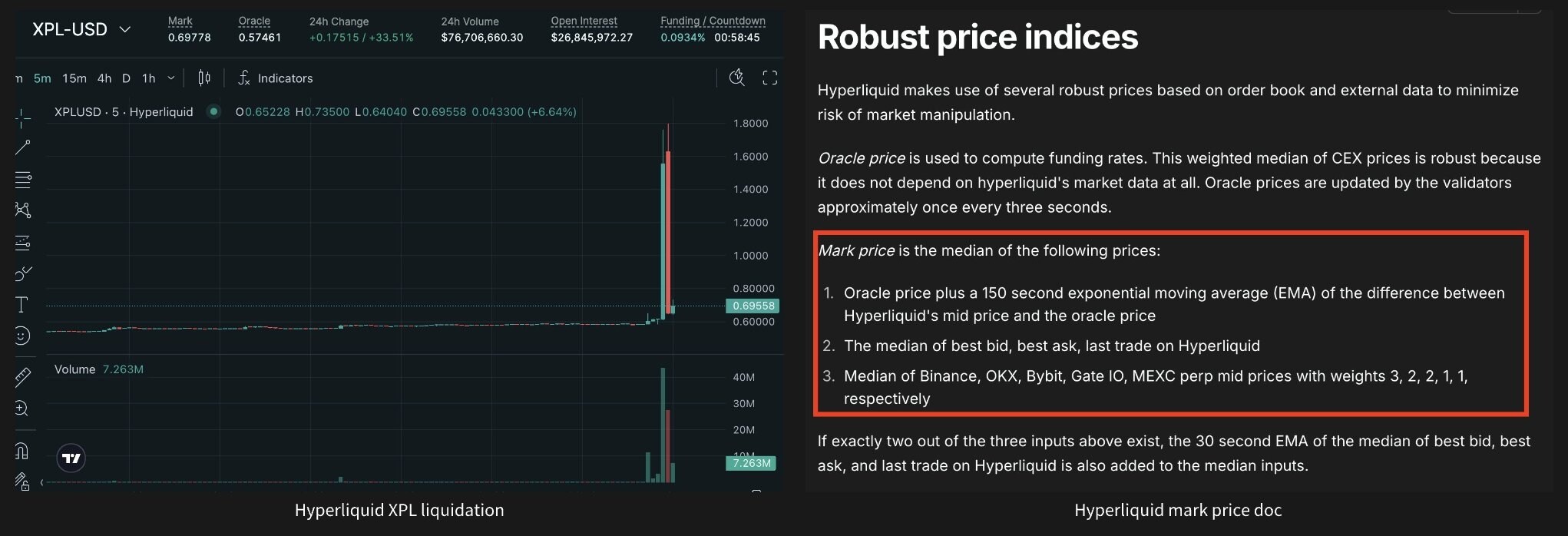

The clearing mechanism is the "lifeline" of any leveraged trading protocol, with its core mission being to prevent the accumulation of systemic risk through forced liquidation when traders' positions incur losses beyond their margin coverage, thereby maintaining the protocol's solvency and overall user trust. However, this seemingly simple safety valve is exceptionally complex in design, as it must seek a fragile balance within a polygon of multiple conflicting goals, including transparency, fairness, resistance to manipulation, sensitivity, and stability.

The difficulty of the clearing mechanism centers on determining the price at which a position should be liquidated. If the platform's internal last price is used directly, a single large transaction or a small transaction during liquidity exhaustion could cause the price to fluctuate sharply, leading to numerous "unfair liquidations" that should not occur. To address this issue, the industry commonly adopts a Mark Price mechanism. The Mark Price is not a single transaction price but a synthetic price aimed at reflecting the asset's "fair value." It is typically derived by aggregating the spot prices from multiple mainstream, highly liquid markets (such as the median or weighted average from Coinbase) and smoothing it with factors like funding rates. The Mark Price is used solely for calculating unrealized profits and losses and determining liquidations, while the last transaction price is used for settling realized profits and losses. This design greatly enhances the fairness and resistance to manipulation of the liquidation process: due to the diverse and decentralized sources of price, it is difficult for a single entity to manipulate multiple markets simultaneously, effectively filtering out isolated abnormal fluctuations and ensuring the objectivity of the liquidation basis.

Chart: Hyperliquid's XPL Incident: On August 26, 2025, a whale raised the price of XPL tokens from $0.6 to $1.8 within minutes, resulting in the liquidation of a $25 million short position, while prices on centralized exchanges remained stable. This occurred because in a "pre-market" scenario, where reliable external price sources are lacking, internal prices are easily manipulated.

However, in the pursuit of a perfect Mark Price, protocol designers also face the dilemma of "Sensitivity vs. Stability." This issue is well summarized in Yaoqi's recent article “Oracle, Oracle, Oracle: How Price Feed Design Turned $60 Million Into a $19 Billion Catastrophe”: a highly sensitive oracle that closely tracks real-time markets can reflect price changes promptly but is also more susceptible to short-term manipulation. For instance, the recent $60 million USDe sell-off was fully absorbed by its sensitive oracle, ultimately triggering a chain liquidation worth $19.3 billion. Conversely, an oracle designed to filter out noise by being overly stable (e.g., using a TWAP with an excessively long time window) may resist short-term manipulation but could respond sluggishly during real, sustained market declines. This "sluggishness" could cause the protocol to miss the optimal window for timely liquidation of losing positions, leading to the continuous accumulation of bad debt and potentially resulting in more severe systemic insolvency.

2.3 Margin Capital Efficiency Issues

Margin capital efficiency is another challenge faced by Perp DEX in competing with centralized exchanges, as well as an area that designers continuously seek to improve. For example, Kyle Samani mentioned in 2020 in “DeFi's Invisible Asymptotes” and “On Forking DeFi Protocols” that this direction would be a focus for future development. The fundamental reason for the difference in margin efficiency between Perp DEX and CEX lies in the differences in their underlying architectures:

1) The high efficiency of CEX is rooted in its core of "centralized trust." Users completely entrust the custody of their assets and the execution of trades to a single entity. This entity thus possesses a global perspective, able to act like a central brain, gaining real-time insights and calculating the total risk exposure of all users on the platform. This omniscient ability allows it to easily implement complex risk hedging; for example, when a user holds both long and short positions simultaneously, CEX can identify that their net risk is nearly zero, significantly reducing margin requirements. More importantly, since CEX effectively controls users' assets, it can re-trade or lend out funds that are temporarily idle but used as margin, creating additional returns for users, which is essentially a re-utilization of idle capital.

2) The design philosophy of Perp DEX is precisely the opposite. Its first principle is "code is law," meaning that the system's security does not rely on any intermediaries but is guaranteed by publicly transparent smart contracts. This principle grants users absolute asset sovereignty but also brings profound constraints. For assets to serve as margin, they must be authorized through their private keys and "locked" in specific smart contracts. This locking process is rigid and isolated. Once capital enters a contract's vault, it is isolated, with its sole mission being to support that independent position, unable to flow to other areas where it might be needed, nor can it be used to earn interest as in CEX. This leads to severe "fragmentation" of capital, where each transaction acts like an independent risk island, requiring its own dedicated margin to maintain security.

This asset isolation and risk atomization result in two consequences: first, the protocol struggles to identify hedged positions. Since smart contracts cannot see a user's actions in other contracts, they can only mechanically require users to provide sufficient collateral for each opposing position, forcing users into excessive over-collateralization. Second, the modular nature of functional components in the DeFi world means that lending protocols and trading protocols operate independently, making their liquidation logic and risk parameters difficult to reconcile, hindering seamless capital flow between the two systems and further exacerbating capital segmentation.

To address these challenges, various solutions have emerged in the industry: Marginfi's unified collateral pool and Drift Protocol's multi-subaccount mechanism can be seen as a "simulation" of centralized efficiency within a decentralized framework. They attempt to re-integrate users' fragmented capital through more complex contract designs, creating a shared margin environment similar to CEX within the protocol, thereby enhancing flexibility. GMX's GLP pool takes a different approach by concentrating risk into a single liquidity pool, simplifying the counterparty model.

Recently, Tarun Chitra and the Bain Capital team published a paper “Perpetual Demand Lending Pools” addressing the integration of perp DEX and lending models. Their proposed "Perpetual Demand Lending Pool (PDLP)" research represents a "reconstruction" from first principles. It no longer attempts to mimic CEX functions but instead returns to the essence of financial risk, viewing perpetual contract trading and lending as two sides of the same coin. The model posits that the risk of a long position is essentially equivalent to borrowing the underlying asset, while a short position is equivalent to borrowing stablecoins. Based on this insight, PDLP unifies both into a cohesive framework, creating a unified asset pool where capital serves as both trading margin and lending liquidity.

