Cryptocurrency, fintech, and AI are converging to form a new financial operating system.

Written by: 0xJeff

Translated by: AididiaoJP

Blockchain is a permissionless global ledger where people can hold, transfer, buy, lend/borrow, and utilize their assets in any way they want from anywhere in the world.

Self-custody of funds (self-custody) allows users to still hold their funds while interacting with services or applications.

This contrasts with traditional financial systems, where banks (physical banks/digital banks) hold user funds and provide banking services to users.

The liquid nature of the blockchain ledger makes it a perfect setting for institutions seeking to transfer capital, businesses looking to expand payment rails through stablecoins, or retail users seeking to invest/optimize their assets.

In this article, we will explore the shift from DeFi to fintech and Web2/Web3, the role of AI, transformations within the industry, and the opportunities that arise.

Let’s dive deeper

Let me tell you about Grab's fintech strategy, as Grab is one of the most dominant ride-hailing or super app players in Southeast Asia.

Grab initially offered ride-hailing services in Malaysia, aiming to make taxis safer and more reliable. The platform gained popularity in Malaysia and expanded to the Philippines, Thailand, Singapore, and Vietnam.

Grab did not just build a taxi app; it established a trust platform in a region with limited infrastructure and a fragmented transportation system.

Then, Grab expanded its service offerings to include private cars, motorcycles, food delivery, parcel delivery, and an in-app payment system (wallet). All services use the same app, drivers, and payment rails, forming a super app ecosystem.

Grab realized that the wallet/payment rail (GrabPay) is the payment infrastructure that holds everything together (users pay for rides and delivery fees, store value, transact with merchants, and drivers and riders use it to store/consume, capturing financial data and transaction behavior).

The payment infrastructure became the foundation for Grab to collaborate with lending and insurance startups to offer financial products (microloans, insurance) to drivers.

Now, GrabPay has evolved into a major regional e-wallet with more integrations and financial services (more embedded finance, merchant loans, driver loans using in-app credit scoring, and partnerships with banks and telecom companies to provide financial products).

Grab's strategy:

Establish a trust platform with a large user base on both the demand and supply sides (users, drivers, merchants/suppliers).

Connect everything with payment rails/wallet infrastructure and capture financial and consumption data.

Build embedded financial products for the user base based on this data.

Grab is now a fintech company, deeply embedding finance: savings, investments, insurance, BNPL (buy now, pay later), and digital banking.

From ride-hailing, food delivery to fintech.

Cryptocurrency and Fintech

We are starting to see strategies similar to Grab's emerging simultaneously in Web3 projects and Web2 companies, where cryptocurrency is becoming fintech, and fintech is becoming more crypto.

Why?

The TAM (Total Addressable Market) of cryptocurrency (revenue generated from services/apps) is very small compared to that of fintech, making it very meaningful to bring the value proposition of cryptocurrency (DeFi, tokenization, stablecoins, lending/borrowing, yield) to a broader consumer base.

Traditional rails still have friction in investing, saving, and accessing banking services, and in many cases, users need to trust service providers to hold their funds for them. Blockchain is the perfect solution to this problem.

2 Case Studies

EtherFi (Crypto ➔ Fintech)

@ether_fi started in 2023 as a liquidity re-staking provider during the @eigenlayer re-staking season, offering re-staked ETH and composable DeFi vault strategies that deploy eETH, weETH, and stablecoins into DeFi strategies to maximize returns. The team focuses on the liquidity and composability of growth strategies.

In 2025, EtherFi plans to pivot to providing banking-like services and fintech functionalities, combining DeFi with everyday financial use cases: spending, saving, earning, connecting crypto and fiat, bill payments, and payroll services.

A feature for achieving more mainstream adoption is the Visa cash card, which allows users to spend their cryptocurrency directly or use their cryptocurrency as collateral to borrow stablecoins for spending (without selling their assets). The card offers about 3% cash back, token incentives, Apple Pay/Google Pay, and its non-custodial nature has attracted a large user base and transaction volume to its platform (and their vault products), meaning more people are depositing funds into EtherFi vaults.

EtherFi is positioning itself as a digital bank, bringing DeFi value to ordinary, mainstream users. Who wouldn’t want to seamlessly borrow stablecoins for spending or earn about 10%+ interest on their stablecoins?

Stripe (Fintech ➔ Crypto)

@stripe started in 2010, providing simplified payment infrastructure for developers and online businesses. Stripe offers merchants a streamlined API to accept payments, manage subscriptions, handle fraud, and embed financial services (solving a lot of headaches for any merchant).

