作者:CryptoBrand

2025年的Web3市场,叙事正悄然生变。除了经久不衰的Meme,更坚实的赛道开始涌现,例如RWA代币化正掀起波澜。有数据显示,仅代币化宝可梦卡牌在2025年8月的交易额就达到了约1.24亿美元。同时,Web3基础设施领域也因机构资金的注入和技术指标的提升而加速成熟。

在这样的背景下,流动性即生命线。无论是新兴协议还是老牌平台,交易量直接关系到市场关注度、代币价格乃至生存空间。交易大赛这一利器在Web3的世界里被赋予了新的生命。

交易大赛:项目增长的催化剂与多方共赢的引擎

交易大赛本质上是一场精心设计的激励游戏,其参与者各取所需,共同构成了一个微妙的生态。

1.CEX的护城河:币安Alpha交易大赛

币安的Alpha计划是典型的CEX打法。“Alpha积分”、“生态竞赛奖励”和“指定交易对奖励”三重激励,实现了“一鱼三吃”。海量的“所下流量”通过交易大赛为媒介,提升了平台的交易活跃度和用户黏性,也为生态项目带来了宝贵的初始流动性关注。

2.DEX的流动性引擎:PancakeSwap的交易大赛

交易大赛可以激励LP,通过奖励吸引用户将资产注入流动性资金池,从而提升协议的TVL和交易深度,降低用户的交易滑点,形成正向循环。

3.任务平台的巧妙桥梁:TaskOn的Trading Race

任务平台在Web3生态中连接项目方与海量用户,通过多样化的任务帮助项目冷启动。TaskOn的Trading Race便是用较低的奖励预算,撬动惊人的交易量。通过Leaderboard、奖励激励的实时分配激活参赛者的胜负欲,将简单的交易行为转化为一场充满激情的竞赛。

