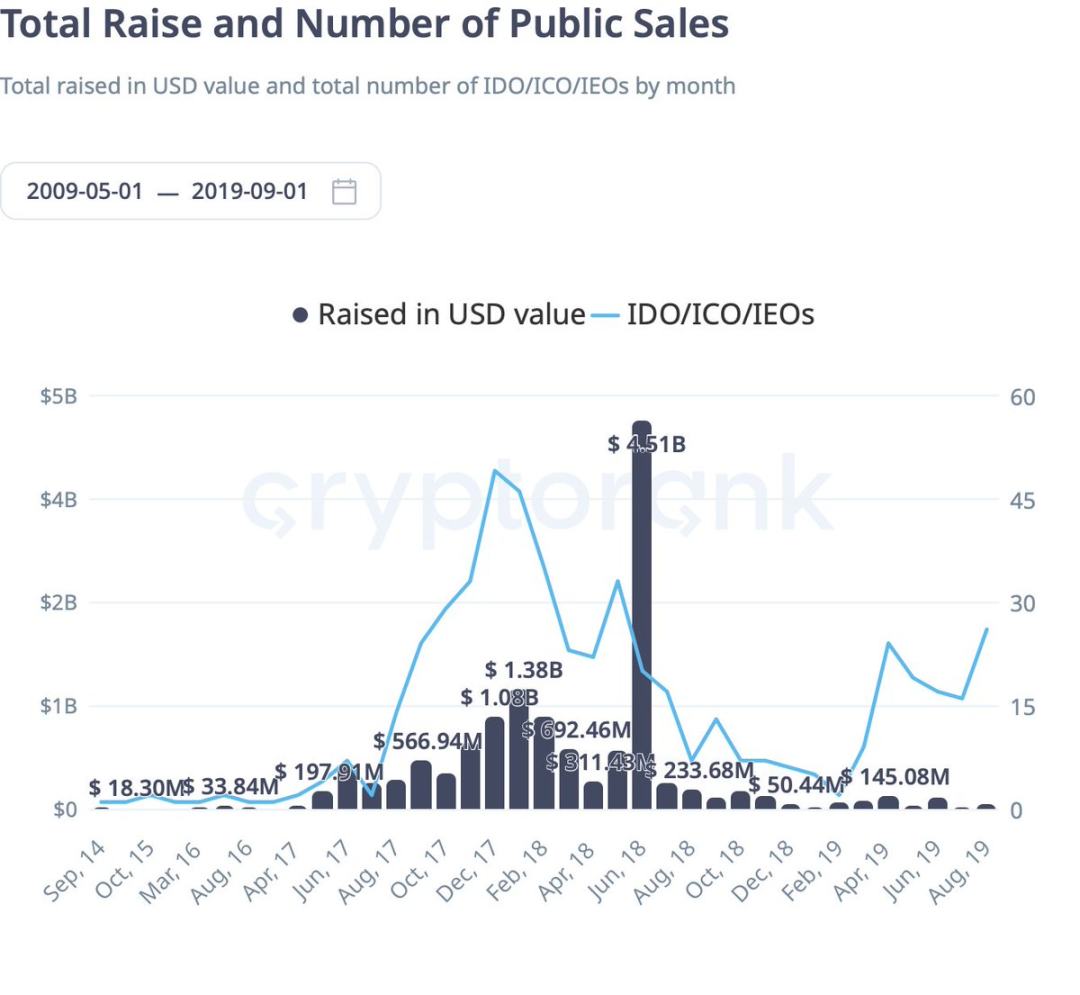

In 2025, ICOs accounted for about one-fifth of all token sale trading volume.

Written by: Stacy Muur

Translated by: Luffy, Foresight News

Since the frenzy of 2017, ICOs (Initial Coin Offerings) have finally returned to the market, but the operational mechanisms are vastly different from the chaotic Gas wars of the past. This is not a nostalgic journey, but a structurally new market shaped by new infrastructure, more refined allocation designs, and clearer regulatory frameworks.

