Paxos 300T Minting Error on Ethereum, Raise Questions on Crypto System

The cryptocurrency world is still quite a surprise to the world, revealing its fast innovativeness, as well as the fact that sometimes it can make dramatic mistakes that become the focus of the whole world. The latest happenings on the Ethereum blockchain shocked a number of people.

What happened with Paxos 300T Tokens?

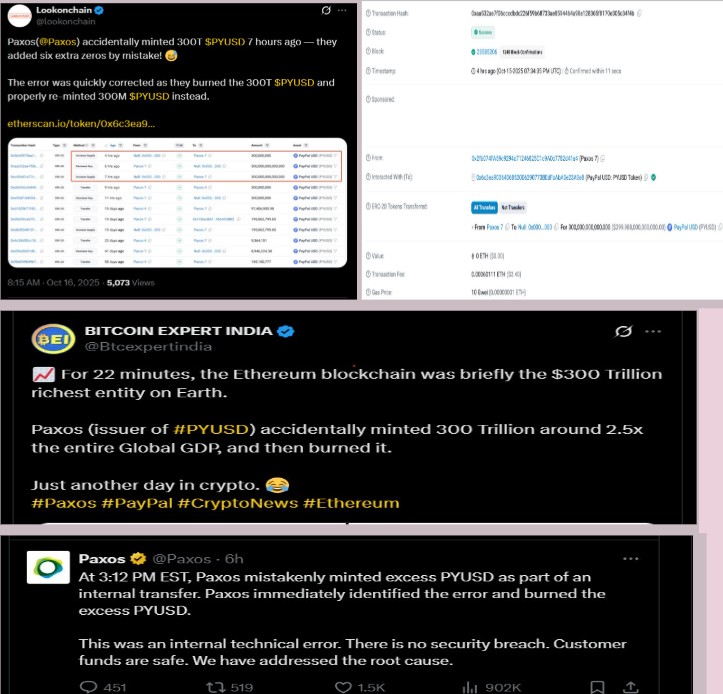

On October 15, 2025, Paxos , the PayPal parent company of PYUSD, accidentally minted 300 trillion tokens of PYUSD on the Ethereum blockchain. This accident happened in an internal transfer process.

They ensured that the error was only technical and no external systems were involved. The crypto community was quick to notice the mistake, and it made news across the globe.

Source: Paxos X

How big was the mistake?

-

The incorrectly minted coins were estimated to be worth about 300 trillion, which is greater than 2.5 times the world GDP in the same period.

-

The reason behind the enormous amount of tokens was due to a simple input mistake: six additional zeros were included by mistake.

-

In perspective, the temporary minting for a moment made Ethereum the richest entity on earth in terms of total value.

How long did 300 Trillion PYUSD last?

The surplus was only some 22 minutes. Throughout this short period of time, the overall valuation of Ethereum shot up in the short term because of the abrupt introduction of the tokens.

Even though it was a temporary situation, it was long enough to initiate an immediate response by platforms that depended on PYUSD.

Immediate Impact of This Mistake

The attack led to short-term delays on crypto platforms. It is important to note that Aave halted PYUSD markets to avoid any irregularities in trade or possible risks.

Although the confusion was short-lived, there was no loss of user money, and the crypto markets soon leveled off following a remedial measure by Paxos.

Source: X

Corrective actions by Paxos

They responded in time to rectify the mistake. The business incinerated the surplus 300 trillion PYUSD tokens, eliminating them from circulation.

Paxos re-emitted the right quantity of 300 million PYUSD, guaranteeing that the supply of the stablecoin was restored to normal. Their prompt action ensured that they did not have any permanent effect on the rest of the crypto market.

Does this accident Impact Paxos Security?

Paxos claimed that it was not a security breach or hacking. The money of customers was not in danger at any point. The company stressed that it was only a technical mishap in the process of internal transfer and that no external systems had been hacked.

Community Reaction

There was buzz on social media regarding the discussions, memes, and debates of the consequences of such a huge fat-finger mistake. Public reactions are hilarious as well as serious.

The crypto community is having a field day after Paxos accidentally minted 300 trillion PYUSD. People are joking about “resetting the economy” and hitting the debt delete button.

Other memes about interns running the money printer unsupervised. Some call it “fake money” and question stablecoin reserves , while a few even suggest it could fuel money laundering.

Overall, reactions are a mix of disbelief, humor, and curiosity about the limits of crypto systems.

The Wrap-Up

This case demonstrates the dangers of human mistakes in crypto operations, even in systems that are planned to have automated protection. Such mistakes are also called fat-finger errors, and they are not the first to happen, such as the 2017 Parity wallet freeze.

Although this time there was no permanent loss or damage, it is a reminder that powerful checks and fail-safes play an important role in regulating stablecoins and blockchain transactions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。