Over time, Stripe has expanded into a full-stack financial infrastructure platform, providing modular APIs and products that allow any company to build, embed, and scale financial services without becoming a bank.

Stripe Connect: Enables marketplaces to pay third-party sellers, drivers, and creators globally, handling complex KYC and compliance in the background.

Stripe Billing: Provides automated subscription systems/backbone for SaaS.

Stripe Treasury: Embedded finance (storing funds, banking services).

Stripe Issuing: Instant creation and management of physical or virtual cards.

Stripe Radar: Integrated machine learning-driven fraud detection.

Stripe is testing crypto rails and acquiring major infrastructure players, having acquired Bridge (stablecoin payment infrastructure), Privy (crypto wallet/onboarding infrastructure), and then announced a full push to have its own blockchain by developing a payment-first L1 (Tempo).

Stripe is positioning itself as the foundational layer for the next generation of global payments, unifying fiat, stablecoins, and on-chain rails under a single developer platform, enabling programmable, borderless currency.

What does all this mean?

Beyond these two players, there are more participants trying to get a piece of the pie.

This essentially means that DeFi and TradFi, Web2 rails and Web3 rails are merging, and blockchain is becoming the backbone infrastructure supporting the real-world economy.

DeFi TVL (Total Value Locked) could grow tenfold from $174 billion to $1.74 trillion in the next five years. The wealth management sector has $140 trillion, and it seems very likely that about 1% will flow into DeFi.

Stablecoins could ultimately power universal applications and platforms behind the scenes while providing yields to users.

Spot, perpetual contracts, and prediction markets are becoming more mainstream, as the value proposition of trading cryptocurrencies, tokenized stocks, on-chain commodities, and any asset (events, politics, macro, Taylor Swift) is enormous. Every business would want to have these user bases.

Due to the industry's convergence, enterprise sales and strategies targeting ordinary retail users will become essential.

Crypto "projects" will need to become "startups." Lower the geekiness, raise the professionalism + the need to build trust.

Builders need to sell DeFi platforms to enterprises, integrating DeFi vault products into fintech applications or wealth management platforms. Additionally, enterprise sales teams need to be formed to understand how to sell to them, with risk/compliance and security being key in their decision-making processes.

We are starting to see early examples of this, with crypto-native teams' activities extending far beyond CT.

@Polymarket received investment from the parent company of the New York Stock Exchange (valuing Polymarket at $9 billion), expanding the prediction market into TradFi and laying the groundwork for the entire prediction market industry.

@flock_io collaborates with governments, banks, international organizations, and publicly traded companies to achieve privacy-preserving domain-specific AI. Flock's dedicated team is tackling traditional industries/capital markets.

@pendle_fi is committed to bringing TradFi/Wall Street onto on-chain interest products—KYC-based, permissioned liquidity pools.

@Mantle_Official launched UR Global digital bank, "the world's first blockchain-based digital bank." A unified multi-asset account (via Switzerland-supported IBAN accounts), debit cards with SWIFT, SEPA, SIC, and L1/L2, facilitating deposits and withdrawals, self-custody, and upcoming DeFi integrations (idle balance yields, Mantle native DeFi products).

@useTria initially started as BestPath, an AI-optimized solver network that finds the best swap paths across EVM, SVM, and other VMs (integrated with Sentient, Talus, Polygon, and Arbitrum Orbit chains). Tria has expanded to offer digital banking/fintech services, starting with cash cards (users earn yields from assets and can directly spend altcoins).

Exchanges are building embedded finance within on-chain wallets, acting as a discovery layer for all things DeFi (and soon TradFi), such as OKX Wallet, Binance Wallet, etc.

More crypto teams are launching crypto cards.

It seems that @CelsiusNetwork's initial direction was correct, achieving native yields on Bitcoin, ETH, and stablecoins, providing services like deposit yields, mortgages, payments, debit cards, etc. The vision was right, but it failed due to severe shortcomings in execution, risk management, and transparency.

How does Web3 AI fit into this?

For simplicity, there are mainly three aspects:

Completing tasks

Ensuring you can trust the AI that completes the tasks

Finding talent to make the AI complete the tasks

Completing tasks

Since crypto is primarily a financial use case, AI systems that enhance DeFi, prediction, and trading experiences are the primary use cases that Web3 AI builders are striving to create.

Trading agents, AI-driven dynamic DeFi strategies, personalized DeFi agents, such as @Cod3xOrg, @Almanak, @gizatechxyz

Prediction AI/ML teams predicting asset prices, outcomes, weather, etc., such as @sportstensor, @SynthdataCo, @sire_agent

AI and ML systems are built on existing crypto verticals (primarily DeFi) to achieve better accessibility, reduce complexity, and improve yield and risk management.