In 2017, anyone could raise millions of dollars in just a few minutes with an Ethereum contract and a white paper. There were no standardized compliance processes, no structured allocation models, and certainly no post-sale liquidity frameworks. Most investors entered blindly, and many watched their tokens plummet shortly after listing. As regulators stepped in to clean up the mess, ICOs gradually faded away in the following years, replaced by venture capital rounds, SAFTs (Simple Agreements for Future Tokens), exchange IEOs (Initial Exchange Offerings), and later, retroactive airdrops.

Now, in 2025, the trend has reversed.

But the change is not that projects are launching at lower valuations; in fact, fully diluted valuations (FDV) are higher than ever. The real change lies in the access mechanisms.

Launchpads no longer rely on pure speed competition or Gas wars. Instead, they screen participants through KYC (Know Your Customer), credit scoring, or social influence, and then distribute quotas to thousands of participants in small amounts rather than large allocations.

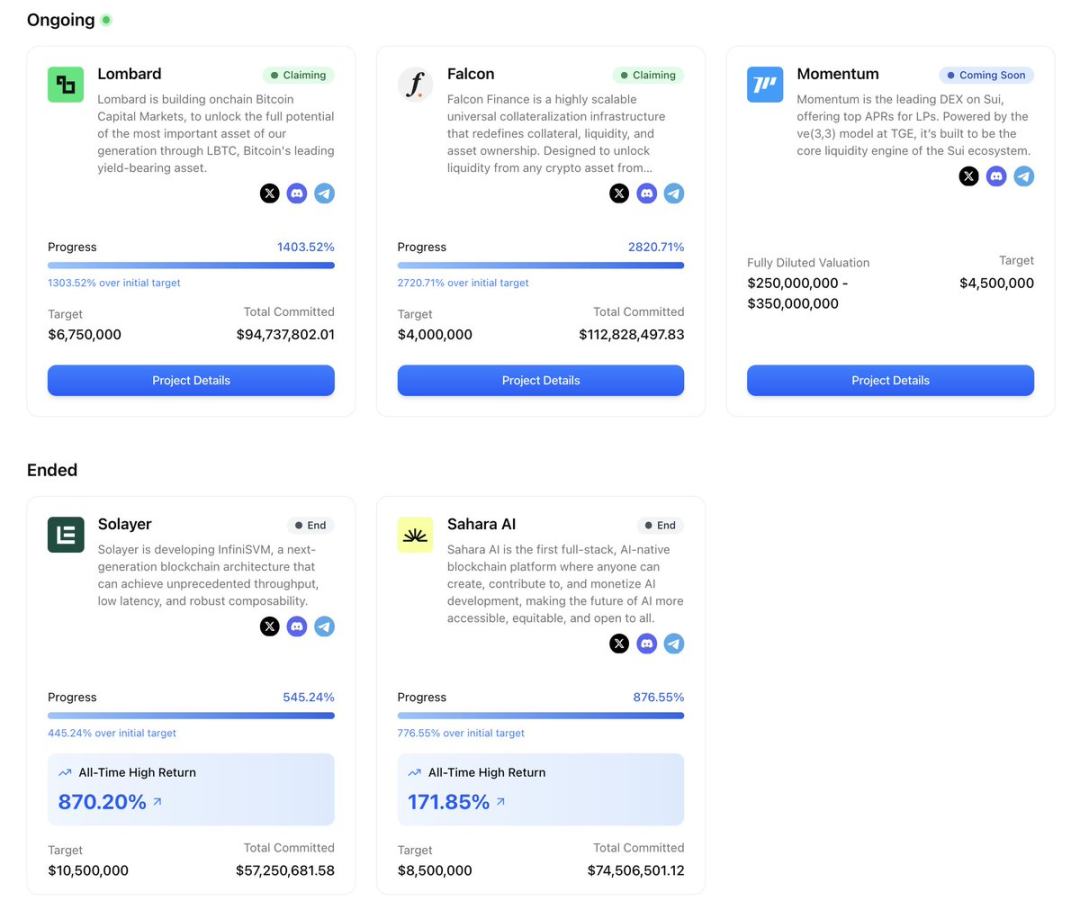

For example, on the Buidlpad platform, I committed to invest $5,000 in Falcon Finance but ultimately received only a $270 allocation, with the remaining funds refunded due to oversubscription. The situation was similar for Sahara AI; I committed $5,000 but only received a $600 allocation.