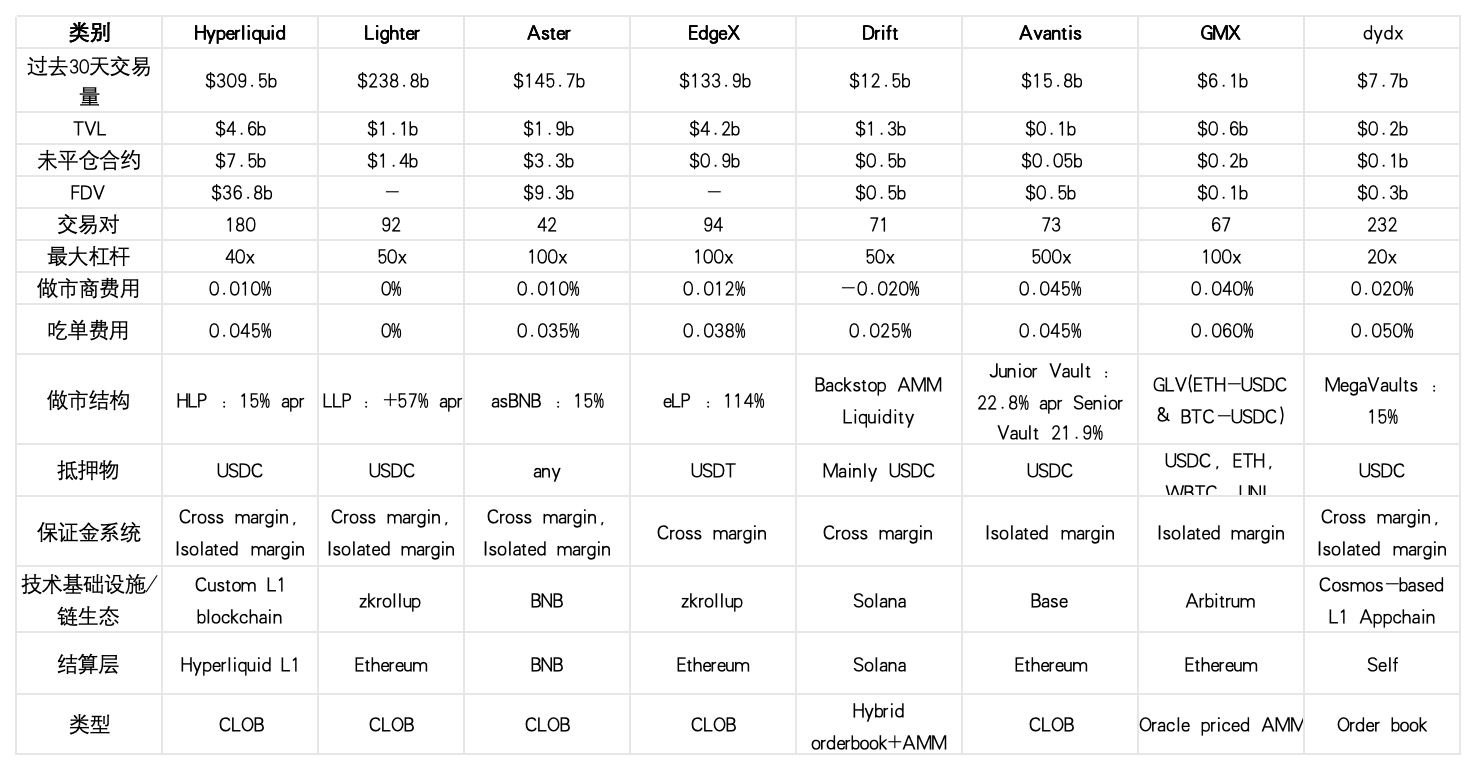

3. Comparison of Perp DEX Operating Data

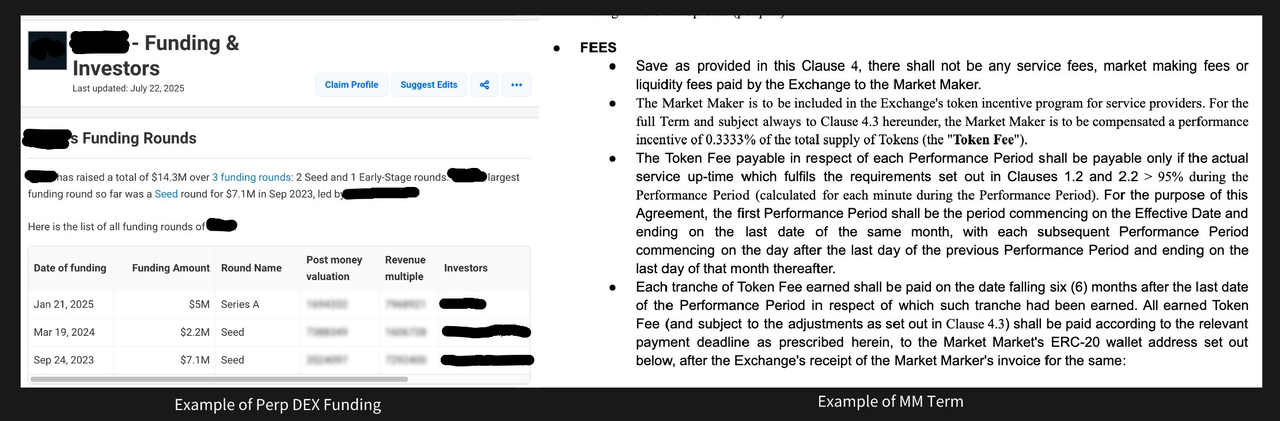

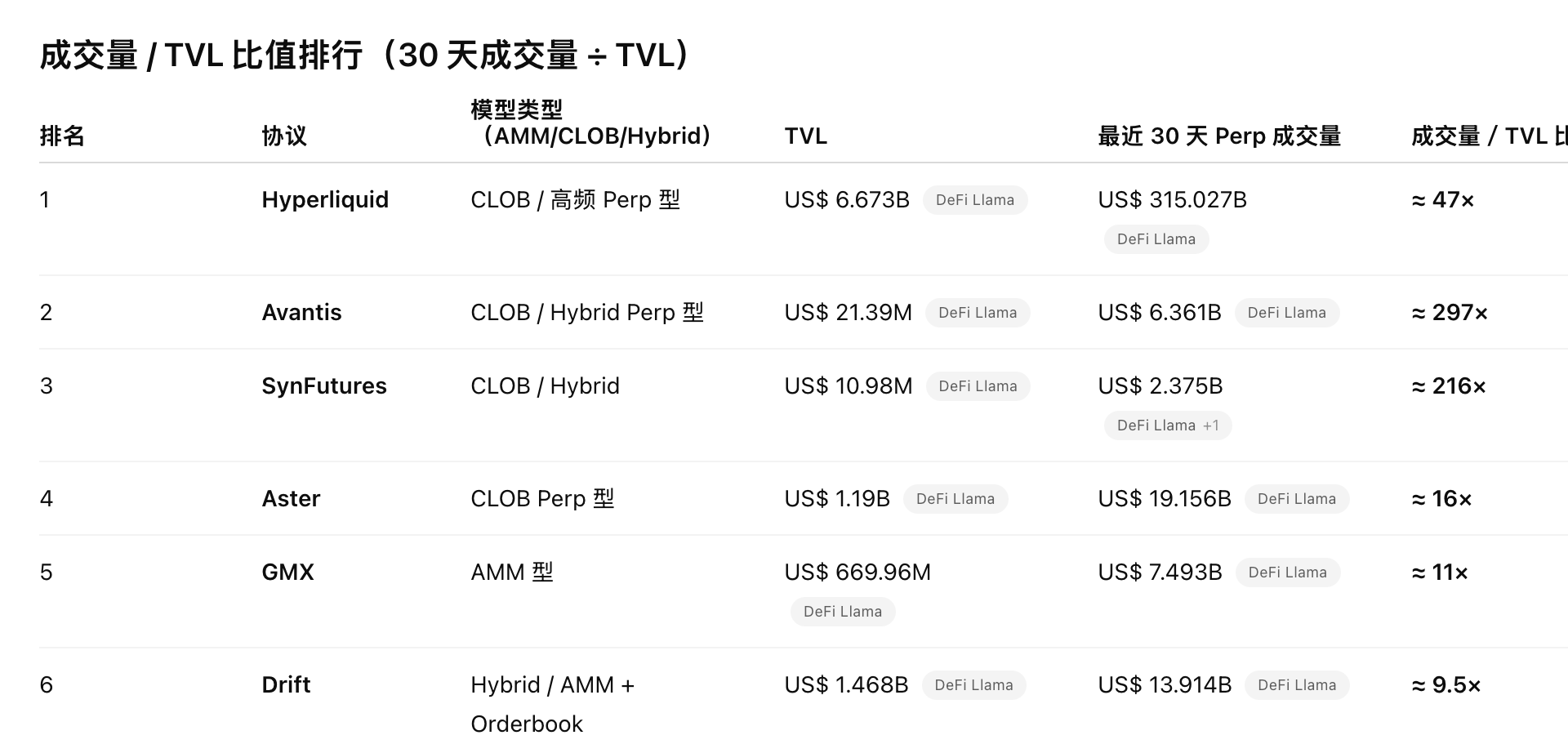

Data Source: defillama, perpetualpulse.xyz (2025.10.20)

Data Source: defillama, perpetualpulse.xyz (2025.10.20)

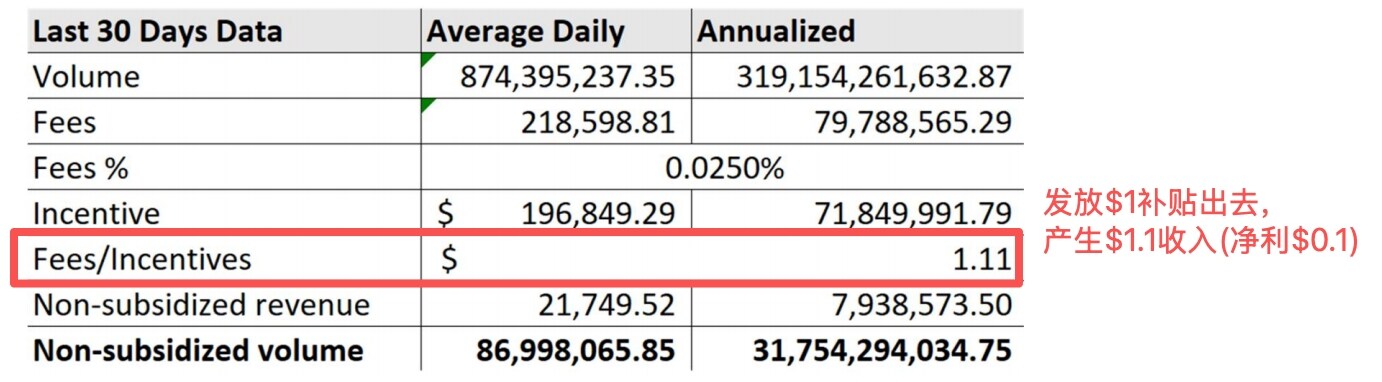

The core of liquidity is "how quickly and at what minimal cost traders can complete a transaction." This cost includes the bid-ask spread, slippage, and trading fees. Many platforms stimulate trading through token incentives to quickly attract users in the early stages, which can lead to a direct negative impact of significant "Wash Trading"—users frequently engaging in self-executing fake trades to earn rewards. Although this trading inflates the platform's "trading volume" data, it does not bring real liquidity. When incentives decrease, this false prosperity disappears (the most typical example being dYdX).

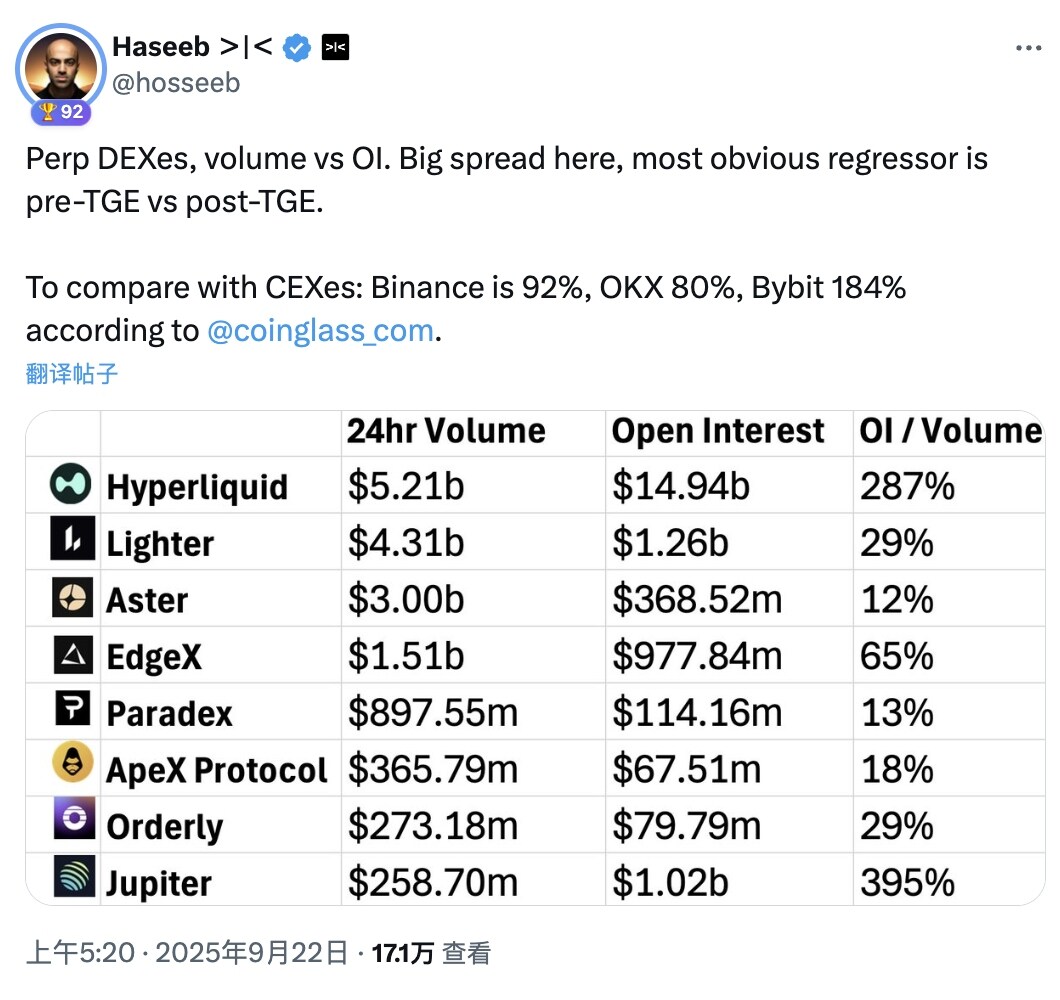

One major dimension for measuring healthy liquidity is the ratio of open interest to trading volume (Open Interest vs Volume). According to OI/Volume data provided by Coinglass, Binance stands at 92%, OKX at 80%, and Bybit at 184%. In contrast, many Perp DEXs that rely on token incentives have a low ratio, indicating that their trading activity is more about volume manipulation rather than real positions. However, this should not be the sole reference standard; it is essential to extend the time period and specifically examine the behavior of major active addresses (recently, the OI to volume ratio has become a narrative for mutual attacks among many project communities, such as hyperliquid and lighter)

Data Source: perpetualpulse.xyz (2025.10.20)

4. Comparison of Four Major Perp DEX Projects: Hyperliquid, Aster, Lighter, edgeX

4.1 Hyperliquid

4.1.1 Founder Jeff's Trading System Design Philosophy — Transparent Market, Non-toxic Flow

In June of this year, Hyperliquid founder Jeff spoke out on Twitter and podcasts (Tweet 1, Tweet 2, Podcast), engaging in a public debate about his controversial "Transparent Market" trading system philosophy, which challenges traditional market structures and has garnered widespread industry attention. It is necessary to delve into his thesis to understand why Hyperliquid's development is disruptive; the following is divided into two parts (clarifying user basic goals and risks, constructing basic principles)

I. Core Motivations and Risk Analysis of Market Participants

Goals of Market Participants: In a trading market, participants' goals can be clearly divided into two categories. The core goal of liquidity demanders (Takers) is to achieve "Best Execution," meaning completing trades at the best price, with the fastest speed and minimal market impact. In contrast, the core goal of liquidity providers (Makers or market makers) is to earn the spread by continuously providing buy and sell quotes, but they face the primary risk of trading losses due to information asymmetry.

Core Risk Identification: "Toxic Flow": The core risk faced by market makers is specifically manifested as "Toxic Flow." This type of trading refers to arbitrage behavior that exploits asymmetric technological advantages, causing market makers' quotes to become instantly invalid, resulting in immediate losses upon execution. In contrast, "Non-toxic Flow" refers to trades that do not rely on instantaneous information advantages, such as buying and selling to establish long-term positions, thus posing much lower risk to market makers. Based on this, the rational strategy for market makers is to avoid trading with "Toxic Flow" while actively providing services for "Non-toxic Flow."

