On October 13, after the avalanche in the cryptocurrency market, Synthetix began a strong recovery, with the token SNX briefly breaking the key price level of $2, reaching a high of $2.53, setting a new annual high, and experiencing a 24-hour increase of over 100%.

The recent surge in SNX is a reassessment of the future value capture ability of the established DeFi infrastructure Synthetix after its fundamental restructuring. The main driving force comes from Synthetix's upcoming decentralized perpetual contract exchange (Perp DEX) set to launch on the Ethereum mainnet in Q4 2025. However, whether it can regain vitality in the trillion-dollar derivatives space still requires the test of time.

CEX Reserves Continue to Flow Out, Whales Double Down

The explosive rise in SNX's price is accompanied by strong on-chain trading activity, demonstrating the overwhelming buying power in the market, and the structure of capital inflow is also changing.

Within 24 hours of SNX's price explosion, its trading volume surged over 500%, proving that market attention and liquidity inflow reached recent highs. Coinbase's trading insights show that the buying ratio is nearly 80%, indicating extremely strong market sentiment, with bullish pressure far exceeding short-term selling pressure.

According to Nansen data, SNX's CEX reserves have dropped to a one-month low of only 73.41 million, down about 16% since September. The decline in CEX reserves limits immediate liquidity, further amplifying price upward volatility in a bullish market environment.

Additionally, from October 1 to 13, the holdings of whale wallets holding over 1 million SNX doubled, indicating that the large-scale, organized accumulation behavior is not driven by retail investors chasing prices but rather by institutional capital or professional traders actively positioning themselves in anticipation of the protocol revenue explosion brought by the V3 launch.

The Pain of L2 Prompts Synthetix V3 to Return to the Ethereum Mainnet

The trigger for SNX's price anomaly is the significant strategic and architectural adjustment of Synthetix V3, which includes the core initiative to migrate back to the Ethereum mainnet from L2 in Q4 2025 and build a new high-performance trading infrastructure.

In the context of a fragmented L2 ecosystem and development challenges, the return to the mainnet is both a reluctant move and a bet on a potential revival opportunity.

In April 2024, Synthetix V3 will launch on Base, officially starting the deployment of the L2 network. However, after more than a year of observation, the liquidity fragmentation caused by multi-chain deployment has led to low capital efficiency and decreased trading depth; the instability of the infrastructure has triggered frequent outages and other practical challenges, prompting Synthetix to abandon the L2 solution. Additionally, multi-chain deployment also carries higher risks for asset cross-chain bridging.

Migrating Synthetix V3 to the L1 mainnet will integrate fragmented liquidity. This transformation will not only leverage the massive liquidity of Ethereum but also integrate the highest level of native security and trust, allowing direct use of mainnet assets without cross-chain bridging, thereby reducing bridging risks and re-staking risks, and enabling seamless combinations with leading DeFi protocols like Aave, further enhancing liquidity and capital efficiency.

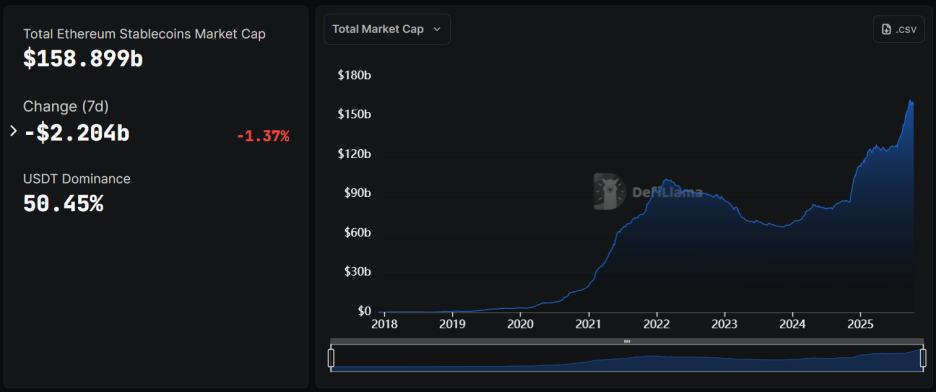

Currently, the market capitalization of stablecoins on Ethereum is nearly $160 billion, making it the deepest liquidity pool in the cryptocurrency market. However, this massive capital has not been fully utilized in derivatives trading and is almost in a "dormant" state. Synthetix V3 plans to directly leverage this enormous liquidity.