Oversubscription does not lower prices; it only reduces individual allocations, maintaining a high FDV while achieving broader token distribution.

Regulation has also kept pace. Today, frameworks like the EU's MiCA (Markets in Crypto-Assets) provide a clear path for compliant retail investor participation, and issuance platforms have simplified KYC, geo-fencing, and qualification checks into straightforward configuration switches.

On the liquidity front, some platforms have gone further by directly coding post-sale policies into smart contracts, automatically injecting funds into liquidity pools or stabilizing early trading prices through mechanisms that buy below a certain price/sell above a certain price.

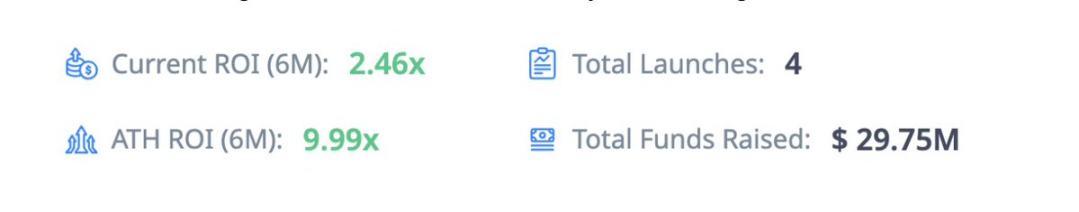

In 2025, ICOs accounted for about one-fifth of all token sale trading volume, a stark contrast to just two years ago when this proportion was negligible.

