Original | Odaily Planet Daily (@OdailyChina)

Author | Wenser (@wenser 2010)

This morning, according to Bloomberg News, three major stock exchanges in the Asia-Pacific region, including the Hong Kong Stock Exchange, have collectively resisted listed companies transitioning to cryptocurrency treasury (DAT) companies. Subsequently, a spokesperson for the Hong Kong Stock Exchange responded that the framework of the Hong Kong Stock Exchange must ensure that the business and operations of all applicants seeking to list, as well as those already listed, are viable, sustainable, and substantive; recently, at least five companies' strategic plans to transition to cryptocurrency treasury (DAT) companies have been rejected. In light of the previous suspension of QMMM Holdings' stock in the U.S. and the vacant Hong Kong office, it appears that many listed companies executing DAT strategies may need to seek new avenues, transitioning from "dual repair of coin and stock" to "failure of coin hoarding strategy." Odaily Planet Daily will provide a brief analysis of this event in this article.

When the Hong Kong Stock Exchange Hits the Pause Button on Listed Companies' "DAT Strategy"

From the news perspective, the resistance by the Hong Kong Stock Exchange, India, Australia, and other stock exchanges against DAT-listed companies is not coincidental, but rather a necessary action after careful consideration and precedent.

The U.S. SEC and Nasdaq Have Already Tightened the "Listed Companies' DAT Strategy" Window

In early September, we mentioned in the article “From Frenzy to Regulation: U.S. Regulators Begin to Cool Down the 'Crypto Fever' for Listed Companies” that "U.S. SEC and Nasdaq have strengthened regulatory scrutiny over listed companies holding large amounts of cryptocurrency and high-risk enterprises suspected of money laundering." Additionally, according to a report by the Wall Street Journal in late September, the U.S. SEC has collaborated with the Financial Industry Regulatory Authority (FINRA) to conduct inquiries into over 200 companies employing DAT strategies.

During the same period, on September 9, Nasdaq-listed company QMMM Holdings (NASDAQ:QMMM) announced plans to invest $100 million to establish a cryptocurrency reserve, subsequently seeing its stock price increase 9.6 times within three weeks. By the end of September, the U.S. SEC deemed the company suspected of manipulating stock prices via social media, ordering it to suspend trading from September 29, and it remains suspended to this day. Recently, a Caixin reporter visiting the company's Hong Kong headquarters found the office vacant, and when inquiring with employees from a nearby company, they stated that the company had moved in September and its new location is unknown.

Earlier, in August, the U.S. stock BNB treasury company Windtree Therapeutics (WINT) was delisted from Nasdaq on August 21 after its stock price remained below $1 for too long, following multiple reverse splits and failing to meet the usual grace period. (Recommended reading: “BNB Treasury Listed Company WINT Delisted: 'Coin Hoarding Strategy' Can't Cure All Ills”)

From the "BTC hoarding strategy" being emulated by numerous listed companies to ETH treasury companies like Sharplink and Bitmine sparking an "ETH hoarding craze," in just 3-4 months, many DAT-listed companies have already moved past the initial phase of frenzied speculation and entered the "market value assessment" phase.

Behind the Ineffectiveness of the "DAT Strategy": The Disappointing Revenue Reports of Listed Companies

As the old saying goes: “Only when the tide goes out do you discover who’s been swimming naked.”

For many U.S. and Hong Kong-listed companies, the truth reflected in this saying is particularly harsh.

Taking the aforementioned Nasdaq-listed company QMMM as an example, according to the financial reports on the U.S. SEC website, the company's revenues for 2022, 2023, and 2024 were $3.396 million, $2.8079 million, and $2.6982 million, respectively, with a net profit of $800,600 in 2022, and net losses of $1.2912 million and $1.5802 million in 2023 and 2024, respectively. Despite previously announcing plans to invest $100 million in Bitcoin, Ethereum, and SOL, its latest annual report shows that as of the end of 2024, the company held only $498,000 in cash and cash equivalents. As of September 30, 2024, QMMM's total assets were only $5.974 million.

Similar data is not uncommon. Previously, Odaily Planet Daily author Dingdang systematically analyzed the phenomenon of market value inversion among many DAT-listed companies in the article “In-Depth Analysis of the Market Value Inversion Phenomenon in Coin-Stock Markets: Value Pit or Capital Mirage?”.

Behind these phenomena lies the illusion and reality of many companies lacking actual business support, merely shell companies with no real revenue, wildly inflating stock prices under the guise of "DAT concept stocks," ultimately leaving ordinary investors with no choice but to take over. According to a recent report from Singapore's crypto research institution 10X Research, retail investors have lost approximately $17 billion in DAT trading. The tightening of DAT-listed company applications by the Hong Kong Stock Exchange is undoubtedly a reluctant move to protect ordinary investors.