Ensure you can trust the AI that completes the tasks

You cannot blindly trust AI, just as you cannot trust anyone; you also cannot trust the infrastructure and people behind the AI. So who do you trust?

Yourself; you verify everything.

This is where verifiable infrastructure comes into play.

Ethereum ERC-8004 acts as a trust layer, serving as the AI's passport + Google's AP2 + Coinbase x402 acts as the payment system/rails (stablecoins and traditional rails), enabling agents to trade with each other or with other Web2 services.

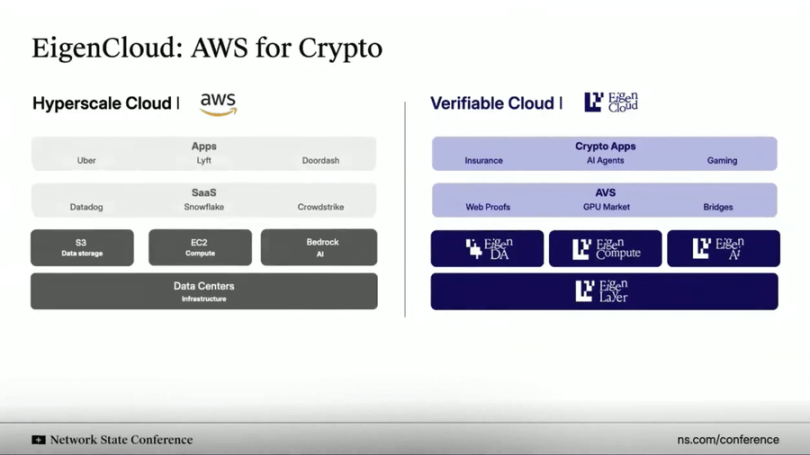

Like AWS Cloud, @eigenlayer is providing verifiable cloud infrastructure for everything. Eigen does not host/run everything on centralized servers but supports off-chain computation while verifying results/inferences on-chain.

This solution (EigenAI and EigenCompute) is well-suited for AI agents/application use cases, such as trading agents and DeFi use cases.

Eigen has a primitive called deterministic reasoning, ensuring that LLMs produce the same output for the same input in repeated executions, meaning they do not produce hallucinations and become deterministic.

Similar to how re-staked ETH is used to collateralize smart contracts, EIGEN is used to collateralize/prove AI agents/applications. Anyone can rerun the exact same reasoning to verify the inference and check if the output matches.

All of this ensures that:

(i) Trading agents do not go rogue;

(ii) Recommendation engines in social media remain consistent/tamper-proof every time;

(iii) Autonomous agents securely hold funds because their reasoning can be audited/verified.

Finding talent to make AI complete tasks

AI/ML engineers are one of the most sought-after resources. If you are truly exceptional, you will be poached by centralized cutting-edge AI labs. If you are extremely exceptional, you will start your own.

Or you can choose to join a Darwinian AI ecosystem.

These ecosystems provide KPI-based incentives for "miners," "trainers," and those who run AI or ML models to contribute/solve specific tasks. If the output you provide is good and meets the goals, you can earn substantial incentives.

Bittensor and @flock_io are two of the most well-known Darwinian AI ecosystems, where miners or trainers can earn six to seven-figure incentives annually based on their performance or the stake they hold within the ecosystem.

The goal of Darwinian AI ecosystems is to attract talent through incentives, forming an active developer community that contributes to specific tasks. The ultimate goal is to reach a stage where the revenue generated from the output exceeds the cost of incentives.

Prediction models on the Bittensor subnet outperform market benchmarks, or Flock delivers privacy-preserving domain-specific AI use cases to large institutions and governments like UNDP and Hong Kong.

Connecting it all together

Cryptocurrency, fintech, and AI are converging to form a new financial operating system.

At its core is the fusion of infrastructure.

Crypto rails are becoming the programmable, borderless settlement layer of the internet.

Fintech is providing the UX, compliance, and trust layers needed for mainstream adoption.

AI is becoming the decision-making and automation layer that optimizes liquidity, personalization, and user experience.

Stablecoins serve as the direct layer powering consumer applications, while on-chain identity + verifiable computation underpin the trust between AI agents/applications, traditional institutions, and fintech integrate DeFi to unlock new revenue opportunities, granting millions of new users direct ownership, transparency, and global access to capital and intelligence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。