Impact of Market Transparency on Market Maker Behavior: Market transparency directly determines the behavior patterns of market makers. In opaque markets, where it is impossible to distinguish between "Toxic Flow" and "Non-toxic Flow," market makers can only adopt defensive strategies, widening the bid-ask spread and reducing order book depth to protect themselves, which increases trading costs for all liquidity demanders, including "Non-toxic" traders. Conversely, in a fully transparent market like Hyperliquid, publicly available on-chain addresses and historical behavior enable market makers to identify and assess the intentions of trading counterparts. When they can identify lower-risk "Non-toxic Flow," their perceived risk significantly decreases, making them more willing to provide narrower spreads and better liquidity depth, ultimately allowing "Non-toxic" demanders to achieve their trading goals at lower costs.

II. Ideal Market Design Principles Based on the Above Analysis

Counterparty Principle: The core idea is that the quality of a trade fundamentally depends on the identity and intentions of the trading counterpart. The traditional view holds that dark pools or OTC platforms can provide better execution due to their "privacy." Jeff argues that this is a misunderstanding. Their true advantage lies in filtering trading counterparts through an access system, excluding "Toxic Flow." "Filtering" is the fundamental reason, while "privacy" is merely a means to achieve filtering. Hyperliquid's solution is more thorough; it makes all participants' behaviors public through completely transparent on-chain addresses, allowing the market itself to perform the filtering. Market makers will proactively collaborate with reputable "Non-toxic" traders based on public trading history and avoid "Toxic" addresses with arbitrage intentions, forming a more efficient and decentralized filtering mechanism.

Competition Principle: This follows a basic economic principle: optimal prices arise from maximized competition. Jeff believes that in traditional OTC trading, a large trader may only be able to request quotes from a few market makers, resulting in a very limited scope of competition. In a transparent on-chain market like Hyperliquid, their trading intentions can be broadcast to all market makers on the platform. This will stimulate hundreds of market makers to engage in fierce bidding to compete for this predictable "Non-toxic" order, continuously lowering their quotes. Maximizing the scope of competition inevitably leads to the optimization of execution quality, as any attempt to capture excess profits will be instantly replaced by more competitive counterparts.

Repeated Games Principle: This emphasizes the fundamental differences in behavior patterns between one-time trades and long-term relationships. In an anonymous market environment, trades are one-time games, and participants' optimal strategies may involve harming their counterparts to maximize their own benefits, leading to widespread distrust. Hyperliquid transforms the market into a repeated game scenario through immutable on-chain addresses. Every action of an address builds its own reputation record. If an address frequently engages in "Toxic" trading, it will quickly be identified and avoided by the market maker community. To maintain a reputation that allows for ongoing trading, all participants are more motivated to adopt honest and predictable behaviors, thus driving the market toward a healthier, positive equilibrium.

Full Transparency Principle: In terms of information processing, information asymmetry is the most dangerous state. The worst-case scenario is when information is known only to a few, such as when an insider at a centralized platform knows the location of users' stop-loss orders, allowing them to precisely "hunt" those orders without external competition. The optimal state is complete information symmetry, where everyone is aware. When everyone knows the location of stop-loss orders, any attempt to trigger liquidation by crashing prices will be anticipated by other rational participants in the market. These participants will become "anti-hunters," placing buy orders near the stop-loss price to acquire cheap tokens, making the cost of hunting extremely high or even unprofitable, thus forming a self-defense mechanism for the market.

4.1.2 Hyperliquid Product and Technical Implementation

Hyperliquid's excellence lies in its ability to not only propose a disruptive "Transparent Market" theory but also to perfectly translate this philosophy into a high-performance, fully vertically integrated trading system through powerful full-stack engineering capabilities. Every technical decision precisely serves the four principles mentioned in Jeff's design philosophy (Counterparty, Competition, Repeated Games, Full Transparency).

I. Building a Dedicated L1 Public Chain HyperCore for "Best Execution"

In response to the common question of "which public chain should be built on," Hyperliquid's answer is "to become that chain," a non-negotiable choice under its product vision (some believe that Hyperliquid may have had professional market-making support from the beginning, as professional market makers can only accept order books, so "ultra-high performance" and "being able to comfortably place and cancel orders before takers" naturally became the core design points of Hyperliquid).

Jeff's "Competition Principle" requires the system to handle massive, high-frequency order updates and bidding from global market makers. Hyperliquid's L1 is "specifically designed to support high-frequency order book trading and near-instantaneous trade finality." In practice, it has supported processing capabilities of up to 100,000 orders per second, physically compressing the space for "Toxic Flow" to exploit delays for arbitrage.

II. Speed Bump and Cancel Order First Mechanism Protecting Market Makers

Hyperliquid's speed bump mechanism, also known as the cancel order first system, is a core design feature of its L1 blockchain. This mechanism prioritizes the processing of cancel orders during block execution, placing other orders for immediate execution afterward. This essentially provides a brief "buffer period" for makers, allowing them to adjust or cancel quotes before taker orders are executed, while taker orders need to be buffered in the memory pool for about three blocks. This design reduces the risk of makers being quickly "sniped" by taker orders.

Why This Design: The core purpose of this mechanism is to protect market makers from toxic flow, allowing them to provide liquidity more comfortably without worrying about being quickly picked off by HFT takers. This aligns closely with founder Jeff's thesis: he believes that traditional order books often lead to a "loser's curse" between HFT takers and makers, where makers are hit by takers before canceling orders, resulting in liquidity degradation, wider spreads, and ultimately harming the execution quality for end users (such as retail traders). By prioritizing cancellations, Hyperliquid optimizes the end-user experience, encouraging makers to provide tighter quotes and deeper liquidity rather than pursuing maximum trading volume or fees. This design also emphasizes decentralization: the dedicated L1 chain ensures the platform maintains solvency during extreme volatility and allows community liquidity pools like HLP (Hyperliquidity Provider) to intervene when makers withdraw, achieving profitable liquidity supply. Overall, this is an improvement over traditional CLOBs, prioritizing retail and makers over toxic takers, thus building a fairer and more efficient ecosystem.

Community Feedback: Although this mechanism operates effectively in practice (currently, Hyperliquid has a high proportion of retail users with good trading experience and depth), it has also sparked controversy: Critics like the GTE team believe it restricts trading among HFT market makers, potentially limiting overall trading volume growth and making it difficult for Hyperliquid to flip Binance; others, like Dan Robinson, hold a positive view of this mechanism.

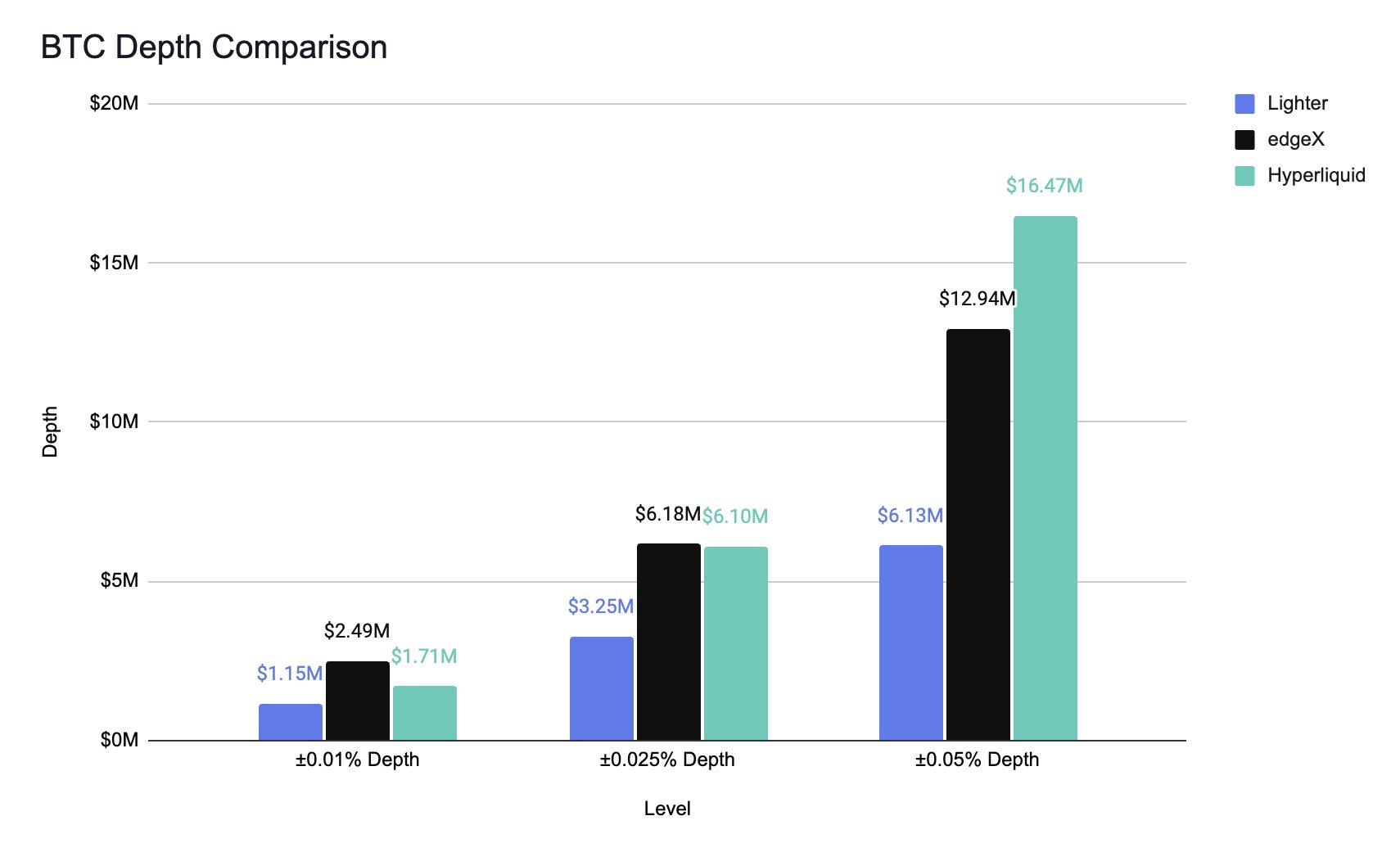

Image: BTC trading pair depth comparison (Hyperliquid, Lighter, EdgeX) @andyandhii compared 1-hour data from Lighter, EdgeX, and Hyperliquid in a test. The results show that Hyperliquid maintains depth when processing large orders exceeding $16 million, while its performance at a $6 million order scale is comparable to EdgeX, indicating that Hyperliquid is indeed the best place for large trades.

3. Redefining "Decentralization" — Fully On-Chain Central Limit Order Book (CLOB)

To understand the technical core of Hyperliquid, one must first grasp its redefinition of the term "decentralization." In a recent article analyzing the development dilemmas of Perp DEXs, co-authored by EdgeX, GTE, and others, there is a statement: Decentralization is often misused in the realm of Perp DEXs — most Perp DEXs merely shift centralized risks from the "custodial layer" to the less visible "execution and settlement layer."

Hyperliquid's Solution: By running all core components — order book, matching, and settlement — completely on a transparent chain, it ensures that the protocol cannot unilaterally intervene in or liquidate user funds. This means that any changes in funds (whether through execution or liquidation) must strictly adhere to publicly verifiable rules that are hard-coded into the on-chain protocol. No "administrator" or "centralized server" can override these rules. The ultimate technical form to achieve this goal is a fully on-chain CLOB.

4. Liquidity Engine HLP — Two Roles: Market Making + Backstop Liquidations

After establishing a fair and transparent CLOB framework, Hyperliquid faces the challenge of "how to inject initial and ongoing liquidity." Its solution is not a one-time complete decentralization but a phased evolution centered around HLP (Hyperliquidity Provider): initially, the protocol's built-in "Market Making Vault" assumes the backstop responsibilities for market making and settlement, gradually delegating liquidity supply to open community Maker Vaults.