Synthetix will vote to terminate L2 deployment in the second half of 2024. Since early 2025, it has been gradually phasing out the L2 network, completely shutting it down by September and fully transitioning to Ethereum. Synthetix announced that the Perp DEX will launch on the mainnet in Q4, and to coincide with the V3 launch, it will hold a trading competition with incentives of up to $1 million to further stimulate community participation and trading enthusiasm.

Before officially abandoning L2 deployment, Synthetix also acquired Kwenta through a governance proposal, exchanging all KWENTA at a ratio of 1:17 for SNX. Kwenta was once the main Perp trading front end of the Synthetix ecosystem, with a cumulative trading volume exceeding $120 billion, and it was a major driver of Synthetix's Perp trading growth, contributing over 95% of the trading increase. This acquisition means that Kwenta will further integrate with Synthetix, and its users and trading will transition to the new mainnet product.

New V3 Product Updates: CLOB and Multi-Collateral Support

To achieve efficient trading on the L1 mainnet, Synthetix V3 adopts a centralized limit order book (CLOB) combined with on-chain settlement in a hybrid model, where order matching runs on a high-performance off-chain system while clearing and settlement are executed on the Ethereum mainnet.

The hybrid architecture of Synthetix V3 aims to address the inherent issues of high slippage, low capital efficiency, and impermanent loss in the DeFi AMM model, ensuring that users can enjoy a low-latency trading experience similar to centralized exchanges (CEX) while retaining the transparency brought by decentralized settlement.

Additionally, to ensure trading fairness, V3 has deployed an anti-MEV (Miner Extractable Value) mechanism, which employs technologies such as account data privacy and progressive configurable liquidation to prevent liquidation positions from being front-run by MEV arbitrageurs, thereby enhancing the system's risk resistance and user trust.

It is worth noting that perpetual contract trading on the mainnet can achieve atomic composability, meaning traders can interact with derivative positions and other L1 DeFi protocols to implement on-chain arbitrage or hedging strategies, which is a core advantage that independent App Chains or L2s find difficult to provide.

The architecture upgrade of Synthetix V3 also includes support for multi-collateral, allowing the protocol to accept high liquidity assets as collateral, including sUSDe, cbBTC, and wstETH. The introduction of multi-collateral significantly broadens the sources of liquidity, lowers the entry barrier for traders, and enhances the capital elasticity of the protocol.

Currently, Synthetix's main products will be divided into three types:

1) Perp DEX (launching on the mainnet): The hybrid CLOB architecture can provide trading speed and volume similar to CEX, with composability and support for various collateral types without cross-chain bridging;

2) Synthetix Liquidity Providers (SLP, launching on the mainnet): Passively market-making through sUSD deposits, profiting from spreads, fees, and liquidation fees, with protocol stability increasing as TVL rises.

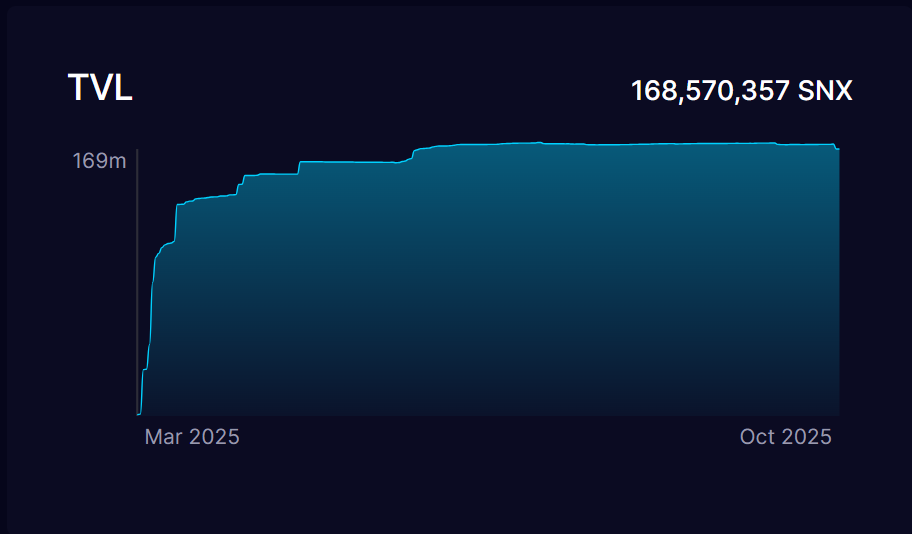

3) Synthetix Staking (420 Pool): Staking SNX or sUSD to earn yields. As of now, the circulating supply of SNX exceeds 343 million, with approximately 169 million tokens staked, resulting in a staking rate of 49.27%. The launch of V3 on the mainnet may further enhance the deflationary effect.