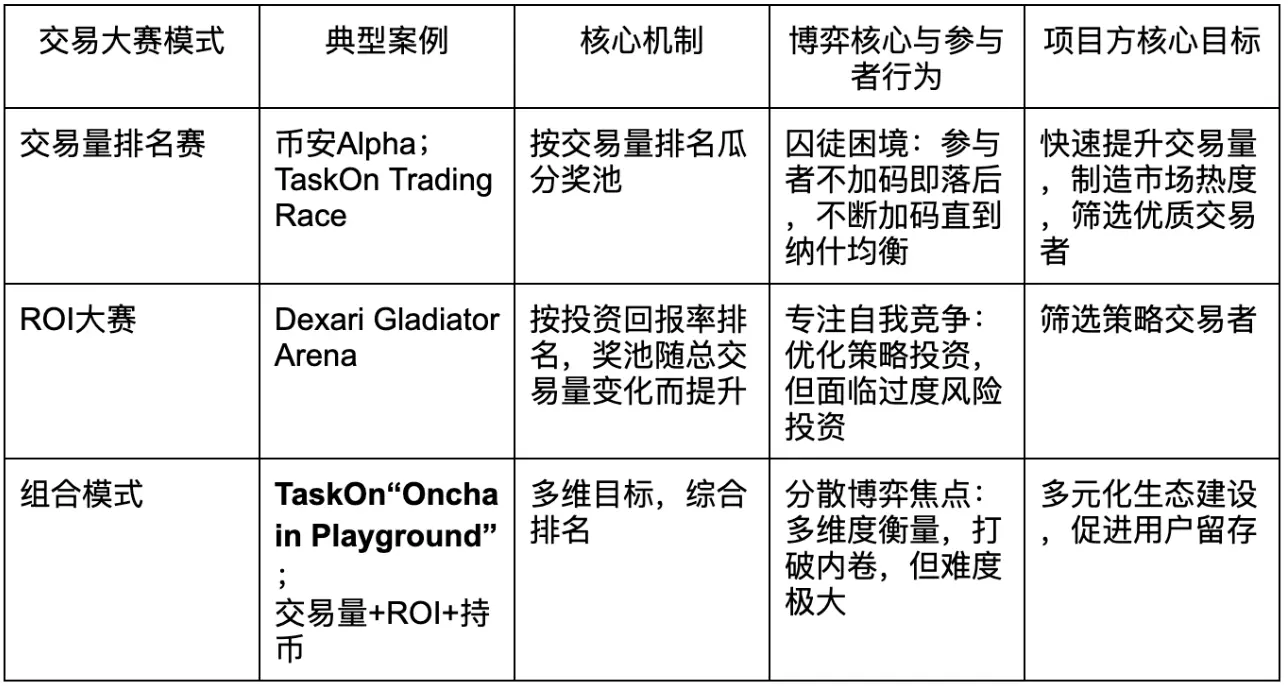

链上交易大赛中的纳什均衡与囚徒困境

为什么交易大赛能成为激活交易量的金手指?为何理性分析最终会导致集体“内卷”?当众多参赛者被置于同一赛场,微观博弈背后隐藏着一套令人上瘾的博弈机制。

交易大赛天然是囚徒困境的完美演绎场。每位参赛者都面临抉择:保持克制还是追加交易?若全体克制则集体收益最优,但只要一人‘背叛’加码,就能轻松超越他人。风险厌恶和FOMO情绪会推动所有人持续内卷,直到奖金被手续费稀释。最终市场会趋向纳什均衡——所有参赛者的投入使其净收益趋近于整体最低,此时无人愿单方面改变策略。这个‘零和均衡’恰是项目方乐见的激励效率最大化状态。

实战推演:币安 Alpha 交易大赛的“磨损”博弈

币安Alpha近期推出了BNB智能链交易竞赛,参与者将通过交易AKE、ARIA、TAKE、BOT和RICE等5个独立交易量池,来角逐310万美元等值大奖。

参与者们为排名展开激烈角逐。经常参与币安Alpha的Heisenberg给我展示了交易策略:“‘用最低费率买入,设置2%-5%卖单,在刷量同时赚取微小价差”。但身旁的凯哥立刻反驳“买入立刻卖出,我亏损了1.6U”。

竞赛的尾声博弈进入白热化,“上一期最后一天交易大赛非常卷,有人被磨损几十U”,Heisenberg生动地描绘了为何会进入囚徒困境:“我们都在赌对方的放弃节点,每次都是几百U的优势在交替排名,最后收益都砸进去也就停了。别上头才能赚钱,可惜你没办法劝对方,也没办法劝自己认赔。”

