作者:Nancy,PANews

“大热必死”几乎是行业共识,但Plasma却上演了一出教科书级的上线首秀,在拿下交易所首发“大满贯”的同时,针对预售和社区的“大撒币”策略,更是将热度拉满。

豪华空投营销效果拉满,FDV冲高至百亿美元

凭借大手笔空投策略,Plasma上线首日便引发市场狂热,也让之前的团队负面传闻不攻而破。

9月25日晚,稳定币公链Plasma正式上线主网,并推出原生代币XPL,初始流通比例将为18%。随后,币安、OKX、Upbit等多家主流交易所几乎同时宣布上线XPL,瞬间点燃市场热情。

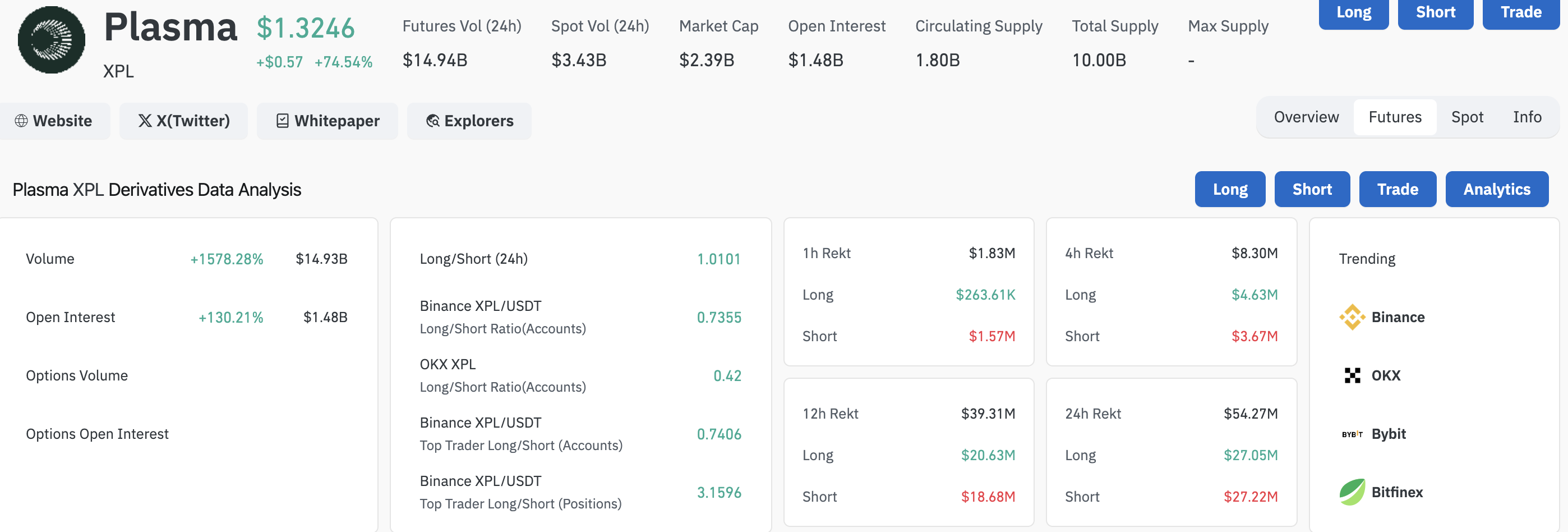

CoinGecko显示,上线后,XPL价格一度拉高至1.47美元,FDV接近120亿美元。根据Coinglass数据显示,其期货交易量在短时间内暴涨至149.3亿美元,日增幅高达1578%,未平仓合约亦快速攀升至14.8亿美元。在Binance XPL/USDT合约中,顶级交易者的多空比约为3.1,显示出大资金普遍偏向看多。例如,Hyperliquid上最大的XPL多仓已浮盈超1000万美元。

事实上,背靠Tether光环,Plasma在之前公售时便遭到巨鲸疯抢,甚至超额认购。根据Dune数据显示,Plasma 在两轮存款中合计吸引资金约16亿美元,参与者近5000人。其中,两轮平均存款约45万美元和28.3万美元。不仅如此,之前Plasma联合币安举行了10亿美元规模的存款空投活动,也同样瞬间售罄。

而这些疯狂抢购的大户,也从预售中获得了一笔非常可观的奖励。据Lookonchain监测,鲸鱼@RegbilTrades参与XPL公售,花费57.18万美元以0.05美元价格买入1144万枚XPL,其盈利已超过1100万美元,回报高达19倍;巨鲸0x790c此前向Plasma存入5000万枚USDT,获得270万美元的公售配额,并以均价0.05美元购买了5409万枚XPL,目前未实现利润超过4770万美元。即便是通过币安渠道参与,据@ai_9684xtpa分析,单个账号打满10万美元也可获取11,489枚XPL,最高收益超1.66万美元。此外,PANews也整理了空投数据,将在后续文章中全面复盘Plasma空投数据。

更令人惊喜的是,Plasma还空投了“豪华猪脚饭”。据悉,Plasma额外为所有预存用户共分配了2500万枚代币,这些代币将平均分配给所有预存者,也就是说,无论存入1美元还是1万美元,都能额外获得9304枚XPL奖励,最高价值超过1.3万美元。这一操作直接赢得了散户参与者的“好感”, 也让营销效果直接拉满。

挖矿激励撬动稳定币生态布局,将与TRON正面竞争?