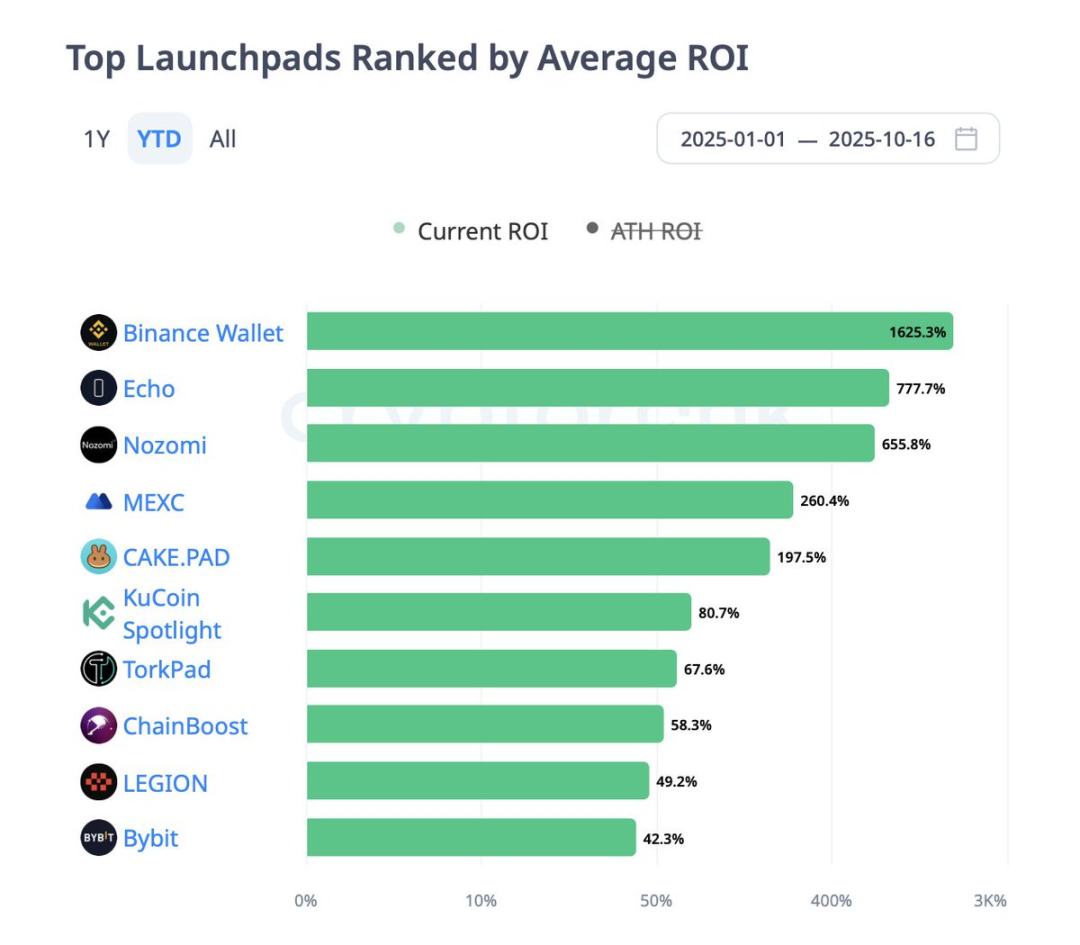

This revival of ICOs is not driven by a single platform but stems from a new generation of issuance systems, each addressing different pain points:

Echo's Sonar tool supports self-custodied, switchable compliance cross-chain sales;

Legion collaborates with Kraken Launch to integrate a reputation-based quota mechanism into the exchange process;

MetaDAO incorporates treasury management and liquidity range features from the launch phase;

Buidlpad focuses on KYC access, community-first distribution models, and provides structured refund mechanisms.

These platforms are working together to transform ICOs from chaotic fundraising tools into carefully designed market structures, with participation methods, pricing, and liquidity all planned rather than cobbled together.

They have each tackled the pain points that plagued the first wave of ICOs, collectively building a more structured, transparent, and investment-worthy environment. Below, we analyze each one in detail.

Echo: Self-Custody, Switchable Compliance, Soaring Popularity

Founded by Cobie, Echo, with its self-custodied public sale tool Sonar, has become one of the breakthrough token launch infrastructures of 2025. Unlike centralized launchpads or exchange IEOs, Echo provides infrastructure rather than a trading market, allowing project teams to choose their sale format (fixed price, auction, or treasury/credit model), set KYC/qualified investor certification/geographic restriction rules through Echo Passport, distribute sale links independently, and launch on multiple chains such as Solana, Base, Hyperliquid, and Cardano.

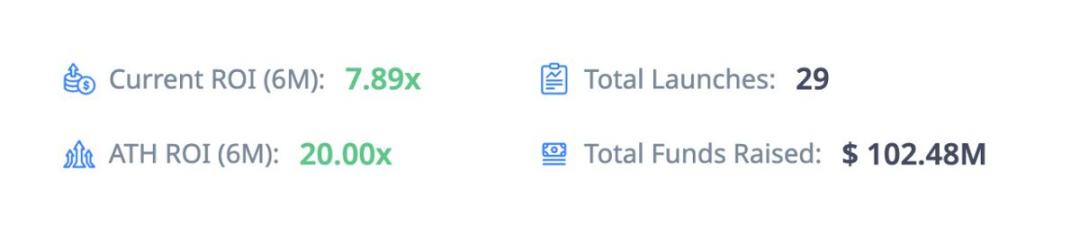

The platform is experiencing rapid growth:

Echo's most notable case is Plasma. In July of this year, the project used a time-weighted treasury model to sell 10% of its tokens at a price of $0.05, attracting over $50 million in committed funds. Plasma's historical highest return on investment (ROI) reached 33.78 times, making it one of the best-performing ICO projects of the year. Following closely was LAB, which also achieved a return of 6.22 times upon listing.