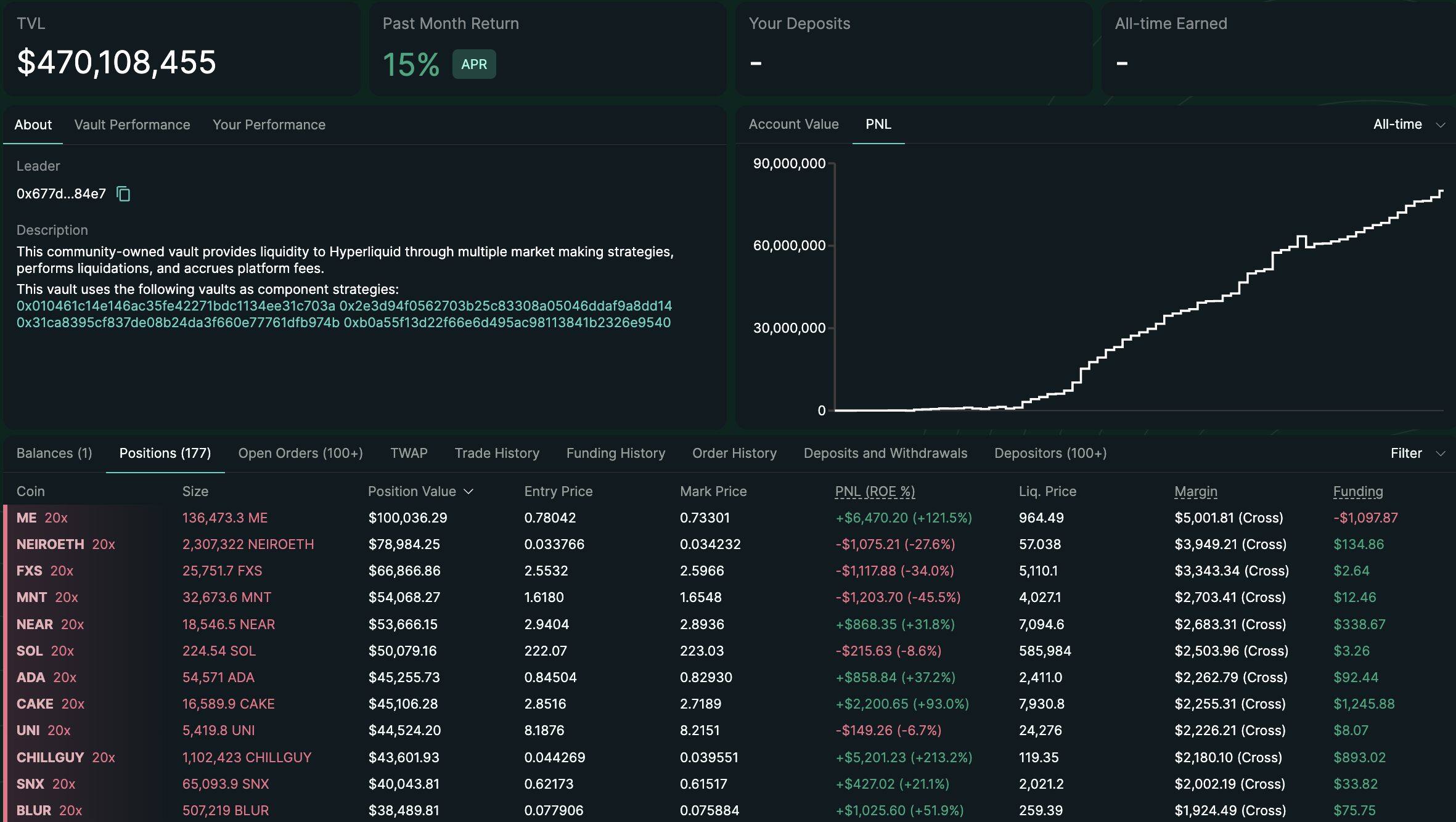

HLP achieves trading liquidity bootstrapping: Hyperliquid first established a framework called "Market Making Vaults," operated by the team leading the flagship market-making vault HLP. The founding team personally guides early liquidity, with the vision of "Democratizing Market Making": HLP does not charge any management fees, and P&L is shared according to depositors' share (currently, P&L is at $80 million). The strategy currently operates off-chain, but positions, orders, trading history, deposits, and withdrawals are all visible on-chain in real-time for anyone to audit.

Founder's Background and Strategy: Jeff Yan, with market-making experience at top quantitative firm Hudson River Trading, actively and professionally manages HLP to synthesize a core experience similar to AMM for early users — a counterparty that is always online and permissionless. However, HLP's market-making strategy is passive, accounting for less than 2% of the platform's total trading volume, with the vast majority of trading volume occurring between non-HLP users.

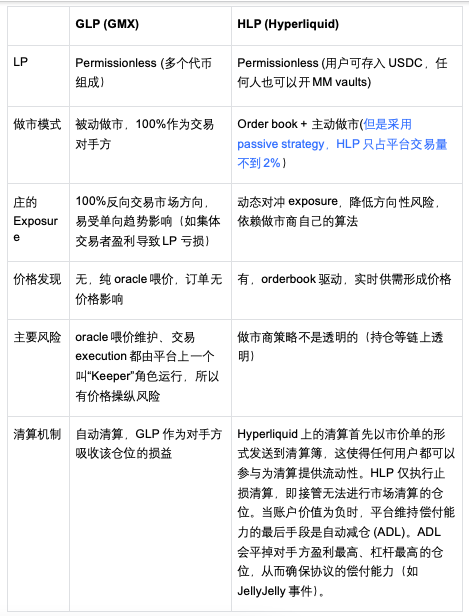

Differences Between HLP and GLP (GMX's LP Pool):

Improving Decentralized Governance with HIPs (Hyperliquid Improvement Proposals): After HLP completed its historical mission of cold start, Hyperliquid gradually returns the power of liquidity supply to the market through community governance proposals, HIPs.

HIP-1: Native Token Standard — A transparent and public mechanism for new asset listings. The premise of liquidity is "having assets to flow." HIP-1 is the first step toward decentralization, establishing a transparent, market-driven new asset issuance mechanism. Through USDC auctions, any project can compete for listing qualifications (Dutch auction, where a new "listing right" is publicly auctioned every 31 hours, starting at twice the price of the last "listing right" transaction, but then gradually decreasing until someone purchases it), solving the past issues of reliance on centralized team reviews and opaque processes, thus introducing a continuous stream of fresh blood into the order book.

HIP-2: Hyperliquidity — Ensuring basic liquidity for newly listed long-tail assets. HIP-1 brings new assets, but the initial liquidity for these long-tail assets becomes a new challenge. To address this, Hyperliquid launched HIP-2: an automated market-making strategy that combines passive liquidity supply concepts with CLOB. We can think of Hyperliquidity as a kind of automated robot liquidity provider that lives within the order book. When a new HIP-1 token is launched, the deployer can use some USDC to initialize the Hyperliquidity strategy, defining a price range, and the protocol will automatically place buy and sell orders within the symmetric range, updating every block (approximately every 3 seconds), essentially functioning as a grid market maker to ensure that even newly listed tokens have basic liquidity from day one.

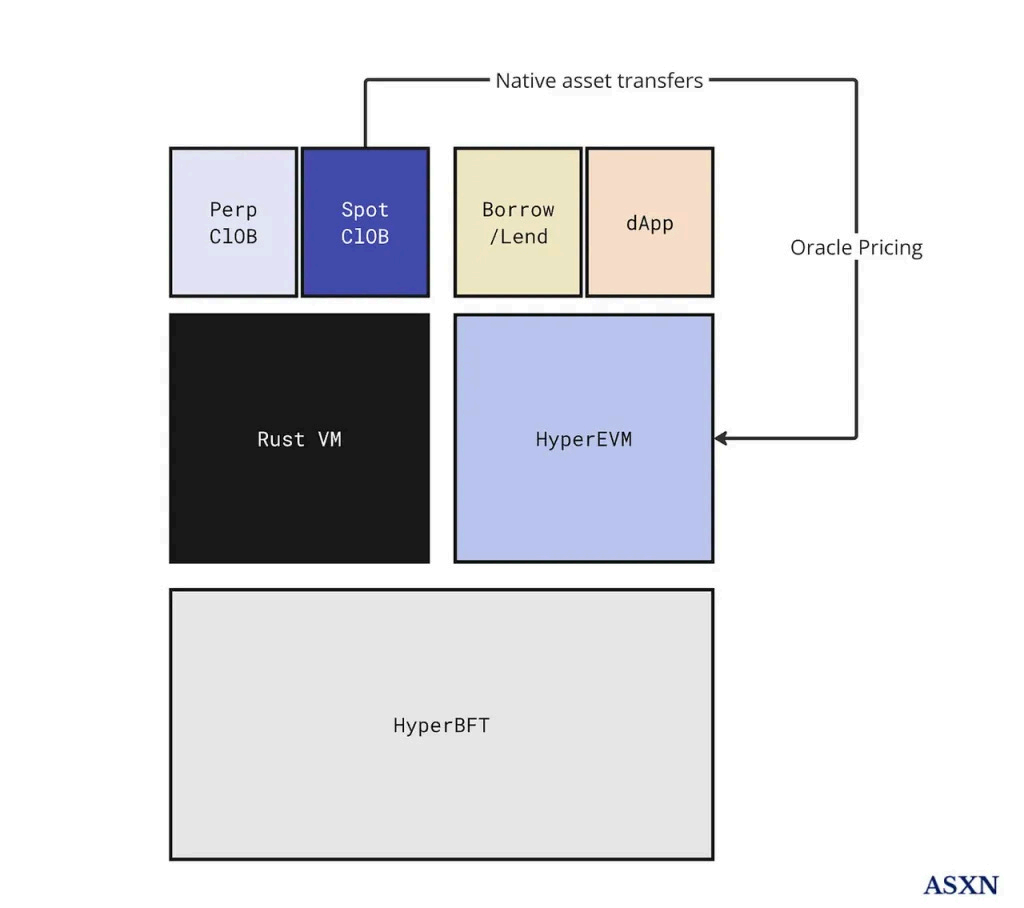

5. HyperEVM — Smart Contract Layer on Hyperliquid L1

Overview: HyperEVM and HyperCore constitute the two main engines on Hyperliquid L1, one focusing on exchange operations and the other supporting generic smart contract development, with both engines sharing a Unified State.

Image: Hyperliquid Chain: HyperCore (Rust VM) + HyperEVM Architecture Diagram

Image: Hyperliquid Chain: HyperCore (Rust VM) + HyperEVM Architecture Diagram

Comparing the entire Hyperliquid to a high-performance computer:

- Unified State: All data, whether it is the order book status, user margin, or the code and storage of EVM smart contracts, is stored here.

- HyperBFT Consensus: The operating system kernel. Its sole responsibility is to receive all incoming instructions (transactions), sort them, and then package them into an immutable instruction set (block), telling the computer what to do next.

- HyperCore (RustVM) and HyperEVM: HyperCore is a dedicated processor designed for trading, handling specific tasks like order book matching and settlement with extreme efficiency; HyperEVM, as a general-purpose processor, can execute any smart contract instructions that comply with Ethereum standards.

- When a new block is generated, HyperBFT distributes the instruction set to the corresponding processors. Transaction instructions are executed by HyperCore, while smart contract instructions are executed by HyperEVM, both reading from and writing to the same unified state.

Specific Use Case: A Seamless Process from Idea to On-Chain Market:

- Tokens issued by projects on HyperEVM can be directly listed and traded on HyperCore.

- Deploying Contracts: A project can use standard EVM tools (like Hardhat) to deploy its ERC20 token contract (e.g.,

XYZ) on HyperEVM. - Launching Trading: The project can participate in the HIP-1 spot auction on HyperCore without any permission, creating a native order book market for its

XYZtoken. - State Linking: The protocol links the contract address on HyperEVM with the spot assets on HyperCore.

- Seamless Experience: From now on, users holding

XYZtokens can use them in DeFi applications on HyperEVM and trade them on the high-performance order book of HyperCore.

4.1.3 Hyperliquid Business and Ecosystem Operation Strategy

1. Protocol Revenue Distribution and Token Buyback

Hyperliquid's main source of revenue is transaction fees, which reached tens of millions of dollars in monthly revenue by 2025 — its annual revenue runway is close to $1 billion (approximately $83 million per month), reflecting the protocol's massive trading scale.