不可否认,Plasma主网上线伊始便打出了一手漂亮的牌。在通过多轮预存款成功引入超20亿美元流动性后,Plasma正借助一系列撒币式激励活动,迅速撬动生态热度。

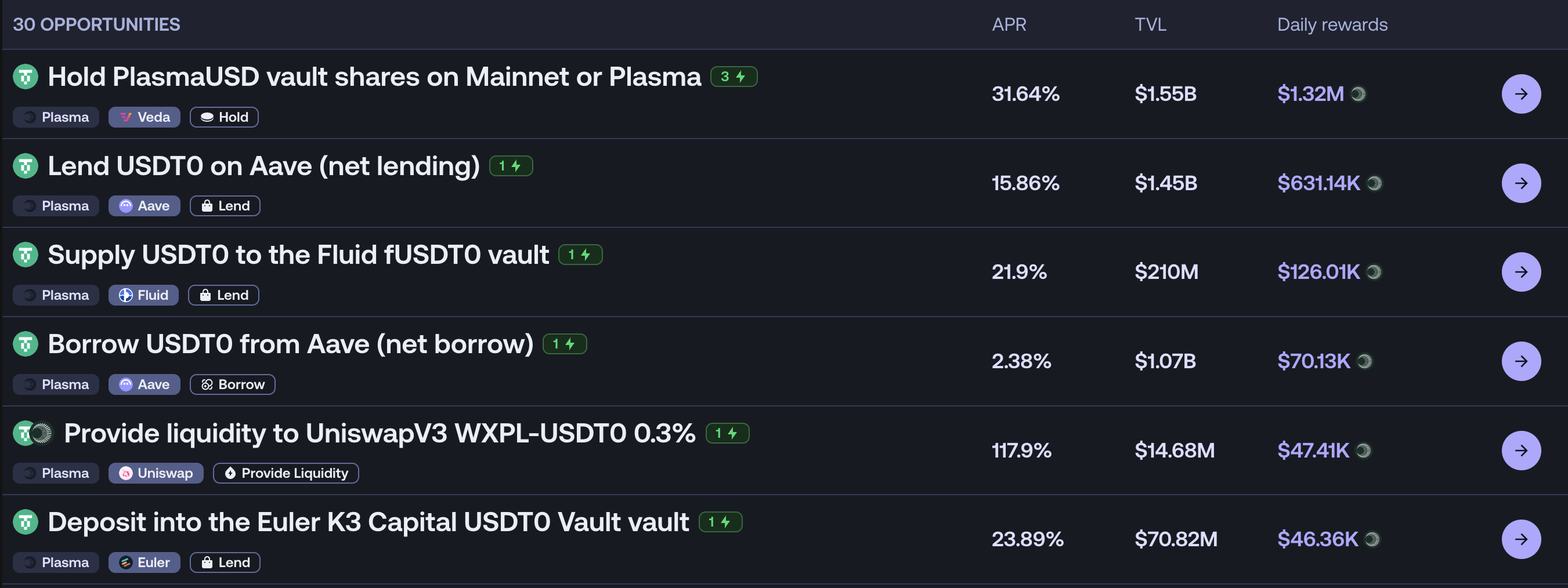

在交易所端,多家平台同步上线XPL挖矿,比如OKX的奖池规模为880万枚、Gate达300万枚、Bitget亦提供220万枚等。与此同时,Plasma与Aave、Ethena、Fluid、Euler等100多个DeFi项目达成合作。根据Merkl页面数据,XPL挖矿收益率普遍在10%-40%之间,TVL从数百万至数亿美元不等。其中官方Vault表现尤为突出,当前存款规模超过15亿美元,年化收益率(APY)高达31.64%。

当然,为了降低流动性管理风险并强化用户锁仓意愿,Plasma选择采取循序渐进的资金注入和激励补贴策略。据其DeFi主管river近日披露,Plasma主网Beta启动时,团队将从以太坊主网桥接10亿美元USDT并逐步注入Aave。但为了避免短时间巨额资金涌入带来市场波动或利用率失衡,Plasma选择分5天分批注入。在此期间,用户若将资金存入Veda金库,可获得额外的XPL奖励;但若在稳定期内选择提现,资金需等待48小时到账,并且将失去该期间的所有收益。

作为一条新L1公链,除了搭建链上生态竞争力外,Plasma还将战略重心放在对稳定币需求旺盛的新兴市场,比如东南亚、土耳其、南美等地,卖点是更低使用门槛,包括自定义Gas代币、零Gas交易以及隐私特性等,也因此被认为是对TRON的正面狙击。

不仅如此,在全球支付场景上,Plasma的野心更进一步。前不久,Plasma宣布将在主网Beta版上线后推出稳定币新型数字银行服务Plasma One,该预付信用卡将使用Plasma区块链作为支付通道,由推出Avalanche Card等产品的Rain公司发行,旨在让世界各地的每个人都能在一个应用程序中,无需许可地以美元进行储蓄、消费和赚取。用户可以边消费边赚钱 ,例如可直接从稳定币余额中支付,同时赚取10%以上的收益。使用其任何一张Plasma One卡(实体卡或虚拟卡)消费,可获得高达4%的现金返还。Plasma表示构建Plasma One的原因是解锁全球美元的使用渠道,并且希望构建基于自有基础设施的技术。

不过,真正能决定Plasma能否走得更长远,并不止于眼下高额补贴下的TVL以及Tether的光环加持,而是它是否能在新兴市场形成长期稳定的用户规模,在现实支付场景中找到真正的落地路径,并承受监管的考验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。