U.S. Gold ETF Holdings Hit Historic Highs as Investors Flock to Safety

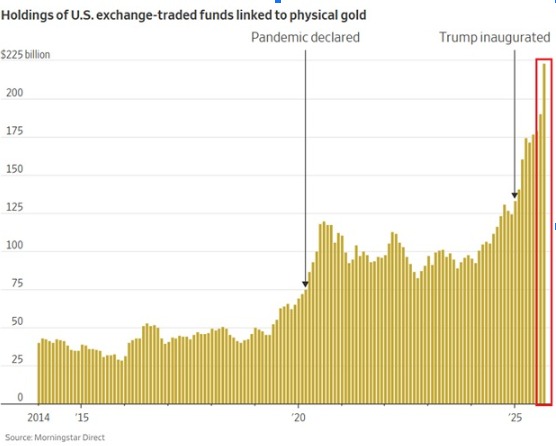

Holdings of U.S. exchange-traded funds (ETFs) tied to physical Precious metal have reached an all-time record. The total value has surged to an estimated $225 billion, marking the strongest accumulation of precious metal–backed assets in history. This remarkable rise reflects growing investor interest amid global economic uncertainty and shifting financial conditions.

U.S. Gold ETF Holdings Hit Record High

According to Morningstar Direct, U.S. gold ETFs have seen an unprecedented influx of capital throughout 2025. The report reveals that the investors are still flocking to Bullion as a safe haven. Having been directly tracking physical bullion, these funds now constitute one of the quickest-expanding sectors in the larger commodities market.

Investor Inflows Reach Unprecedented Levels

In September 2025, U.S. gold ETFs had a record 33-billion net inflows. Analysts indicate that geopolitical factors, the rise or fall of interest rates and weaker dollar have compelled investors to hedge their investments using Bullion . The steady inflows indicate that there are firm beliefs in the long-term stability of the metal.

Prior to the declaration of the pandemic in 2020, the total gold ETF holdings were approximately at 50 billion, so the current one approximately is 4.5 times greater. That explosive growth serves to emphasize how international crises and price increase anxiety can redefine investor behavior.

The outbreak of the pandemic has caused a scramble towards defensive assets, which began at the beginning of 2020. Equity markets have been volatile, but the value of Bullion has remained constant as a store of value. A lot of portfolio managers currently refer to Bullion as a strategic imperative and not a hedge of choice.

Global Gold Assets Climb Sharply

Globally, gold-backed ETFs have also posted impressive growth. Total assets under management rose 23% quarter-over-quarter in Q3 2025, reaching a record $472 billion. The growth indicates good demand at the international level, not just by the U.S. investors but also by Europeans and the Asian market.

The increase in the number of holdings comes with the increased prices of Precious metal , both in the physical market and in the central bank buying. Analysts suggest additional inflows in case of persistence in the inflation pressures or aggravation of the geopolitical tensions.

According to market pundits, the recent boom of gold ETFs could point to a possibility of a change in the attitude of institutional investors. A considerable number of people regard Precious metal as the stabilizing factor in unpredictable political and economic periods. As investor confidence in the traditional markets shakes, the precious metal has again shown its strength.

By the end of October 2025, It will continue being among the most demanded assets in terms of capital preservation and diversification.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。