币安推出Yield Basis空投和上市,全球交易所同步进行

Yield Basis空投和上市正式定于2025年10月15日,由币安主导一场重大的多平台发布。该DeFi协议通过使用杠杆流动性解决了无常损失问题,将在UTC时间11:00在币安及其他几家顶级交易所上市其代币YB,此前进行了创纪录的预TGE销售。

币安引领行业

该平台宣布$YB为其HODLer 空投页面上的第53个项目,提前奖励BNB持有者。

来源:X

在10月9日至11日期间,订阅BNB至Simple Earn或On-Chain Yields的用户自动符合空投资格。分发将在交易开始前进入现货钱包,给予忠实持有者提前访问的机会。

分发:空投将在交易开始前至少1小时进入现货钱包。

交易开始:2025年10月15日,UTC时间11:00

交易对:USDT、USDC、BNB、FDUSD、TRY

存款已开放:10月14日,UTC时间12:00

网络:BNB智能链和以太坊

多重上市确认广泛市场兴趣

除了币安,ONUS、BitMart、Kraken、Bybit、Gate、KuCoin和MEXC也将在2025年10月15日UTC时间11:00同时上市YB。

ONUS:链下转账 + VNDC/USDT兑换

BitMart:主上市,YB/USDT交易对

预市场价格:$1.03

预市场FDV:$1.03B

这一协调的多交易所发布信号显示出强大的流动性支持和广泛的机构及零售参与。

Yield Basis是什么?项目概述

在交易开始之前,了解Yield Basis的独特之处非常重要。

该协议使用户能够提供BTC流动性而不产生无常损失,使用2倍杠杆头寸和crvUSD借贷。通过维持50%的债务/50%的股权比例并进行自动再平衡,头寸以1:1的比例跟踪BTC,同时赚取Curve交易费用。

存入BTC – 接收ybBTC(2倍杠杆LP)

赚取BTC费用或质押以获取YB发行

投票锁定YB以进行治理和费用分享

这一结构从根本上消除了无常损失,而不是通过激励来掩盖,这是DeFi流动性的一项重大创新。

YB代币经济学分析

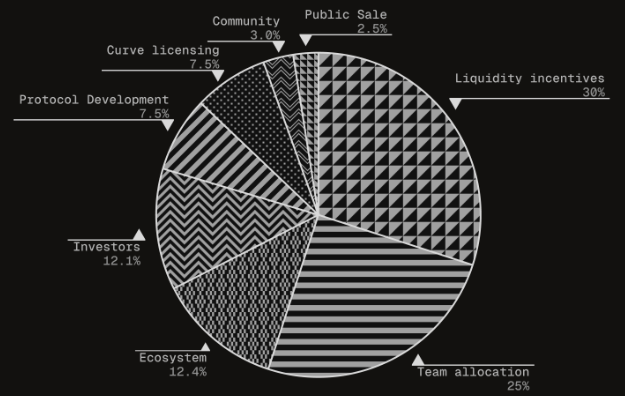

Yield Basis的代币总供应量固定为10亿个,战略性地分配到所有优先领域。流动性激励和团队分配分别占30%和25%,生态系统(12.4%)和投资者(12.1%)几乎相同。其他部分根据规划进行分配。

来源:白皮书

发行计划支持长期增长,逐步的流动性激励和团队归属设计旨在在多个年度内对齐激励。

价格展望和早期需求

YB的预上市活动提供了明确的需求信号。

在币安预TGE期间,Yield Basis看到了巨大的需求,承诺了456,051 BNB,目标为1,918 BNB,超额认购达23,772%(约237倍)。以$1.03的预市场价格和$1.03B的FDV,这显示出强烈的早期购买兴趣。

基于类似的发布,YB在前两天的交易价格可能在$1.25到$1.45之间。如果需求保持强劲,可能在接下来的几周内达到$1.60–$1.80,得益于高流动性和在多个主要交易所的上市。

结论

Yield Basis以强大的基本面、多链支持和无与伦比的早期需求进入市场。其独特的杠杆流动性模型、对BNB质押者的追溯空投以及多交易所上市策略使其成为2025年潜在的DeFi项目。

这种炒作是否能转化为持续的表现将取决于流动性采用、BTC市场状况和协议增长,但迄今为止的参与规模表明了显著的早期动能。

免责声明: 本文仅供信息参考,不构成财务建议。加密投资存在风险。在投资或交易之前,请务必自行研究(DYOR)。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。