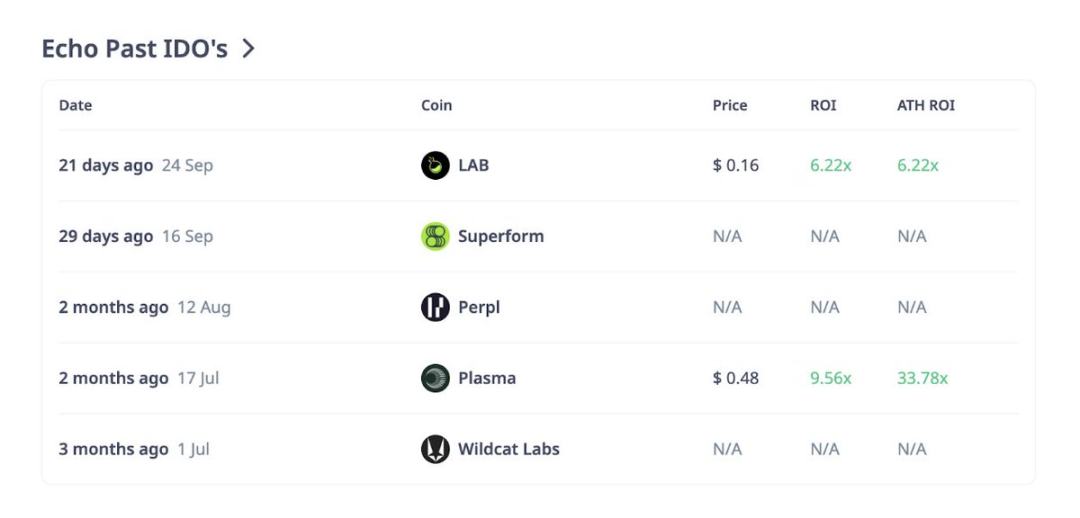

Here is an overview of Echo's recent sale projects:

These figures reflect both the potential for returns and the variability of those returns. While Plasma and LAB delivered high multiples, other projects like Superform and Perpl have yet to list or announce performance. It is important to note that Echo does not enforce a post-sale liquidity framework; liquidity pool injections, market maker requirements, and unlocking schedules are determined by the issuers, not mandated by the platform.

Investor Note: Echo's flexibility makes it the highest-returning launch infrastructure in this cycle, but it also requires investors to conduct due diligence. Be sure to confirm the following three points:

Compliance switch settings (KYC/qualified investor rules);

Sale format (treasury, auction, or fixed price);

Issuer's liquidity plan (Echo does not standardize this requirement).

Legion and Kraken Launch: Combining Reputation and Regulation

If Echo represents issuer-led flexibility, Legion is its complete opposite; it is a structured, reputation-based public sale channel.

In September of this year, Kraken Launch officially went live, with its underlying technology fully supported by Legion. This is the first time token sales can be conducted directly within Kraken accounts, adhering to MiCA compliance requirements and determining participant priority through reputation scoring.

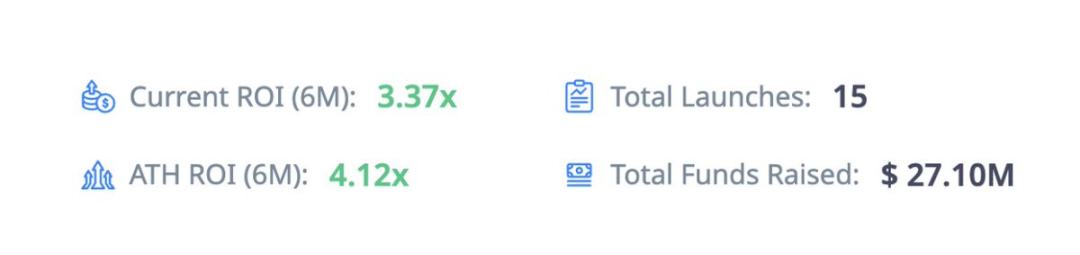

The platform is growing rapidly:

