Will SEC Crypto ETF Filings 19b-4 Withdrawal Boost or Delay Approvals

Imagine waiting for a landmark moment in cryptocurrency investing—then the rules suddenly change mid-game. That’s exactly what’s happening in the U.S. SEC crypto ETF news market this week.

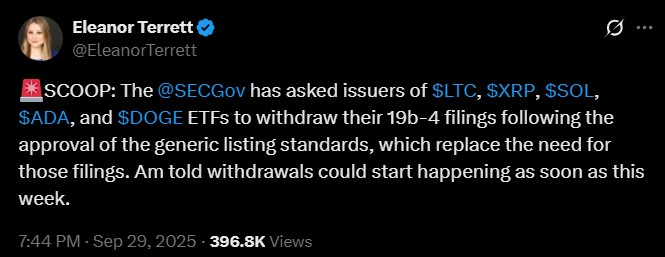

Investors and analysts were expecting decisions on 16 highly anticipated spot exchange traded funds, Eleanor Terett latest X post has added a twist, as SEC crypto ETF filings 19b-4 withdrawal has been requested from the issuers, but why?

Here’s everything you need to know for LTC, XRP, SOL, ADA, and DOGE ETFs.

SEC Crypto ETF Filing Withdrawal Request – Should Investors Worry?

As per latest Eleanor Terrett crypto comment on X, a well-known analyst, confirmed that the Security exchange commission has asked issuers of spot ETFs for LTC, XRP, SOL, ADA, and DOGE to withdraw their 19b-4 filings. At first glance, this may sound alarming.

But here’s the key takeaway: This Filings 19b-4 Withdrawal is not a setback. According to her, this is a procedural update following the Federal Securities Authority’s new generic listing standards.

Investors asking whether SEC crypto etf approve or delay should understand that it's not delayed; they are simply moving to a more streamlined approval process.

What Are SEC Generic Listing Standards ?

Two weeks ago, they approved generic listing standards, a rule that simplifies how crypto ETF filings can get listed. Traditionally, each traded fund required a 19b-4 filing—a complex and time-consuming process.

Under the new rules:

-

Exchanges no longer need individual security entry approval for each token

-

Tokens that meet commission's criteria can be approved through a simple S-1 filing.

-

The commission can approve any listed fund at any time, even if previous deadlines are approaching.

Analysts say this rule is a game-changer for the cryptocurrency industry and new exchange traded fund launches and demonstrates that the securities regulator board approval process can now be faster and more efficient.

Deadlines vs. New Rules: What’s Really Happening?

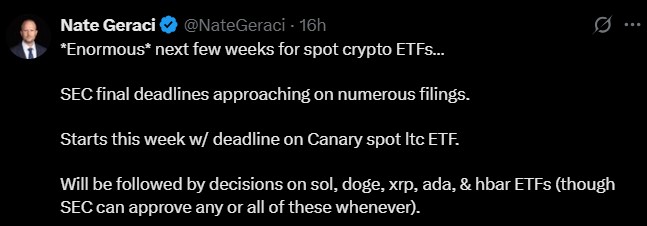

Before the generic listing standards, as per Onur a famous analyst’s X post, investors were tracking 16 SEC crypto ETF October deadline:

-

Canary’s Litecoin Traded Fund: October 2

-

Grayscale’s Solana & Litecoin Trusts: October 10

-

WisdomTree’s XRP fund: October 24

Thanks to the 19b-4 filings withdrawal and the new generic listing framework, these deadlines are no longer restrictive.

Why This Change Matters for Investors

-

Faster Approval – Listed funds can now launch without waiting for lengthy 19b-4 filings.

-

Reduced Uncertainty – Investors no longer worry about procedural delays.

-

Market Flexibility – The regulatory body can act on any token meeting the criteria, enabling timely and efficient decisions.

Analysts like Nate Geraci called October an “enormous” month for cryptocurrency exchange traded funds, and this update confirms the market is moving toward a faster and more efficient system.

Conclusion

The SEC Crypto ETF Filings 19b-4 Withdrawal is a procedural shift, not a setback. Generic listing standards are reshaping the investment funds landscape, making approvals faster and more flexible.

If you’re watching Litecoin, XRP, Solana, ADA, or DOGE this month, this is a moment to stay ready for the upcoming approvals because the security commission isn’t slowing down the cryptocurrency listed fund revolution—it’s actually accelerating it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。