也额外提醒一下交易员们,要注意计算好交易摩擦和Token背景调研,毕竟只有赚了钱,才是参与交易大赛的初衷。

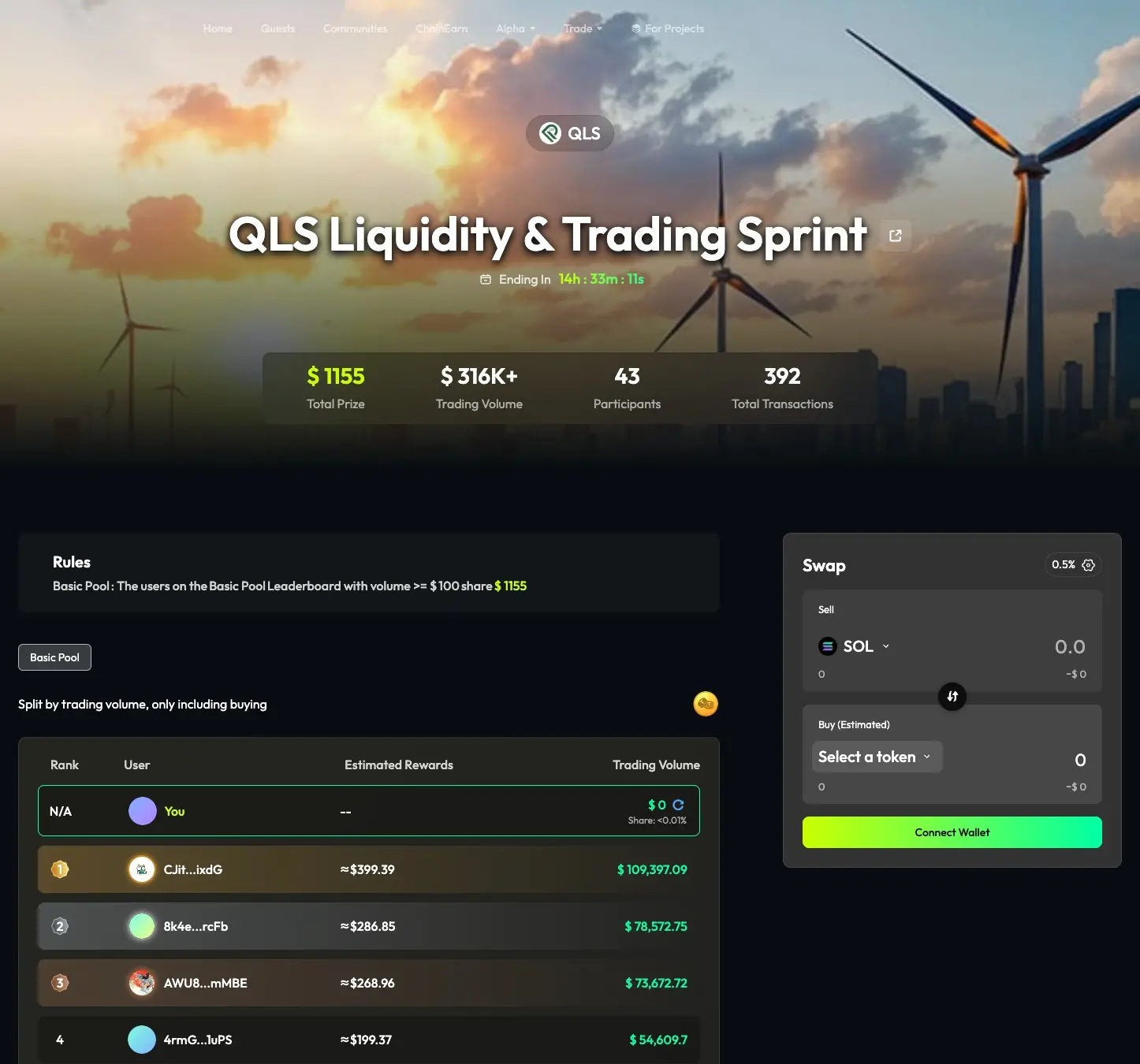

效率与资本:TaskOn Trading Race 的效率

在TaskOn平台上,一场QLS 流动性与交易冲刺的竞赛以1155美元的奖金,驱动了三十多万美元的交易量。

Trading Race页面上实时显示交易量、总奖池、参与者等信息,并没有将Swap入口做大,反而将Leaderboard置于最显眼的位置,通过排名和实时奖励的变化,提供一个公开、实时更新的排行榜,随着用户的排名上升或下降,参赛者的竞争心理和胜负欲也随之波动,是最大的肾上腺素来源,也刺激了交易热度加码。

在博弈白热化阶段,禀赋效应和沉没成本提供了更深层的心理干扰。一旦用户通过交易获得了某个排名,他会视这个“临时所有权”为已有,随着排名下跌,风险厌恶和沉没成本驱动着他们‘再搏一把’,企图挽回“损失”。甚至有时候,这种争夺无关奖励,而是荣誉。

在TaskOn的Discord社区中我看到有用户在跟管理员提问,能否针对Trading Race推出相关的勋章。我私信了这个名为“Bella”的用户,她说“大额交易的旅程更多时候是一种链上荣誉的体现,这种勋章我分享到推上,比直接晒交易截图更自然。”

所以TaskOn在规则设计上也维持了天平的平衡,所有关于交易的信息:用户的交易量、预计收益都透明可查,更容易计算全盘的成本,也易于实现纳什均衡——当算出普遍平衡的交易点,并把这个目标设置成交易底线,散户就更可控实现利益最大化。