The Future of the DAT Strategy: Having Real Business Support and Proving the Necessity of Coin Hoarding Business

Currently, the situation indicates that the windows for DAT-listed companies in Hong Kong, India, Australia, the UK, and other regions are tightening. Specifically,

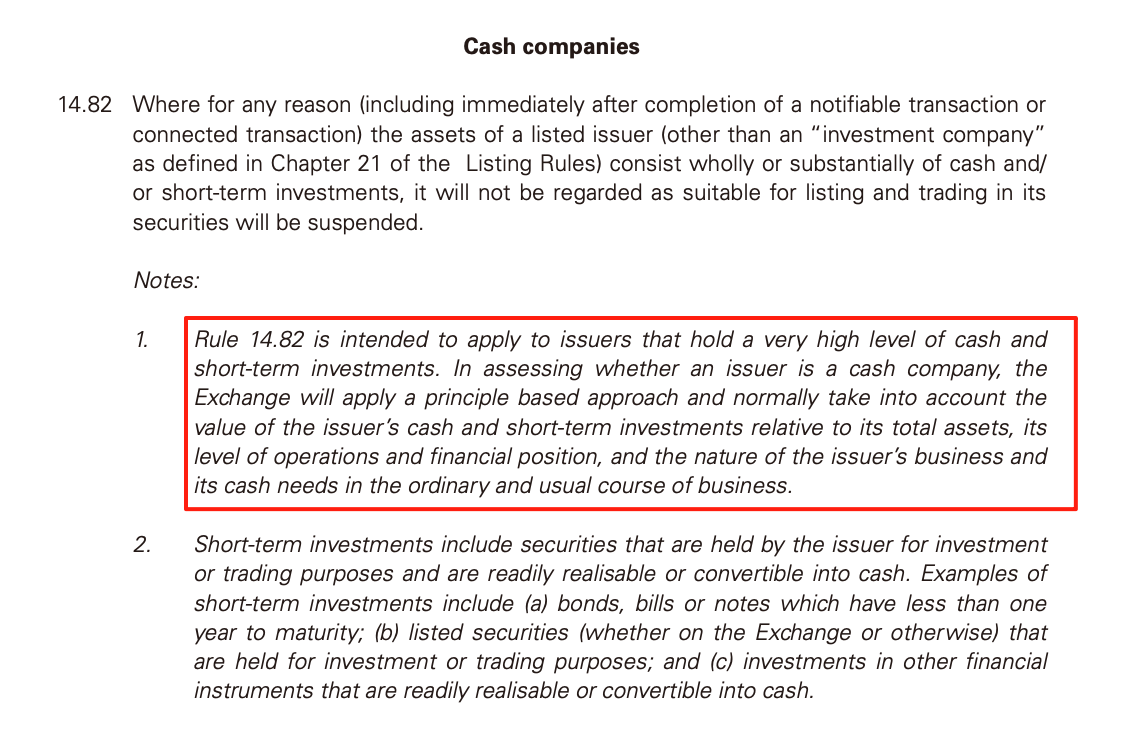

- According to the Hong Kong Stock Exchange Rule 14.82, if a listed company's assets are primarily composed of cash or short-term investment products, such companies will be classified as "Cash Companies" and may be suspended from trading. This rule aims to prevent shell companies from profiting from their listed status;

- In September, the Bombay Stock Exchange in India rejected the listing application for preferential allotment shares from Jetking Infotrain, which had previously stated it would invest part of its earnings in cryptocurrency.

- The Australian ASX Ltd. exchange recently also stated that it prohibits listed companies from having cash or cash-like assets accounting for 50% or more of their balance sheet; the CEO of Australian-listed company Locate Technologies Ltd stated that this clause essentially makes the adoption of DAT "virtually impossible."

- Additionally, according to informed sources, there are regulations prohibiting listed companies in former British territories from transforming into purely "coin hoarding companies."

In contrast, the Japanese stock exchange has a relatively open attitude towards the DAT strategy, but there are currently differing opinions.

According to Hiromi Yamaji, CEO of the Japan Exchange Group, at the end of September, he stated, "If a listed company makes appropriate disclosures regarding the purchase of BTC, it is difficult to strictly define that behavior as not allowed." In contrast, Japan currently has 14 listed companies holding BTC, ranking first in Asia.

However, regarding the representative Japanese listed company executing the "BTC hoarding strategy," Metaplanet, the globally renowned index company MSCI Inc. (Morgan Stanley Capital International) provided a different answer. In February of this year, Metaplanet, supported by its hotel management business, was selected to enter the MSCI Japan Small Cap Index, and subsequently, Metaplanet continued to purchase BTC. This move drew dissatisfaction from MSCI, which recently proposed to exclude large DAT-listed companies from its global index.

According to Simon Hawkins, a partner at Latham & Watkins law firm, for many potential hoarding companies, whether they can successfully obtain regulatory approval may largely depend on their ability to "prove that purchasing crypto assets is an important part of their operational business."

In summary, strictly controlling the proportion of cryptocurrency assets on the company's balance sheet and clearly articulating to regulatory authorities the necessity of purchasing crypto assets for business support will be essential lessons for future DAT-listed companies.

Recommended Reading

Hong Kong Cryptocurrency Treasury Company QMMM Ordered to Suspend Trading by U.S. SEC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。