Ethereum surged against Bitcoin on its way toward a peak of nearly $5,000 this summer, but the reigning cryptocurrency reasserted itself this weekend, as a tit-for-tat between the U.S. and China over tariffs and trade sent economic concerns flaring for a second time this year.

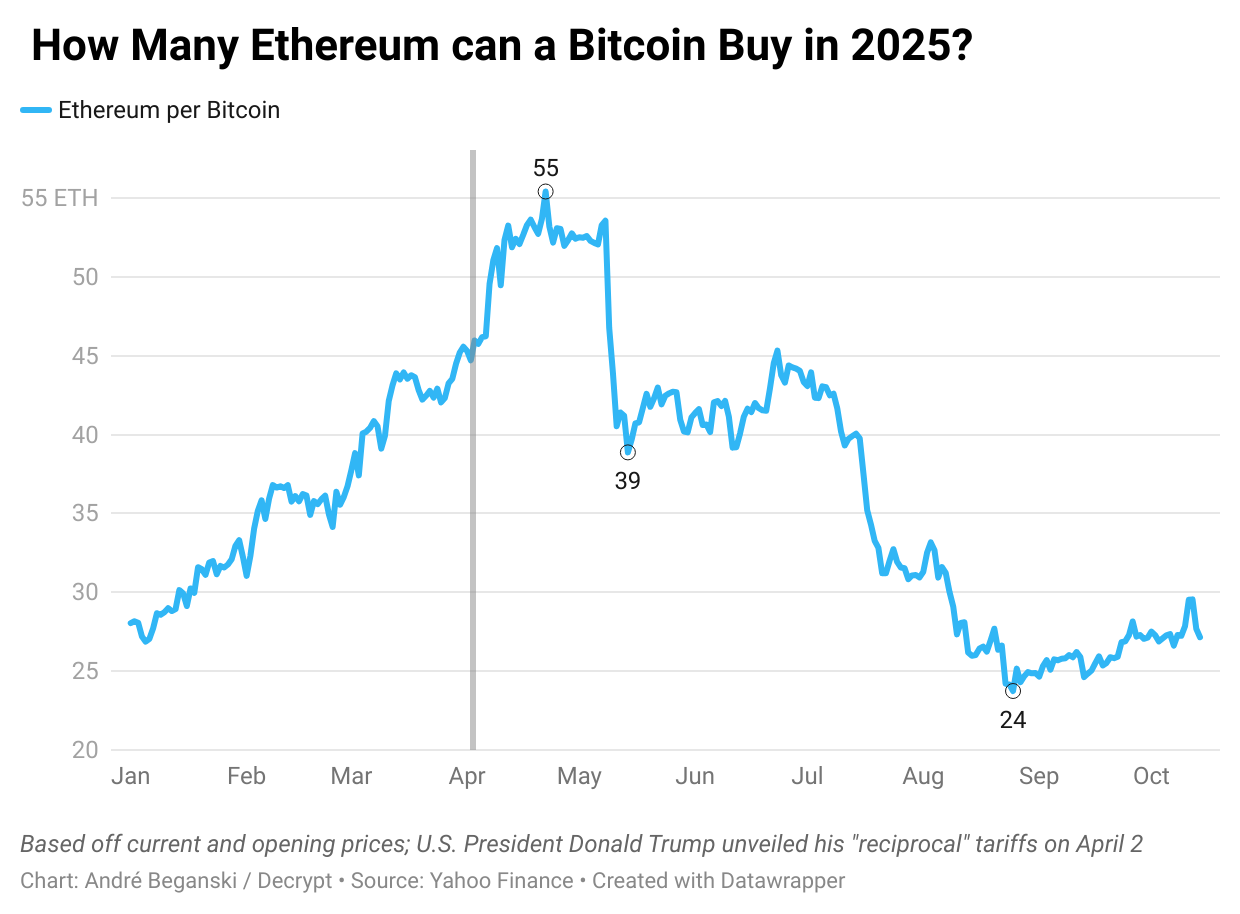

Although the price of both assets fell in U.S. dollar terms, Bitcoin’s value increased relative to Ethereum, to the point that a single Bitcoin was worth nearly 30 Ethereum on Friday, according to Yahoo Finance. On Tuesday, a single Bitcoin had weakened to around 27.7 Ethereum.

As China sanctioned U.S. components of a South Korean shipping company, and U.S. Treasury Scott Bessent suggested the economy of America’s largest trading partner was “weak,” it appeared that President Donald Trump’s tariff threat on Friday could prompt another standoff ahead.

Pedro Lapenta, head of research at crypto asset manager Hashdex, told Decrypt that Ethereum’s recent underperformance against Bitcoin “reflects shifting macro narratives more than fundamentals.” That includes a so-called debasement trade, which is also benefiting Bitcoin more, as investors seek shelter from potential currency devaluation.

“Bitcoin naturally captures that hedge demand first,” he said. “But the structural story for Ethereum remains strong, anchored in the rise of regulated stablecoins, tokenization, and institutional adoption of on-chain finance.”

At its weakest this year, a single Bitcoin was worth 23.7 Ethereum, which coincided with the smaller asset’s climb to a new all-time high of $4,956 in August, according to CoinGecko.

Throughout most of April, however, a single Bitcoin was worth at least 50 ETH, reflecting one of its strongest periods against the smaller asset this year, while the Trump administration managed expectations around “reciprocal” tariffs.

At the time, Bitcoin was the only digital asset that appeared to benefit from perceived shifts in the global geopolitical order or risk, with some analysts comparing its performance to gold.

Between the Federal Reserve’s calculus on interest rate cuts and an ongoing government shutdown, the Trump administration’s trade moves are just one factor shaping markets. But there are also developments specific to the crypto industry that one should consider, according to Juan Leon, senior investment strategist at Bitwise.

He said Ethereum’s recent run stems from investor excitement toward the emergence of Ethereum treasury firms and the passage of stablecoin legislation. Along with a supportive regulatory environment, he said the setup “holds promise for an altcoin rally” into next year.

Bitcoin has outperformed Ethereum for several years, but the smaller asset’s price has increased relatively more this year, despite losing most ground gained against Bitcoin in recent weeks.

In market cycles past, Bitcoin’s peak has been followed by a sustained period of strength for cryptocurrencies like Ethereum, often called an “altcoin season.”

TD Cowen analyst Lance Vitanza told Decrypt that he’s “never been a believer in this or any ‘altcoin season,’” arguing that only a handful of tokens are likely to survive as legitimate tech.

That said, he believes Ethereum “represents real technology” and is likely to play a meaningful role in decentralized finance, such as the potential tokenization of trillions of dollars in assets. As a result, he said Ethereum “could appreciate meaningfully over time.”

Vitanza said that Ethereum will always be more volatile than Bitcoin, and there may be some months where the smaller asset performs better. But Vitanza said “would be surprised if the outperformance, if any, were to persist” more than a few months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。