Growth Challenges, Stablecoin Depegging Issues Remain to be Resolved

Although Synthetix's prospects have shifted, the frequent depegging risks of its core stablecoin sUSD within the ecosystem undermine user trust in the protocol's products.

In response to the depegging issue of sUSD, the community has discussed two potential solutions. The first is to suspend the SNX buyback and burn plan and shift to sUSD debt destruction to reduce the supply of sUSD to help it re-peg. The tokenomics model needs to be updated after V3 successfully launches on the Ethereum mainnet and sUSD performs stably.

In December 2024, the official announcement will implement this plan, but the results have been less than ideal, as sUSD experienced significant depegging twice this year in April and July, even reaching a maximum depegging of below $0.75.

The second solution is to introduce native interest rates for sUSD after the completion of the V3 migration, which has not yet been implemented, and its effectiveness remains to be seen. However, the long-term success of the protocol will depend not only on a high-performance trading system but also on the reliability of its management of ecosystem assets.

As of now, DeFiLlama data shows that Synthetix's TVL is approximately $243 million, all concentrated on the Ethereum mainnet. The protocol's cumulative Perp trading volume is $62.72 billion, with an average daily trading volume of about $42 million.

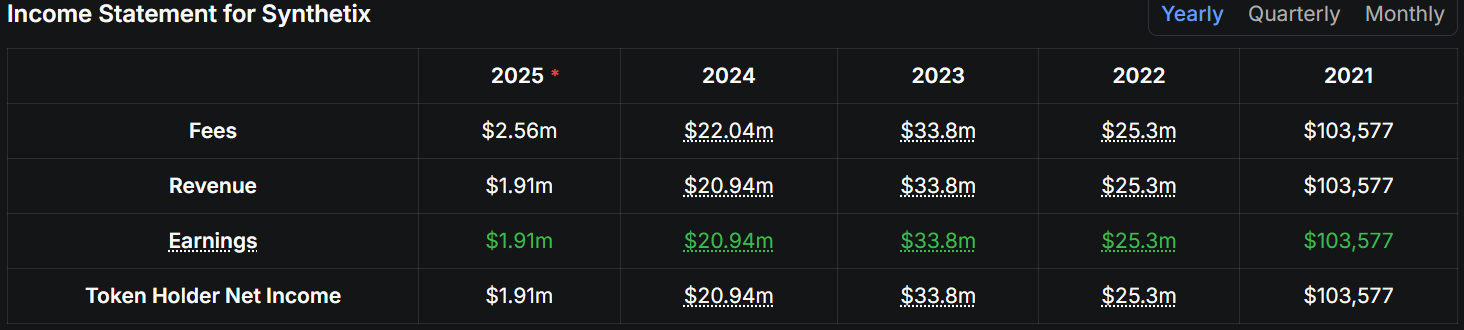

Additionally, Synthetix's profit and loss statement shows that the protocol's revenue peaked in 2023, but since the focus shifted to the L2 deployment strategy, its revenue has significantly shrunk by about 38%, even falling below 2022 levels. The substantial reduction in revenue may be one of the important motivations for Synthetix's return to the Ethereum mainnet.

It is especially noteworthy that since Synthetix V3 has not yet launched on the Ethereum mainnet, its annual fee income and perpetual contract trading volume are zero, indicating that the explosive price of SNX is primarily based on market expectations for the future.

As an established DeFi project, the market anticipates that this breakthrough is a pre-reassessment of Synthetix's strategy to return from L2 experimentation to L1 core infrastructure. Once V3 successfully launches and effectively captures perpetual contract trading fees, the current valuation of SNX may be undervalued.

For investors, verifying the actual captured perpetual contract trading volume and fee income data after the V3 mainnet launch will be key indicators for assessing SNX's growth potential and valuation. Additionally, whether the protocol can provide a low-latency, high-performance trading experience and the stable performance of the stablecoin sUSD will be important factors affecting its long-term competitiveness and user acquisition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。