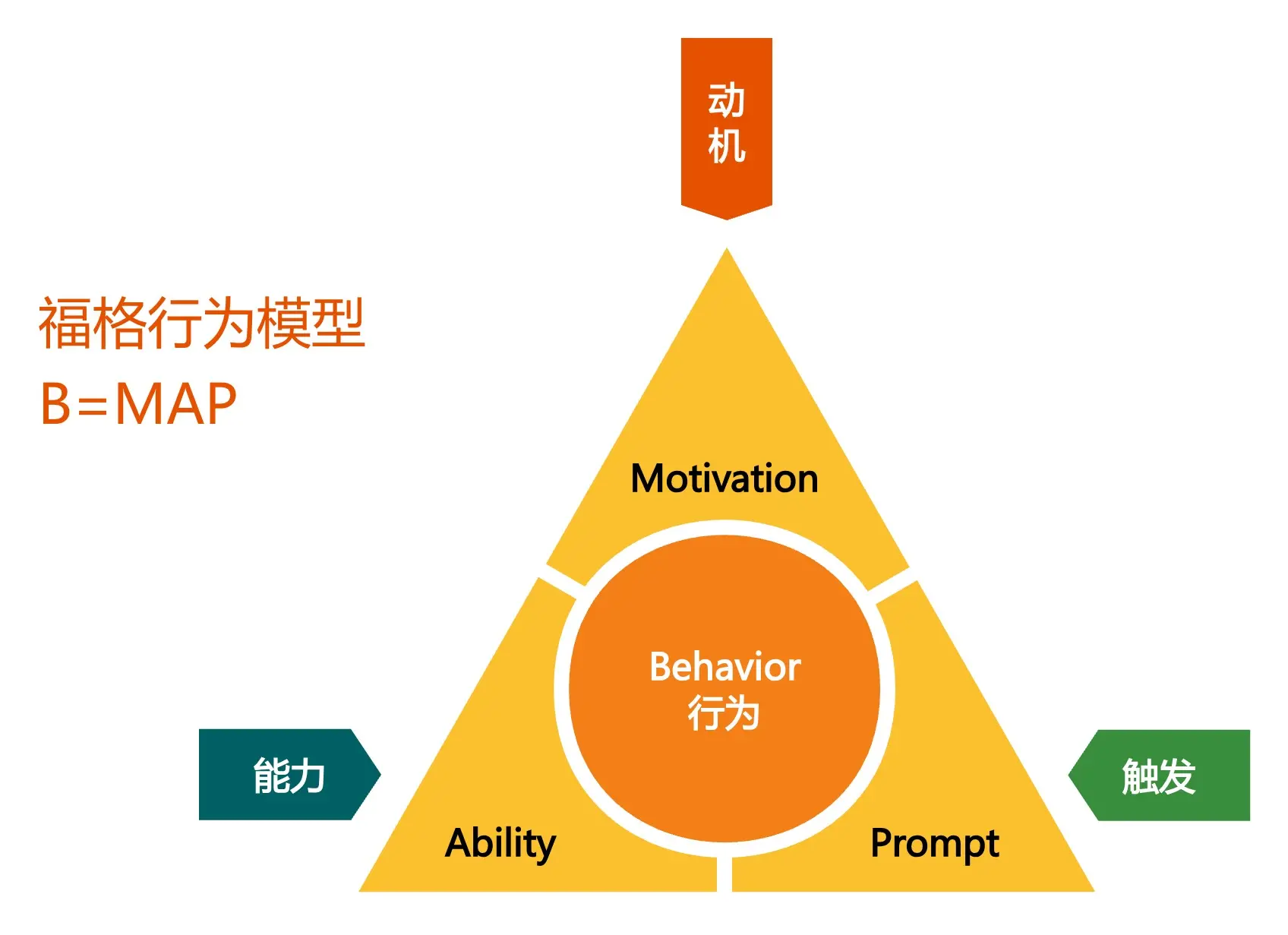

正如福格行为模型所阐述的那样:当强烈的动机、被简化后的操作能力,以及无处不在的排行榜触发,这三者齐备时,用户的交易行为便如水银泻地,一发不可收拾。

如何打造好一场交易大赛?

成功打造一套交易大赛的底层逻辑,首先要用好钩子模型——让用户“上瘾”的循环。

就像我们刚分析过的TaskOn Trading Race,通过钩子模型的四个阶段,让用户从被动参与变为主动投入:

触发:活动公告、社区推送(外部触发)与FOMO的焦虑(内部触发)启动循环;

TaskOn的Trading Race活动会推上首页,并且在推特等渠道广而告之。公开的动态收益,FOMO情绪更容易推动飞轮启动;

行动:用户进行最简单的交易操作;

多变酬赏:钩子模型最精妙之处:排行榜名次的浮动、奖励获得的不确定性构成的多变酬赏,持续刺激用户的多巴胺分泌;