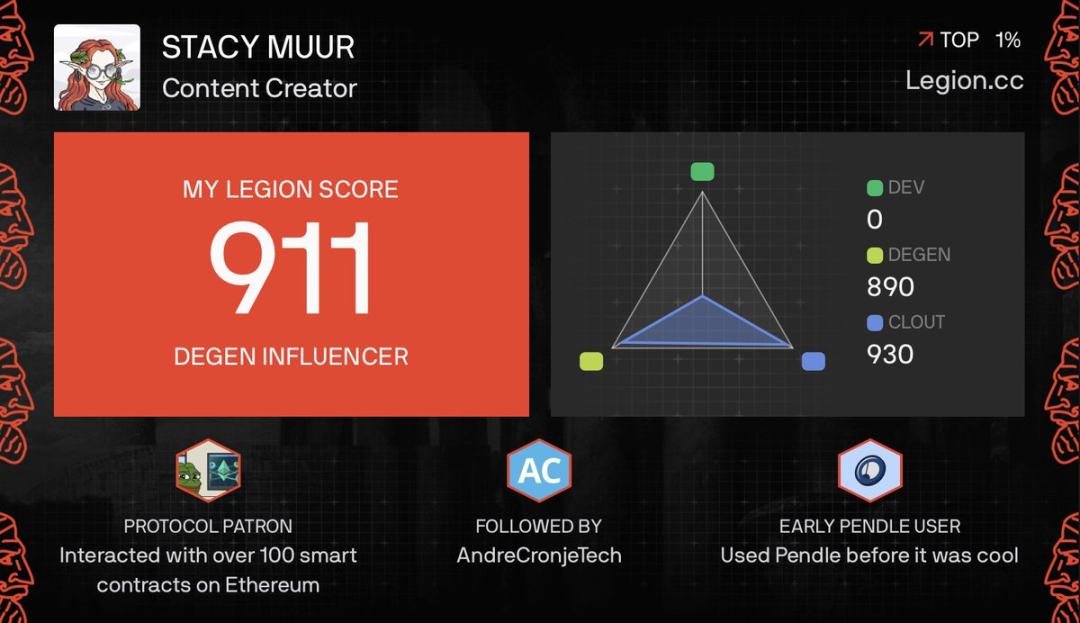

At the core of Legion is the Legion scoring mechanism—a reputation metric ranging from 0 to 1000, calculated based on on-chain activity, technical contributions (such as GitHub submissions), social interactions, and endorsements from others.

Project teams can reserve a certain percentage of token allocations (usually 20%-40%) for high-scoring users, with the remaining allocations opened up for first-come-first-served or lottery phases. This completely overturns the traditional ICO allocation model: instead of rewarding the fastest bots, it rewards developers, contributors, and influential community members.

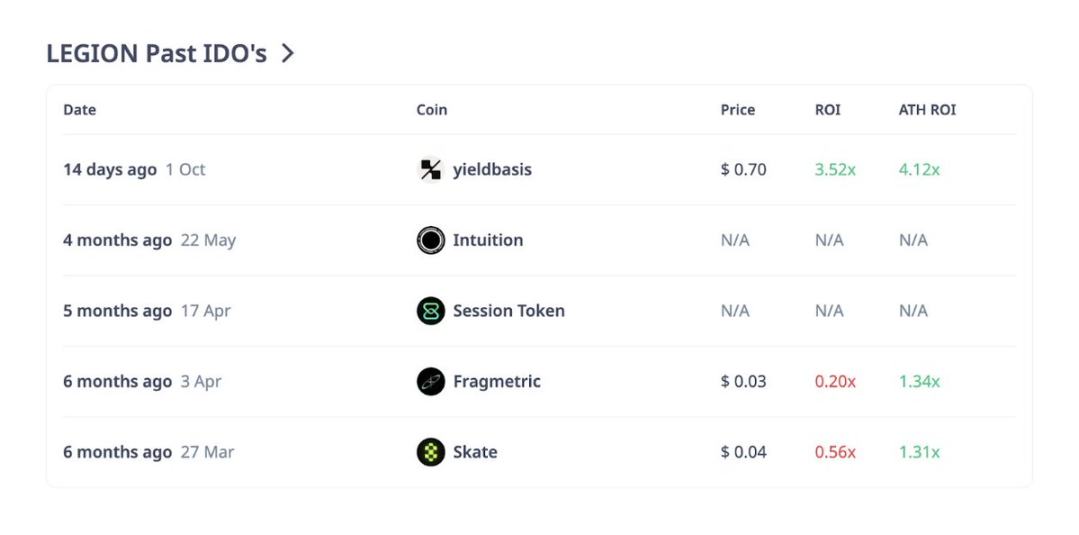

Here is an overview of Legion's recent sale projects:

The integration with Kraken adds an extra layer of security: exchange-level KYC/AML (Anti-Money Laundering) audits and first-day liquidity. This combines IPO-style launches with community quota mechanisms. Early cases like YieldBasis and Bitcoin Hyper saw significant oversubscription during the preferential phase (for high-scoring users), while low-scoring users were directed to limited-quantity public sale rounds.

