作者: Chloe, ChainCatcher

去年 11 月,FBI 突击搜查了 Shayne Coplan 在纽约的公寓,与他创办的初创公司 Polymarket 涉及选举赌注有关。

今年 7 月,Polymarket 斥资 1.12 亿美元,收购了衍生品交易所 QCX LLC(或 QCEX),藉此取得 DCM 执照,让 Polymarket 得以进军美国市场。

收购完成后,Polymarket 经历了数周的等待,直到 CFTC 在今年 9 月核发“无异议函(No-Action Letter)”,正式允许该公司在特定范围内营运,而不会遭到执法部门追究。不到一个月的时间,10 月 7 日纽约证券交易所母公司洲际交易所(ICE)宣布将向 Polymarket 投资高达 20 亿美元,这笔交易对 Polymarket 的估值为 80 亿美元。

几乎同时,Polymarket 最大竞争对手 Kalshi 也宣布以 50 亿美元估值完成 3 亿美元融资,并计划允许 140 多个国家的客户在其网站上投注。

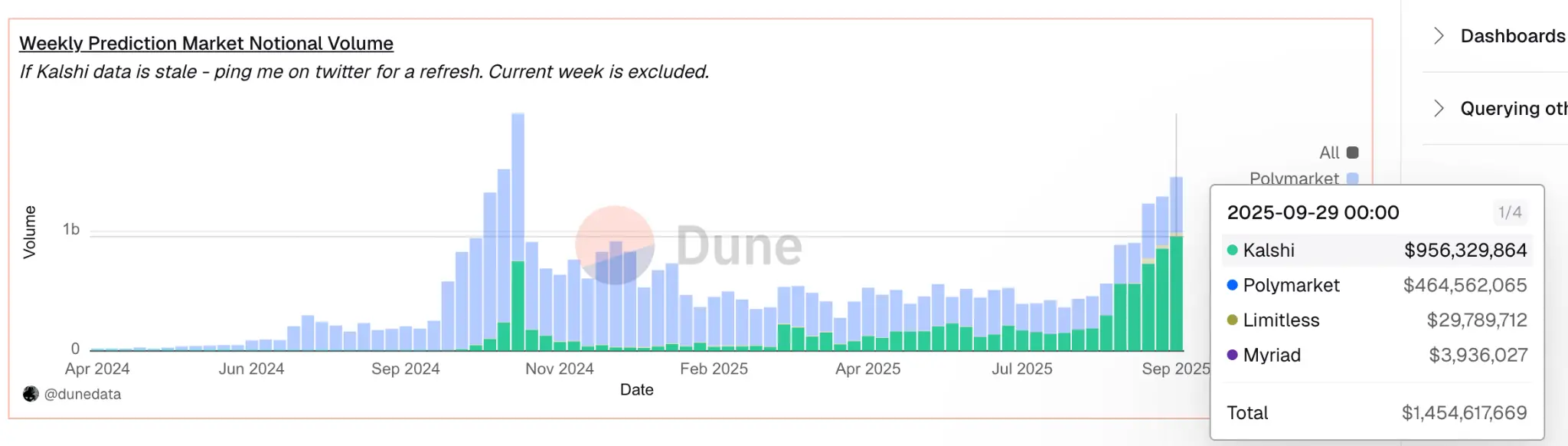

根据 Dune Analytics 的数据,Kalshi 最近超越 Polymarket,占据了全球市场份额的 60% 以上,相较于去年约 3 亿美元大幅攀升,Kalshi 的年度交易量已增长至约 500 亿美元。

而两家公司在同一週内纷纷宣布融资,凸显预测市场平台已走向主流市场视野,且 Polymarket 与 Kalshi 都已具备监管合法性,如今已在相同起点上较量。

ICE 真正意图为何?

首先,ICE 选择以 20 亿美元投资 Polymarket,可能早已佈局许久,是多年布局区块链与数字资产后的一步旗。这家身为纽约证券交易所运营商的巨擘,早在 2018 年便推出 Bakkt,提供比特币託管与期货业务,并在各种公开场合中强调代币化将成为未来市场基础设施的核心。

CEO Jeffrey Sprecher 更在 2022 年公开预言,数字资产将成为各类资产价值传输的轨道。然而,从进入比特币期货,到直接投资一个完全链上运行的加密原生平台,ICE 做出这番抉择,突显其视野已从数字资产的单一品类,转向更深层的“区块链原生数据基础设施”。

Polymarket 之所以受到 ICE 青睐,源于它与其他 Web3 项目截然不同的运作模式。很多打着去中心化旗号的平台,核心数据与结算仍在中心化服服器中进行,Polymarket 则将市场运行、结算、交易全部置于链上。

由部署在 Polygon 链上的智能合约结算,以 USDC 作为抵押,并以代币化的结果呈现。用户直接在链上铸造 YES/NO 代币,这些代币作为 ERC‑20 资产存在于钱包中,在预测事件结束时可以自由交易或兑换。结算过程由 UMA Optimistic Oracle 处理,并与 Chainlink 的合作,将资产价格类市场的结果直接发布到链上。这种运作模式等同让每一次交易、每一笔结算、不论结果,都形成了不可篡改、透明可审计的链上数据。

