Author: hitesh.eth, Crypto KOL

Compiled by: Felix, PANews

This article delves into Bittensor, explaining why it is not a decentralized OpenAI, but rather a decentralized AI economy; it elaborates on how dTAO reshapes incentive mechanism design, how subnet economies operate, and why TAO represents a cultural resistance to centralized AI.

What Changes Occurred After dTAO?

Many may be wondering what Bittensor aims to achieve. Is it trying to create a decentralized OpenAI, or is there a deeper intention? In fact, the crypto community generally believes it could be a decentralized OpenAI, but confusion arose when it lifted subnet restrictions and introduced dTAO (which also involves subnet tokens) to make it more competitive. This shift is crucial as it transitions the network's reward distribution from centralized voting by a few validators to a system entirely driven by the market.

The introduction of dynamic TAO (dTAO) fundamentally changed the operational mechanism of the ecosystem. The allocation rights of the daily TAO issuance were completely transferred from the root validators (subnet 0, criticized as an oligarchic voting system) to be determined by the market price of each subnet's alpha token. Each mining subnet now has its own alpha (α) token and its own automated market maker (AMM) pool. This means each subnet can develop an independent, capital-driven economy. The staking method shifted from delegating TAO to a single validator (subnet 0 staking) to purchasing and staking subnet-specific alpha tokens (α). Stakers now bear market risks but can directly influence resource allocation. The previously rigid 50/50 reward distribution between miners and validators evolved into the current 41/41/18 distribution, better funding subnet owners (18%) and incentivizing continuous innovation in subnet core incentive mechanisms.

Grand Vision

Today, Bittensor is competing with centralized AI development and distribution platforms, providing infrastructure for developers to build various AI use cases across different industries. This is crucial for understanding Bittensor's total addressable market (TAM). While companies like OpenAI are competing in an instant market worth billions, selling finished AI products such as subscription services or API access, Bittensor targets the entire AI value chain market worth trillions—encompassing computing infrastructure, data validation, model training, and a peer-reviewed intelligence layer.

If successful, Bittensor, as a foundational, permissionless platform for all decentralized AI, has a TAM that far exceeds any proprietary AI company. Bittensor is developing and deploying various AI models, building a coordination engine for a distributed and decentralized AI ecosystem, while incentivizing people to provide funding and computing resources to achieve the highest levels of quality, efficiency, and outcome trust across decentralized AI projects for different use cases. This is more akin to building a decentralized AI value chain, where anyone can participate through capital, knowledge, and computing power.

Bittensor is for everyone, not just the 0.000001% of the world that can participate in OpenAI.

Bittensor's overarching vision is to create a neural internet. Over the past four years, Bittensor has built a loyal community, gathering top venture capital firms like DCG, crypto researchers like Sami Kasab, and many geniuses working daily to advance this vision. They create content, host podcasts, develop products, and are igniting a movement. Bittensor has also built a subnet ecosystem, with approximately 126 subnets currently active. The current cost of a subnet is about 1600 TAO (640,000 USD), a dynamic cost that changes based on the frequency of new subnet registrations. After a few months of pause, new subnet registrations have now reopened.

One of the earliest Bitcoin pioneers, Barry Silbert, founded Grayscale in 2013 with the idea of attracting institutional investors to Bitcoin. Now, he is building a similar fund for subnet tokens. Grayscale announced a $10 million fund called the "Yuma Subnet Composite Fund," which can invest in top-ranking subnet tokens by market capitalization.

Subnet Tokens

Subnet tokens are currently one of the most overlooked assets on crypto Twitter. 99% of users know nothing about this area. The core idea of subnet token pricing is that it is denominated in TAO rather than simply pegged, and is determined by the liquidity ratio in its automated market maker (AMM) pool. The higher the value of subnet tokens relative to TAO, the more issuance they receive. More issuance attracts more miners to host and run AI models and provide computing resources. Miners compete with each other to optimize the output of subnet models, with better results leading to higher prices. Or more precisely, better services attract more staking demand, resulting in price increases, ensuring the overall output quality of AI models for different use cases across various subnets. Validators ensure that miners maintain quality.

Their job is to verify the work of miners and score them. Based on this score, miners receive issuance from the subnet. Approximately 7200 TAO are issued daily, and this number will be halved in the next two months with the first Bittensor halving event occurring in December.

This means there is currently fierce competition in the mining ecosystem for maximum rewards. Most miners will stick to mining in the best-performing subnets, and if they mine in top subnets, the prices of those subnet tokens will rise accordingly. More mining demand driven by high issuance will always lead to an increase in subnet token prices. The initial demand for mining subnets usually comes from the use cases they are building, the teams behind them, past performance, and speculation supported by large companies.