Leaderboard的滑动,预计收益直接减少100刀,直观“损失”更容易推动用户的交易情绪。

投入:用户投入的时间、Gas费、乃至情感,都增加了其沉没成本;

最终形成了一个正向的飞轮,飞轮达到上限后,项目方可以围绕着“规则——奖励——竞技氛围(排行榜)——品牌化”的路径,打造一个标准化的竞赛品牌,形成循环的正向增长飞轮。

交易大赛的深层价值与未来演进

除了单一项目方的独立运营,同生态的项目联合举办交易大赛,更能实现生态赋能和交易量的规模效应。随着交易维度的增加,玩法也趋于多元化,使得用户的交易策略本身成为PK的主角。

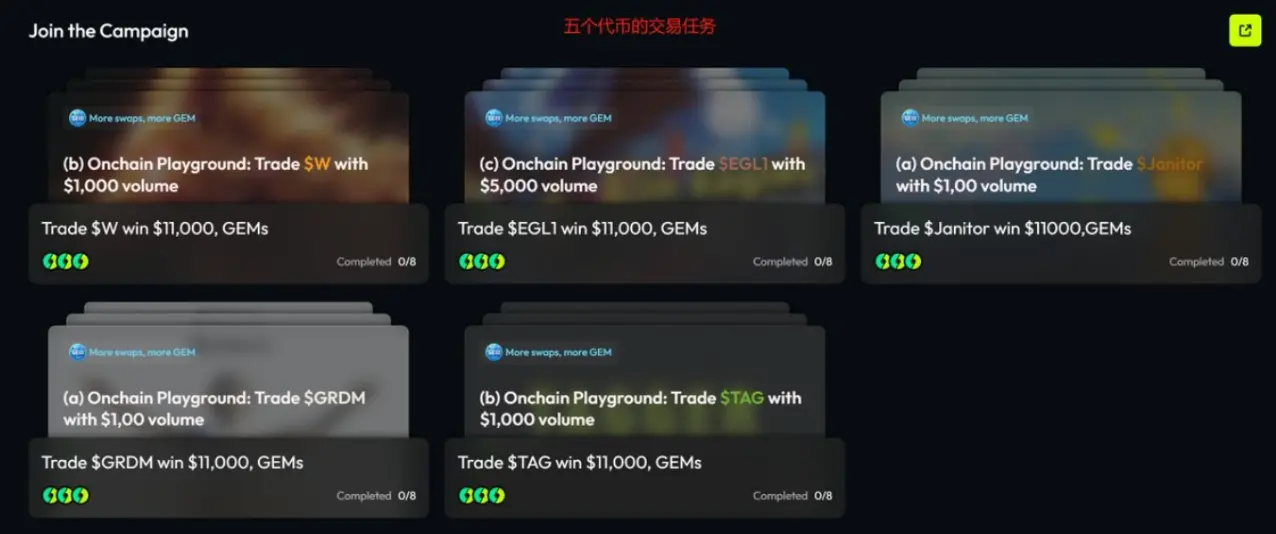

案例进阶:TaskOn与FourMeme的“Onchain Playground”