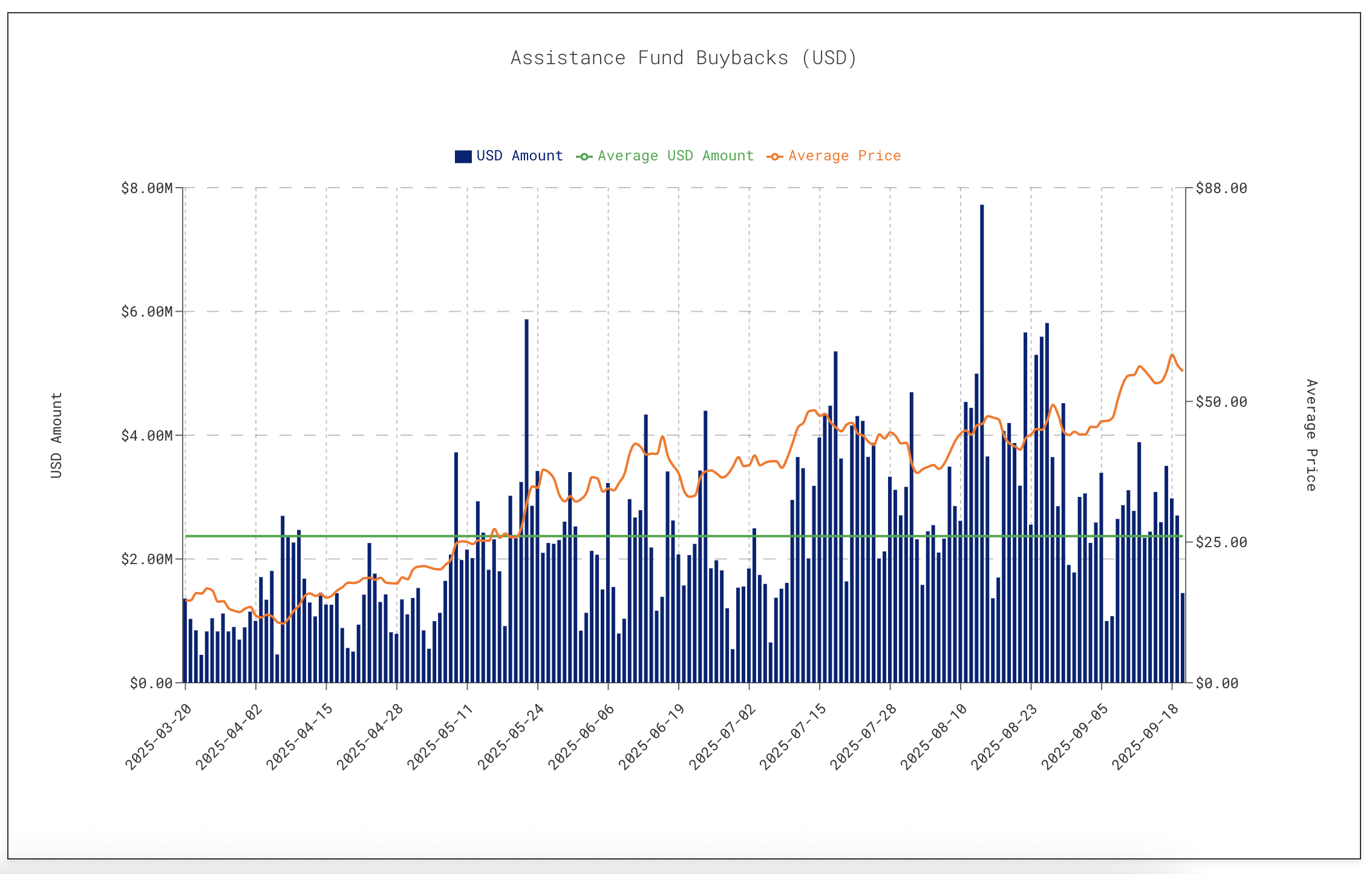

In terms of revenue distribution, Hyperliquid adopts a highly transparent and community-oriented strategy, returning almost all protocol revenue to token holders and the ecosystem to avoid the common "team sell-off" phenomenon seen in traditional projects. 97% of transaction fee revenue is used for the buyback of HYPE tokens and ecosystem funds: this portion of funds flows into the "Assistance Fund," which continuously buys back HYPE through the secondary market, implementing a permanent deflationary burn plan. Only 3% of the fee revenue is allocated to the HLP market-making vault to incentivize liquidity providers.

Image: 97% of transaction fee revenue flows into the Assistance Fund for continuous buybacks of HYPE through the secondary market.

2. Market Making Fund

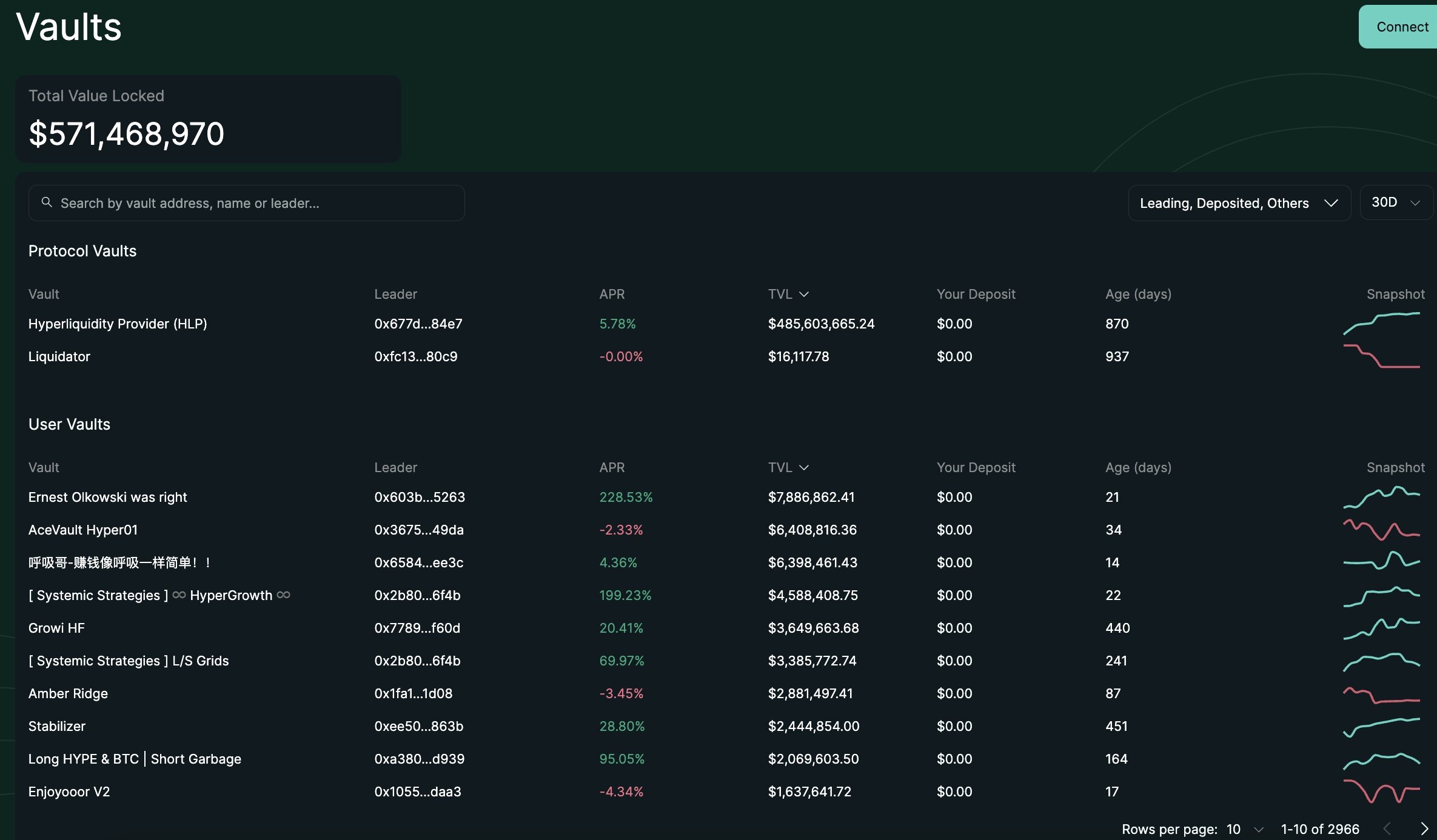

HLP vault is the core market-making and settlement mechanism of the Hyperliquid protocol, acting as the platform's passive market maker and last liquidator, similar to a combination of an exchange's "insurance fund" and "market-making pool." Any user can deposit USDC into the HLP vault and participate in sharing the profits and losses of the market-making strategy, thereby democratizing the profit opportunities traditionally limited to professional market makers for ordinary users.

The HLP strategy runs automatically in the background (currently, some strategies are executed off-chain, but positions and fund changes are publicly verifiable on-chain), taking on the responsibilities of providing counterparty liquidity in the order book and taking over forced liquidation positions. In return, the HLP vault enjoys a portion of the protocol's fees (approximately 3% as mentioned above) and liquidation profits, which are used to enhance the vault's yield.

Since its launch in mid-2023, the scale and performance of the HLP vault have grown significantly: TVL has quickly climbed to the $500 million level. The annualized yield between 2023 and 2024 reached the range of 8-15%, and more importantly, its returns have a low or even negative correlation with the trends in the crypto market, achieving considerable risk-adjusted returns under relatively low volatility (for example, from mid-2023 to 2024, the correlation of HLP returns with BTC was -9.6%, and the Sharpe ratio was significantly higher than that of BTC), making HLP particularly attractive to users: it provides a robust source of returns different from simple token holding and hedges against single market trend risks to some extent.

In terms of risk management, the HLP vault adopts a loss isolation principle, ensuring that even if the vault incurs losses, it does not affect other parts of the protocol: each trading market and account is on a per-position margin basis, meaning that losses incurred by one asset do not spill over to other asset markets. When a leveraged position is liquidated, the HLP's liquidation module (also known as the liquidator vault) first attempts to close the position through order book matching; if market liquidity is insufficient for liquidation and there is a risk of bad debt, the protocol will initiate an automatic deleveraging (ADL) mechanism, using unrealized profits from profitable positions of the underlying asset to hedge against losses. This mechanism is triggered only in extreme cases and is rarely used under normal circumstances.

3. Token Airdrop

Hyperliquid adopts an aggressive community decentralization strategy for token issuance: a combination of large-scale airdrops and trading incentives quickly gathers popularity and converts users into shareholders. In the HYPE token TGE at the end of November 2024, the official airdropped 31% of the total supply directly to early users, covering over 100,000 active trading participants of Hyperliquid.

4. HIP-3 Decentralized Market Deployment Mechanism — Transforming Hyperliquid into "AWS for Liquidity"

HIP-3: Builder-Deployed Perpetuals is a major upgrade launched by Hyperliquid in 2025. It decentralizes the creation rights of perpetual contract markets from validator governance to the community and third-party developers, achieving a fully on-chain permissioned deployment mechanism. Previously, the launch of new markets relied on centralized processes, which were inefficient; HIP-3 opens market creation through auction and staking models, stimulating external innovation. The pre-IPO market's perp project Ventuals is an example of a HIP-3 ecosystem project.

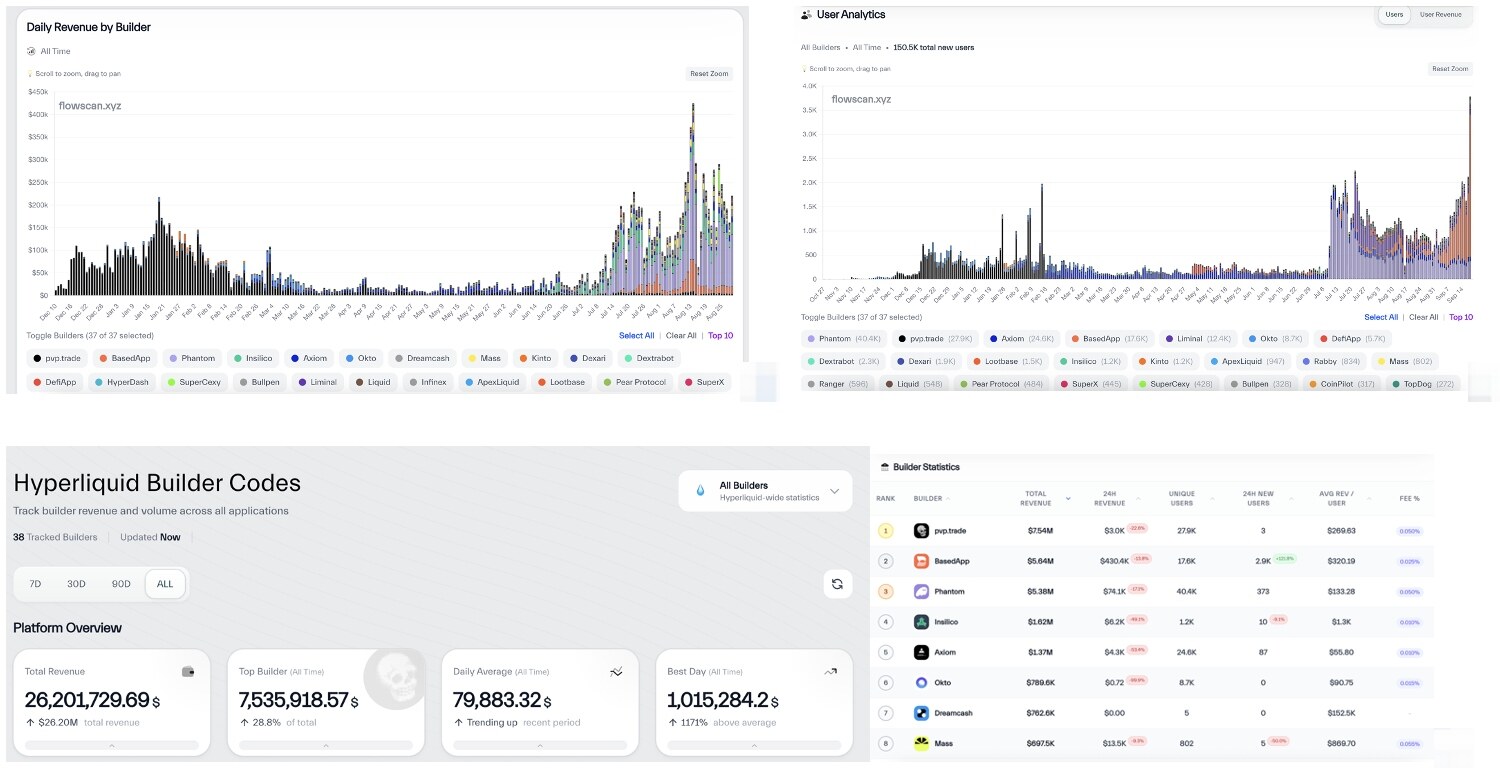

5. Builder Code — Finding More Growth Engines from Front-End Traffic Entry

Builder Codes is an innovative product launched by Hyperliquid, providing third-party developers (such as wallets and other front-end trading applications like prediction markets and trading bots) with a set of protocol-native, programmable business models. Its core logic abandons simple API calls in favor of a rigorous on-chain workflow.