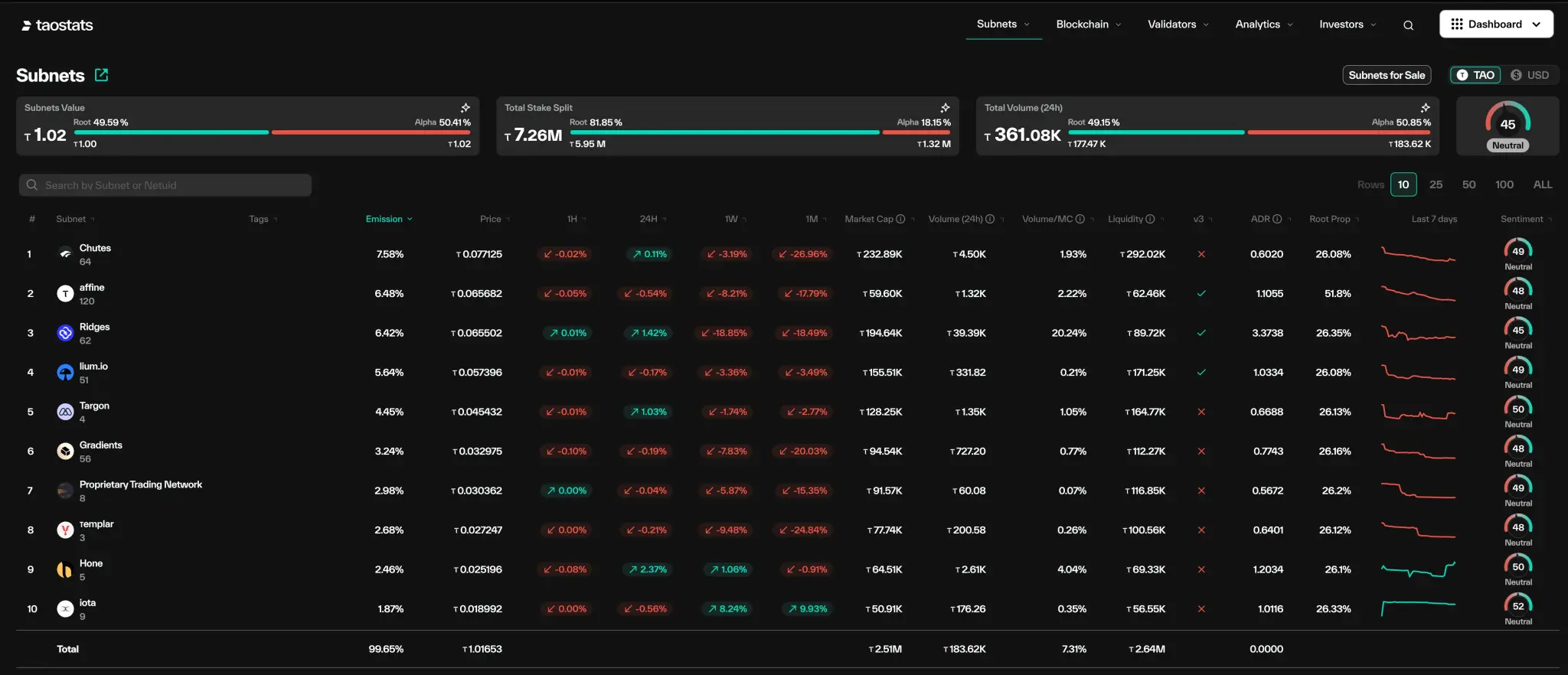

Currently, the top subnet tokens with the highest issuance include Chutes, Ridges, Gradient, etc. Some of these subnets are also backed by venture capital, such as Gradient, which is building the AI Trains platform. It is built by Rayon Labs, which also operates the leading subnet Chutes by issuance. Many of these subnets are collaborating to exchange services. For example, Ridges is a client of Chutes; Sportstensor is building AI models for sports betting and predictions; and subnets like OpenKaito support Kaito's InfoFi Pioneer. Taofi is also part of Bittensor. They launched a DEX that allows you to easily bridge and swap subnet tokens from the Base network.

Trust in TAO

If you ask which subnet tokens will attract demand, you need to track the growth of subnet token prices relative to TAO. The more growth seen over different time frames, the higher the demand, and then you need to look at the ADR (alpha distribution ratio). It should be less than 1, as deregistration is now open. The worst-performing subnets are deregistered weekly. If the ADR ratio is above 1, the community may lose some of the value of the TAO collateral staked to acquire that token due to liquidation discounts at the time of deregistration.

You can also track the staking pools of different subnets. The more TAO staked to acquire subnet tokens, the more likely the price will rise. Therefore, subnet tokens depend more on how long they can attract high issuance. If they continue to receive high issuance and the business around the subnet generates revenue from the services and products it provides, then the price of subnet tokens may continue to rise. The overall market cap growth around the subnet will directly drive up the price of TAO.

But it is advised to stay away from things you do not understand. Subnet tokens are not like ordinary altcoins or junk coins. They require a deeper logical understanding, so if you believe in their vision, invest in TAO. TAO is not meant for trading; it is a cultural symbol against the centralization of AI.

The question is not whether decentralized AI will exist, but who will own it. Bittensor has made its choice, and others will too.

Related Articles: Bittensor Subnet Investment Guide: Seize the Next Wave of AI

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。