比特币清算可能达到102亿美元,如果$BTC上涨10%:几率如何?

想象一下——比特币价格的一小步变动可能会抹去102亿美元的对赌。这听起来很疯狂,对吧?但如果$BTC USDT仅上涨10%,这正是可能发生的事情。

交易者和投资者正在密切关注,因为这可能导致历史上最大的比特币清算之一。让我们看看这为什么重要,以及这可能意味着什么。

102亿美元的空头面临风险:比特币清算因素

Ash Crypto表示,如果$BTC价格上涨10%,大约102亿美元的空头头寸可能会被自动平仓。当这种情况发生时,交易者必须购买资产以弥补损失,这会推动价格上涨。

这被称为比特币空头挤压,它可以迅速使市场变得非常看涨。简单来说,即使资产小幅上涨,也可能引发一波购买潮,抹去对该币进行做空的交易者,而如果这种势头持续,价格可能会大幅上涨。

ETF资金流出显示市场犹豫

根据吴区块链的消息,美国现货比特币ETF资金流出持续,在10月17日出现了净367百万美元的代币流出。根据今天最新的BTC新闻,这是连续第三天出现资金流出。

现货以太坊ETF也有2.32亿美元的流出,九个基金中没有任何资金流入。

这表明投资者现在非常谨慎。但历史表明,当投资者犹豫不决时,可能会很快出现大幅价格波动——尤其是如果比特币清算发生。

BTC价格分析:现在是整合区,稍后可能反弹?

目前,价格在106,948美元左右交易,24小时上涨1%,但本周下跌5%。图表显示价格在106K附近横盘整理。

RSI (46.4):中性

MACD:早期看涨交叉的迹象可能暗示小幅上涨。

支撑位:106,000美元

阻力位:107,800–108,500美元

经过仔细分析TradingView图表,如果价格突破108.5K美元,可能会触发102亿美元的比特币清算,导致短期挤压反弹至112K–115K美元。如果未能突破阻力,当前BTC价格预测可能会在105,000–107,000美元之间徘徊。

BTC上涨的4个原因:为什么短期挤压感觉迫在眉睫

交易者在问BTC会涨10%吗?以下是四个强烈的理由,表明答案是肯定的:

1. 特朗普暗示大幅降息:较低的利率意味着资金成本更低。投资者可能会承担更多风险,将资金从债券转移到数字资产。这可能有助于全球最大的加密货币上涨。

2. Coinbase溢价差转为负:早前在2025年3月至4月出现过这一信号,正是在价格上涨60%之前,而同样的图表正在重复,这可能意味着代币正在悄然积累压力,准备大幅跳升。

3. 币安正在积累:币安的大额购买显示聪明的投资者认为此次崩盘是一个买入机会。

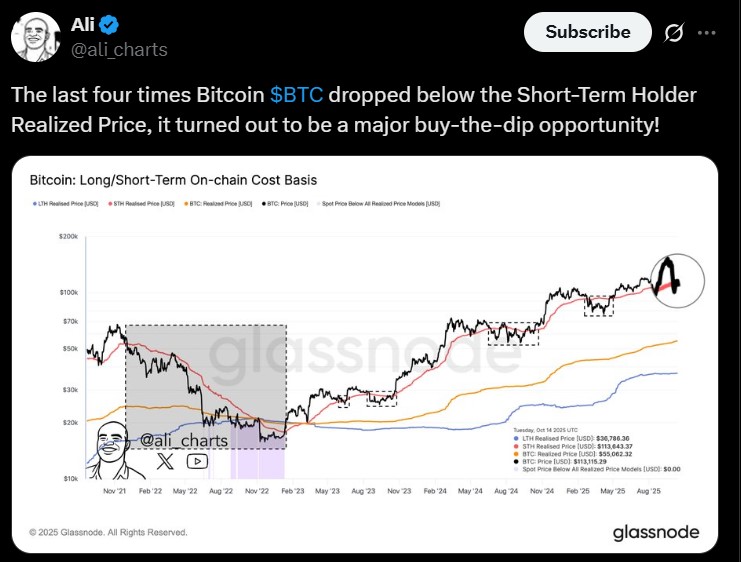

4. 短期持有者实现价格信号: 加密分析师Martinez Ali 的链上数据表明,它接近历史买入区间。每次发生这种情况时,通常标志着底部,暗示趋势反转和价格突破可能会发生。

结论:短期挤压即将来临?

所有这些因素;ETF资金流出、价格横盘整理和看涨信号——都表明比特币清算事件可能会触发强劲反弹。即使是小幅的BTC上涨也可能迫使空头平仓,迅速推动价格上涨。

请仔细关注$108.5K的阻力位。突破该阻力位可能会导致短期挤压反弹,目标价位在$112,000–$115,000之间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。