For example, in July of this year, Phantom integrated Hyperliquid Builder Codes: the Builder Code mechanism allows Phantom to route user trades to Hyperliquid's order book through a custom interface and enables Phantom to earn additional fees from the transactions. The total fees paid by users = Hyperliquid's base trading fee + Builder (Phantom)'s additional routing fee.

Data Source: https://www.flowscan.xyz/

6. USDH

USDH is the native dollar stablecoin of the Hyperliquid ecosystem, designed to replace the dominant USDC on the platform and capture substantial interest income back into the ecosystem. In September 2025, Hyperliquid initiated a public bidding process, attracting proposals from giants like Paxos, Frax, and Ethena, with Native Markets winning after 9 days of validator voting.

The $5.5 billion on the Hyperliquid chain mainly consists of USDC held by users (as trading margin or liquidity), and the interest generated from these reserves (approximately $200 million/year) is retained by USDC issuer Circle for its operations and profits, rather than being directly distributed to USDC holders. This is because USDC is a non-interest-bearing stablecoin, and holders only enjoy a 1:1 dollar peg, while the issuer earns returns by managing the reserves.

Now, with Native Markets issuing USDH, the situation is similar: USDH is also a non-interest-bearing stablecoin, and Native Markets does not intend to directly distribute any interest to USDH holders (i.e., 0%), but they promise to use 100% of the net interest income generated from reserves for the Hyperliquid ecosystem: 50% will go to the Assistance Fund for buying back HYPE tokens from the secondary market (enhancing HYPE value), and the other 50% will be used to expand the application scenarios of USDH, such as incentivizing Builder Code front-end integration, using USDH for pricing in HIP-3 markets, user incentives, and partner collaborations. This means that USDH holders will not receive interest directly but can benefit indirectly from ecosystem growth (such as higher liquidity, incentives, and HYPE appreciation, if they also hold HYPE). This design aims to "internalize" the returns within Hyperliquid, rather than allowing them to flow out like USDC.

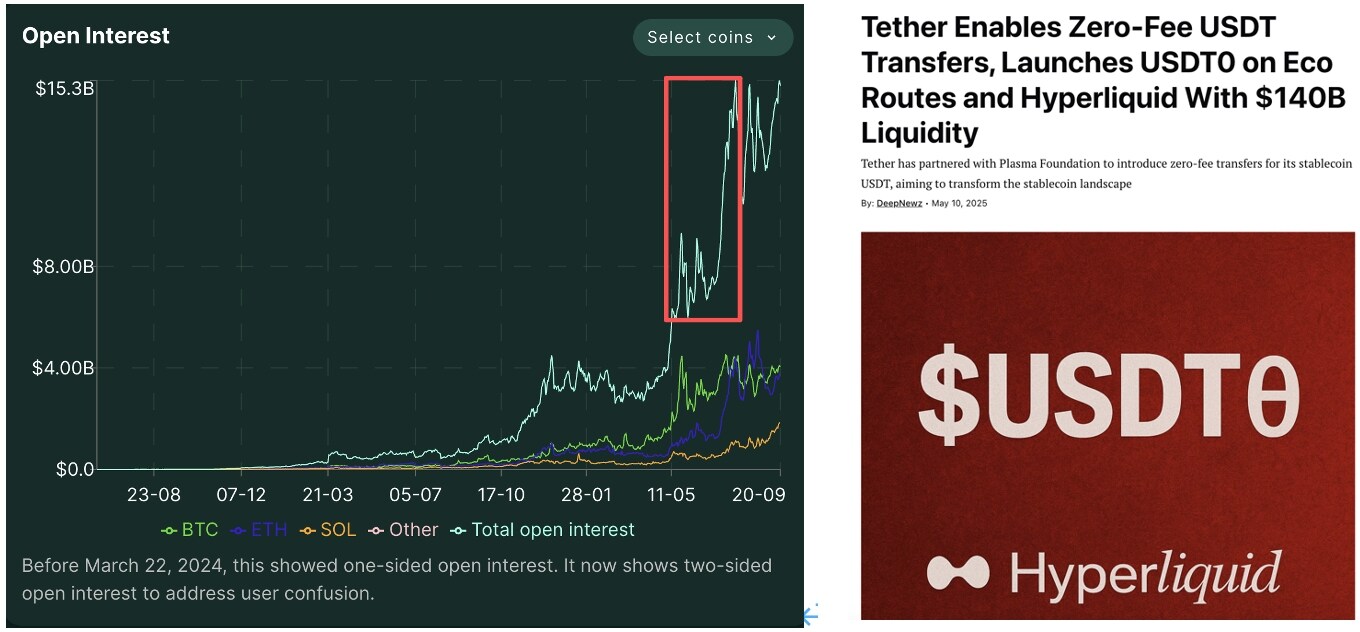

PS: It is worth mentioning that after May, Hyperliquid's platform saw a significant surge in open interest (daily OI rose from $5 billion to over $12 billion), primarily due to the collaboration with USDT0, which attracted USDT users to Hyperliquid.

7. Community Feedback: The team has conducted thorough market research and flexibly adjusted strategies at different stages to provide users with the products they need.

According to a podcast by Hyperliquid's Chinese community influencer Little Raccoon titled “Web3 101—Why Do Whales Love Using Hyperliquid?,” Hyperliquid has captured users in the following six stages:

- Early Deep Users in the Perpetual DEX Track: The early team proactively DM'd deep users from early perpetual DEX tracks like GMX on Twitter and invited them to participate in Private Beta testing.

- Copy Trading System: The second wave of early users mainly came from the funding pool of the "copy trading system," which is healthier for market making and LPs.

- Token Index Bundles: The third wave of user growth, which was also the most concentrated period of user data growth for Hyperliquid, occurred when they launched a FriendTech ecosystem token ETF product, which, although not necessarily profitable, garnered significant attention.

- Airdrops: The next wave of significant user growth came from airdropping Memecoins Purr, rather than waiting a year and a half to issue governance tokens.

- Whale Positions: The recent wave of attention has come from "whale positions," with traders like James Wynn or Aguila Trades, who have large positions and significant profits and losses, becoming a phenomenon in Chinese media.

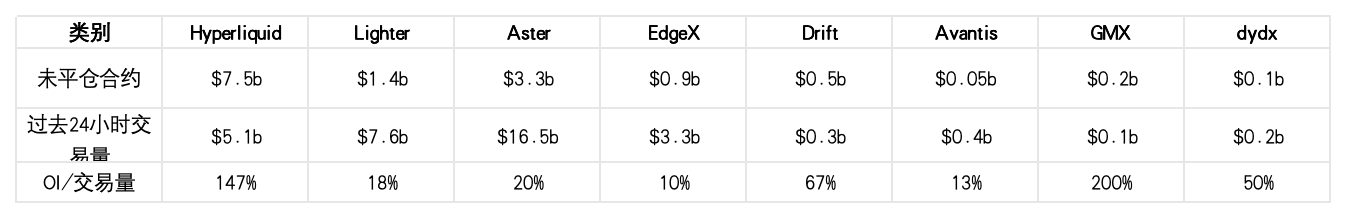

4.2 Aster

Aster is a perpetual DEX that emerged on March 31, 2024, from the merger of the multi-asset liquidity protocol Astherus and the perpetual contract protocol APX Finance. It is highly integrated with the BNB ecosystem, providing perpetual trading backend integration for PancakeSwap, and is fully funded by YZi Labs, with strong ecological resources and traffic support.

4.2.1 Aster Team's Thesis

In May 2025, during a market controversy involving a high-profile liquidation event of well-known crypto trader James Wynn, Hyperliquid's Jeff publicly issued a "Transparent Market Theory" tweet in response to the market controversy. Meanwhile, the Aster team responded with a tweet expressing that it was an excellent time to launch a dark pool perpetual DEX.

Aster CEO Leonard has a completely different view on Jeff's Transparent Market Theory: he believes that large trades can significantly impact market prices, leading to slippage and losses. Professional traders and institutions need effective ways to hide their trading intentions to avoid being exploited by other traders, especially those using "front-running" strategies.

We believe it may be difficult to define whose theory is right or wrong. Jeff's theory aims to eliminate "arbitrage bad actors" who have no impact on pricing risk in trading systems through a game-theoretic mechanism, which is disruptive for traditional trading systems (as even traditional stock exchanges do not have similar protective mechanisms for market makers). Theoretically, this environment could be more friendly to many mid-sized market makers, reducing the space for arbitrage using tech asymmetry, but the tradeoff may be that it could sacrifice some price discovery efficiency. Additionally, as a taker, one might encounter issues of absolute transparency and targeted attacks.

Aster aims to provide a specific solution addressing these two tradeoffs, potentially capturing different users (especially takers who are more sensitive to large trades and fear being front-run or targeted for losses).

4.2.2 Aster Product and Technical Implementation

1. Dual-Mode Architecture (GMX + Hyperliquid) — Serving Two Completely Different User Groups

Aster is known for its "dual-mode" trading experience. For ordinary users, Aster offers Simple Mode: a market-making mechanism based on on-chain liquidity pools, allowing users to trade directly with the liquidity pool, similar to GMX's GLP + Oracle Priced AMM model, without needing to place orders. The LP corresponding to the market acts as the counterparty, and this mode even supports ultra-high leverage of up to 1001 times, referred to as the "Degen Mode," catering to retail users who prefer high-stakes trading. The simple mode does not require users to pre-fund their platform accounts; assets in users' wallets can directly participate in trading, lowering the entry barrier.

For professional traders, Aster offers Pro Mode: utilizing a CLOB mechanism to provide a high-performance matching environment for quantitative institutions and market makers. The professional mode is equipped with features including grid trading bots, advanced APIs, and privacy orders. Additionally, the fee structure for Pro Mode is specifically designed to undercut Hyperliquid: Aster maker 0.010% / taker 0.035%, while Hyperliquid charges 0.015% / 0.045%.

2. Differentiated Functionality: Privacy Orders — A Theory Opposed to Jeff's Transparent Market Trading System Philosophy

1) Aster's Main Solution — Hidden Orders

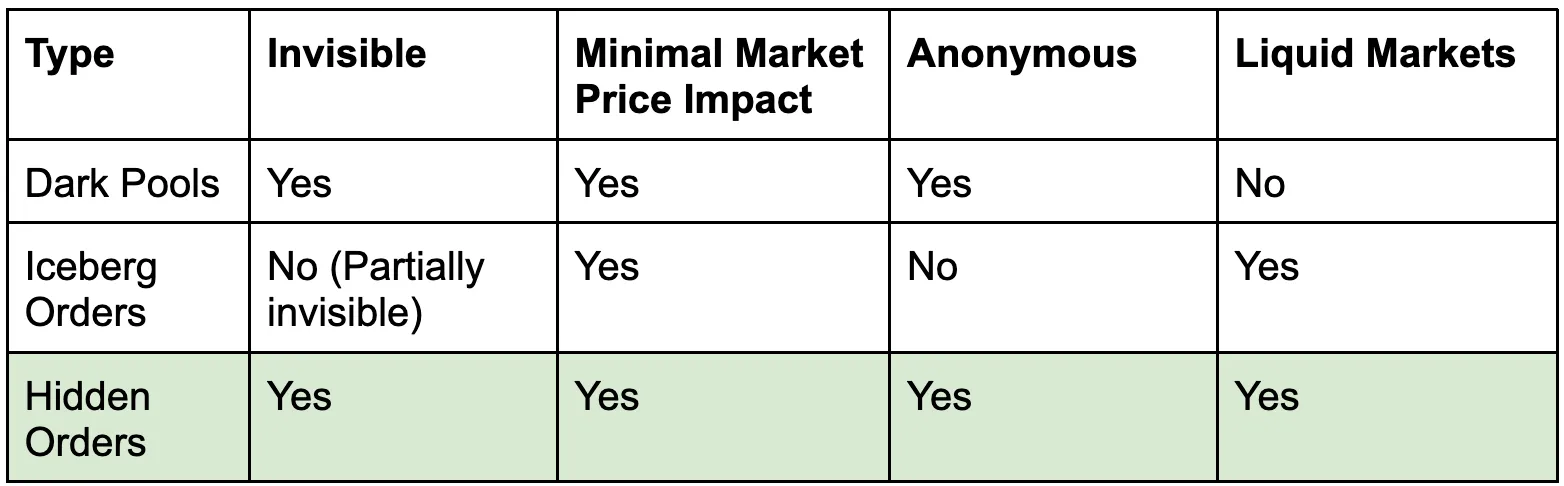

Following the above reasoning, Aster lists three types of existing privacy environments for trading orders and their respective trade-offs:

- Dark Pools: Executing large trades in a completely anonymous private venue separate from the public order book.