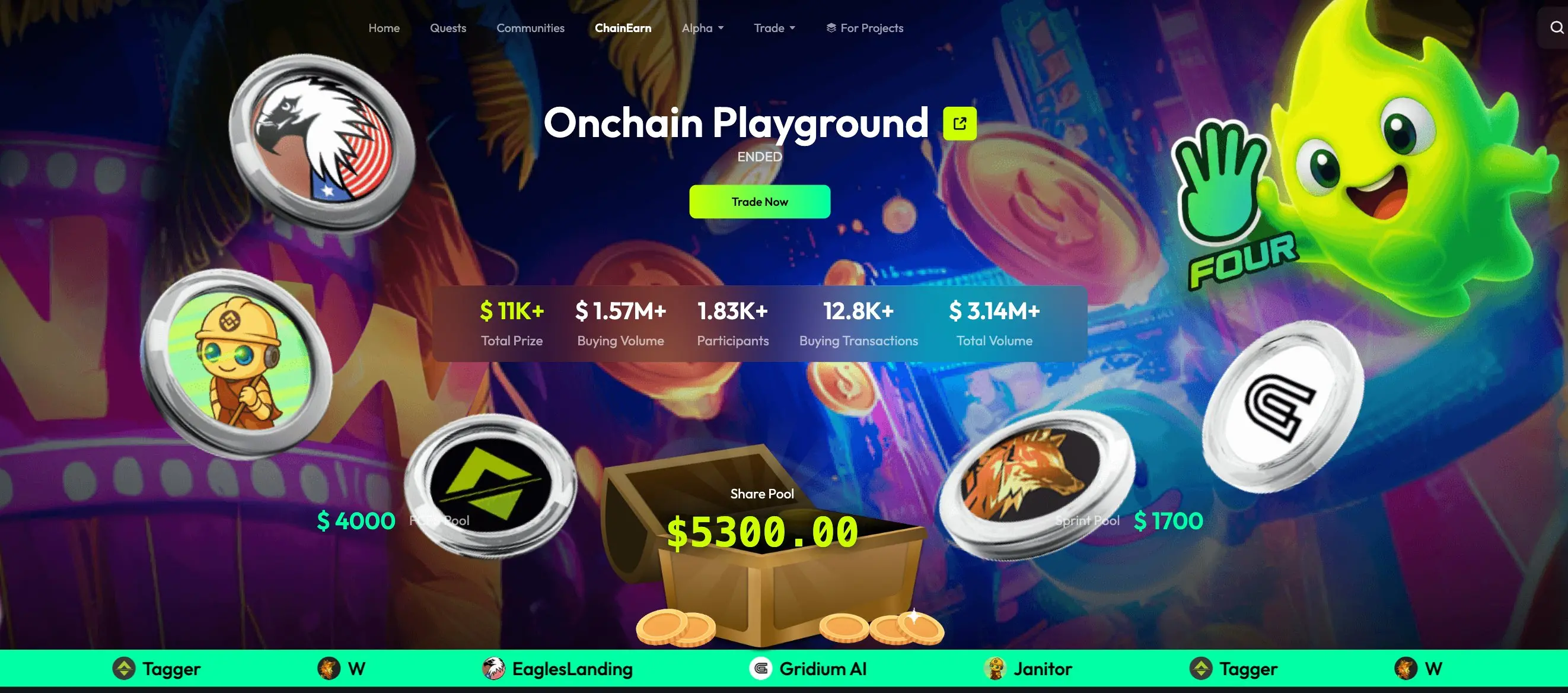

TaskOn与FourMeme联合推出的Meme交易大赛“Onchain Playground”正是这种思路的典范。它集结了$EGL1、$Janitor等五个热门Meme币,并设计了一套精密的“三维”飞轮玩法,将竞争从单纯的内卷拉升到策略维度:

FCFS Pool:用户为偏好的项目完成交易任务,即可瓜分4000美元基础奖池,并获得平台GEMs奖励。

Share Pool:用户需统筹考量多个“Task Collections”,冲击总交易量榜单,瓜分5300美元奖池。此奖池会随总交易量动态增长,打破了收益上限,激励核心玩家持续投入。

Sprint Pool:激活了GEMs的玩法价值,凭借GEMs的数量瓜分最终的1700美元冲刺池。此时,GEMs成为衡量收益的唯一指标。

这套机制的精妙之处在于成功地在用户间植入了 “如何高效获取GEMs” 这一核心策略命题。用户不仅要相互比拼交易量,更要在不同任务间权衡精力分配,思考最优策略以实现三个奖池的利益最大化。也展示联合竞赛赛的潜力——通过基础博弈层、策略竞争层和资源调配层的三维设计,将竞争从单纯交易量比拼提升至策略博弈维度。最终总交易量突破了300万美元,1000多个用户进行了交易的角逐。

对项目方而言,交易大赛是启动增长的杠杆;对用户来说,也是一个绝佳的交易试验田。未来的交易大赛模式可以更加多元。

其实未来的交易大赛可以向Hold Token竞赛、结合veToken模型,ve(3,3)模式等方向发展,将短期激励转化为长期协议绑定、收益给予和权重加码。更加贴合Web3生态的需求。

链上交易大赛,是一个将人性博弈、经济激励和加密技术完美结合的微观实验场。它清晰地展示了,在合理的规则设计下,个体的理性决策纵然会陷入“囚徒困境”,但最终却能在“纳什均衡”中,推动整个生态向着活跃、稳定和繁荣的方向演进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。