对 ICE 而言,Polymarket 的价值不限于预测市场,而在于它所生成的庞大且可验证的链上预测数据。

不同于传统金融的预测资料可能受制于中心化编纂与操控,Polymarket 的数据是真实反映市场参与者集体预期的价格信号,且这些信号记录于公链之上,全球可访问且无法人为操纵。

ICE 计划将自己定位为“Polymarket 事件驱动数据的全球分销商”,把这些即时概率作为情绪指标提供给机构客户,并将其视为宏观经济预测、风险建模等领域的新型数据源。

更进一步来看,这种链上数据还可成为新型金融产品的底层资产。例如,Polymarket 可以根据某一组事件概率构建“代币化指数”,而 ICE 则能以此发行对应的衍生品,类似“事件驱动的 ETF”,例如追踪美国总统选举、美联储利率决策、比特币价格走势的概率曲线。

整合成链上透明性与金融专业性的产品,有机会成为新一代机构级资产配置工具。

Polymarket 的美国回归之路缩小与 Kalshi 的差距

且 Polymarket 的监管回归之路,通过收购 QCX LLC 获得的 DCM 执照,先採用了自我认证机制处理事件市场,允许其在 CFTC 不反对的情况下无需预先批准即可上市新合约。

过去来看,Kalshi 是第一个受 CFTC 监管的预测市场,用户可以直接对真实世界事件的结果进行交易,不是受事件影响的股票,不是可能因消息而波动的货币,而是事件本身。

这种机制允许 Kalshi 自行设计新的事件合约,只需向 CFTC 提交合约设计文件,无需事先逐一获得批准。如果 CFTC 在审查期内不提出异议,合约就可以直接上市交易。CFTC 保留事后审查和叫停的权力,但这种“先行后审”的模式大幅提升了产品开发速度。这让 Kalshi 能够快速推出涵盖天气、经济数据、政治事件、娱乐奖项等各类事件市场,而不必每次都陷入漫长的审批流程。

在 Polymarket 被罚款并离岸运营的 2022 至 2024 年间,这套监管框架是 Kalshi 最坚固的护城河。

通过收购 QCX LLC,Polymarket 获得了与 Kalshi 完全相同的监管许可和运营机制。它现在同样持有 DCM 执照,同样可以採用自我认证机制在 CFTC 不反对的情况下自行上市新合约,并且获得了 CFTC 的无异议函,正式确认可以在此框架下合法运营。

这个转变的意义远超表面。在 2022 至 2024 年上半年,Kalshi 与 Polymarket 之间的竞争根本不在同一个赛道上。Kalshi 拥有美国执照,可以合法服务美国用户,而 Polymarket 只能做离岸业务。

当时的竞争并非在同一赛道上。Kalshi 的核心优势来自其坚不可摧的合规地位,而 Polymarket 儘管在加密原生用户中受欢迎,却因监管限制无法进入美国市场。如今情况完全不同,两家公司都持有相同级别的交易所执照,都採用相同的合约审批流程,都能以相同的速度开发新产品,都可以完全合法进入美国市场,可以说过去 Kalshi 所享有的监管套利空间已经消失。

加密媒体 CryptoSlate 则指出:“Kalshi 的合规优势曾经看起来坚不可摧。然而,如果 Polymarket 能够在类似的 CFTC 框架下运作,同时利用 ICE 的技术和数据复盖范围,两者之间的差距将开始消失。”

Polymarket 与 Kalshi 更像是经营理念的对决

Kalshi 从一开始进入市场就秉持金融交易所的形象和营运理念,而非加密货币初创公司。它在 CFTC 的全面监督下运作,以美元清算交易,要求 KYC 验证,并将其产品定位为风险管理工具而非投机赌注。

创始人 Tarek Mansour 和 Luana Lopes Lara 经常将他们的目标描述为建立“日常事件的期货交易所”。Kalshi 植根于传统市场结构,强调透明度和渐进式增长,将合规视为其核心竞争优势。该公司扩展至 140 个国家,并拥有日益增长的宏观和文化市场清单,试图通过监管确定性来建立坚不可摧的护城河。

Polymarket 的轨迹截然不同。它在 DeFi 热潮期间崛起,成为一个开放的代币化平台,用户可以使用稳定币就几乎任何主题进行交易。其速度和开放性使其在加密原生用户和政治投注者中非常受欢迎,但其监管风险限制了其获得主流资本的机会。

当美国监管机构在 2022 年对 Polymarket 处以罚款并限制其业务时,这似乎证实了 Kalshi 长期以来的论点,即合规是扩展规模的唯一途径。然而,ICE 的合作关系或许将翻转这一叙事,证明了一旦可信的中介机构搭建桥樑,加密原生模式可以与监管合法性共存。

结果是趋同:Kalshi 略微转向创新,而 Polymarket 则向监管靠拢。 Kalshi 的合规优势曾经看起来坚不可摧。然而,如果 Polymarket 能够在类似的 CFTC 框架下运作,同时利用 ICE 的技术和数据复盖范围,以及链上透明数据的独特价值,两者之间的差距将逐渐消弥。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。