Of course, it is not perfect. Some early users have pointed out that the Legion scoring may overemphasize social influence—holders of large X platform accounts may rank higher than actual developers, and the transparency of the scoring weight system needs improvement. However, compared to the chaotic lottery systems of the past, this is a significant advancement.

Investor Note: The Legion score is crucial. If you want to secure allocations in quality project sales, you need to build your on-chain record and contribution profile early. Additionally, be sure to confirm the allocation distribution ratio between each project's preferential and public sale rounds, as different projects may adjust this rule.

MetaDAO: Mechanism First, Marketing Second

MetaDAO is doing something that no other launch infrastructure has ever attempted: directly encoding post-sale market policies into the protocol itself.

Its operational mechanism is as follows: if a sale on MetaDAO is successful, all USDC raised will be deposited into a treasury managed by the market, and the token minting rights will be transferred to that treasury; the treasury will inject 20% of the USDC, along with 5 million tokens, into the liquidity pool of a Solana DEX; at the same time, the treasury is set to "buy below the ICO price and sell above the ICO price," creating a soft price range around the anchor price from the first day of the sale.

The seemingly simple mechanism has fundamentally changed the dynamics of early trading. In traditional ICOs, if liquidity is insufficient or insiders sell off, the secondary market price can plummet; however, with MetaDAO's price range mechanism, early prices often fluctuate within a limited range—resulting in smaller declines and capping surges. This is a mechanism-based guarantee rather than a verbal promise. If there is no demand in the market, the treasury funds will eventually be depleted, but it can guide market behavior on critical first days.

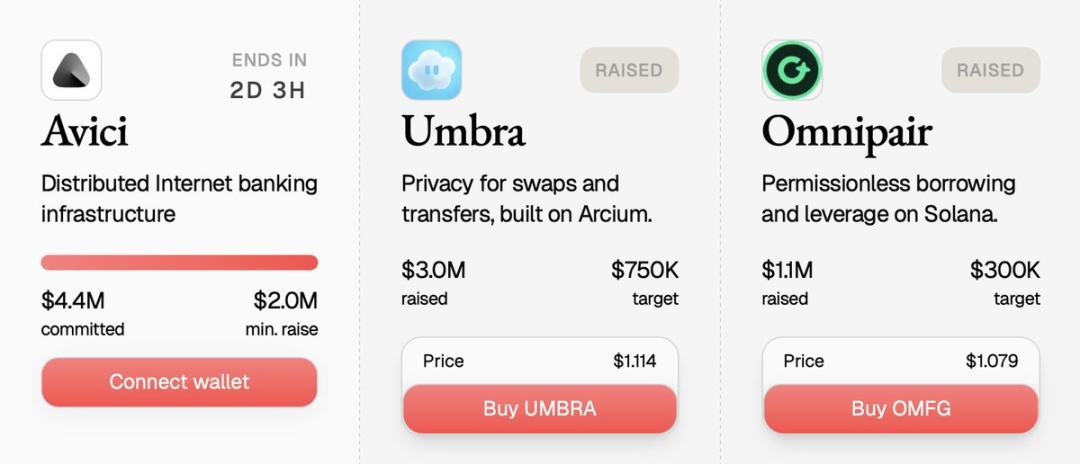

The most representative case is the Solana privacy protocol Umbra. Umbra's sale attracted over 10,000 participants, with committed funds reportedly exceeding $150 million, and the sale page displayed real-time data on large allocations. Witnessing this transparent distribution feels like a glimpse into a more structured future for ICOs—transparent, on-chain, and policy-controlled.

Investor Note: When participating in a MetaDAO sale, be sure to note the ICO price and understand the price range rules. If you buy at a price slightly above the upper limit of the range, be aware that the treasury may become your counterparty (selling tokens) during the price increase; if you buy at a price slightly below the lower limit of the range, you may be taken over by the treasury. MetaDAO rewards investors who understand the mechanism rather than speculators chasing trends.