- Iceberg Orders: Splitting a large order into many smaller orders, displaying only a small portion on the public order book ("the tip of the iceberg"). When a small portion is filled, another part automatically replenishes until the entire order is completed.

- Hidden Orders: Placing completely invisible limit orders directly into the public market's matching engine, visible to the market only after the order is filled.

- Aster believes that for the high-leverage, fast-paced crypto perpetual market, hidden orders are the best choice. They balance execution secrecy, centralized liquidity, and minimal market impact, providing traders with a better trading experience than dark pools and iceberg orders.

2) The General Technical Logic of Implementing Hidden Orders

The fundamental problem that Hidden Orders aim to solve is how to execute a completely confidential, private trade in a fully transparent, public system. This problem can be broken down into the following three sub-problems:

- I need to prove to the system that I have a legitimate, well-funded order, but I must not disclose any details of the order: cryptographic encapsulation (locally encrypting the order in the wallet), generating ZK proofs (proving sufficient collateral supports leveraged positions, correct price/quantity format), submitting ZK proofs on-chain, and storing trading intentions in a non-public data structure (private state tree).

- How do hidden orders find counterparties and execute trades (invisible to everyone): unified liquidity pool + shadow matching algorithm, unified liquidity pool (hidden orders share a pool with public orders to ensure optimal execution opportunities), shadow matching algorithm (decrypting hidden orders).

- When a match occurs, how to prevent attacks at the moment of final settlement: during matching, the engine first submits a hash commitment to lock the transaction fingerprint, then reveals the plaintext data and atomically executes the asset exchange, preventing front-running and sandwich attacks.

4.2.3 Aster Business and Ecosystem Operation Strategy

1. Product and User Operations

The Aster team leverages its previous experience from APX (exploring GMX and Orderbook routes) to achieve user segmentation coverage through the two modes: beginners can start with Simple Mode (high leverage, one-click trading without order placement suitable for degens), and gradually transition to Pro Mode (providing privacy features in CLOB to address previous controversies surrounding Hyperliquid), thereby improving user retention.

In terms of asset support, Aster not only supports perpetual contract trading for mainstream crypto assets but also boldly launched 24/7 perpetual trading for traditional stock derivatives like US stocks, allowing users to trade contracts for stocks like Tesla around the clock.

Image: User discussions in the TG group in April of this year (when YZi Labs had not yet invested).

Aster has been rooted in the Binance ecosystem from the very beginning, collaborating with leading projects such as PancakeSwap and SafePal to quickly establish brand trust and acquire user traffic (for example, users can directly trade Aster contracts within the SafePal wallet, and PancakeSwap provides liquidity support for its stablecoins). Upon launching its spot market, Aster partnered with the on-chain credit protocol Creditlink, becoming the only platform to claim its CDL token airdrop, thereby establishing a close connection with the emerging on-chain credit track. Additionally, Aster has joined the token support program of Four.meme, providing traffic and channel support for Meme projects, and the three major project parties jointly held a trading competition.

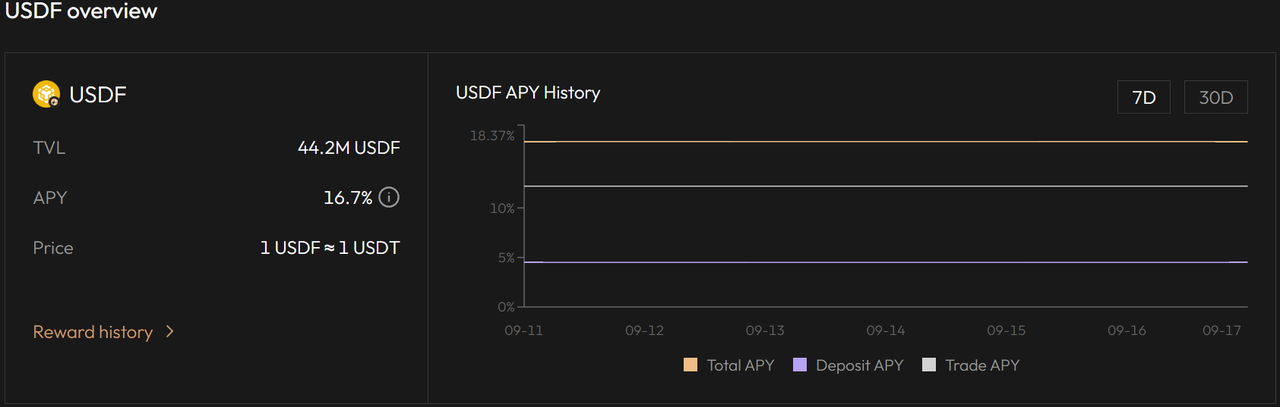

II. Exploring the Combination of Margin and DeFi: Introducing USDF to Make Margin "Interest-Bearing"

Aster allows users to use liquid-staked tokens (such as asBNB) and the native yield-bearing stablecoin USDF (a Delta-neutral yield stablecoin issued by Lista DAO) directly as margin, meaning users can achieve "multiple benefits": earning staking rewards while also using yield-bearing assets for leveraged trading. For example, users holding asBNB can earn ecological staking rewards while also using it as margin to open positions. Aster's extreme pursuit of capital efficiency unlocks another dimension of returns for traders.

Aster has specifically developed the Trade & Earn feature, encouraging users to use USDF as margin (encouraging users to convert their USDT into USDF to earn a base APY of 4.5%, and then trade using USDF as margin to earn an additional 12.2% APY, totaling 16.7% returns). The enhanced wealth effect has also stimulated the steady growth of Aster's TVL.

III. Token Distribution and Economic Incentives

The Aster team plans to allocate 53.5% of the token supply to community airdrops to reward early contributors and traders. Among them, up to 8.8% (704 million tokens) will be airdropped to eligible users in the points activity on the day of TGE, with the remaining portion gradually released over 80 months.

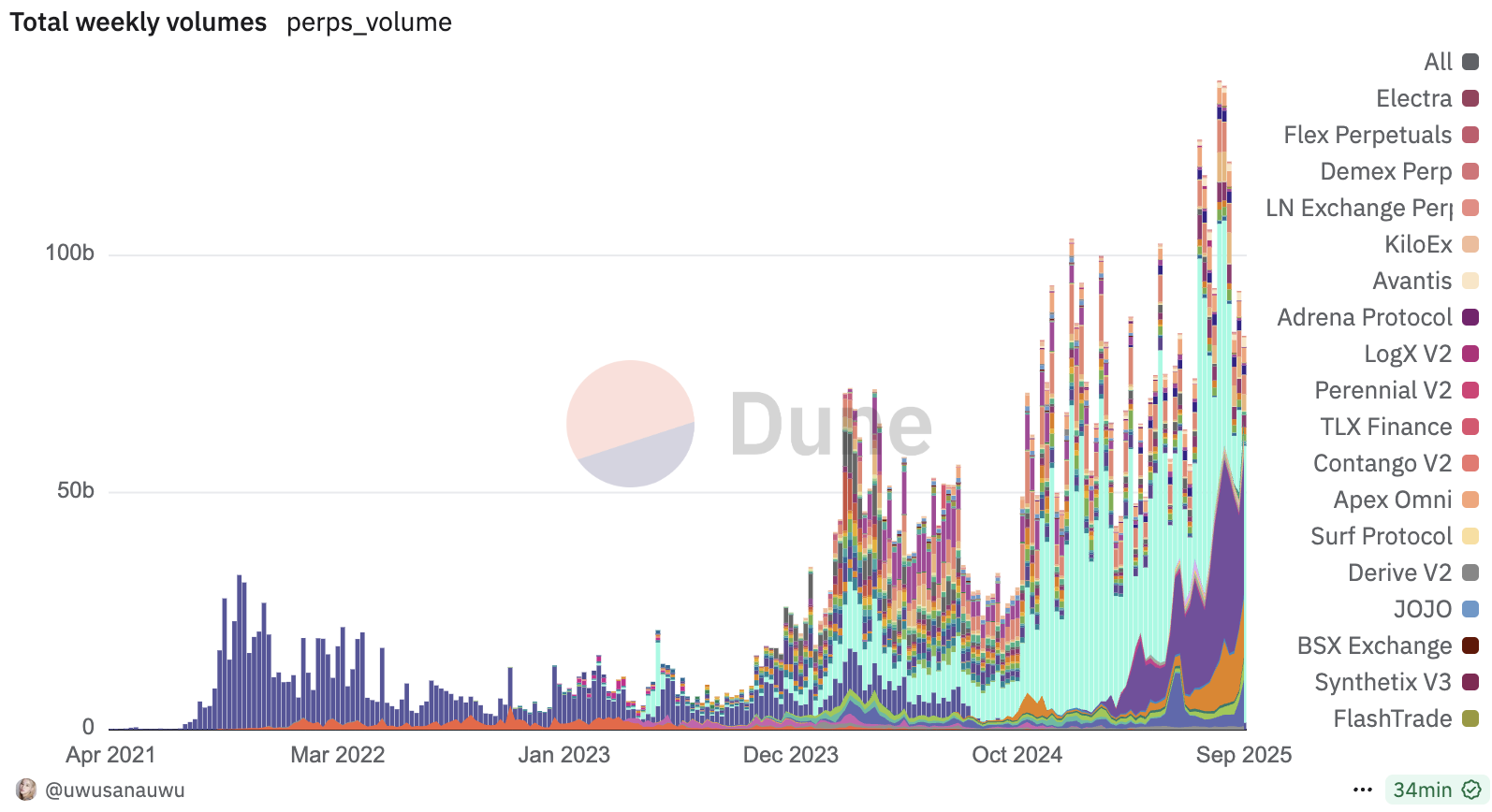

Image: However, as we mentioned in the previous third section, many in the community question the generally low OI/Volume ratio of current perp DEXs, reflecting that most are wash trading to inflate volume for airdrops.

IV. Introduction of Market Makers

Aster introduces Market Makers to enhance order book depth and reduce slippage, especially since the Hidden Orders in Pro Mode require reliable counterparties. The main operational strategy is to provide fee discounts and exclusive API access to encourage them to inject liquidity. The ecological allocation (30%) is used for market maker incentive programs, such as rewarding high-frequency quote providers through grants or buyback mechanisms. The platform also integrates yield-bearing assets through partners (such as Lista DAO) to indirectly attract market makers to participate in the USDF pool. To further strengthen liquidity, Aster introduces a market-making fund, allocating funds from the treasury (7%) and ecological distribution to establish a dedicated fund supporting automated market-making strategies. This fund provides incentives for high-volatility assets (such as BTC perpetuals), and fund participants can receive $ASTER rewards and protocol revenue sharing.

4.3 Lighter

The Lighter project was initially positioned as a spot DEX but later transformed into a perp DEX. It is a CLOB perp that relies on a self-built zk rollup settlement based on Ethereum, providing matching speeds and experiences close to centralized exchanges. Its main technical highlight is that zk snark proof ensures that the matching logic and settlement results of each order are verifiable, solving the trust issue of on-chain trading. The project's founder, Vladimir Novakovski, has a background in financial quant (former Citadel high-frequency trader) and graduated from Harvard University with a degree in economics. Major investors include a16z, Coatue, and others.

4.3.1 Product Design Philosophy of Lighter Founder Vladimir Novakovski

The Lighter team believes that the main issues with existing Perp DEXs are "compromises on the core principles of decentralization":

- Compromise on performance leads to centralization: In pursuit of high performance, almost all order book DEXs have centralized the core function of matching on off-chain servers.