Buidlpad: Embracing Compliant Retail Investors

Buidlpad focuses on a simple yet powerful function: providing a clear path for compliant retail investors to participate in community rounds. Established in 2024, the core process is divided into two phases: first, users complete KYC registration and appointment; then, during the funding window, they submit their funding commitments. If the sale is oversubscribed, excess funds will be refunded. Some sales also manage demand through tiered FDV, with lower FDV in the early stages and higher FDV in later stages.

Buidlpad's milestone moment occurred in September this year with the sale of Falcon Finance. The project aimed to raise $4 million but ultimately secured $112.8 million in committed funds, with an astonishing oversubscription of 28 times. The KYC phase ran from September 16-19, the funding phase from the 22nd to the 23rd, and refunds were completed by the 26th. The entire process was smooth, transparent, and entirely driven by retail investors.

Simplicity is Buidlpad's advantage. It does not employ a complex scoring system or predictive treasury; it focuses solely on providing structured participation channels for the community that passes compliance checks. However, it is important to note that liquidity still entirely depends on the issuer's planning, and cross-chain decentralized sales can sometimes lead to dispersed post-sale trading volumes.

Investor Note: Mark key dates. The KYC/appointment window is a hard threshold; missing it will result in losing allocation eligibility. Additionally, carefully read the tier structure—early stages often allow entry at a lower FDV.

Cross-Platform Commonalities and Risks

Overall, these platforms exhibit several common characteristics:

Oversubscription is common, but the hype may not last. Falcon's 28 times oversubscription, Plasma's hundreds of millions in attention, and Umbra's massive demand—all these headline figures seem dazzling. However, without sustained use cases, high FDV often means that early prices will drop after the post-sale halo fades.

Mechanisms determine volatility. MetaDAO's buy-sell range can indeed reduce chaos but may also limit profit ceilings near the selling range; Echo and Buidlpad rely entirely on issuer self-discipline; Legion depends on exchange listings to provide liquidity depth.

Reputation systems change allocation logic. With Legion, early scoring can mean a significant difference in obtaining substantial allocations versus competing in limited public sale pools.

Compliance screening is an advantage rather than a flaw. KYC windows, qualified investor switches, and preferential scoring filters—these mechanisms may reduce chaos but also intensify participation stratification.

Beneath these appearances, risks still exist: scoring systems may be manipulated, treasuries may be mismanaged, large holders can still dominate allocations through multiple wallets, and regulatory enforcement may lag behind marketing hype. These mechanisms are not a panacea; they merely change the landscape of market competition.

2025 Investor Guide

To navigate the new wave of ICOs wisely, one must think from a structural perspective:

Clarify the mechanisms first, then restrain FOMO. Is it a fixed price or an auction? Is there a preferential phase or purely first-come-first-served? Is there a treasury price range or complete laissez-faire?

Mark eligibility window periods. KYC/appointment deadlines, qualified investor requirements, geographic restrictions—missing one date could mean missing out on the entire allocation.

Understand the liquidity plan. Is it MetaDAO's coded liquidity range? Kraken's exchange listing? Or is it issuer-planned on Sonar? Liquidity determines early price trends.

Targeted positioning. To participate in MetaDAO, understand the price range; to participate in Legion, accumulate scores early; to participate in Buidlpad, aim for the early stages.

Manage positions wisely. Oversubscribed popular projects do not necessarily indicate strong secondary market performance. Treat these investments as structured bets rather than guaranteed moonshot opportunities.

Author's Reflection

The return of ICOs in 2025 is not about nostalgia but about new infrastructure, new rules, and a more self-disciplined market. Platforms like Echo, Legion, MetaDAO, and Buidlpad have each addressed some of the flaws in the 2017 ICO model: some focus on compliance, some optimize allocations, and some improve liquidity policies. Together, they have transformed public token sales from speculative frenzies into a process closer to structured capital formation.

For investors, this means that the advantage is no longer just about entering early but understanding the mechanisms. Because in 2025, ICOs are not heading towards extinction; they are maturing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。