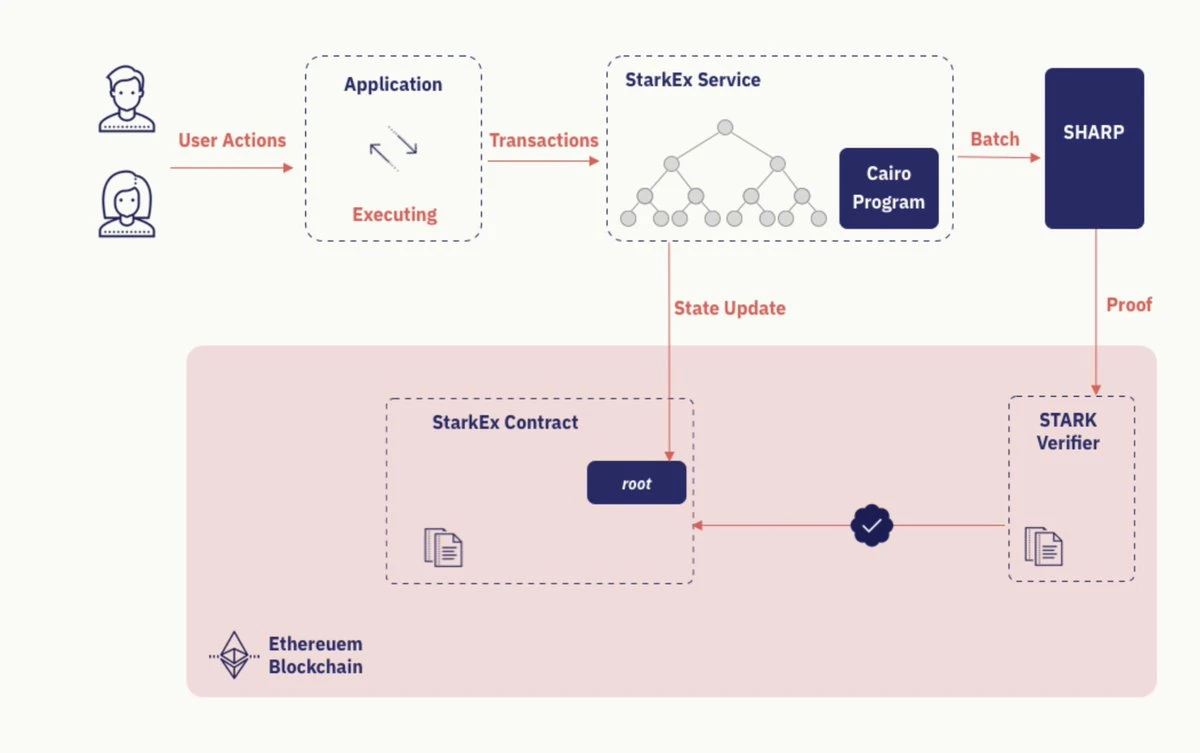

- False "verifiability": Existing zk rollup solutions like StarkEx completely entrust the matching process to centralized operators, while ZK proofs only verify the results but do not include verification of the matching process. They believe that if the core fairness principle of "Price-Time Priority" (the highest bidder and the lowest seller are prioritized; in case of the same price, the first order placed is prioritized) cannot be strictly enforced, then such verification is incomplete, leaving room for centralized operators to act maliciously (for example, it cannot be verified whether trades were indeed executed in the order they were placed).

- Sacrificing security and ecology for sovereignty: Application chain solutions, in pursuit of complete autonomy, have detached from Ethereum, which is a regression. They believe that the security of derivatives exchanges and their composability with the DeFi ecosystem are crucial and should not be sacrificed for performance.

- AMMs cannot meet professional trading needs: They firmly believe that order books are the most efficient and professional trading model. Due to inherent slippage and impermanent loss issues, AMMs cannot become the mainstream infrastructure of financial markets.

They envision an ideal Perp DEX:

- Not using generic L2, but building a highly optimized Rollup from scratch for the specific trading scenario to achieve extreme performance.

- By implementing a complete matching and settlement engine in the ZK circuit, taking the "execution power" of trading away from centralized Sequencers and giving it to immutable mathematical algorithms.

- Designing ZK-optimized data structures to create new tools like "order book trees," making it computationally feasible to execute complex exchange logic within the circuit.

- Resolutely not detaching from Ethereum to inherit its unparalleled security, liquidity, and composability.

4.3.2 Lighter Product and Technical Implementation

Lighter's core goal is to use zero-knowledge proofs to build a trading protocol that mathematically guarantees process fairness, achieves result efficiency, and inherits Ethereum's top-tier security, completely solving this "impossible triangle."

1. Infrastructure: Application-Specific ZK-Rollup

Lighter can be understood as a "trading-specific Layer 2 scaling solution" tailored for itself, with the core idea of processing thousands of transactions at high speed off-chain, then packaging the "execution summary" of these transactions into a concise, tamper-proof zk snark proof, and finally publishing this proof on Ethereum for verification.

How it works: Users send transactions to the Sequencer >> The Sequencer is responsible for ordering the received transactions into a block >> The Prover obtains this ordered block, executes each transaction within the block on its own server, and generates a ZK proof for the entire execution process >> The Prover submits this proof to a smart contract on Ethereum >> The smart contract verifies this proof, ensuring that all transactions that occurred off-chain are valid and compliant, thus updating the entire system's state.

2. Core Engine: Verifiable Process Matching and Settlement Engine

This part of the technical implementation is the most critical technical differentiator for Lighter. Traditional zk rollup exchanges only verify the "results" of transactions (for example, proving that orders A and B were indeed executed), but the "process" of execution (i.e., why A and B were matched instead of A and C) is entirely determined by centralized black-box service providers. Lighter's engine encodes the fundamental principle of "Price-Time Priority" into the ZK circuit, allowing the matching process to be zk-verified for adherence to this principle.

How it works: When the Prover executes a transaction, it not only verifies that two orders can match. It is, within the ZK circuit, mandatorily and provably:

- Finding the best quote in the current market (the lowest selling order or the highest buying order).

- If the prices are the same, finding the earliest posted order.

- Executing the matching of this highest-priority order.

- Every step of this process is recorded in the ZK proof. The settlement logic is similarly executed in a verifiable and fair manner within the circuit.

What problem does it solve: It fundamentally eliminates the ability of centralized operators to conduct order review, favor specific market makers, or engage in front-running trades.

4.3.3 Lighter Business and Ecosystem Operation Strategy

1. Product and User Operations

The most core unique feature of the product/technology is ensuring that the matching logic and settlement results of each order can be verified through zk snark proof, solving the trust issue of on-chain trading (ensuring matching fairness through customized ZK circuits, with matching adhering to "price-time priority" and hard-coded in the circuit, primarily addressing miner MEV front-running issues).

Additionally, to capture market share from Hyperliquid, Lighter's most differentiated user operation feature is the implementation of a 0-fee strategy: no fees for placing or taking orders. This strategy immediately attracted a large number of traders and market makers to migrate: in the past month, Lighter's average daily trading volume reached $3.8 billion, ranking second, and its TVL surged from several million to $500 million.

2. Token Distribution and Economic Incentives

Lighter has not yet issued tokens but has adopted a points program to incentivize early users and liquidity providers, aiming for future airdrops. Users earn Lighter points by trading on the platform or providing liquidity to public pools, and they can also receive additional points for inviting others (via Discord invite codes). Points are settled weekly and rankings are dynamically adjusted.

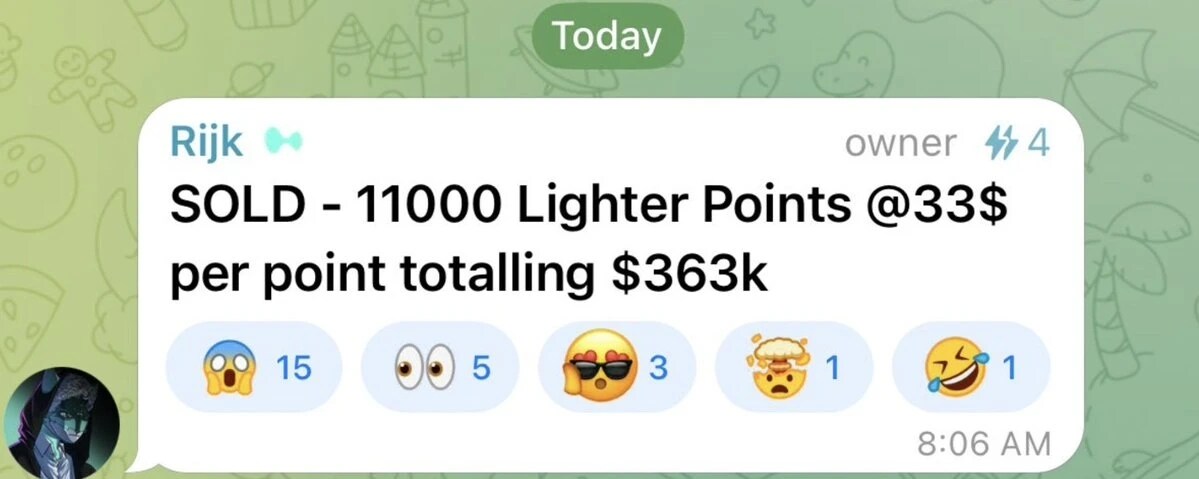

Due to the successful precedent set by Hyperliquid (which airdropped 31% of its tokens to users), the market generally expects Lighter to convert points into token airdrops at a certain ratio. This expectation has led to a surge in OTC trading of points: screenshots show that Lighter points are trading at approximately $33 per point in the OTC market, with a cumulative transaction volume reaching $363,000. As the total supply of points has not yet been disclosed, it is currently difficult to provide a reasonable token valuation. However, we can refer to Hyperliquid's path: at that time, Hyperliquid airdropped 30% of its tokens to the community, with a valuation of around $3 billion at launch. If Lighter adopts a similar distribution strategy, its overall valuation is likely to be at least $3 billion. Although the final valuation of the airdrop remains highly uncertain, the speculative trading of points has become an important driving force behind Lighter's trading volume and open interest growth.

4.4 EdgeX

EdgeX is one of the first projects launched by the new accelerator incubated by Amber Group in July 2024. It is currently gaining popularity in the Korean community, with users reporting a good experience with the mobile app.

4.4.1 EdgeX Design Philosophy

The core of EdgeX's product philosophy is "to create products that traders truly love to use." The team has deeply understood the common pain points in the current crypto market between CEX and DEX and has proposed a systematic solution.

- Trust crisis and asset security risks of CEX: User asset security cannot be self-verified, and issues such as platform misappropriation, censorship, or single points of failure always hang over traders like the sword of Damocles.

- Performance and experience bottlenecks of existing DEXs: Most DEXs, especially early AMM models, face high gas fees, trading delays, slippage, and MEV attacks. Even order book DEXs often struggle to match the performance and user experience of CEXs, with relatively scarce features (such as advanced order types and leverage) and complex onboarding processes that exclude many retail users accustomed to the smooth experience of CEXs.

- Fragmentation and high barriers to entry in DeFi Lego: The existing modular systems are still highly fragmented, with high development thresholds, making it difficult for ordinary users to leverage their composability. Developers wanting to launch a financial product need to integrate technologies across consensus, execution, settlement, and other layers, which is costly and inefficient.

4.4.2 EdgeX Product and Technical Implementation:

In response to the above pain points, EdgeX's solution reflects a clear evolution path from application to platform, from V1 to V2:

V1 Implementation — Perpetual Contracts and Forced Withdrawals Based on StarkEX

- EdgeX uses StarkEX perpetual contracts to achieve trustless settlement and censorship-resistant features (such as forced withdrawals).

- Since it operates on Layer 2, users' transactions are executed off-chain first, then submitted to StarkEx to generate proofs, and finally settled on Ethereum. This ensures both the integrity and verifiability of transactions.

- If EdgeX fails to process a user's withdrawal request within a grace period (usually 1-2 weeks), users can initiate a forced withdrawal.

- First, users can register their Stark Key to a certain L1 address and then submit a withdrawal request directly to Ethereum. If the request is ignored, users can exit directly through a Merkle proof.

- It is important to emphasize that EdgeX never holds user funds. Funds are always kept in Ethereum contracts, and only the user's own signature can move them.

V2 Implementation — Building a Modular Financial System to Lower the Barriers to DeFi Innovation

- EdgeX V2 aims to provide a series of plug-and-play financial modules (trading, liquidity, lending, wallets, etc.). This system is like Lego blocks in the financial field, allowing users and developers with little programming experience to easily customize and build their own financial products, significantly reducing innovation costs and entry barriers.

- At the same time, EdgeX in V2 completes the construction of a unified DeFi entry point: by aggregating multi-chain liquidity and providing a unified front-end UI (web, app, TG bots), EdgeX aims to become a bridge for retail users to enter the vast and complex multi-chain DeFi world from CEX, simplifying the complexities of multi-chain and multi-protocol.

- In summary, EdgeX's philosophy is to start from a trader's most urgent "point" (a user-friendly Perp DEX) and gradually build an open, efficient, and secure "plane" (a modular financial ecosystem), with the ultimate goal of leading a more innovative, efficient, and inclusive decentralized financial future.

Mobile-First Experience. Currently, most traders access Hyperliquid or Lighter through OKX Wallet or Phantom, while EdgeX simplifies this process by launching a native mobile application (now available on the App Store), allowing users to trade conveniently anytime and anywhere (popular in the Korean community).

5. dydx, GMX Why They Lost the Competition

5.1 Why dYdX with Its First-Mover Advantage Failed — The Overly Ponzi-Like Token Rebate Incentives Ultimately Burned Out

COO of Fulid/Instadapp DHM tweeted in May this year, “What did dydx do wrong” discussing with the community why dydx lost the competition despite its advantages, which sparked widespread discussion (240,000 views, 246 comments), and the reasons have been summarized in the comments.

Topic: Why did dydx lose to hyperliquid?

- Capital Advantage: Raised $85 million through several rounds of financing, with top VC investments from a16z, Paradigm, Polychain, Dragonfly.

- Airdrop Scale: dYdX's initial airdrop value reached $2 billion, surpassing Hyperliquid's $1.6 billion.

- First-Mover Advantage: Had 5 years of development time to create the most competitive product (white paper released in 2017).

- Revenue Capability: Generated over $530 million in cumulative revenue.

- Technical Autonomy: Also built its own chain (dYdX Chain), theoretically giving the team all the tools to create the best-performing matching engine.

1. Summary of Reasons: Problematic Liquidity Incentive Model